Summary:

This proposal seeks approval from the AAVE community to increase the borrowing limit of Stasis Euro (EURS) on the Polygon network and to remove its current isolation status. This change aims to enhance the liquidity and utility of EURS within the AAVE ecosystem, thereby providing more opportunities for users and promoting further adoption of EURS on Polygon.

Motivation

Over the years, EURS has demonstrated stable and reliable performance as a fiat-backed stablecoin pegged to the Euro. Its adoption and usage across decentralized finance (DeFi) platforms have grown, showing significant demand and user trust. However, its current borrowing limit and isolation status on AAVE restrict EURS’s full potential to serve a broader user base and limit its functional utility within the platform.

References/Useful links:

Main Links:

- Website — STASIS

- Source Code — STASISNET (STASIS) · GitHub

- STASIS provides 4 verification streams. All data is available publicly: Transparency and reserve verification

- Independent Auditor Reports — STASIS EURO - CertiK Skynet Project Insight

- Token contract: $1.07 | STASIS EURS Token (EURS) Token Tracker | Etherscan; UChildERC20Proxy | Address 0xE111178A87A3BFf0c8d18DECBa5798827539Ae99 | PolygonScan.

- Main socials: Telegram/Twitter/LinkedIn.

STASIS/EURS Background:

EURS is the largest euro-backed digital asset, combining the benefits of the world’s second most-traded currency with the transparency, immutability, and efficiency of distributed ledger technology. Created by stablecoin issuer platform STASIS, EURS mirrors the euro’s value on the blockchain and is supported by assurance mechanisms provided via an ecosystem of liquidity providers, custodians, exchanges, payment platforms, and others. Each token is backed 1:1 by euros held in the company’s reserve accounts (1).

STASIS is a European Web3 fintech company that develops customer-friendly instruments to manage digital currencies and public blockchains for payments and settlements, e-commerce, and DeFi. This platform has a solid track record and vast expertise in technological, financial, and legal fields. Since all EURS are backed with fiat euro, there is no risk for investors and everyday users, who can always exchange their digital assets to fiat and vice versa thanks to the firm’s Sellback Service (2).

EURS stablecoin combines experience, trust, technology, and financial infrastructure to enable business growth, narrowing the gap between the European financial and digital asset markets. EURS is the oldest, largest and legal stablecoin, accessible in 175 countries. Issued since 2018, STASIS EURO has zero conflict of interest and is audited by a top global firm — the BDO. All EURS assets are backed on a 1:1 basis with liquid euro balances or cash, and reserves are held at the Lithuanian Central Bank. With over 6B euros transferred on-chain, EURS supports 7 blockchains.

Since USD-backed stablecoins are heavily dominating the market, Europeans/Asians are regularly forced into undesired dollar exposure with little on-chain hedging options. EURS stablecoin seeks to challenge the U.S. Dollar’s dominance in global financial markets. By 2024, it had become a popular tool for daily transactions, free of risks and volatility inherent in conventional cryptocurrencies. The potential of stablecoins use cases has been recognized in times of crisis, and the demand for EURS is growing steadily in the DeFi field.

Rationale

- Increase Borrowing Limit: Raising the borrowing limit for EURS will allow for larger positions, accommodating the needs of users who require higher liquidity for trading, yield farming, or hedging.

- Remove the Isolation Status: Currently, EURS is designated as an isolated asset, which means it can only be used as collateral for borrowing the same asset. Removing this restriction will enable EURS to be used as collateral for borrowing other assets, thereby enhancing its utility and integration into the broader AAVE ecosystem.

- Risk Assessment: Preliminary risk assessments indicate that EURS maintains robust backing and compliance with relevant financial regulations, suggesting that adjustments to its borrowing parameters are justified. Further analysis and community discussion are encouraged to validate these findings.

Benefits for AAVE

- Enhanced liquidity: Increasing the borrowing limit and removing isolation status will enhance liquidity, making it easier for users to execute larger transactions and strategies.

- Increased adoption: EURS’s improved utility could lead to increased adoption, benefiting the AAVE ecosystem by attracting a larger and more diverse user base.

- Risk diversification: Allowing EURS to be used for a broader set of borrowing options helps diversify the risk profile of the assets on the AAVE platform.

Next Steps

- Receive the comprehensive feedback from the AAVE community on this proposal through discussions and Governance Forum.

- Conduct an on-chain voting of the proposed changes and ensure alignment with AAVE users expectation.

- Upon approval, coordinate with the AAVE development team for the technical implementation of the changes in the smart contracts.

Community and Communication:

STASIS is active on Telegram, Twitter, LinkedIn, and Discord server. The project team also maintains a YouTube account (3). STASIS and EURS are often mentioned in global press media (4). Gregory Klumov, the founder and CEO of the STASIS EURS project, is the project’s main spokesperson (5), often sharing his views on crypto. The STASIS website includes a mailing address in lsle of Man, and a contact e-mail (6).

Conclusion:

This proposal aims to adapt the EURS offerings on the AAVE platform to meet the evolving needs of the community while ensuring stability and security within the ecosystem. The proposed adjustments to the borrowing limits and isolation status of EURS on Polygon are designed to enhance its functionality and support broader financial activities on the platform.

Next Steps

- Open discussion in the forum for community feedback.

- Adjust the proposal based on community input and expert analysis.

- Proceed to a Snapshot vote if the discussion indicates general community support.

Product videos

Team’s expertise video

Project Review

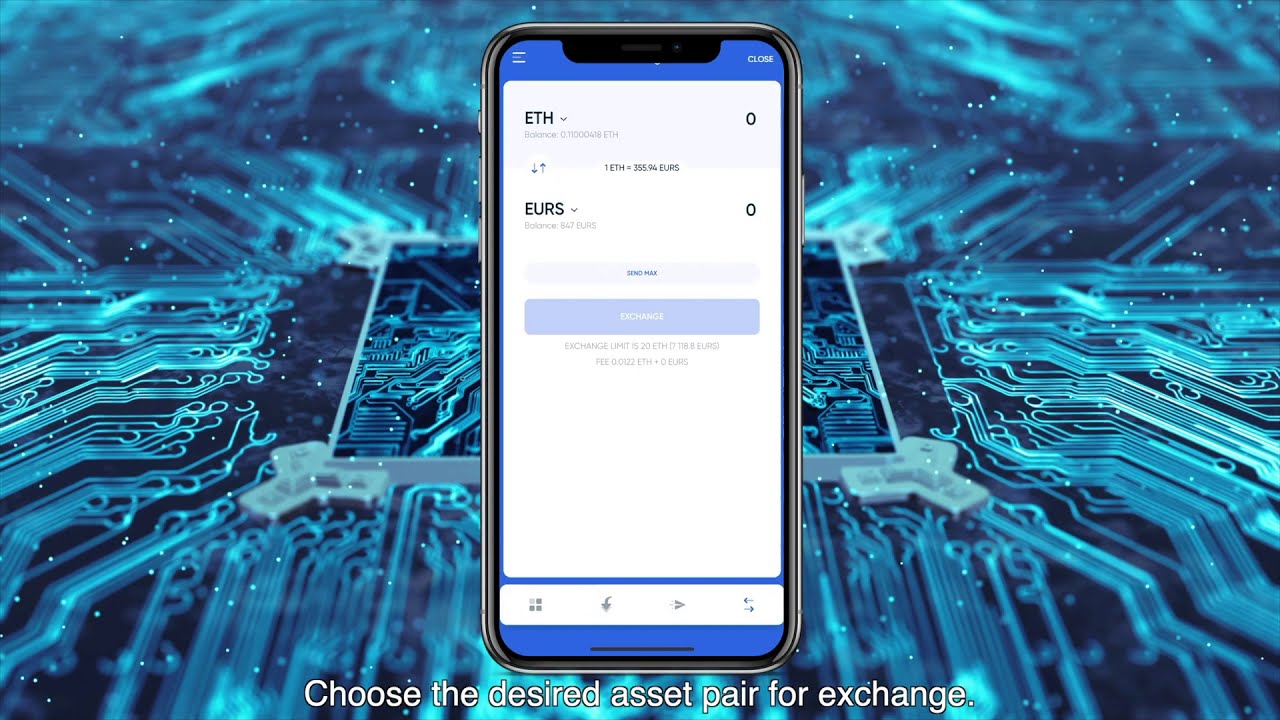

STASIS Wallet Introduction

STASIS Wallet

References

-

Social media accounts

- Blog: STASIS Blog - Medium News, stories & insights about the STASIS, EURS, stablecoin sector and Web3

- Twitter: https://twitter.com/stasisnet

- Telegram: Telegram: Contact @stasis_community

- LinkedIn: LinkedIn Login, Sign in | LinkedIn

- GitHub: https://github.com/stasisnet

- YouTube: https://www.youtube.com/channel/UCq7eJ9c8ec2PEQweJg-pcDA

- STASIS/ EURS in PRESS

-

Stablecoin Issuer Promises Full Audits of Euro-Backed Crypto Token

-

Self-Regulatory Advancements To Crypto Market Will Spark Interest From Institutional Investors

-

New Wallet From Stablecoin Issuer STASIS Syncs With Financial Institutions

- STSS Limited (lsle of Man) Reg number. 015541V, 2nd Floor, Quay House, South Quay, Douglas, IM1 5AR, lsle of Man; CO@STASIS.NET.

Regards,

STASIS project team