TokenLogic January Update

A busy start to the year with 12 AIPs and 30 Snapshot votes. The TokenLogic team participated in 11 of 12 AIPs and 25 of 30 Snapshot votes. In addition to being an active delegate and separate from our partnership with karpatkey, we have also made significant progress on the bridging, swapper and asset manager contracts.

Many of these contracts are currently at the review stage with BGD. We take security very seriously and the safety of the DAO’s funds are our number one priority. The review progress is very thorough and we are going to great lengths with BGD to ensure everything works correctly.

Aave Swapper Contract Upgrade

We wanted to update the forum on the status of the development work for the Aave Swapper Upgrade to support both limit orders and TWAP orders.

These contracts, as well as the bridging contracts, move millions of dollars so we want to ensure with thorough testing (both programmatic testing as well as live testing) that our contracts work as expected and the DAOs funds are always safe. We have performed all the necessary live tests as well as added all the programmatic tests for our contracts and they are in the review phase with BGD labs.

To be protected against MEV, these contracts rely on COW Swap under the hood to find a match for the swaps, and they had some trouble picking up orders once created so it took a bit longer than we wanted to finish the live tests end-to-end.

The Aave Swapper is currently in the review phase. This review phase is very thorough and we are having conversations to finalise the work and update the contract implementation so these new types of orders can be used by the DAO.

Bridge Contract Updates

A brief summary of the status of each of the three bridges being prepared as part of the [ARFC] Treasury Management - Tooling Upgrade. Please note, developing the contract requires input from the various teams.

- Optimism to Ethereum

- Currently in the review phase

- Arbitrum to Ethereum

- Currently in the review phase

- Avalanche to Ethereum

- The Avalanche Foundation is evaluating adding smart contract support to the Avalanche Bridge. Once this is complete, we will be able to build out the bridging contract for Aave.

Strategic Asset Manager Contract Upgrade

TokenLogic has been working closely with the Paladin team to integrate the ability to create quests via the SAM contract.

The SAM contract upgrade is currently in the review stage.

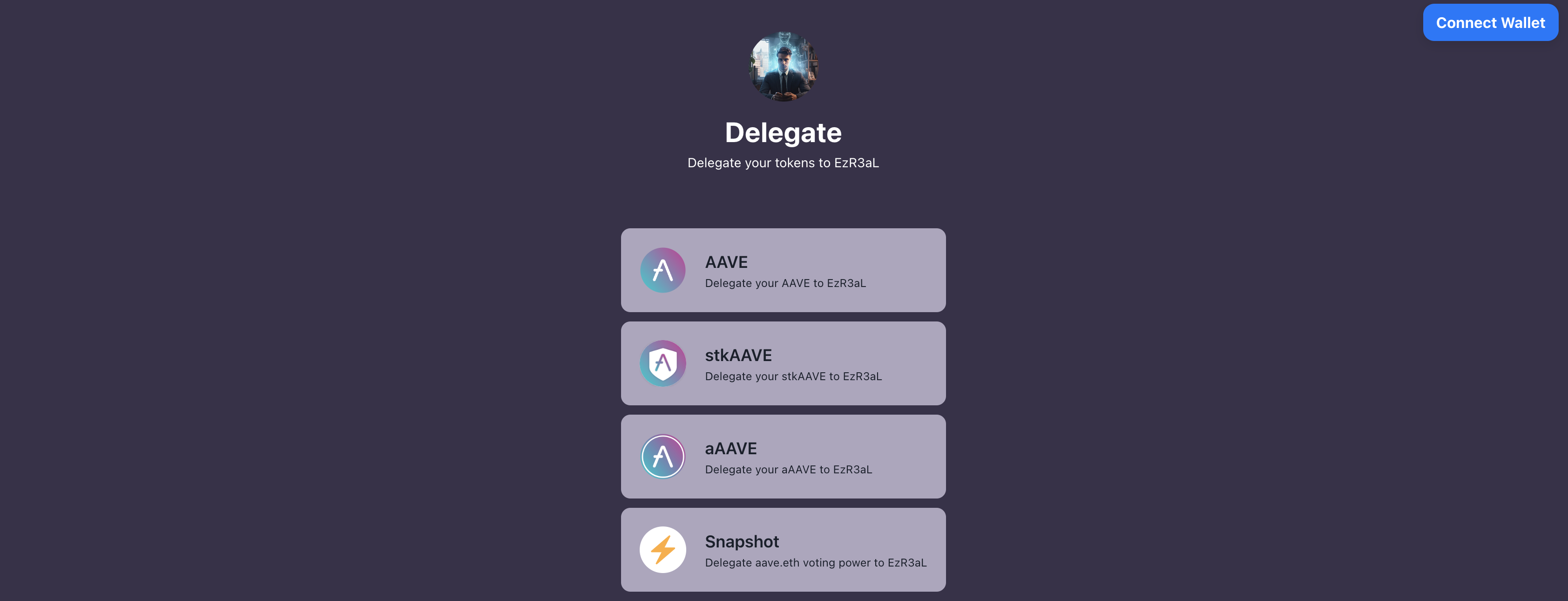

Delegate Platform UI

We are glad to share with the Aave Community new delegate platform frontends for both TokenLogic and EzR3al.

TokenLogic Link: https://delegate.tokenlogic.com.au/

EzR3al Link: https://ezr3al.tokenlogic.com.au/

We hope with the upcoming Merit incentive program more aAAVE, stkAAVE and AAVE holders participate in governance by delegating to one of the many delegates in the Aave Ecosystem. If any recognised delegate would like a delegate platform frontend, please reach out and we will support as best we can.

Snapshot Votes

[TEMP CHECK] Launch Aave V3 on Kava EVM

Vote Cast: YAE

In general, we support the continued expansion of Aave v3 deployments.

[TEMP CHECK] Add PYUSD to Aave v3 Ethereum Market

Vote Cast: YAE

We support adding pyUSD to Aave v3. Similar to sDAI we expect users to deposit pyUSD as collateral.

[TEMP CHECK] GHO Stability Module Launch

Vote Cast: Option A

We are supportive of deploying the GSM without swaps enabled. We beleive the GSM should be funded with swaps enable once the GHO price is trading closer to peg.

[TEMP CHECK] Further Aave v1 deprecation strategy

Vote Cast: YAE

We support sunsetting the legacy v1 market.

[ARFC] Retroactive bug bounties proposal (pre-Immunefi)

Vote Cast: YAE

We support the proposed payoouts in line with BGD recommendations.

[ARFC] Harmonize USDT Risk Parameters on Aave V3 Markets

Vote Cast: YAE

We believe all USDT LTV and LT parameters should be harmonised with USDC and DAI.

[TEMP CHECK] Add ggAVAX to AAVE v3 on Avalanche

Vote Cast: ABSTAIN

We beleive it to early to consider adding ggAVAX as the risk profile of this asset remains relatively high.

[TEMP CHECK] Add sFRAX to Ethereum V3

Vote Cast: YAE

We support adding interest bearing collateral assets to Aave and look forward to the Risk Service Providers feedback at ARFC stage.

[ARFC-Addendum] Update StkGHO Launch Parameters

Vote Cast: Option B

We favour aligning the cooldown period with other assets in the Safety Module and increasing the AAVE rewards to 50/day. We believe 100 AAVE per day at the start is to much and creates to much risk of GHO trading above peg.

[TEMP CHECK] Onboard fdUSD to Aave v3 on BSC

Vote Cast: YAE

We support stable coin diversity and look forward to hearing the Risk Service Providers feedback during the ARFC phase.

[ARFC] Treasury Management - GSM Funding & RWA Strategy Preparations

Vote Cast: YAE

We are co-author of this proposal and support securing the DAO’s runway, GSM and investments.

[ARFC] Gauntlet recommendation for MAI / MIMATIC deprecation phase 2

Vote Cast: YAE

Given the current market conditions for MAI, we support reducing Aave Protocol’s expsoure to MAI.

[TEMP CHECK] Aave V3 MVP deployment on Neon EVM Mainnet

Vote Cast: YAE

We support progressing to the next phase to assess whether or not Aave v3 should be deployed on Neon. We are looking forward to BGD feedback.

[ARFC] Update stETH and WETH Risk Params on Aave v3 Ethereum, Optimism and Arbitrum

Vote Cast: YAE

We support improving Aave’s competitive position in the market and this proposal is a strategic initiative that will help sustain Aave’s dominant market position.

[ARFC] Aave V3 Deployment on Scroll mainnet

Vote Cast: YAE

With support from Risk Service Providers and BGD, we support deploying Aave v3 on Scroll.

[ARFC] AMPL Interest Rate Updates on V2 Ethereum

Vote Cast: YAE

We support the interest rate strategy amendments as presented by Chaos Labs.

[ARFC] Introducing “Frontier” - Staking as a Service for the Aave DAO

Vote Cast: YAE

We suport the ACI running Ethereum nodes on behalf of Aave DAO. Marc has extensive experience in running nodes and we are glade to be a signer on the multi-sig.

[ARFC] Add PYUSD to Aave v3 Ethereum Market

Vote Cast: YAE

We support adding collateral types that generate yield. We also look forward to working with the Trident team to help grow pyUSD adoption on Aave Protocol.

[ARFC] Gauntlet USDC.e Supply and Borrow Cap Recommendation on Optimism Aave v3

Vote Cast: NAE

Increasing caps for USDC.e would only result in a longer co existence of USDC.e and native USDC. We do not support encouraging the use of USDC.e on Aave Protocol and expect for this asset to be deprecated in time.

[ARFC] Recommendation to freeze and set LTV to 0 for DPI on Aave v3 Polygon

Vote Cast: YAE

The DPI token has seen no adoption on Polygon and should be phased out where there is no business case to retain the asset.

[ARFC] Recommendation to freeze and set LTV to 0 for BAL on Aave v3 Polygon

Vote Cast: YAE

We support Chaos Lab’s and Gauntlet’s feedback. “We recommend freezing and setting LTV to 0 for BAL on Aave v3 Polygon because it contributes minimally to the protocol’s reserve growth, compared to the risk it adds to the protocol.”

[ARFC] Recommendation to freeze and set LTV to 0 for CRV on Aave v3 Polygon

Vote Cast: YAE

Same reasoning as previous proposal.

[ARFC] Recommendation to freeze and set LTV to 0 for SUSHI on Aave v3 Polygon

Vote Cast: YAE

Same reasoning as previous proposal.

[ARFC] Add sFRAX on Ethereum V3

Vote Cast: YAE

We support adding yield generating collateral assets like sDAI, pyUSD and now sFRAX.

[ARFC] Modify Retroactive bug bounties proposal (pre-Immunefi)

Vote Cast: Option C

Our rational for voting Option C can be found on the forum here.

AIP Votes

Polygon V2 Reserve Factor Updates

Vote Cast: YAE

We support continually increasing the RF values to support the migration of users from Polygon v2 to v3.

Chaos Labs Risk Parameter Updates - WBTC.e on V2 and V3 Avalanche

Vote Cast: YAE

We support reducing WBTC.e exposure and encouraging users to migrate to BTC.b on v3.

Stablecoin IR Curves Updates

Vote Cast: YAE

Borrowing rates across Aave Protocol have been high and often exceed the Slope 1 Interest Rate. We support increasing stable coin Interest Rate parameters across all Aave deployments.

V2 Deprecation Plan, 2024.01.02

Vote Cast: YAE

We support the continued transition from v2 to v3 by reducing the Liquidation Thresholds (LT) on Aave V2 Ethereum.

Aave Funding Updates (part 2)

Vote Cast: YAE

We prepared this proposal with karpatkey and it will ensure all Aave Service Providers are funded for the duration of all the known contracts.

Aave v3 BNB Activation

Vote Cast: YAE

We support the continued expansion and deployments of new iterations of Aave v3 on new networks.

StkGHO Activation

Vote Cast: YAE

We believe creating stkGHO will provide buy pressure on GHO and will help bring the price back to $1.00 ready for the GSM and many new liquidity pool to be launched.

GHO Stability Module

Vote Cast: YAE

We support deploying the GSM in line with Chaos Labs and Gauntlet’s receommendation. In the future, we expect the GSM will need funding and we are already working on ensure the DAO has adequate funds available for this.

Reserve Factor Updates (Jan 15, 2024)

Vote Cast: YAE

We support continually increasing the RF values to support the migration of users from Polygon v2 to v3.

Request for Bounty Payout - January 2024

Vote Cast: YAE

We support rewarding the efforts of developers who find issues with the Aave Protocol as outlined in this proposal.

Update ETH EMode and WETH Risk Params on Aave v3 Ethereum, Optimism and Arbitrum

Vote Cast: YAE

This proposal will improve Aave’s competitiveness and will encourage users to remain on Aave. The ETH reserve will become more capital efficient and will hopefully lead to more users migrating funds from v2 to v3.