LlamaRisk supports onboarding USR to Aave v3 Core Instance contingent upon establishing a formal bug bounty program. USR is a synthetic stablecoin secured by ETH through a delta-neutral framework that employs short perpetual futures to maintain its $1 peg. The protocol’s dual-token model features USR as the stablecoin and RLP as an insurance layer that absorbs potential losses, providing an additional stability buffer.

USR itself is not yield-bearing, though holding it is currently incentivized through a points program. Users seeking yield can stake USR to receive (w)stUSR, which accrues rewards from the collateral pool. Currently overcollateralized at >115%, the protocol generates yield primarily from ETH staking (diversified across Lido, Binance, and Dinero) and funding fees from short perpetual futures positions on Binance, Hyperliquid, and Deribit. The collateral pool distributes profits daily, with 70% allocated proportionally between stUSR and RLP holders, while 30% goes exclusively to RLP as a risk premium.

While reviewing this asset, we considered rehypothecation risks: Resolv deposits ~99k stETH ($198.63M) on Aave V3 Ethereum to borrow $67.17M in WETH (2.40 health factor) for managing redemptions and margin requirements. When wstETH exceeds 50% of collateral, the excess is unstaked to redeem borrowed ETH. This strategy generates yield on idle capital while maintaining liquidity for operations. With its conservative health factor, this practice doesn’t raise concerns but warrants monitoring.

USR has maintained strong price stability, showing minimal fluctuations over the previous six months. MixBytes and Pessimistic have audited the codebase, and all critical issues have been resolved. Liquidity is concentrated on Curve, Uniswap V3, and Balancer, with a Chainlink market price oracle now implemented. Issued under British Virgin Islands law, Resolv employs Ceffu and Fireblocks for custody with off-exchange settlement to mitigate CEX solvency risks. Governance relies on upgradeable proxy contracts with a one-day timelock, controlled by a 3/5 multisig Gnosis Safe.

Collateral Risk Assessment

1. Asset Fundamental Characteristics

1.1 Asset

USR, developed by Resolv Labs, aims to address the shortcomings of traditional stablecoins by limiting exposure to real-world asset risks. Founded in June 2023 by Fedor Chmilev, Ivan Kozlov, and Tim Shekikhachev, Resolv Labs focuses on creating a stablecoin that operates independently of fiat currencies, relying instead on crypto-native collateral. USR is an ERC-20 token pegged to the US Dollar and collateralized with ETH. Its design uses a delta-neutral framework that employs short perpetual futures positions to counteract ETH’s volatility and maintain price stability.

A key element of the Resolv protocol is its dual-token model. While USR is designed for users seeking a low-volatility, stable asset, the Resolv Liquidity Pool (RLP) token is an insurance layer, ensuring USR remains overcollateralized. RLP absorbs risks related to the hedging strategy, such as adverse funding rate movements, while capturing staking and derivative returns. This separation helps shield USR from direct market fluctuations while generating yield within the crypto ecosystem.

The dual-token setup further enhances USR’s security by using RLP for additional coverage. Surplus collateral backs RLP, with each token’s price tied to the amount of ETH collateralization. In exchange for assuming potential market and counterparty risks on behalf of USR, RLP holders receive a larger share of the collateral pool’s profits. Resolv is live on the Ethereum mainnet, and both USR and RLP tokens can also be bridged to Base.

1.2 Architecture

To mint USR, users deposit USDC or USDT at a one-to-one value exchange rate minus any minting fees currently set to zero.

Source: Resolv Medium, Date: March 6th, 2025

They may also stake their USR to receive stUSR, a yield-bearing variant of the stablecoin. Staking is optional but grants access to profits generated by the Resolv collateral pool. The value of stUSR matches USR, yet the number of stUSR tokens grows over time through rebasing. Unstaking is possible at any point on a one-to-one basis without delay. There is no configurable timeframe or conditions for unstaking.

Whitelisted holders can redeem USR for USDC or USDT whenever they wish at an equal value rate, with redemptions typically processed within 24 hours and no associated fees. It should be highlighted that redemptions are manually processed off-chain. There is no built-in delay mechanism for redemptions at the smart contract level; the issuer provides an indicative timeline. There is no timelock or waiting period for burning tokens—the entity shall immediately process redemptions with an approved role.

The core of this architecture is the collateral pool, which safeguards the ETH supporting the tokens and manages hedging activities. The pool consists of ETH (including staked ETH hedged by short ETH futures), stablecoins (USDC and USDT), and shares of the Superstate USCC fund. The pool’s target exposure is roughly 95% in the ETH Delta-Neutral Cluster and 5% in Superstate USCC.

A current snapshot of the asset allocation presents a different picture. One plausible explanation for this variation is the presence of negative or low funding rates, combined with shifts in market volatility, which may have led to adjustments in the protocol’s allocation strategy.

Source: https://app.resolv.xyz/, Date: March 6th, 2025

This pool generates yield for stUSR holders by collecting staking rewards and funding fees from short perpetual futures. The delta-neutral approach offsets ETH price swings and sustains a steady net value.

Active management aims to keep the collateral pool overcollateralized at all times. Futures positions are maintained on highly liquid venues: inverse ETHUSD perpetual futures backed by ETH collateral at a target margin ratio of 30% and linear perpetual futures backed by USDC at a 42.5% target margin ratio. The leverage employed across exchanges stands at 2x, with 3x as the allowed maximum - an adjustment reflecting a more conservative stance in response to ongoing elevated market volatility.

The protocol aims to distribute these positions as 50% on Binance, 30% on Hyperliquid, and 20% on Deribit. As of the date of this report, the asset proportions are as follows:

Source: https://app.resolv.xyz/, Date: March 6th, 2025

On-chain holdings reside in an upgradable proxy contract, while off-chain components are secured by institutional custodians - Ceffu and Fireblocks. Portions of the pool are designated for future trading margins and maintained in custody wallets outside the exchanges. Margin is provided to Deribit with Fireblocks custody and to Binance through Ceffy custody. A segment of the collateral pool’s ETH is staked to diversify returns and mitigate risk, with a target allocation of around 70% to Lido via wstETH, 15% to Binance through wbETH, and 15% to Dinero using apxETH.

Resolv also employs Aave v3 on the Ethereum Mainnet to borrow ETH against wstETH, meeting short-term liquidity needs such as redemptions and margin requirements. If more than half of the staked ETH is committed as collateral, any surplus is withdrawn from staking to repay the borrowed ETH.

The assets held in the on-chain treasury wallet are verifiable on Debank:

- $26.8M in stablecoins and vanilla ETH;

- $156.6M staked with Lido;

- $77.7M in Aave v3 lending;

- $48.9M staked with Dinero;

Similarly, assets custodied with Fireblocks can be verified on Debank at any time (~$35M in ETH and $28M in stETH). However, live data is unavailable for Ceffu custody, which currently holds assets valued at $95M. Periodical custodian attestations are also unavailable.

Collaterization

RLP functions as the insurance layer for USR, absorbing potential losses from counterparty, market, and liquidity risks. According to the protocol documentation, RLP is intended to cover scenarios such as a trading venue’s insolvency and negative funding rates, and it also serves as a safeguard against significant liquidity withdrawals within the protocol.

Based on data on the protocol’s front end, the current USR Collateralization Ratio (CR) stands at 118.30%. This figure is calculated by dividing the total collateral pool value by the USR TVL. From December to March, the total TVL quickly rose, with the RLP portion scaling from roughly $30M to over $100M. Because RLP coverage grows with USR issuance, the protocol maintains a comfortably high collateralization ratio—consistently above 110%.

Source: https://app.resolv.xyz, Date: March 10th, 2025

1.3 Tokenomics

Profits generated by the protocol are distributed in a way that compensates those who contribute to USR’s stability. The yield derived from the collateral pool and hedging activities is divided between stUSR and RLP token holders, with 70% of these earnings channeled to stUSR and RLP holders on a proportional basis and the remaining 30% reserved exclusively for RLP holders. The allocation rate is not hardcoded. Instead, it entirely relies on the caller (addresses with SERVICE_ROLE) to specify the amounts at the time of distribution.

Revenue primarily comes from ETH staking rewards and funding fees associated with the short perpetual futures. These proceeds are apportioned daily, leading to an increase in the quantity of stUSR tokens. RLP’s valuation, in contrast, either rises in tandem with realized returns or contracts if losses occur during a given reward period.

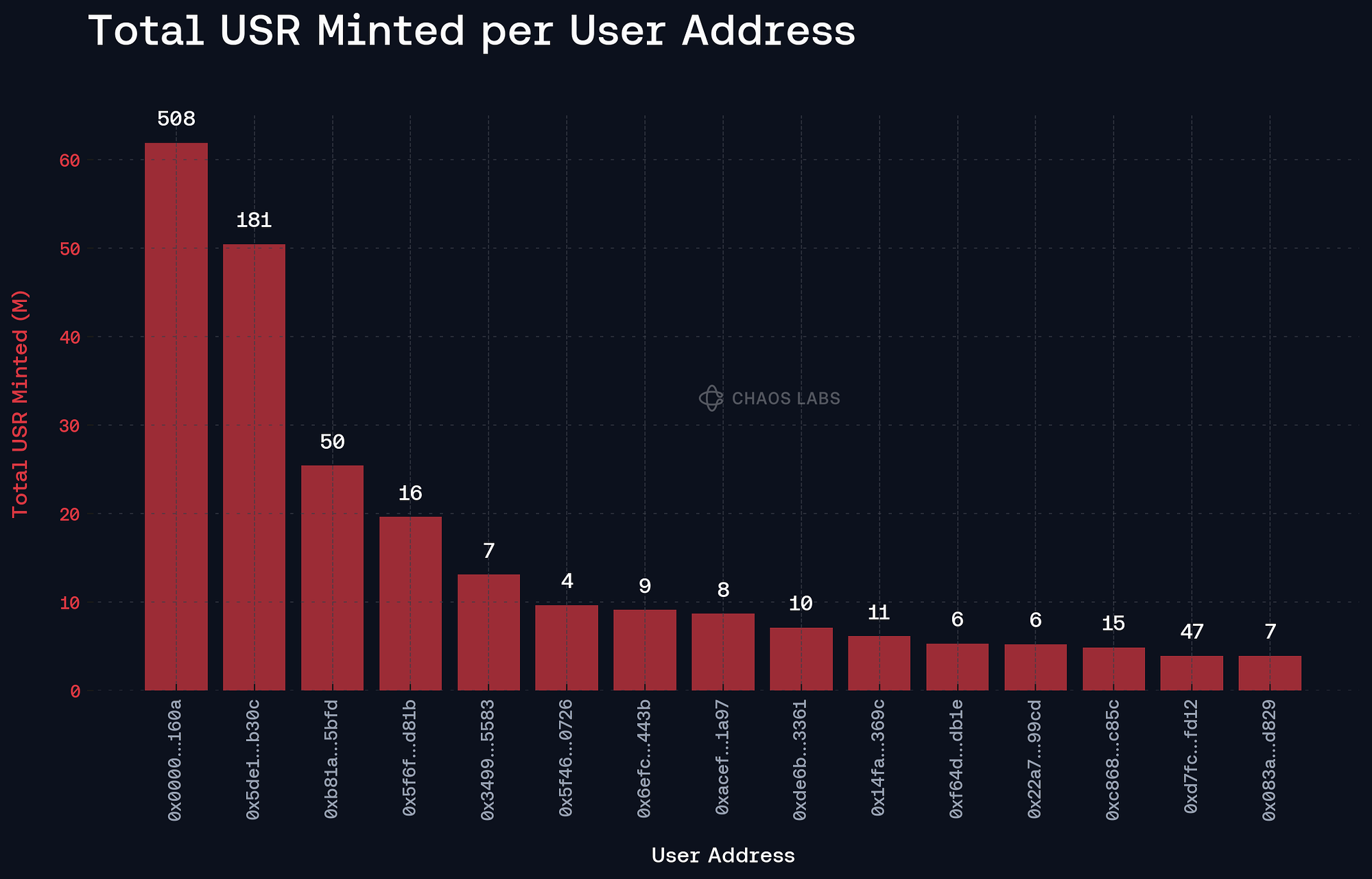

1.3.1 Token Holder Concentration

USR exhibits a high concentration of holdings among a small number of addresses. The two largest addresses alone hold a combined 65.72% of the total supply, with stUSR: 0x6c8984bc7DBBeDAf4F6b2FD766f16eBB7d10AAb4 owning 37.96% and 0xD2eE2776F34Ef4E7325745b06E6d464b08D4be0E having 27.76%. The third-largest holder, Morpho Blue, accounts for an additional 16.51%, further consolidating a centralized distribution structure.

Source: Etherscan, Date: March 5th, 2025

2. Market Risk

2.1 Liquidity

2.1.1 Liquidity Venue Concentration

Curve, Uniswap V3, and Balancer account for most USR liquidity depth. The liquidity is strongest on Curve, where TVL and trading volume outperform the other venues. A recent change in the USR/USDC pool parameters (Ramp_A up from 500 to 2000 over one week, and set_new_fee from 0.04% to 0.02% and offpeg_fee_multiplier from 2x to 5) should also result in more liquidity depth.

2.1.2 DEX LP Concentration

Up to 10M USR can be exchanged for USDC before running into an undesirable slippage rate of about 8%, corresponding to the liquidity bonus. Conversely, up to 100M USDC can be deployed to acquire USR before reaching that threshold.

Source: LlamaSwap, Date: March 12th, 2025

2.2 Volatility

USR has exhibited low volatility over the past six months, maintaining a relatively stable price around its intended peg of $1.00.

Source: Geckoterminal, Date: March 5th, 2025

2.3 Exchanges

The market presence of USR is still limited to a few major DEXes mentioned above, with no CEX listings.

The largest liquidity pools exist on Curve, where USR is paired with RLP, GHO, USDC, and DOLA. Uniswap v3 also supports a USR/USDC market. Balancer V2 offers a USR/GYD pair with limited liquidity (<500k).

2.4 Growth

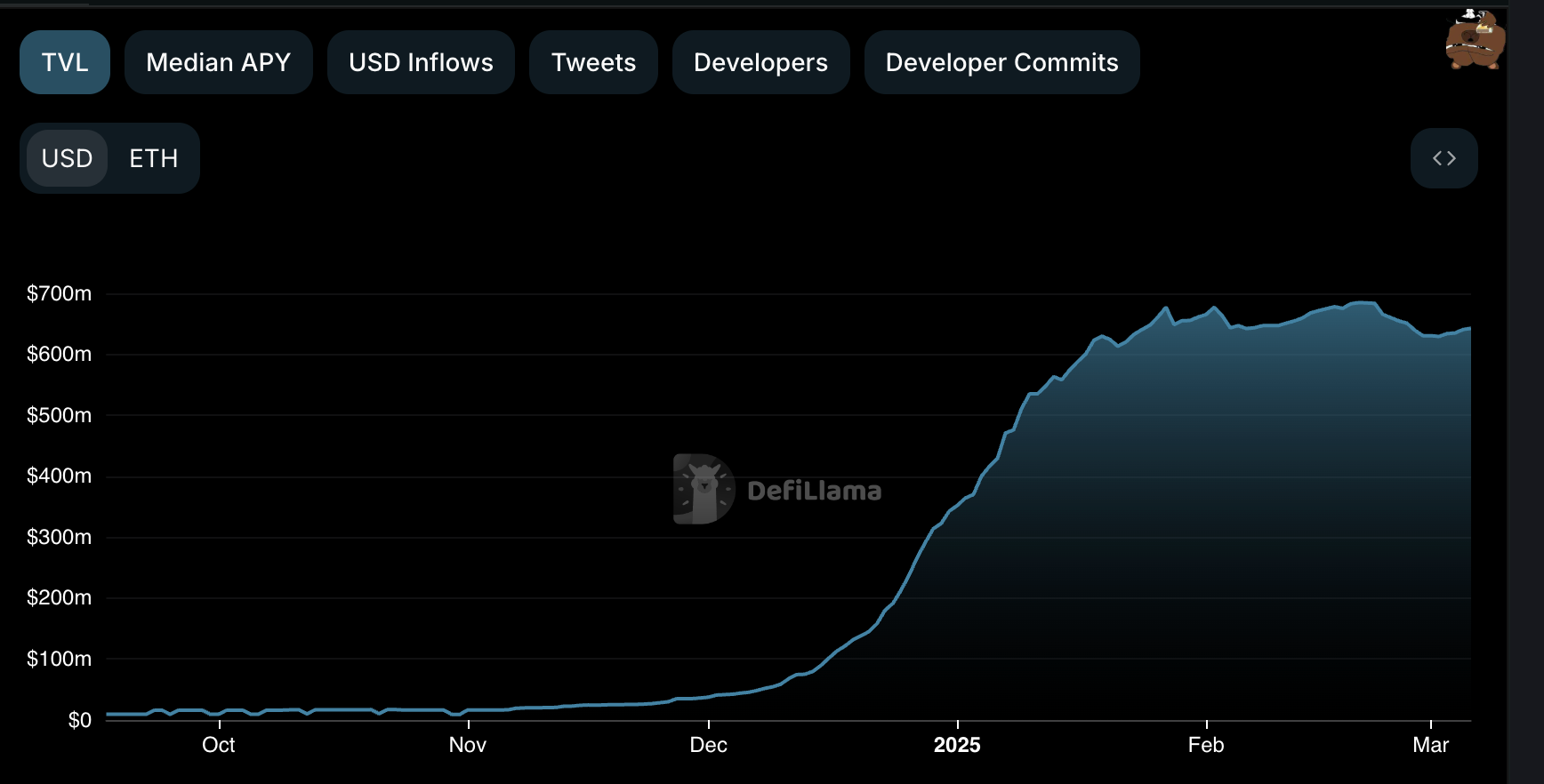

Resolv’s TVL is currently standing at $642.6M. The protocol saw minimal activity in the early months, maintaining a flat trajectory before experiencing a steep acceleration starting in December 2024. The ongoing points program should be considered a contributing factor to the increase in capital inflows. An indicative stUSR APY of 5–6% does not solely justify the spike in deposits.

Source: DefiLlama, Date: March 6th, 2025

The total supply of all Resolv assets has grown significantly since early December, and it is dominated by the core asset of the ecosystem - USR. RLP has expanded at a slower rate. stUSR has grown in tandem with USR issuance but in a relatively lower proportion. This suggests that while some users are staking for yield, a significant portion prefers maintaining liquid holdings.

Source: Dune LLR, Date: March 10th, 2025

3. Technological Risk

3.1 Smart Contract Risk

Token contracts and staking contracts were audited by:

- MixBytes: 1 critical and 4 medium findings, all resolved.

- Pessimistic: 3 medium and 13 low severity issues, all fixed or addressed.

PoR Oracle security audit by MixBytes established 1 critical finding, which was fixed.

wstUSR was further audited by:

- Pashov: 4 medium, 3 low severity findings, all resolved, 1 low acknowledged.

- Pessimistic: 2 medium severity findings (1 fixed, 1 commented) and 2 low severity findings (both commented).

An additional security review by Sherlock found 1 medium issue that has been fixed accordingly.

3.2 Bug Bounty Program

There is currently no active bug bounty. The team mentioned they are discussing with ImmuneFi and intend to launch one shortly.

3.3 Price Feed Risk

Resolv uses a Proof-of-Reserves (PoR) oracle (UsrPriceStorage contract) as part of its core system architecture for its redemption process. A USR/USD Chainlink market price feed is also available, with a 1% deviation threshold and a 24-hour heartbeat. The PoR oracle provides the most accurate representation of USR’s underlying reserves, making its available aggregatorV3interface suitable for Aave integration purposes.

During USR redemptions, the protocol’s pricing mechanism determines redemption values. The redemption contract calls getRedeemPrice to obtain the Chainlink USDC price and multiplies it by the current USR token price from getUSRPrice. This USR price is calculated in UsrPriceStorage through the setReserves function, updated daily by a privileged SERVICE_ROLE based on token supply and available reserves.

The pricing logic implements a Proof-of-Reserves mechanism. When reserves are fully backed, it maintains a 1:1 price ratio. Under undercollateralization, it scales the price proportionally (price = reserves * 1e18 / usrSupply). The USDC market oracle integration ensures dollar-denominated redemption values, providing more USDC per USR when the market price drops below $1 through a time-dependent pricing formula.

Following price determination, the system burns the redeemed USR tokens and transfers withdrawal tokens after applying redemption fees. It checks treasury reserves (treasuryWithdrawalTokenBalance) and can utilize Aave borrowing (treasury.aaveBorrow) to maintain liquidity during high redemption volumes. As the SERVICE_ROLE updates the PoR oracle and executes redemptions, the system accurately reflects the current collateralization status throughout the redemption process.

3.4 Dependency Risk

The USR contract incorporates several technical dependencies:

- ERC-20 standard for implementation of standard token functions (transfer, balanceOf, and totalSupply)

- EIP-2612 / EIP-712 Extensions to support permit-based approvals via off-chain signatures and enable gas-efficient, flexible transaction authorization

- OpenZeppelin Role-Based Access Control (RBAC) defines roles to restrict access to sensitive functions like minting and burning

- The use of Initializable from OpenZeppelin’s upgradeable contracts

Resolv utilizes external bridging through Stargate to ensure the presence of USR and RLP on Base.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

Governance has not yet been launched, and the TGE will be announced later. The governance token, $RESOLV, is envisioned to provide holders with voting power for governance proposals, allocation of treasury tokens, and other features oriented toward protocol growth.

ToS Overview

Resolv Terms of Service set out clear requirements for accessing website services. These Terms govern the relationship between any user of the Resolv protocol and its associated frontend web application hosted at https://app.resolv.xyz. Users must not be classified as “Prohibited Persons”, which includes ineligible U.S. Persons, the Government of Venezuela, citizens, residents, governments, or officials of Prohibited Jurisdictions (Cuba, North Korea, Iran, Syria, Crimea, Donetsk, Luhansk, Kherson, and Zaporizhzhia regions of Ukraine), persons on any Sanctions List or considered Sanctioned Persons.

Resolv Digital Assets Ltd. (RDAL) is the issuer of USR and holds full authority over the use, purchase, sale, and redemption of Resolv Tokens and the Resolv Protocol itself.

Under the Terms, RDAL retains exclusive control and absolute discretion over the composition of the Resolv Collateral Pool, which secures the value of Resolv Tokens. RDAL reserves the right to postpone the redemption or withdrawal of a Resolv Token when faced with illiquidity, unavailability, or the loss of any assets that form part of the Resolv Collateral Pool. In such circumstances, RDAL may redeem USR or RLP by transferring in-kind assets from the Resolv Collateral Pool. Direct purchases and redemptions of tokens with the issuer are restricted to verified customers.

The Terms are governed by the British Virgin Islands (BVI) laws. All disputes arising from using the protocol services or the Terms are subject to the exclusive jurisdiction of the BVI courts.

Legal Structure

Resolv Labs Ltd is the entity that interacts with users regarding both access to and use of the website and protocol services. It is registered in the British Virgin Islands (BVI) under company number 2127832, although further specifics concerning its formation date and ownership structure remain unavailable to the public. The same lack of publicly accessible details applies to the Resolv Digital Assets Ltd issuer.

The team obtained a Legal and Regulatory Memorandum under the laws of the British Virgin Islands, which evaluates the nature of Resolv Tokens and the overall functionality of the protocol. Due to confidentiality constraints, the memorandum’s findings cannot be fully disclosed. Still, the analysis confirms several critical points: first, the token does not constitute an “investment activity” under the Securities and Investment Business Act (SIB Act), meaning the issuer should not be required to register with or obtain a license from the British Virgin Islands Financial Services Commission under that statute; second, the issuer is not mandated to get registration or licensure under the Virtual Asset Service Provider (VASP) Act; and third, the issuer similarly faces no registration or licensure obligation for engaging in “financing business” or “money services business” within the jurisdiction of the BVI Financial Services Commission.

Under specific eligibility requirements, U.S. customers may only access the USR token if they qualify as Accredited Investors under Rule 501(a) of Regulation D under the U.S. Securities Act. Resolv’s team has reportedly engaged specialized legal advisors to handle the complexities of admitting U.S. participants, and their conclusions will be delivered in writing for LLR assessment.

Custody

Ceffu is the custodian for Binance operations, maintaining an omnibus account for client collateral with daily (24-hour) margin settlements on Binance. One key legal concern in using omnibus accounts is the risk that client assets could inadvertently become commingled, potentially leading to legal uncertainties. In this case, Ceffu employs an English law trust structure to ensure client assets remain entirely separate from the custodian’s equity or liabilities.

Ceffu operates under CH Europe Digital Solution sp. z o.o., a company registered in Warsaw, Poland. It is listed in the Register of Activities in the Field of Virtual Currencies under the number RDWW-749. Terms of Use stipulated that custodial services of virtual assets provided by Ceffu are not subject to financial services licenses, and the company is not authorized as a financial institution providing licensed financial services. It remains to be seen how the European arm of Ceffu will comply with the much stricter requirements of MiCA. In March 2023, reports indicated that Ceffu planned to apply for a Capital Markets Service license from the Monetary Authority of Singapore (MAS), which application cannot be confirmed as of the date of this report.

Fireblocks serves as the custodian for Deribit, where Resolv utilizes a segregated Multi-Party Computation (MPC) smart contract to manage daily settlements of margin and unrealized profit-and-loss calculations. Fireblocks holds several state-level Money Transmitter Licenses across the United States. A third-party disaster recovery provider stands ready to facilitate on-chain asset retrieval should the custodian experience significant disruption, preserving the integrity and accessibility of client holdings.

Whitelisting

Whitelisting protocols govern direct issuance and redemption by requiring that any wallet address first be added to an on-chain allowlist. These addresses are added only after the successful completion of KYC/KYB procedures, which remain available to corporate entities and individuals not situated in or associated with restricted jurisdictions. The team has self-reported approximately two hundred addresses on the allowlist. As part of the project’s anti-money laundering measures, Resolv has engaged a third-party provider - Synaps, alongside a dedicated Money Laundering Reporting Officer from Provenance. Elliptic provides KYT screening of wallet addresses.

At the time of writing, 25 different addresses are set as whitelisted entities, as specified in the whitelist contract.

4.2 Access Control Risk

4.2.1 Contract Modification Options

Contracts employ an upgradable proxy pattern, allowing modifications through RBAC. The proxies are owned by a 3/5 GnosisSafe multi-sig. The structure and management of roles are inherited from the AccessControl framework. Only accounts with specific roles can execute contract modifications. The initializer sets the default admin role to the deployer (via msg.sender). Default admin delay (timelock) is also explicitly set by the contract owner during initialization. After deployment, the default admin can assign or revoke the SERVICE_ROLE.

DEFAULT_ADMIN_ROLE is the highest-level administrative role that can grant and revoke roles, has full control over sensitive contract functions and modificationsSERVICE_ROLE holders grant permission to call mint and burn functions

USR Requests Manager

USR Requests Manager contract is used to perform USR token minting and redemptions. These processes are not atomic, as they involve off-chain redemption servicing.

- Requests are initiated via

requestMint and requestBurn functions and settled correspondingly via completeMint and completeBurn functions. Completion functions can only be executed by the SERVICE_ROLE.

DEFAULT_ADMIN_ROLE controls whitelist and access management via setProvidersWhitelist and setWhitelistEnabled functions, sets the treasury address and allowed tokens. This role can also execute emergency procedures: pause the contract, withdraw all tokens in case of emergency, and change the pointer to the UsrRedemptionExtension contract.

USR Redemption Extension

USR Redemption Extension contract facilitates the redemption of USR tokens into specified withdrawal tokens while enforcing certain limits, fees, and governance permissions. It integrates with key components such as a treasury, price oracles, and a price storage mechanism.

The redeem function checks if the redemption limit has reset, updating lastResetTime and resetting currentRedemptionUsage if necessary. The function validates that the requested redemption amount does not exceed the daily limit and then burns the corresponding USR tokens from the sender’s balance. Next, it retrieves the redemption price from the oracle and calculates the equivalent withdrawal token amount, adjusting for differences in token decimals and applying the redemption fee (configurable up to 10%). If the treasury lacks sufficient balance, it borrows the missing amount via Aave before increasing the contract’s allowance.

DEFAULT_ADMIN_ROLE can pause and unpause the contract, modify redemption parameters (fees, limits, treasury, oracle), and manage allowed withdrawal tokens.SERVICE_ROLE executes redemptions.

The daily redemption limit is 1M USR, and the redemption fee is 5 bps (0.05%).

Whitelist

Whitelist contract is owned by the same 3/5 GnosisSafe multi-sig and manages the whitelist of minters. Owner can add or remove addresses from the whitelist. Currently, there are 25 whitelisted addresses.

Treasury

Treasury contract serves as a central entity for managing various financial operations, including transfers, deposits, withdrawals, and allowances for ERC20 tokens and ETH. The contract integrates with Lido, Aave, and Dinero through specific connectors, enabling interaction with these protocols. There are enforced limits on maximum amounts for each borrowing, supplying, and redemption operation. The permission structure revolves around two main roles:

- The

DEFAULT_ADMIN_ROLE role is capable of setting operation limits, managing whitelists, pausing or unpausing the contract, and updating protocol connectors.

SERVICE_ROLE enables the execution of financial operations, including transfers, deposits, withdrawals, and borrowing, but within the constraints set by the admin.

Reward Distributor

Reward Distributor contract is designed to handle the distribution of staking rewards between stUSR stakers and a designated fee collector. The fee collector address is currently pointing to a separate SafeProxy

DEFAULT_ADMIN_ROLE can update the feeCollectorAddress and pause/unpause the contract.SERVICE_ROLE can call the distribute function to allocate staking rewards.

4.2.2 Timelock Duration and Function

The AccessControlDefaultAdminRulesUpgradeable extension provides the timelock mechanism for the proxies. It defines the delay period (currently set to 1 day) that must elapse before certain sensitive administrative actions (like role changes or upgrades) can be executed.

4.2.3 Multisig Threshold / Signer identity

The DEFAULT_ADMIN and proxy owner is a GnosisSafe with 3/5 threshold and the following signers:

- 0x17645fbBF4C858Eb49F4939d4874764097F05F0A

- 0xe84B20A7590C51bB4aA913F29407254A4D817C77

- 0x5bfeEe5e8105C7Ca7F78B08C61C25842656bDa18

- 0x21bDFE7265a702D7f462B46c00a0fB39B39B9972

- 0x8F96b74058a5Df5921835DeAdE88cb76b61E0C50

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and available here.

Resolv’s Proof-of-Reserves (PoR) oracle accurately represents USR’s underlying reserves, making it suitable for Aave integration purposes. This PoR feed is preferable to market rate pricing, which could introduce problematic short-term volatility for eMode borrowing.

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.