Overview

Chaos Labs supports listing XAUt on Aave’s Ethereum Core instance. Below is our analysis and initial risk parameter recommendations.

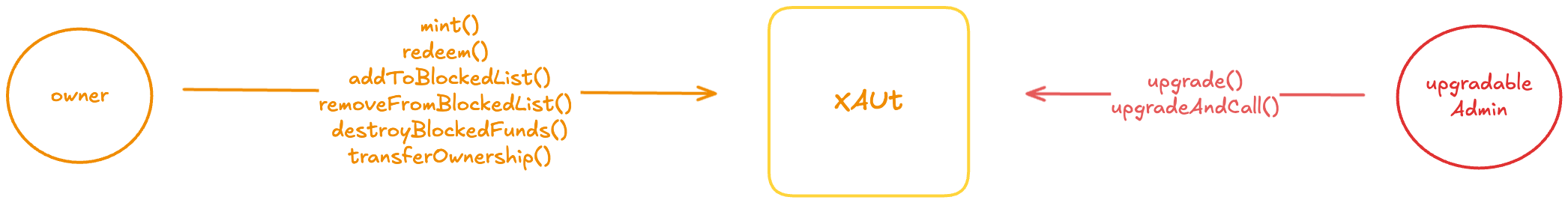

Technical Overview

XAUt, or Tether Gold Token, is a digital asset issued by TG Commodities S.A. de C.V., representing ownership of one fine troy ounce of physical gold per token. Each XAUt is fully backed by a uniquely identifiable gold bullion bar stored in a Swiss vault and meeting “London Good Delivery” standards set by the LBMA. Users verified through Tether Gold’s KYC process can purchase or redeem tokens via the primary market on Tether’s platform, with redemptions requiring full gold bar denominations.

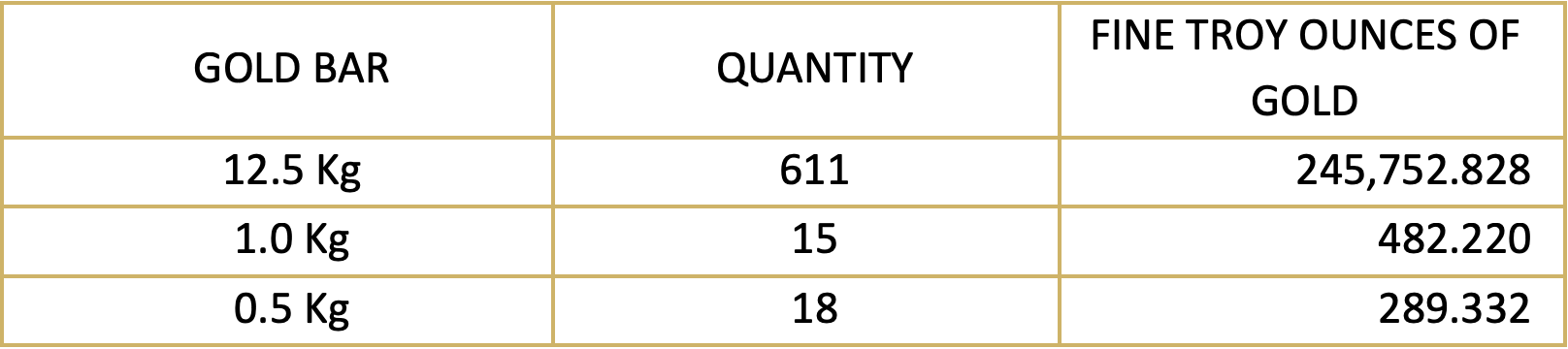

A complete reserve report has been carried out by BDO Italia S.p.A., an independent member of the global BDO network and a licensed statutory audit firm in Italy. From the reserve report, we observe that the total gold held in reserve amounted to 246,524.380 fine troy ounces, while the XAUt tokens in circulation were 246,524.330000 XAUt, demonstrating a strict 1:1 asset backing with a marginal surplus of physical gold. This affirms that each token is fully collateralized by a corresponding fine troy ounce of gold securely vaulted. The market value of the reserves, as of 31 March 2025, was reported at $770,036,001, based on a valuation of USD 3,123.57 per ounce. The gold inventory, consisting of 644 bars, majorly 12.5 kg bars (611 units), is stored in Swiss vaults and conforms to the London Good Delivery standards set by the LBMA. Importantly, the inventory is not recognized as an asset of Tether, but rather constitutes the legally segregated property of XAUt token holders, thereby forming the physical foundation for all outstanding tokens.

Reserve Inventory Breakdown

Only users who complete the required KYC verification process are eligible to mint new XAUt tokens through the Primary Market, which operates via the Tether Gold Website. Tokens can only be minted after TG Commodities confirms that a corresponding quantity of physical gold has been deposited with the custodian and passed intake procedures. The minimum minting amount is 50 XAUt. A non-refundable verification fee of $150 is charged during the onboarding process; however, this fee is credited back upon successful KYC approval and can be applied toward future redemptions. There are no ongoing storage or custody fees. Redemptions are only allowed in full gold bar increments. Alternatively, KYC Verified Customers may opt for TG Commodities to sell the redeemed gold on their behalf in the Swiss market and receive fiat proceeds. Tether Gold does not support redemption or physical delivery for Secondary Market holders.

Legal Structure

XAUt are issued by TG Commodities, S.A. de C.V., a company incorporated and operating under the Laws of El Salvador. TG Commodities is a registered Stablecoin Issuer and Digital Assets Service Provider (DASP), duly authorized by El Salvador’s National Commission of Digital Assets (CNAD) with registration number PSAD–0032. The company is wholly owned by Tether Holdings, S.A. de C.V., and Tether Operations, S.A. de C.V., both incorporated in El Salvador. TG Commodities is a member of the Tether Group. The physical gold backing XAUt is vaulted in Switzerland and held by an affiliated but legally separate Swiss custodian, which operates independently of the Tether Group and maintains distinct financial accounts, personnel, and customer records. This structure ensures that the Gold Reserves are legally segregated assets owned by the token holders, not the issuer, and are not available to satisfy Tether’s own liabilities.

TG Commodities Legal Structure

TG Commodities’ issuance of XAUt is formally governed by El Salvador’s Law for the Issuance of Digital Assets and the Regulations on Public Offerings of Stablecoins, under which XAUt qualifies as a regulated stablecoin backed by an international reserve asset. Pursuant to Article 5 of the Stablecoin Regulations, TG Commodities submitted a complete Relevant Information Document (RID) and was granted authorization to issue stablecoins following the CNAD’s Resolution of No Objection. The RID discloses TG Commodities’ legal structure, shareholding, governance, minting/redemption rules, and physical gold inventory processes, in compliance with documentary requirements enumerated in the public-offering regime.

Market Cap & Liquidity

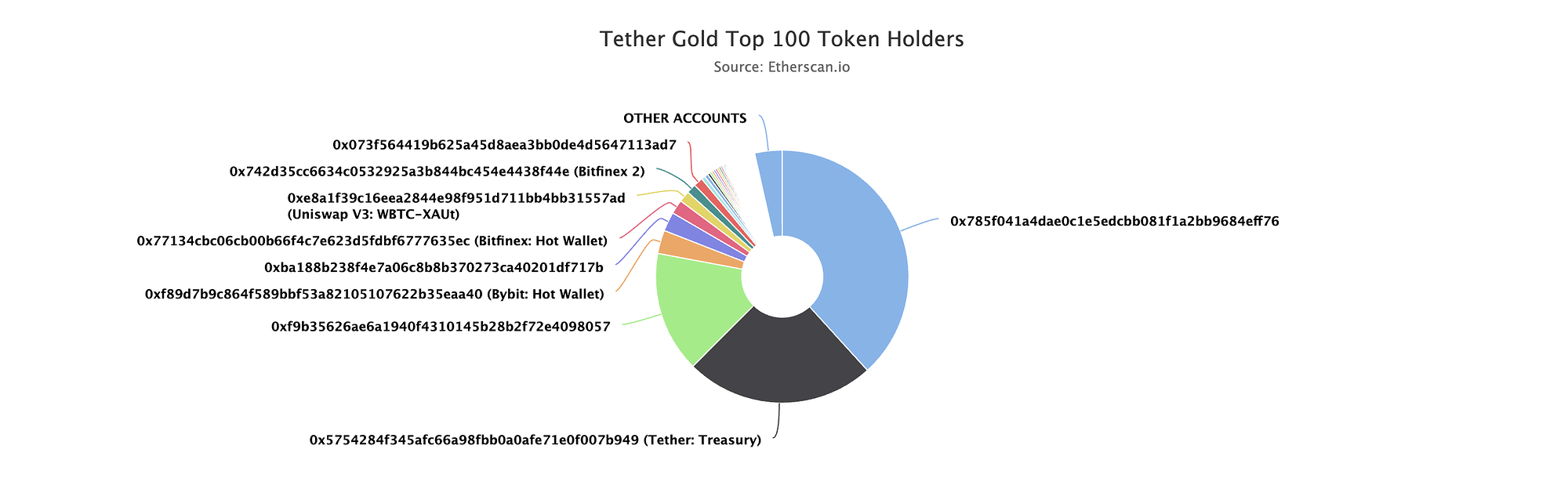

A total of 246,524.33 XAUt has been minted to date, resulting in a market cap of $822.55M. Of this amount, 186,879.51 XAUt is currently in circulation, distributed across 8,204 holders. The remaining 59,644.82 XAUt is held by Tether and remains in a ready-to-sell state.

XAUt Top Holder

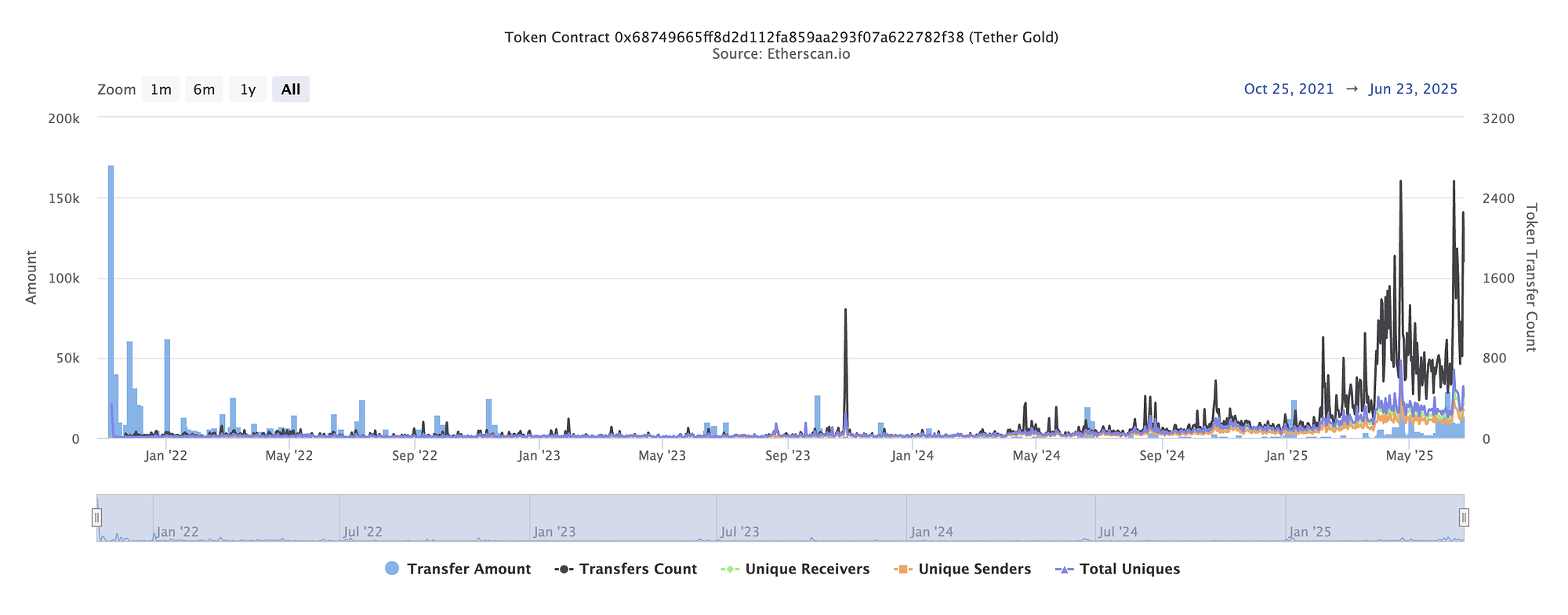

XAUt has shown strong on-chain activity over the past six months, particularly in the past month, during which the average daily transfer amount exceeded 5K.

XAUt On-Chain Activity

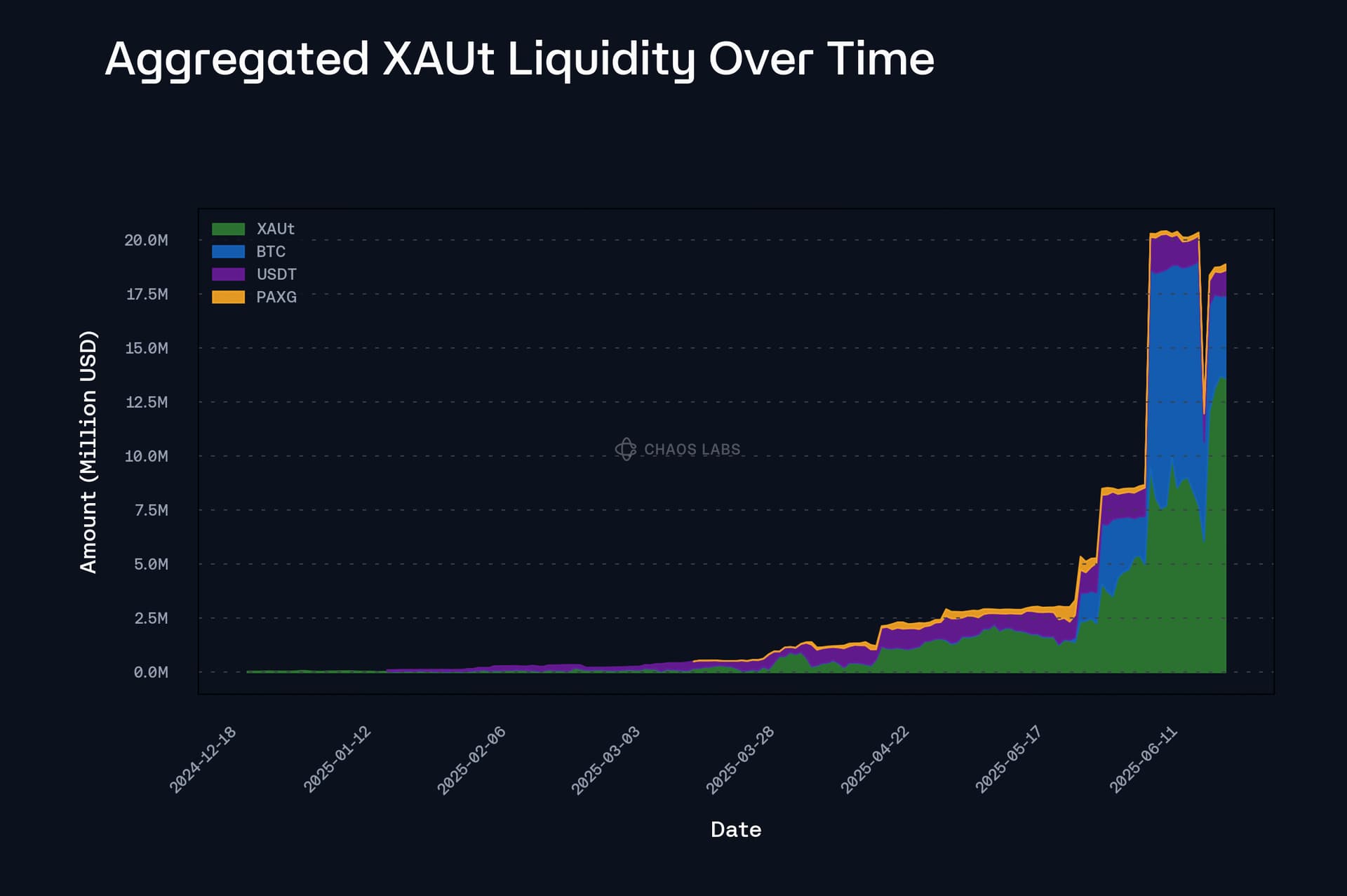

XAUt’s onchain liquidity is primarily supported by three key pools. The largest is the WBTC/XAUt pool on Uniswap V3, with a TVL of $16.8M, followed by the XAUt/USDT pool, which holds $2.4M. In addition, there is a Curve pool for XAUt/PAXG with $1.27M in TVL.

In addition, we observed that the liquidity in the current two uniswap pools has only recently seen a significant increase, whereas prior to that, both maintained relatively low volumes. Upon further analysis, we found that before early 2025, some of the XAUt trading activity took place in a separate XAUt/USDT Uniswap V3 pool with a 0.05% fee tier. Below, we present the aggregated XAUt liquidity across these four pools over time.

Volatility

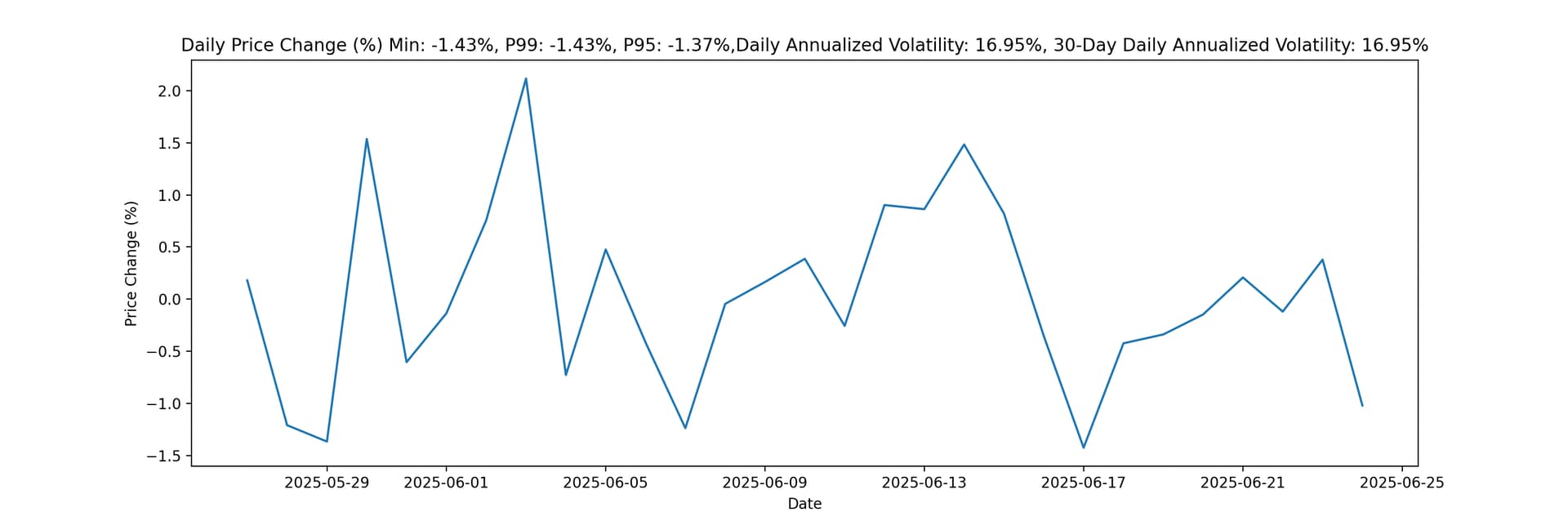

XAUt’s volatility is tightly correlated with the price of gold. In the past 30 days, XAUt exhibited a moderate uptick in volatility, reaching a daily annualized level of 16.95%.

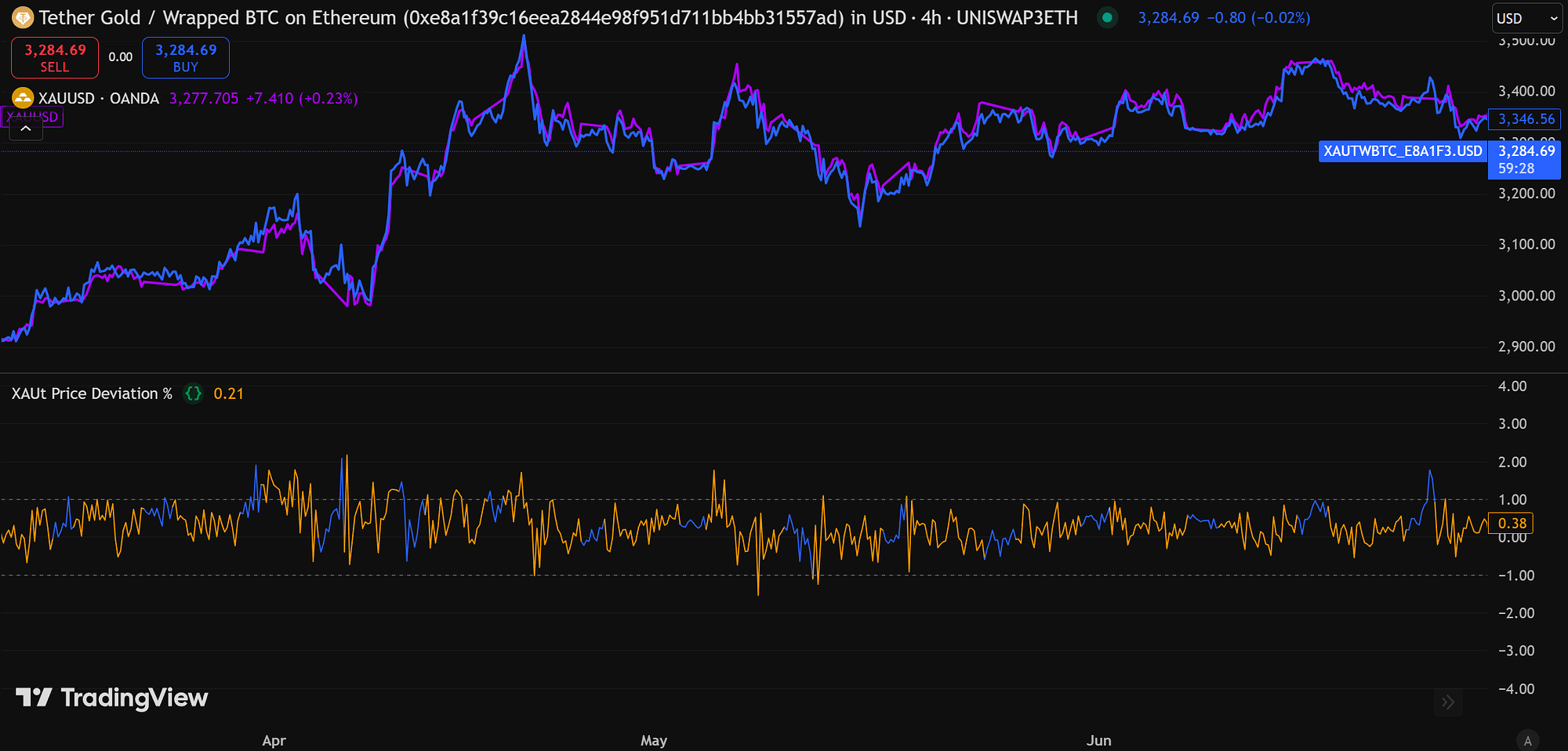

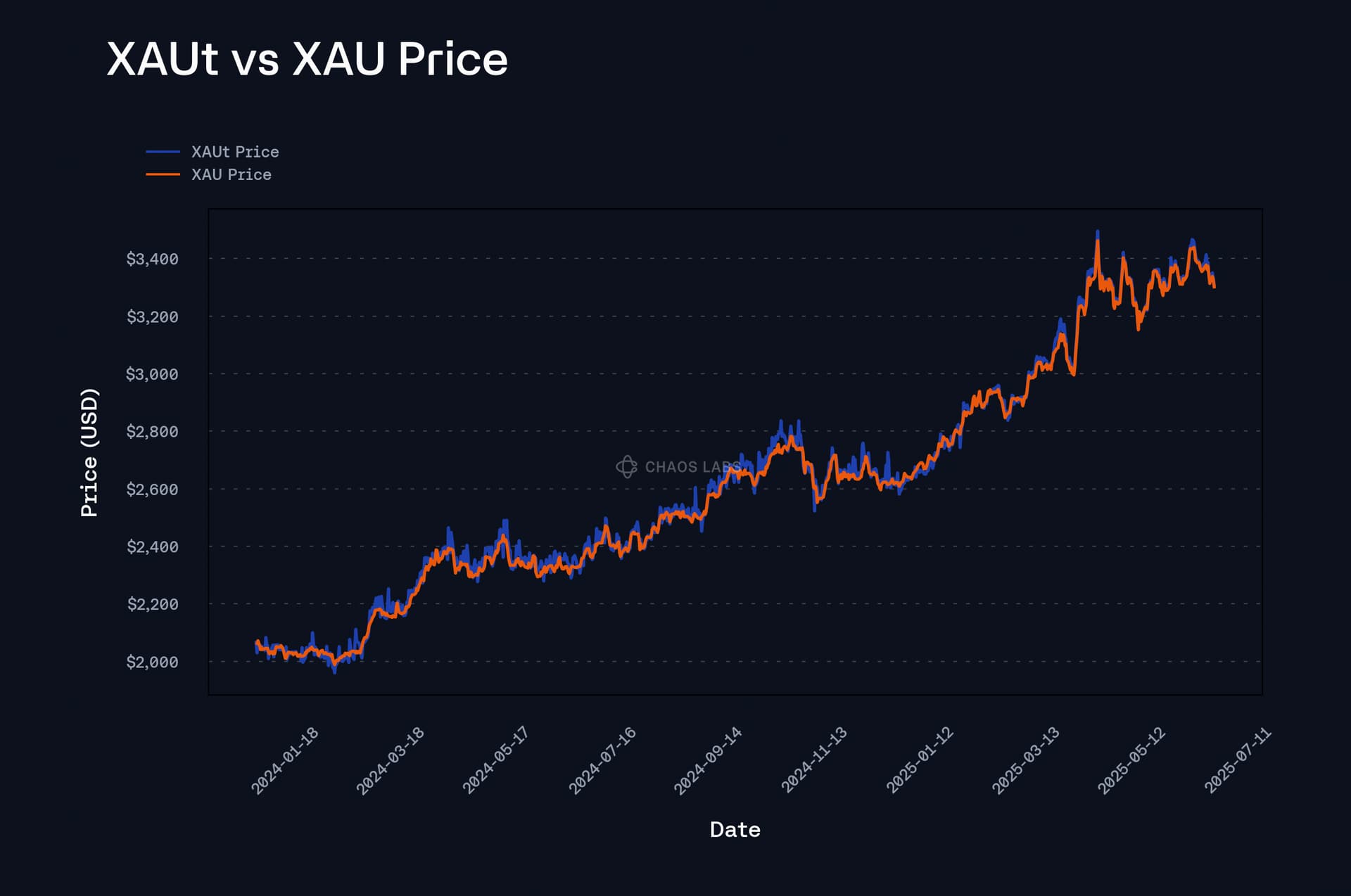

Below is the historical price comparison between XAUt and XAU. The price of XAUt is derived from transaction data in the XAUt/USDT Uniswap liquidity pool, while the XAU price is sourced from the XAU Chainlink oracle. As shown in the chart, XAUt has generally tracked the market price of gold closely over the past year, in line with its one to one physical gold backing model. Nonetheless, occasional price dislocations have been observed.

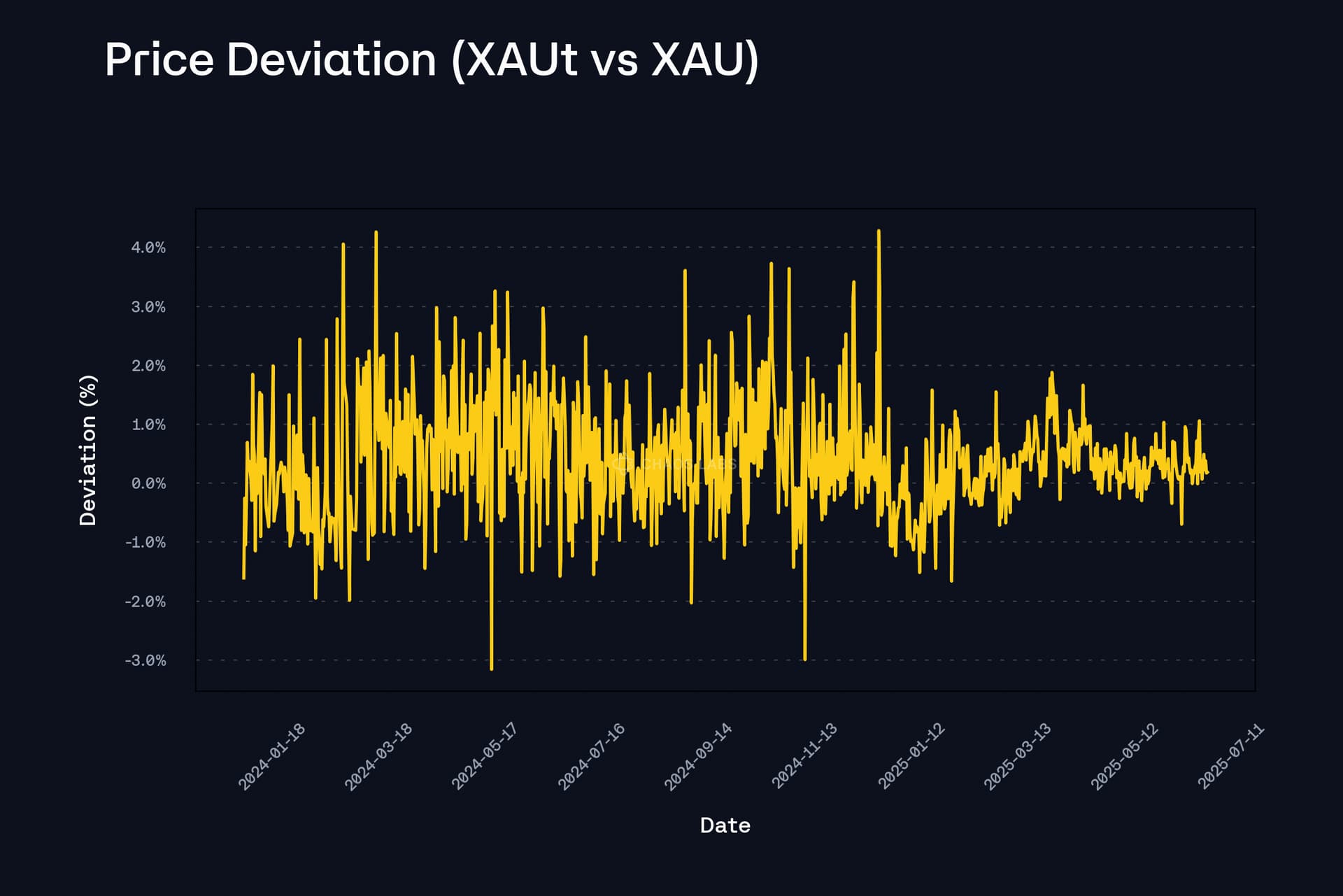

These deviations are primarily driven by the structural difference between XAUt’s continuous trading on crypto exchanges and the limited operating hours of traditional gold markets. While physical gold does not trade on weekends, XAUt remains fully tradable around the clock. This mismatch can lead to temporary price gaps during off-market hours, when no real-time benchmark is available from the gold market. During such periods, XAUt may diverge from the spot price of gold, with the peg typically re-aligning once traditional markets reopen. As shown below, the largest recorded deviation we observed reached approximately 4.5%.

Another contributing factor to the observed deviations between the XAUt trading price in the Uniswap pool and the XAU Chainlink oracle is the historically low liquidity in the XAUt/USDT pools prior to 2025. In low-liquidity environments, even modest trades can result in price slippage, making arbitrage less profitable or even unviable after accounting for transaction costs. As a result, when temporary dislocations between XAUt and the underlying gold price occurred, there was limited incentive for arbitrageurs to correct the spread. However, as onchain liquidity for XAUt improved, especially after January 2025, we observed that the price deviations gradually became smaller.

LTV, Liquidation Threshold, and Liquidation Bonus

Although XAUt’s reserve structure ensures a 1:1 physical gold backing, which underpins its fundamental stability, the observed volatility, particularly during off-market hours, warrants a conservative risk parameter configuration. Specifically, we recommend setting the Liquidation Bonus at 6%, the LTV ratio at 70%, and the LT at 75%.

Supply Cap and Borrow Cap

Given XAUt’s current robust on-chain liquidity, alongside its significant liquidity on centralized exchanges, assigning a relatively high supply cap is reasonable. However, since the surge in on-chain liquidity has occurred only within the past month, leaving limited historical data, we recommend setting an initial supply cap of 5,000 XAUt. Chaos Labs will continue to monitor market conditions and user behavior to adjust the supply cap as needed in real time.

Based on our historical observations, XAUt, being a volatile asset, is most likely to be borrowed for shorting purposes. Therefore, we do not recommend enabling it as a borrowable asset at this time.

Oracle

We recommend utilizing the XAU oracle to price XAUt. Unlike physical gold, which trades during standard market hours, XAUt remains tradable 24/7. This structural difference often leads to price dislocations, particularly during weekends when gold markets are closed but XAUt continues to trade.

Using the XAU oracle also introduces safety properties for lending protocols. During upside deviations, where XAUt trades above the last published gold price, the oracle limits user borrowing capacity by anchoring to a more conservative value, effectively imposing a lower LTV ratio over the weekend. On the downside, significant divergence would require an abrupt and sustained decline in gold price, a historically rare event. Even in those cases, price reversion at market open typically restores the peg before any protocol-level risk is realized.

Isolation Mode and Debt Ceiling

Chaos Labs also recommends listing the asset in Isolation mode to prevent it from being used as collateral to borrow volatile assets. Significant price movements in the borrowed assets, combined with potential deviations between XAUt and XAU during off-market hours, could increase the risk of bad debt.

CAPO

We recommend using the XAU/USD oracle as the primary pricing source for XAUt. However, in anticipation of the future availability of a dedicated XAUt oracle alongside significant observed growth in the underlying asset, we may propose a stable CAPO adapter configuration that ensures XAUt pricing remains within a reasonable range anchored to the underlying gold market. The purpose of this CAPO is to safeguard against oracle returns that could deviate significantly to the upside from the spot price of gold during market hours, which may distort market behavior and lead to mispriced collateral values. Simultaneously, this structure would inherit any underlying exposure in the event of an adverse scenario occurring to Tether, akin to USDT. However, this previously described CAPO setup can introduce risks of downside price manipulation without the presence of sufficiently deep liquidity; for this reason, we recommend analysing the risks of this configuration in depth before its adoption.

Specification

Following the above analysis, we recommend the following parameter settings:

| Parameter |

Value |

| Asset |

XAUt |

| Isolation Mode |

Yes |

| Borrowable |

No |

| Collateral Enabled |

Yes |

| Supply Cap |

5,000 |

| Borrow Cap |

- |

| Debt Ceiling |

$3,000,000 |

| LTV |

70% |

| LT |

75% |

| Liquidation Penalty |

6% |

| Liquidation Protocol Fee |

10% |

| Variable Base |

- |

| Variable Slope1 |

- |

| Variable Slope2 |

- |

| Uoptimal |

- |

| Reserve Factor |

- |

| Stable Borrowing |

Disabled |

| Flashloanable |

Yes |

| Siloed Borrowing |

No |

| Borrowable in Isolation |

No |

| E-Mode Category |

N/A |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0