Stablecoin IR Curve Monthly: 2024-01-01 through 2024-01-31

Summary

Gauntlet would like to provide the community with an update on stablecoin IR curve over the previous month. Gauntlet is continuing to monitor rates. At this time, we do not recommend any parameter updates, but will keep the community informed.

Motivation

Following previous recommendation of increasing stablecoin Slope1 to 6% across Aave V2 and V3 deployments, we continue to witness high utilization of stablecoin assets and volatile borrow rates across Aave markets. However, with variable borrow rates sliding recently, we recommend keeping current Slope1 parameters before taking further actions.

Assessment

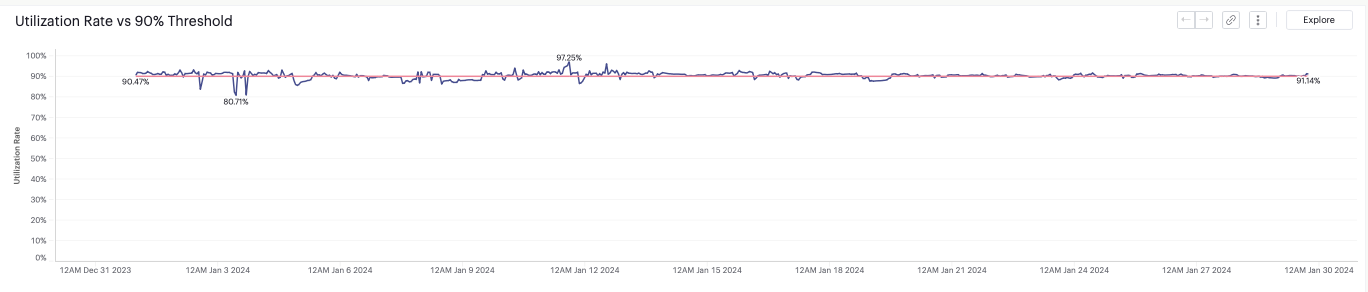

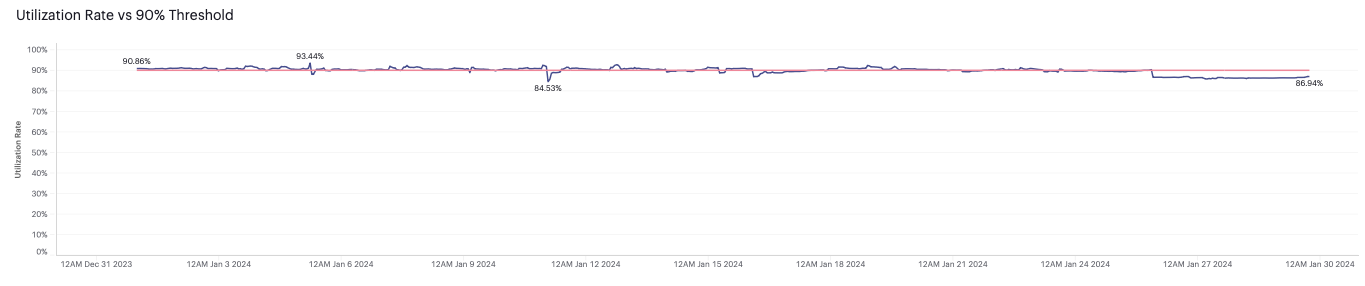

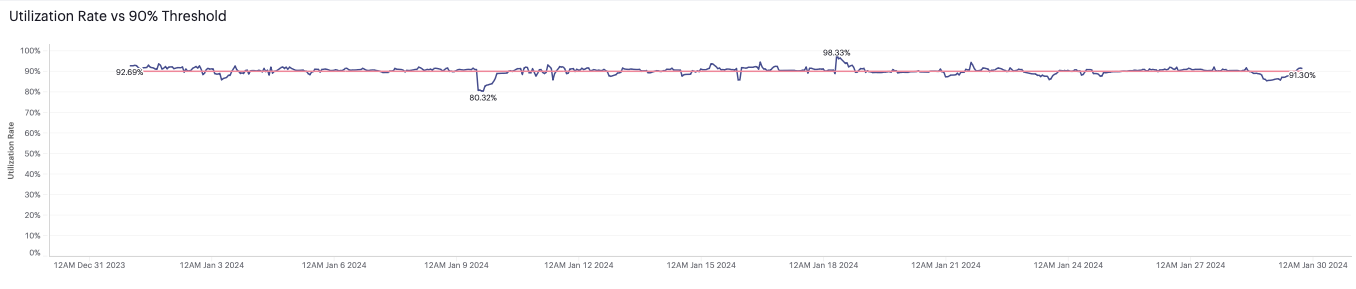

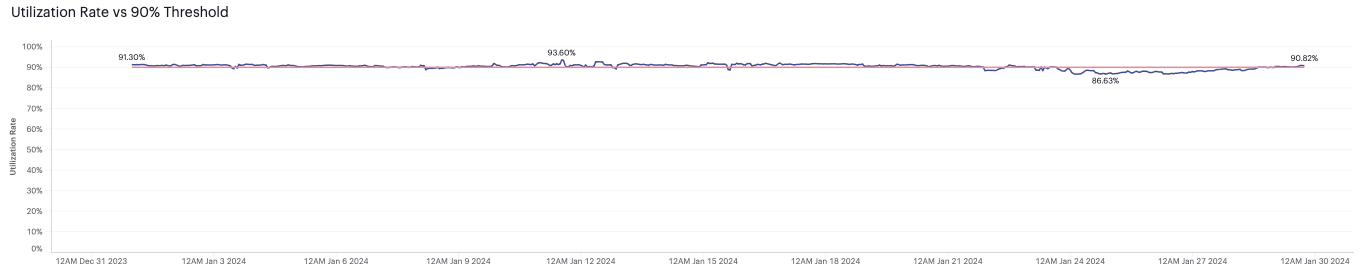

High Utilization Rate

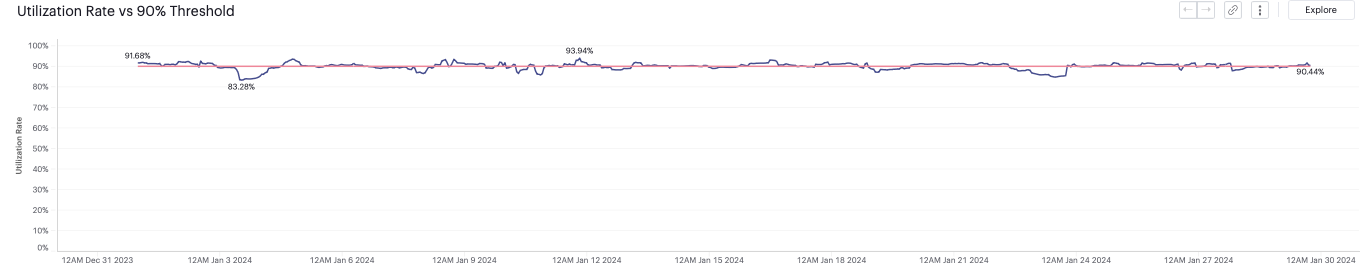

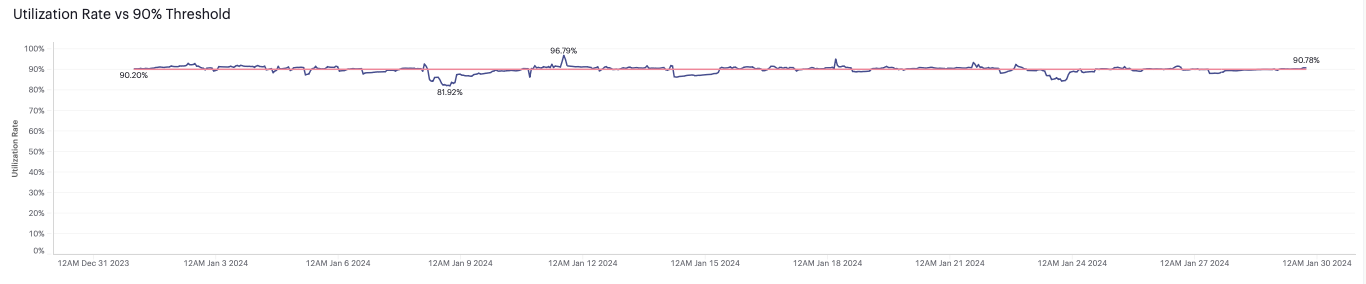

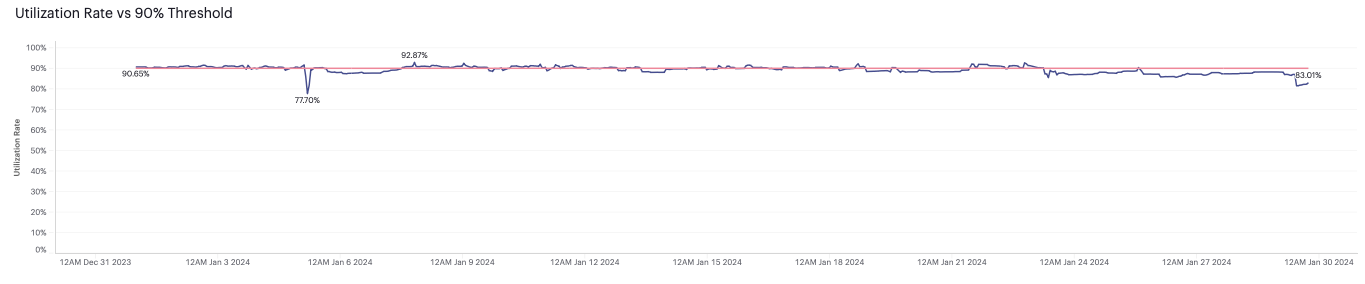

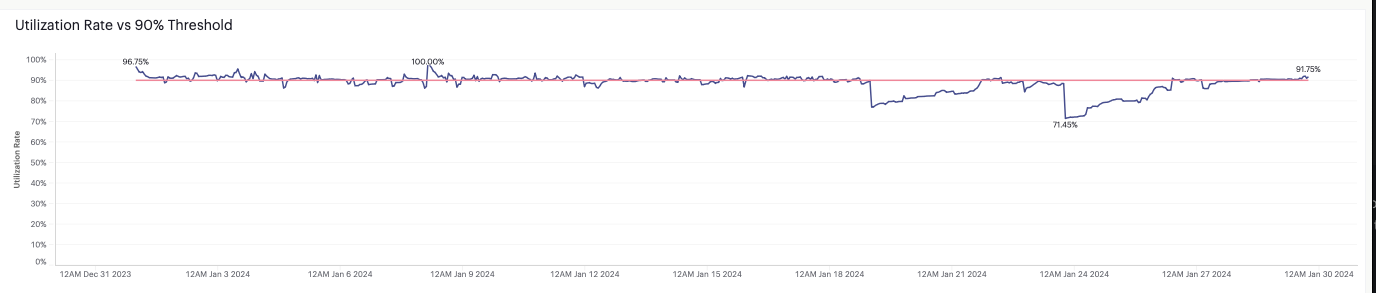

Stablecoin borrowing demand remains high and utilization has remained at Uopt after AIP-3. For USDC, USDT and other stablecoin utilization rates on other markets, please find them on Gauntlet Risk Dashboard.

Native USDC

Polygon

Ethereum

Optimisim

Bridged USDC

Polygon

Optimisim

USDT

Polygon

Ethereum

Optimisim

Variable Borrow Rates

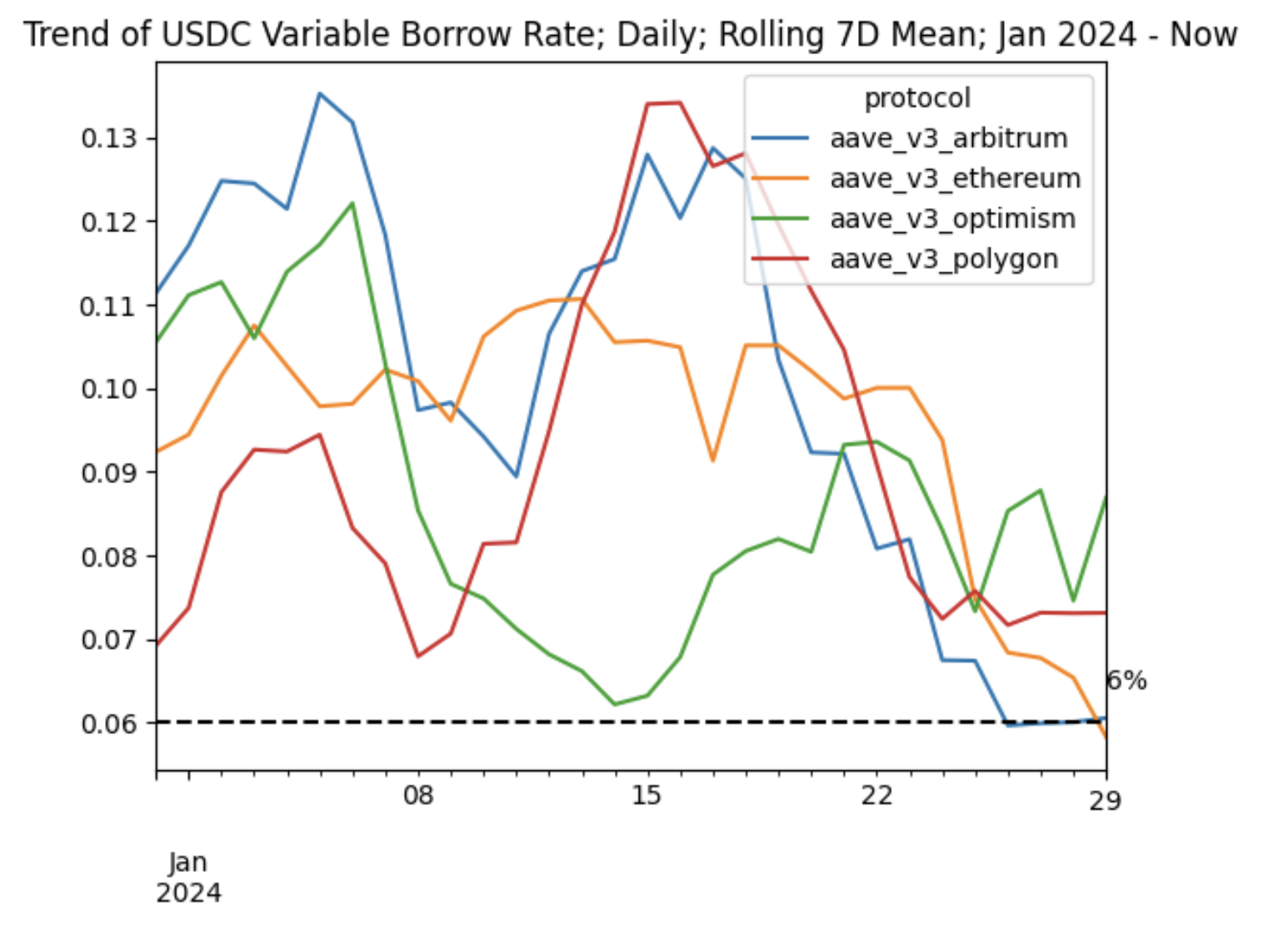

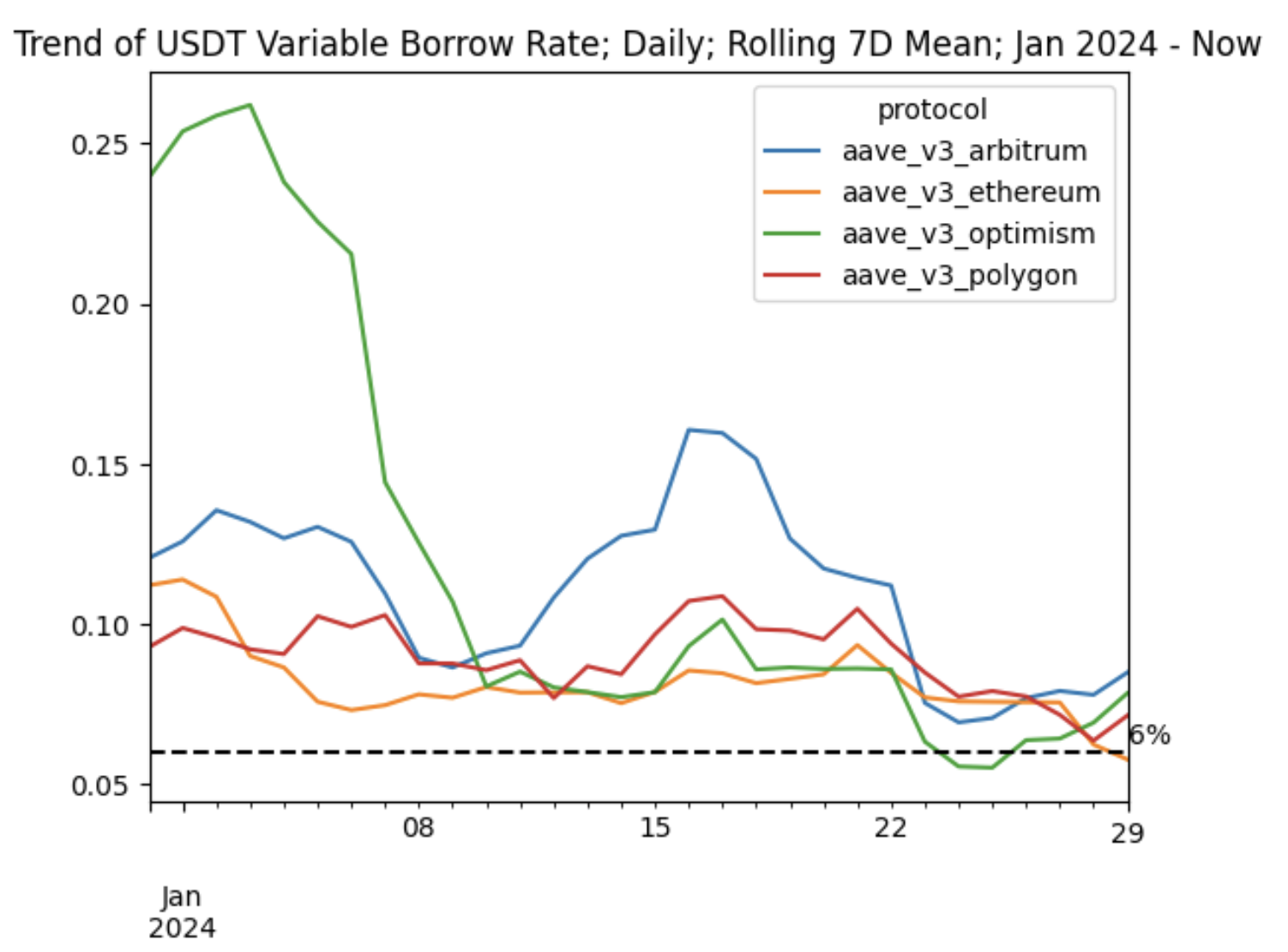

Below shows the trend of USDC and USDT variable borrow rate over time, averaged over a 7-day rolling period, starting from Jan 2024 to the current. Rates have been dropping since Mid Jan.

TradFi Rates

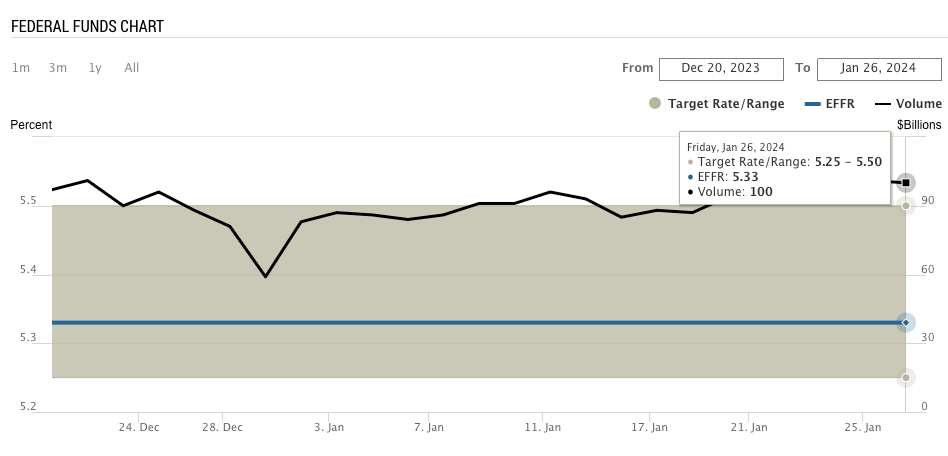

Risk-free Rate - Fed Fund Effective Rate: The current FFE rate remains at 5.33%.

The Federal Funds Effective Rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. Federal Funds Effective Rate is often considered “risk-free”

Source: newyorkfed.org

FFER Roadmap

The Federal Reserve kicked off the year in neutral, opting to keep interest rates unchanged at a meeting of its policy-setting committee today (Wed, Jan 31 2024), and signaled that cuts are possible but not imminent.