Summary

LlamaRisk supports the onboarding USDG to Aave V3 Ethereum as deposit- and borrow-enabled, non-collateral at launch, conditional to the establishment of a formal bug bounty program. USDG is a fiat-backed non-yield-bearing stablecoin, issued by Paxos entities regulated in Singapore (MAS) and the EU (FIN-FSA, EMI under MiCA), fully reserved in cash and short-dated U.S. government instruments custodied via DBS. Smart-contract code has been audited (Zellic, Trail of Bits, Halborn). A Chainlink USDG/USD oracle is live. Access control is role-based, with a multisig admin supported by proprietary offline HSM infrastructure designed to require multiple authorized signers for every administrative action.

Primary risks are an off-chain holding concentration in one single bank and on-chain liquidity concentrated in two Curve pools. Treasury banking and custody are centered at DBS Bank. Issuance and redemption are KYC-gated via Paxos APIs with stated settlement up to T+5 business days. Attestations are monthly, with the last report dated 29 August 2025. Contracts are upgradeable, and the default admin can reconfigure roles following the 3-hour delay window.

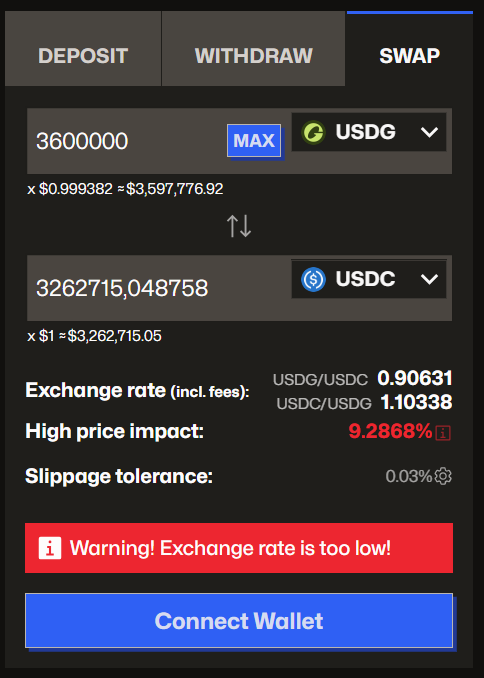

On Ethereum, USDG currently maintains adequate on-chain liquidity, with a combined $14 million distributed across two Curve pools. The USDG/USDC pool holds around $8 million in TVL, while the USDG/USDL pool adds approximately $6 million. Together, these venues provide adequate depth for moderate secondary market activity, with approximately 3.6m USDG that can be swapped for USDC within 9.28% slippage.

1. Asset Fundamental Characteristics

1.1 Asset

Global Dollar (USDG) is a fully regulated, US dollar-pegged stablecoin issued by Paxos Digital Singapore (PDS) under the oversight of the Monetary Authority of Singapore (MAS). Reserves are custodied and cash-managed at DBS Bank with monthly publishing of third-party attestations. The reserve states full 1:1 backing in cash and short-duration U.S. government instruments. Holders do not receive reserve yield, and mint/redeem is KYC-gated via Paxos or approved distributors.

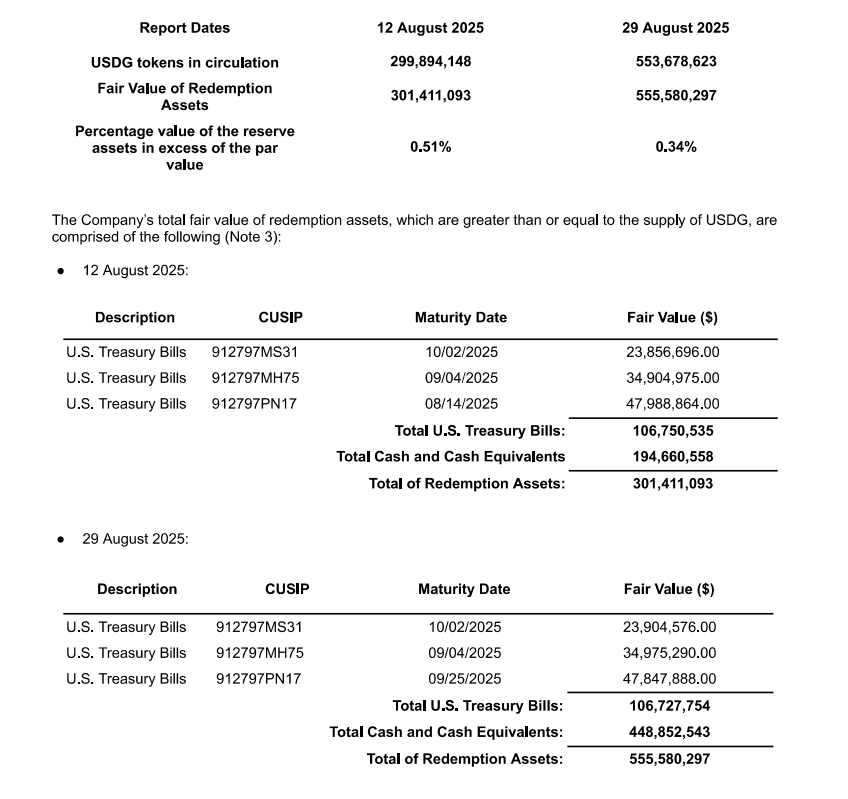

Source:

Paxos report, October 22, 2025

Reserves

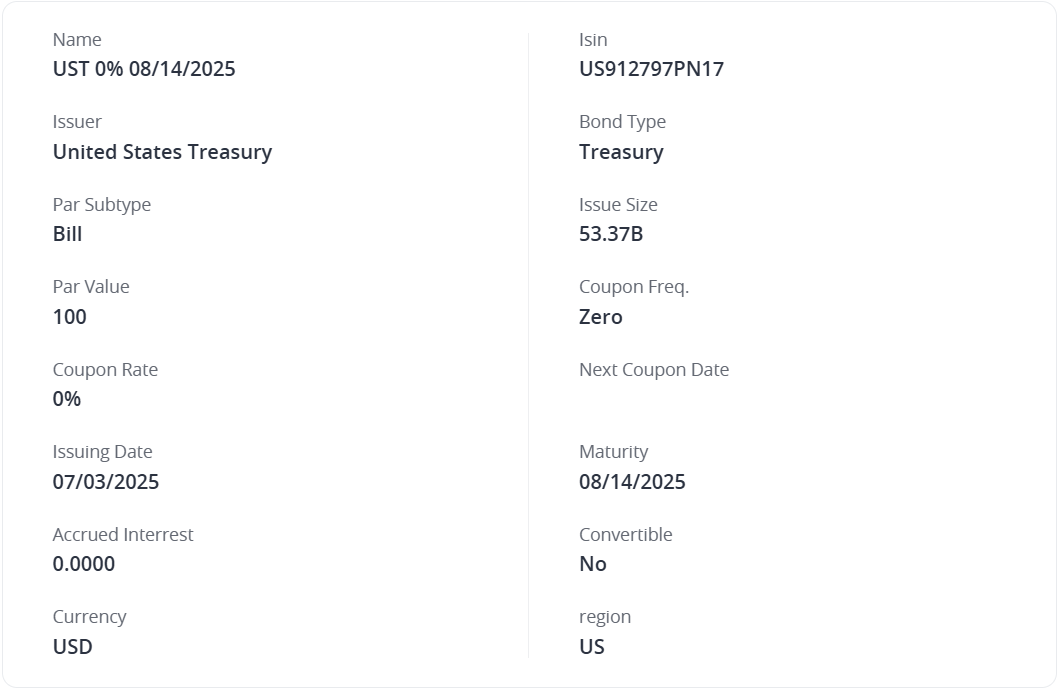

Source:

Webill, October 22, 2025

Source:

Webill, October 22, 2025

Source:

Webill, October 22, 2025

The reserve assets are held in:

(a) Cash in segregated bank deposit accounts is held for the benefit of USDG holders. Any balances held as US dollars are T+0 (immediately) liquid and can be made available to customers on demand, subject to banking hours restrictions, to the extent applicable.

(b) Debt securities with up to three months’ residual maturity. US Government securities (USGs) with three months or less to maturity provide liquidity upon maturity, unless liquidated in advance of maturity via sale through the OTC secondary market.

If market events require additional liquidity, Paxos International can liquidate USGs in the open market for T+0 or T+1 settlement, given the inherent liquidity and depth of the USG market.

(с) Reverse repurchase agreements that are overcollateralized by U.S. government securities are entered into with counterparties that are not Paxos affiliates and are adequately creditworthy (as defined by the MAS credit rating requirements), with final maturities not exceeding one business day. Given the inherent overcollateralization of repo, the soundness of the USG collateral, and the creditworthiness of the counterparties, there is immaterial credit risk in holding balances in repo.

(d) Institutional Stable NAV USD Government Money Market Funds, money market funds (MMFs) composed of direct investments in cash, US Government securities (USGs), and/or overnight repurchase agreements overcollateralized by USGs. MMFs should maintain a weighted average maturity (WAM) of no greater than 60 days and a weighted average life (WAL) of no greater than 120 days.

1.2 Architecture

The USDG architecture works as a mint–burn, chain-native issuance system coordinated by an off-chain control plane:

Deposit

Source:

Paxos docs, October 22, 2025

A participant funds a Paxos account via bank rails exposed through the Fiat Transfers API that works via Wire (Fedwire and SWIFT) and CUBIX networks. After the USD is received in Paxos’ reserve accounts, Paxos programmatically mints USDG and sends it to a pre-registered withdrawal address on the user-selected blockchain.

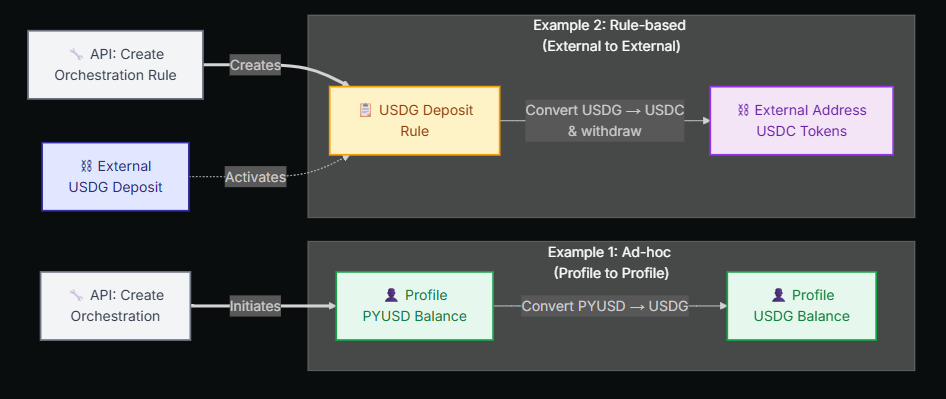

Convert

Source:

Paxos docs, October 22, 2025

Orchestrations in Paxos enable automated or manual conversions between different stablecoins and currencies. Ad-hoc orchestrations are one-time conversions triggered between internal profiles, while rule-based orchestrations automatically convert assets upon external deposits to predefined destinations. The process includes validation, conversion, and delivery, with progress tracked through webhooks or API monitoring.

Redeem

Source:

Paxos docs, October 22, 2025

To redeem, the participant creates a Paxos deposit address for USDG via API call on the relevant chain. Next, initiate a stablecoin transfer from your external address (A in the diagram). If you set conversion_target_asset to USD when creating the address, Paxos automatically credits your USD balance once the on-chain transfer is confirmed (B). The mint/burn is event-driven by fiat movements - burn precedes the release of fiat. Then Create Fiat Withdrawal API is called to retrieve the Paxos banking information and specifies which Profile balance to credit and send USD to (C).

1.3 Tokenomics

USDG reserves determine its maximum supply. New coins can be minted when funds are added, and tokens must be burned when funds are removed in order to preserve USDG’s 1:1 peg to the US dollar. All cash and cash equivalent reserve assets are held in segregated accounts to protect user assets. USDG is available for purchase and fully redeemable from Paxos on a one-to-one basis for US dollars (1 USDG = 1 USD).

All other USDG transactions operate according to the rules of the USDG smart contracts, following the ERC-20 and approved blockchain protocols.

1.3.1 Token Holder Concentration

Source: USDG Top 100 Holders,

Etherscan, October 21, 2025

The top five addresses collectively hold over 60% of the total USDG supply, reflecting a high concentration among a small number of custodial and institutional wallets, including Kraken, Galaxy Digital, and Paxos.

Top five holders of USDG:

2. Market Risk

2.1 Liquidity

On Ethereum, liquidity is concentrated across two major Curve pools. The USDG/USDC pool, launched on 9 September, holds around $8 million in liquidity and reports a daily trading volume of approximately $1.58 million. The second pool, USDG/USDL, adds another $6 million in liquidity, further strengthening on-chain market depth for USDG.

Source:

Curve Finance, October 21, 2025

On Ethereum, a 3.6M USDG/USDC swap quotes about 3.263M USDC out, for an effective price impact around 9.28%. That slippage level indicates limited on-chain depth for this route at that size, while still showing high sensitivity to execution timing.

2.1.1 Liquidity Venue Concentration

Source: USDG Pools,

DEXScreener, October 21, 2025

On-chain liquidity is concentrated on Ethereum, split mainly between two Curve pools: the USDG/USDC pool with around $8 million in liquidity and the USDG/USDL pool holding roughly $6 million. Together, they account for nearly all on-chain depth. A small Uniswap pool also exists, but contributes only marginal additional liquidity relative to the Curve markets.

DEX LP Concentration

On Ethereum, USDG currently exhibits sufficient secondary market liquidity. The main on-chain venues are two Curve pools: USDG/USDC, holding about $7.9 million in TVL, and USDG/USDL, with roughly $6 million. In the USDG/USDC pool, liquidity is provided primarily by Paxos through two addresses - its primary address and a secondary address. In contrast, the USDG/USDL pool is funded exclusively by Paxos’s primary address, accounting for all liquidity provision in that pool.

This structure reflects Paxos’ active role in building and maintaining USDG liquidity on Ethereum, with on-chain depth currently sufficient to support routine transactions and moderate institutional flows with minimal price impact.

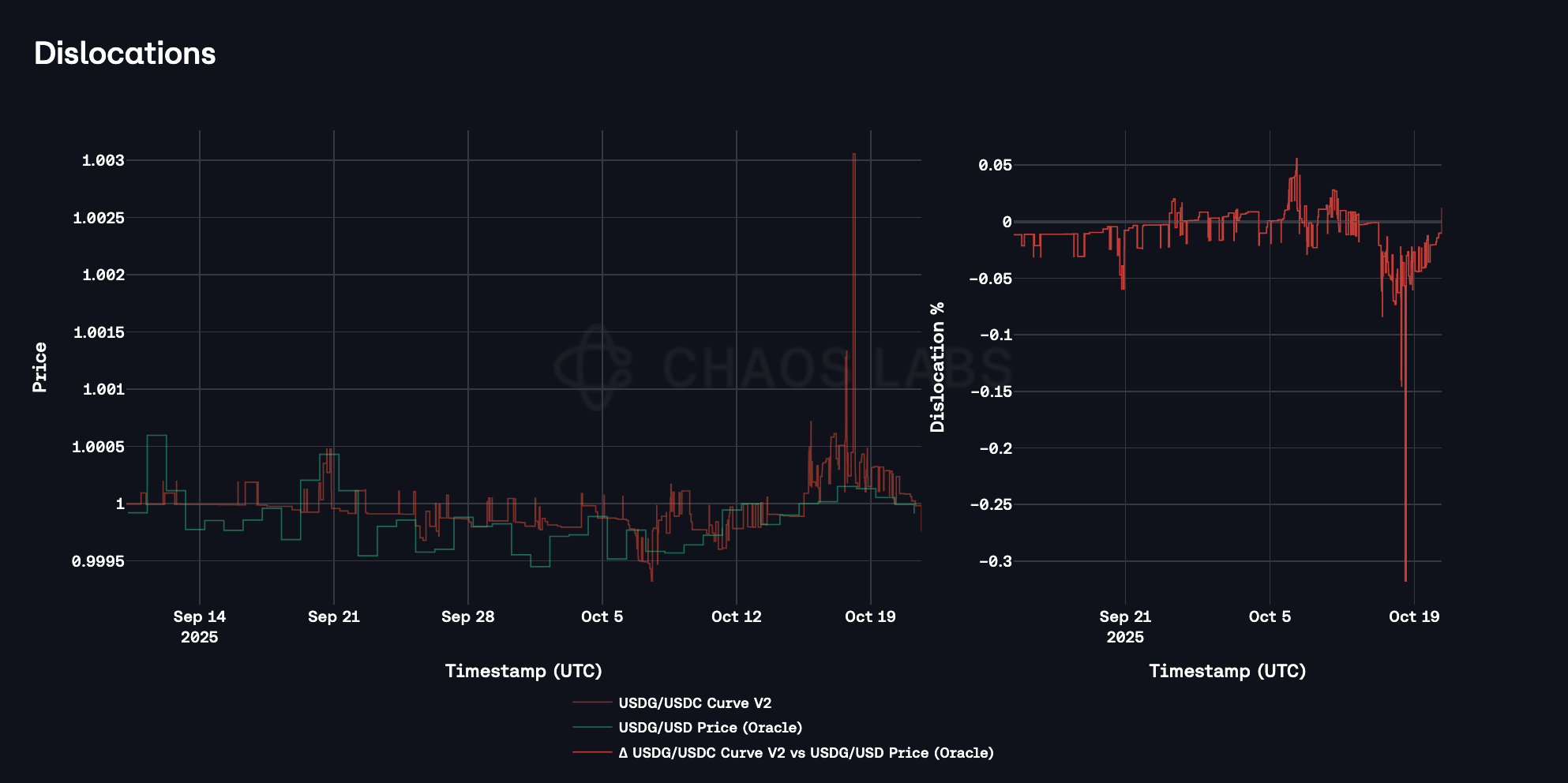

2.2 Volatility

Source:

Curve pool, October 21, 2025

On Ethereum, USDG/USDC holds a tight $1 peg, with intraday prints typically within a few basis points and brief deviations closing quickly on arbitrage flow.

2.3 Exchanges

Source:

USDG Exchanges, October 22, 2025

USDG is listed across several major centralized exchanges, including Kraken, PointPay, EarnBIT, and OKX. Trading pairs are primarily against USD, USDT, and USDC.

On PointPay, the USDG/USDT market shows the deepest liquidity, with more than $820,000 available within +2% of the mid-price and $654,000 within –2%, supporting daily volumes above $2.69 million. Kraken also provides strong liquidity in USDG/USD, with approximately $220,000 within +2% and $2.37 million within –2%, while additional depth exists in USDG/USDT and USDG/USDC pairs. OKX also supports a USDG/USDT market, with roughly $617,000 in buy-side depth and $521,000 in sell-side depth, alongside daily trading volumes around $258,000.

2.4 Growth

Source:

Dune, October 21, 2025

The total circulation of USDG has grown steadily over the past year, with supply on Ethereum surpassing $300 million at peak. Growth has been supported by consistent treasury mints aligned with market demand.

3. Technological Risk

3.1 Smart Contract Risk

Paxos Global Dollar stablecoin contracts have been audited multiple times by Zellic, Trails of Bits, and Halborn.

The last major code release, dated November 4, included changes on transfers to a single base repo for all Paxos stablecoins with base functionality and an added ability to support mint/burn for multiple addresses via SupplyControl.

Audit history:

- Zellic (Nov, 2024) - 1 critical and 2 informational.

The audit focused on Paxos Stablecoin’s code security and design issues.

- Trails of Bits (Nov, 2024) - 0 critical, 4 low, and 7 informational.

The audit focused on the security of Paxos Cross Chain messaging enablement via LayerZero.

- Halborn (July, 2025) - 0 critical, 0 high and 1 informational.

The audit focused on the security review of Paxos contracts after changes in PaxosTokenV2.sol contract that adds a public function [initializeDomainSeparator()](https://github.com/paxosglobal/paxos-token-contracts/commit/4421d2b5fe5d26300676b849cd84626bd0c1a079) that recomputes and stores DOMAIN_SEPARATOR.

3.2 Bug Bounty Program

As of October 22, 2025, there is no publicly advertised bug bounty program for Paxos USDG’s smart contracts.

3.3 Price Feed Risk

For USDG pricing, we suggest using Chainlink’s USDG/USD price feed as the primary oracle source. This feed operates with 16 underlying oracles and updates every 24 hours, providing better transparency and resilience for the stablecoin valuation. The deviation threshold for this price feed is set to 0.25%.

3.4 Dependency Risk

Cash management and custody of USDG reserves are handled via DBS Bank Ltd., headquartered in Singapore. Paxos names DBS Bank as the primary banking partner for cash management and custody of USDG reserves. This centralizes operational, sanctions-screening, and jurisdictional exposure at a single large counterparty, which can affect primary mint/redeem capacity if disrupted.

An independent accounting firm issues monthly reserve attestations that reconcile total USDG supply to reserve balances, with reports published on Paxos’ website by the end of the following month. The attestation provider is Enrome LLP, an independent Singapore firm. Paxos states the examination is conducted under standards established by the Institute of Singapore Chartered Accountants.

Paxos uses Chainalysis for Transaction Monitoring and Surveillance. Ongoing transaction monitoring and risk assessments for fraud detection and prevention are

conducted by Chainalysis, a third-party blockchain intelligence firm.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

Legal structure

Paxos issues USDG under a dual-issuer framework calibrated to jurisdictional regimes. Outside the European Economic Area, issuance is undertaken by Paxos Digital Singapore Pte. Ltd., a Major Payment Institution authorized by the Monetary Authority of Singapore to provide Digital Payment Token services, with status reflected in the MAS Financial Institutions Directory. Within the EEA, issuance is conducted by Paxos Issuance Europe Oy, a Finnish Electronic Money Institution supervised by the FIN-FSA, which offers USDG as an electronic-money token under MiCA. Paxos’s product materials and legal terms mirror this bifurcation and make explicit that the EU launch is structured within the MiCA perimeter.

Source:

FIN-FSA, October 22, 2025

The legal character of USDG is that of a fiat-referenced, single-currency stablecoin maintained at parity and supported on a one-for-one basis by U.S. dollar cash and U.S. dollar-denominated high-quality liquid assets. These reserves are held in segregated accounts “for the benefit” of token holders and are separated from corporate funds. USDG falls within the scope of Paxos’s USD Stablecoin Terms, which prescribe eligible reserve instruments for each issuing entity and make clear that the tokens are not designed to produce yield or confer any return to holders. In the EU, the whitepaper treats USDG as an EMT carrying a par-value monetary claim and a standing right of redemption “at any moment” into U.S. dollars, aligning the token’s rights profile with MiCA’s construct.

Primary-market access is conditioned on full onboarding. Only verified “Customers” may mint or redeem directly with Paxos; non-customers may hold and transfer USDG but have no direct redemption claim against the issuer. The terms reserve Paxos’s discretion to suspend minting or decline redemptions where required by law or to avert legal exposure, while affirming that, absent a reasonable justification and subject to operational minimums, verified customers’ stablecoins are “freely redeemable.” Paxos also states that it does not charge fees to mint or redeem Paxos-issued stablecoins, including USDG.

RoW Issuance

Holder rights and obligations flow from the governing terms and the applicable regulatory regime. For holders outside the EU, the issuer of record is Paxos Digital Singapore Pte. Ltd. Verified non-EU customers of Paxos Digital may redeem USDG at par for U.S. dollars at any time, subject to the conditions set out in the terms of service and applicable compliance reviews. Paxos Digital is required to maintain full backing in U.S. dollars or approved dollar-denominated securities, with those assets held in segregated custodial accounts for the benefit of token holders. The intent is that reserves remain separate from corporate assets so that, in an insolvency of Paxos Digital, ordinary creditors do not access the reserve; practical recourse will, however, turn on Singapore law and the mechanics of the insolvency administration.

Singapore’s regime imposes segregation and safeguards expectations that are material to risk analysis. MAS requires licensed issuers and intermediaries dealing in MAS-regulated stablecoins to segregate customer assets from their own and to structure custody so that customer property is not available to general creditors on an intermediary’s insolvency. These expectations parallel the safeguarding discipline imposed on DPT service providers and are coupled with ongoing supervisory oversight of reserves, segregation, and AML/CFT controls. Issuers are obligated to facilitate one-for-one redemptions into fiat against fully segregated reserves designed for bankruptcy remoteness. Stablecoins regulated in Singapore are not protected by the Deposit Insurance Scheme; neither issuer nor custodian insolvency triggers government-backed deposit coverage for token holders.

EU Issuance

Within the EU, Paxos Issuance Europe Oy acts as an authorized EMI and a MiCA-compliant EMT issuer. Rights and protections for EU holders are defined by MiCA and detailed in the MiCA-compliant whitepaper. EU holders benefit from a statutory safeguarding right over funds corresponding to outstanding USDG: Paxos EU must maintain reserves equal to at least the aggregate nominal value of USDG held by EEA users, with reserves confined to high-quality, low-risk instruments such as cash and short-term sovereign paper, kept legally segregated from Paxos EU’s own funds, placed with qualified custodians, and structured to be bankruptcy-remote so that holder claims are protected if Paxos EU becomes insolvent.

Redemption mechanics reflect these allocations of responsibility. USDG is redeemable one-for-one for U.S. dollars. EEA-resident holders have an enforceable right of redemption at par against Paxos EU at all times, subject to compliance checks.

The whitepaper’s insolvency protections describe how segregation operates in practice. Reserve accounts are structured so that, if Paxos EU were to become insolvent, those accounts—which exist for the legal benefit of token holders—are not available to satisfy the issuer’s general creditors and are instead devoted to meeting redemption claims. The reserve custody arrangements are crafted to protect against the custodian’s own insolvency as well: the reserve is intended to remain outside the custodian’s bankruptcy estate and free from creditor liens, preserving identifiability and availability for token-holder claims, subject to Finnish insolvency procedures overseen by the court-appointed administrator and the FIN-FSA. Funds received for USDG are not covered by Member State deposit-guarantee schemes, and holders should not ascribe deposit-insurance characteristics to the token.

Attestations

Transparency over reserves is maintained through monthly attestations. Paxos publishes USDG reserve attestations performed by an independent firm - Enrome LLP - under applicable assurance standards established by the Institute of Singapore Chartered Accountants (“ISCA”). Although attestations are not full financial-statement audits, their cadence, methodology, and publication approach align with prevailing stablecoin practice.

4.2 Access Control Risk

4.2.1 Contract Modification Options

Paxos employs a multi-layered framework for proposing and implementing contract modifications to USDG. All changes begin with an internal proposal, typically drafted and reviewed by cross-functional teams.

On Ethereum, USDG uses the UUPS pattern, so upgrades are authorized in the implementation made via upgradeTo / upgradeToAndCall function. In USDG, the authority that can pass an upgrade is the contracts with the DEFAULT_ADMIN_ROLE. The address that holds this role tied to off-chain HSM multisig owned by Paxos team.

4.2.2 Timelock Duration and Function

The USDG token contract is owned by an IERC5313-style Admin address. A 3-hour defaultAdminDelay applies only to accepting a pending defaultAdmin transfer: beginDefaultAdminTransfer(newAdmin) schedules the handover at current_timestamp + delay, and acceptDefaultAdminTransfer() can succeed only after that time.

Changes to the delay are scheduled with changeDefaultAdminDelay. If the delay is increased, the new value takes effect only after a 5-day wait, while decreases take effect immediately. No other admin-authorized calls are time-locked by this mechanism

4.2.3 Multisig Threshold / Signer identity

Paxos uses four role-based access controls for the USDG contract, each controlled by Paxos’ defaultAdmin address backed by proprietary offline HSMs that enforce multi-person approvals. The admin address sits at 0x3Af3e85f4f97De7AD0f000B724Fb77fE5ffc024B is operated by the Paxos team and governs all four roles, with each role’s functions ultimately controlled by the defaultAdmin address.

- DEFAULT_ADMIN_ROLE: controls governance of the token’s privileges. It can grant and revoke every other role, change role-admin relationships, rotate the IERC-5313 owner, and authorize UUPS upgrades through the contract’s

authorizeUpgrade gate.

- PAUSE_ROLE: operates the emergency halt. Holders can call

pause() and unpause() to toggle the token’s whenNotPaused guard, which blocks on-chain transfers and any other functions wired to that modifier.

- ASSET_PROTECTION_ROLE: enforces account-level controls. Holder can freeze and unfreeze specific addresses and invoke a post-freeze wipe that burns the frozen balance on chain to reflect lawful seizure or forfeiture.

- SUPPLY_CONTROLLER_MANAGER_ROLE: administers mint/burn operators and their limits. Holder can add and remove “supply controllers” that execute mint and burn, configure guardrails such as per-controller permissions and rate or cap parameters.

Aave V3 Specific Parameters

Aave V3 specific risk parameters for USDG will be presented jointly with @ChaosLabs.

Price feed Recommendation

We recommend using Chainlink USDG/USD price feed as the primary oracle source.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.