title: [ARFC] Safety Module & Umbrella Emission Update

author: @TokenLogic

created: 2025-09-09

Summary

This publication outlines the next incremental reduction in Safety Module emissions and also, the first update to Umbrella emissions.

Motivation

Umbrella

Since our last update, user deposits in Umbrella have increased from $248.9M to $357.0M, well exceeding the Target Coverage of $293.3M.

Source: Aave Analytics | TokenLogic

Source: Aave Analytics | TokenLogic

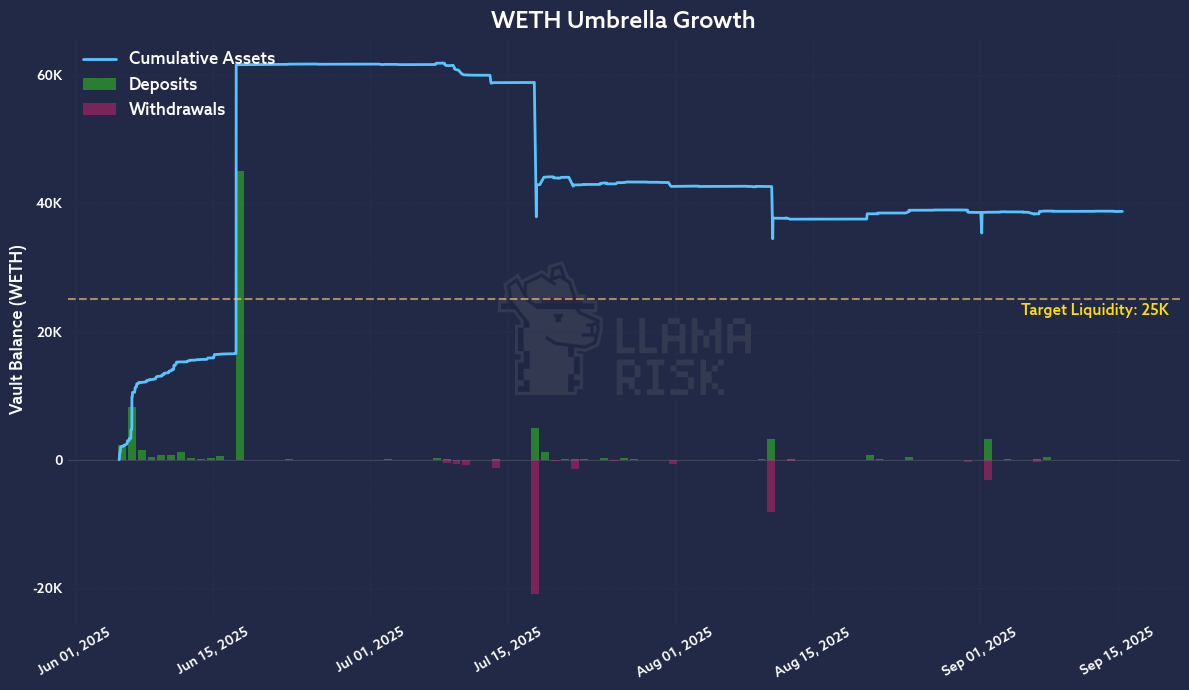

Most notably, ETH deposits within Umbrella are consistently over the Target Liquidity, they are ~54% at the time of writing. With less than $5M in cooldown, this trend is likely to continue given the high level of concentration with one use comprising 61% of ETH liquidity.

Source: Aave Analytics | TokenLogic

Source: Aave Analytics | TokenLogic

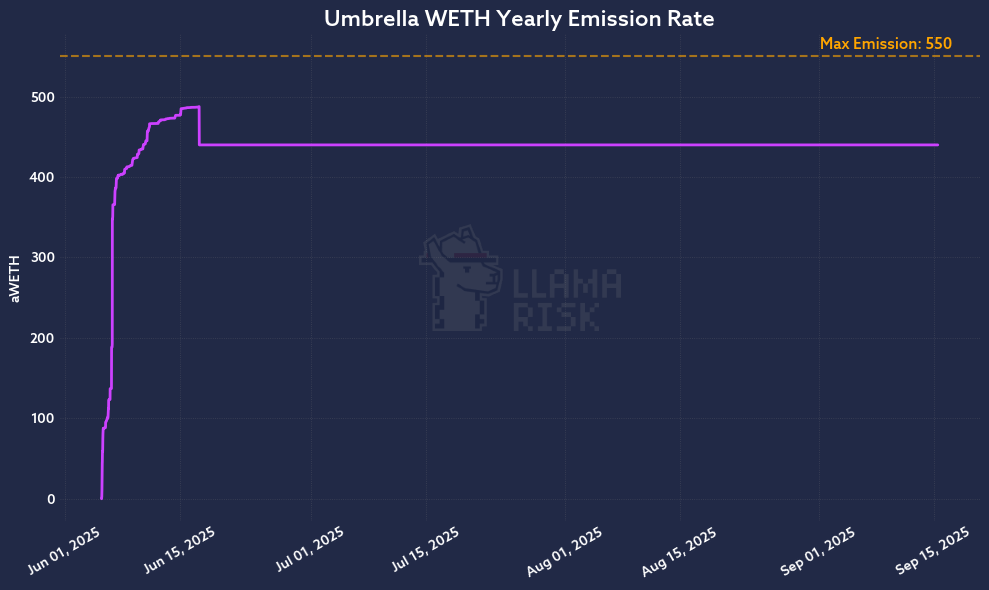

In response, this publication proposes reducing the Max waETH Emission Rate. By reducing the Max Emissions from 550 to 440 the new emission rate at the Target Liquidity amount would be 1.205 ETH/day and equal to the current emission rate. However, this would be the first emission update since Umbrella went live, and with this in mind a notably smaller reduction is proposed with a subsequent follow up proposal when more data to assess the elasticity of users’ appetite for deploying capital into Umbrella is available.

This publication proposes reducing the Max Emission Rate from 550 to 500 representing a 10% reduction in annual budget. Depending how the market responds, a further amendment can be proposed at a later date.

Safety Module Overview

At the start of 2025, the daily AAVE emission rate was 820 AAVE/day, this proposal if implemented will further reduce AAVE emissions to 300 AAVE/day across all Safety Module categories.

When implemented, AAVE emissions will be reduced from 390 AAVE/day to 300 AAVE/day. A reduction of 90 AAVE/DAY, is equivalent to 32,850 AAVE/year: worth $9.85M in annual savings with AAVE trading at $300.

With AAVE trading at $300 the daily AAVE buyback rate is approximately 476 AAVE/day, the result is Aave DAO increasing its AAVE holdings by 176 AAVE/day excluding any Service Provider related expenses. This is a considerable improvement from a runway perspective.

stkAAVE

On the 5th June 2025, the Umbrella upgrade went live, resulting in AAVE emissions for the stkAAVE category being reduced inline with the new Aavenomics presented by the @ACI team. This publication continues to implement the Aavenomics vision by further reducing AAVE emissions and slashing exposure on the Aave Safety Module.

When implemented, this proposal will further reduce Slashing risk to 0% for stkAAVE holders. stkAAVE Holders will benefit from a risk free-yield with a 7-days cooldown period. The improved risk profile and reduced cooldown period improves the overall attractiveness of holding stkAAVE.

stkAAVE Emission Schedule

| Category | Pre-Umbrella | Umbrella Update | Update #1 | Update #2 |

|---|---|---|---|---|

| Date | Mar 14, 2024 | Jun 05, 2025 | Jul 29, 2025 | Proposed |

| stkAAVE | 360 AAVE/Day | 315 AAVE/Day | 260 AAVE/Day | 260 AAVE/Day |

| Cooldown | 20 days | 20 days | 20 days | 7 days |

| Slashing | 30% | 20% | 10% | 0% |

The chart below show the stkAAVE yield reducing over time from 4.58% on the 5th June 2025 to 3.37% on 31st August 2025.

Source: Aave Analytics | TokenLogic

Over this period, the amount of AAVE staked has changed from 2,870,483 AAVE on the 5th June 2025 to 2,811,859 AAVE on the 8th September. A change of 58,624 AAVE or a reduction of 2.04% since the 5th June 2025.

Source: Aave Analytics | TokenLogic

Given the strong support for stkAAVE at the reduced rate, we propose leaving stkAAVE emissions as-is and monitoring the impact of how the market responds to further reductions in stkABPT and also, the 112,091 AAVE currently in cooldown due out 12th September.

Source: Aave Analytics | TokenLogic

Reducing Slashing from 10% to 0%, improves the risk profile of stkAAVE by eliminating the slashing tail risk of being slashed by a shortfall event.

The current stkAAVE category receives 260 AAVE/day, for an annual spend of 94,900 AAVE. This compares favourably to the total 84,640 AAVE purchased to date via the Buyback program since the 9th April 2025.

stkABPT

stkABPT Emission Schedule

| Category | Pre-Umbrella | Umbrella Update | Update #1 | Update #2 |

|---|---|---|---|---|

| Date | Apr 29, 2025 | Jun 05, 2025 | Jul 29, 2025 | Proposed |

| stkABPT | 240 AAVE/Day | 216 AAVE/Day | 130 AAVE/Day | 40 AAVE/Day |

| Cooldown | 20 days | 20 days | 20 days | 20 days |

| Slashing | 30% | 20% | 10% | 0% |

Since the 5th June 2025, when the Umbrella upgrade went live, stkABPT emissions reduced from 240 AAVE/day to 130 AAVE/day. Over this time, 42.41% of the liquidity has been removed from the pool with the majority coming from one of a select few liquidity providers. On the 1st September, a single user redeemed 227,952 BPT as AAVE and wstETH from the Balancer pool, then redeposited a portion.

Source: Aave Analytics | TokenLogic

Overall, the number of unique users remains unchanged with a net reduction of 13 users over the last 30 day period, to 453 unique addresses.

With the recent large withdrawal, the stkABPT yield has increased to average 14.90% over the last 7 days. On the 22nd September another large withdrawal day (83,142 ABPT) is anticipated, with 82,411 of the 83,142 ABPT being the same user mentioned earlier. The chart below shows the yield profile since 1st August 2025 with the overall yield expected to increase to around 19-20% APR from the 22nd September.

Source: Aave Analytics | TokenLogic

To balance the liquidity outflows, we recommend reducing the AAVE emissions to the stkABPT category by ~70%, to 40 AAVE/day, which reduces the yield to around 6.5-8% after allowing for the stkABPT currently in cooldown. The resulting yield compares favourably to the previous guidance of ~8% when combined with a reduction in slashing risk from 10% to 0%. More generally, the resulting impact is expected to lead to the market finding a new equilibrium.

Over the last 30 days, the utilisation of the ABPT liquidity, Swap Volume / Pool TVL, experienced 3 large trading days resulting in over 6% utilisation. The vast majority of swaps, 93.8%, are under $40k USD. A reduction in pool TVL is not likely to impede the pools ability to attract swap volume.

Source: Aave Analytics | TokenLogic

The emergence of new liquidity pool(s) mentioned in the next section presents an opportunity to measure the impact of new liquidity pools with improved capital efficiency.

AAVE Liquidity

Balancer

Over the last month, we have continued to work with Balancer on refining AAVE liquidity. With a focus on attracting swap volume, we have elected to proceed with a reCLMM (non-boosted) pool by submitting the gauge proposal for Ethereum and Arbitrum.

The two pools being considered are linked below:

Based upon the historical data available on Ethereum, the Impermanent loss from 1st August to 7th September 2025 ranged from -0.41% to 0.41% utilising data from an initial deposit of slightly less than $10k. During this period, AAVE/WETH traded within an 18% price range, which is quite low by historical standards and the liquidity in the pool was rebalanced four time.

Whilst recognising the sample period is only 40 days and the pools liquidity was always less than $90k, the below chart highlights the volatility in swap fee APR. With deeper liquidity and the Balancer team continuing to promote more pool integrations, we expect the data to normalise over time enabling us to better compares to other liquidity venues.

With over $250M in liquidity for the majority of August 2025, the reduction in AAVE emissions is expected to result greater liquidity outflows from the pool. With users withdrawing liquidity from the pool expected to accelerate, we recommend the Aave DAO begin providing liquidity to the reCLMM pool as part of the transitioning towards both more efficient and lower cost liquidity without adversely affecting users ability to trade AAVE on Balancer. An initial $10M liquidity provision is proposed, funded from the Economic Reserve and Collector Contract, and depending upon the utilisation and impermanent loss exposure of the pool the allocation is to be adjusted in the future. A $10M reCLMM allocation is expected to be sufficient to replace the liquidity within the weighted 80/20 AAVE/wstETH pool.

Aerodrome

Liquidity on Aerodrome has reduced from approximately $10M USD in AAVE/WETH to around $3M even though a notably higher yield was achieved relative to Balancer since the last forum update. We will continue to monitor the pool over time to see if the elevated yield is able to attract any organic user deposits following stkABPT rewards being reduced.

Source: https://dune.com/0xkhmer/aerodrome

Source: https://dune.com/0xkhmer/aerodrome

Specification

This proposal when implemented via AIP will:

Reduce AAVE Emissions

| SM Category | Current | Proposed |

|---|---|---|

| stkAAVE | 260/day | 260/day |

| stkABPT | 130/day | 40/day |

Reduce Slashing Risk

| SM Category | Current | Proposed |

|---|---|---|

| stkAAVE | 10% | 0% |

| stkABPT | 10% | 0% |

Reduce Cooldown Period

| SM Category | Current | Proposed |

|---|---|---|

| stkAAVE | 20 days | 7 days |

| stkABPT | 20 days | 20 days |

AAVE/wETH Liquidity Funding

Create allowances to a new Aave Liquidity SAFE, for the equivalent of $5M AAVE and $5M aEthWETH from Aave Ecosystem Reserve and Aave Core instances on Ethereum at the time the AIP is submitted.

- Asset: AAVE

0x7Fc66500c84A76Ad7e9c93437bFc5Ac33E2DDaE9 - Amount: $5M USD

- Asset: aEthWETH:

0x4d5F47FA6A74757f35C14fD3a6Ef8E3C9BC514E8 - Amount: $5M USD

- Spender: Aave Liquidity

0xAAA973Fe8A6202947e21D0a3a43d8E83ABE35C23 - Method: approve() AAVE and aEthWETH on the Ecosystem Reserve and Aave Collector contract to the new Aave Liquidity SAFE.

The signers on the new Aave Liquidity SAFE are the same as other Asset holding SAFEs, detailed here, with a 3 of 4 signer requirement.

Forward Looking Statement

Similar to the previous proposal, approximately 30 days after the AIP is executed, TokenLogic will review how users respond to the changes and the impact this has on AAVE liquidity. With a favourable outcome across both AAVE DEX liquidity and WETH deposits in Umbrella, the next update is likely to include the following updates:

- Direct AAVE liquidity provisioning to be increased;

- stkABPT rewards to be reduced to zero; and,

- Umbrella wETH Max Emissions to be revised lower if liquidity remains elevated relative to the Target Liquidity.

Disclosure

TokenLogic does not receive any payment for this proposal.

Next Steps

- Gather feedback from the community.

- If consensus is reached on this ARFC, escalate this proposal to the Snapshot stage.

- If Snapshot outcome is YAE, escalate this proposal to the AIP stage.

Copyright

Copyright and related rights waived via CC0.

Source: Balancer Team.Assumes price is near the middle of the range.

Source: Balancer Team.Assumes price is near the middle of the range.