Proposal updated by ACI to reflect latest Specifications 2025-10-30

Summary

LlamaRisk proposes an update to the Aave V3 Core Umbrella target liquidity levels, prompted by a roughly 54% increase in total debt since the mechanism launched 4 months ago. The significant growth in USDC and USDT borrowing has rendered the initial coverage levels outdated. To align with current market conditions, the recommendation is to increase the target liquidity for USDT to 130 million and decrease the target for GHO to 8 million. In contrast, the targets for USDC and WETH will remain unchanged. This addresses the observed shifts in borrow activity and ensures coverage levels are appropriate for the current risk exposure.

In addition to adjusting existing modules, we propose expanding Umbrella’s scope to include three high-impact assets: wstETH, USDe, and WBTC. This expansion would bring assets accounting for 98.12% of total borrows under Umbrella’s protection. In the medium term, the associated increase in annual emissions would be offset by the ongoing depreciation of legacy staking modules.

Introduction

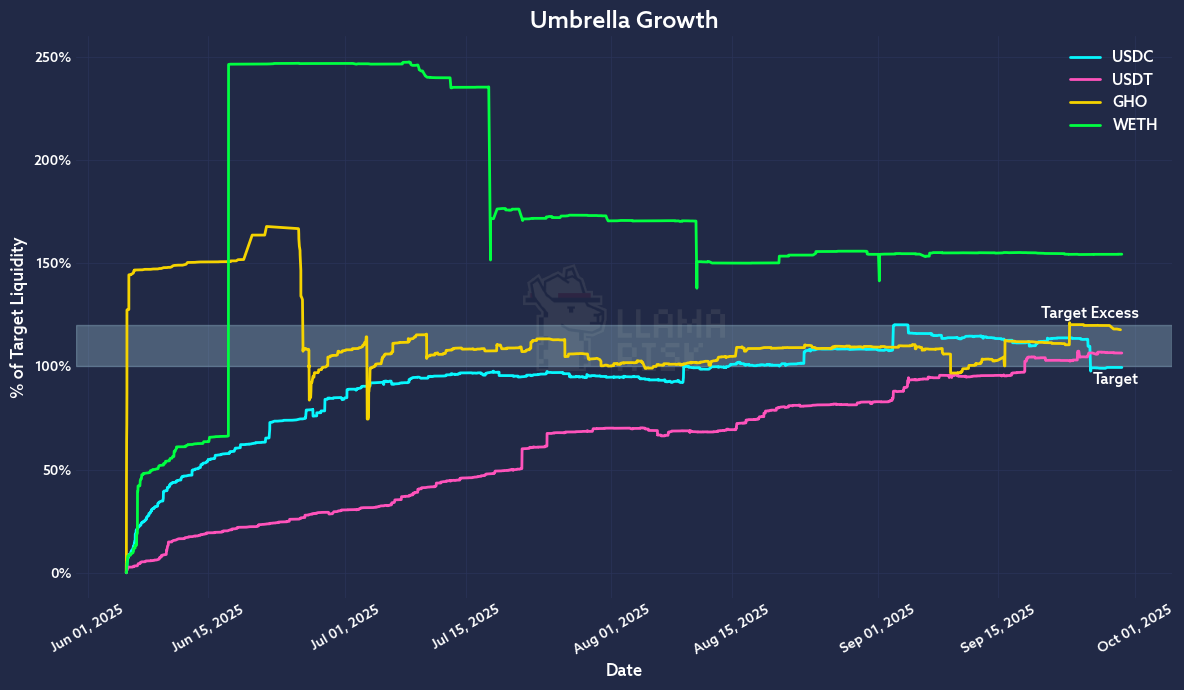

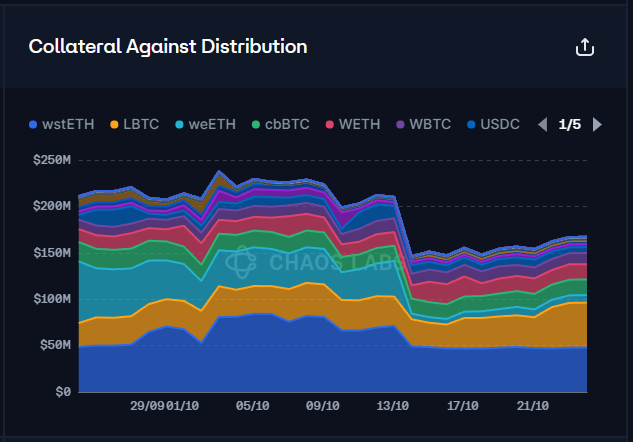

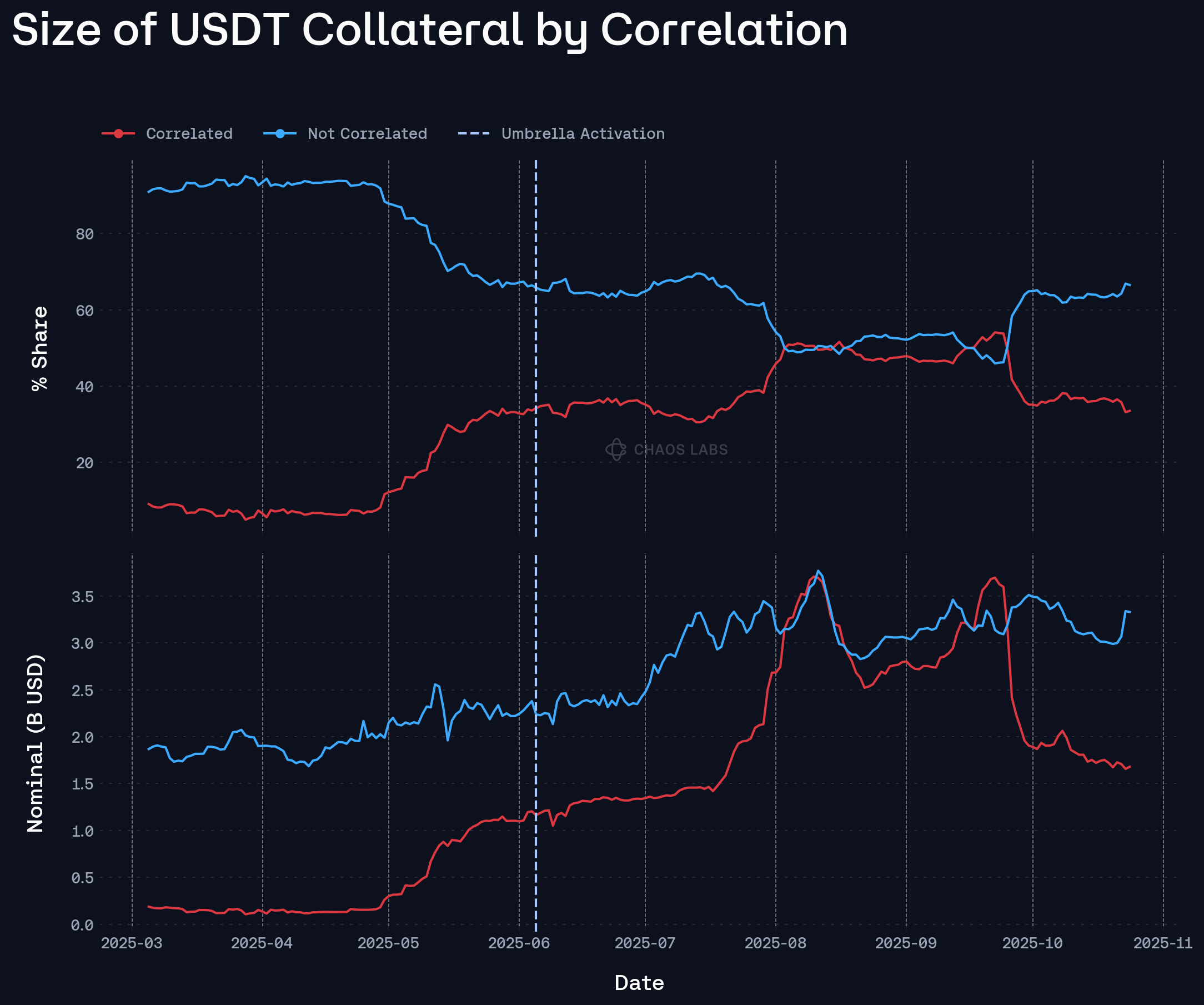

It has been four months since the launch of Umbrella, which has proven successful, with all existing modules reaching their target coverage levels. However, since the initial insurance caps were recommended, market dynamics have shifted, particularly for USDC and USDT; both have seen significant supply and borrow activity growth on the Aave V3 Core instance.

Source: LlamaRisk, September 29, 2025

Beyond these assets, others such as wstETH and USDe represent a substantial share of Aave’s TVL, highlighting the need to expand Umbrella’s coverage to include them. As a result, the scope is to re-evaluate the existing insurance cap recommendations for currently covered assets, in light of updated liquidity and risk conditions, and to propose new coverage paths for additional high-impact assets on the Aave V3 Core instance. This expansion would support the gradual phase-out of stkAAVE coverage while maintaining overall coverage levels and optimizing the efficiency of the emissions.

Existing Umbrella Modules

Coverage Evolution

Since its launch, the total debt on the Aave V3 Core instance has grown significantly, from $13.8B to $21.3B, marking a ~54% increase. The four assets currently covered under Umbrella, USDC, USDT, WETH, and GHO, now account for $18.7B, or 87.7% of total borrows.

Source: LlamaRisk, September 29, 2025

While it may appear that most of Aave’s borrow exposure is already secured through Umbrella, it’s important to recognize that the initial insurance recommendations were made based on significantly lower borrow caps set nearly five months ago. Given the substantial increase in total debt since then, the original caps no longer reflect current market conditions.

The individual growth trajectories of the covered assets since Umbrella’s launch are detailed here:

Source: LlamaRisk, September 29, 2025

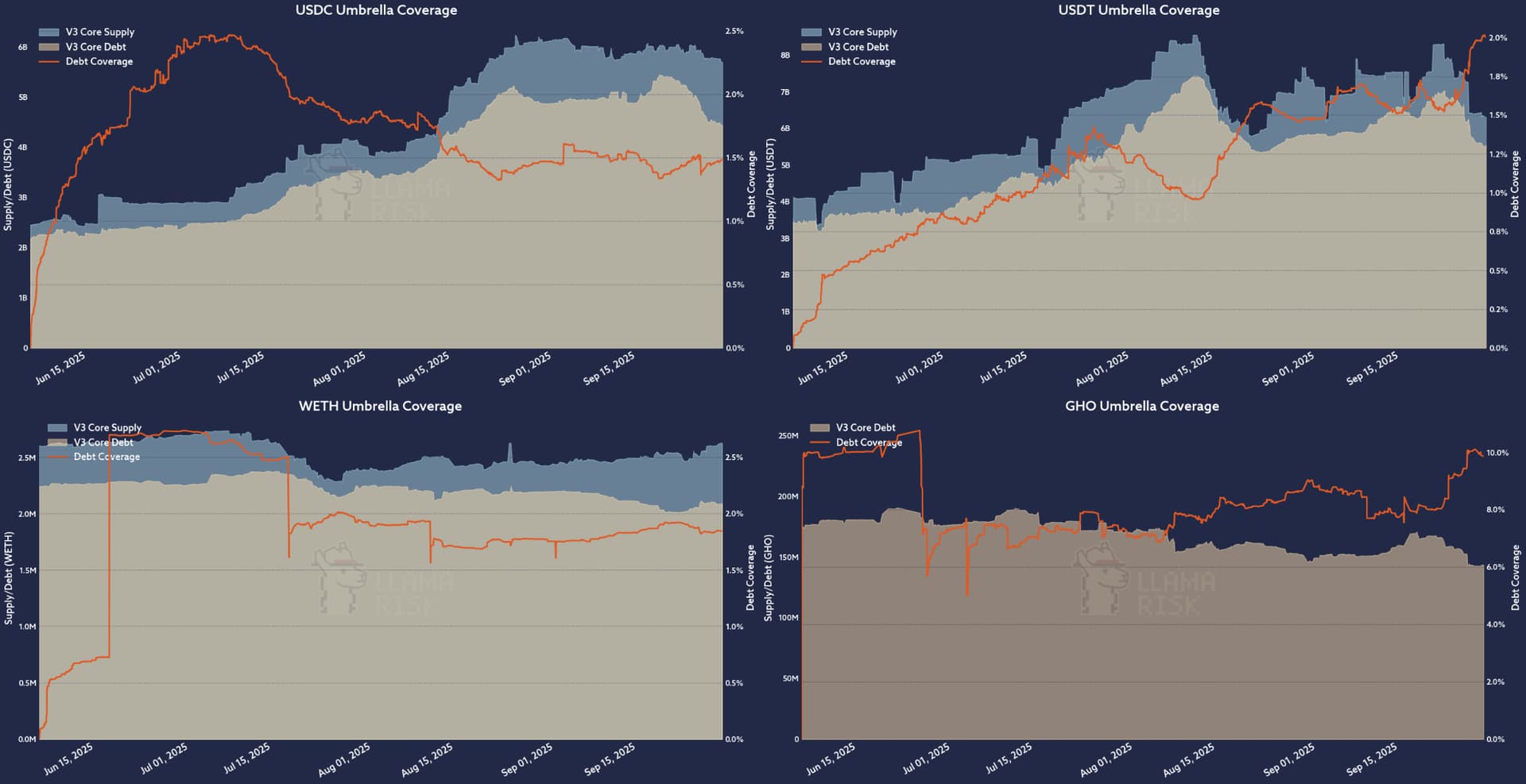

WETH and GHO have maintained relatively stable supply and borrow levels since the launch of Umbrella. In contrast, USDC and USDT have experienced significant growth in both supply and borrow activity. In response to this demand, their respective caps were raised multiple times:

- USDC supply cap increased from $4.8B to $7.5B, and the borrow cap from $4.32B to $7B

- USDT supply cap rose from $5.25B to $9.5B, and borrow cap from $4.72B to $8.8B.

Adjusted Coverage Estimations

Following the changes, new liquidity targets for each asset under Umbrella were determined using our VaR methodology, which simulates extreme market stress using historical price data to generate synthetic shock scenarios. It models user liquidations under these shocks to estimate each asset’s liquidation capacity (the maximum debt that can be liquidated profitably for liquidators). Based on the simulation run done on September 29, 2025, we present the liquidation capacity changes overlaid with the asset borrow cap changes:

| Asset | Liquidation Capacity Change | Borrow Cap Change |

|---|---|---|

| USDC | 50,400,000 USDC → 117,700,000 USDC | 4,320,000,000 USDC → 7,000,000,000 USDC |

| USDT | 12,200,000 USDT → 42,730,000 USDT | 4,720,000,000 USDT → 8,800,000,000 USDT |

| WETH | 6,900 WETH → 697 WETH | 2,700,000 WETH → 2,900,000 WETH |

| GHO | 5,000,000 GHO → 18,220,000 GHO | 180,000,000 GHO → 180,000,000 GHO (unchanged) |

Over the four months since the initial simulation run on May 15, 2025, the liquidation capacity for USDC, USDT, and GHO has increased substantially, while WETH capacity has declined. These shifts are primarily explained by changes in borrower distribution: when a larger share of debt is concentrated in a few large borrowers, liquidity capacity decreases as fewer liquidatable positions fall within the inlier set defined by the Interquartile Range (IRQ) method.

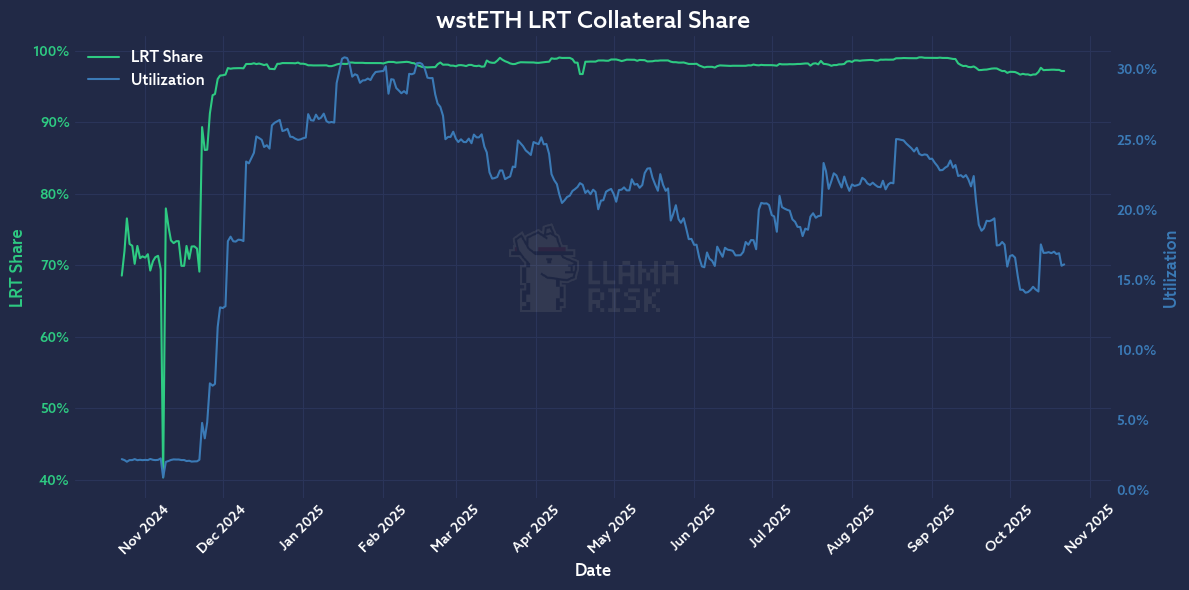

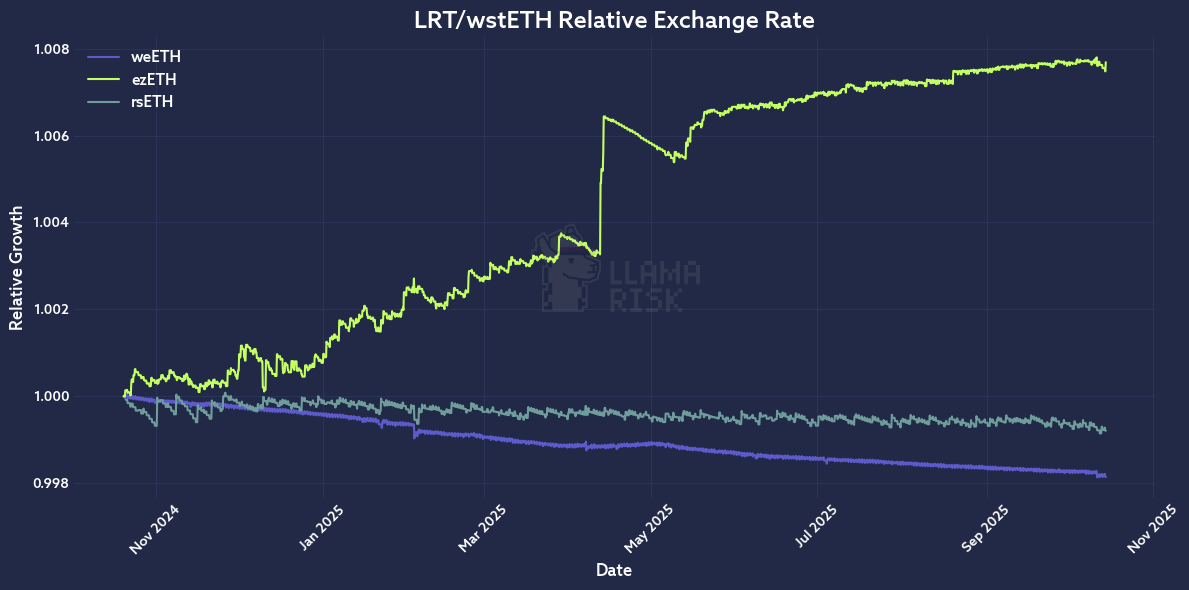

In the case of WETH, the decline in liquidation capacity was further exacerbated by market conditions. Increased price volatility of ETH resulted in a shortage of WETH liquidity in secondary markets. At the same time, the long validator exit queue created a parallel shortage of LST/ETH liquidity on DEXs. This is particularly relevant since the two largest WETH borrowers, accounting for ~47% of WETH borrows, engage in LST/LRT looping strategies at low health factors of 1.02 and 1.06. As a result, the availability of profitable liquidation opportunities in WETH diminished.

Source: LlamaRisk, September 29, 2025

Moreover, shock simulations indicate that GHO, USDC, and USDT were among the most stable assets, experiencing minimal negative price movements. WETH, while showing a mild average drawdown of approximately -0.057% under stressed scenarios, still demonstrates relatively stable and predictable behavior. This stability suggests that, although their current liquidation capacity is low, WETH and GHO remain manageable from a risk perspective due to their robust shock resilience during market stress.

To put the overall numbers into perspective, the changes in total debt and borrow cap coverage since the initial deployment are as follows:

| Asset | Initial Total Debt Coverage* | Current Total Debt Coverage* | Initial Borrow Cap Coverage | Current Borrow Cap Coverage |

|---|---|---|---|---|

| USDC | 135,400,000 USDC | 183,368,556 USDC | 3.13% | 2.62% |

| USDT | 150,250,000 USDT | 153,486,582 USDT | 2.46% | 1.74% |

| WETH | 31,900 WETH | 39,294 WETH | 1.18% | 1.35% |

| GHO | 17,000,000 GHO | 32,351,731 GHO | 9.44% | 17.97% |

*Total debt coverage is the sum of liquidity capacity and the current Umbrella Module deposits.

Based on the details presented above, new target liquidity recommendations for the existing Umbrella Modules are as follows:

| Asset | Current Target Liquidity | Current Liquidity | Recommended Target Liquidity |

|---|---|---|---|

| USDC | 66,000,000 USDC | 65,668,556 USDC | 66,000,000 USDC (unchanged) |

| USDT | 104,000,000 USDT | 110,756,582 USDT | 130,000,000 USDT |

| WETH | 25,000 WETH | 38,597 WETH | 25,000 WETH (unchanged) |

| GHO | 12,000,000 GHO | 14,131,731 GHO | 8,000,000 GHO |

For USDC, the increase in liquidity capacity has proportionally tracked the borrow cap expansion, and a similar pattern is observed for GHO. In contrast, WETH coverage has been maintained primarily through substantial deposits into its Safety Module. The main exception is USDT, where current borrow cap coverage has declined. Based on these observations, we recommend increasing USDT’s target liquidity while reducing GHO’s target liquidity by 33%, as its existing liquidity capacity is already sufficient. To accommodate the higher USDT target liquidity, we propose that the DAO adjust incentive emissions for the USDT Umbrella modules.

With these changes, the maximal emissions would be increased by 920K aUSDT per year, partially offset by a reduction of 400K GHO per year in GHO module emissions. This adjustment would preserve the current APY ranges, maintain spend efficiency for the DAO, and ensure continued attraction of sufficient staked liquidity.

No changes are recommended for the WETH module at this time, as its deposits remain comfortably above the target coverage level, and neither a target liquidity increase nor additional incentives are required to sustain participation.

Expansion of Umbrella Modules

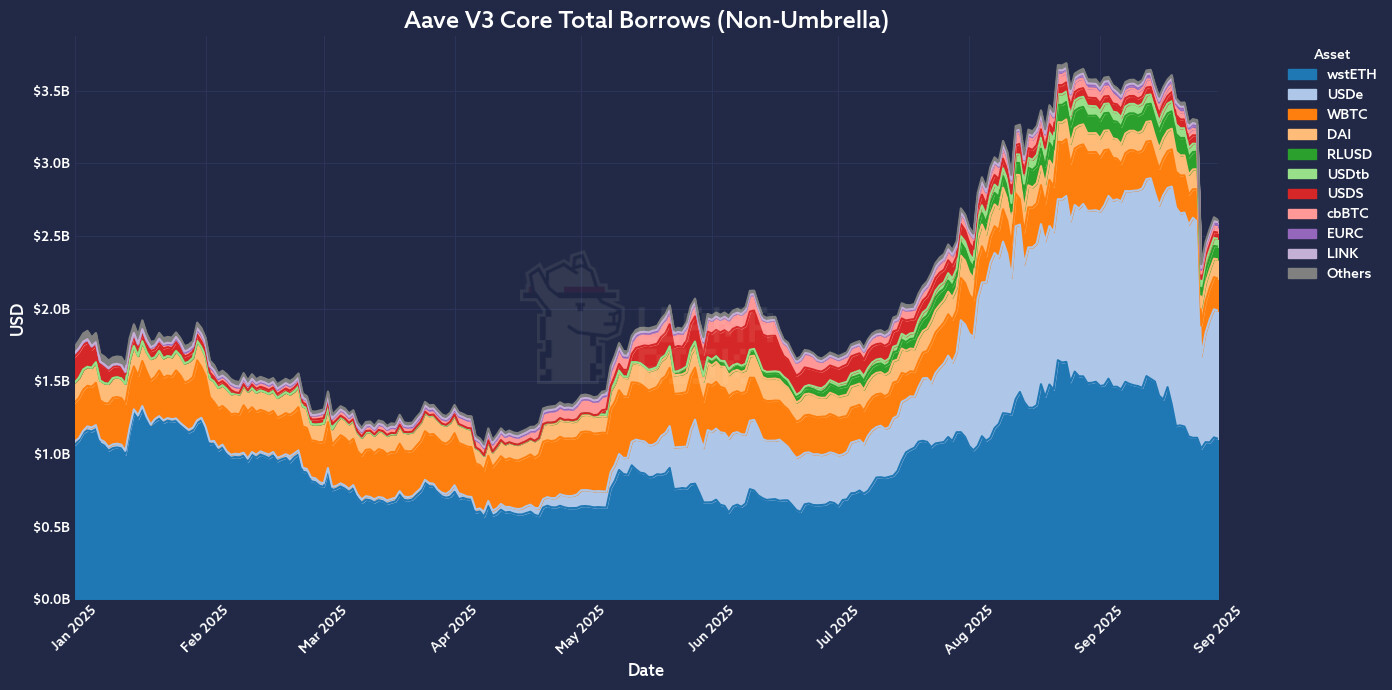

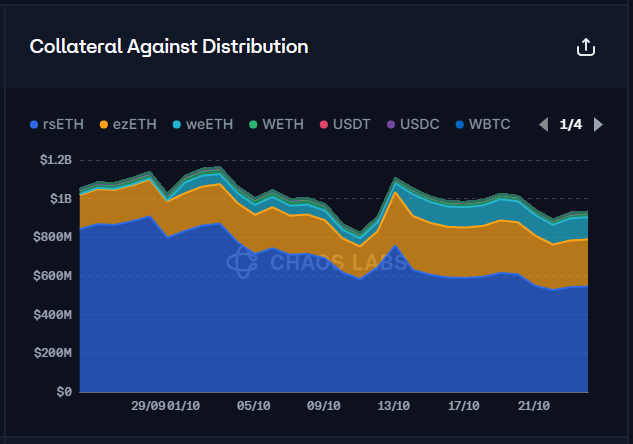

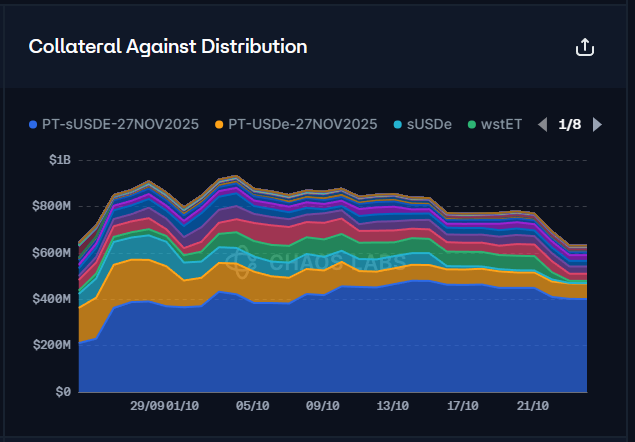

There are currently 32 assets on Aave V3 Core with non-zero borrow balances that are not yet included under Umbrella coverage. However, only a subset of these, six assets, have borrows exceeding $50M, making them the most relevant candidates for near-term inclusion. These include wstETH ($1.1B), USDe ($882M), WBTC ($220M), DAI ($133M), RLUSD ($88M), and USDtb ($54M).

Source: LlamaRisk, September 29, 2025

Based on observed growth trends, several stablecoin borrow markets, notably USDe, RLUSD, and USDtb, have shown meaningful increases in 2025. As part of the next phase of Umbrella expansion, we propose adding wstETH, USDe, and WBTC to the coverage framework, while continuing to monitor the other emerging stablecoins for future inclusion.

Following the addition of these three assets, the Umbrella Safety Module would encompass assets that collectively account for approximately 98.12% of total borrows on Aave V3 Core, equivalent to $20.9B in outstanding debt. After this expansion, only $390M in borrowings would remain outside Umbrella’s scope. The table below outlines our target liquidity recommendations for the proposed assets.

| Asset | Current Borrow Cap | Liquidation Capacity | Recommended Target Liquidity | Total Debt Coverage | Coverage of Borrow Cap |

|---|---|---|---|---|---|

| wstETH | 480,000 wstETH | 2,950 wstETH | 9,050 wstETH | 12,000 wstETH | 2.5% |

| USDe | 2,500,000,000 USDe | 0 USDe | 43,920,000 USDe | 43,920,000 USDe | 1.76% |

| WBTC | 28,000 WBTC | 454 WBTC | 250 WBTC | 704 WBTC | 2.51% |

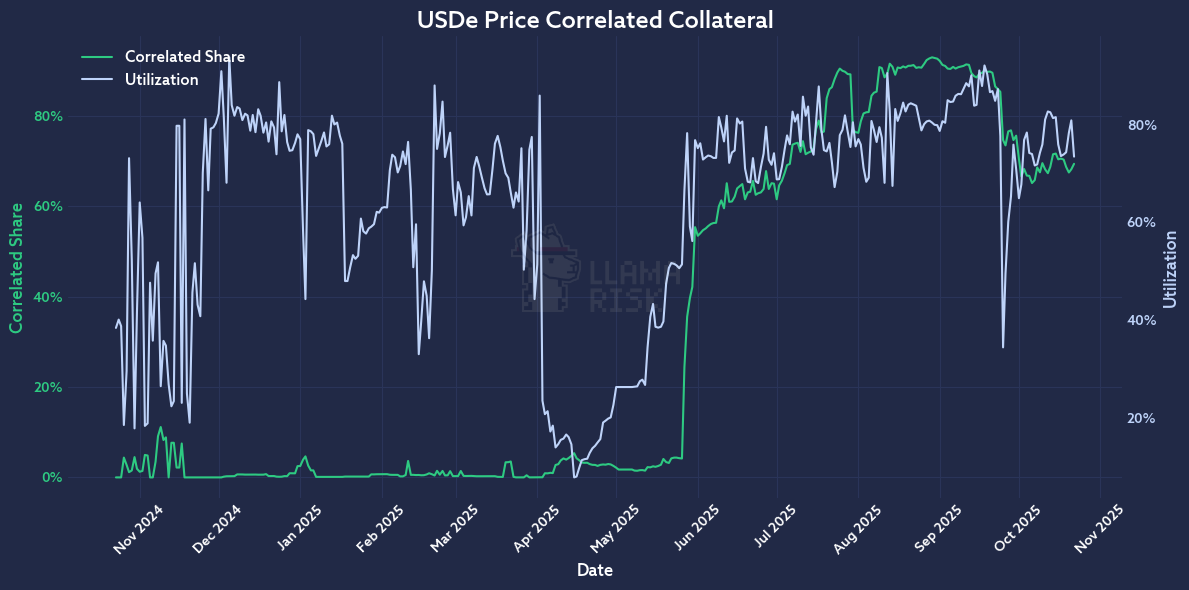

According to our methodology, the liquidation capacity for USDe is effectively zero, partially due to insufficient market liquidity to liquidate USDe borrow positions profitably under shock scenarios. Albeit, USDe exhibited zero shock deviation, suggesting stable pricing behavior even in stressed conditions. In contrast, wstETH showed the highest simulated price shock at -0.058%, which still represents a relatively mild drawdown. WBTC demonstrated greater resilience, with a smaller shock value of -0.04%, indicating stronger stability during market stress situations.

To support the inclusion of these new assets into the Umbrella Safety Module, we estimate the following maximum annual emissions required to maintain sufficient risk-adjusted yield at target liquidity levels: 50 awstETH (~$255K), 773K aUSDe ($780K), and 0.5 aWBTC ($57K), targeting Umbrella APY of 0.55%, 1.76%, and 0.2% at target liquidity. This would result in an additional annual cost of approximately $1.09M to the DAO.

Conclusion & Recommendations

We recommend the following adjustments and additions to the Umbrella Safety Module to better align with current market conditions and borrow activity. Once implemented, these changes will increase the total annualized Umbrella emissions from $8.74M to $10.35M, while expanding coverage by an additional $192M. Reserves amounting to 98.12% of total borrows on Aave V3 Core would become covered by Umbrella.

Ultimately, this increase in emissions would be offset by the ongoing deprecation of legacy staking modules, which currently cost the DAO approximately $42.6M per year. Therefore, this transition reflects a more capital-efficient and scalable approach to risk management within the Aave protocol.

Revised Recommendations

| Staked asset | Covered asset | Target Liquidity | Max emission (rewards at target liquidity) | Umbrella APY range (up until excess liquidity) | Total APY (Aave + Umbrella)* | Cooldown/unstake window | Deficit offset |

|---|---|---|---|---|---|---|---|

| aUSDe | USDe | 20,000,000 USDe | 550,000 aUSDe/year | 1.83%-5.5% | 6.14%-9.81% | 20/2 days | 100,000 USDe |

| aWBTC | WBTC | 250 WBTC | 1.5 aWBTC/year | 0.39%-1.2% | 0.42%-1.23% | 20/2 days | 0.5 aWBTC |

| aUSDT | USDT | 104,000,000 USDT → 130,000,000 USDT | 3,670,000 → 4,587,500 aUSDT/year | 2.35%-7.05% | 7.37%-12.07% | - | - |

* Aave APY reflects the 1-year average Supply APY.

Based on the revised parameters, the updated borrow coverage for the newly onboarded assets, USDe, and WBTC, is as follows:

| Asset | Current Borrow Cap | Total Debt Coverage (Liquidation Capacity + Target Liquidity) | Coverage of Borrow Cap |

|---|---|---|---|

| USDe | 2,500,000,000 USDe | 20,000,000 USDe | 0.8% |

| WBTC | 28,000 WBTC | 704 WBTC | 2.51% |

Next Steps

- Incorporate feedback and escalate ARFC to a Snapshot vote.

- If the ARFC Snapshot outcome is YAE, publish an AIP vote for final confirmation and enforcement of the proposal.

Disclaimer

This review was independently prepared by LlamaRisk, a DeFi risk service provider funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.