Summary

This proposal seeks to:

- Minimize exposure to MKR as a collateral asset on Aave

- Deprecate the matured PT-eUSDe-14AUG2025

- Increase the supply cap of rsETH on the Linea instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

MKR (Ethereum Core)

The Sky Protocol is in the process of completing the migration from MKR to SKY as its governance token. Phase Three of this migration will take effect on September 18th, 2025, introducing a Delayed Upgrade Penalty of 1% on the MKR → SKY migration. This penalty increases by a percentage point every 3 months, thereby diminishing the expected value of MKR over time. Coupled with its status as a true legacy token via one-way migration, this renders it unsuitable as collateral on Aave.

Current Market Context

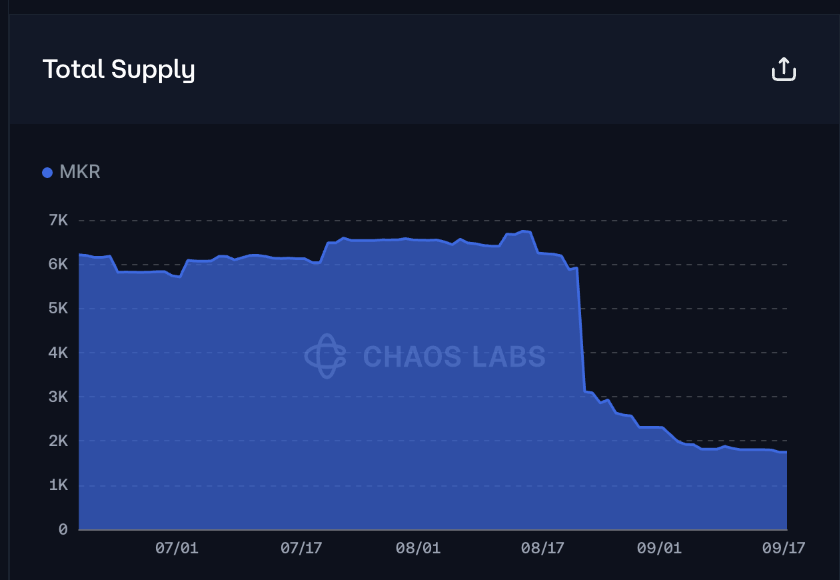

Currently, just $3M worth of MKR collateral and $1.1M in MKR collateralized stablecoin debt is present within the protocol; a decrease of nearly 80% in the last month; much of the current and historical borrowing demand was attributed to entities affiliated with the underlying protocol.

The effective isolated debt is $0 at the moment, representing prior interest accrual on MKR collateralized debt positions and indicating significant protocol outflows.

Given the minimal utilization and declining risk-adjusted value of MKR, we recommend decreasing the supply cap to 1 to align with the assets fundamental representation as a redeem-only asset and will proceed with additional deprecation steps in a following proposal.

PT-eUSDe-14AUG2025 (Ethereum Core)

Akin to previous matured Principal Tokens, we aim to formally deprecate PT-eUSDe-14AUG2025 by setting its supply cap to 1.

wrsETH (Linea)

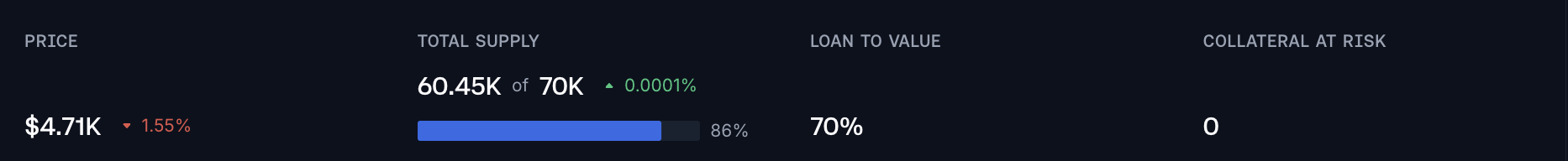

wrsETH on Linea has exhibited substantial growth over the last 5 days, adding over 35 thousand tokens, indicating persistent demand to use the asset as collateral.

Supply Distribution

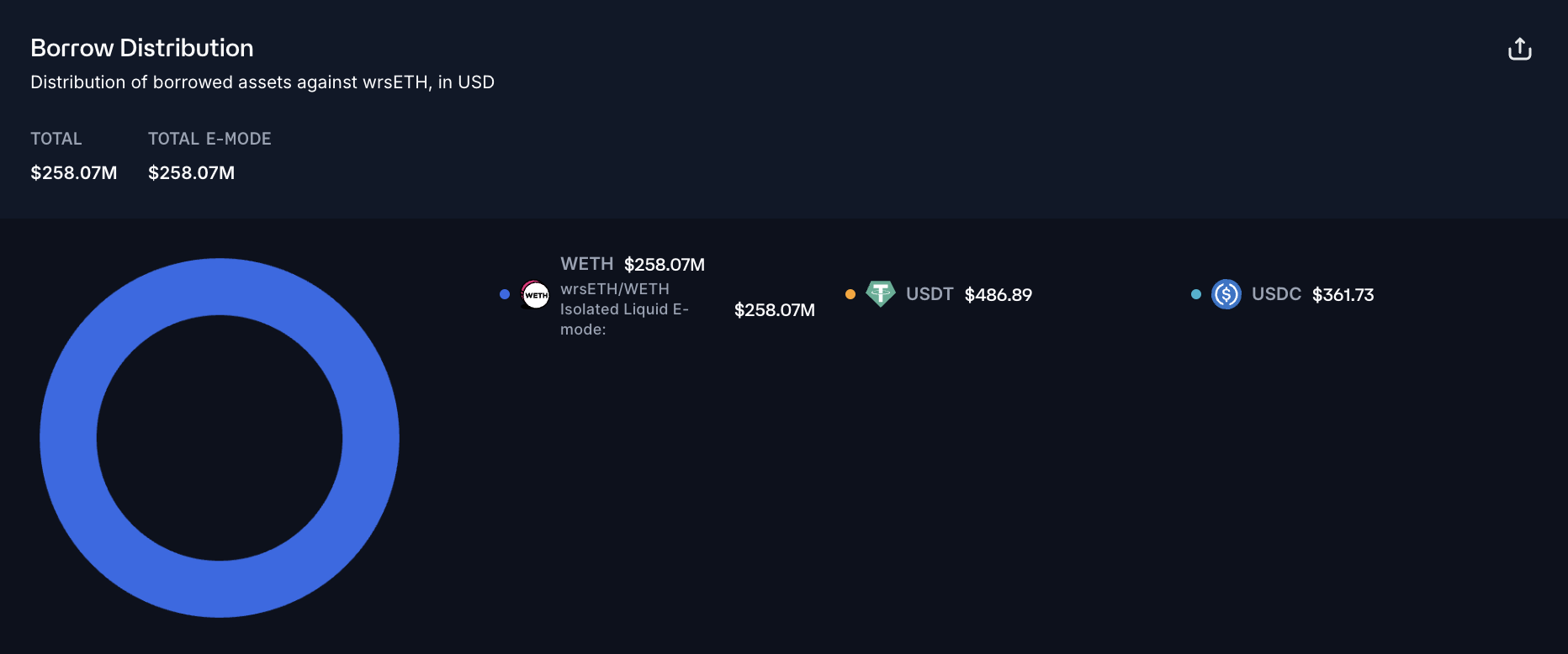

wrsETH supply distribution is highly concentrated, with the top two users accounting for nearly all of the supply pool. These users employ a leveraged restaking strategy by repeatedly using wrsETH as collateral for WETH debt, profiting from the spread between the LRT’s underlying yield and WETH borrow rates.

As mentioned, the asset is exclusively used to borrow WETH, facilitated by the wrsETH/WETH E-Mode, which provides high capital efficiency. While the health factors of the users are 1.02 and 1.03, no significant liquidation risk is assumed due to the high correlation between the debt and collateral assets.

Liquidity

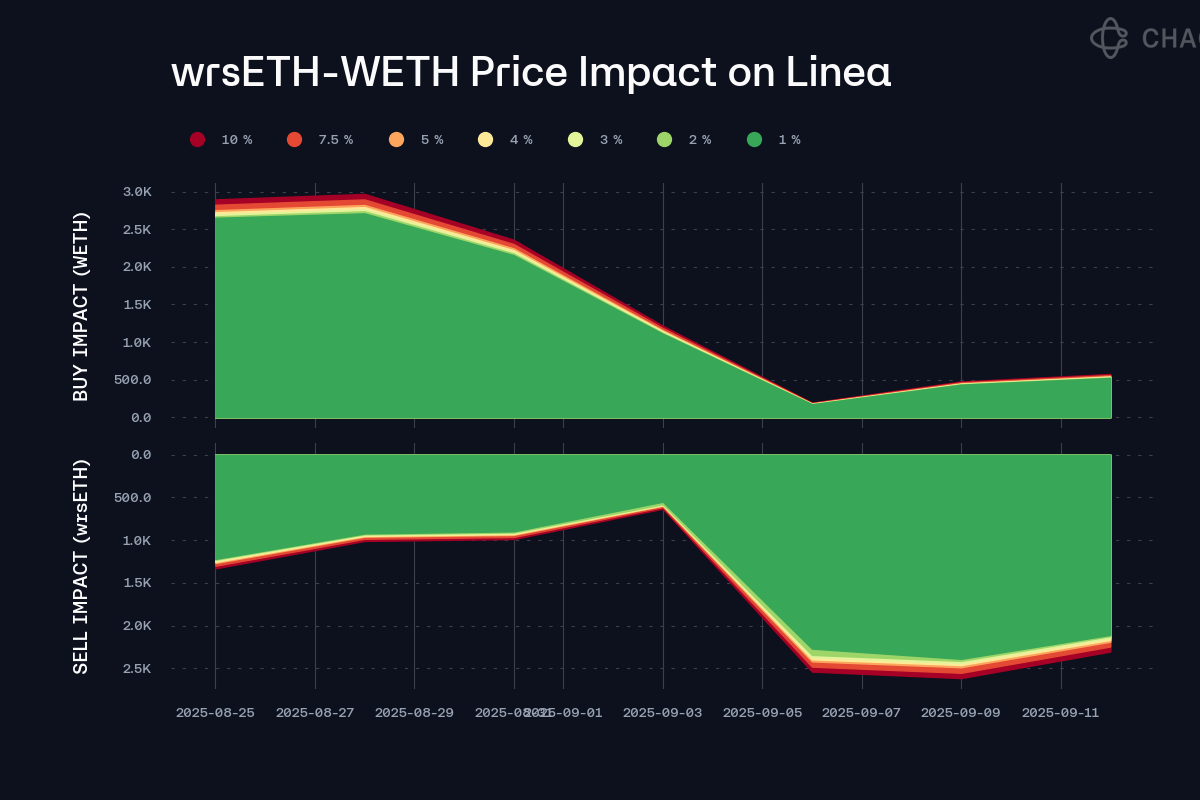

At the time of writing, wrsETH liquidity on Linea is sufficient to facilitate a sell order of 2 thousand tokens at 1% slippage, limiting the risk of bad debt.

Recommendation

Given the persistent supply of wrsETH, along with low liquidation risk and deep on-chain liquidity, we recommend doubling the token’s supply cap. This adjustment poses no enhanced risks for the protocol while enabling additional WETH borrowing due to the nature of the strategies, thereby driving additional revenue.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap |

|---|---|---|---|

| Ethereum Core | MKR | 2,000 | 1 |

| Ethereum Core | PT-eUSDe-14AUG2025 | 1,200,000,000 | 1 |

| Linea | wrsETH | 70,000 | 140,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.