Summary

A proposal to:

- Increase the supply cap of WETH on the Mantle Instance

- Increase the supply cap of wrsETH on the Mantle Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

WETH

WETH has reached its supply cap of 30,000 tokens on the Mantle instance following an inflow of over 25,000 tokens in the past 24 hours.

Supply Distribution

The supply distribution of WETH exhibits a high level of concentration, with the top supplier accounting for approximately 62% of the market, while the top three suppliers collectively account for 77%. As can be observed on the plot below, only a subset of suppliers are utilizing WETH as collateral; the majority of these positions are borrowing USDT0 with a conservative health factor, presenting minimal risk.

Liquidity

Currently, the majority of WETH liquidity is concentrated in mETH, USDT, and USDC pools across Merchant Moe and Agni Finance DEXs. While the liquidity is largely indirect to USDT0, the market presents minimal risk, allowing for a moderate expansion of the supply cap.

Recommendation

Given the elevated demand to supply WETH on the Mantle instance, fueled primarily by the ongoing incentive program rather than borrowing revenue. Given the minimal risk associated with the market, we recommend increasing the asset’s supply cap.

wrsETH

wrsETH has reached its supply cap of 6,000 tokens on the Mantle instance. Demand is primarily driven by relatively low WETH borrow rates combined with wrsETH supply incentives, making wrsETH–WETH leveraged restaking strategies highly profitable.

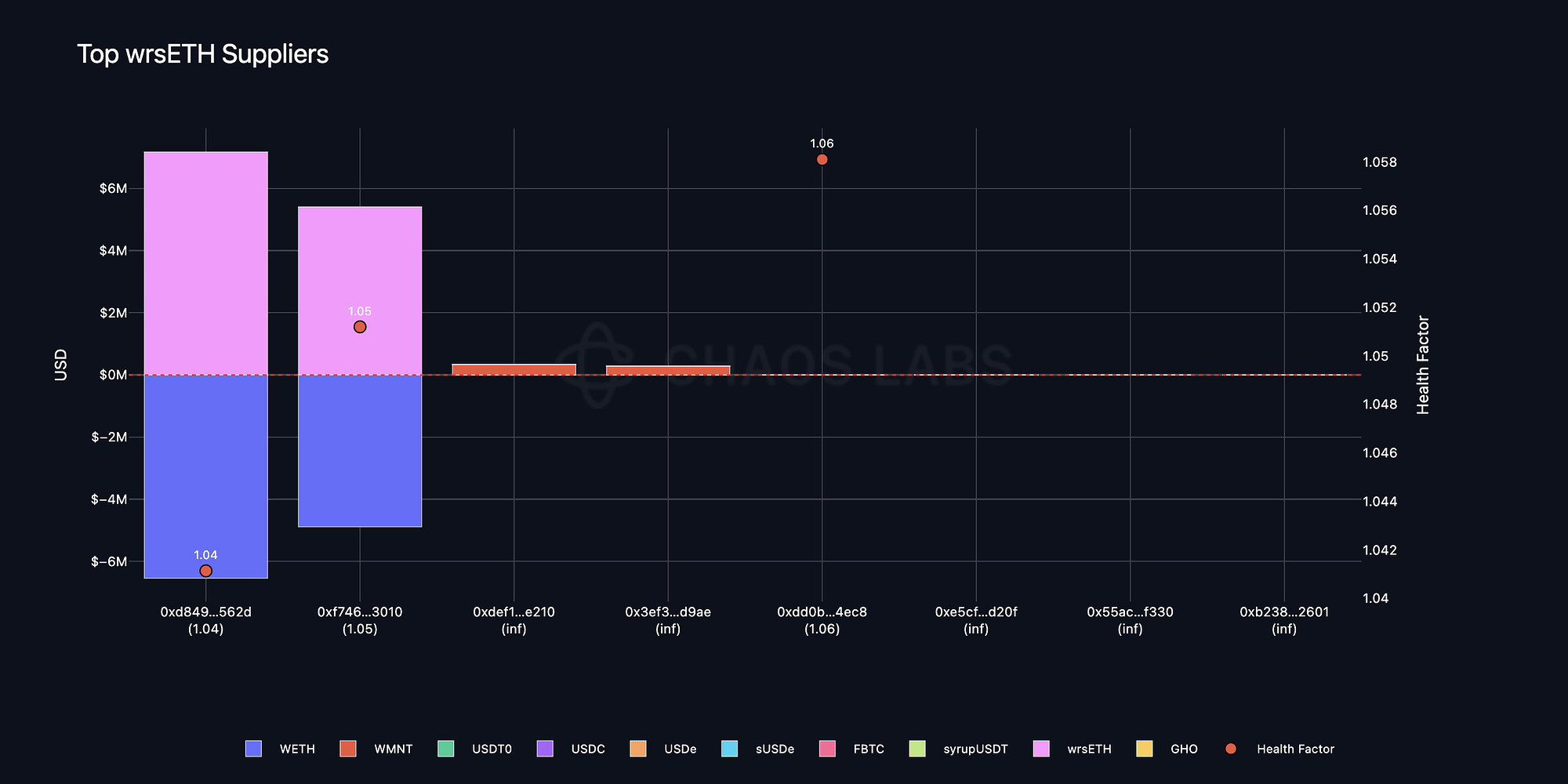

Supply Distribution

The supply of wrsETH on the instance is effectively split between two users who, as previously discussed, are participating in leveraged restaking strategies by collateralizing WETH debt with wrsETH, thereby earning a leveraged spread on the rate differential. Considering the nature of this strategy and the high correlation between the assets, the market currently presents minimal risk.

Liquidity

wrsETH liquidity is currently concentrated within a wrsETH-WETH Merchant Moe pool, which has a TVL of approximately $2.3 million.

Recommendation

Considering the demand to loop the asset on the Mantle instance, the limited liquidation risk, and sufficient liquidity, we recommend increasing the supply cap of wrsETH.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Supply Cap | Recommended Supply Cap |

|---|---|---|---|---|---|

| Mantle | WETH | 30,000 | 60,000 | 28,000 | - |

| Mantle | wrsETH | 6,000 | 12,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.