Summary

A proposal to:

- Increase the borrow caps of wstETH on the Base instance

- Increase the supply cap of wrsETH on the Base instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

wstETH (Base)

wstETH supply on Base has seen a substantial increase over the past 20 days, growing by over 14,000 tokens. Additionally, we expect a drastic increase in borrow demand for the asset.

Supply Distribution

The supply distribution is highly concentrated, as the top user accounts for over 40% of the total, while the top 5 users represent 68% of the market. The users exhibit typical behavior for this asset, maintaining WETH borrow positions at low health factors. The suppliers are engaged in leveraged staking, earning a spread between the wstETH underlying yield and the WETH borrowing rate.

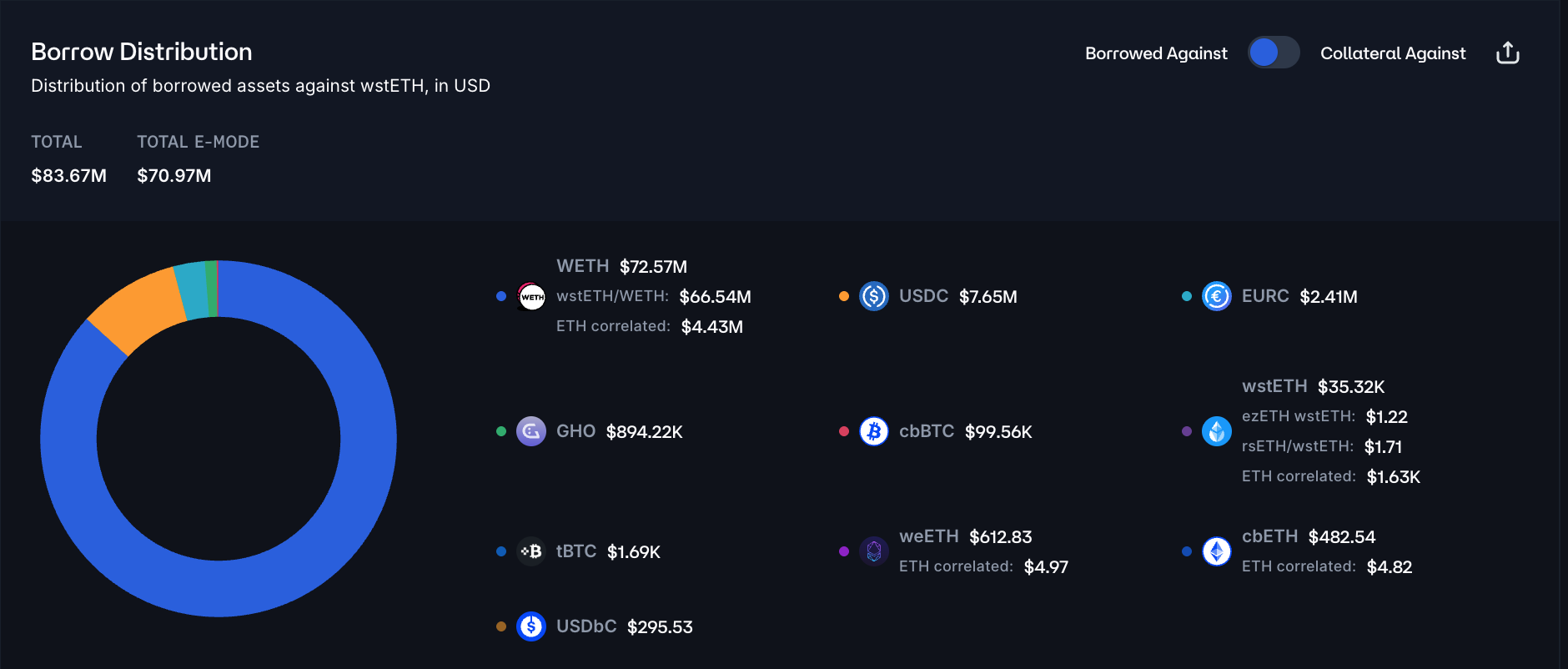

As mentioned, the largest asset borrowed against wstETH is WETH, representing over 86% of the total posted debt. While wstETH is actively used to collateralize a substantial amount of debt, the risk of liquidations is minimal due to the high price correlation of wstETH and WETH.

Borrow Distribution

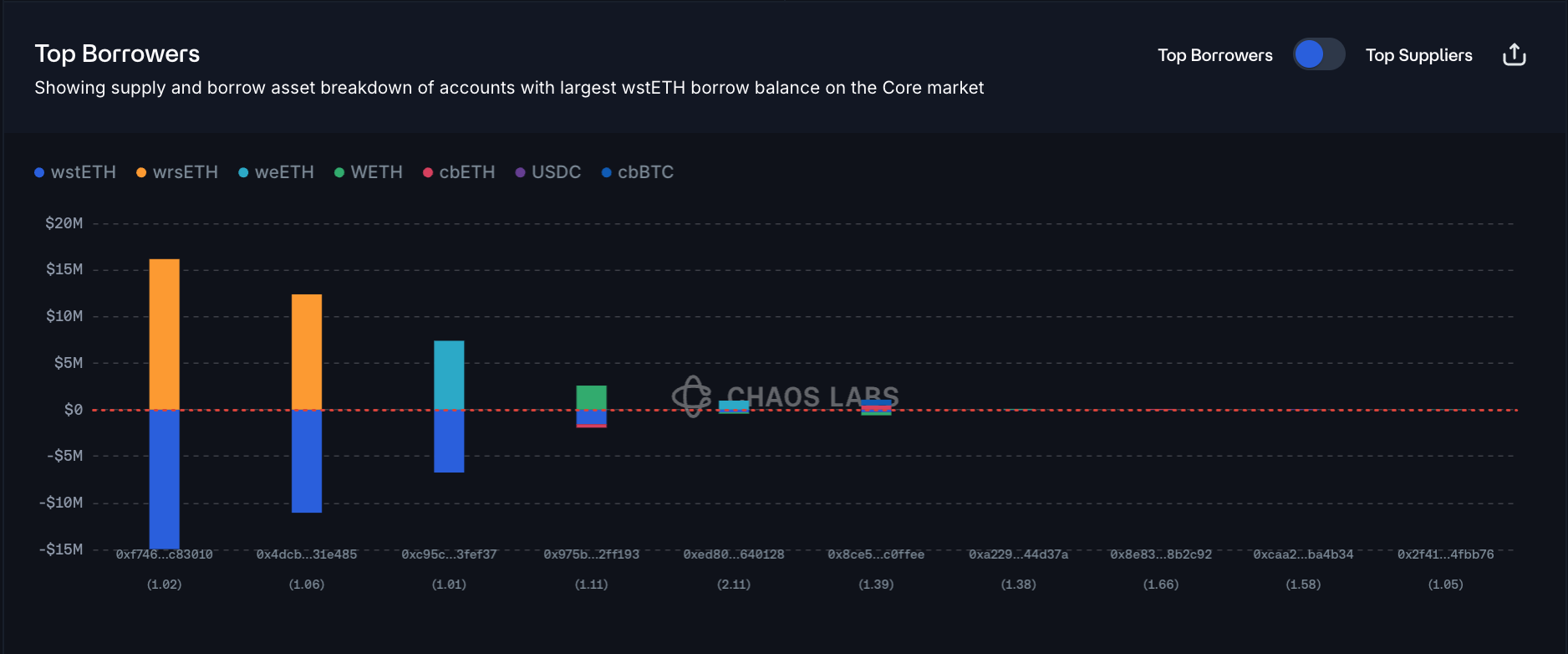

The concentration of the borrow distribution is similar to supply, as the top two users account for over 75% of the market. The users are supplying wrsETH and weETH to facilitate wstETH borrowing, effectively utilizing the spread between LST’s borrow rate and LRT’s additional restaking yield compared to LST. The health factors are clustered around the 1.02—1.11 range, indicating substantial leverage in the looped positions.

wstETH borrowing is primarily facilitated by wrsETH and weETH, as the users leverage restaking yield premiums. The market currently does not present significant risk, as the debt and collateral prices are tightly correlated.

Liquidity

At the time of writing, the liquidity on Base is sufficient to facilitate a swap of 1,600 wstETH at less than 1% slippage, supporting an increase in the supply and borrow caps.

Recommendation

Given the persistent borrowing demand, safe user behavior, along with deep on-chain liquidity, we recommend doubling the borrow cap of wstETH on the Base instance.

wrsETH

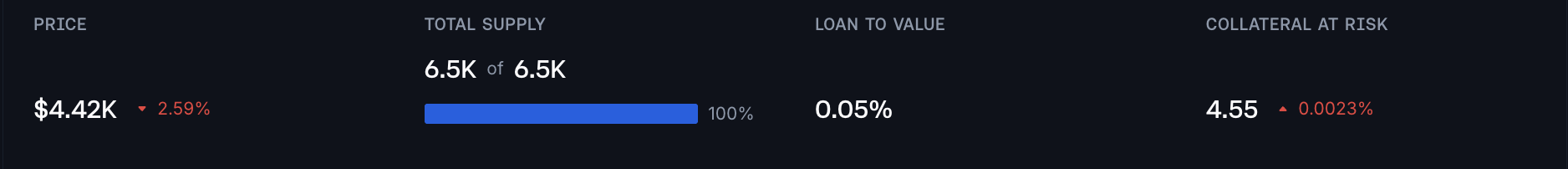

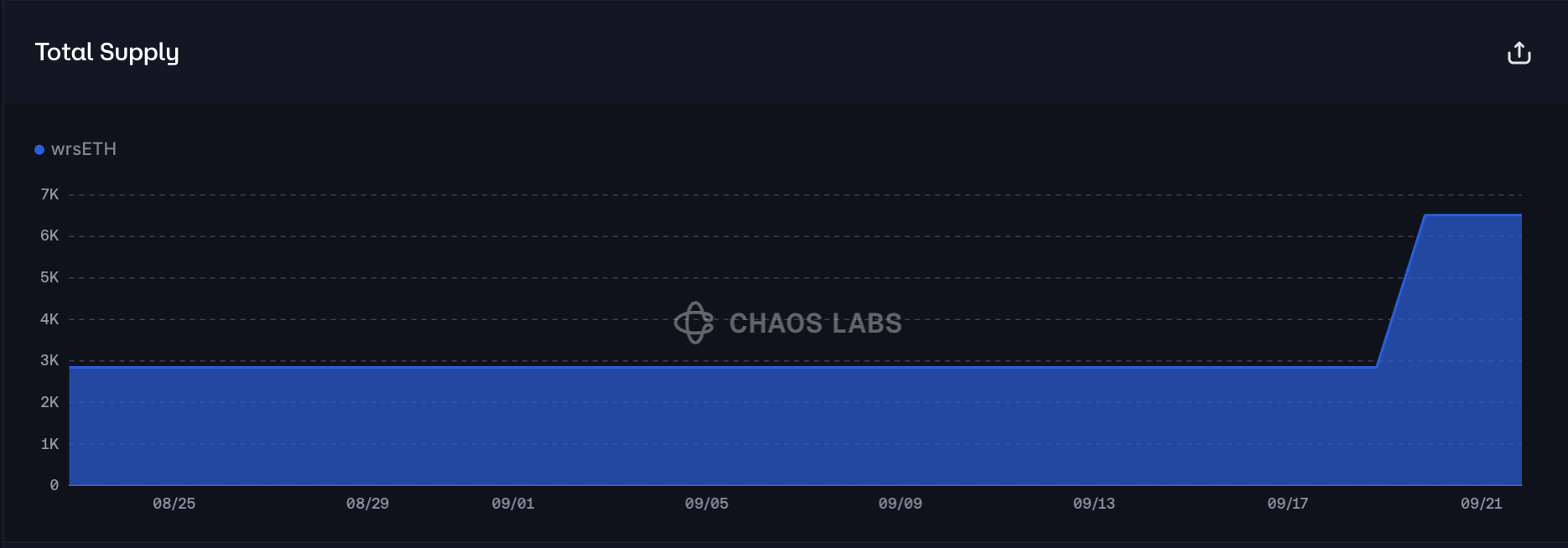

wrsETH on Base has reached its supply cap of 6,500 tokens following a spike in activity that added over 3,500 tokens on September 19.

Supply Concentration

The supply is highly concentrated, as two users represent over 95% of the market. We observe that users borrow wstETH with wrsETH collateral, likely looping to leverage a restaking yield premium. The corresponding health factors are 1.02 and 1.06, respectively, typical for such strategies.

wstETH is effectively the only asset borrowed against wrsETH collateral. Due to the high correlation between the two assets, liquidation risk is minimal.

Liquidity

At the time of writing, wrsETH liquidity on Base has sufficient depth to limit the slippage on a 250 token sale to 0.1%.

Recommendation

Considering the rapid increase in demand for wrsETH as collateral, safe user behavior, and low liquidation risk, we recommend doubling the supply cap of wrsETH.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Base | wstETH | 41,000 | - | 9,220 | 18,440 |

| Base | wrsETH | 6,500 | 13,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.