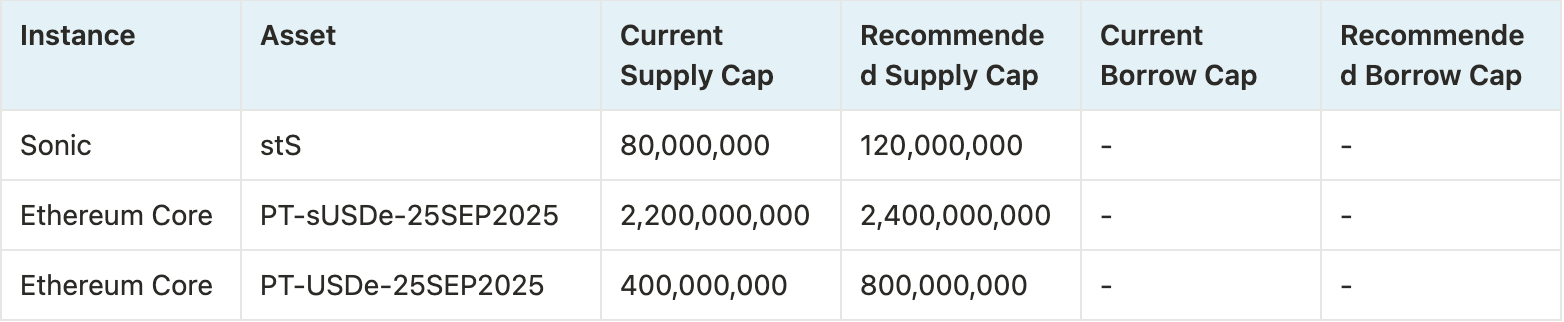

Summary:

A proposal to:

-

Increase the supply cap of stS on the Sonic instance.

-

Increase the supply cap for PT-sUSDe-25SEP2025 on the Ethereum Core instance.

-

Increase the supply cap for PT-USDe-25SEP2025 on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

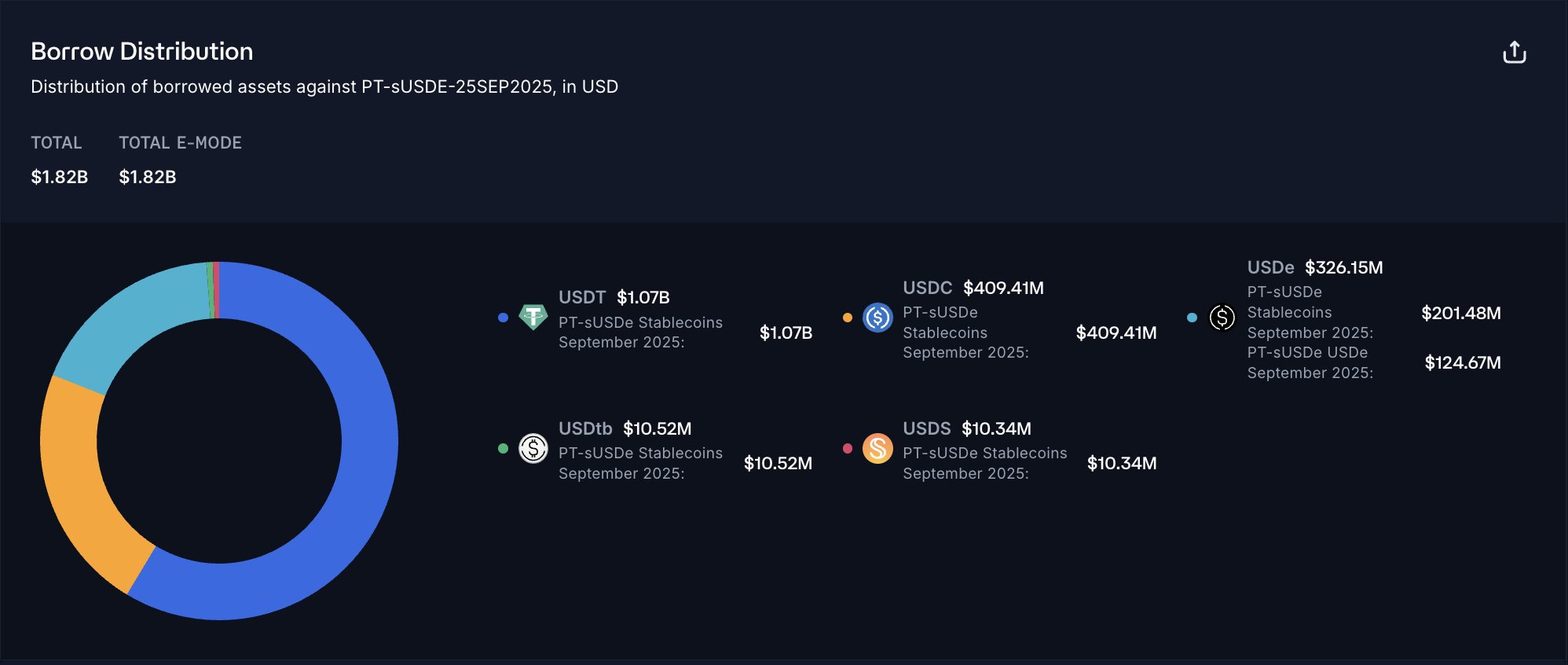

stS (Sonic)

stS has reached 98% supply cap utilization after new deposits entered the market, adding 20M in about two days and indicating strong user demand.

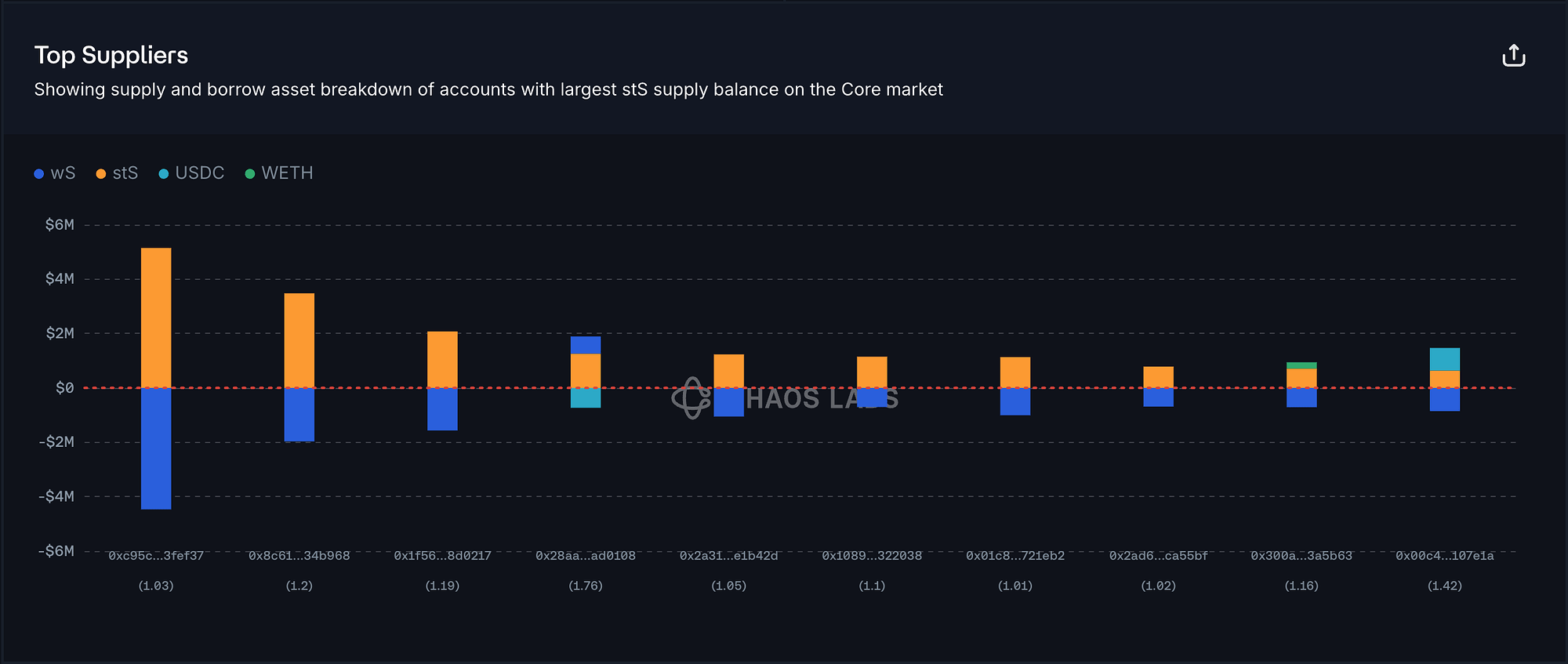

Supply Distribution

The supply of stS is slightly concentrated, with the top supplier accounting for 20% of the total distribution. However, we do not view this as a notable risk, as this user is borrowing wS. Additionally, the remaining top suppliers show similar patterns, primarily supplying stS and borrowing wS, which indicates limited liquidation risk given the correlation between these assets.

wS currently accounts for nearly 92% of the total borrow distribution.

Liquidity

Currently, selling 8M stS for USDC incurs around 7% price slippage. While this liquidity is relatively limited compared to stS’s overall supply, the safe user behavior suggests that increasing the supply cap is still viable. However, we will account for this limited liquidity and propose a slightly conservative cap increase.

Recommendation

Given the safe user-behavior, we recommend increasing stS’ supply cap.

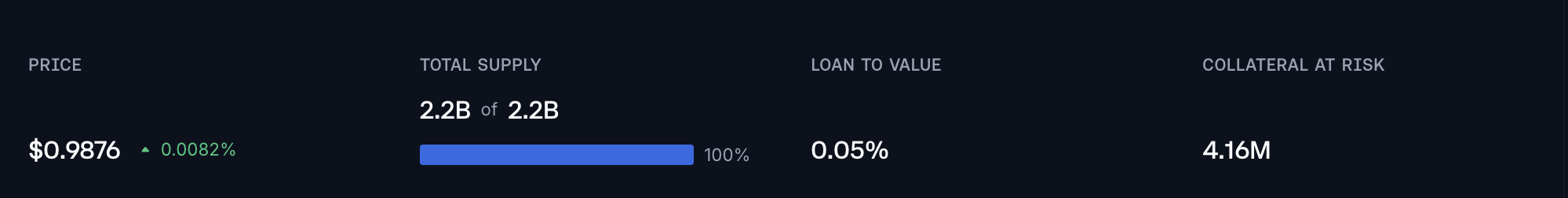

PT-sUSDe-25SEP2025 (Ethereum Core)

PT-sUSDe-25SEP2025 has reached its supply cap at 2.2B following the recent inflow of $200M since August 6th, which indicates persistent demand.

Supply Distribution

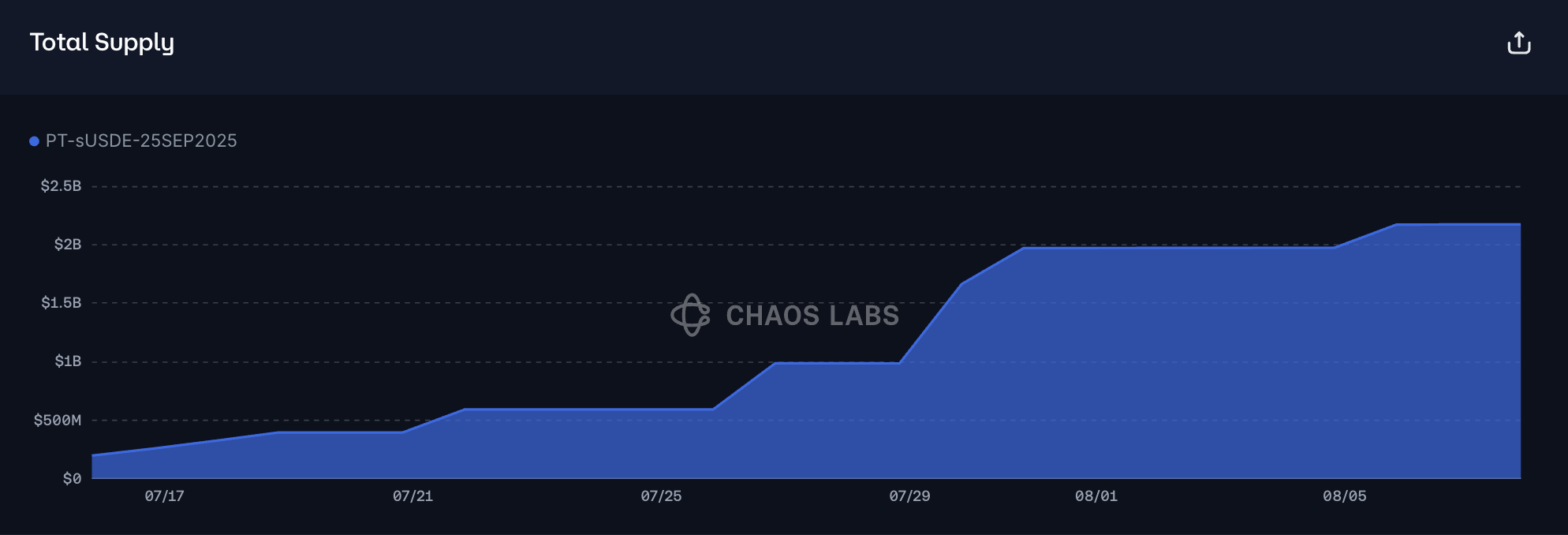

The supply is moderately concentrated, with the top user accounting for less than 6% of the total, while top 23 wallets have a cumulative supply of 54%. The health scores of the top positions are highly concentrated around 1.03, however given that the debt and collateral assets are tightly correlated, liquidation risk is effectively minimal.

The overwhelming majority of debt borrowed against the collateral is USDT and USDC with an 80% dominance. Most of the borrowing is facilitated using Stablecoins and USDe E-modes, which allow for additional capital efficiency. Risk of significant liquidations is minimized due to the fact that the debt and collateral assets’s prices are highly correlated.

Market

PT-sUSDe-25SEP2025 implied yield has experienced elevated volatility recently, ranging from initial 12.5% to the recent low of 9.5%. While such high volatility affects the PT’s price, the impact diminishes as the sensitivity of the PT’s price to the implied yield decays with maturity.

Liquidity

Currently, Pendle’s AMM can handle over 75M of liquidations with only 2.5% slippage, supporting a supply cap increase.

Additionally, Pendle’s orderbook has over 70M of liquidity at or above 9% implied yield.

Recommendation

Given the persistent market demand for PT-based strategies, we recommend increasing the supply cap by 200M. With low liquidation risk and strong liquidity, this increase will not introduce additional risks for the protocol.

PT-USDe-25SEP2025 (Ethereum Core)

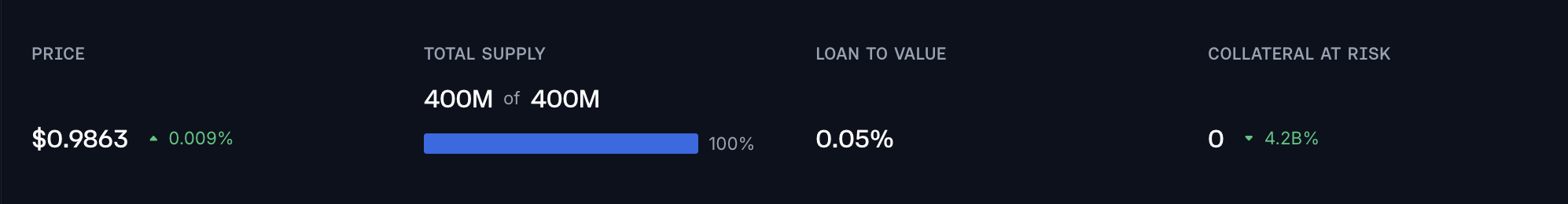

PT-USDe-25SEP2025 has reached its supply cap at 400M, following the recent increase of 200M. Though the asset has only been listed as collateral since the end of July, it has attracted a significant amount of liquidity, indicating strong market demand.

Supply Concentration

PT-USDe has a higher supply concentration than PT-sUSDe, with the top supplier holding 13% of the total and the top 7 wallets holding about 70%. Suppliers’ health factors are tightly clustered between 1.01-1.04. Although such concentration typically increases liquidation risk during price volatility, the risk is significantly mitigated since the borrowed assets are either highly correlated with or serve as the underlying of the collateral asset.

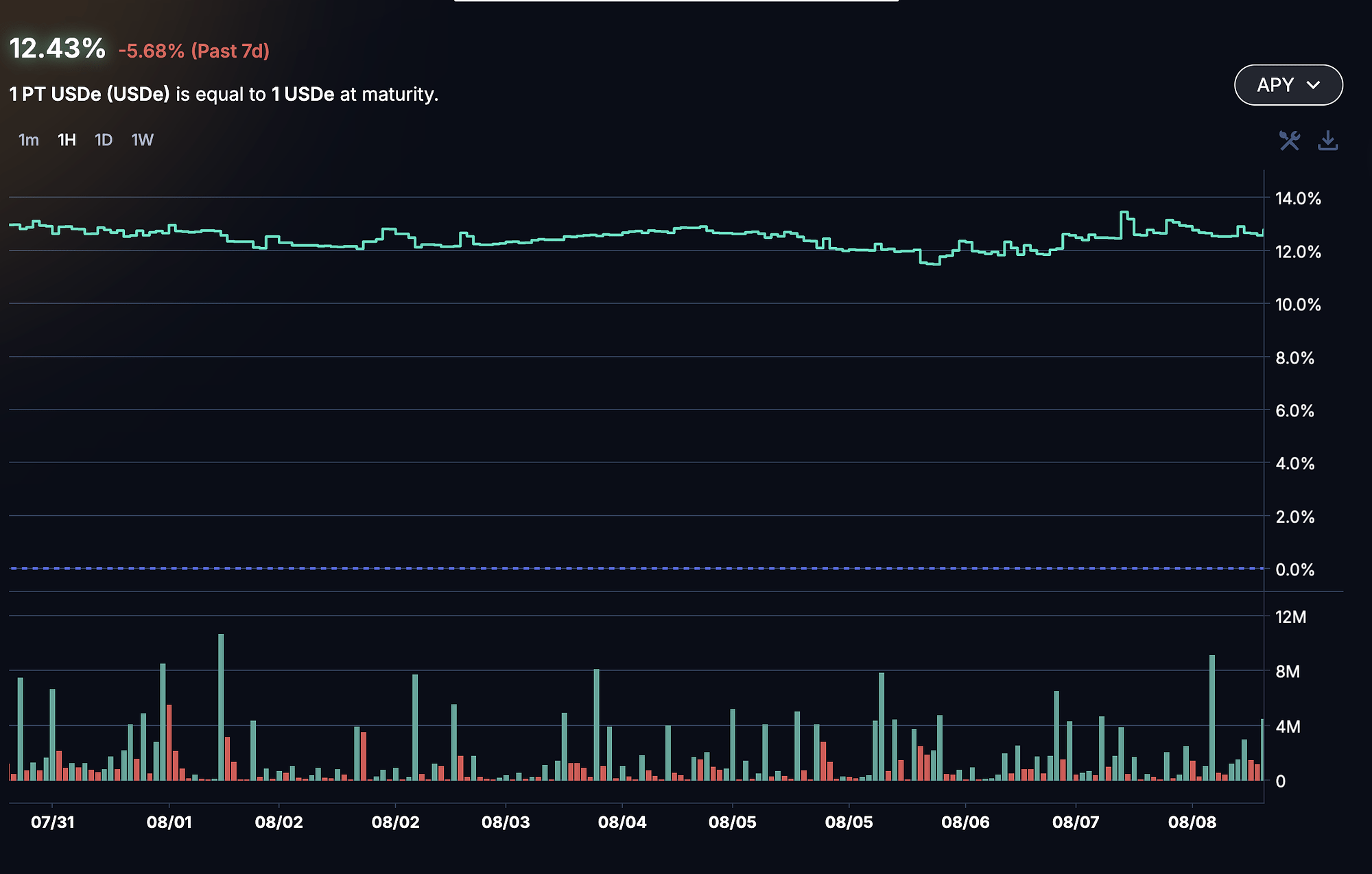

Market

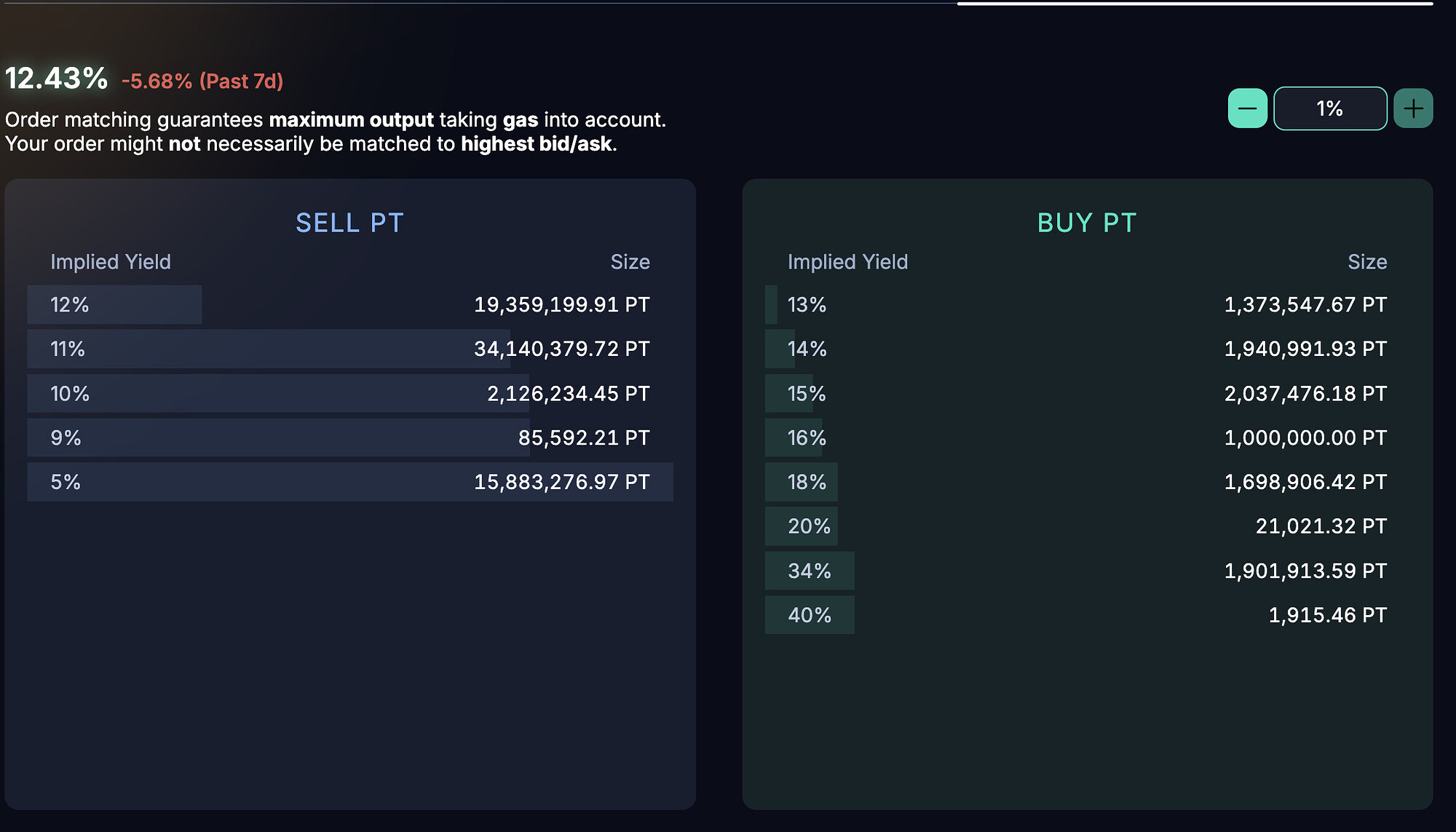

The implied yield has been moderately volatile this week, initially rising to 13.5% before stabilizing at 12% and rebounding to ~12.5%. While yield fluctuations impact the price of principal tokens, their effect diminishes with maturity.

Liquidity

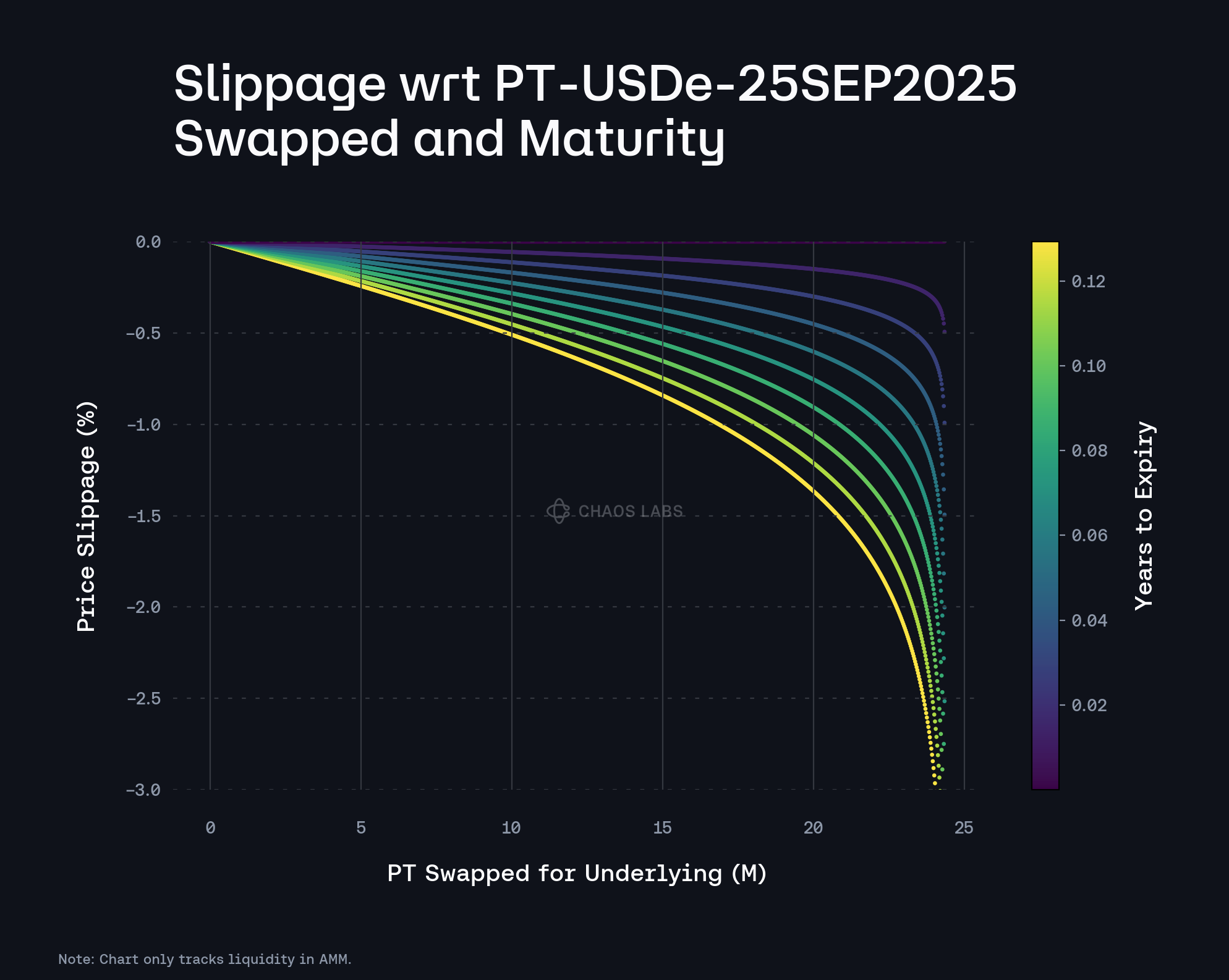

At present, AMM liquidity on Pendle is sufficient for a 24M PT-USDe-25SEP2025 swap with a moderate 2% slippage, supporting an increase in supply caps.

Pendle’s Orderbook has over 50M of liquidity at or below 11% implied yield.

Recommendation

Considering current market conditions, significant outstanding demand, deep liquidity, and low liquidation risk, we recommend increasing the supply cap of PT-USDe-25SEP2025 by 400M.

Specification

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0