Summary:

A proposal to:

- Increase supply and borrow caps for USDC on the Linea Instance

- Increase supply and borrow caps for USDT on the Linea Instance

- Increase the supply cap for WETH on the Linea Instance

- Increase the supply cap for weETH on the Linea Instance

- Increase the supply cap for ezETH on the Linea Instance

- Increase the borrow cap for USDtb on the Ethereum Core Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDC (Linea)

USDC has reached its supply cap of 12M, following an inflow of more than 7M USDC over the past two days.

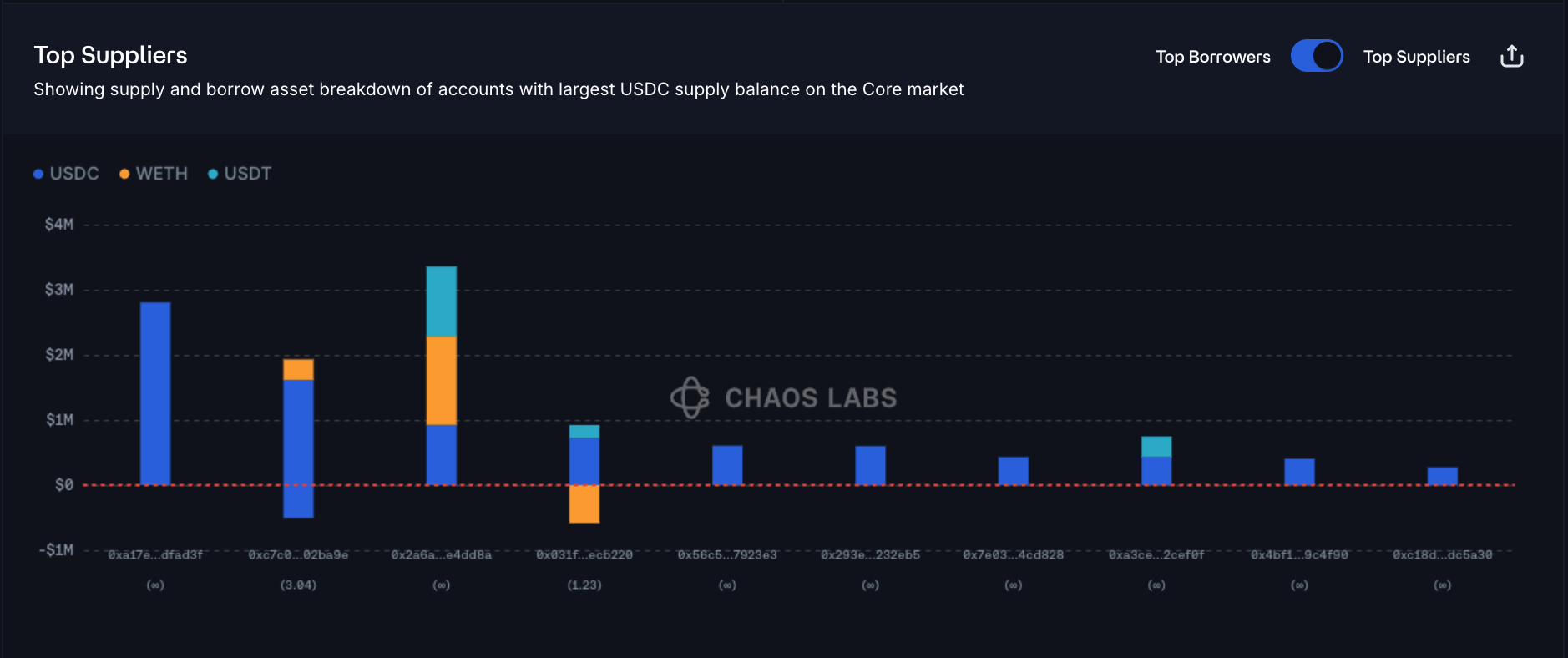

Supply Distribution

USDC supply distribution shows moderate concentration: the top supplier accounts for over 20% of total supply, while the top 5 users collectively hold 65%. Since the vast majority of suppliers have no debt, liquidation risk is minimal.

USDC is primarily used as collateral for additional USDC loans or WETH borrowing. While over 45% of USDC-collateralized debt is in volatile assets, the absolute dollar-equivalent size of the market remains small, valued at ~$1M, posing no significant risks to the protocol.

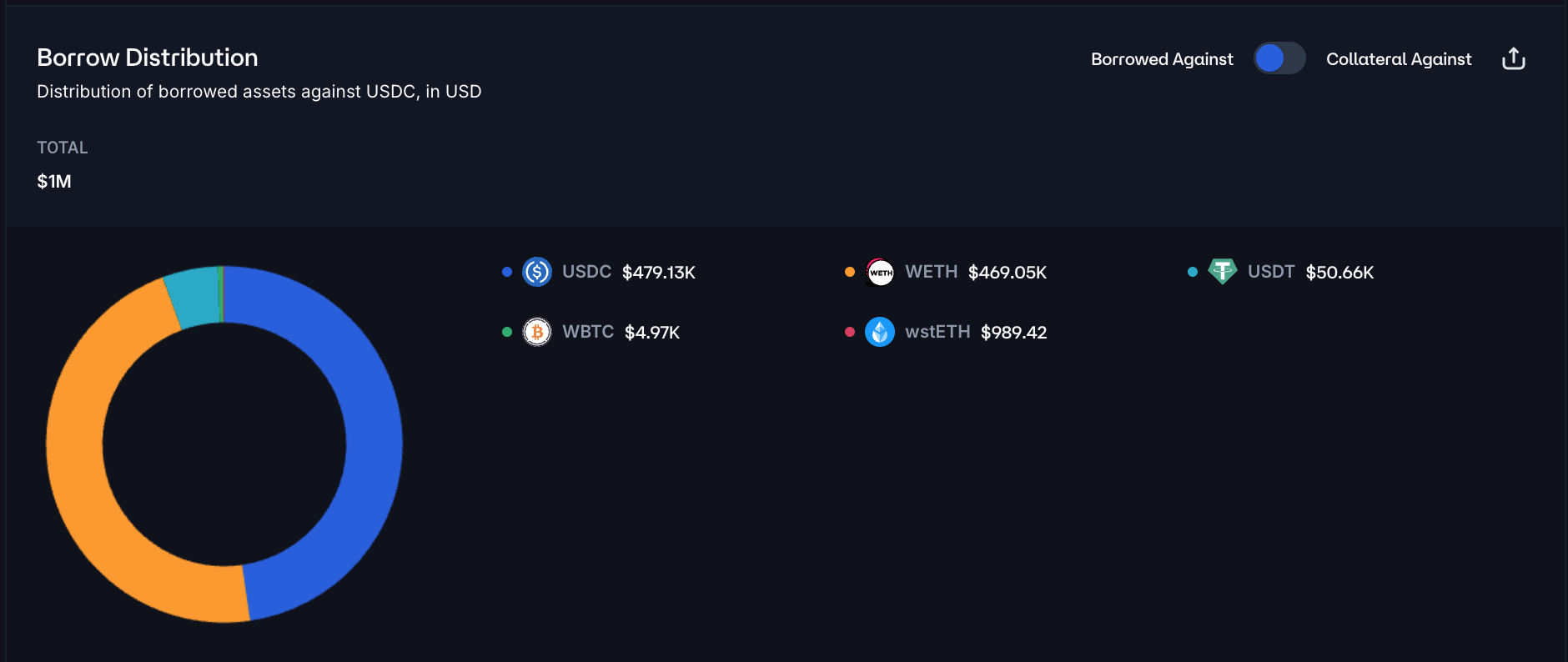

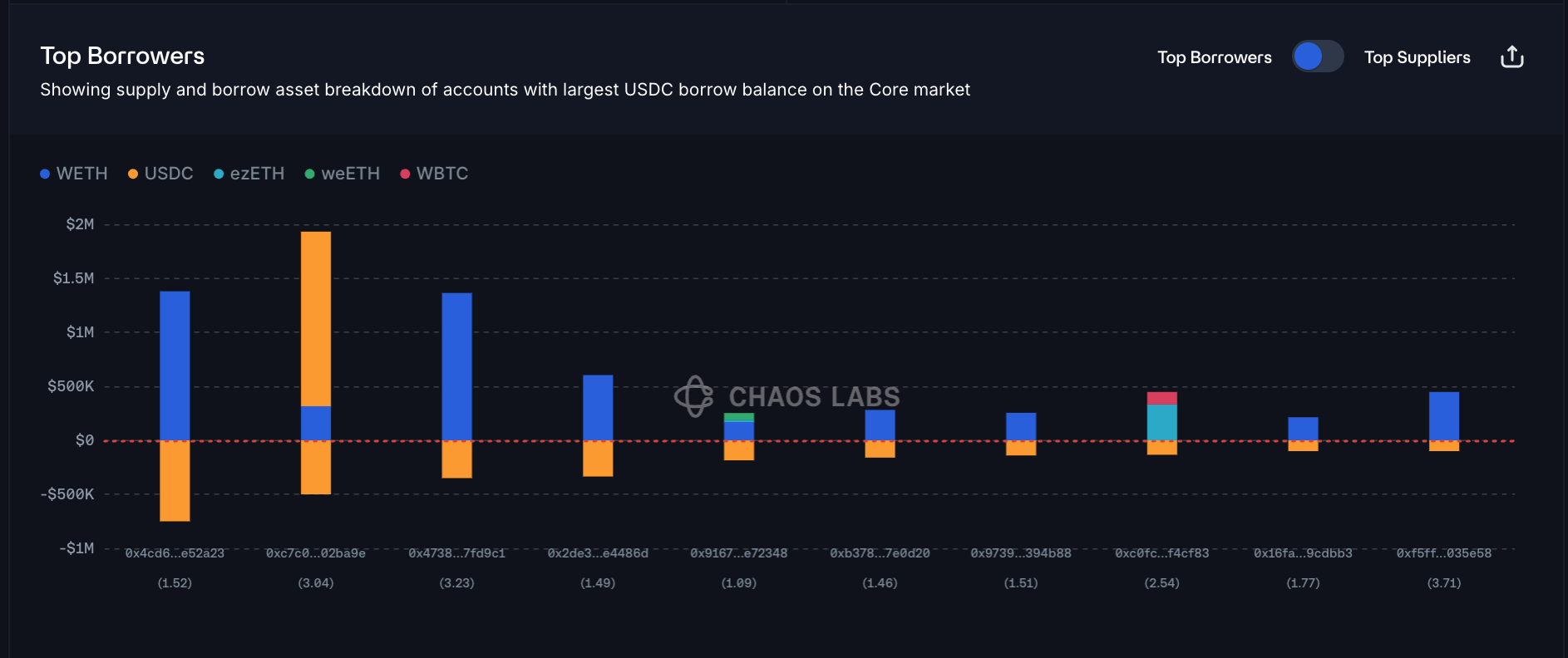

Borrow Distribution

USDC’s borrow distribution has a lower concentration compared to the supply, with the top 19 borrowers accounting for a total of 59%. Health scores of the top borrowers are primarily in the safe 1.4 - 4.0 range, significantly limiting liquidation risk.

The overwhelming majority of USDC-based debt is collateralized with volatile assets like WETH, WBTC, ezETH, etc., accounting for ~90% of all posted collateral.

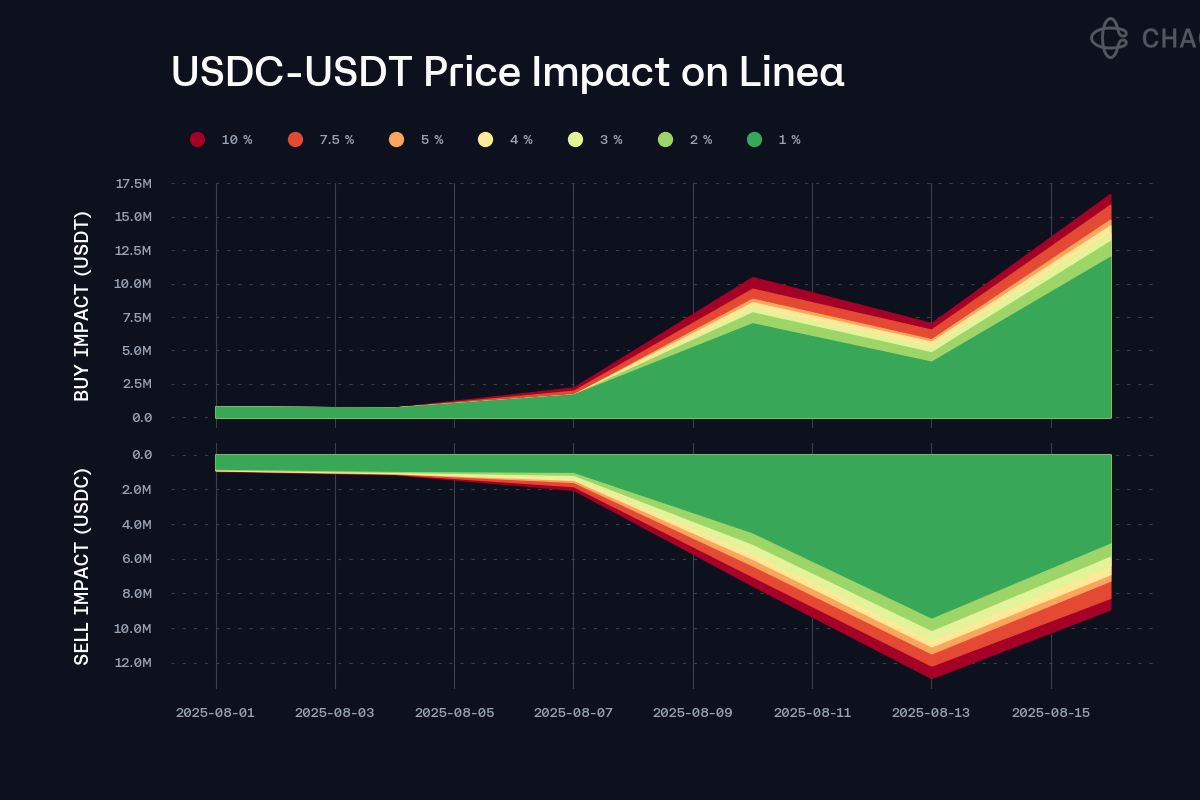

Liquidity

USDC’s on-chain liquidity has expanded significantly, growing from 1M to 8M. Currently, the market can absorb a 6M USDC sell order with only 1% slippage, supporting an increase of supply and borrow caps.

Recommendation

Given the increased demand for USDC, favorable market dynamics, safe user behavior, and deep on-chain liquidity, we recommend increasing the supply and borrow caps of USDC on Linea to 24M and 21.6M tokens.

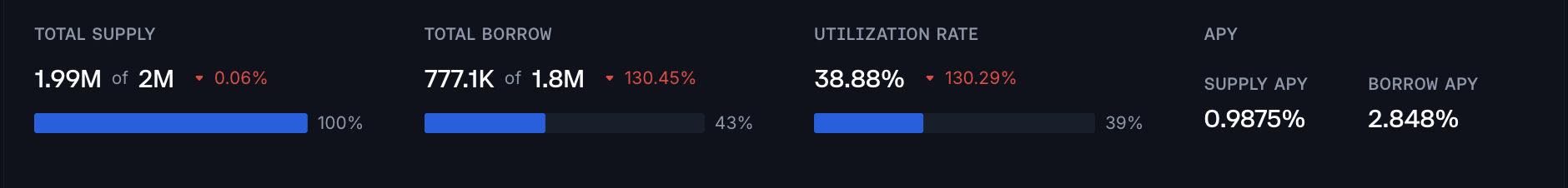

USDT (Linea)

USDT has reached 100% of its supply cap at 2M tokens, following a $1M inflow since August 13th.

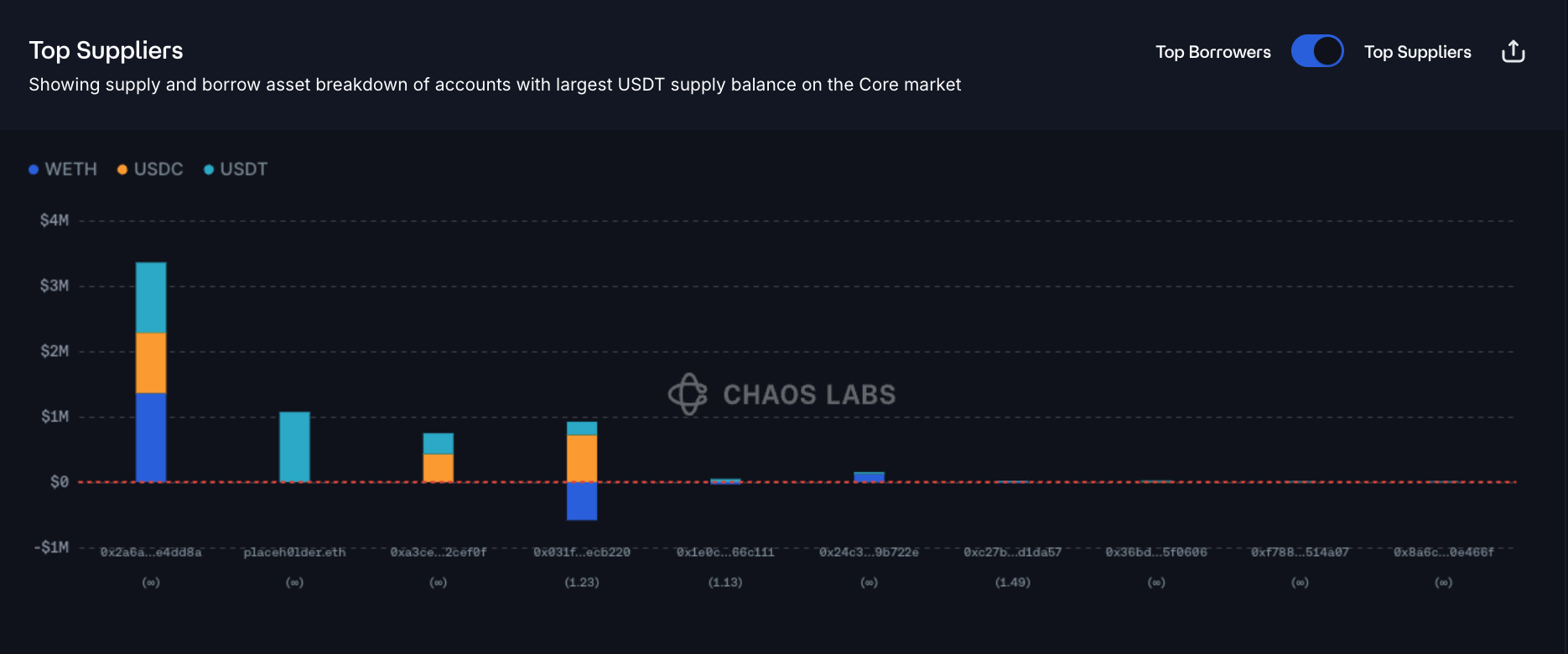

Supply Distribution

USDT’s supply distribution is highly concentrated: the top wallet accounts for over 50% of the supply, while the top 3 wallets have a cumulative share of 80%. While such concentration typically raises concerns, the risk is effectively mitigated as the top suppliers have no outstanding debt.

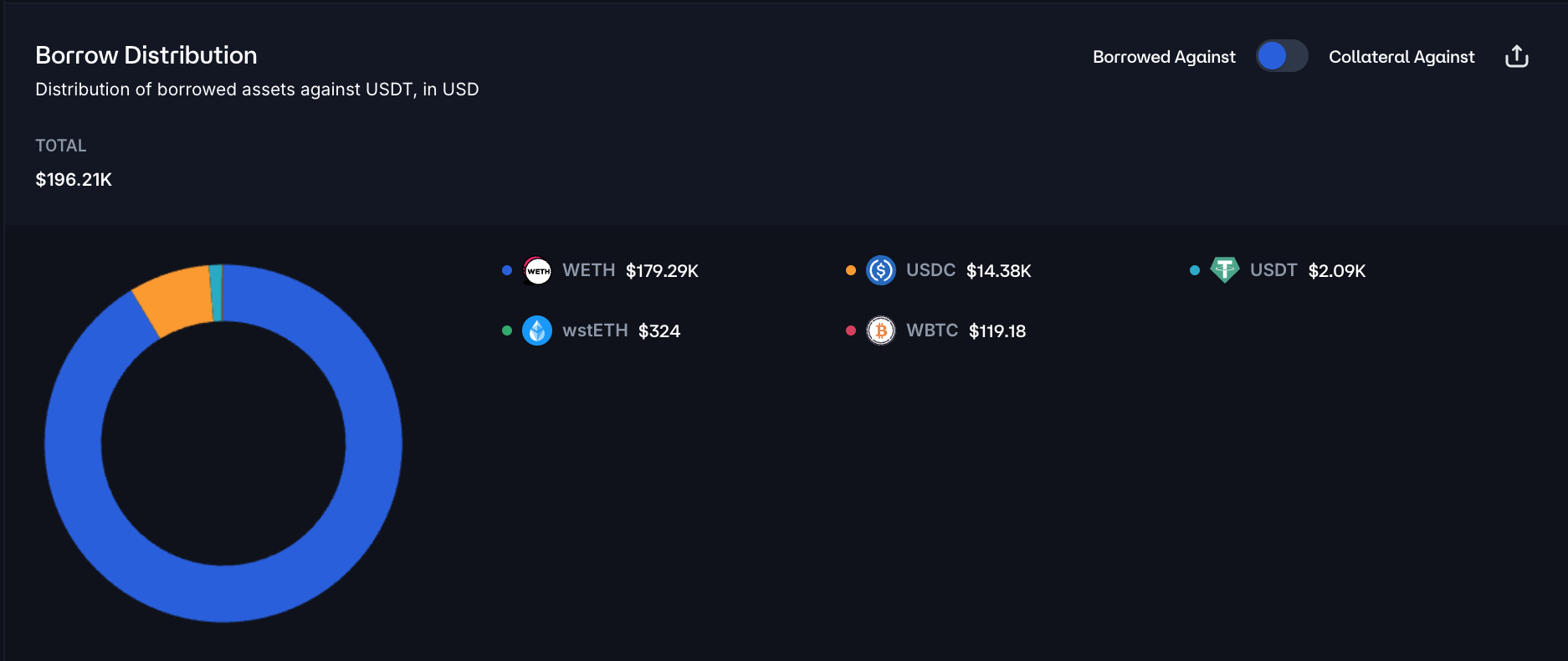

Only a small portion of the supplied USDT is used as collateral. WETH is the largest borrowed asset, with current borrowing volume at $180K, posing minimal risk of bad debt.

Borrow Distribution

USDT’s borrow distribution is moderately concentrated as the top user’s debt is 12% of the total, while top 5 users account for over 40%. The health scores of the top borrowers are in the 1.42 - 2.25 range, posing no significant liquidation risk.

WETH and WBTC account for 85% of all collateral posted against USDT-based debt. Although these assets are volatile, borrower health factors are generally clustered in the mid-range, reducing the likelihood of forced liquidations.

Liquidity

Over the past two weeks, USDT’s on-chain liquidity has grown more than 10x. Currently, a swap of 12.5M USDT to USDC is estimated to incur ~1% slippage, supporting an increase in supply and borrow caps.

Recommendation

We recommend doubling the USDT supply and borrow caps to 4M and 3.6M tokens in response to accelerating demand. Despite high supply concentration, risk remains limited as top suppliers hold no significant borrow positions. Coupled with healthy collateralization behavior and deep on-chain liquidity, this adjustment provides additional capacity while preserving a conservative risk profile.

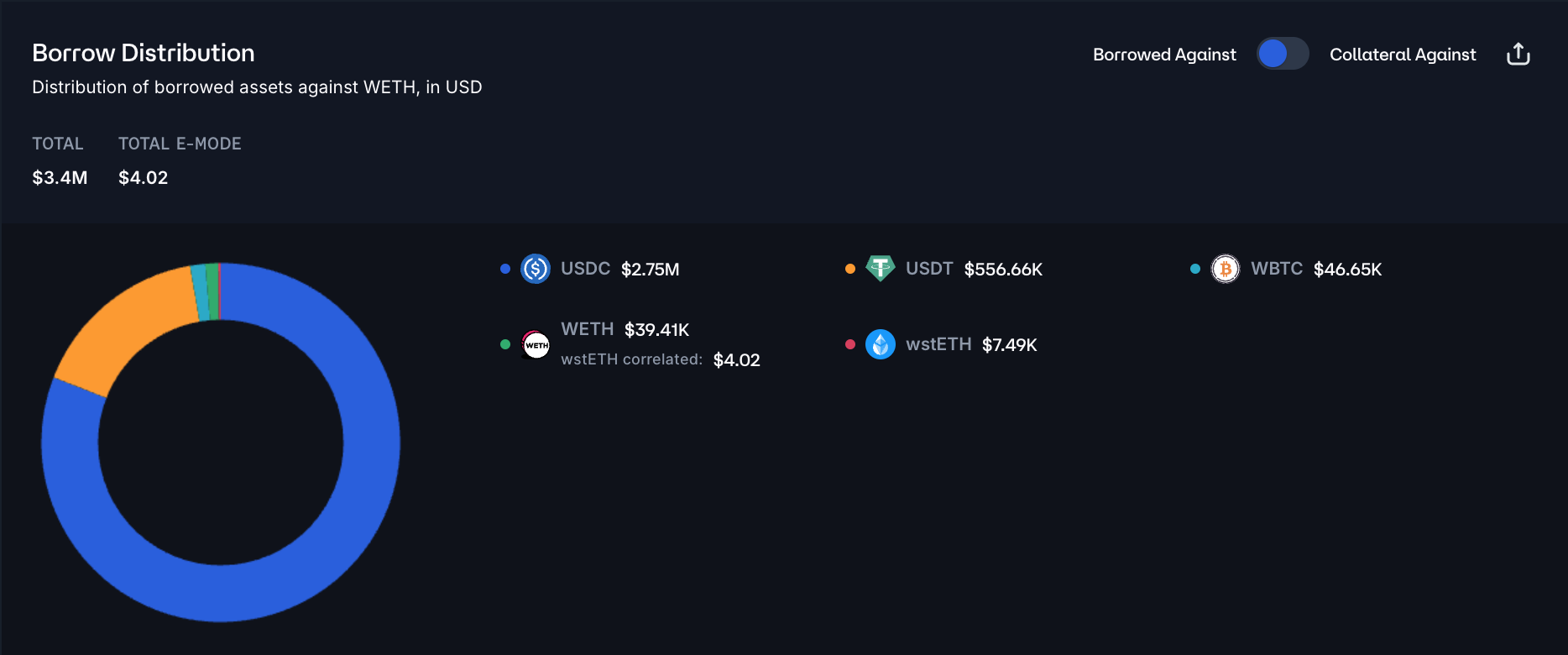

WETH (Linea)

WETH’s supply cap has been filled at 9.6K tokens, following an inflow of 6.4K WETH in the past 10 days.

Supply Distribution

WETH supply concentration is high, with the top supplier providing over 25% of the total supply. However, liquidation risks are limited, as most top suppliers do not have any borrow positions.

Only about 8% of WETH supply is used as collateral. Most debt positions are in USDC and USDT, accounting for 88% of WETH-collateralized borrowing.

Liquidity

WETH’s on-chain liquidity has increased significantly. At present, a sell order of 750 WETH is expected to incur a conservative 1% slippage, supporting an increase in supply caps.

Recommendation

We recommend increasing the WETH supply cap by 9.6K tokens. The adjustment is supported by strong demand growth, highly concentrated yet low-risk supplier positions with minimal borrow exposure, and sufficient on-chain liquidity capable of absorbing large trades at conservative slippage levels.

ezETH (Linea)

ezETH has reached 68% of its supply cap utilization, reflecting a strong growth trend over the past two weeks.

Supply Distribution

The supply distribution of ezETH presents a concentration risk, with the top supplier accounting for 38% of the total. However, since this user is borrowing WETH, a highly correlated asset, we do not view this as a material risk.

The largest borrowed asset against ezETH is WETH, accounting for 97% of the total, which significantly reduces the risk of large-scale liquidations.

Liquidity

Currently, a 1.8K ezETH sell to WETH will incur less than 3% price slippage.

Recommendation

Given the safe user behavior and strong on-chain liquidity, we recommend increasing ezETH’s supply cap.

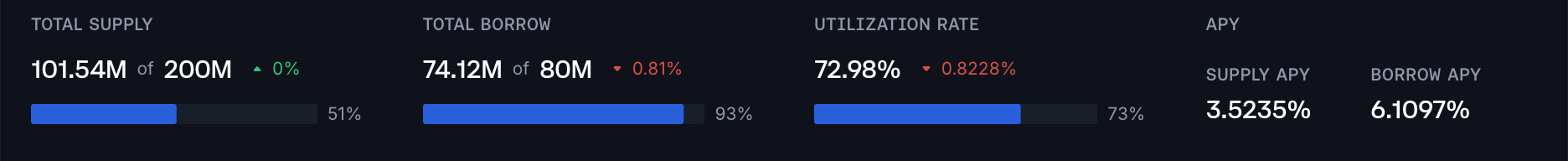

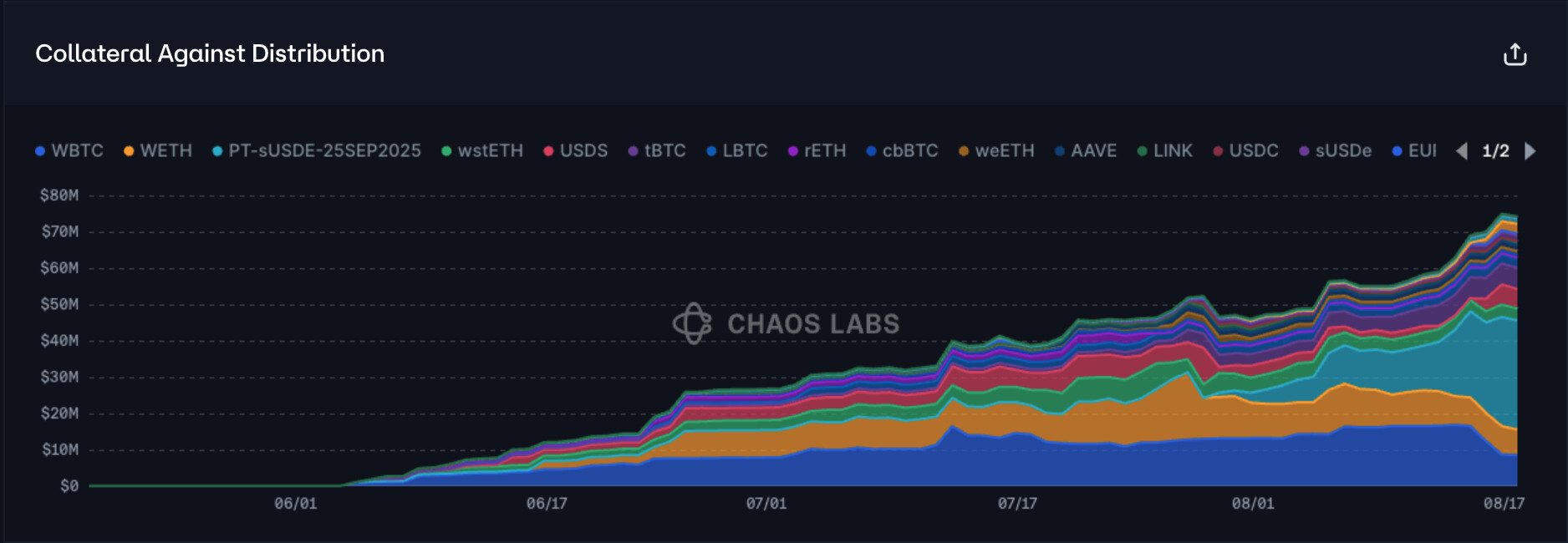

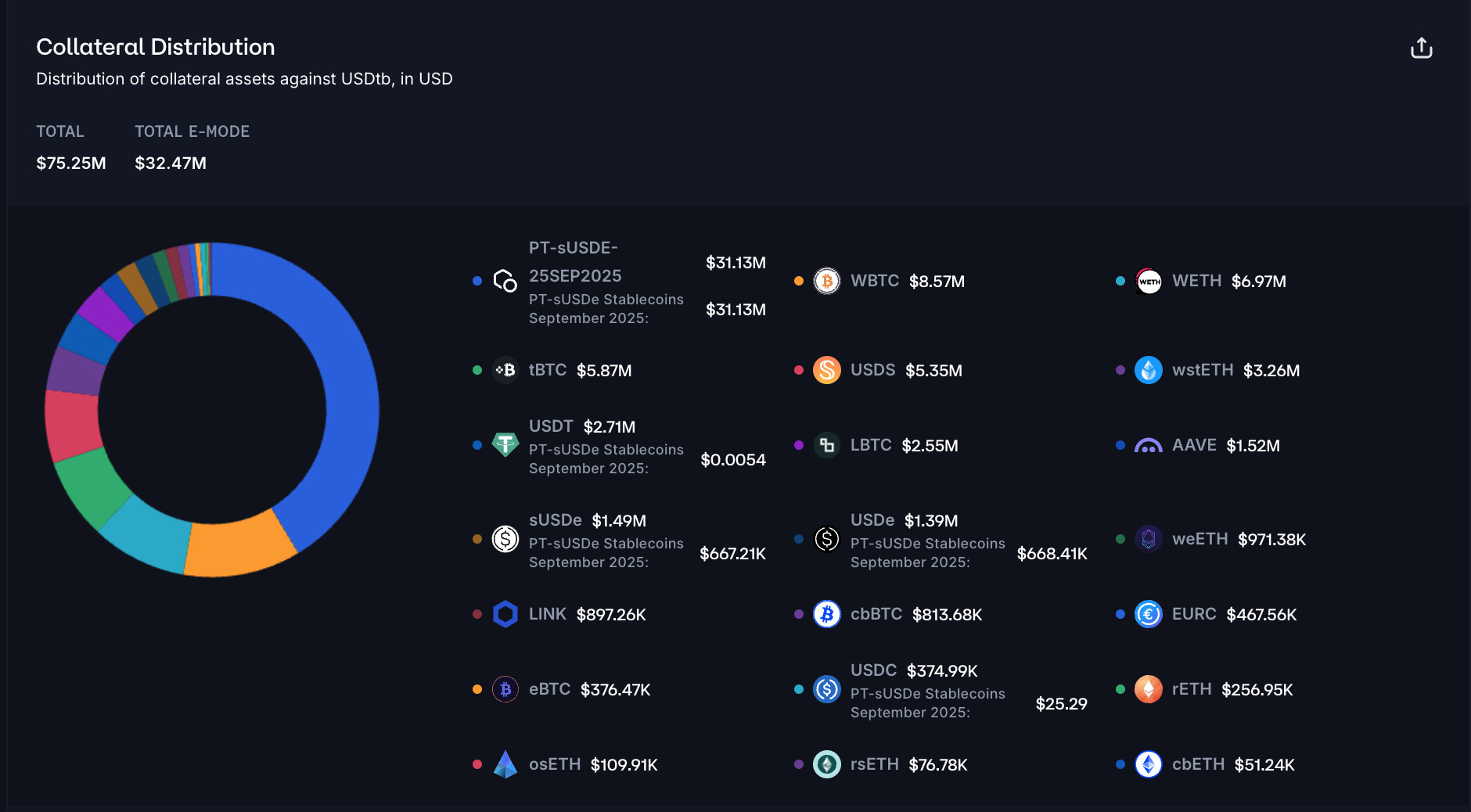

USDtb (Ethereum Core)

USDtb has reached 93% of its borrow cap, following the addition of USDtb to the PT-sUSDe Stablecoins September 2025 E-Mode, which allows borrowing USDtb using PT-sUSDe collateral, facilitating additional looping.

Supply Distribution

USDtb supply is facilitated by a single entity — Ethena. Ethena uses Aave to generate additional yield on USDtb, which forms part of Ethena’s reserve. By supplying the asset on Aave, Ethena creates additional yield for the users who have deposited their funds to mint USDe.

Borrow Distribution

USDtb’s borrow distribution shows moderate concentration, with the top borrower accounting for just over 20% of total borrowings and the top 9 users collectively holding 57%. Borrower health factors are generally clustered between 1.02 and 2.0, typically considered risky. However, the likelihood of significant liquidations is reduced, as a large share of these positions involves correlated assets on both the debt and collateral sides.

The majority of collateral backing USDtb debt positions consists of stablecoins or USDe-based PTs, with PT-sUSDE, USDT, sUSDe, USDe, and USDC together accounting for over 55% of the total. This composition significantly limits liquidation risk, as debt and collateral are highly correlated.

Recommendation

Considering strong USDtb borrowing demand, low liquidation risks, and significant on-chain liquidity, we recommend increasing the borrow cap to 160M to align with the target utilization.

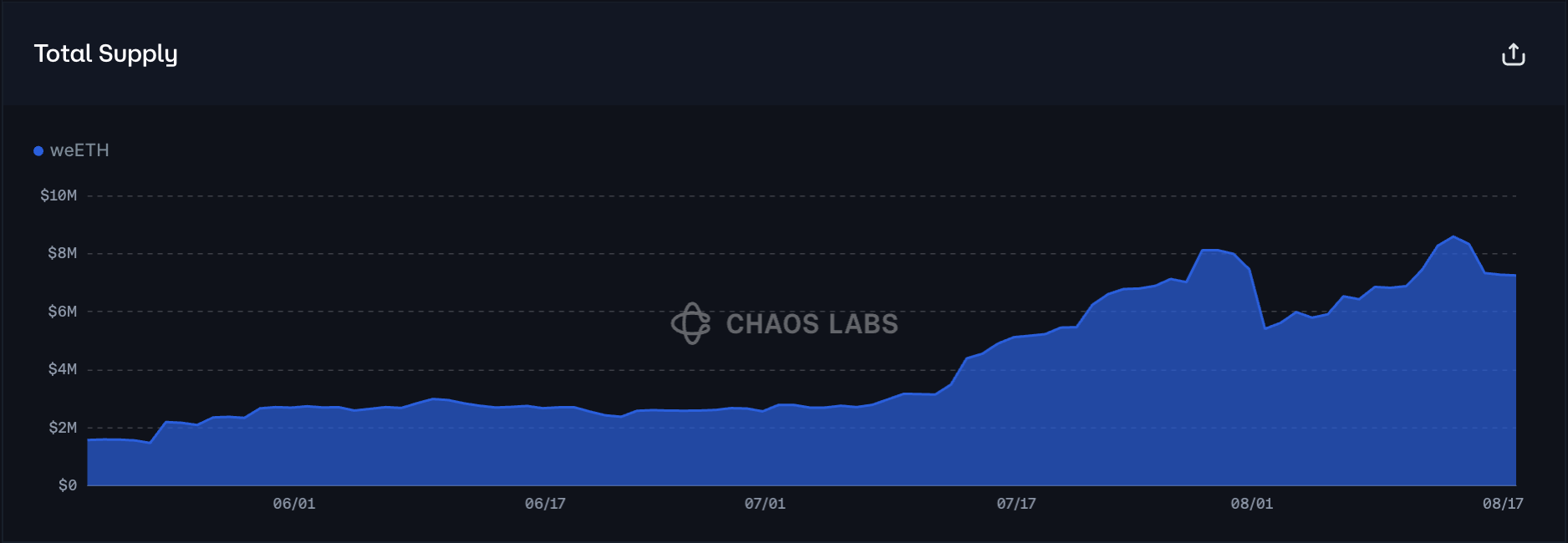

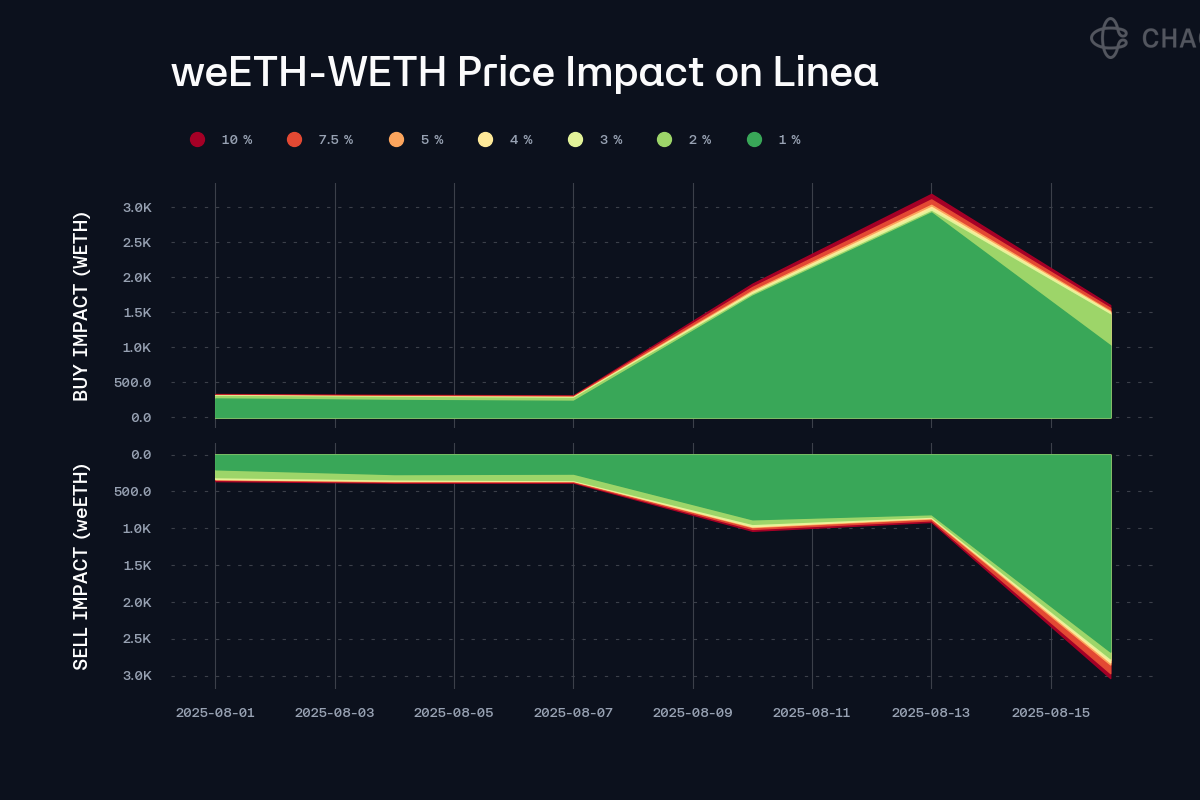

weETH (Linea)

weETH has experienced a substantial increase in supply over the past 30 days, growing by 500 tokens and demonstrating strong growth momentum.

Supply Distribution

weETH’s supply distribution is highly concentrated as the top supplier accounts for over 34% of the total supply, while the top 15 wallets have a cumulative share of 79%. Additionally, health factors are tightly clustered in the 1.02 - 1.4 range. Typically, these two factors combined would pose significant risks, but due to the high correlation of the debt and collateral assets (WETH/weETH), the liquidation risk is effectively minimized.

WETH is the largest borrowed asset by far, accounting for 97% of all borrowing. Users leverage weETH to borrow WETH to profit from the spread between LRT rewards from Ether.fi and the WETH borrow rate. Due to the high correlation between the debt and collateral assets, liquidation risk is significantly reduced.

Liquidity

weETH liquidity on Linea has seen significant growth recently. At present, a sell order of 2.5K weETH would incur only 1% slippage. This robust on-chain liquidity supports increasing the weETH supply cap.

Recommendation

Taking into account strong demand, deep liquidity, and safe user behavior, we recommend increasing weETH’s supply cap on the Linea instance by 4K tokens.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 12,000,000 | 24,000,000 | 10,800,000 | 21,600,000 |

| Linea | USDT | 2,000,000 | 4,000,000 | 1,800,000 | 3,600,000 |

| Linea | WETH | 9,600 | 19,200 | 8,800 | 17,600 |

| Linea | ezETH | 4,800 | 9,600 | - | - |

| Linea | weETH | 4,000 | 8,000 | - | - |

| Ethereum Core | USDtb | 200,000,000 | - | 80,000,000 | 160,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.