Summary:

A proposal to:

-

Increase the supply and borrow caps of USDC on the Linea instance.

-

Increase the supply cap of wstETH on the Linea instance.

-

Increase the supply and borrow caps of USDT on the Linea instance.

-

Increase the supply cap of ezETH on the Linea instance.

-

Increase the supply cap of weETH on the Linea instance.

-

Increase the supply and borrow caps of WETH on the Linea instance.

-

Increase the supply and borrow caps of WBTC on the Linea instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

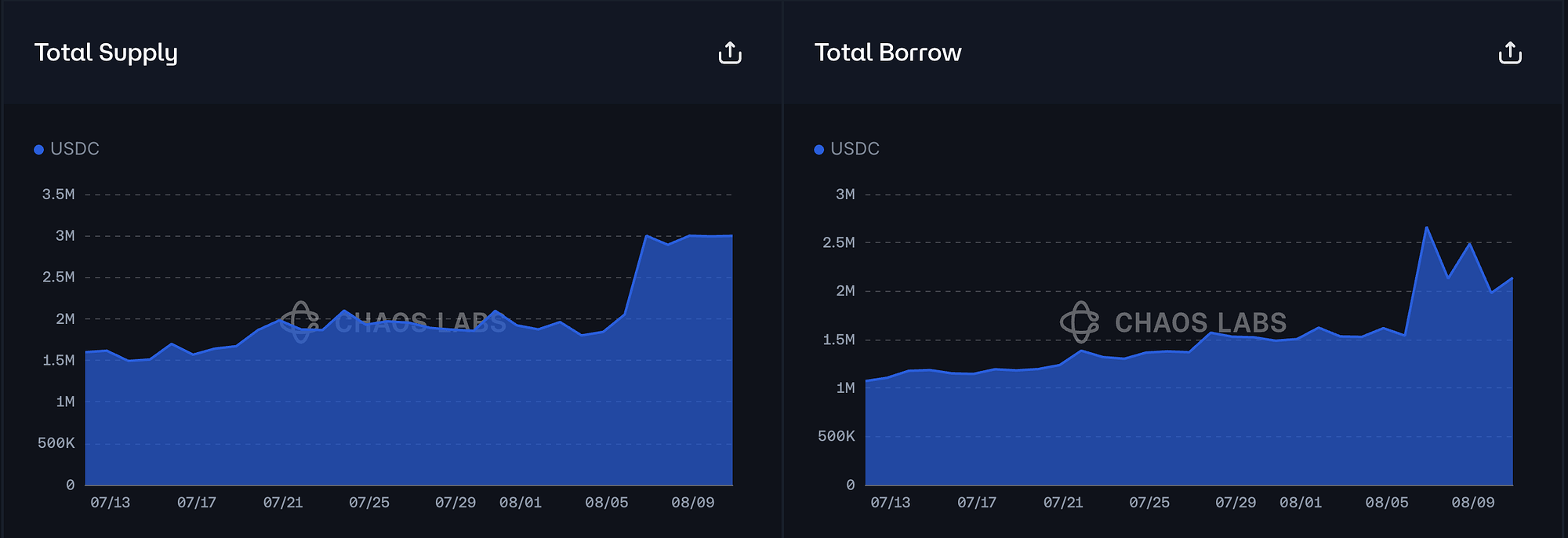

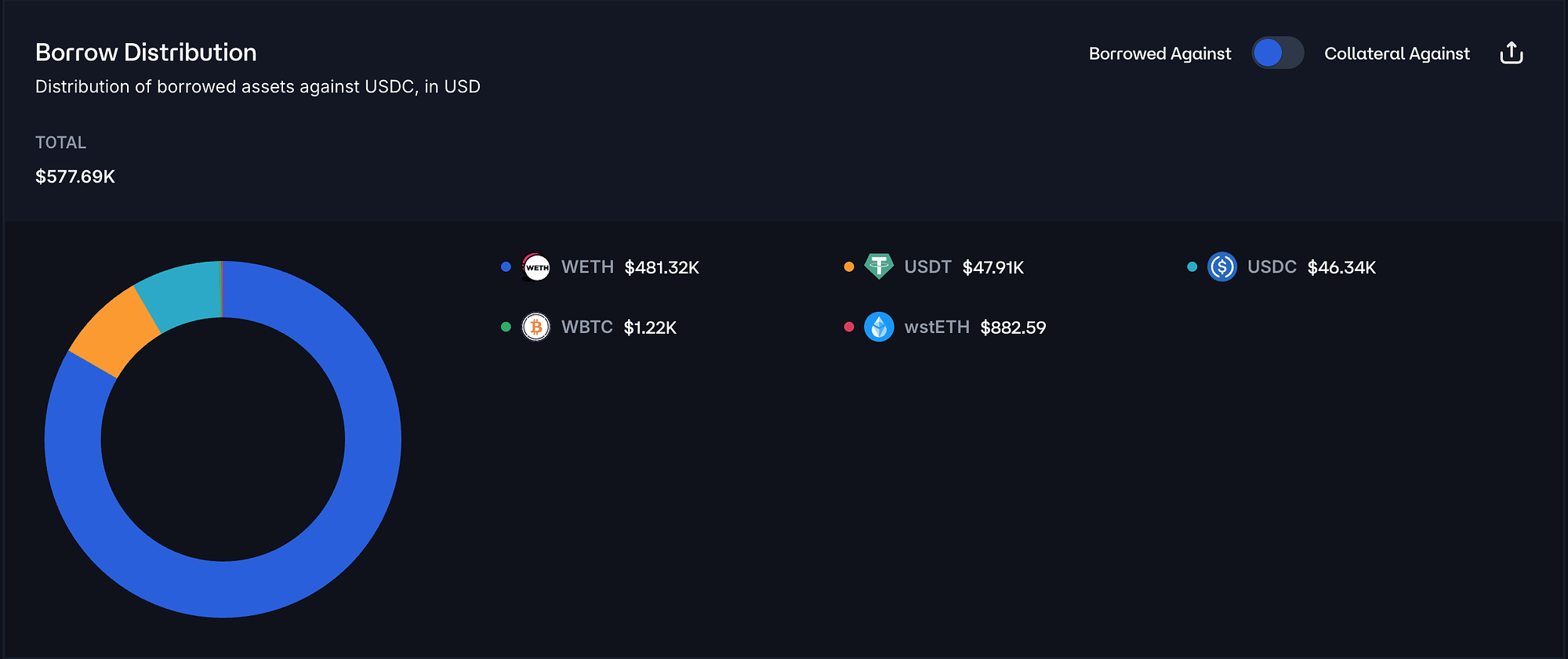

USDC

USDC has reached almost 80% borrow cap utilization and 100% supply cap utilization.

Supply Distribution

The supply distribution of USDC presents limited liquidation risk. Among the top 10 suppliers, 8 have no borrowing activity, indicating minimal liquidation risk. The only two positions with active borrowing both hold high health scores, so they do not currently raise significant concerns.

The largest borrowed asset against USDC is WETH, but the borrowed amount is less than $500K.

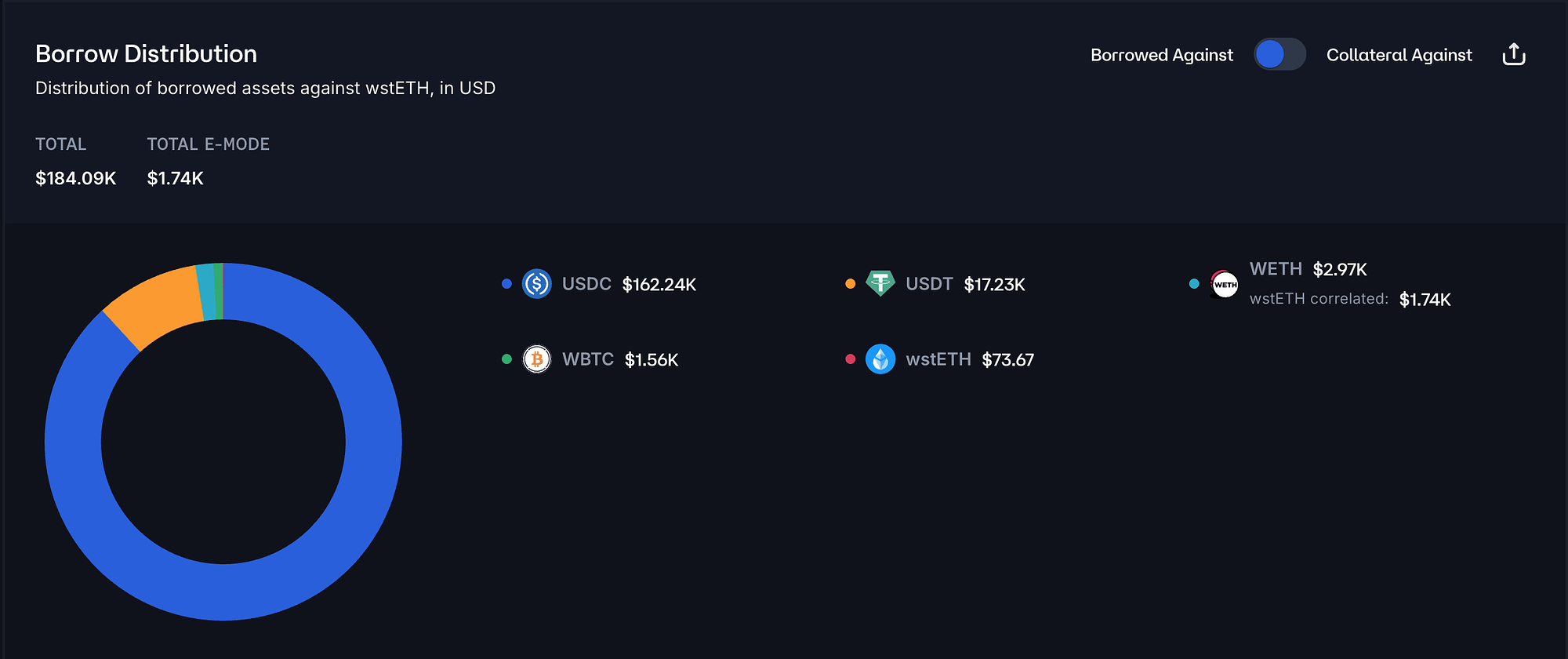

Borrow Distribution

The borrow distribution of USDC is not concentrated, with the top borrower accounting for less than 10% of the total borrowed USDC. Additionally, each borrower holds a relatively high health score, which significantly reduces the risk of liquidation.

Recommendation

Given the safe user behavior, we recommend increasing both USDC’s supply cap and borrow cap.

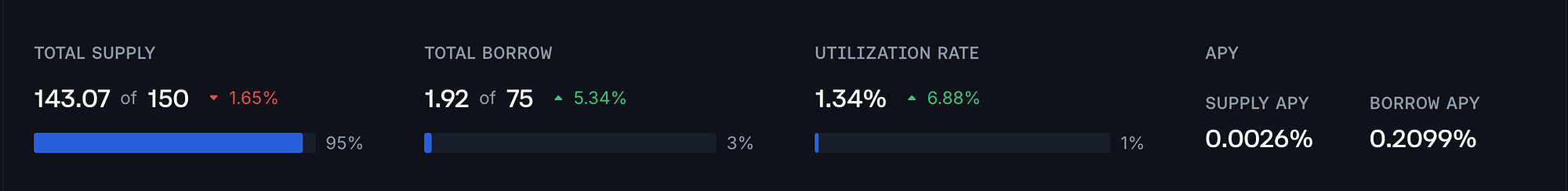

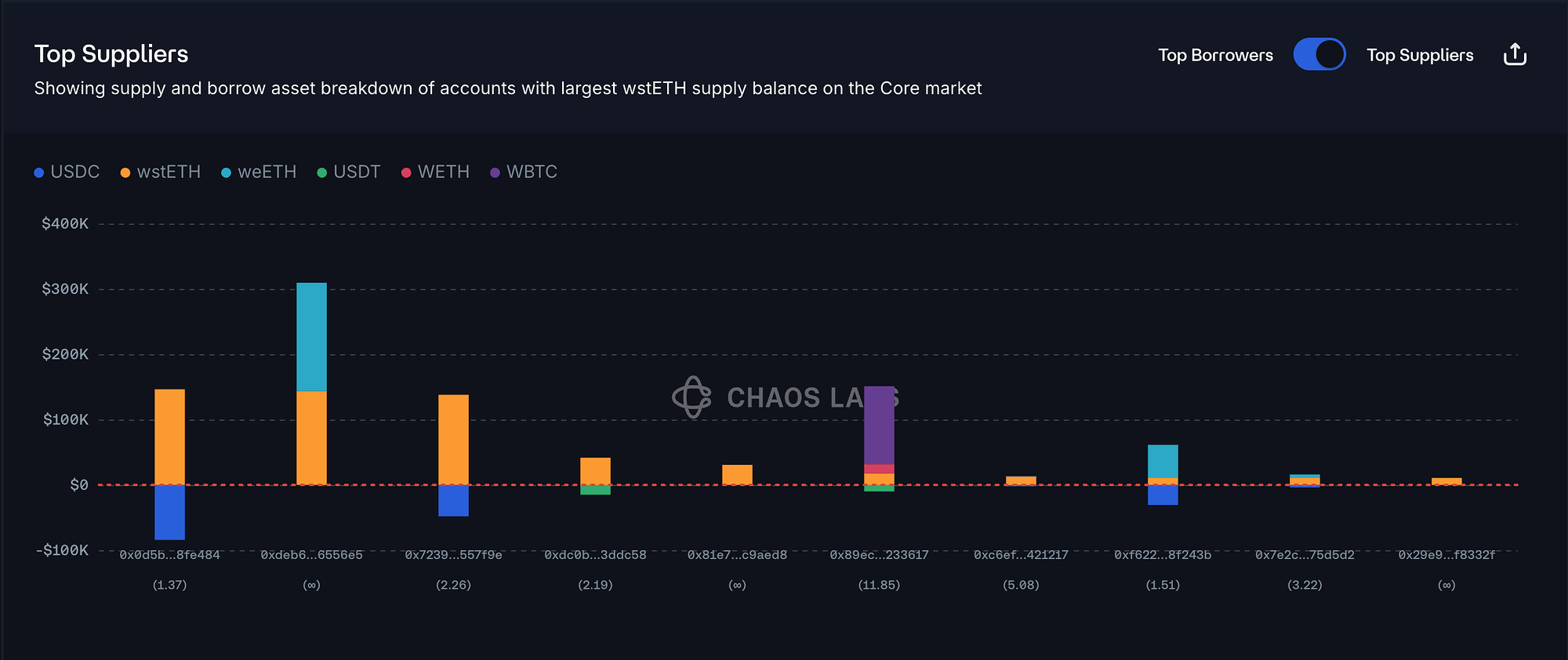

wstETH

wstETH has reached 95% supply cap utilization, while its borrow cap utilization is at 3%.

Supply Distribution

The supply distribution of wstETH shows a minor concentration risk, with the top supplier accounting for around 20% of the total supply. However, we do not view this position as a notable risk, given that it currently holds a health score of 1.37.

The remaining top suppliers either have no borrowing activity or maintain high health scores, which significantly reduces the risk of liquidation.

The largest borrowed asset is currently USDC, accounting for 88% of the total distribution.

Liquidity

wstETH’s liquidity is sufficient to support a supply cap increase. Currently, selling 1,200 wstETH would incur less than 5% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing wstETH’s supply cap.

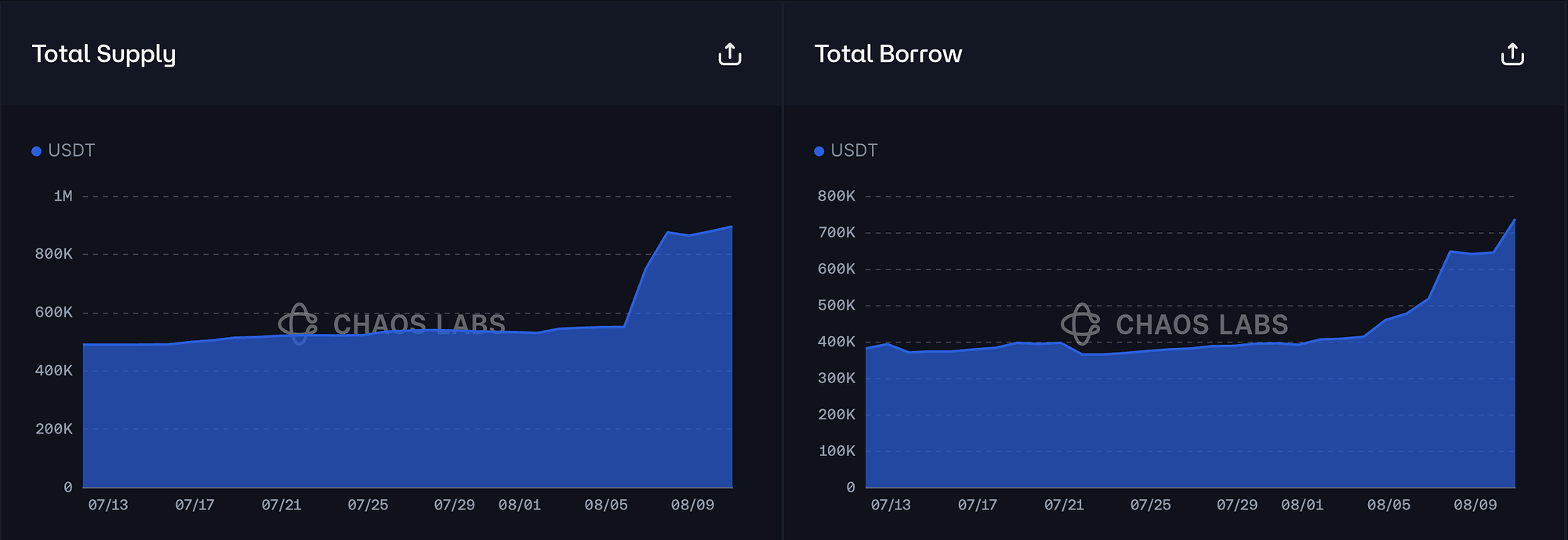

USDT

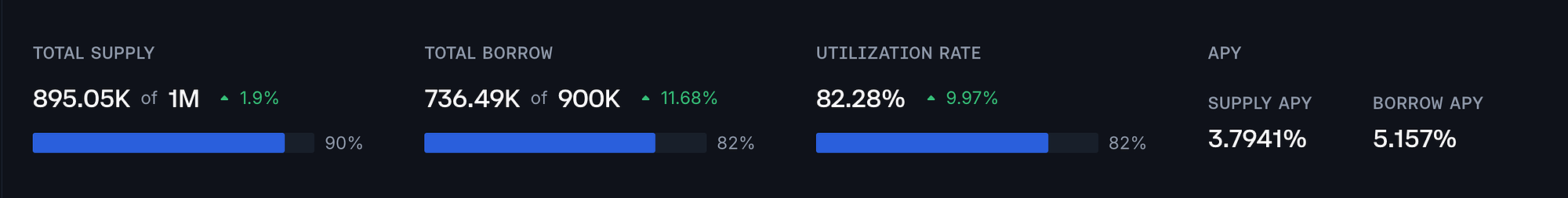

USDT has reached 90% supply cap utilization and 82% borrow cap utilization.

Supply Distribution

The supply distribution of USDT poses minimal liquidation risk, as top suppliers either have no active borrow positions or maintain strong health scores.

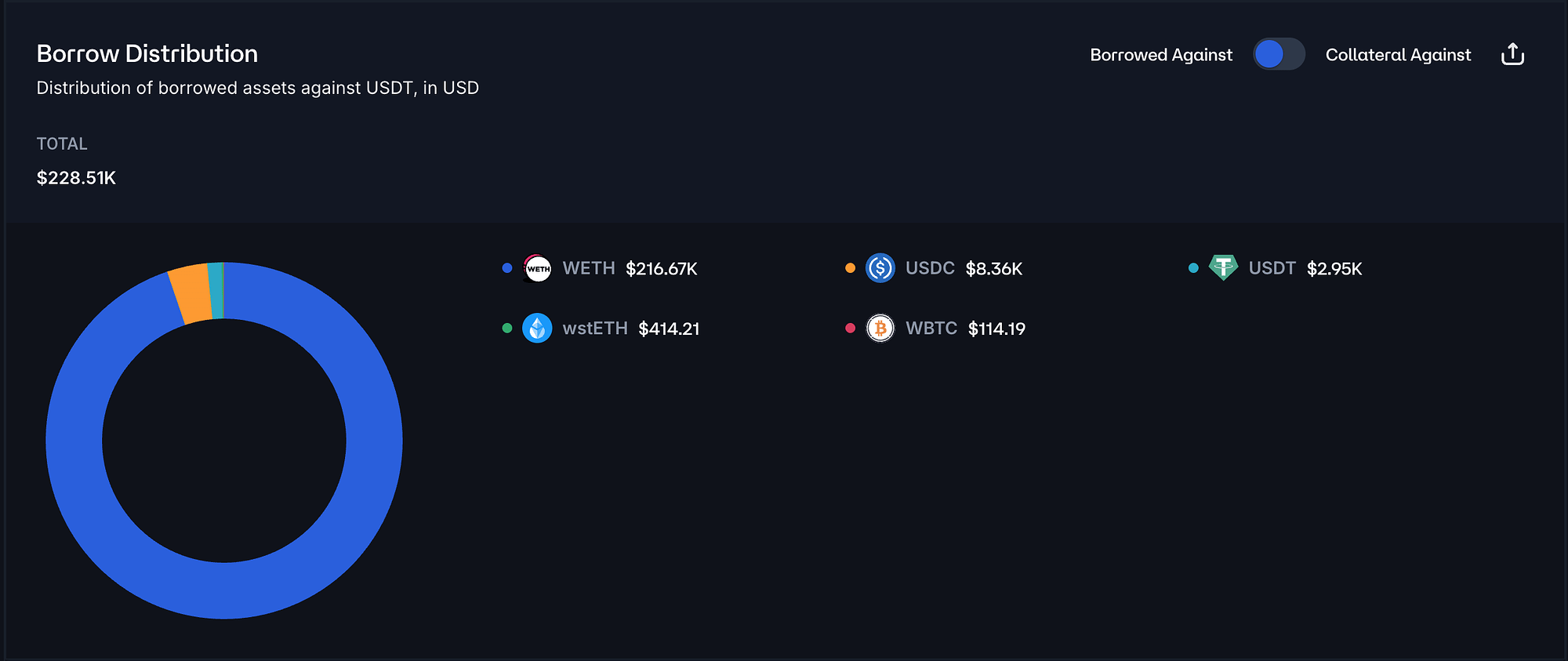

The largest borrowed asset against USDT is WETH, which represents 95% of the total borrowed asset distribution.

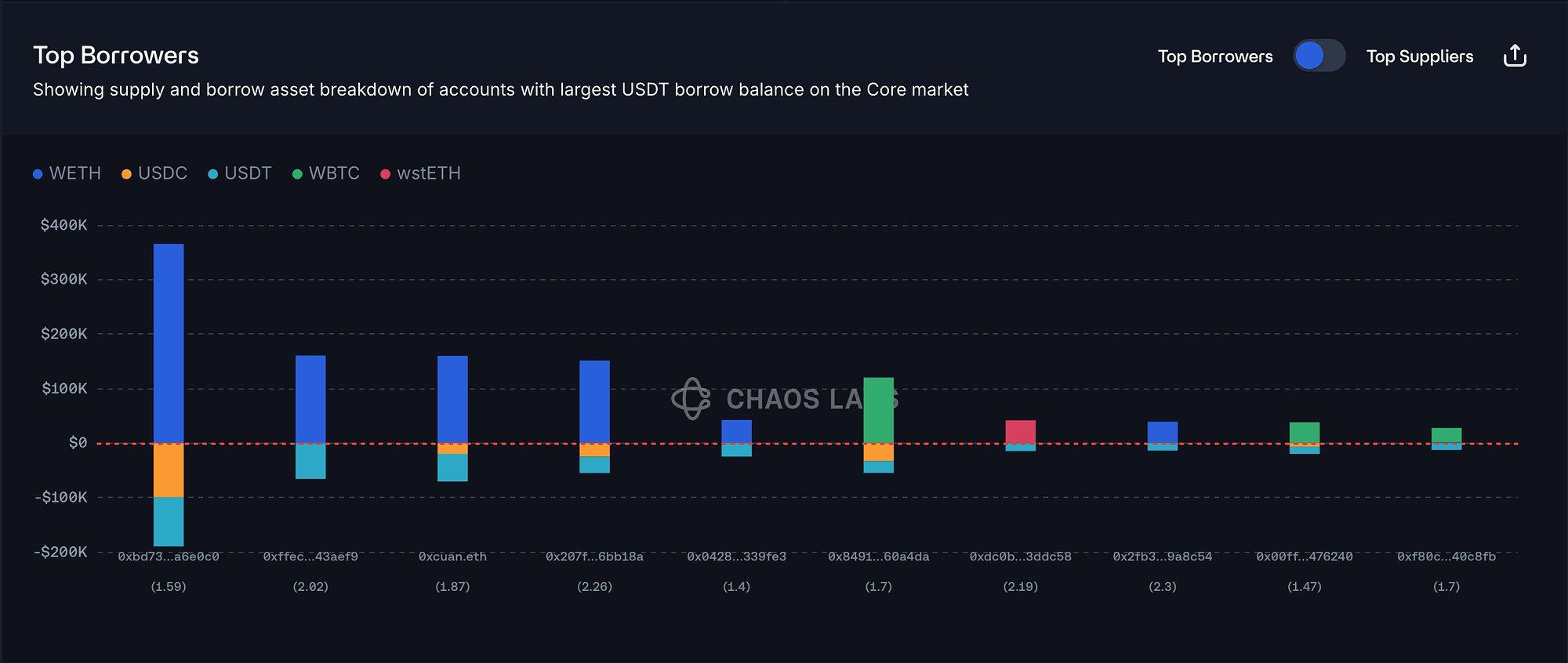

Borrow Distribution

The borrow distribution of USDT shows limited concentration, with the top borrower representing only about 10% of the total borrowed amount. Furthermore, all top borrowers maintain strong health scores, which significantly reduces the likelihood of immediate liquidations.

Recommendation

Given the safe user behavior, we recommend increasing both USDT’s supply cap and borrow cap.

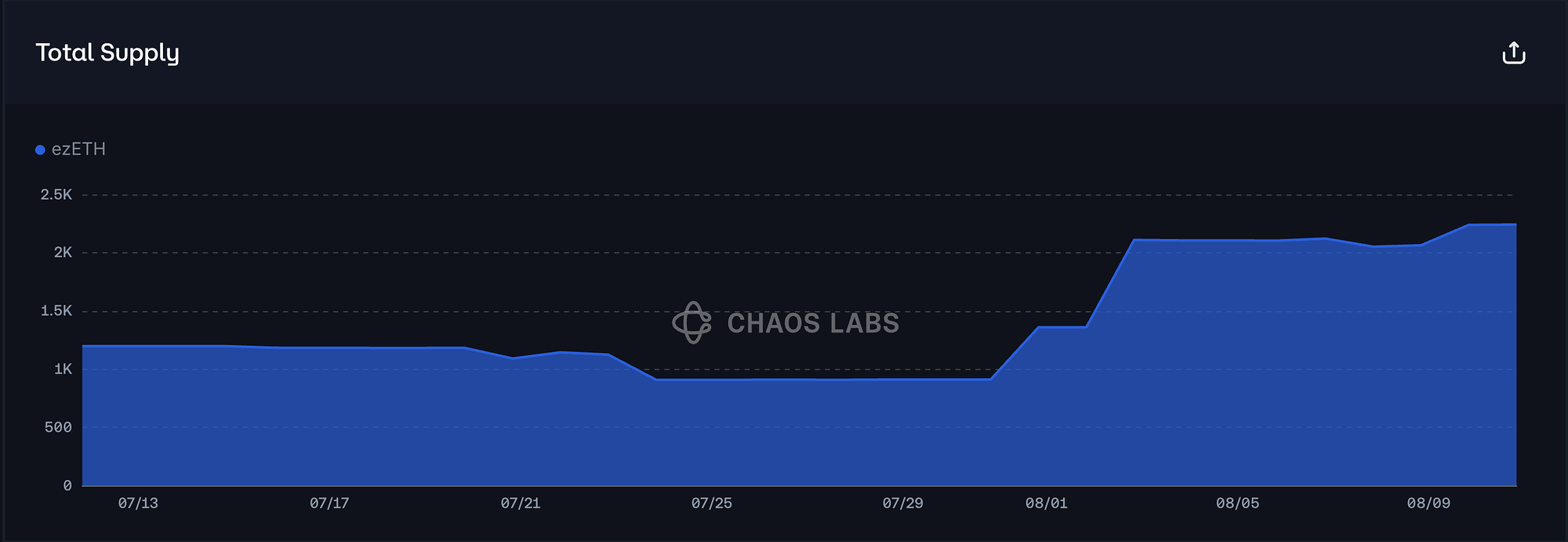

ezETH

ezETH has reached 93% supply cap utilization.

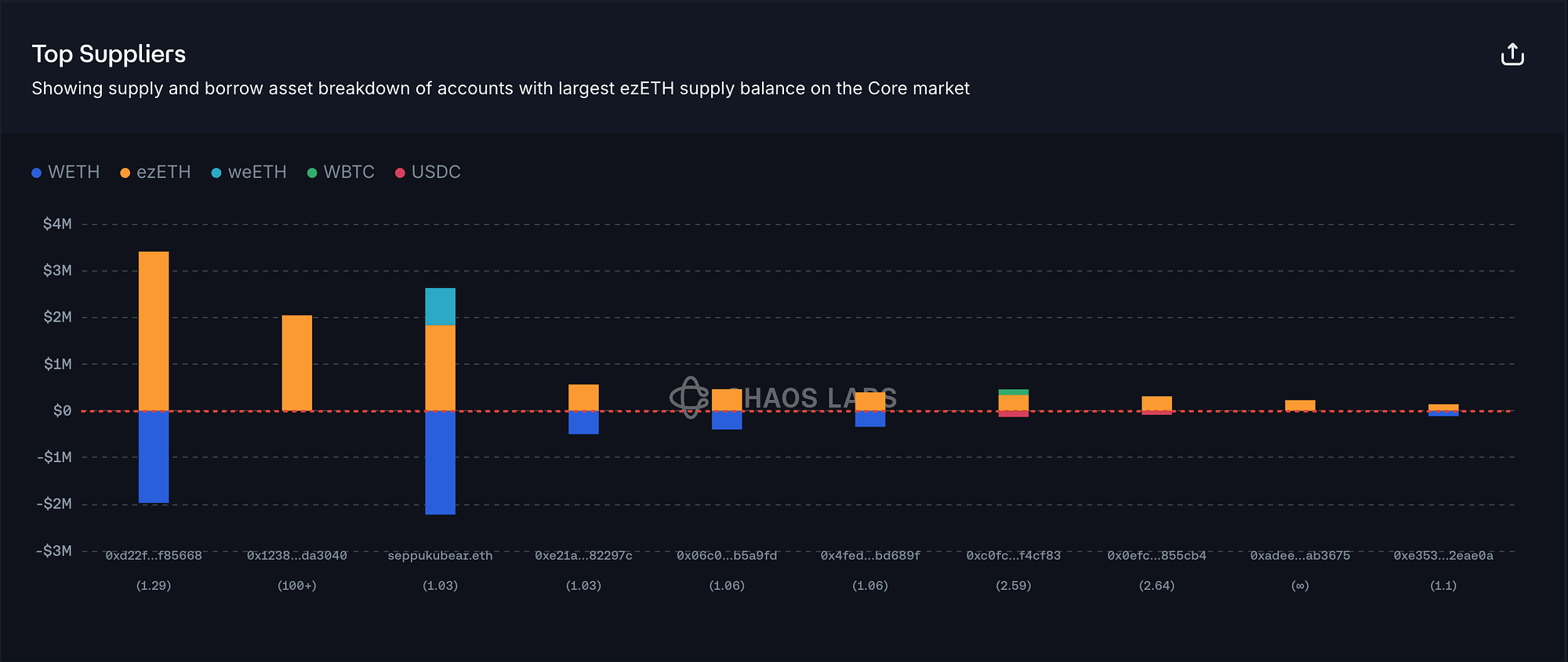

Supply Distribution

The supply distribution of ezETH presents minimal risk. Among the top ten suppliers, one position has no borrowing activity, seven are engaged in looping WETH, and the remaining two maintain health scores above 2. These factors collectively help significantly reduce the likelihood of immediate liquidation.

Liquidity

ezETH’s liquidity is sufficient to support a supply cap increase. Currently, selling 1,000 ezETH would incur less than 5% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing ezETH’s supply cap.

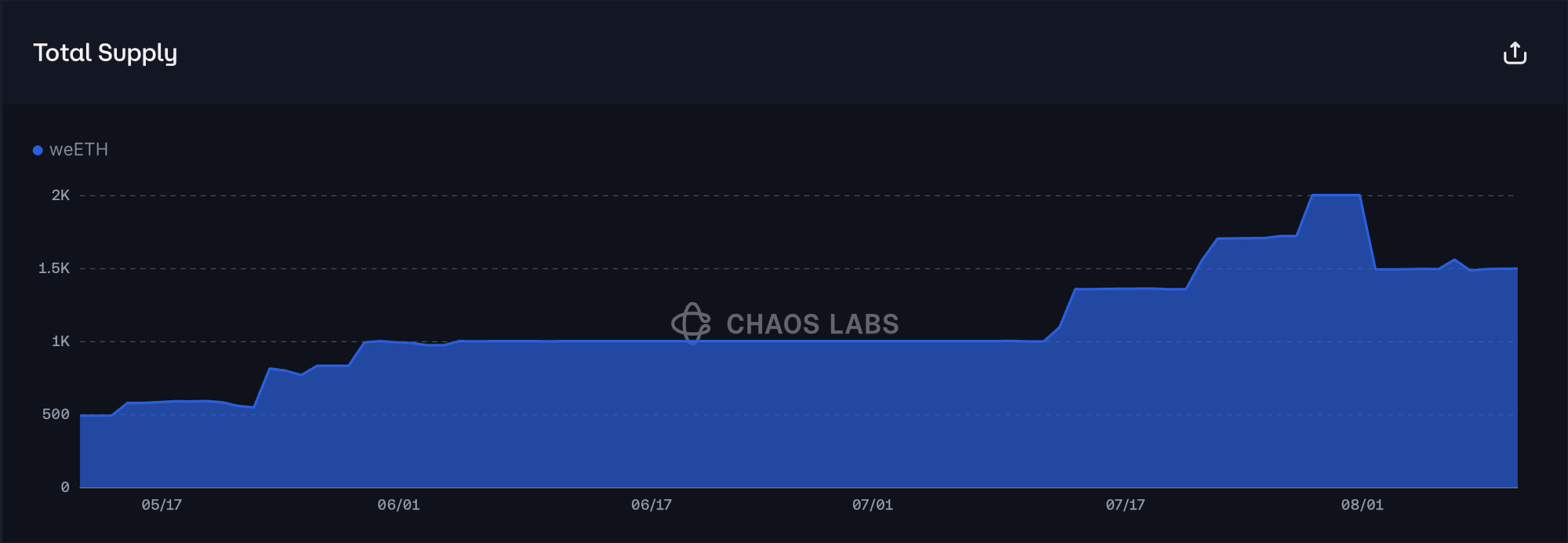

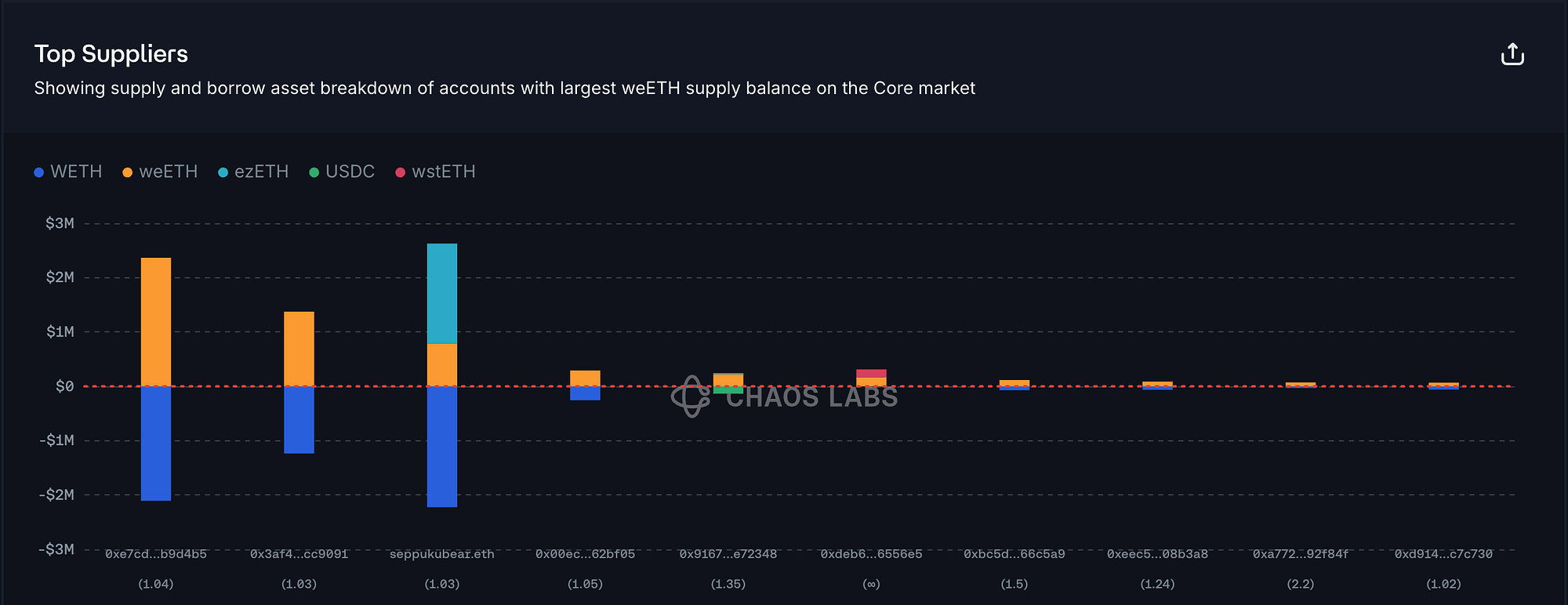

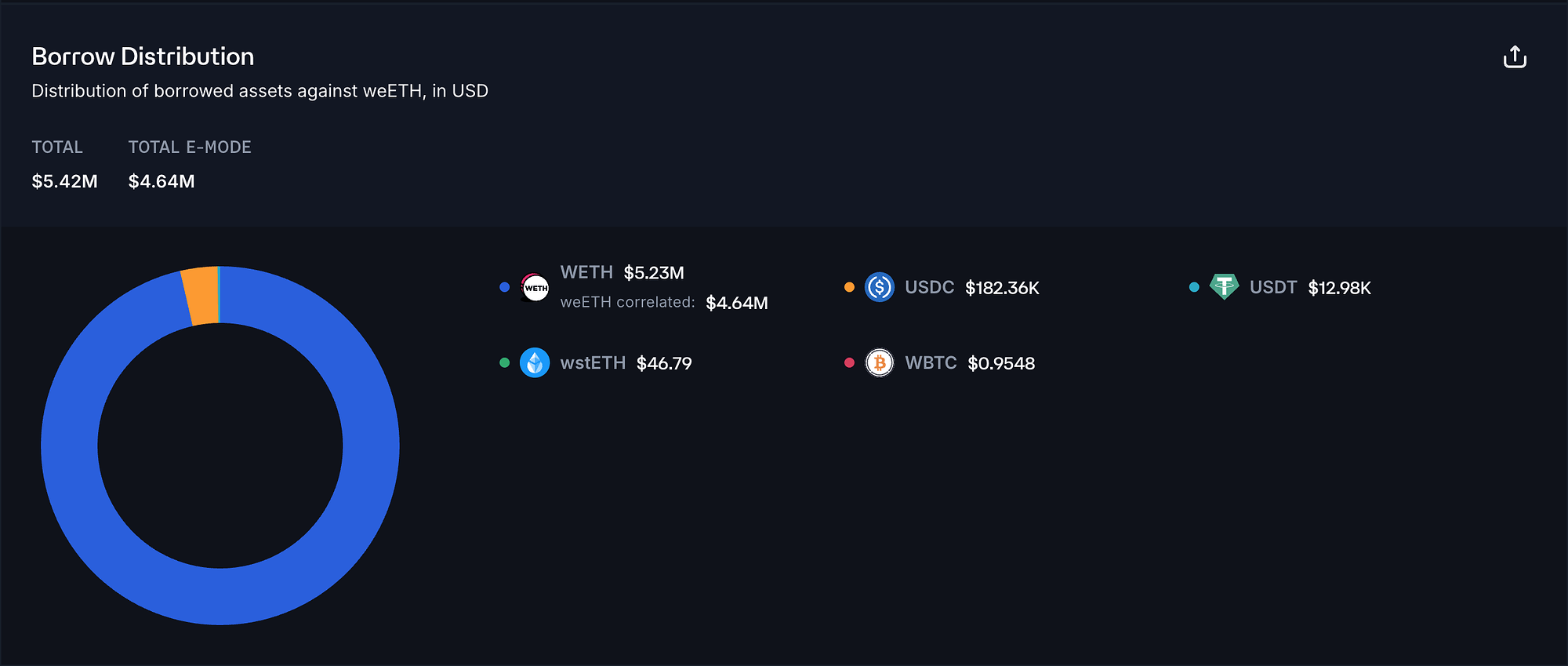

weETH

weETH has reached 75% supply cap utilization, and given its growth sign since July 2025, we believe it is reasonable to assess the potential for increasing its supply cap.

Supply Distribution

The supply distribution of weETH presents minimal liquidation risk, as 9 out of the top 10 suppliers are borrowing WETH, a highly correlated asset. The only supplier borrowing USDC maintains a healthy score, further reducing the likelihood of immediate liquidation concerns.

The largest borrowed asset against weETH is WETH, making up roughly 97% of the total borrowed asset distribution. This high degree of correlation between collateral and debt reduces the likelihood of large-scale liquidations.

Liquidity

weETH’s liquidity is sufficient to support a cap increase. Currently, selling 1,000 weETH would incur less than 4% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing weETH’s supply cap.

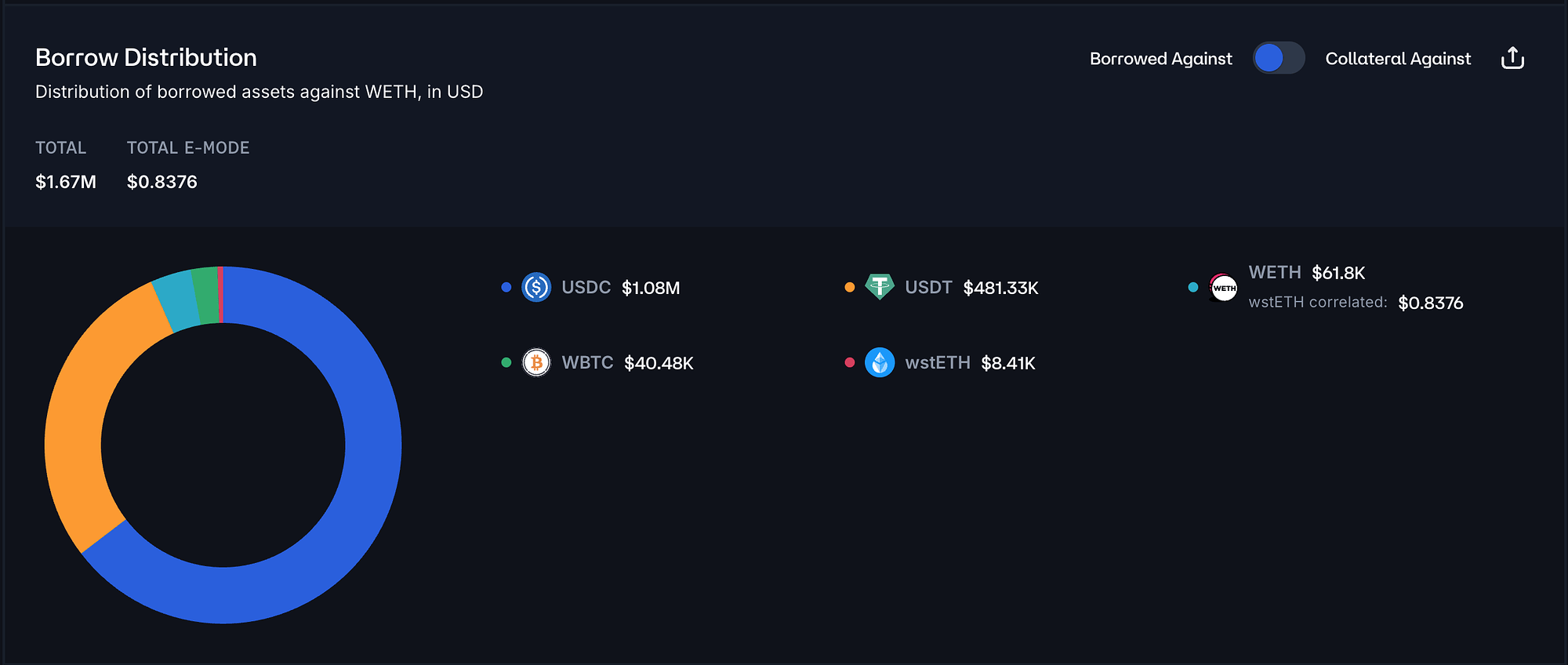

WETH

WETH has reached 66% supply cap utilization and 59% borrow cap utilization, on a sustained growth trajectory over the course of the last few weeks.

Supply Distribution

The supply distribution of WETH poses minimal liquidation risk, as all top suppliers maintain robust health scores, with the lowest observed score at 1.6. This strong collateral position significantly reduces the likelihood of immediate liquidations.

The largest borrowed asset against WETH is USDC, accounting for 65% of the total borrowed asset distribution.

Borrow Distribution

The borrow distribution of WETH is slightly concentrated, with the largest borrower accounting for approximately 18% of the total borrowed amount. However, since this user is supplying ezETH and weETH, we do not consider this concentration to present a significant concern.

Most of the other top borrowers are also supplying ezETH or weETH, and the strong correlation between these assets substantially reduces the likelihood of liquidations.

Liquidity

Currently, selling 1,500 WETH to USDT would incur less than 5% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing WETH’s supply and borrow caps.

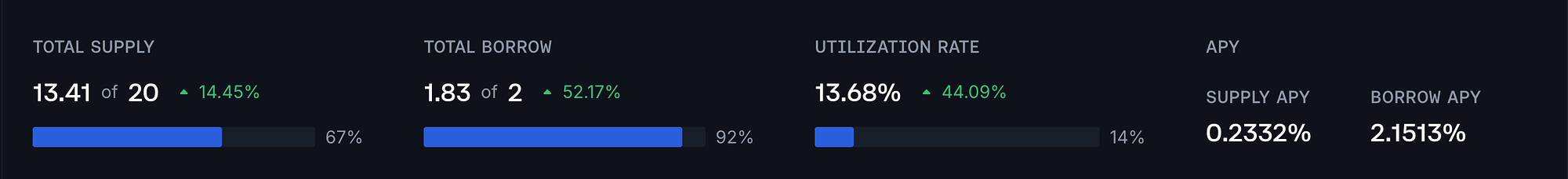

WBTC

WBTC has reached 67% of its supply cap utilization and 92% of its borrow cap utilization. In light of the expected future demand mentioned above, we will also assess the possibility of increasing its supply cap.

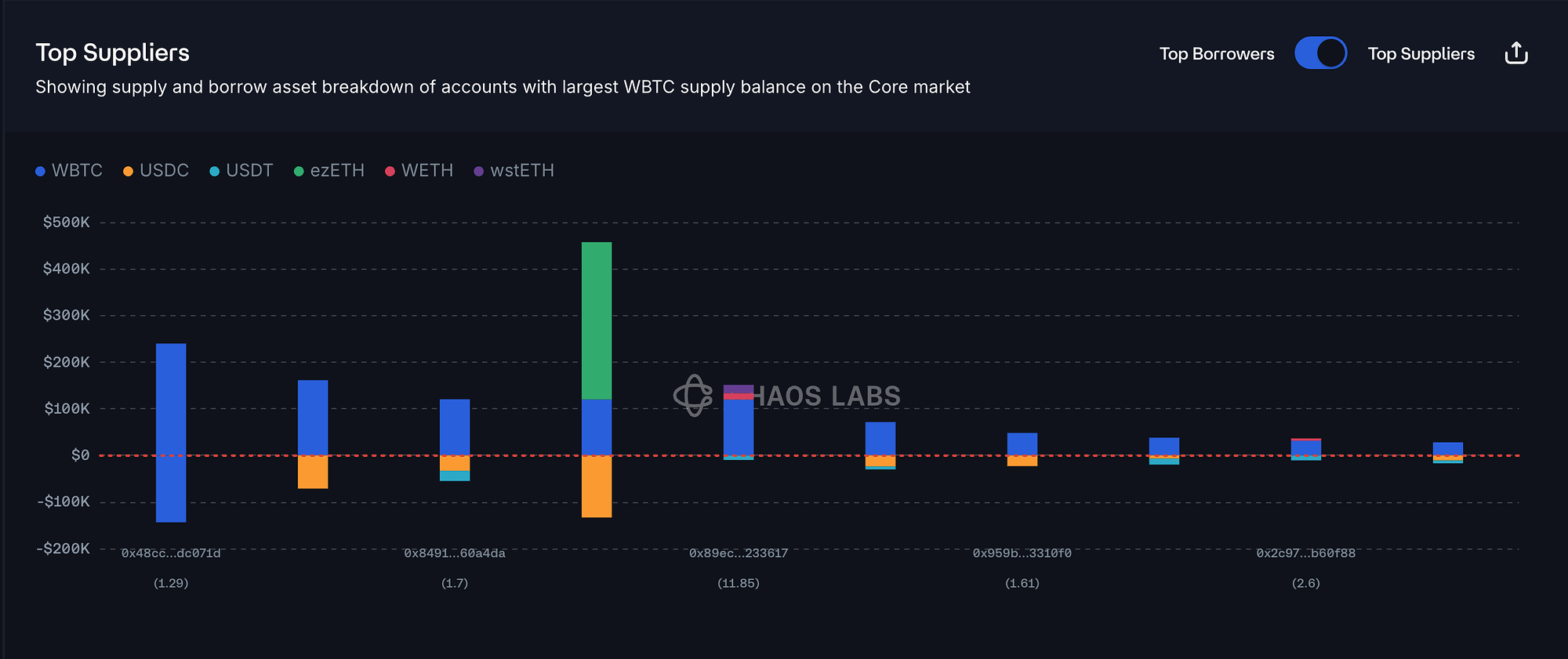

Supply Distribution

The supply distribution of WBTC shows a slight concentration risk, with the largest supplier accounting for approximately 15% of the total supply. However, as this user is borrowing WBTC itself, this does not currently present a material risk.

The remaining top suppliers all maintain high health scores, which significantly reduces the likelihood of liquidations.

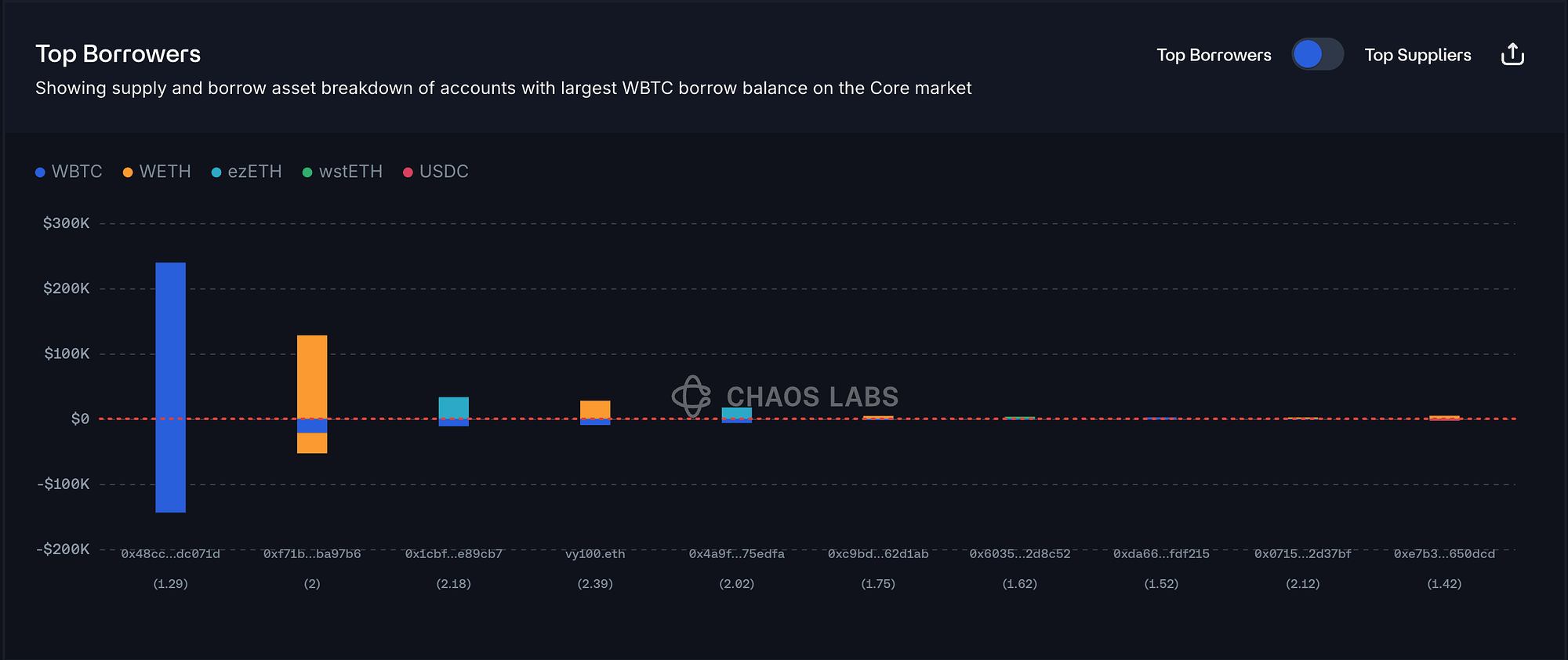

Borrow Distribution

The borrow distribution of WBTC also presents limited risk. The top borrower is the same position as the top supplier we analyzed above. The remaining top borrowers also maintain healthy health scores, significantly reducing the likelihood of liquidations.

Liquidity

Currently, selling 10 WBTC would incur less than 4% price slippage, which supports the case for a supply cap increase.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing WBTC’s supply and borrow caps.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Linea | USDC | 3,000,000 | 6,000,000 | 2,700,000 | 5,400,000 |

| Linea | wstETH | 150 | 300 | 75 | - |

| Linea | USDT | 1,000,000 | 2,000,000 | 900,000 | 1,800,000 |

| Linea | ezETH | 2,400 | 4,800 | - | - |

| Linea | weETH | 2,000 | 4,000 | - | - |

| Linea | WETH | 4,800 | 9,600 | 4,400 | 8,800 |

| Linea | WBTC | 20 | 40 | 2 | 4 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0