Summary

A proposal to:

- Increase the supply and borrow caps of PYUSD on the Ethereum Core Instance

- Increase the supply cap of ezETH on the Arbitrum Instance

- Increase the supply cap of syrupUSDT on the Ethereum Core Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

PYUSD (Ethereum Core)

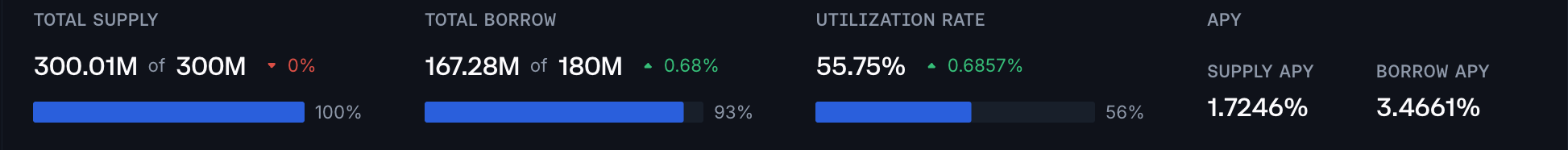

PYUSD has reached its supply cap of 300 million tokens and is approaching its borrowing cap of 180 million following elevated lending activity since late November.

Supply Distribution

The supply of PYUSD is moderately concentrated, with the top user accounting for approximately 15% of the market, while the top 5 users have a cumulative share of 46.5%. The distribution of health factors primarily falls in the 1.07-1.24 range. Given that the majority of suppliers are using PYUSD to collateralize stablecoin borrowing positions, the implied risk in the market is minimal.

As mentioned previously, the majority of borrowing is concentrated in stablecoins like USDC, RLUSD, and USDe, which represent 86% of the borrowing. Given the high correlation of PYUSD and the borrowed stablecoins, the liquidation risks on the supply side of the PYUSD market are minimal.

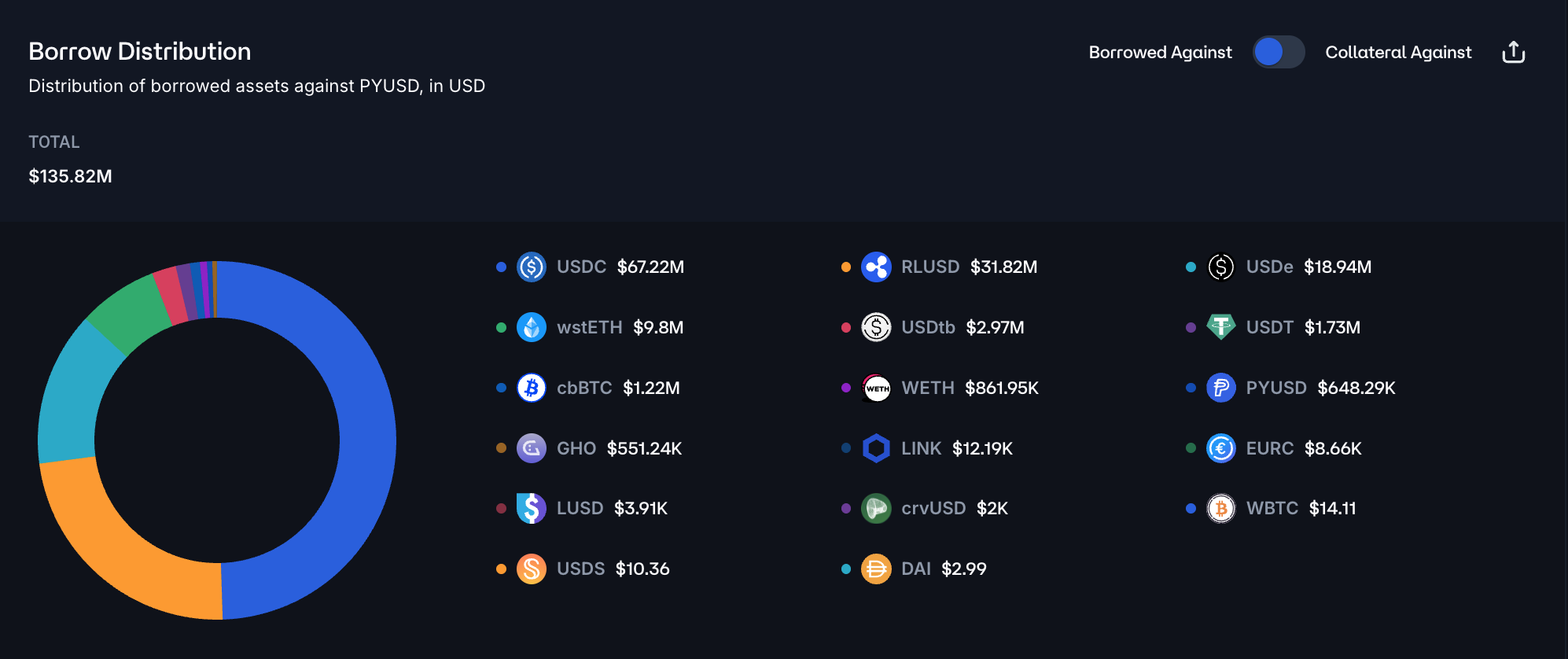

Borrow Distribution

PYUSD borrowing exhibits a higher level of concentration as the top 2 users effectively represent 44% of total PYUSD debt. Borrowing is facilitated by a broad mix of volatile and stable assets, with the health factors ranging from 1.09 to 2.06.

The overwhelming majority of PYUSD debt is represented by ETH- and BTC-based assets, namely weETH, wstETH, cbBTC, and WBTC, which account for 69% of all collateral posted against PYUSD debt. Considering the relatively safe distribution of health factors on the volatile-asset-backed positions, the liquidation risk in this market is moderate.

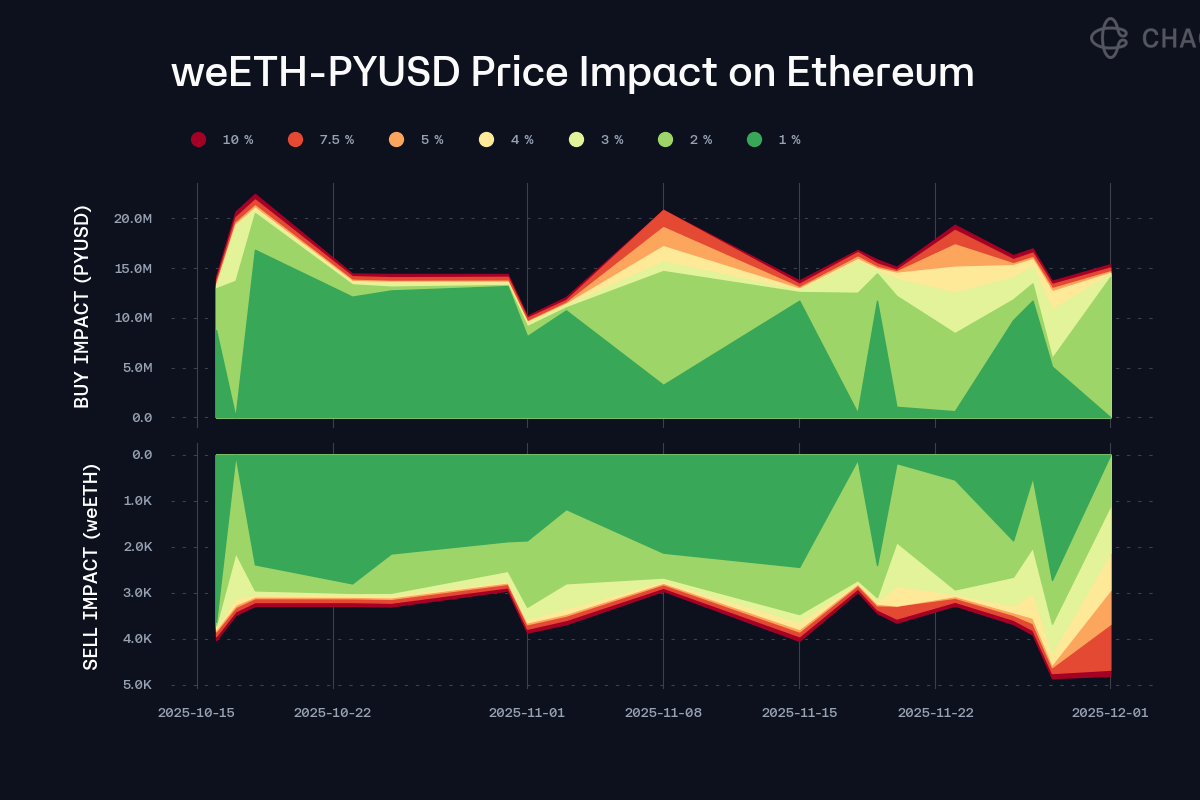

Liquidity

At the time of writing, the on-chain liquidity profile for PYUSD has depth sufficient to liquidate a substantial proportion of posted collateral at minimal price impact.

Recommendation

Considering the constrained risks associated with lending activity and the substantial on-chain liquidity in primary collateral assets, we recommend increasing the supply and borrow caps of the asset.

ezETH (Arbitrum)

ezETH has reached 95% of its supply cap on the Arbitrum instance following an inflow of approximately 4.5 thousand tokens in the past 24 hours.

Supply Distribution

The supply distribution of ezETH is highly concentrated, as the top user represents approximately 70% of the market. As is the case with wrsETH, ezETH is utilized primarily to borrow WETH recursively. The strategy is leveraging the spread between the underlying yield of ezETH and the borrow costs of WETH. The distribution of the health factors in the market follows the expected distribution as users maintain position health scores around 1.03-1.05 to balance leverage and risk.

Given the high correlation of the debt and collateral assets, the market currently presents minimal risk.

Liquidity

At the time of writing, slippage on a 90 ezETH to WETH swap is estimated to be less than 50 basis points, allowing for a modest expansion of the supply cap.

Recommendation

Considering the low risk associated with the user behavior and substantial demand to loop the assets, we recommend a conservative increase of the supply cap of ezETH.

syrupUSDT (Ethereum Core)

syrupUSDT has reached its supply cap of 50 million tokens following its recent listing, indicating strong demand for the asset as collateral on Aave v3.

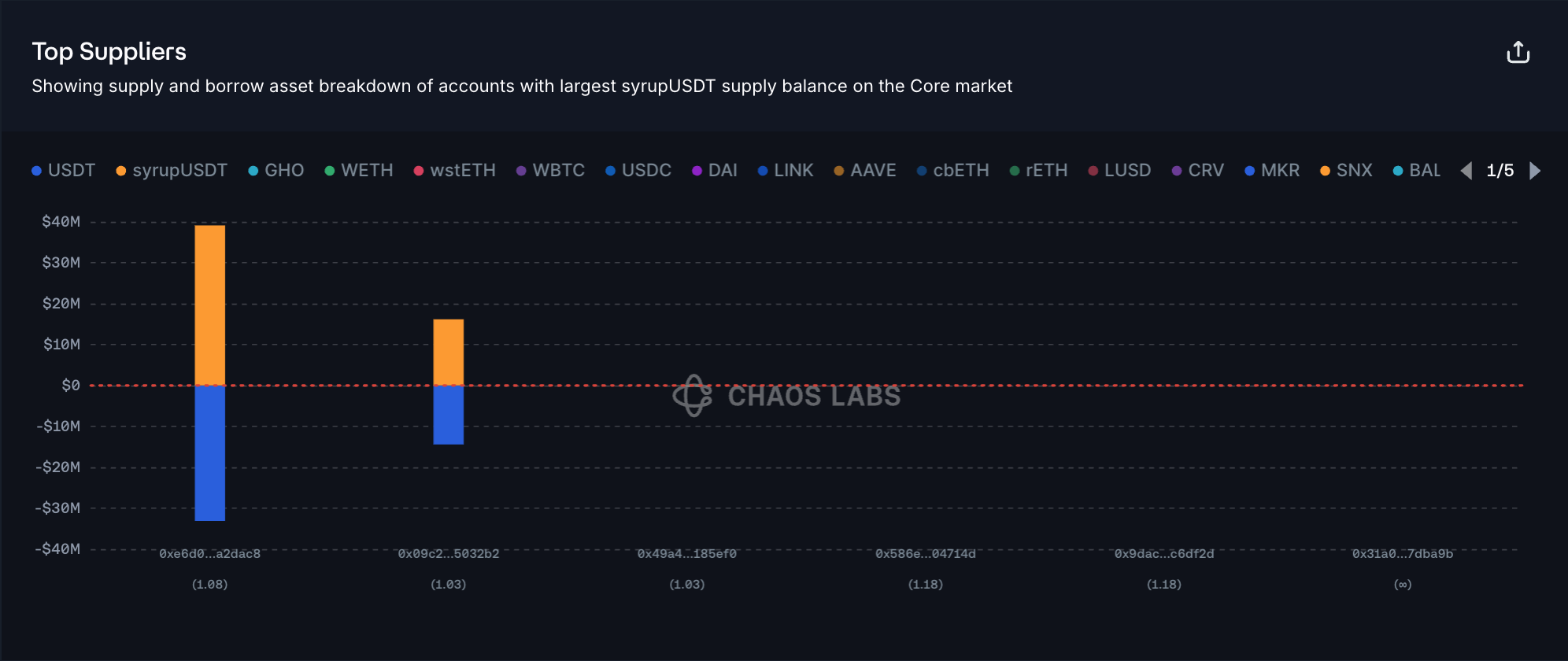

Supply Distribution

The supply distribution of syrupUSDT is highly concentrated, as the top user represents approximately 80% of the market. As can be observed, users are supplying syrupUSDT to collateralize USDT borrow positions, which is typical for such markets. The process is iterated recursively in order to maximize net yields, which represent the leveraged spread between the underlying yield of collateral and borrowing costs of debt. The users exhibit relatively safe health factors, clustered around 1.03, which, given the high correlation between debt and collateral, presents minimal risk.

Liquidity

At the time of writing, a sell order of 2 million syrupUSDT would be limited to 0.5% slippage. Such liquidity depth, facilitated primarily by Fluid DEX and Uniswap v4, allows for a substantial increase in the asset’s supply cap.

Recommendation

Considering the safe user behavior, high correlation of the debt and collateral assets, along with deep on-chain liquidity, we recommend increasing the supply cap of syrupUSDT.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PYUSD | 300,000,000 | 400,000,000 | 180,000,000 | 240,000,000 |

| Arbitrum | ezETH | 21,000 | 32,000 | - | - |

| Ethereum Core | syrupUSDT | 50,000,000 | 100,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.