Summary

A proposal to:

- Increase the borrow cap of rlUSD on the Ethereum instance.

- Increase the supply and borrow caps of pyUSD on the Ethereum instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

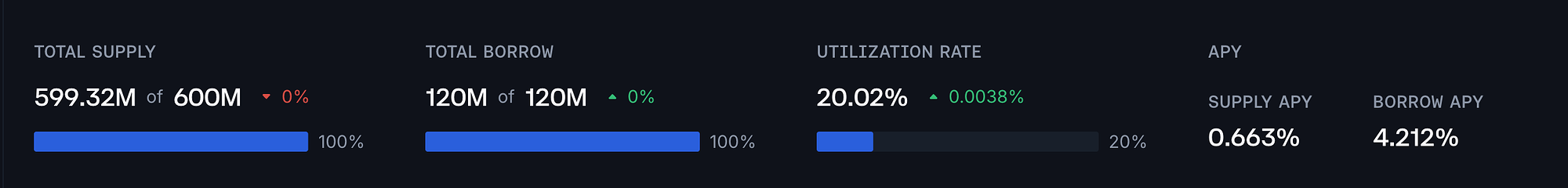

rlUSD (Ethereum Core)

rlUSD’s borrow cap utilization have reached 100%.

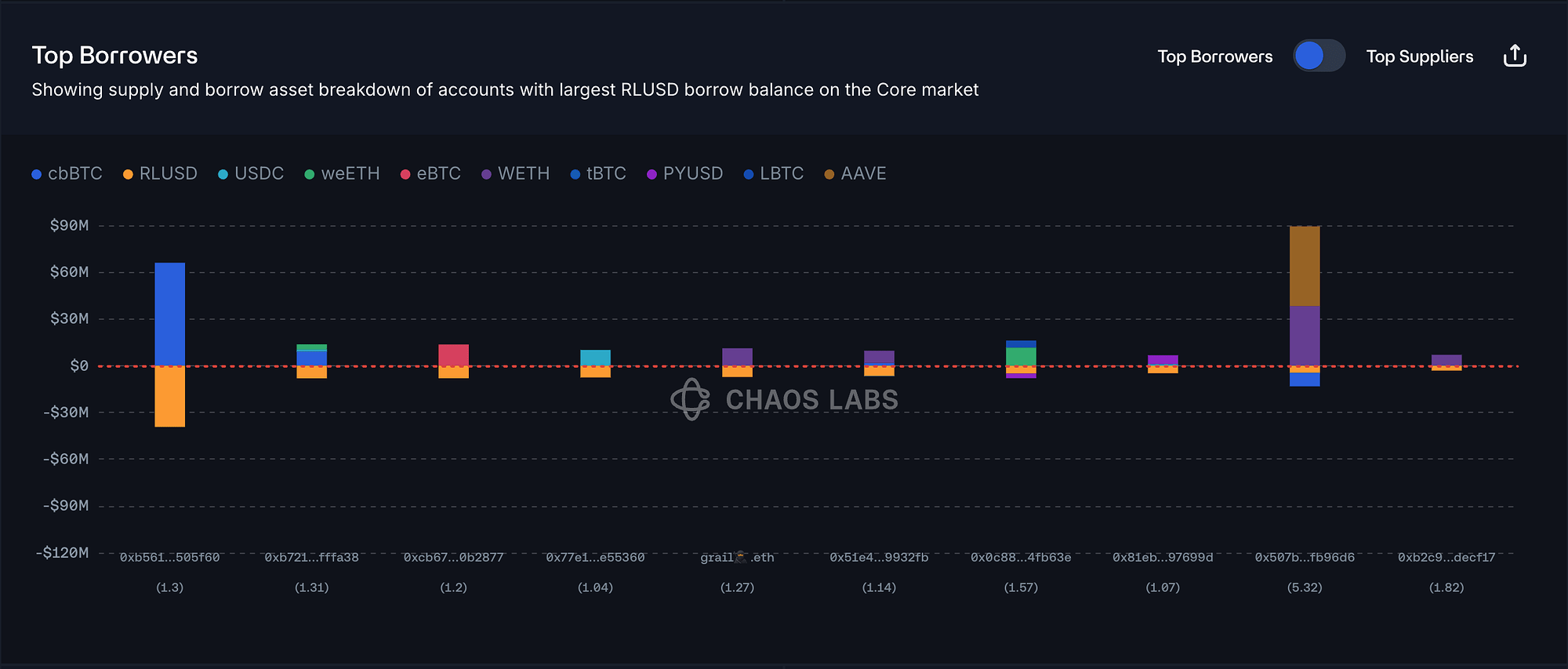

Borrow Distribution

The borrow distribution of rlUSD shows some concentration risk, with the largest borrower accounting for 32% of the total. However, we do not view this as a material concern, as this borrower currently maintains a healthy health score of 1.3.

The remaining top borrowers are either using stablecoins as collateral or maintaining strong health scores, indicating limited liquidation risk at the moment.

The largest collateral assets backing rlUSD debt are cbBTC and WETH, accounting for approximately 39% and 17% of the total collateral distribution, respectively.

Recommendation

Given the safe user behavior, we recommend increasing the rlUSD borrow cap.

pyUSD (Ethereum Core)

pyUSD’s supply cap utilization and borrow cap utilization have both reached 100%.

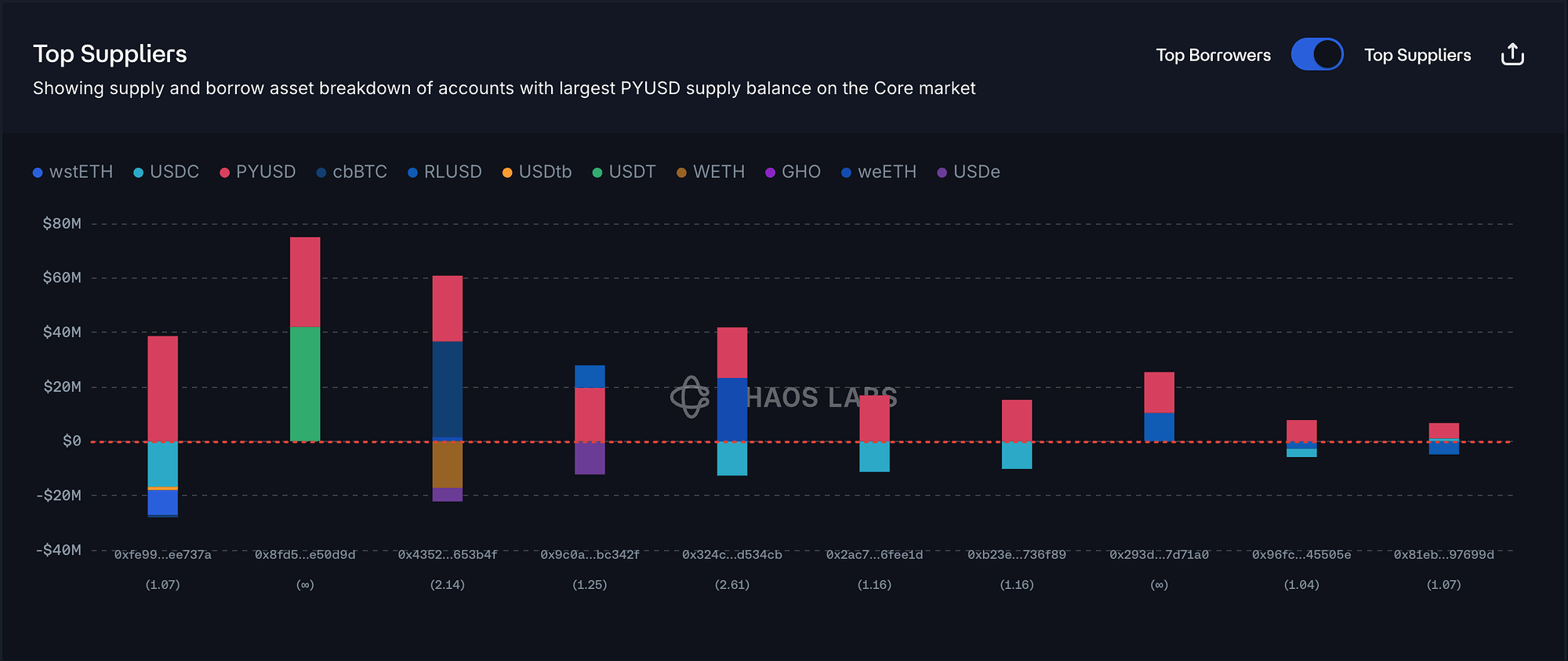

Supply Distribution

The supply distribution of pyUSD shows only minor concentration risk, with the top supplier accounting for 16% of the total. In addition, the top pyUSD suppliers present limited liquidation risk, as they either maintain high health scores, have no borrowing activity, or are borrowing majorly stablecoins.

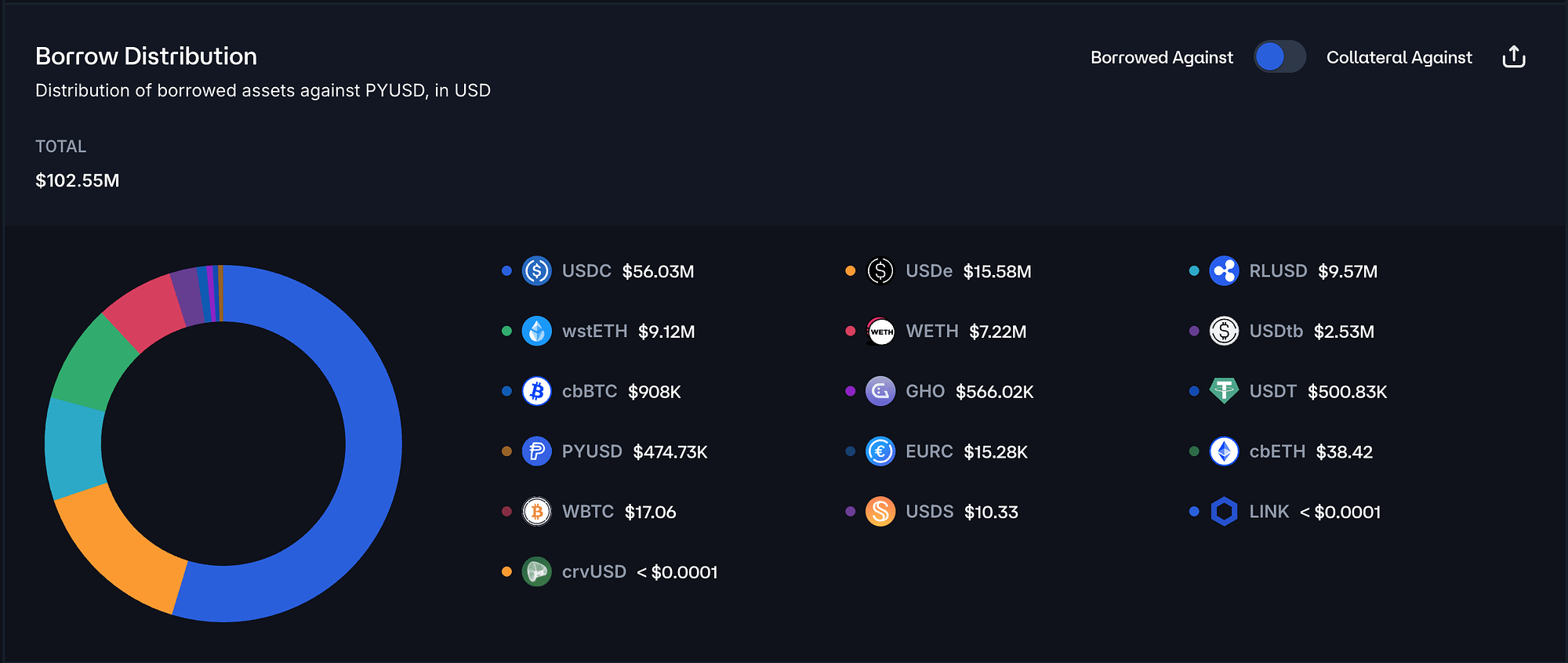

As shown, the largest borrowed assets against pyUSD are USDC, USDe, and rlUSD, which together account for approximately 80% of the total borrowed-asset distribution. This significantly reduces the likelihood of large-scale liquidations.

Borrow Distribution

The borrow distribution of pyUSD also presents limited liquidation risk. All top borrowers either maintain a healthy health score (>1.1) or are collateralizing stablecoins, which substantially reduces the likelihood of liquidation.

Recommendation

Given the safe user behavior, we recommend increasing pyUSD’s supply and borrow caps.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum | rlUSD | 600,000,000 | - | 120,000,000 | 240,000,000 |

| Ethereum | pyUSD | 240,000,000 | 300,000,000 | 120,000,000 | 180,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.