Summary

A proposal to:

- Increase the supply and borrow caps of EURC on the Ethereum Core instance

- Increase the supply cap of PYUSD on the Ethereum Core instance

- Increase the supply cap of EURe on the Gnosis instance

- Increase the supply cap of ezETH on the Arbitrum instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

EURC (Ethereum Core)

EURC has reached its supply cap at 46 million tokens, following an inflow of over 10 million during the past week.

Supply Distribution

The supply distribution of EURC is moderately concentrated. The top user represents 19% of the market, while the 5 positions account for less than 60%. From the top 10 suppliers, only 5 use EURC as collateral, with health factors distributed in a wide 1.04 - 1.84 range, which presents minimal risk as borrowed assets are predominantly stablecoins.

As mentioned previously, stablecoins, namely USDC, USDtb, USDT, and PYUSD, represent over 95% of all debt posted against EURC. Considering the high correlation between debt and collateral prices, the risk of liquidations in the market is minimal.

Borrow Distribution

The borrow distribution of EURC is also moderately concentrated, with the top user representing approximately 20% of the market and the top 10 borrowers having a cumulative share of 60%. Additionally, the positions exhibit safe health factors, presenting limited risk of liquidations.

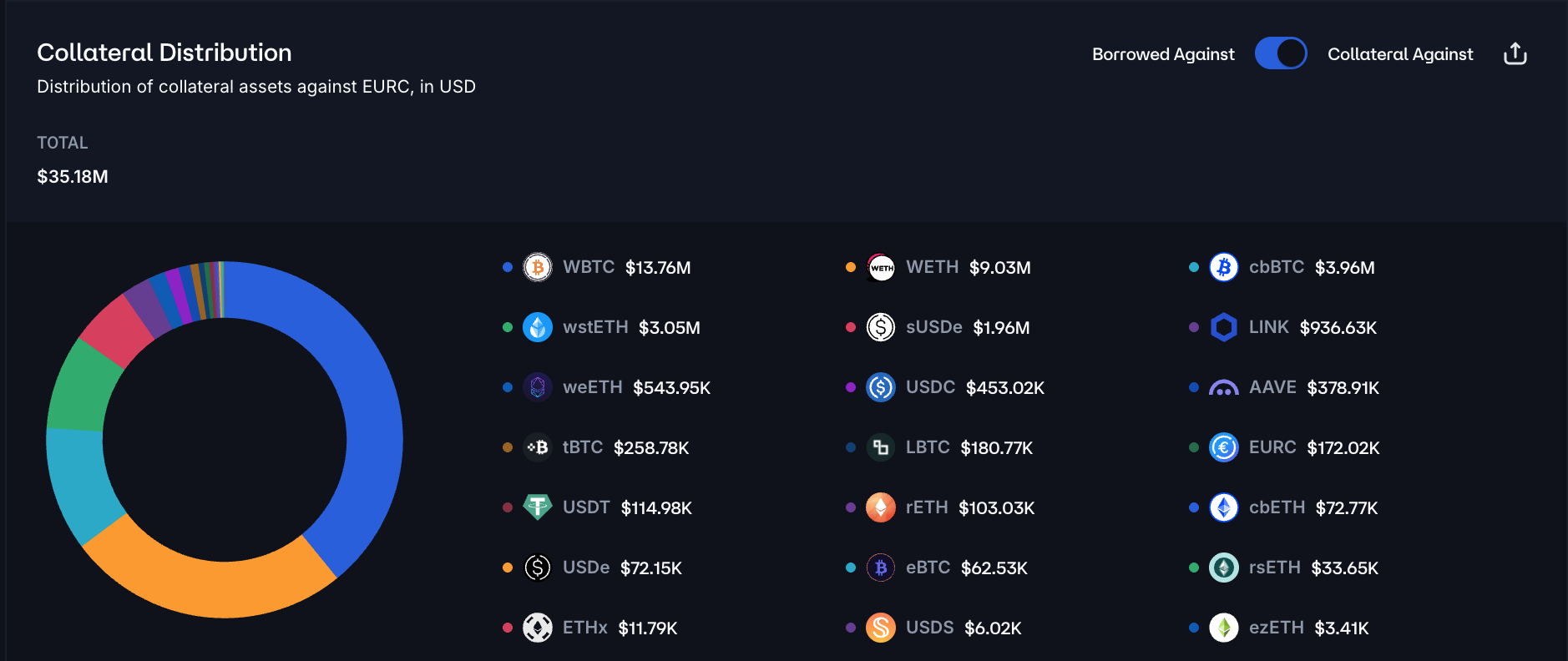

EURC debt positions are primarily collateralized by volatile assets like WBTC, WETH, cbBTC, and wstETH, representing over 85% of all posted collateral. While the positions have moderate exposure to volatility risks, the safe health factors ensure a low probability of liquidations.

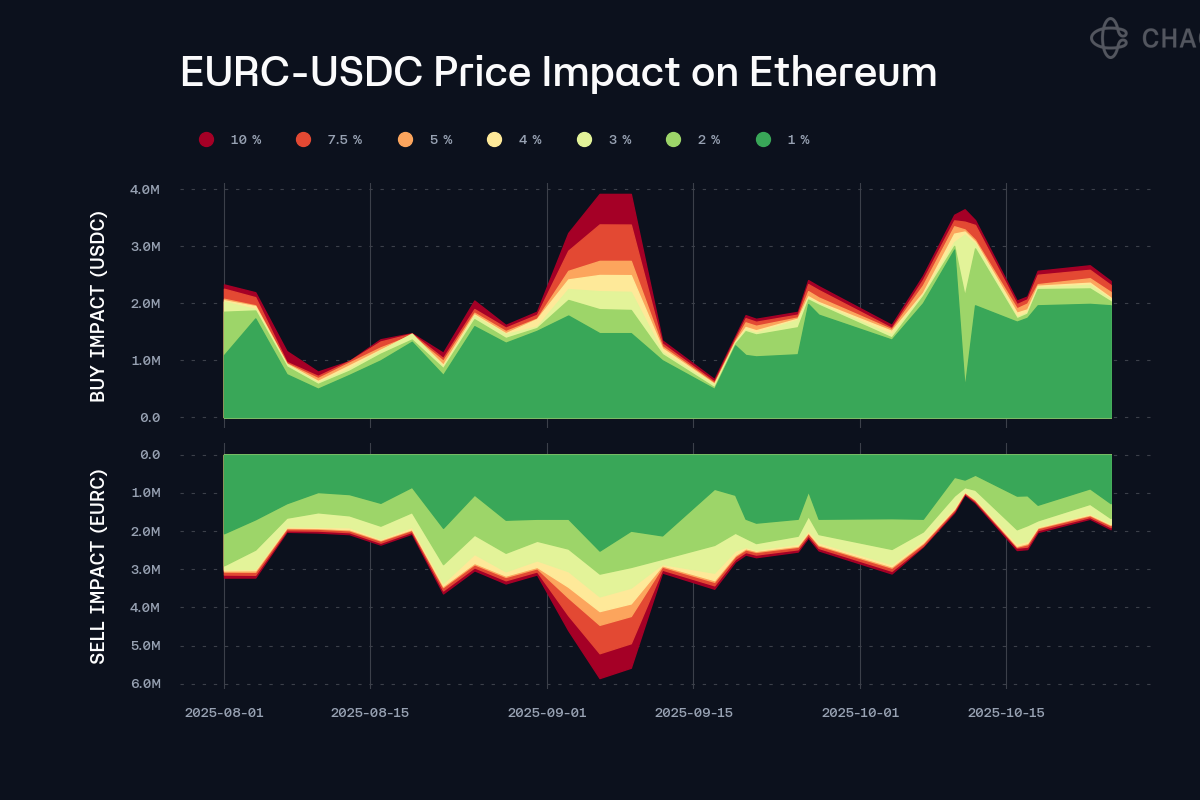

Liquidity

At the time of writing, on-chain liquidity on Ethereum is sufficient to limit slippage on a 2 million EURC sell order to 2%, supporting an increase of the supply and borrow caps.

Recommendation

Considering the increased demand to lend and borrow EURC, safe user behavior, correlated borrowing, and substantial DEX liquidity, we recommend increasing the supply and borrow caps of EURC on the Ethereum Core instance.

PYUSD (Ethereum Core)

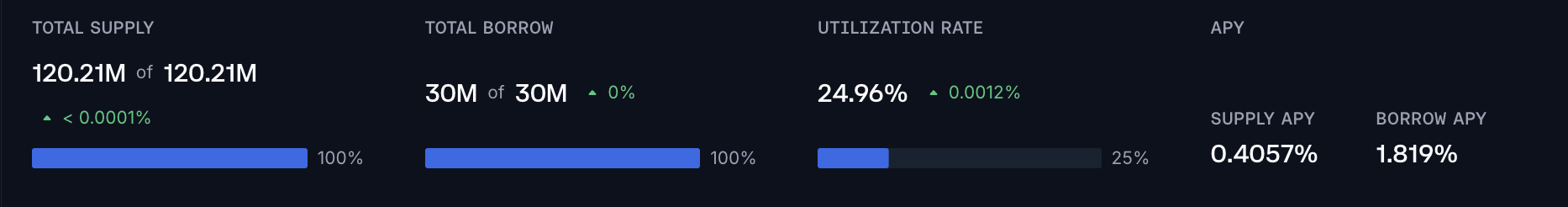

PYUSD has reached both its supply and borrow caps at 120 and 30 million, respectively, indicating growing demand for the asset on the Ethereum Core instance.

Supply Distribution

The supply of PYUSD is moderately concentrated, with the top two users holding approximately 50% of the supply. The asset is utilized primarily to collateralize borrow positions with other stablecoins like USDC; hence, the risk of substantial liquidations remains minimal.

Borrow Distribution

PYUSD’s biggest borrowers are highly concentrated and use volatile assets such as weETH and WETH as collateral. However, their health scores remain safe in the 1.31 to 1.93 range, and the positions are actively managed, resulting in low risk in the market.

Liquidity

In recent weeks, PayPool and Spark PYUSD Reserve Curve pools have scaled to as much as $28M and $100M TVL, respectively, creating a substantial liquidity layer for the asset and limiting the probability of failed liquidations.

Recommendation

Considering the substantial and growing demand for PYUSD on the Ethereum core instance, safe user behavior, correlated borrowing, and deep on-chain liquidity, we recommend increasing the asset’s supply cap by 130 million and borrow caps by 90 million. Given that the risk steward configuration allows for a maximum increase of 100%, the updates to the borrow cap will occur over two separate adjustments.

EURe (Gnosis)

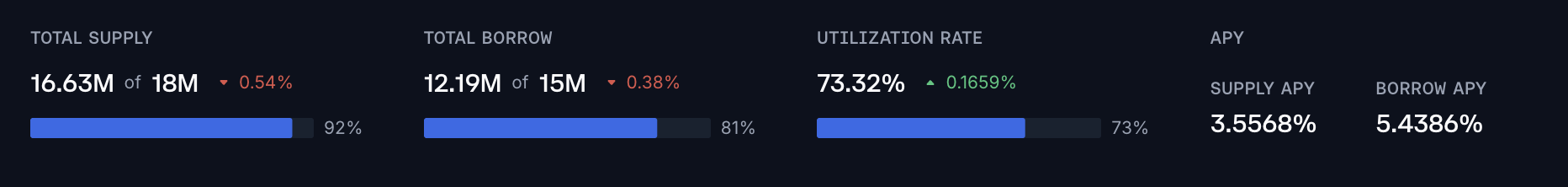

EURe has reached over 92 and 81% of its supply and borrow caps on the Gnosis instance.

Supply Distribution

The supply of EURe is moderately concentrated, as the top user represents over 20% of the market. Additionally, the majority of suppliers are not exposed to any debt, thereby limiting the probability of liquidations in the market.

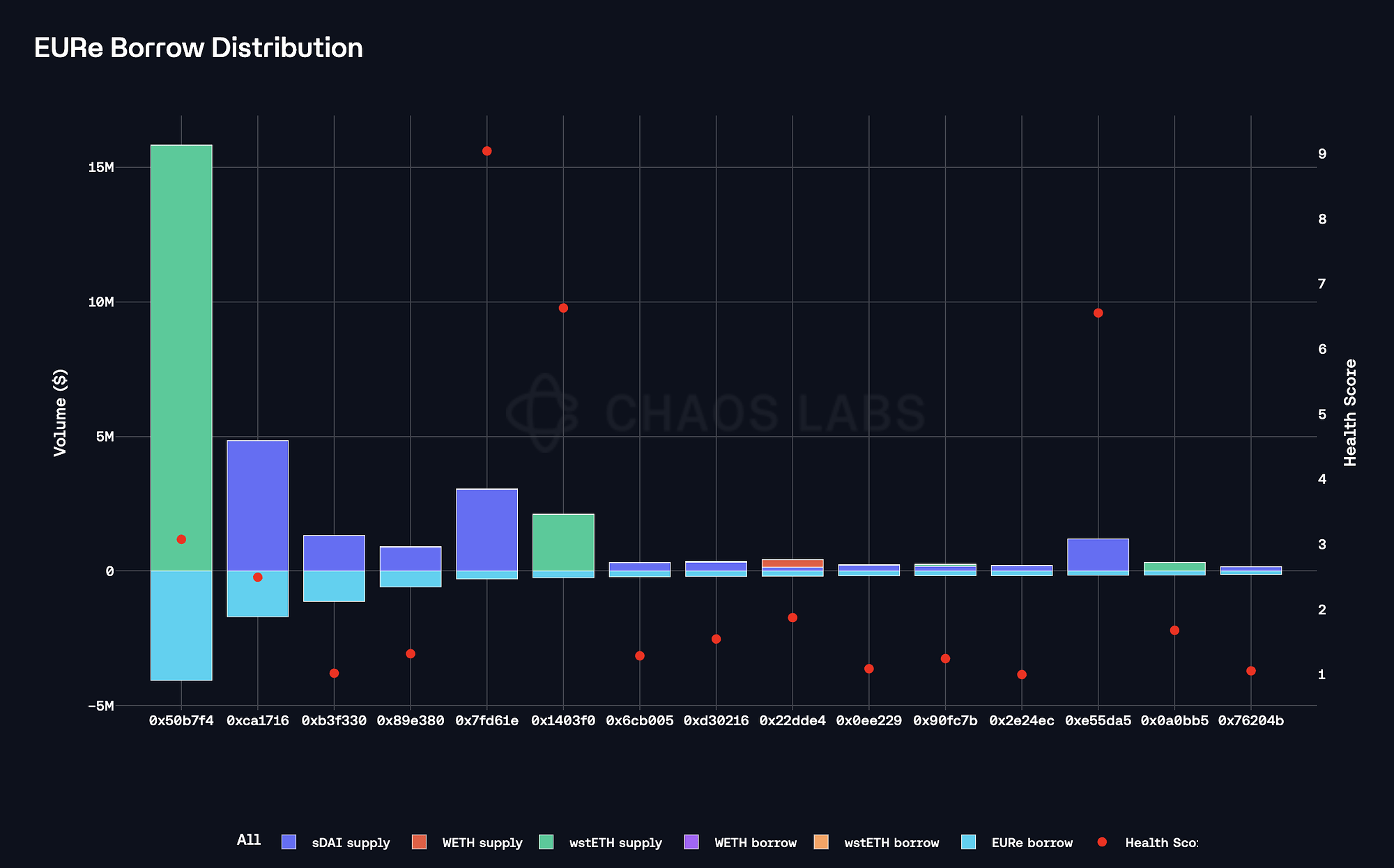

Borrow Distribution

The borrower distribution of EURe is moderately concentrated, as the top user accounts for over 30% of net borrowing, while the top 3 users represent approximately 50% of the market. The distribution of the health factors is predominantly safe, as the most significant positions are in the 1.40 - 3.24 range. We also observe substantial stablecoin looping, where users are supplying sDAI and borrowing EURe to leverage the spread between the underlying yield and borrow rate of EURe. Such positions exhibit lower health factors, primarily clustered around 1.05, however, minimal liquidation risk is assumed due to the high correlation of debt and collateral.

The distribution of collateral posted against EURe debt is split mainly between volatile ETH-based assets and staked DAI. Considering the health factors of volatile collateral positions and the substantial correlation between sDAI and EURe, the liquidation risk in the market is minimal.

Liquidity

At the time of writing, a swap of 1.5 million EURe would be limited to 5% slippage, supporting a conservative increase of supply and borrow caps.

Recommendation

Given the substantial demand to both supply and borrow EURe, correlated borrowing strategies, and substantial liquidity, we recommend increasing the supply and borrow caps of EURe on the Gnosis instance.

ezETH (Arbitrum)

ezETH has reached its supply cap on the Arbitrum instance following an inflow of over 6,700 tokens in the past 4 days.

Supply Distribution

The supply distribution of ezETH is highly concentrated, as the top 3 users represent over 90% of the market. As can be observed on the chart below, the suppliers are collateralizing WETH debt with ezETH, thereby participating in leveraged staking and earning a spread between the underlying yield of ezETH and the borrow rate of WETH.

As mentioned previously, WETH represents the overwhelming majority of debt posted by ezETH collateral. While the positions have health factors mostly centered in the 1.08 - 1.36 range, no liquidation risk is assumed due to the high correlation of the debt and collateral assets.

Liquidity

At the time of writing, on-chain liquidity on Arbitrum is sufficient to facilitate a swap of 300 ezETH at 1% slippage, supporting an increase in the supply caps.

Recommendation

Considering the increasing demand to loop ezETH with WETH, substantial DEX liquidity, and high correlation of the debt and collateral assets, we recommend increasing the supply cap of ezETH to facilitate further expansion of WETH borrowing activity on the Arbitrum instance.

PT-USDe-15JAN2026 (Plasma)

PT-USDe-15JAN2026 has reached its supply cap at 200 million tokens, following an inflow of over 50 million in the last five days, indicating persistent demand to participate in looping strategies.

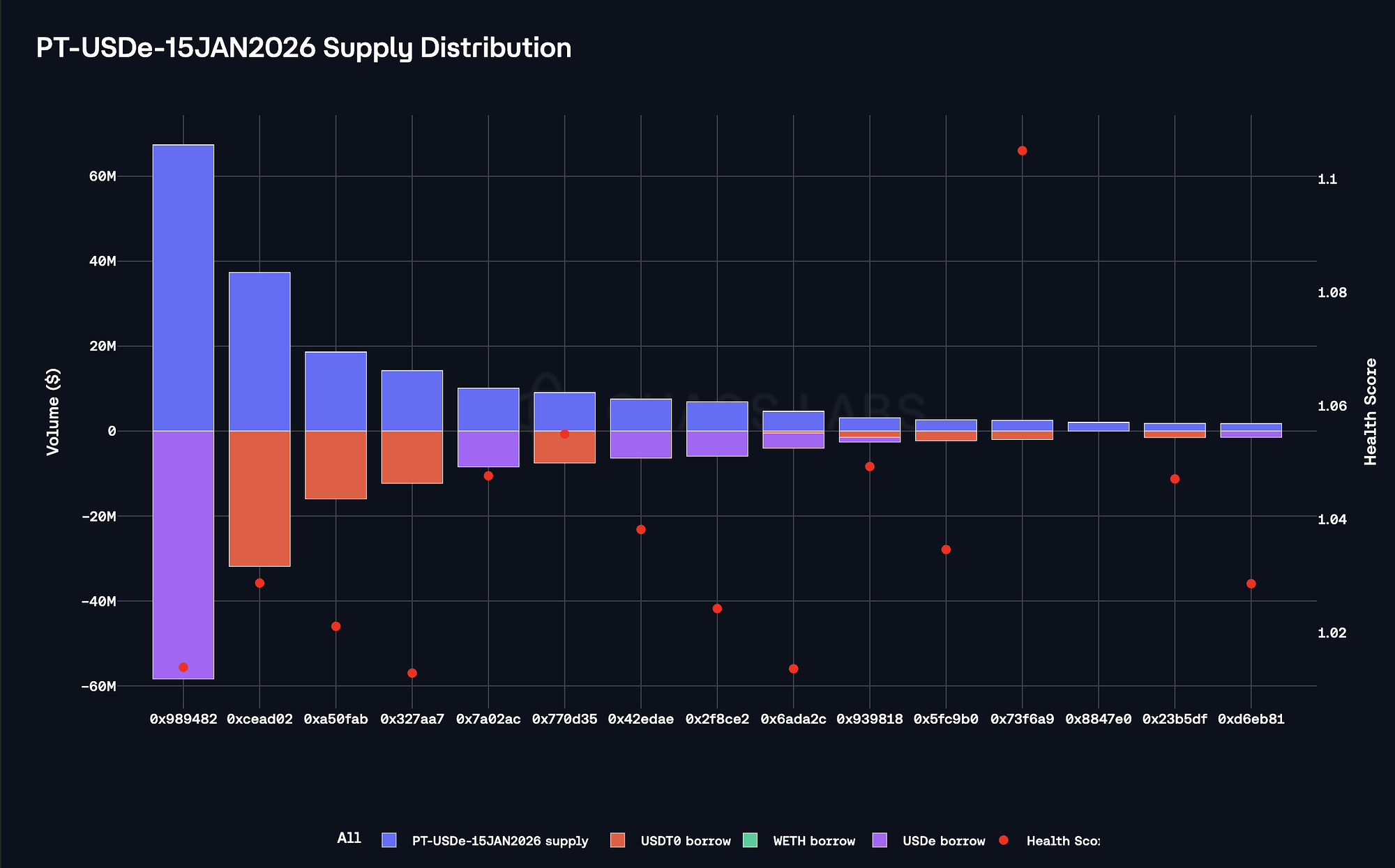

Supply Distribution

PT-USDe’s supply distribution is moderately concentrated, as the top user accounts for over 39% and the top 5 wallets represent approximately 84% of the total. The distribution of health factors is narrow, centered in the 1.02-1.11 range. The suppliers leverage the spread between the fixed yield of the USDe principal token and stablecoin borrow rates.

PT-USDe suppliers borrow a mix of USDT0 and USDe, facilitated by the respective E-Modes. Due to the high correlation of debt and collateral prices, the risk of liquidations in the market is minimal.

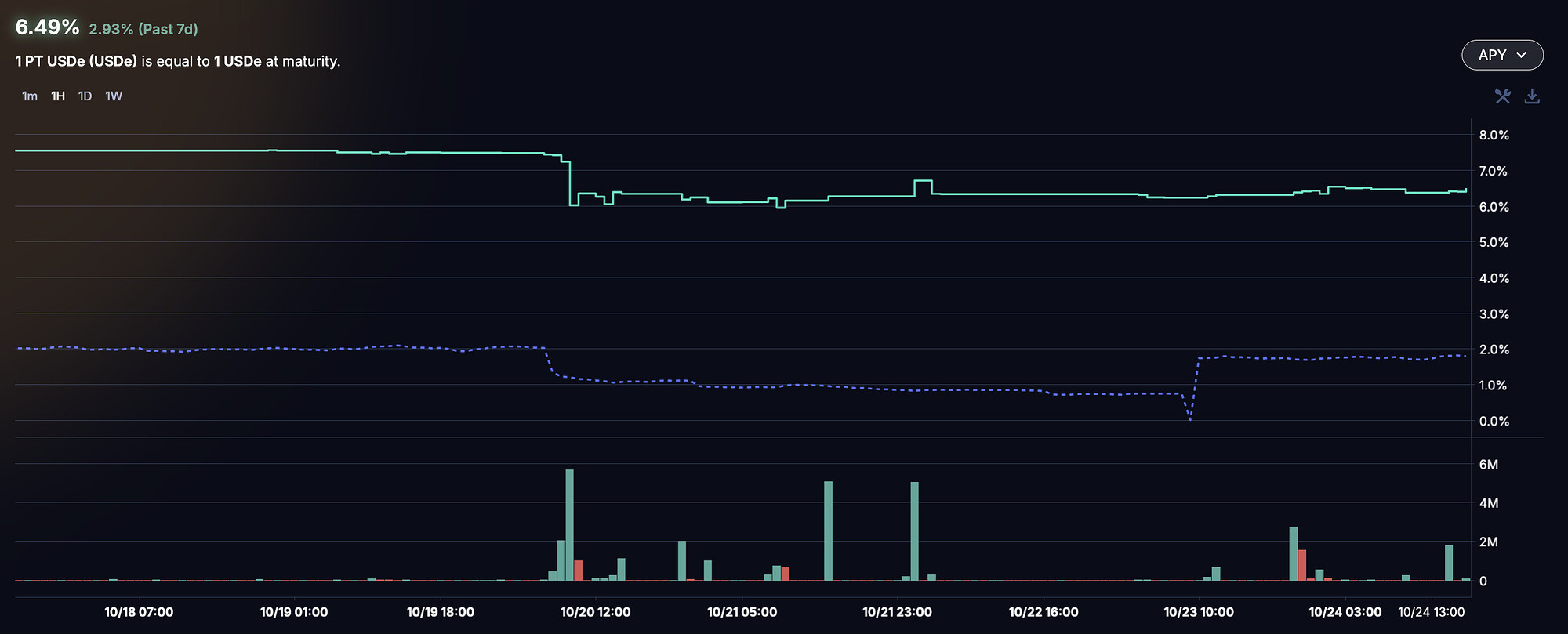

Market and Liquidity

At the time of writing, Pendle’s AMM has over $24 million of liquidity and can facilitate a sell order of over 15 million tokens with 0.5% slippage, providing a substantial liquidity buffer in case of liquidations.

Additionally, while the implied rate has seen some volatility in the recent week, dropping ~100 basis points, the magnitude of its effect on the price of the principal token is minimal.

Recommendation

Considering the significant demand to use PT-USDe-15JAN2026 as collateral, the low risk of the strategies, deep AMM liquidity, and implications for stablecoin borrow rates, we recommend increasing the supply cap of the asset.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | PYUSD | 120,210,000 | 240,000,000 | 30,000,000 | 120,000,000 |

| Ethereum Core | EURC | 46,000,000 | 70,000,000 | 42,320,000 | 64,000,000 |

| Gnosis | EURe | 18,000,000 | 27,000,000 | 15,000,000 | 22,500,000 |

| Arbitrum | ezETH | 14,000 | 21,000 | - | - |

| Plasma | PT-USDe-15JAN2026 | 200,000,000 | 400,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.