Summary:

A proposal to:

- Increase supply cap for wstETH on the Gnosis instance.

- Increase supply cap for stS on the Sonic instance.

- Increase supply and borrow caps for wS on the Sonic instance.

- Increase UOptimal and reduce Slope 2 for WETH on the Arbitrum Instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

wstETH (Gnosis)

wstETH has reached 95% supply cap utilization, while its borrow cap utilization remains at 5%.

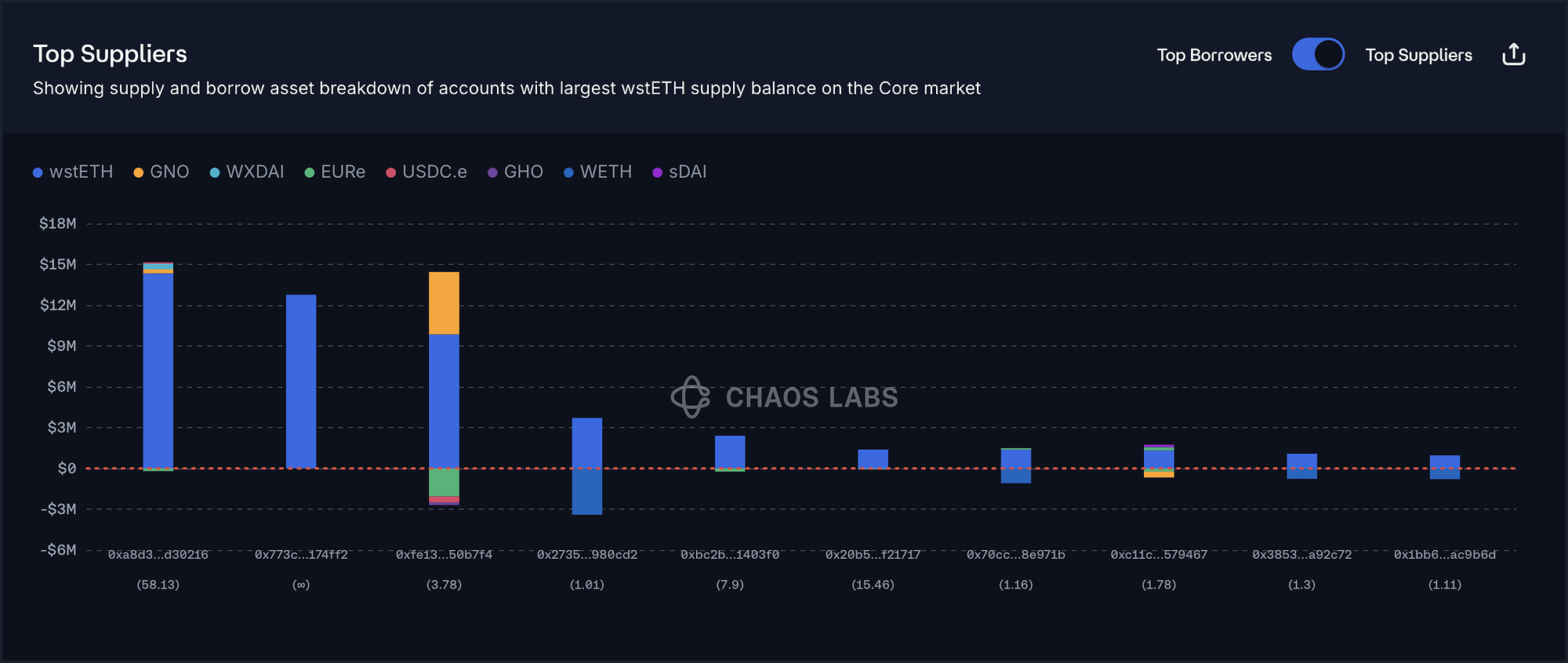

Supply Distribution

The supply distribution of wstETH presents a minor concentration risk, with the top supplier accounting for around 22% of the total. However, we do not view this position as carrying any immediate liquidation risk, as the user has only borrowed $200K against collateral worth $15M.

The remaining top suppliers are either looping (borrowing WETH) or maintaining very high health scores, which substantially reduces the likelihood of liquidations.

The largest asset borrowed against wstETH is WETH, accounting for 56% of the total borrowed distribution. This behavior significantly reduces the risk of large-scale liquidations.

Liquidity

wstETH’s liquidity has remained largely stable over the past three months, with a slight decline observed in the past month. At present, selling 150 wstETH would incur less than 4% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing wstETH’s supply cap.

stS (Sonic)

stS’s supply cap utilization has reached 92%.

Supply Distribution

The supply distribution of stS presents limited concentration risk, with the top supplier accounting for only 14% of the total. Among the top 10 suppliers, nine are borrowing wS, a highly correlated asset, which significantly reduces liquidation risk. The only user borrowing USDC also maintains a high health score and thus does not present any material risk at this time.

The largest asset borrowed against stS is wS, which accounts for 92% of the total distribution. This reflects current user looping behavior and indicates a low likelihood of large-scale liquidation risk.

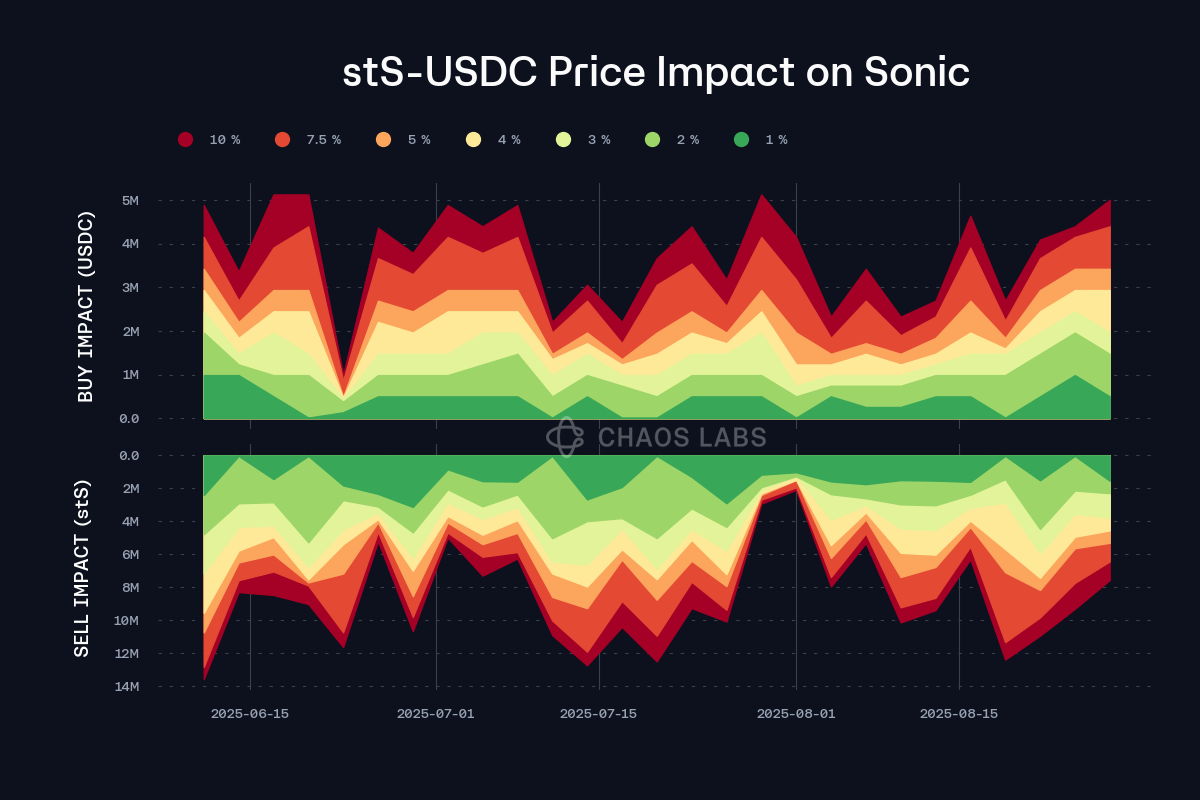

Liquidity

stS’s liquidity has been generally stable over the past three months, with recent increases. At present, selling 8M stS would incur less than 3% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing stS’s supply cap.

wS (Sonic)

wS has reached 88% supply cap utilization and 82% borrow cap utilization.

Supply Distribution

The top wS supplier currently accounts for 19% of the total distribution, suggesting that concentration risk is minor. In addition, with only $161K in debt against $11M in collateral, this position does not pose any immediate liquidation risk.

The remaining top suppliers also present limited liquidation risk, as all maintain health scores above 1.2.

The largest borrowed asset against wS is USDC, which currently accounts for 96% of the total borrowed asset distribution.

Borrow Distribution

The borrow distribution of wS also presents limited immediate liquidation risk, as 9 out of the top 10 borrowers are collateralizing stS to borrow wS. The only position collateralizing uncorrelated assets currently maintains a health score of 1.3, further reducing the likelihood of liquidation.

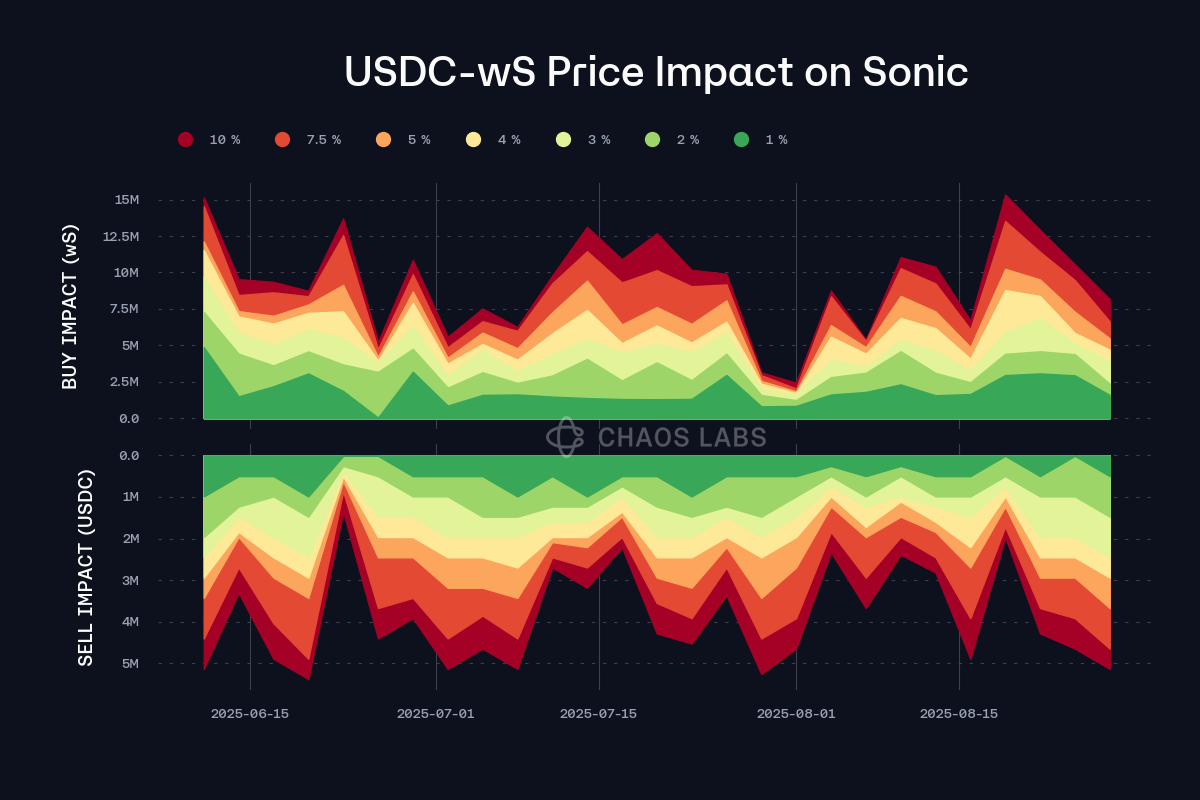

Liquidity

wS liquidity has fluctuated but remained generally stable, sufficient to support a supply cap increase. At present, selling 8M wS into USDC would incur less than 4% price slippage.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing wS’s supply and borrow caps.

WETH (Arbitrum)

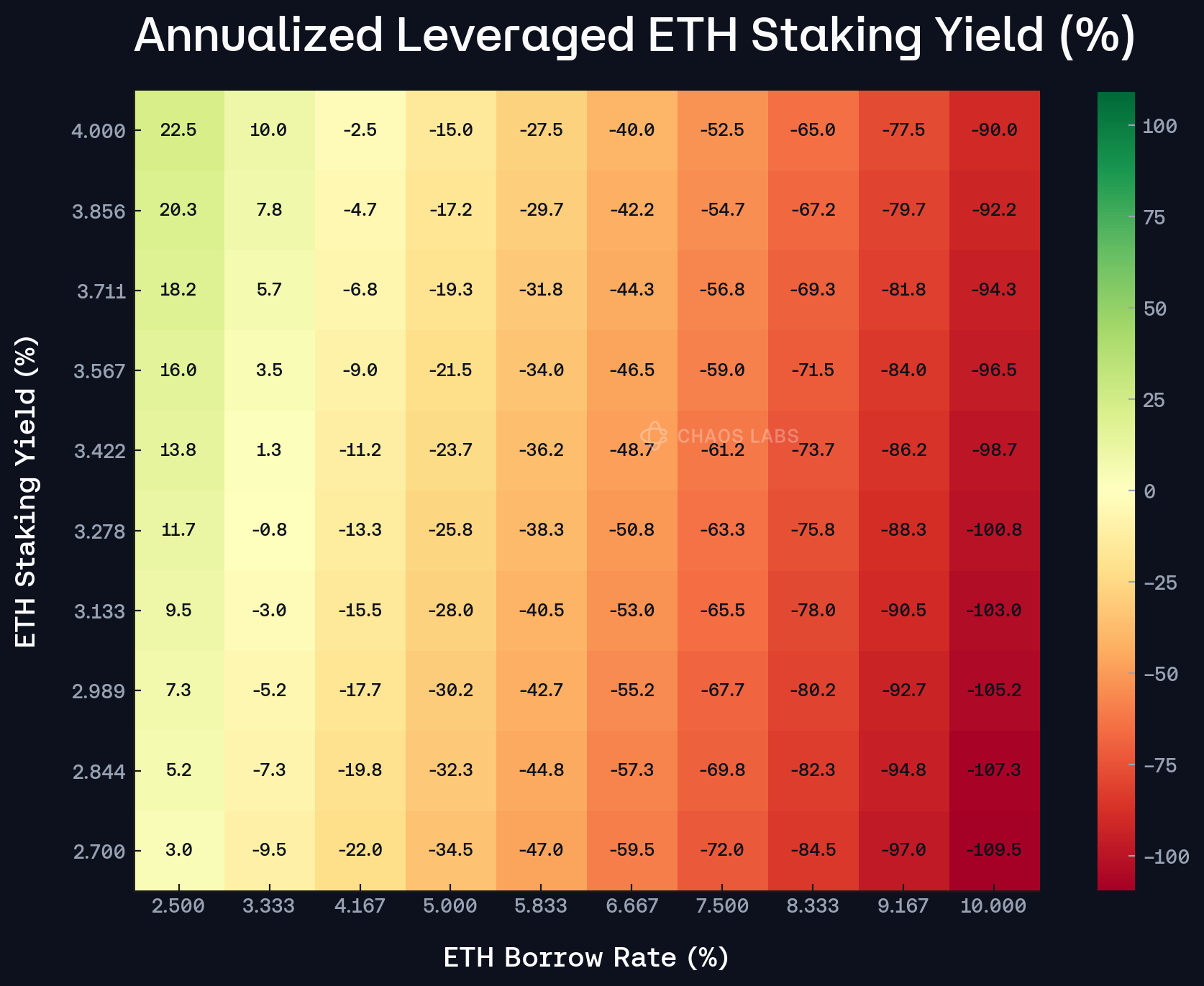

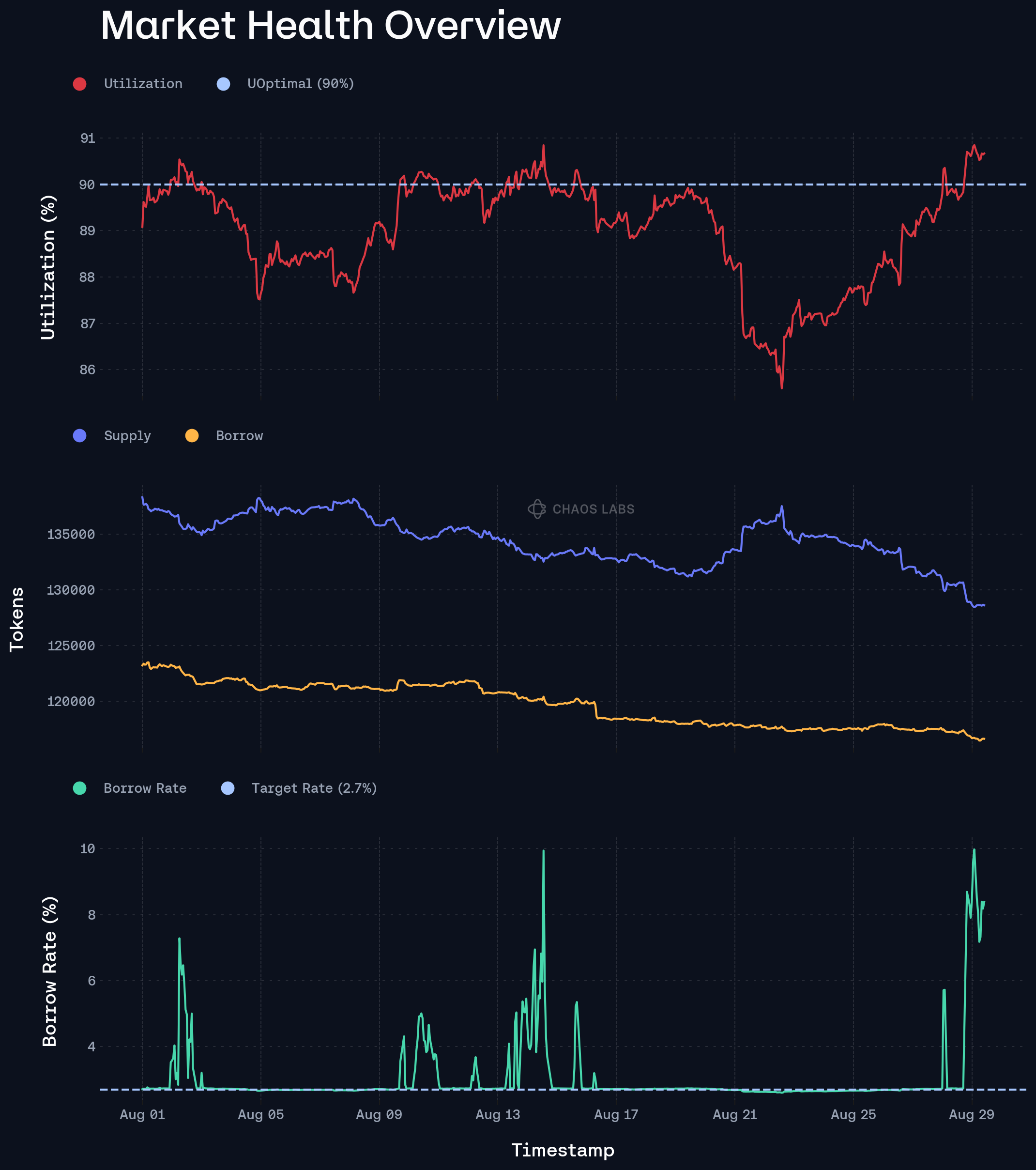

Due to a recent drop in WETH supply on the Aave Arbitrum instance, the market’s utilization has spiked to 91%, causing a high interest rate. Following the passing of its vote, we recommend adjusting WETH’s Slope 2 and Uoptimal to mitigate the rate volatility and minimize the unwind of leveraged staking positions in preparation for the implementation of the dynamic Slope 2 algorithm.

Currently, over 96% of the WETH borrowers within the Arbitrum market are performing leveraged staking using LST collateral. These positions, as depicted in the research about dynamic Slope 2 adjustments, are highly sensitive to WETH borrow rate changes.

Taking a conservative assumption of 15x leverage, and given the current borrow cost of WETH at this heightened utilization, of 8.3%, the positions in the market are expecting in the neighbourhood of -80% APR.

This rate volatility has been recurring over the last month due to a gradual drop in available WETH supply in the market. This change is expected to perform an immediate mitigation through the UOptimal increase and address the rate through a longer duration change, such as Slope 2 decrease.

Recommendation

Given the previously covered reasoning, we recommend increasing the UOptimal of WETH on the Aave V3 Arbitrum instance to 92% and decreasing the Slope 2 from 80% to 60%.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Gnosis | wstETH | 12,000 | 15,000 | 190 | - |

| Sonic | stS | 120,000,000 | 180,000,000 | - | - |

| Sonic | wS | 210,000,000 | 420,000,000 | 100,000,000 | 200,000,000 |

| Instance | Asset | Current UOptimal | Recommended UOptimal | Current Slope 2 | Recommended Slope 2 |

|---|---|---|---|---|---|

| Arbitrum | WETH | 90.00% | 92.00% | 80.00% | 60.00% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.