Summary

Chaos Labs recommends migrating the LBTC oracle on Aave V3 Ethereum instance from the BTC / USD Chainlink feed to a composite LBTC–BTC exchange-rate feed wrapped in a CAPO limiter. The change stems from Lombard’s activation of LBTC’s yield-bearing design on 22 July 2025. Staking rewards will be converted to LBTC and burned, causing the token’s fair value to drift above 1 BTC. If Aave continues valuing LBTC at a strict 1:1 peg with BTC, while no risk is posed to the protocol, the asset will be underpriced to its intrinsic value, hence causing a diminishing of the pool’s capital efficiency.

Similarly to LBTC, Chaos Labs recommends implementing a CAPO limiter to the eBTC exchange rate; however, the eBTC internal accountant is already expected to include LBTC yield accrual.

Motivation

LBTC

Lombard has confirmed that all BTC deposited have already been accruing Babylon staking rewards since 6 April 2025, and that on 22 July 2025, LBTC will become a yield-bearing token, passing those rewards into the asset’s price. Unlike earlier distributions, users will not harvest BABY or any other reward token, as the value will accrue gradually to LBTC, increasing its BTC-denominated exchange rate.

Lombard’s website states that in addition to the accumulated rewards since April 6, the unclaimed BABY airdrop balances will be swapped for LBTC, and the obtained tokens burned, effectively increasing its per-asset backing.

LBTC’s current design does not offer an on-chain function to determine the asset’s exchange rate, as this function is covered by a third-party proof-of-reserve oracle in collaboration with Redstone. However, Lombard recently deployed a new accounting oracle, which can be used for its Aave pricing.

The initial yield distributions are expected to be weekly; however, Lombard intends to adopt a daily distribution in the future, which will prevent drastic exchange rate movement.

Additionally, the acquisition of LBTC assets to burn is expected to be performed through the BTC market to prevent liquidity issues.

If Aave continues to value LBTC via the static BTC / USD feed once this process begins, the protocol will underprice collateral, leading to a less efficient market. However, given LBTC’s borrowability not being enabled in the Aave instance, the underpricing of collateral does not prevent a market risk.

eBTC

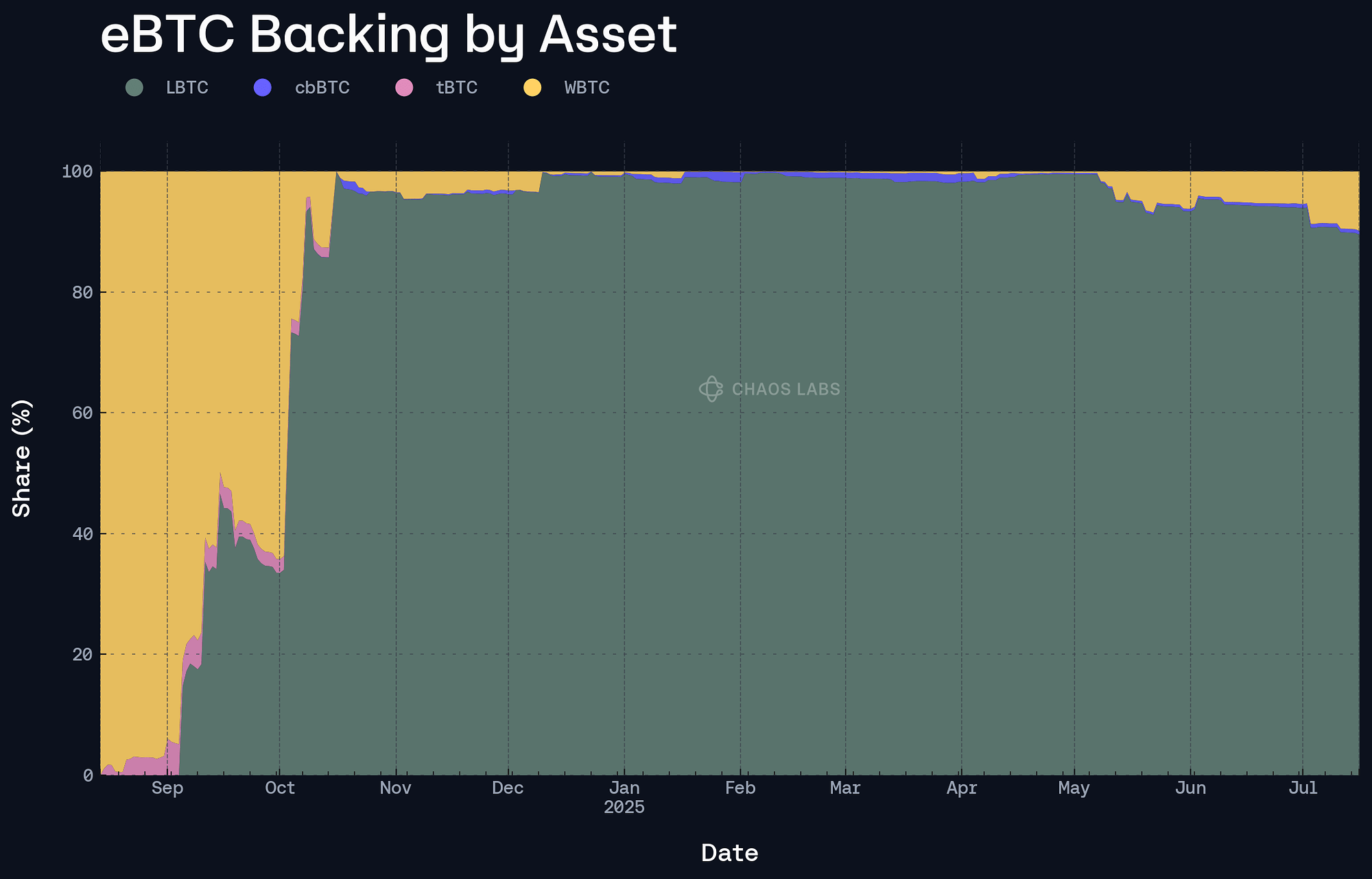

eBTC represents a restaked version of LBTC, and its backing is represented primarily by LBTC and, to a minor extent, by BTC wrapper to provide more responsive withdrawals. Its withdrawal process and internal accounting adopt a WBTC-anchored exchange rate; as such, any yield accrued to the underlying LBTC is expected to be properly represented in the eBTC’s internal exchange rate with respect to the underlying aggregate share of LBTC that collateralizes eBTC. However, in order to prevent a possible exchange rate manipulation, we recommend adopting a CAPO feed to wrap the internal rate.

Technical Analysis

LBTC

To determine the effective yield since the launch of the staking, we account for the combination of non-distributed airdrop and accumulated rewards as reported by the Lombard website as 59M BABY, which at the current price is valued $3.1M.

Given current LBTC marketcap of $1.73B , if no additional tokens were to be claimed, we estimate the accrued yield of LBTC to represent an increase in LBTC price of 0.18%, representing an annualized yield of 0.93% if started on April 6th.

In order to ensure a sufficient margin of error given by changes in BABY’s price and LBTC market cap prior to launch, we recommend adopting an initial maxYearlyRatioGrowthPercent of 2%.

This parameter can be adjusted following the launch of the asset and after observation of the effective yield accrued.

We additionally recommend a 7-day snapshot delay combined with a Snapshot Ratio of 30 days to protect the exchange rate from short-term yield volatility and ensure timely updates to minimize discrepancies between the exchange rate and the CAPO limiter.

eBTC

As eBTC’s backing has historically ranged between 90% and 99% LBTC, we recommend adopting a maxYearlyRatioGrowthPercent of 95% of the one recommended for LBTC, as such 1.9% is best suited to represent the expected rate of accrual of the asset.

Specifications

LBTC

Oracle Setup

| Asset | Current Oracle | Recommended Oracle |

|---|---|---|

| LBTC | BTC/USD Chainlink | LBTC/BTC Internal Oracle * BTC/USD Chainlink |

CAPO Parameters

| maxYearlyRatioGrowthPercent | Snapshot Ratio | Snapshot Delay |

|---|---|---|

| 2.00% | 30 days | 7 days |

eBTC

CAPO Parameters

| maxYearlyRatioGrowthPercent | Snapshot Ratio | Snapshot Delay |

|---|---|---|

| 1.90% | 30 days | 7 days |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0