June 2025

This update highlights Chaos Labs’ activities and proposals in June.

Highlights

Addition of USDe to Ethena PT E-Modes

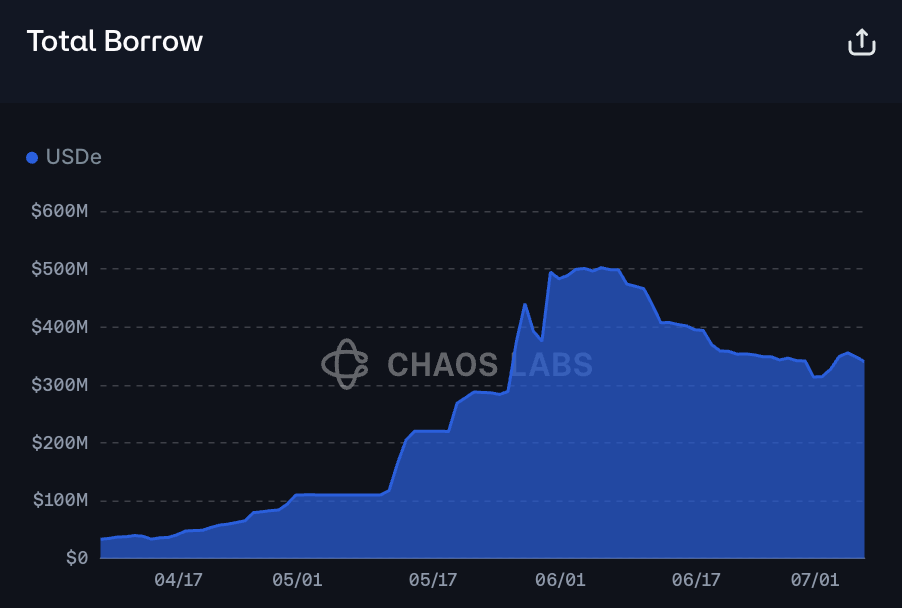

The previous creation of a USDe-specific E-Mode allowed users to leverage USDe-linked PT tokens against USDe itself was a success, as USDe has generated a significant revenue relative to its size.

However, to move between the Stablecoin and USDe E-Modes was cumbersome for users, requiring the full unwinding of a position. To address these frictions, we recommended adding USDe to the Stablecoin E-Mode, allowing users to easily migrate between the two without unwinding their position.

USDT IR Adjustments

We conducted active monitoring of markets leading to rapid-response recommendations for USDT, helping to mitigate rate spikes as the result of user behavior. HTX (formerly Huobi) was engaged in a pattern of depositing and withdrawing large amounts of USDT on Core; this became increasingly problematic as utilization increased because of USDT borrow demand from PT token deposits.

To address this, we first lowered Slope 2, then lowered it further and increased UOptimal, then finally reverted Slope 2 and UOptimal to their previous values. This led to limited disruptions to users and continued growth on both the supply and borrow sides.

USDT on Core

Onboard wstLINK to Aave V3 Core Instance

Chaos Labs supported the listing of wstLINK on Core, finding that the asset was suitable from a risk perspective and may provide a significant increase in LINK borrow utilization. Chainlink Staking currently operates in v0.2, which is composed of the Community and Node Staking Pools, the former being individual or institutional holders who do not provide oracle services directly and are not subject to slashing. Node Operators are responsible for running oracle services and can be slashed.

Based on the staked LINK market dynamics, stLINK has traded at a slight premium to LINK on secondary markets, reflecting that airdrops from Chainlink BUILD projects have begun, and users were expecting it to be listed on Aave, which would effectively increase its yield. Along these lines, we also recommended an adjustment to LINK’s IR and borrow cap parameters to better optimize for this use case.

Early Renewal Proposal

Chaos Labs proposed a 12-month early renewal of our risk management partnership with the Aave DAO as a new and separate engagement stream in parallel with the current engagement. This proposal reflected Chaos Labs’ transition from periodic risk reviews to delivering deeply integrated, protocol-native risk automation infrastructure. Additionally, we noted that we have conducted:

- 64 asset listing analyses in the past 7 months (vs. 46 in the entire previous year), reflecting a sharp increase in volume and diligence scope.

- 13 new deployment listings, with 10 scheduled to go live shortly, significantly expanding protocol reach and impact.

- 226 supply cap, 203 borrow cap, and 572 interest rate curve updates executed through the Risk Stewards, scaling operational coverage.

- 260 total forum posts spanning proposal authorship, parameter reviews, research, and real-time risk insights, reinforcing Chaos Labs’ governance leadership.

The section below covers two of our most prominent Risk Oracle deployments, managing caps and PT token collateral parameters, respectively. We have also significantly enhanced our monitoring platform, especially with a new SVR dashboard that displays value recaptured over time, amongst other metrics.

Risk Oracles

Supply and Borrow Cap Oracles

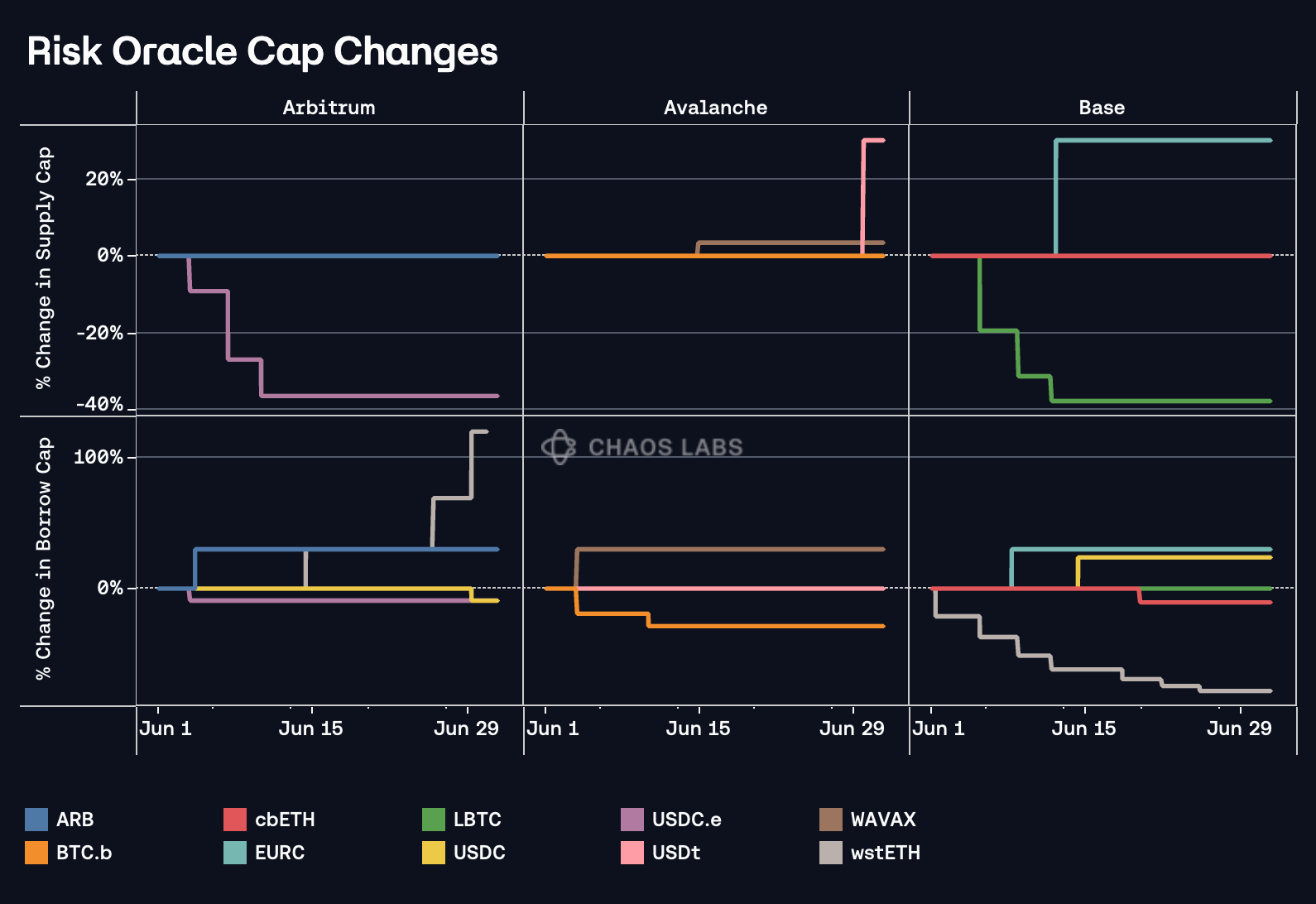

The supply and borrow cap risk oracles on Arbitrum, Avalanche, and Base continued to function efficiently, executing changes on numerous markets. The most significant changes came on Arbitrum’s wstETH market, where the oracle recommended increasing the borrow cap from 1,400 to 3,075 over the course of multiple adjustments.

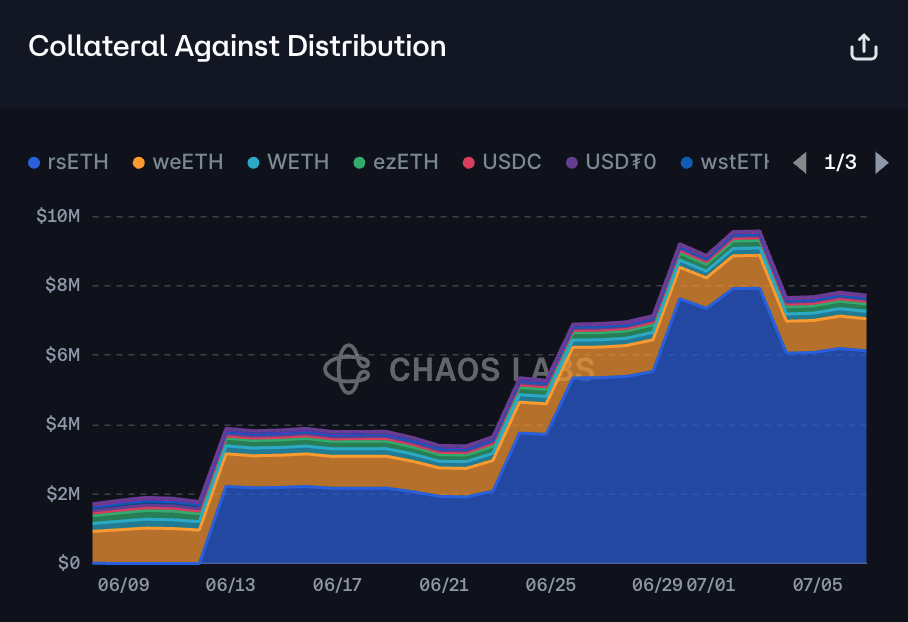

This allowed for frictionless increases in wstETH borrows on Arbitrum as a result of increased leverage against rsETH.

wstETH on Arbitrum

PT Risk Oracle

The value of assets utilizing the PT risk oracle has eclipsed $2B in combined TVL. The chart below shows two of the three parameters dictated by risk oracles: Liquidation Bonus and Liquidation Threshold, as well as total supply in USD terms.

We can observe that PT-sUSDE’s LT remained steady while its LB decreased, reflecting its approaching maturity. Meanwhile, the LTs of both PT-USDe and PT-eUSDE increased throughout the month in conjunction with their LBs falling. The oracle continues to function optimally and has allowed for significant, responsible growth in these assets.

Forum Activity

- We published the following proposals and updates, including risk parameter updates:

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.02.25

- Chaos Labs Risk Stewards - Adjust Supply Caps and Interest Rate on Aave V3 - 06.03.25

- Chaos Labs Risk Stewards - Adjust USDT Interest Rate Curve on Aave V3 - 06.05.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.07.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.09.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.11.25

- [ARFC] Addition of USDe to Ethena Principal Token Stablecoin E-Modes

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.14.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.18.25

- Chaos Labs x Aave DAO — Early Renewal Proposal

- Chaos Labs Risk Stewards - Interest Rate Adjustments on Aave V3 Avalanche - 06.24.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.26.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 06.27.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 06.28.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 06.30.25

- Additionally, we provided analysis regarding the following proposals and discussions:

- [Direct to AIP] Asset Parameters Optimization

- [Direct to AIP] Onboard rsETH to Aave V3 Linea Instance

- [ARFC] Launch GHO on Avalanche & set ACI as Emissions Manager for rewards

- [ARFC] Onboard tBTC to Aave v3 on Base

- [ARFC] Onboard wstLINK to Aave V3 Core Instance

- [Direct to AIP] Onboard wBTC to Sonic V3 Instance

- [ARFC] Add USR to Aave v3 Core Instance

- [Direct to AIP] Onboard sUSDe September expiry PT tokens on Aave V3 Core Instance

- [Direct-to-AIP] Aave v2 non-Ethereum pools next deprecation steps

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and Borrow Cap Risk Oracle integration on additional Chains leveraging Edge infrastructure.

- Continuous monitoring of SVR and associated parameterization

- Pendle Dynamic Risk Oracle for each PT asset deployment

- Risk Oracle integration for automated interest rate curve adjustments in response to demand

- Circuit Breaker for LSTs and LRTs

- Umbrella parameterization and methodology

- GHO: ongoing recommendations, including a comprehensive quantitative framework for the GHO savings rate.

- Continuous optimization of risk parameters on all V3 deployments.

- Parameterization for new Liquid E-Modes.

- Analysis and parameter recommendations for new assets and markets.