Overview

Chaos Labs supports listing wstETH on Aave V3’s Plasma instance. Below we present our analysis and initial risk parameter recommendation.

Plasma Market

Since its launch, the Plasma instance of Aave has experienced rapid growth, scaling to over $6 billion, largely driven by the prevalence of high-yield strategies supported by the ongoing incentive campaign and market conditions. Listing wstETH would unlock additional utility for instance users and support further growth by enabling new strategies like LRT/LST looping and establishing a new collateral base.

Asset Overview

wstETH is a wrapped version of Lido staked ETH, which is bridged to Plasma using CCIP. The wstETH is one of the largest assets on a set of instances due to its stability and underlying yield. While no substantial wstETH/USDT or wstETH/WETH pool is established on Plasma at the moment, we expect the liquidity to catch up before the listing.

Due to the lack of established pools, we will utilize DEX prices from Ethereum Uniswap V3 in order to analyze the asset’s performance in terms of volatility and dislocations from the oracle price.

Dislocations

Comparing minute-based wstETH/ETH average prices on Uniswap with a corresponding wstETH/WETH oracle, we observe that the frequency of dislocations is minimal as the pool exhibits high peg-stability. The largest noticed dislocation had a magnitude of 0.15% and, per our deeper analysis, was caused by a swap of substantial size.

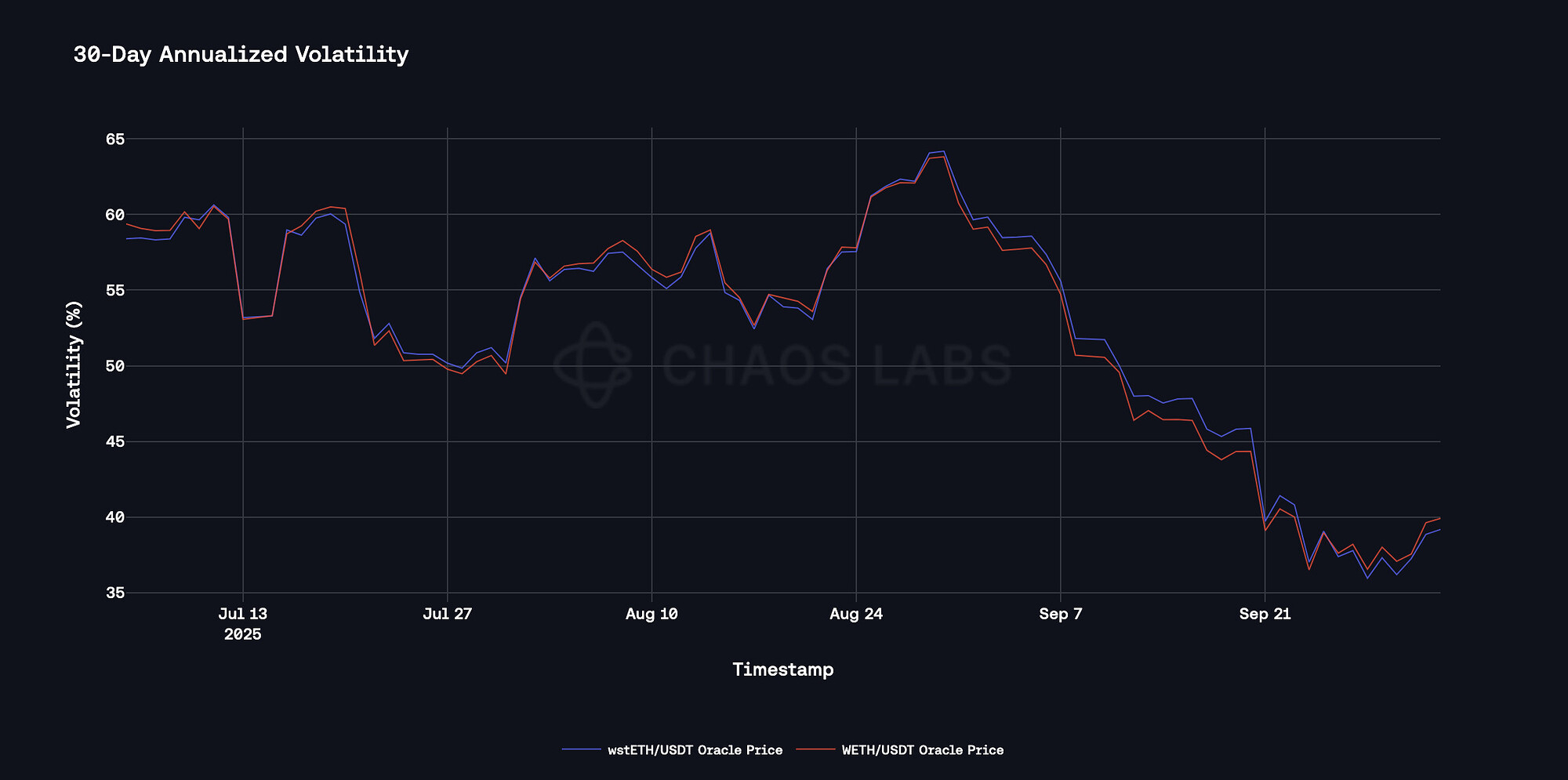

Volatility

wstETH’s 30-day annualized volatility largely mirrors that of WETH, due to the high correlation of the assets’ prices, as WETH is the underlying of wstETH.

While wstETH mostly inherits WETH volatility profile, some deviations in volatility occur due to additional risk associated with the asset or slight market inefficiencies caused by imbalances in liquidity or market responsiveness.

E-Modes

To provide additional utility and facilitate higher capital efficiency, we recommend introducing a specialized E-Mode. The proposed wstETH/WETH E-Mode aims to reflect the configurations currently available on the other chains and will allow borrowing WETH at higher risk parameters, namely LTV, LT, and LB. The configuration aims to increase the utility of both the asset and the instance by allowing users to deploy wstETH in a leveraged staking strategy, incentivizing additional WETH borrowing demand.

Liquidity

At the time of writing, no liquidity pool has been established for wstETH; nevertheless, we expect the liquidity to catch up shortly. Additionally, the Plasma protocol team has established a $300M liquidation backstop to ensure efficient execution of liquidations on the Aave Plasma instance during periods of market stress.

Recommendation

Chaos Labs supports the proposal to list wstETH on the Plasma instance. The listing will increase the instance’s utility and incentivize additional activity that will support further growth and increase the protocol’s revenue. We recommend aligning wstETH’s risk parameters and interest rate configuration with those of the Ethereum Core instance.

Specification

Following the above analysis, we recommend the following parameter settings:

wstETH Configuration

| Parameter | Value |

|---|---|

| Asset | wstETH |

| Isolation Mode | No |

| Borrowable | Yes |

| Collateral Enabled | Yes |

| Supply Cap | 20,000 |

| Borrow Cap | 5,000 |

| Debt Ceiling | - |

| LTV | 78.5% |

| Liquidation Threshold | 81.0% |

| Liquidation Penalty | 6.0% |

| Liquidation Protocol Fee | 10% |

| Variable Base | 0% |

| Variable Slope1 | 0.55% |

| Variable Slope2 | 40% |

| Uoptimal | 90% |

| Reserve Factor | 35% |

| Stable Borrowing | Disabled |

| Flashloanable | Yes |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

| E-Mode Category | see below |

wstETH/WETH E-Mode

| Parameter | wstETH | WETH |

|---|---|---|

| Collateral | Yes | No |

| Borrowable | No | Yes |

| Max LTV | 94% | - |

| Liquidation Threshold | 96% | - |

| Liquidation Bonus | 1.0% | - |

wstETH CAPO

| maxYearlyRatioGrowthPercent | ratioReferenceTime | MINIMUM_SNAPSHOT_DELAY |

|---|---|---|

| 9.68% | monthly | 7 days |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0