I’m Caz, the developer of DeFi Simulator, an open source Aave debt simulator. DeFi Simulator recently received a grant to implement our Aave asset risk parameter editor. Thank you to AGD and the Aave ecosystem for this opportunity, I’m excited to deliver this new feature!

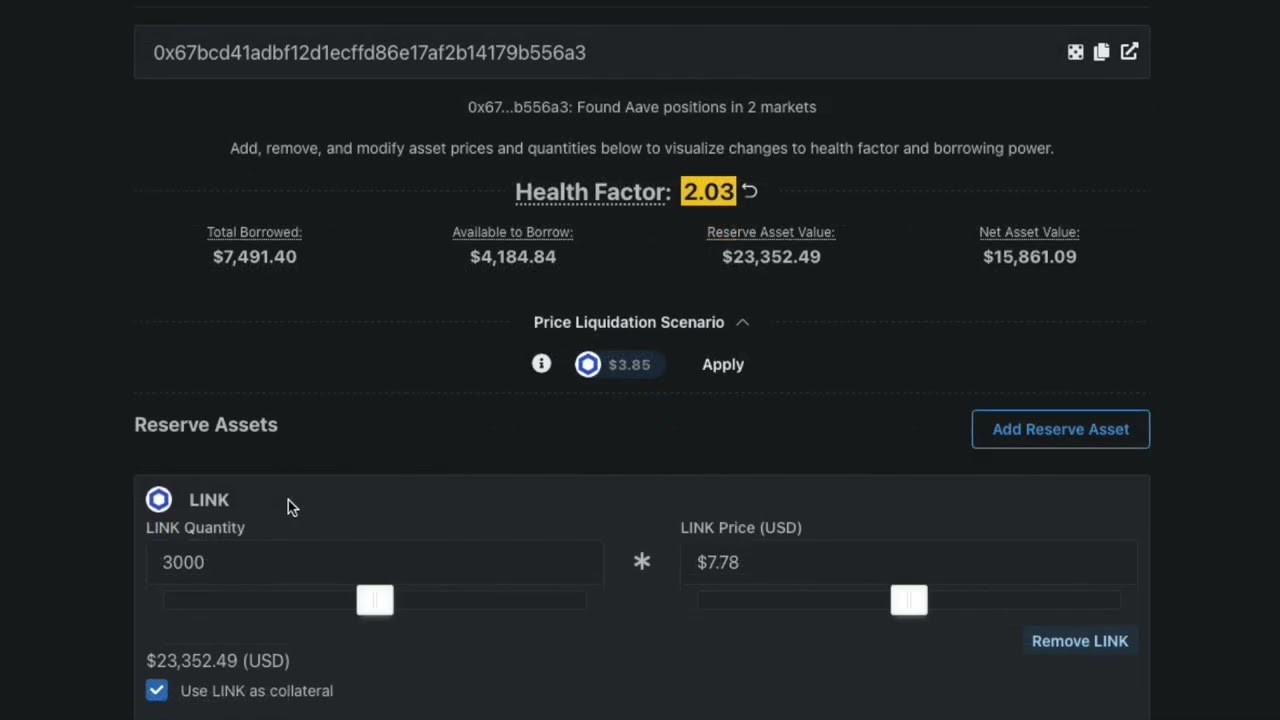

The existing DeFi Simulator asset editor UI

Project Description

The project will consist of an intuitive UI in the existing Defi Simulator interface. The UI will make the following asset risk parameters editable:

- Liquidation Threshold

- Collateral Loan to Value

- E-Mode Liquidation Threshold

- E-Mode Collateral Loan to Value

- E-Mode Category

- Supply Cap

- Borrow Cap

- Borrowable

- Collateral Enabled

As in other editable fields within DeFi Simulator, changes to these values will trigger real time feedback on overall position information such as health factor, asset liquidation price scenario, and borrowing power.

This enhancement will give users the power to precisely understand how changes to asset risk parameters affect their position, and further understand how these governance changes pair with other user actions or potential market changes. Further, this integration can be a tool for any Aave ecosystem stakeholder to get a more nuanced understanding of how a particular governance proposal may affect any particular position.

Additional Features

Along with the asset risk parameter editor, this grant sponsors additional tangential features, including eMode support, enhanced asset details, and integrating solicited feedback from the community. These additional features will help us in our goal to become a premier tool for users in the Aave ecosystem.

I will be leaving updates in this thread as we release related features on a rolling basis. Please leave any feedback or questions here and I’ll respond ASAP.

Thanks again to the Aave Grants DAO and the greater community for this opportunity to enhance UX for end users and provide this new utility to all stakeholders and governance participants.

App: https://defisim.xyz

Twitter: https://twitter.com/defisim

Discord: DeFi Simulator

Grant proposal overview