This week, Horizon Total Value Locked (TVL) increased to $561.5m, with over $178.3m in net borrows, and $310.4m in stablecoin supply.

Highlights

- TVL has increased to $562 million, with a total stablecoin supply of $310 million and net borrowings standing at $178 million. RLUSD and USCC remain the dominant supplied assets, driven mainly by previously opened positions and ongoing incentive programs.

- The updated parameters have already been noticed by some users (e.g., via new supply → borrow transactions), confirming the new settings are functioning as intended.

- The incentivization programs for RLUSD supply and USDC borrow markets continue to be active.

Incentivize Program

Incentive programs on Horizon stimulate liquidity supply and borrowing activity, with active campaigns for USDC and RLUSD.

- USDC: The borrowing campaign remains active, offering daily rewards of $2,282, which effectively reduces the borrowing cost by approximately 3.5%.

- RLUSD: The new lending-focused campaign has begun, distributing $24,876 in daily rewards, capped at a 15% APY.

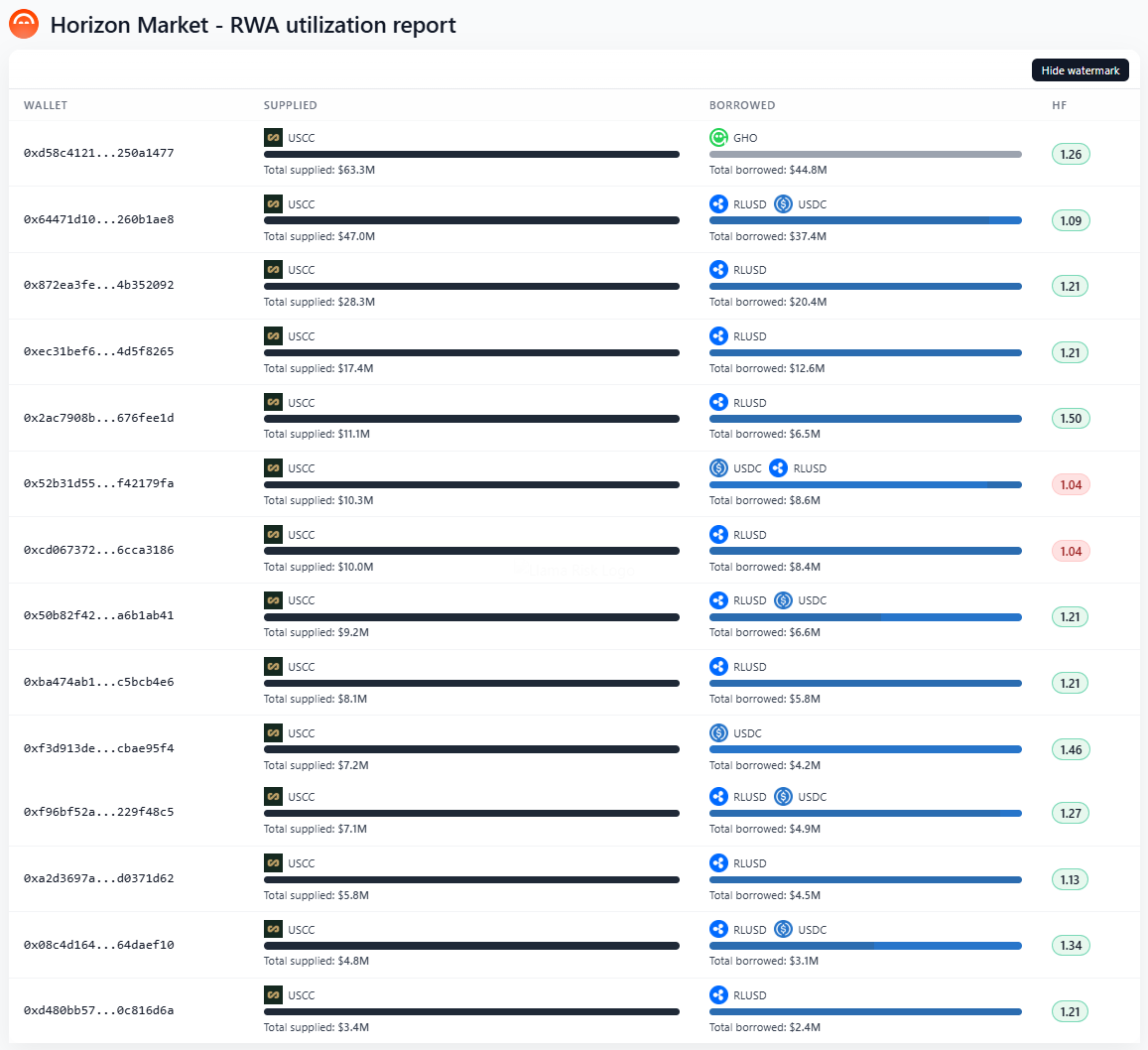

Utilization Report

In the sixteen weeks following Horizon’s market activation, total borrowed balances increased to $178.3m, driven by new borrowing parameters that boosted stablecoin borrowing demand. USCC remained the dominant supply asset used as collateral to borrow against.

Source: LlamaRisk, December 19, 2025

Parameter changes during this period

- RLUSD: The supply cap was raised to 201.5m on 16 December.

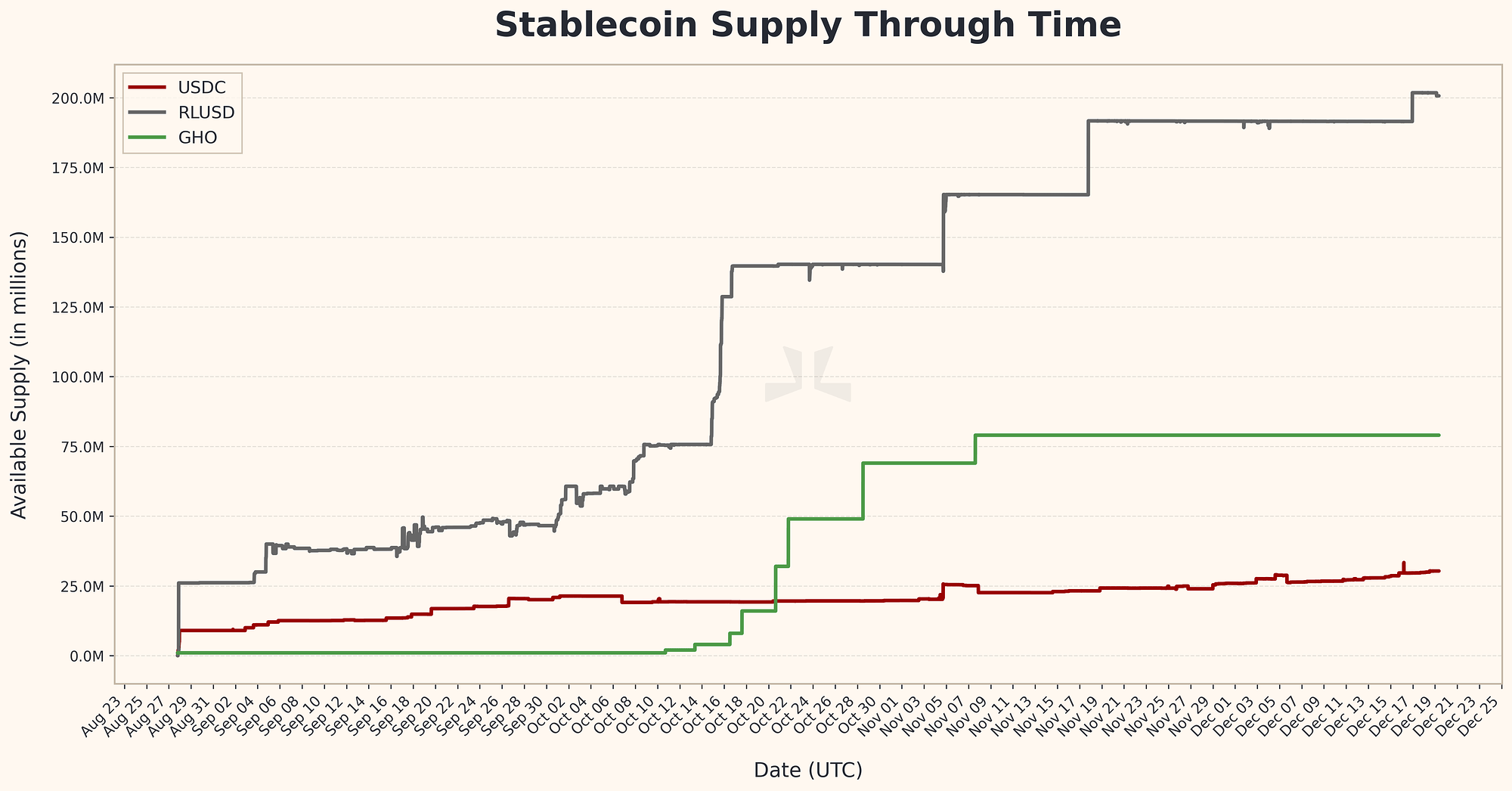

Supply (stablecoins)

The total stablecoin supply on Horizon increased by 4.2% to $310.4m, growth driven by a rise in the supply of both RLUSD and USDC. This growth followed an increase in the supply cap for RLUSD and changes in protocol parameters last week that stimulated market participation.

- RLUSD: The supply increased by 5.4% from $191.2m to $201.5m.

- USDC: The supply increased by 9.7% from $25.6m to $29.5m.

- GHO: The supply hasn’t changed and currently stands at $79.4m, managed by the GHO Steward.

Source: LlamaRisk, December 19, 2025

Supply (RWAs)

The total supply of Real-World Assets (RWAs) increased by 2.7%, holding $251.1 million. The increase in supply was driven solely by the expansion of USCC positions, while supply across other assets was broadly unchanged to modestly lower.

The changes in individual RWA supplies were as follows:

- USCC: Supply decreased by 9.5%, from $210.5m to $240.6m.

- JTRSY: Supply remained at zero with no assets supplied.

- USTB: Supply hasn’t changed and currently stands at $392.5k.

- JAAA: Supply hasn’t changed and currently sits at $2.5m.

- USYC: Supply remained at zero with no assets supplied.

- VBILL: Supply decreased by 18%, from $9.27m to $7.6m

Source: LlamaRisk, December 19, 2025

Borrow

Total net borrowing on Horizon increased by 7.2% to $178.3m, driven by higher borrowing parameters that boosted demand for USDC liquidity.

- USDC: Net borrow increase by 12.3%, from $21.3m to $23.9m.

- RLUSD: Net borrow increase by 9.5%, from $99.7m to $109.2m.

- GHO: Net borrow hasn’t changed and currently sits at $45.2m.

Source: LlamaRisk, December 19, 2025

Stablecoin Utilization

This week, GHO utilization remained largely unchanged, while RLUSD utilization remained mostly flat. USDC utilisation edged higher, reflecting a modest uptick in borrowing demand.

Source: LlamaRisk, December 19, 2025

Stablecoin Supply Rates

The thirteenth incentive campaign is now underway, with RLUSD incentive APY continuing to decrease. We observed a brief decline in RLUSD APY, resulting from a delay in activating the incentive campaign. Meanwhile, USDC rates remained broadly stable.

Source: LlamaRisk, December 19, 2025

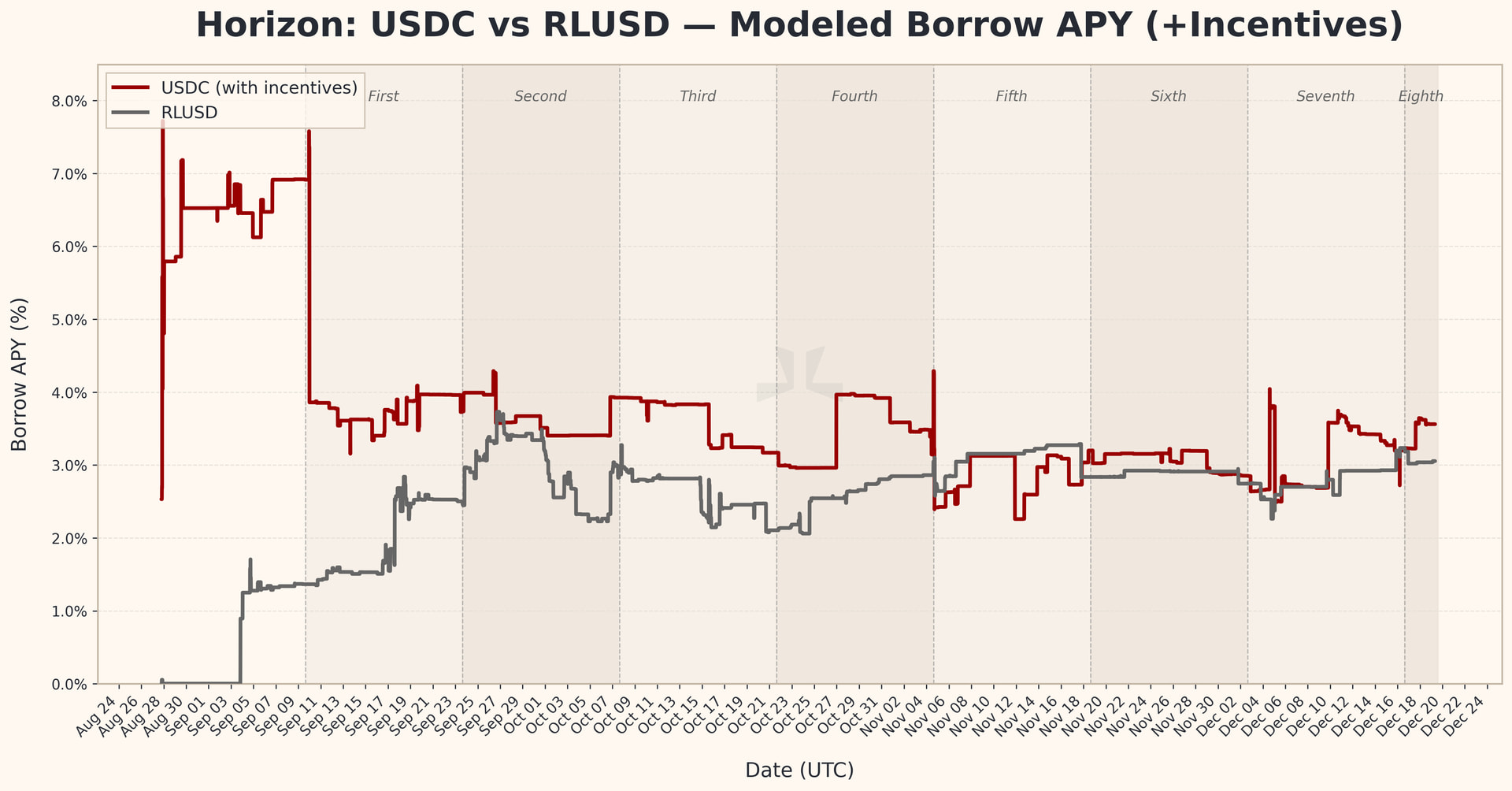

Stablecoin Borrow Rates

USDC and RLUSD borrowing rates remained steady over the week, exhibiting limited volatility and no discernible trend.

Source: LlamaRisk, December 19, 2025

Profitability heatmaps for leverage looping

USCC and USTB yields have remained relatively stable, continuing to trade within a narrow range. USCC yields fell and now sit at 4.8%, while USTB remains stable at 3.68%, keeping the broader yield backdrop relatively steady.

USCC

Source: LlamaRisk, December 19, 2025

Source: LlamaRisk, December 19, 2025

USTB

Source: LlamaRisk, December 19, 2025

Source: LlamaRisk, December 19, 2025