title: [TEMP CHECK] - Add GHO/USDC/USDT BPT to Safety Module

author: @TokenLogic - @MatthewGraham and @scottincrypto

created: 2023-10-23

Summary

This publication proposes creating a new GHO/USDC/USDT BPT stable coin category within the Aave Safety Module (SM).

Motivation

There are two main benefits to adding the GHO/USDC/USDT BPT to the SM:

- Diversify assets within the SM

- Support GHO liquidity

The GHO/USDC/USDT on Balancer v2 is the main GHO liquidity pool and the current TVL is around $10.4M.

Introducing the GHO/USDC/USDT BPT category provides diversification to the SM and for each unit of GHO in the liquidity pool, the Aave DAO accures interest from GHO debt.

If the Aave DAO elects to proceed with the strategy outlined below, the B-80AAVE-20wstETH BPT can also be integrated into the SM and replace the B-80AAVE-20wETH BPT from Balancer v1.

Rewards Strategy

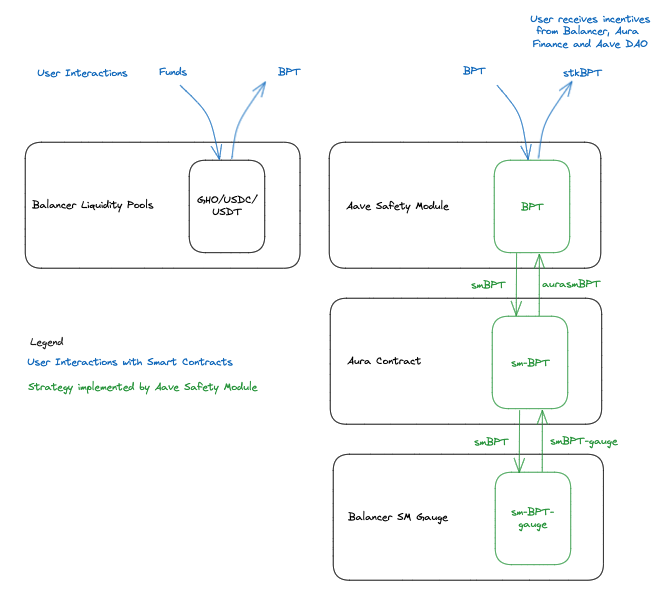

This publication proposed the GHO/USDC/USDT BPT be the first asset added to the SM using the new strategy shown below. The graphic details how the yield from Balancer and Aura Finance is integrated and routed to depositors.

Within the strategy, the BPT representing a claim to the liquidity within the Balancer v2 liquidity pool remains in the SM and is controlled by the Aave Protocol at all times. This limits the risk exposure to the Balancer v2 liquidity pool as the smBPT deposited into Aura Finance’s contract and Balancer’s gauge contract serves only an accounting purpose and has no economic value.

Upon implementation of the new smBPT gauge, Aave’s vlAURA position can be used to vote rewards to the smBPTgauge on Balancer. These rewards can be claimed without unstaking from the SM.

In addition, the DAO can allocate funds to the GHO Liquidity Committee (GLC) for the purpose of creating Quests/Bribe campaigns and directing additional yield to SM depositors. The new 90-day emission windows, supports creating periodic budgets with clear TVL and APR targets. This grants the DAO the ability to periodically amend the vlAURA voting strategy and Quest/Bribe budget to support onboarding additional BPTs in effort to diversify the SM whilst targeting specific APR and TVL ranges.

The implementation of the strategy requires the Balancer community to support the creation of a smBPT gauge. A forum post was shared with the Balancer community earlier this year. We have received feedback that both Balancer and Aura Finance support the proposed integration and creation of smBPT guages as needed.

Composable Stable v5 Pool Details

The GHO/USDC/USDT pool is a ComposableStablev5 pool and the general pool details can be found here.

The asset weights with ComposableStablev5 pools are dynamic and change based upon deposit and withdrawals. This means the pool can be skewed, overweight, towards one asset relative to another. The risk of being overly concentrated in one asset is highlighted by the current pool composition being >70% GHO. If USDC, USDT or GHO experiences an issue, the pool is likely to be majority the asset experiencing the issue. Further details on the pool type risks can be found here.

The amplification factor setting, currently a low 200, reflects the off balance nature of the pool. The Amplifcation setting is controlled by a Balancer Multisig and can be adjusted higher or lower. When the pool is balanced, most likely also when the GHO peg is acheive, it is expected to be >2000. The higher the amplification factor the more efficient the pool becomes.

GHO Peg

Only when GHO recovers the peg and the pool is more balanced, should the GHO/USDC/USDT BPT be added to the SM.

Given the time to create and audit the smart contracts to integrate the strategy into the SM, the GHO peg should be recovered.

Ultimately the borrow rate will support the peg and this is being gradually increased over time as mentioned here.

In effort to align this integration with broader GHO liquidity strategy, this forum publication is now being shared. It will take time to develop and prepare the contracts. Work has already began in preparation to support developing the smart contracts.

Next Steps

- Gather community feedback on this TEMP CHECK

- If community consensus is reached, escalate this proposal to TEMP CHECK Snapshot stage

- If the snapshot outcome is YAE, escalate the proposal to ARFC stage

The ARFC will present the target TVL and APR range, along with other parameters for the initial implementation. Some insights have already been shared in this proposal.

All associated development work is to be performed by @bgdlabs and will require audit.

In the past Balancer and Aura Finance have expressed interest in supporting the integration by way of contributing to the audit costs. Nothing is confirmed and this will be revisited closer to the implementation date.

Disclosure

TokenLogic receives no compensation beyond Aave protocol for the creation of this proposal. TokenLogic is a delegate within the Aave ecosystem.

We would like to recognise the contributions of @Dydymoon who initially work with @MatthewGraham on this type of proposal when @Llamaxyz was proposing to upgrade the SM. We would also like to recognise @solarcurve’s contribution of coming up with the smBPT gauge idea.

This proposal has been refined and differs from past work, but incorporates the work of @Dydymoon and @solarcurve - we would like to recognise there contributions and thank them for there efforts.

Copyright

Copyright and related rights waived via CC0.