Title: [ARFC] Treasury Management - GHO Liquidity Strategy Update

Author: @TokenLogic

Dated: 2023-09-08

Summary

This publication details the revised liquidity strategy for GHO across Ethereum DeFi.

Motivation

This publication outlines the GHO liquidity strategy with two main objectives:

- Improve GHO peg

- Promote diversified liquidity across multiple exchanges

It is widely accepted that the GHO peg requires improvement. This was especially evident when GHO traded at beneath 96 cents.

Furthermore, several liquidity pools have come about organically on Maverick, Uniswap and Curve. Similar to the Balancer pools, these pools are mostly GHO which is reflective of the GHO price relative to the stable coin being paired within each pool.

Do note, the existing Balancer pools are not being supported by Aave DAO. These pools are being supported by veBAL and vlAURA holders, mostly from contributors within each community.

The two initial pools being considered are GHO/USDT/USDC and GHO/LUSD until SM integration. This will be presented in a separate forum publication for future discussion. This publication will outline the Primary and Secondary Pools being proposed for GHO:

- Balancer GHO/USDC/USDT - Primary

- Balancer GHO/LUSD - Primary

- Maverick GHO/LUSD Static - Secondary

- Maverick GHO/LUSD Both - Secondary

- Uniswap (Bunni) GHO/USDC Wide - Secondary

- Uniswap (Bunni) GHO/USDC Narrow - Secondary

- Curve Finance GHO/crvUSD - Secondary

For the purpose of this publication, we shall focus on the non Curve Finance pool. The GHO/crvUSD, and potentially GHO/FRAXBP, will be supported initially by the Aave DAO strategic asset holding once ready. How the DAO is to deploy the recently acquired CRV, is still yet to be determined.

This proposal aims to create a structure of liquidity outside of the SM strategy, including efficient options such as concentrated ranges of liquidity incentivised with and create a 3 months trial budget for vote incentives/rewards.

Maverick

Maverick is an AMM capable of automating liquidity strategies without requiring maintenance. It enables to maximise capital efficiency by automating the concentration of liquidity as price moves. This built-in feature also helps LPs to eliminate the high gas fees that come from adjusting positions around price themselves.

MAV is the governance token, however the tokenomics aren’t fully revealed yet. It’s known that MAV has a veTokenomics model. MAV emissions didn’t start yet, but it’s possible to incentivize liquidity on Maverick by adding rewards by creating & incentivising a boosted pool for a defined amount of time between 3 to 30 days.

A GHO/LUSD pool with 3 BPS & 0,1% width, with liquidity in the range from 0,9811 to 0,9980 GHO per LUSD has been created and incentivised by Liquity with 1,5k LQTY per 7 days during 3 weeks. Additionally, LUSD liquidity managers proposed to create co-incentives for GHO/LUSD pools by committing up to 5K LQTY/month for the trial duration if this proposal is approved.

Considering that a range can’t be updated by governance, and since the pool was full GHO a few days ago, we’re considering updating the strategy above by creating a wider mode static boosted pool, and creating a pool mode both on top.

As that the full max estimated TVL is unlikely to be deposited at launch & since the unspent budget can’t be clawback (liquidity mining), incentives will start with a lower amount for a small duration (7 days) to easily follow the liquidity growth with the budget. Additional incentives can be added at any time.

Pros of incentivising liquidity on Maverick

- Automated rebalancing

- Fully customisable strategy

- Maximal liquidity efficiency

- Co-incentives if paired with LUSD

- Protocol Owned Liquidity can reduce costs

Cons of incentivizing liquidity on Maverick

- MAV emissions are not live yet

- Updating a range requires to create a new position

- Pools contracts are not verified yet

- Boosted pools incentives are limited to 30 days (can be renewed)

Uniswap v3, Bunni.pro & Liquis

Uniswap V3 allows concentrated liquidity: liquidity allocated within a custom price range. It highly increases liquidity efficiency, leading to more volume, and with the potential of supporting stablecoins peg.

Bunni is a liquidity engine for incentivizing Uniswap v3 liquidity composed of two parts:

- Protocol that wraps Uniswap liquidity positions into fungible ERC-20 tokens

- vetokenomics system for incentivizing Bunni liquidity

It enables the creation of gauges receiving emissions while liquidity is in range. However, the liquidity isn’t actively rebalanced and gauges can be killed if the liquidity is out of range.

Liquis is a governance wrapper for Bunni.pro similar to Convex & Aura.

A GHO/USDC pool with 0,05% fees, with the range from 0,9497 to 1,0247 GHO per USDC has been created by community members. Timeless core contributors created an initial smaller range from 0,9757 to 1,0253 GHO per USDC, and submitted the proposal TRC-66 to enable GHO/USDC Gauge with 2% Cap on Bunni, which was approved on July 27th.

Ranges can be updated by governance, and since GHO went below the current price over the past days, we’re considering updating the wide range above, and creating a new narrow one on top.

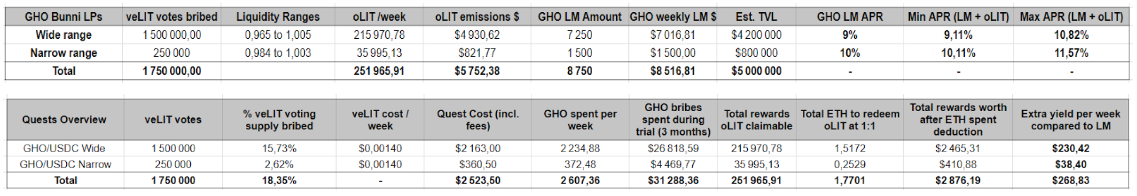

The Aave DAO does not hold veLIT & oLIT incentives total worth is limited, so to reach the TVL target, this strategy will initially be supported with both veLIT/vlLIQ votes incentives created on Warden Quest, and GHO liquidity mining deposited on Bunni.pro gauges.

Bunni gauges are not live yet, so the Min/Max APR on oLIT emissions will update depending on the actual working supply of each pool. For these estimations, the working supply used is from the current GHO-USDC proportionally to the estimated TVL.

Liquis just launched and will enable a better optimisation but the LIQ token has no price yet, and the first round vote ended on September 6th so it’s not yet included in the tables below but this strategy will most likely be improved in the coming weeks.

Nevertheless, they have a launch partner program ongoing giving access to LIQ tokens vested in exchange of a bribe amount committed over 6 months max, but closing this week as the protocol launched.

The conditions are 0,1% of LIQ supply vested over 4 years for 10,000$ worth of votes incentives for vlLIQ holders (controlling veLIT voting power). While the tokens are vested, the voting power can still be used until the end of the vesting duration, further increasing the yield or enabling recycling part of the bribes spent. More information on the program can be found here.

veLIT bribes were initially considered, so if this proposal is approved, the Aave DAO will be a launch partner by committing an amount of $20k of votes incentives for vlLIQ holders over the next 3 months and will receive 0,2% of the LIQ supply.

These estimations are made at the current time so it excludes LIQ emissions, liqLIT redemption mechanism, DAO vested voting power & impact on the strategy. The tables will be updated in the coming weeks if the overall strategy is approved. The proportion of bribes veLIT vs vs LIQ vs LM might also be optimized during the trial.

Similar to Maverick, as the full max estimated TVL is unlikely to be deposited at launch & because the unspent budget can only be clawback, which represents a limited part of the budget, LM rewards will be added progressively every 7 days to follow the TVL growth.

Pros of incentivizing liquidity on Bunni/Liquis

- Built on top of Uniswap v3

- LIT tokenomics are live (oLIT & veBoost)

- Liquis (Convex-like) recently launched will enable strategy optimisation

- Launch partner program earning LIQ tokens vested & voting power

- Updating a range earning rewards can be done by governance

- Extra liquidity mining rewards can be added on Bunni gauges

- Protocol Owned liquidity can reduce costs

Cons of incentivizing liquidity on Bunni/Liquis

- Liquidity is not automatically rebalanced

- oLIT option token design is complex for users (liqLIT improves this)

- BPT 80/20 design & oLIT redemption create selling pressure on LIT token

- Reward are split between emissions from bribes + LM

- Bunni gauges can be killed if out of range (Process)

Balancer & Aura:

As mentioned earlier, the existing Balancer pools are not being supported by Aave DAO yet and votes on GHO gauges depend on veBAL and vlAURA holders, mostly from contributors within each community. Moreover, GHO/USDC/USDT & GHO/LUSD are expected to be included in the SM at a later stage, but might need to create a base liquidity supported by the DAO before external votes fades away.

Both pools currently have classic gauges eligible for BAL rewards. According to recent changes from AIP-42, the budget allocated will be used to create vlAURA votes incentives on Warden Quest.

The initial strategy proposed is 400k vlAURA votes bribed to sustain 5% APR on a $5M TVL for each pool. The APR could be increased later on by using Aave voting power and blacklisting the DAO from the created Quests to attract more voters for the same cost.

However, spending incentives on stableswap liquidity could be counter-effective before GHO peg is restored, so incentives might start after concentrated liquidity ones, and if the external support left.

Similar to Maverick & Bunni, since the full max estimated TVL is unlikely to be deposited at launch, incentives will be deposited progressively to follow the liquidity growth. Nevertheless, 100% of the budget is spent in bribes so the unspent budget can be clawback on Warden Quest, enabling Aave DAO to pay a fixed price per vote for an important amount without overspending if the votes target isn’t reached.

As always, happy to fix potential mistakes in the strategies estimations if any.

Reward Budget Overview

Maverick & Uniswap v3, Bunni & Liquis (Concentrated Liquidity)

Balancer/Aura

The budget breakdown below contains two different margins:

- Assume that all strategies will begin to be incentivized at the same time, and with the maximum amount. It’s not what will happen but enables flexibility for the committee

- Assume that the bribe cost might increase and/or that more liquidity is needed on the different layers, so while the goal is not to spend it, a 20% buffer has been added to the committee budget (buffer not included in the above table)

Summary

Any unspent budget will be either deduced from the next budget request if the committee is renewed, or sent back to the Aave DAO treasury.

Specification

The following outlines how the this proposal is to be implemented:

- TokenLogic will provide analysis, estimation and monitoring of liquidity

- TokenLogic will facilitate the creation of liquidity pools not yet in production

- Liquidity Committee will implement on-chain transactions on-behalf of Aave DAO

Further details about the Liquidity Committee can be found here.

Disclaimer

TokenLogic receives no payment from Aave DAO or any external source for the creation of this proposal. TokenLogic is a delegate within the Aave ecosystem.

Next Steps

Gather feedback about updating GHO liquidity for more efficient solutions, and post an ARFC snapshot vote.