Author: Aave Labs

Date: Jan 17, 2024

Summary

The TEMP CHECK proposes a strategy for integrating the GHO stablecoin, the native Aave Protocol asset, across multiple blockchain networks. The objective is to enhance GHO liquidity, accessibility, and interoperability while maintaining security and stability. After thorough evaluation of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), we believe it is possible to deploy GHO cross-chain. Aave and Chainlink have maintained a longstanding partnership, consistently aligning on the principles of security, stability, and the advancement of the Protocol.

Motivation

The current limitation of GHO, which is primarily accessible only via minting on the Ethereum mainnet or through secondary markets, represents a significant constraint in its potential reach and utility across DeFi. We believe the future of GHO is to become a multichain asset where users can interact across various networks using GHO. Moving cross-chain increases the accessibility and liquidity of GHO for a larger spectrum of users. For instance, operating on networks with lower transaction fees can make GHO more cost-effective for users, particularly for smaller transactions. Additionally, faster transaction speeds on alternative chains can enhance the user experience, making GHO a more attractive option for time-sensitive operations.

After thorough technical analysis and evaluation of technical solutions available on the market, Aave Labs suggest implementing a canonical, unified cross-chain strategy for GHO using Chainlink’s CCIP.

CCIP stood up against alternatives thanks to:

- A strong network of decentralized oracle operators (DON), enhancing security on cross- chain messaging

- A ready-made, audited and secure infrastructure for bridging tokens

- A flexible relayer mode with the possibility to pay transaction fees in a variety of tokens (including LINK, and possibly in the future, with GHO)

- Ability for the system to have some critical components controlled by the Aave DAO

- An impeccable track record over multiple years of collaboration with the Aave DAO

Specification

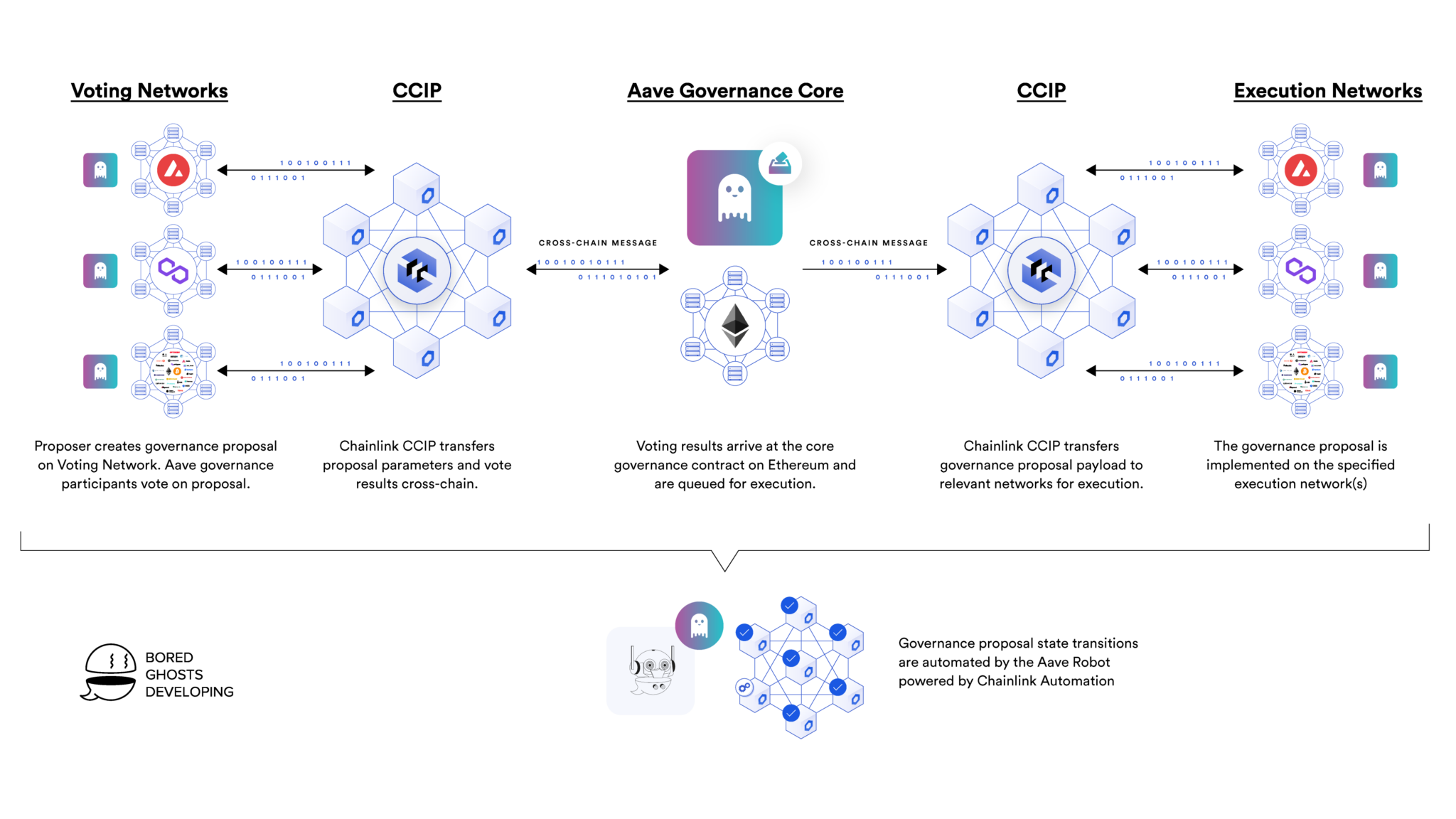

Chainlink’s CCIP is a standard for cross-chain communication that enables different blockchain networks to interact with each other securely and efficiently. It allows smart contracts on one blockchain to send messages and execute actions on another blockchain.

Aave Labs proposes using Chainlink’s CCIP infrastructure to move GHO across blockchain networks. This will allow the seamless transfer of the GHO token between source and destination networks. By “transferring tokens,” CCIP tokens are not technically transferred, but locked/burned on the source chain and then released/minted on the destination network. Cross-chain GHO uses a combination of lock/release and mint/burn models, backing the aggregated liquidity across chains with locked GHO on Ethereum. Every destination chain will have a canonical version of the GHO token and an Aave Governance controlled facilitator with a specific bucket capacity.

- Transfering GHO from Ethereum to another chain: GHO tokens get locked in a vault contract on Ethereum, GHO tokens get minted via Facilitator on the destination chain.

- Transfering GHO from another chain to Ethereum: GHO tokens get burned via Facilitator on the other chain, GHO tokens get released from the vault contract on Ethereum.

- Transfering GHO from one chain to another (none of them are Ethereum): GHO tokens get burned via Facilitator on source chain, minted via Facilitator on destination chain.

Lines in blue show the bridging from the upper domain to the lower domain. Lines in green show the opposite direction. A simulated transaction between Sepolia and Arbitrum Testnet is available to see here.

Each network will have a canonical version of GHO and a facilitator, controlled by Aave Governance, that will manage facilitator buckets and onboard GHO liquidity from Ethereum. The liquidity on each network will depend on the bucket capacity of the Facilitator and CCIP configuration (e.g. rate limit (CCIP Architecture | Chainlink Documentation)). The total amount of liquidity across chains is always less than or equal to the amount of GHO tokens locked on Ethereum. Our approach includes providing a technical assessment of the suitable supported networks and equips the DAO with the opportunity to decide which network(s) to deploy.

Upon approval, we plan to deploy the GHO token on the destination network(s) where GHO will be supported by the Aave DAO. We will implement a custom CCIP token pool contract to facilitate the transfer of GHO between mainnet and destination networks. Chainlink will allow this contract, which is part of the CCIP infrastructure, to be fully controlled by Aave Governance. Additionally, Aave Labs will support a UI integration where users can seamlessly bridge assets to and from supported networks.

Conclusion & Next Steps

The TEMP CHECK’s proposal to integrate the GHO stablecoin across multiple blockchain networks is the first step towards enhancing the utility and expansion of GHO. By leveraging Chainlink’s Cross-Chain Interoperability Protocol (CCIP), users will be able to bridge GHO in a secure and easy way. Following a positive evaluation of this proposal, our actions will include:

- Initiating the technical implementation process.

- Conducting an in-depth technical analysis to identify the most suitable networks for deployment.

- Presenting options to the DAO for selecting the initial network for deployment and configuring Facilitator buckets accordingly.

We encourage community feedback on this strategy.

Aave Labs