Summary

A proposal to gradually wind down the frozen markets on Aave V2 Ethereum via a series of LT reductions.

Motivation

As part of Gauntlet’s and Chaos’ ongoing commitment to maintaining the highest standards of operation on Aave, we propose to gradually wind down the frozen Aave V2 Ethereum markets via a scheduled series of LT reductions, similar to the framework approved by the DAO for CRV.

This proposal represents the next step in continuous efforts to reduce risk in the V2 markets and encourage the transition to V3. It follows a series of previous proposals, including:

- [ARFC] Chaos Labs - Incremental Reserve Factor Updates - Aave V2 Ethereum

- [ARFC] Freeze CRV on V2

- [ARFC] Chaos Labs Risk Parameter Updates - Aave V2 Ethereum - 2023.6.23

- [ARFC] TUSD Offboarding Plan

- [ARFC] Set CRV LTV to Zero on V2

- [ARFC] Chaos Labs Risk Parameter Updates - Aave V2 Ethereum - 2023.08.09

- [ARFC] TUSD Offboarding Plan Part II

While we advocate for proactive offboarding of the market, our recommendation is that Chaos and Gauntlet deliver a bi-weekly analysis and recommendation for each individual LT reduction. This would be similar to the process of increasing supply caps. If the risk managers agree on a single recommendation, the proposal would move directly to an AIP, but in case of disagreement, the more conservative approach would be adopted, with the alternative proposal put to a Snapshot vote for the community to decide.

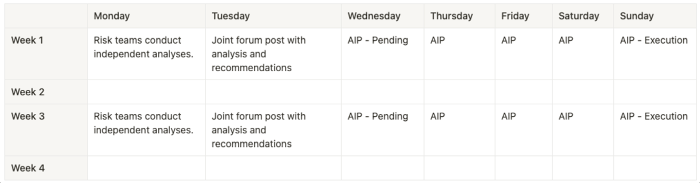

Plan:

Following is our recommended bi-weekly plan for communications and community transparency of the process:

- Monday - Risk teams conduct independent analyses and recommendations, considering (but not limited to) the following:

- Impact of the LT reduction on user positions - number of accounts and total amounts eligible for liquidation post-LT update

- Impact of the LT reduction on the health factor of the top accounts

- On-chain liquidity

- Tuesday - Gauntlet and Chaos Labs post a joint recommendation post after syncing on their analyses above

- Wednesday - Post AIP

- If risk teams are not aligned on a single recommendation, a Snapshot vote could be posted to gauge community preference.

Next Steps:

- We invite the community to provide their insights and feedback on this proposal.

- We will follow up with a Snapshot to approve this framework on September 25, 2023.

Disclaimer

Chaos Labs and Gauntlet have not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0

Appendix

Below, we provide more analysis on the inputs and quantitative criteria for deprecation. Any recommendations would follow the framework and process above, but in the interim, we wanted to provide the below context for community transparency. The first step is for the community to align on the framework and process itself via Snapshot vote on September 25th.

Criteria for Evaluation:

-

Health Factor (HF): For each asset, we should maintain a weighted average HF for borrowers above 1 with a 2-standard deviation buffer.

For context, the weighted average HF for borrowers on this platform stands at approximately 1.5. A detailed analysis of user positions reveals variance in distribution: certain assets display a skewed distribution, while others are normal. However, the liquidity for these assets is generally consistent and well-established, significantly exceeding the supply of the asset on Aave.

-

Liquidity Considerations: The available supply of ZRX exceeds its estimated supply caps, based on Gauntlet’s methodology for supply and borrow caps. Due to this excess supply, we’ve implemented an additional buffer to reduce the risk of liquidation. This buffer is calculated as a weighted average of the minimum maintenance Health Factor (HF) plus a 2-standard deviation daily volatility buffer. The established maintenance level for ZRX is 1.4.

User Analysis

| Asset | User Address | Supplied | % of Total Supply | Current HF | Liquidatable LT |

|---|---|---|---|---|---|

| ZRX | 0x1a5023cc3067da8cc1f5e7846d3a3662c954416a |

$7.72M | 95% | 1.35 | 31% |

| CVX | 0x30dd12344ce6bb4596c37f68b507028fabfe2e0f |

$209K | 62% | 1.14 | 31% |

| TUSD | 0x16af29b7efbf019ef30aae9023a5140c012374a5 |

$879K | 39% | 1.26 | 60% |

| MKR | 0x143e79a9e576fddb5de9ae144ecd0ad17a716179 |

$273K | 4.7% | 1.68 | 30% |

| MKR | 0xac1dbac279f02a4ec333ad17279093dcf6230136 |

$116K | 2% | 1.64 | 30% |

| MKR | 0xffe6212baf6c88850dcd6511cd32be11c50d3a61 |

$106K | 2% | 1.77 | 29% |

| MANA | 0x23b4f89e21c82aa54a7cfa263b36e724e70dd69a |

$77.3K | 12% | 1.12 | 47% |

| ENS | 0xab192cf0d1d01203862f618b65b31fdedb8b3305 |

$204K | 2.3% | 1.09 | 49% |

Recommendations

Note: the weighted HF for most users does not change (after LT changes in both the conservative and aggressive case) because they are holding other assets in their accounts.

Conservative:

Based on these recommendations, no users will be liquidated. For assets that exhibit significant concentrations among a few large users, we add a buffer equivalent to the daily GK volatility for added safety.

| Asset | Current LT | Current Weighted Average HF | New LT | New Weighted Average HF | Number Accounts Liquidated | Total Amount Liquidated (USD) | Needed HF |

|---|---|---|---|---|---|---|---|

| 1INCH | 0.4 | 1.44 | 0.39 | 1.44 | 0 | 0.0 | 1.09 |

| BAT | 0.4 | 1.55 | 0.37 | 1.55 | 0 | 0.0 | 1.07 |

| CVX | 0.35 | 1.82 | 0.34 | 1.8 | 0 | 0.0 | 1.06 |

| DPI | 0.42 | 1.4 | 0.39 | 1.4 | 0 | 0.0 | 1.06 |

| ENJ | 0.52 | 1.38 | 0.51 | 1.38 | 0 | 0.0 | 1.07 |

| MANA | 0.54 | 1.57 | 0.52 | 1.56 | 0 | 0.0 | 1.07 |

| MKR | 0.5 | 1.33 | 0.49 | 1.33 | 0 | 0.0 | 1.09 |

| REN | 0.32 | 1.69 | 0.29 | 1.68 | 0 | 0.0 | 1.14 |

| SNX | 0.49 | 1.74 | 0.48 | 1.74 | 0 | 0.0 | 1.11 |

| TUSD | 0.75 | 1.67 | 0.74 | 1.67 | 0 | 0.0 | 1.0 |

| YFI | 0.5 | 1.39 | 0.47 | 1.39 | 0 | 0.0 | 1.07 |

| ZRX | 0.42 | 1.45 | 0.37 | 1.36 | 0 | 0.0 | 1.52 |

Aggressive:

Under these recommendations, each asset will see less than $2,000 of its collateral liquidated. In total, this will affect 30 accounts, leading to a cumulative liquidation of $8,625.22 in collateral value.

| Asset | Current LT | Current Weighted Average HF | New LT | New Weighted Average HF | Number Accounts Liquidated | Total Amount Liquidated (USD) | Needed HF |

|---|---|---|---|---|---|---|---|

| 1INCH | 0.4 | 1.44 | 0.01 | 1.44 | 5 | 1521.86 | 1.09 |

| BAL | 0.35 | 1.57 | 0.25 | 1.57 | 2 | 168.25 | 1.06 |

| BAT | 0.4 | 1.55 | 0.25 | 1.55 | 3 | 1246.82 | 1.07 |

| CVX | 0.35 | 1.82 | 0.34 | 1.8 | 0 | 0.0 | 1.06 |

| DPI | 0.42 | 1.4 | 0.27 | 1.38 | 2 | 136.26 | 1.06 |

| ENJ | 0.52 | 1.38 | 0.49 | 1.37 | 1 | 674.13 | 1.07 |

| MANA | 0.54 | 1.57 | 0.49 | 1.56 | 1 | 30.54 | 1.07 |

| MKR | 0.5 | 1.33 | 0.35 | 1.28 | 4 | 470.13 | 1.09 |

| REN | 0.32 | 1.69 | 0.28 | 1.68 | 1 | 481.57 | 1.14 |

| SNX | 0.49 | 1.74 | 0.44 | 1.74 | 1 | 24.08 | 1.11 |

| TUSD | 0.75 | 1.67 | 0.65 | 1.61 | 5 | 797.16 | 1.0 |

| UNI | 0.7 | 1.6 | 0.65 | 1.59 | 3 | 1798.69 | 1.07 |

| YFI | 0.5 | 1.39 | 0.45 | 1.39 | 2 | 1266.73 | 1.07 |

| ZRX | 0.42 | 1.45 | 0.37 | 1.36 | 0 | 0.0 | 1.52 |