Overview

Chaos Labs supports the listing of stAVAX on the Aave v3 Avalanche instance.

stAVAX represents the liquid staking derivative for AVAX and has historically maintained a reasonable depth of onchain liquidity. However, the asset experienced a significant contraction in liquidity over recent months, leading to reduced market depth and temporary deviations from its fair value.

This dynamic has recently improved. A coordinated reintroduction of liquidity on a DEX has restored meaningful depth and stabilized the secondary market price. With this recovery, stAVAX once again exhibits the liquidity conditions required for safe collateralization on Aave.

In light of these developments, Chaos Labs recommends enabling stAVAX as collateral within the correlated E Mode configuration, while maintaining a moderate supply cap to account for the still developing liquidity base.

Below is our detailed analysis and initial risk parameter recommendations.

Staking on Avalanche

Avalanche operates on a delegated Proof of Stake mechanism, where both validators and delegators contribute to network security and earn staking rewards in return.

To become a validator on the Avalanche Primary Network, participants must meet the minimum hardware requirements and stake at least 2,000 AVAX. Once active, validators can receive delegations from other users, allowing them to secure additional stake weight. The total delegated amount per validator is capped at 5× their self staked amount, for example, a validator staking 2,000 AVAX may receive up to 8,000 AVAX in delegations in total.

When creating a validator, operators must specify a validation duration, which can range between 15 days and 1 year. During this period, the staked funds remain locked and cannot be withdrawn or transferred until the end of the chosen duration. Validator expected to participate in consensus duties through out the validation duration.

Unlike many other proof of stake networks, Avalanche does not employ deposit or withdrawal queues. Instead, funds become immediately available once the validator’s chosen staking duration ends. This design provides predictable liquidity timing and avoids the uncertainty associated with queue based exit mechanisms.

Validators are eligible to receive staking rewards only if they remain online and responsive for at least 80% of their validation window. Upon completion, the staked amount and accrued rewards are automatically returned to the staker’s payout address without requiring any manual claim transaction.

Risks of Staking on Avalanche

Staking on Avalanche carries minimal protocol level risk compared to networks that implement punitive slashing mechanisms. The Avalanche consensus design does not impose slashing for validator downtime or misbehavior, instead, validators are simply ineligible to receive rewards if performance criteria are not met.

As a result, the primary risks of staking on Avalanche are opportunity cost and reward loss, rather than direct capital loss, making it relatively lower risk from a validator and delegator perspective but still requiring consistent uptime and network connectivity to ensure reward eligibility.

Hypha

Hypha is the protocol and development team behind stAVAX, an Avalanche LST. The project is a rebrand of GoGoPool, evolving from its original validator marketplace into a broader infrastructure and staking ecosystem purpose built for Avalanche L1s.

Hypha provides infrastructure, tooling and validator coordination for new Layer 1 networks built on Avalanche. Through its framework, Hypha aims to simplify the technical and operational challenges of launching and securing decentralized networks, while connecting projects with professional, high quality validators.

stAVAX

stAVAX is Hypha’s liquid staking token (LST) for the Avalanche network. Originally launched in April 2023 under the name ggAVAX, the protocol was later rebranded to stAVAX as part of Hypha’s broader infrastructure and ecosystem expansion.

stAVAX follows the ERC-4626 vault standard, representing a non-rebasing, yield-bearing token that accumulates staking rewards through its increasing exchange rate relative to AVAX.

Holders of stAVAX earn Avalanche consensus-layer staking rewards as well as potential MEV-derived rewards generated through validator operations.

Users deposit AVAX on the Avalanche C-Chain, minting stAVAX in return. The protocol then transfers these assets to the Avalanche P-Chain, where they are utilized to create validators.

Hypha applies a 10% fee on staking reward.

Minipools

Hypha’s Minipool architecture mirrors the design pioneered by Rocket Pool, democratizing validator participation on Avalanche by allowing smaller operators to run validators with reduced capital requirements.

Anyone can participate as a validator operator by creating a Minipool, contributing 1,000 AVAX (half of Avalanche’s 2,000 AVAX validator requirement). The remaining 1,000 AVAX is sourced from the protocol’s pooled deposits provided by stAVAX minters.

Minipool operators choose their own validation duration at setup. During this period, funds in the minipool are locked and cannot be reclaimed by the protocol to fulfill redemptions.

To borrow AVAX from the protocol, Minipool operators must stake Hypha’s native token, GGP, as collateral. The minimum requirement is 100 AVAX-equivalent in GGP, maintaining 110% over-collateralization. Operators may increase their collateral ratio, up to 150% is incentivized by the protocol.

While Avalanche’s native staking system does not include slashing, Hypha enforces a performance-based penalty for underperforming Minipool operators. If a Minipool fails to meet uptime or reliability thresholds, the operator’s staked GGP can be slashed.

This mechanism does not affect stAVAX holders or the token’s backing, but serves as an internal enforcement system to maintain high validator performance.

Hypha also offers a managed infrastructure service for Minipool creators who prefer not to run node software or hardware directly. In this model, cloud service provider handles all technical operations and uptime management in exchange for an operational hosting fee, lowering the entry barrier for less technical participants.

Validator Distribution

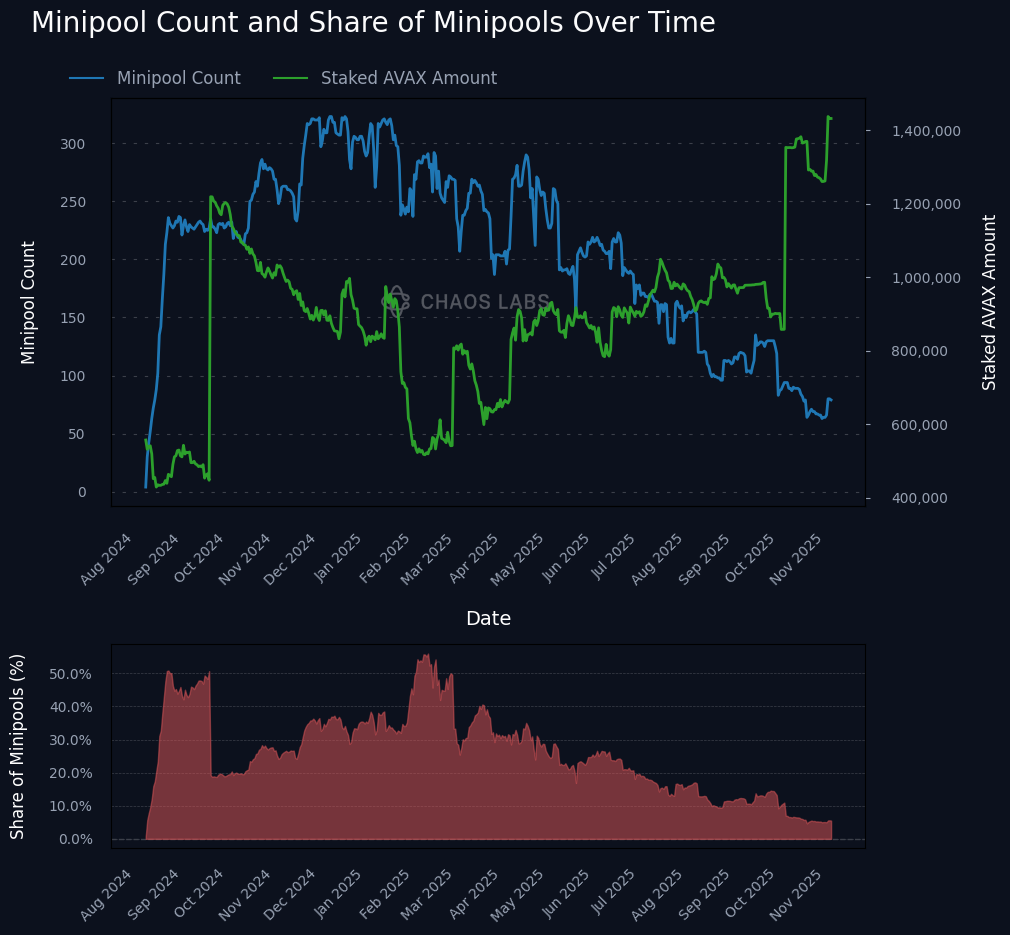

While the Minipool framework was designed to promote decentralized validator participation, in practice, only a small portion of stAVAX deposits are currently utilized to launch Minipools. Based on on-chain data, roughly 5% of the total staked AVAX is managed through Minipools, while the remaining 95% is staked by the Hypha team through internally managed validators.

At present, there are approximately 80 active Minipool validators, each staking around 2,000 AVAX, with 1,000 AVAX sourced from the stAVAX protocol and the remaining 1,000 AVAX provided by the Minipool operator. These Minipools operate with validation durations ranging from 15 to 360 days, depending on the operator’s chosen configuration.

In addition, there are five non-Minipool validators that manage approximately 95% of the protocol’s staked AVAX, each configured with a 15 day validation duration and staggered start times. This structure allows Hypha to manage validator rotation in a predictable and controlled manner, ensuring that liquidity is periodically released and readily available to service redemption requests.

The payout address associated with Minipool validators is avax10f8305248c0wsfsdempdtpx7lpkc30vwzl9y9q, while the payout address for Hypha operated validators is avax1ukya4342ewusq0hptaxqpm28fs9cc3kgqm70ld.

This validator distribution implies that, even in a worst-case scenario, the protocol could service over 95% of its underlying stake within a 15 day period, given that all Hypha run validators operate on short and predictable cycles.

While current states provides redemption reliability, it also highlights that community participation in Minipool operation remains limited. The muted demand can be largely attributed to the requirement for GGP collateralization and the decline in the GGP token price, both of which diminish the economic incentive for independent operators. As a result, while the protocol remains fully functional and liquid, the current validator set is primarily concentrated among Hypha managed nodes.

Market Capitalization

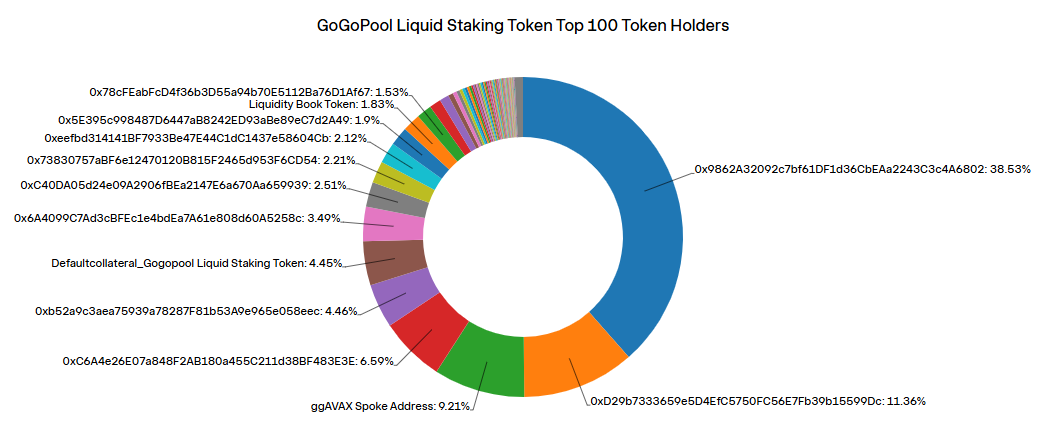

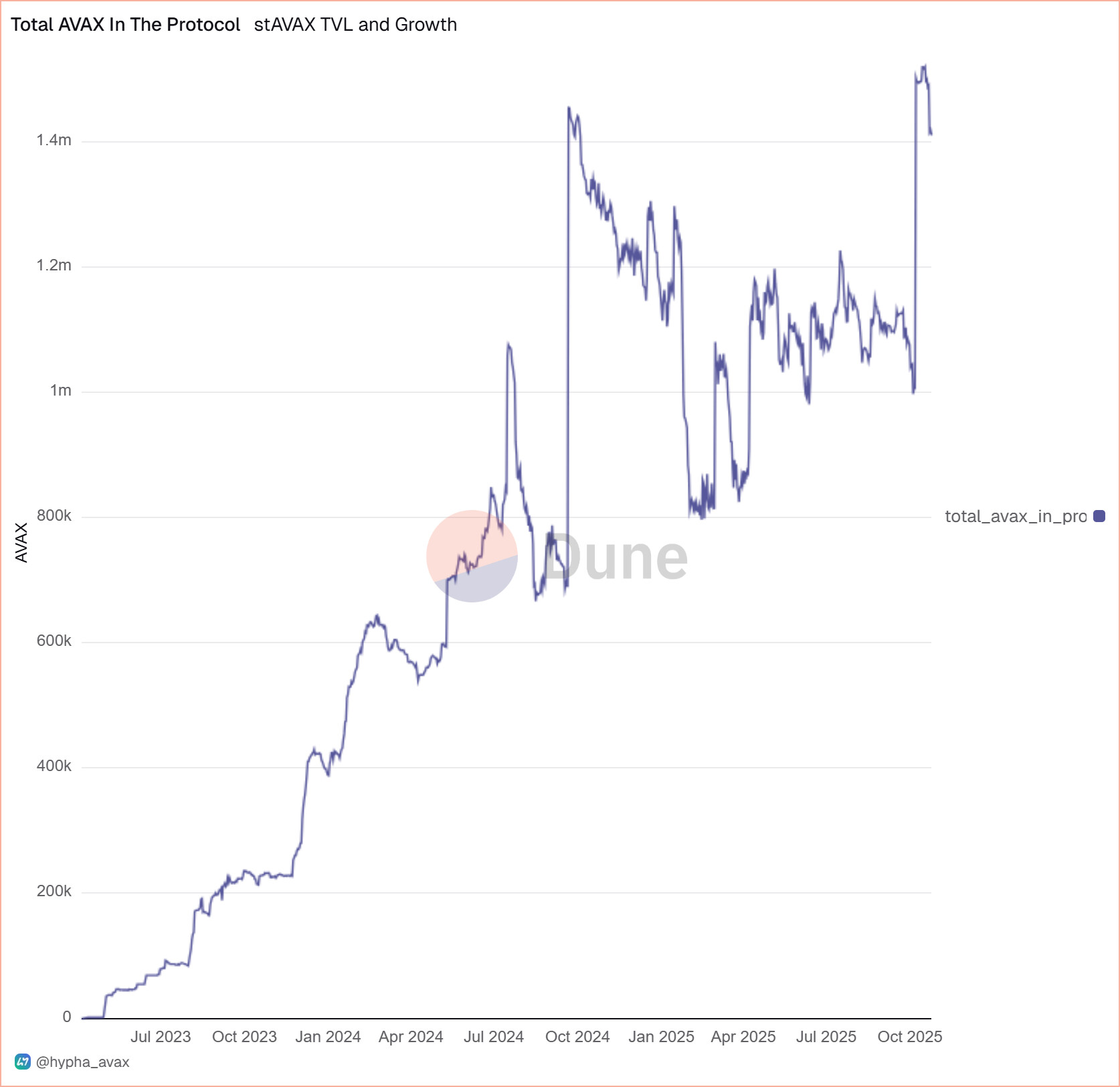

The circulating supply of stAVAX has recently reached new all-time highs, climbing to approximately 1.6 million tokens. This marks a recovery and renewed expansion in supply dynamics following a period of stagnation.

At present, the market capitalization of stAVAX stands around $31.5 million, reflecting a recent downtrend primarily driven by the decline in AVAX’s underlying price rather than changes in staking demand.

Liquidity

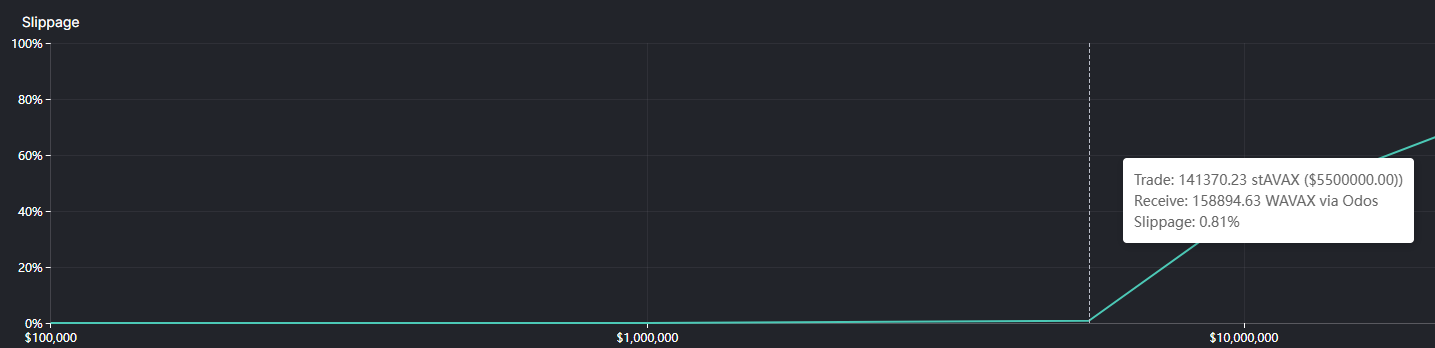

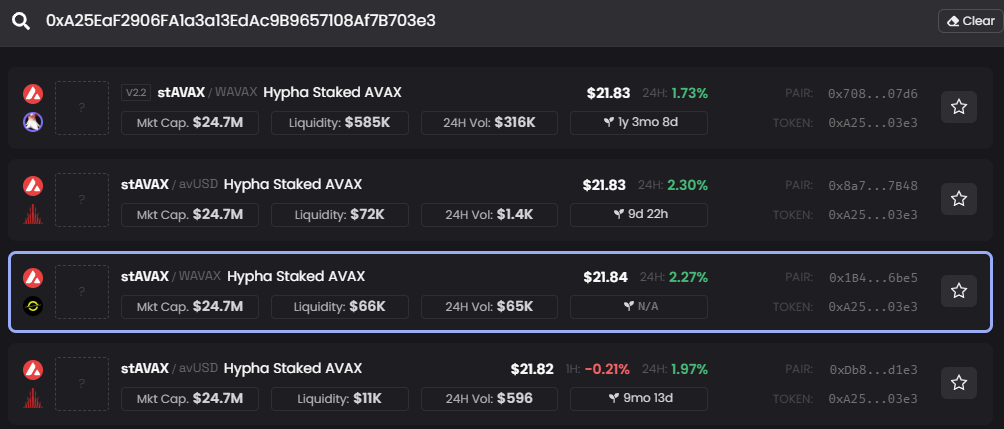

stAVAX’s onchain liquidity profile has recently improved following a prolonged period of contraction. Historically, the asset maintained a healthy liquidity base, with total onchain depth ranging between $5 - 15 million, primarily concentrated in the LFJ stAVAX/wAVAX pool.

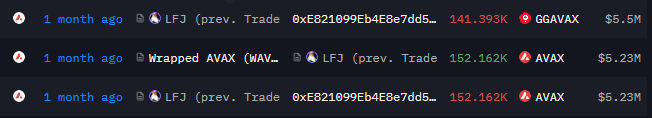

However, this liquidity base was almost entirely withdrawn on September 24, 2025, when a single large LP accounting for approximately 90% of the pool exited their position. This resulted in a 98% decline in available onchain liquidity. For several weeks thereafter, stAVAX’s market depth was minimal, severely limiting secondary market trading and leading to periods of secondary market depegging.

In recent weeks, liquidity conditions have markedly improved. The Hypha team, in collaboration with partners, reintroduced a $5 million stAVAX/AVAX pool on Pharaoh Exchange, restoring meaningful market depth. Including smaller pools on other venues, the total on chain liquidity now exceeds $5.1 million, representing a significant recovery in secondary market pricing for the asset.

Volatility

Historically, stAVAX has maintained a tight price peg to its underlying exchange rate, reflecting strong on-chain liquidity depth across key trading venues.

However, following the sharp contraction in on-chain liquidity in late September 2025, the asset began exhibiting deviations from its fair value peg. During this period, stAVAX briefly traded at a discount of approximately 0.8% before recovering toward parity.

With the reintroduction of meaningful liquidity, peg conditions have materially improved. Market pricing has returned close to the protocol’s internal exchange rate.

Minting & Redeeming

Minting

The minting process for stAVAX begins when a user deposits AVAX on the Avalanche C-Chain via calling the depositAVAX() function on the TokenggAVAX contract. This triggers the minting workflow that issues yield-bearing stAVAX tokens representing a user’s share of the staking pool.

The number of stAVAX shares to be minted is determined dynamically based on the current exchange rate between the protocol’s totalAssets and totalSupply.

The calculation follows the logic:

shares = deposited AVAX * (totalSupply / totalAssets)

ensuring that each deposit reflects a proportional claim on the underlying staking pool.

A Deposit event is emitted, and the calculated shares are minted and transferred to the user’s address in a single atomic transaction.

The deposited AVAX is immediately wrapped into wAVAX and added to the amountAvailableForStaking balance, which tracks idle liquidity pending deployment to the P-Chain for validator creation.

Minipool Deployment

Once sufficient liquidity is available, a multisig triggers MinipoolManager contract to initiate a new validator cycle. This account borrows 1,000 AVAX from the stAVAX pool (representing staker deposits) and combines it with 1,000 AVAX provided by a Minipool operator from the Vault contract , forming minimum of 2,000 AVAX required for validator creation.

The multisig then exports 2,000 AVAX from the C-Chain to the P-Chain through an atomic transaction and creates a new validator with a specified payout address and a predefined validation duration set by the Minipool operator during setup.

Redeeming

The redemption process for stAVAX allows users to exchange their yield-bearing tokens back into native AVAX, duration subject to the protocol’s available liquidity. The process is coordinated through the WithdrawQueue contract, which manages pending requests in a First-In, First-Out (FIFO) order.

- Unstake Request Creation

Users initiate a redemption by calling the requestUnstake() function on the WithdrawQueue contract. Upon request creation, the user’s stAVAX tokens are transferred and escrowed within the WithdrawQueue contract until the redemption is serviced

- Exchange Rate and Claimable Amount Determination

The amount of AVAX to be received is calculated at the time of the unstake request, based on the current stAVAX exchange rate.

- Unstake Delay and Claimable Time

When the unstake request is created, the function sets a claimableTime parameter equal to currentTime + unstakeDelay.

- The

unstakeDelay is a protocol-defined cooldown period (currently 15 days) that represents the waiting time before redemption can be serviced. It is important to note that unstakeDelay does not strictly enforce redemption timing; it only prevents the cancellation of the request. The contract administrator retains the ability to fulfill a request even if the claimableTime has not yet been reached.

- If liquidity remains unavailable, the actual fulfillment may take longer than the nominal 15 day delay.

- Request Cancellation Option

Users may cancel a pending unstake request before the claimableTime has been reached or request fulfilled by the protocol admin. Once the claimable time elapses or request gets fulfilled, the request becomes non-cancelable.

- Fulfillment and Liquidity Sourcing

The protocol sources AVAX from validators exiting the P-Chain by calling depositFromStaking(), which transfers available funds into the WithdrawQueue contract. This function is not user initiated, it is invoked by entities holding the DEPOSITOR_ROLE.

- Processing Order and Logic

When depositFromStaking() is executed, it iterates over the oldest pending requests in FIFO order. Notably, the function does not check whether a request’s claimableTime has elapsed, meaning that fulfillment can occur even before the nominal 15 day delay, provided the protocol chooses to process it early.

This design implies that the 15 day delay is enforced off-chain as a soft constraint, while on-chain logic prioritizes available liquidity.

- Request Fulfillment and Token Burn

For each unstake request processed, the contract emits a RequestFulfilled event.

The corresponding stAVAX tokens are burned and the matched amount of AVAX is credited back to the user’s pending claim balance.

- Claiming AVAX

Once a user’s request is fulfilled, they can call the claimUnstake() function to receive their underlying AVAX directly.

The claim operation completes the redemption cycle.

Observed Redemption Performance

The current WithdrawQueue contract was deployed on September 3, 2025, marking the start of the updated redemption mechanism for stAVAX. Since its deployment, a total of 201 unstake requests have been created, all of which have been successfully fulfilled.

In terms of processing speed, more than 60% of all redemption volume has been serviced within 60 hours (2.5 days) of request creation. The longest observed redemption took approximately 180 hours (7.5 days), still well below the 15 day unstake delay parameter set by the protocol.

These outcomes indicate that while the protocol has a nominal 15 day redemption window, in practice redemptions are fulfilled substantially faster due regular Minipool rotation.

Even though redemptions are mostly processed within hours or within one to two days of request creation, further analysis of redemption timing patterns suggests that fulfillment activity is not evenly distributed throughout the day. As shown in the histograms below, redemption requests are initiated by users across all hours, reflecting a globally distributed user base. In contrast, actual redemption processing by the protocol is highly concentrated within an eight-hour window between 15:00 and 22:00 UTC.

More than 85% of all fulfilled redemptions occur within this specific timeframe, strongly indicating that redemption execution is managed manually by the Hypha team rather than through a fully automated system. This time clustering pattern aligns with working-hour activity, implying that manual intervention is required to trigger the depositFromStaking() function, which sources AVAX from completed validator cycles.

While the system’s current performance remains reliable with no backlog observed, the lack of automation introduces operational dependency on manual execution. Implementing automated redemption fulfillment would help eliminate timing bias and further enhance user experience, particularly for global participants operating outside this narrow processing window.

LTV, Liquidation Threshold, and Liquidation Bonus

With the recent reintroduction of stAVAX liquidity on Pharaoh Exchange and the resulting restoration of peg stability, the market now provides materially stronger support for orderly liquidation flows. The secondary market discount has closed, and price deviations have diminished following the return of meaningful depth.

Chaos Labs recommends configuring an E Mode category that allows controlled collateral usage under correlated and risk-contained settings.

The E-Mode pairs stAVAX with wAVAX, enabling efficient collateralization with minimal liquidation risk.

Oracle/Pricing

Pricing for stAVAX relies on the valuation of the underlying AVAX assets staked through the Hypha protocol, derived from the protocol’s total asset value relative to its total token supply. This reflects the real time exchange rate between stAVAX and AVAX, which increases over time as staking rewards accrue.

To compute the stAVAX/USD price, Chaos Labs recommends the following oracle composition:

- stAVAX/AVAX Exchange Rate — derived from

convertToAssets() on the TokenggAVAX contract.

- CAPO Adapter — enforces controlled growth through a capped rate of change, preventing manipulation or abnormal reward acceleration.

- AVAX/USD Feed — the external AVAX/USD price oracle is used to convert the derived stAVAX/AVAX value into USD terms.

CAPO

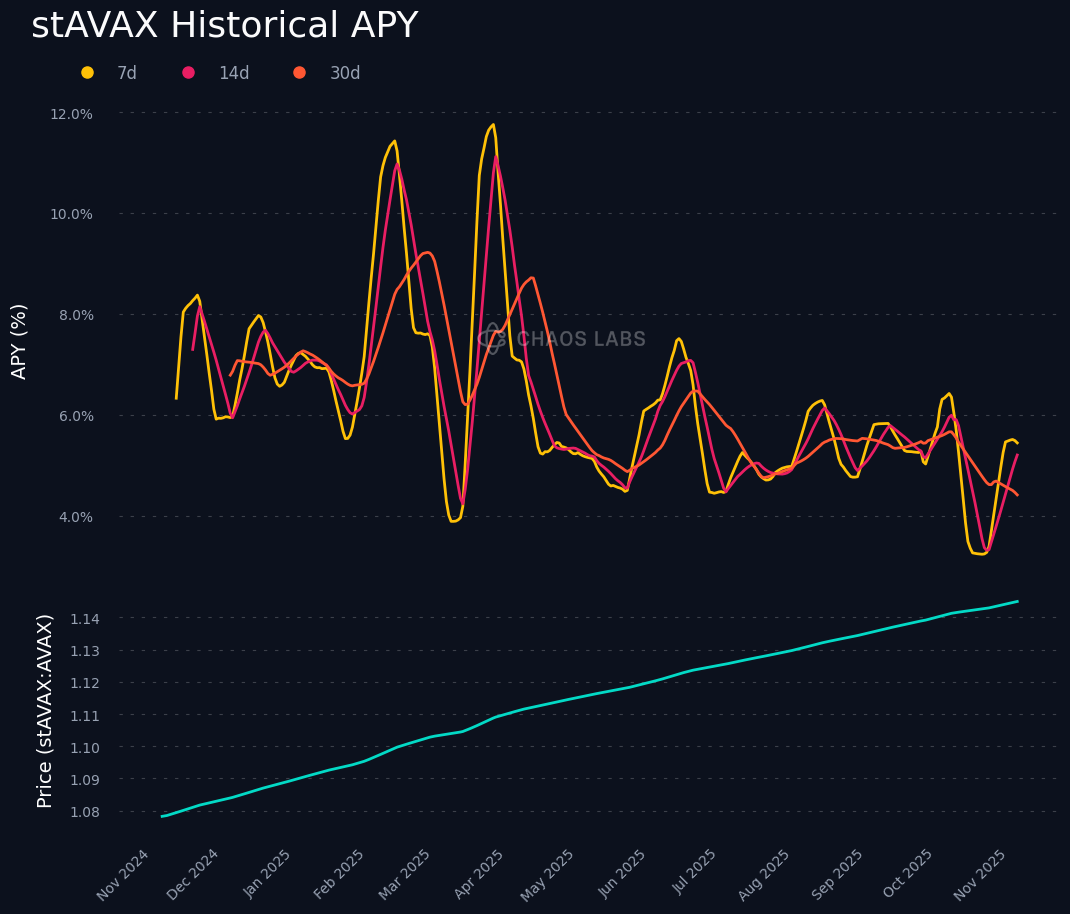

stAVAX accrues yield from Avalanche consensus layer staking rewards, which increase the token’s exchange rate relative to AVAX over time. The growth in NAV reflects validator uptime.

To ensure oracle stability and prevent irregular or artificially accelerated increases in the stAVAX/AVAX exchange rate, Chaos Labs recommends implementing a CAPO adaptor. The CAPO acts as a rate limiter, enforcing controlled changes in the oracle reported price and safeguarding against manipulation or data feed inconsistencies.

Proposed CAPO configuration parameters:

maxYearlyRatioGrowthPercent: 7.82%, aligned with Avalanche’s expected net staking yield.MINIMUM_SNAPSHOT_DELAY: 14 days, ensuring sufficient data smoothing and resilience against short term deviations in reported rates.

Specification

| Parameter |

Value |

| Asset |

stAVAX |

| Isolation Mode |

No |

| Borrowable |

No |

| Collateral Enabled |

Yes |

| Supply Cap |

500,000 |

| Borrow Cap |

- |

| Debt Ceiling |

- |

| LTV |

0.05% |

| LT |

0.1% |

| Liquidation Penalty |

10% |

| Liquidation Protocol Fee |

10% |

| Variable Base |

- |

| Variable Slope1 |

- |

| Variable Slope2 |

- |

| Uoptimal |

- |

| Reserve Factor |

- |

| Stable Borrowing |

Disabled |

| Flashloanable |

Yes |

| Siloed Borrowing |

No |

| Borrowable in Isolation |

No |

| E-Mode Category |

stAVAX/wAVAX |

E-mode (stAVAX/wAVAX)

| Parameter |

Value |

Value |

| Asset |

stAVAX |

wAVAX |

| Collateral |

Yes |

Yes |

| Borrowable |

No |

Yes |

| Max LTV |

90.0% |

- |

| Liquidation Threshold |

92.0% |

- |

| Liquidation Bonus |

2.0% |

- |

CAPO

| maxYearlyRatioGrowthPercent |

ratioReferenceTime |

MINIMUM_SNAPSHOT_DELAY |

| 7.82% |

monthly |

14 days |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0