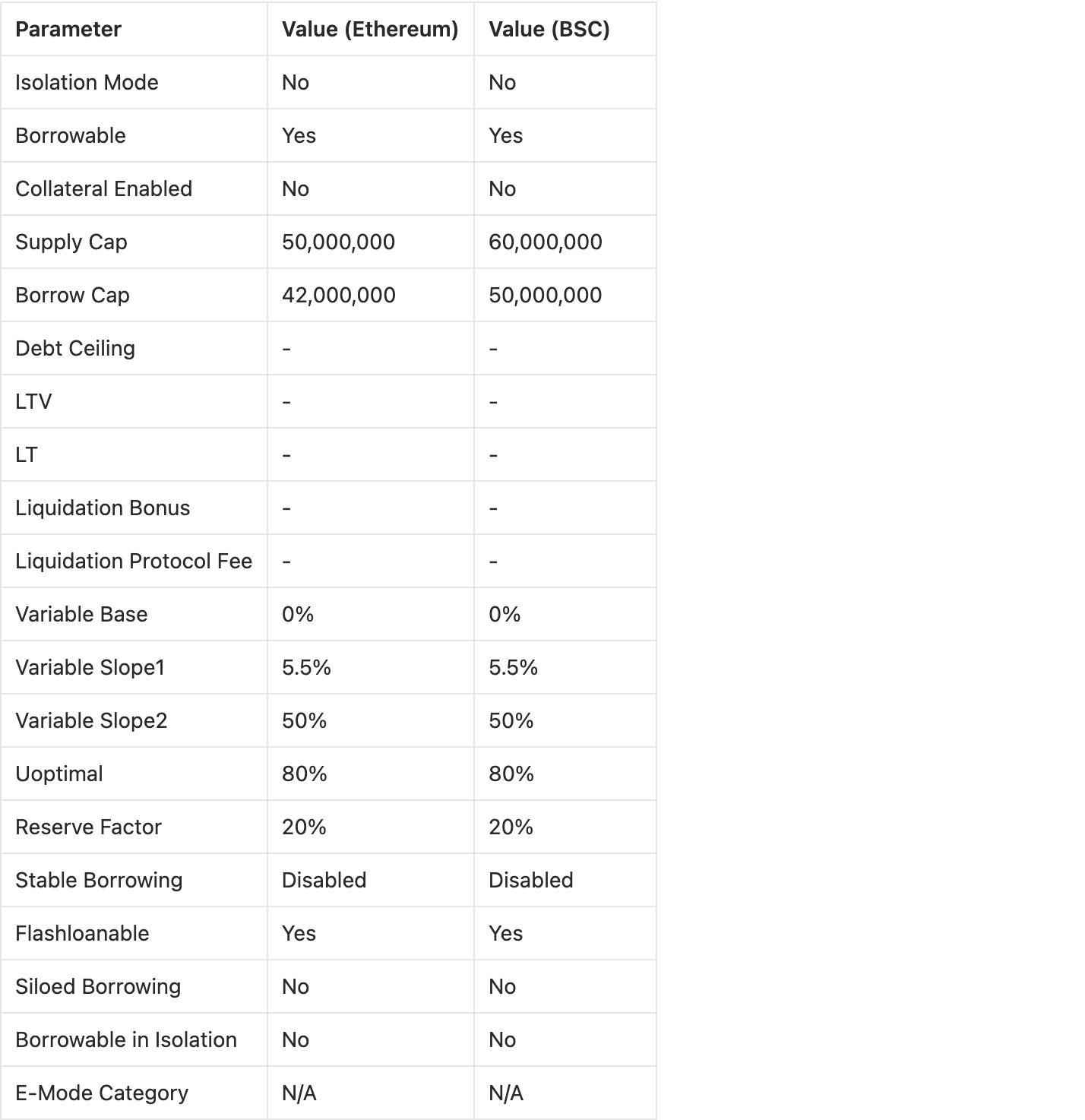

We recommend onboarding USD1 as borrow-only on the Core and BNB instances. Risks posed by this asset include USD1 being a new BitGo product, which uses a codebase without a public audit and with no bug bounty. There are no excess assets held in reserve. In addition, one address supplies the vast majority of on-chain liquidity, which could decrease liquidity quickly and restrict profitable liquidation. Approximately 92% of the total supply is currently held by Binance, which introduces market risk should all of it be sold into the current on-chain liquidity. Finally, outcomes ultimately depend on the continued compliance and competence of USD1’s operating team, though contract upgradeability options are limited.

With these risks in mind, we note good on-chain liquidity and a simple architecture, with available attestations—though these attestations should become more frequent (the most recent attestation is dated June 30, 2025). The reserve report satisfies the letter of a minimal AICPA attestation; however, the explanations of holdings distribution and available liquidity facilities could be more thorough. Access control is responsibly handled with a 3-day timelock. The asset is growing quickly (even if heavily concentrated), which has resulted in high volumes while retaining a relatively tight USD peg.

See full asset evaluation below

1. Asset Fundamental Characteristics

1.1 Asset

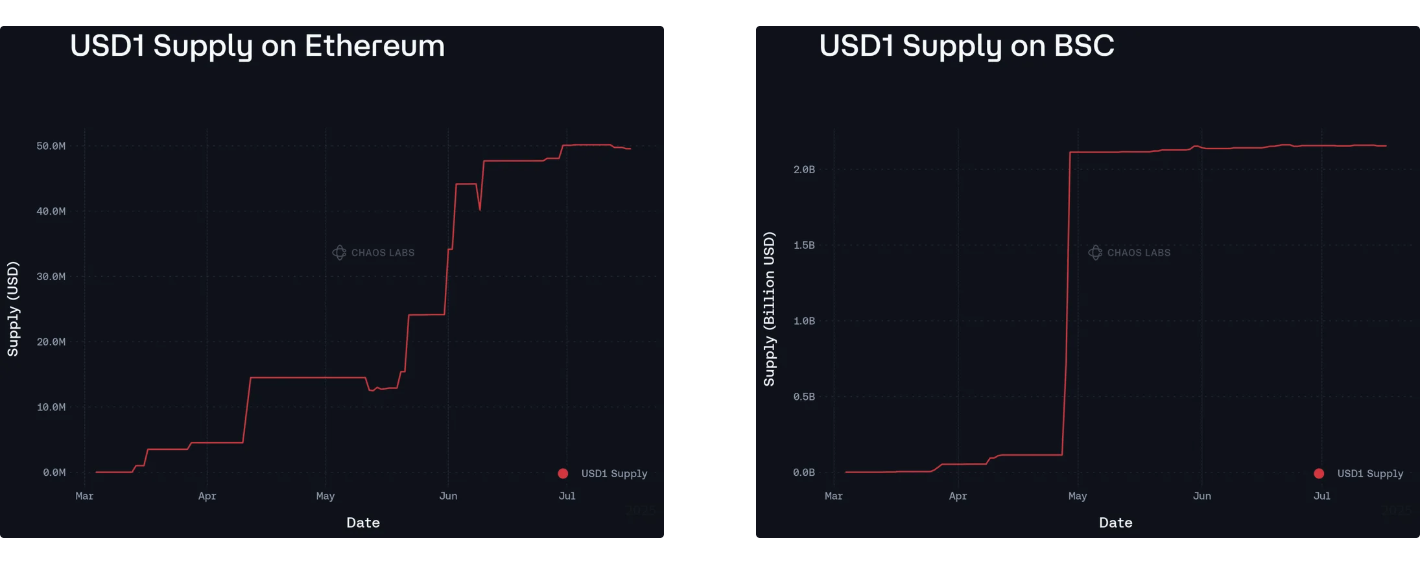

USD1 is a stablecoin launched by World Liberty Financial and maintained by BitGo. This stablecoin was deployed on January 28, 2025, is native to BNB Chain, and is ERC-20–compatible. Other chains are considering supporting the asset. It has a current maximum total supply of 2.15 billion. This asset is also live on Ethereum, with a total supply of 60.8 million on that network and on Tron, with a market capitalization of $25.8 million.

This asset is backed by U.S. Treasuries and short-term bonds. It is pegged to USD and does not pass yield to holders. USD1 is labeled an “institutional-ready stablecoin,” focusing on cross-border transactions.

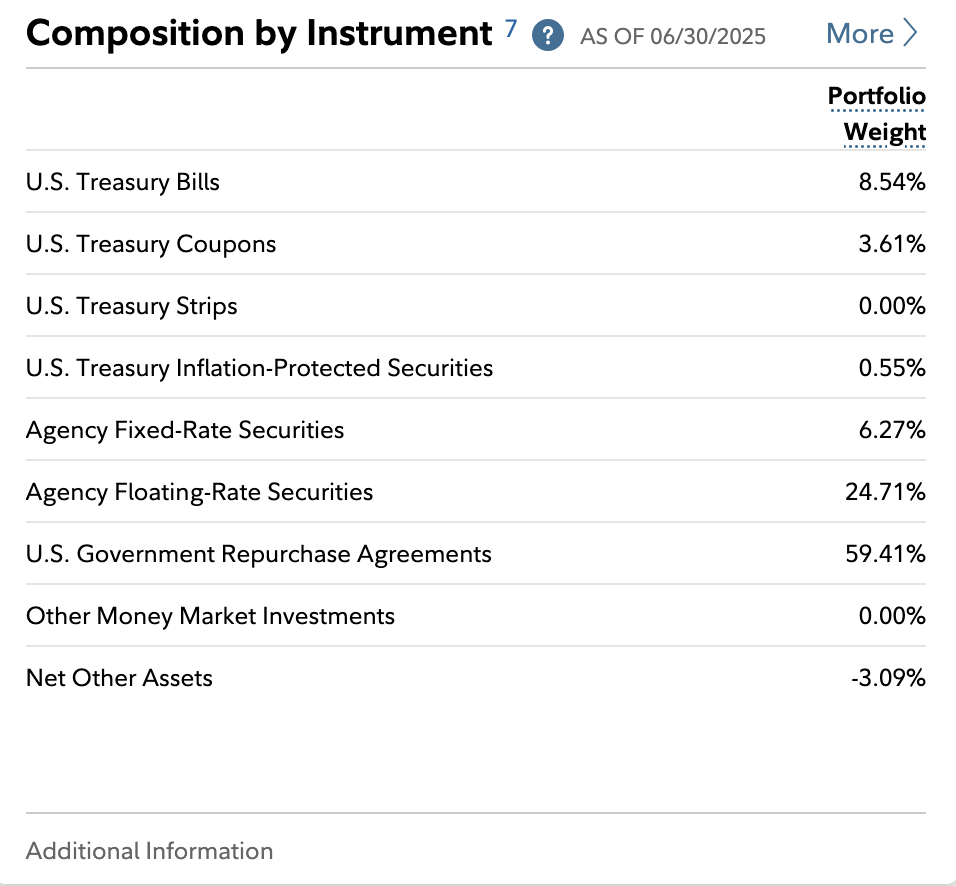

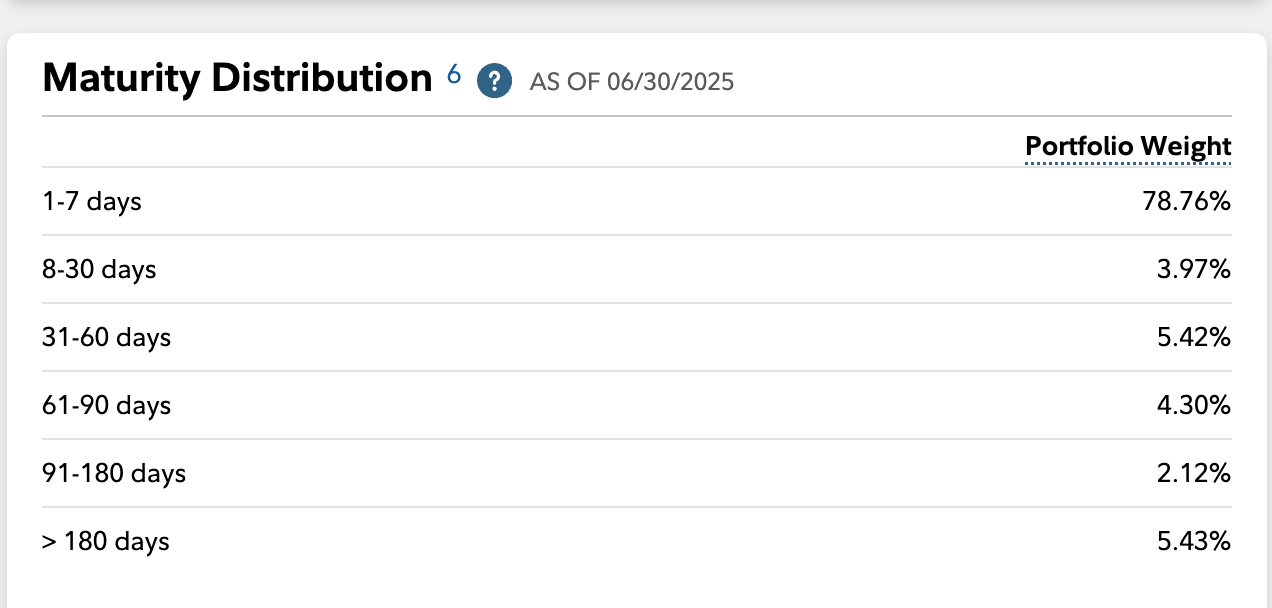

Three attestations for the stablecoin are available, and they note 1:1 backing in the April attestation. Crowe LLP notes that nearly all funds are stored in “government money market funds.” The latest attestation, dated June 30, 2025, shows over $328 million held in “cash or cash equivalents.” Given that it has been more than a month since the last attestation and the stablecoin has grown quickly, more frequent attestations would help mitigate collateral risk.

Source: FRGXX Composition, Fidelity, July 15, 2025

It is worth being aware that this stablecoin has almost no overcollateralization, something nearly all other stablecoins enjoy. This is important, given that the entire collateral is held in Fidelity’s FRGXX money market fund. Should this fund experience a rapid price decrease, USD1 will not have sufficient collateral to hold its peg. Nevertheless, this is a conservatively allocated fund, meaning the chances of a volatility event are low. As of August 7, 2025, the most recent composition report is dated June 30, 2025.

1.2 Architecture

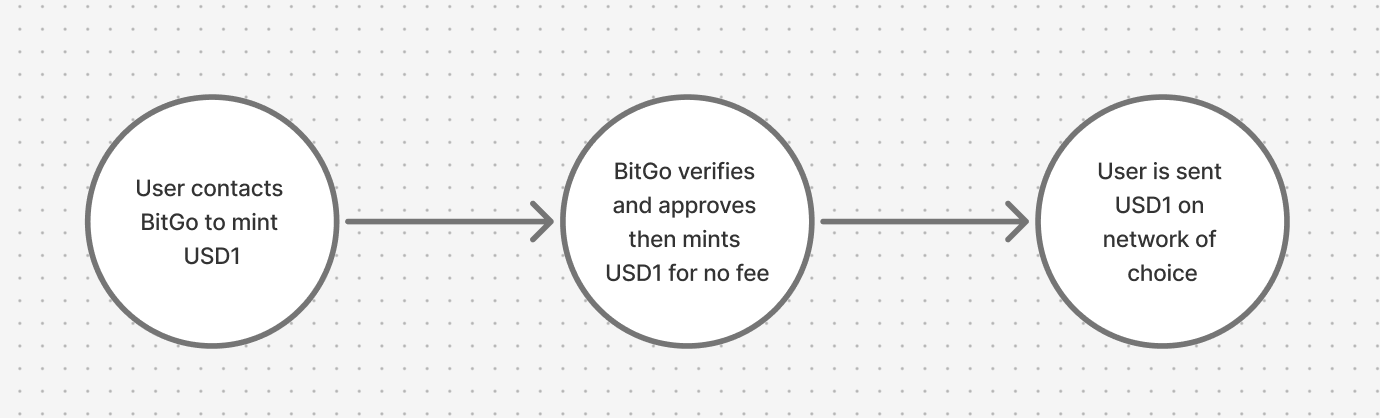

Source: USD1 minting architecture, LlamaRisk

Very little information is available about USD1’s architecture, and the following is an interpretation of USD1 publicity material, not documentation.

USD1 is a stablecoin backed by assets held by BitGo. They self-report that it is “100% backed by short-term U.S. government Treasuries, U.S. dollar deposits and other cash equivalents.” To obtain USD1, users must fill out a form for BitGo to contact them. This form requires key information that constitutes KYC, not unlike how other leading stablecoins gate mint and redemption. Once this process is complete, the customer sends BitGo the corresponding amount of USD they would like to receive in USD1. BitGo mints and sends the USD1.

Once the user receives the USD1, the token is freely transferable, like USDC.

Individuals or entities cannot mint USD1 with BitGo if they are on U.S. or international sanctions lists, located in, or residents of, comprehensively sanctioned jurisdictions such as Crimea, Donetsk, Luhansk, Cuba, Iran, North Korea, or Syria, or if they fail BitGo’s KYC or AML checks. BitGo may also block minting for anyone whose activity violates the law or exposes BitGo to legal or compliance risks.

1.3 Tokenomics

USD1’s tokenomics are straightforward in theory: one U.S. dollar held by BitGo backs one USD1. WLFI, an associated governance token that completed its public sale in May, has not been identified as having governance rights over this stablecoin. This token recently opened on the pre-market trading venue LBank, which is headquartered in Hong Kong.

As a dollar-pegged stablecoin, USD1’s tokenomics are familiar to Aave.

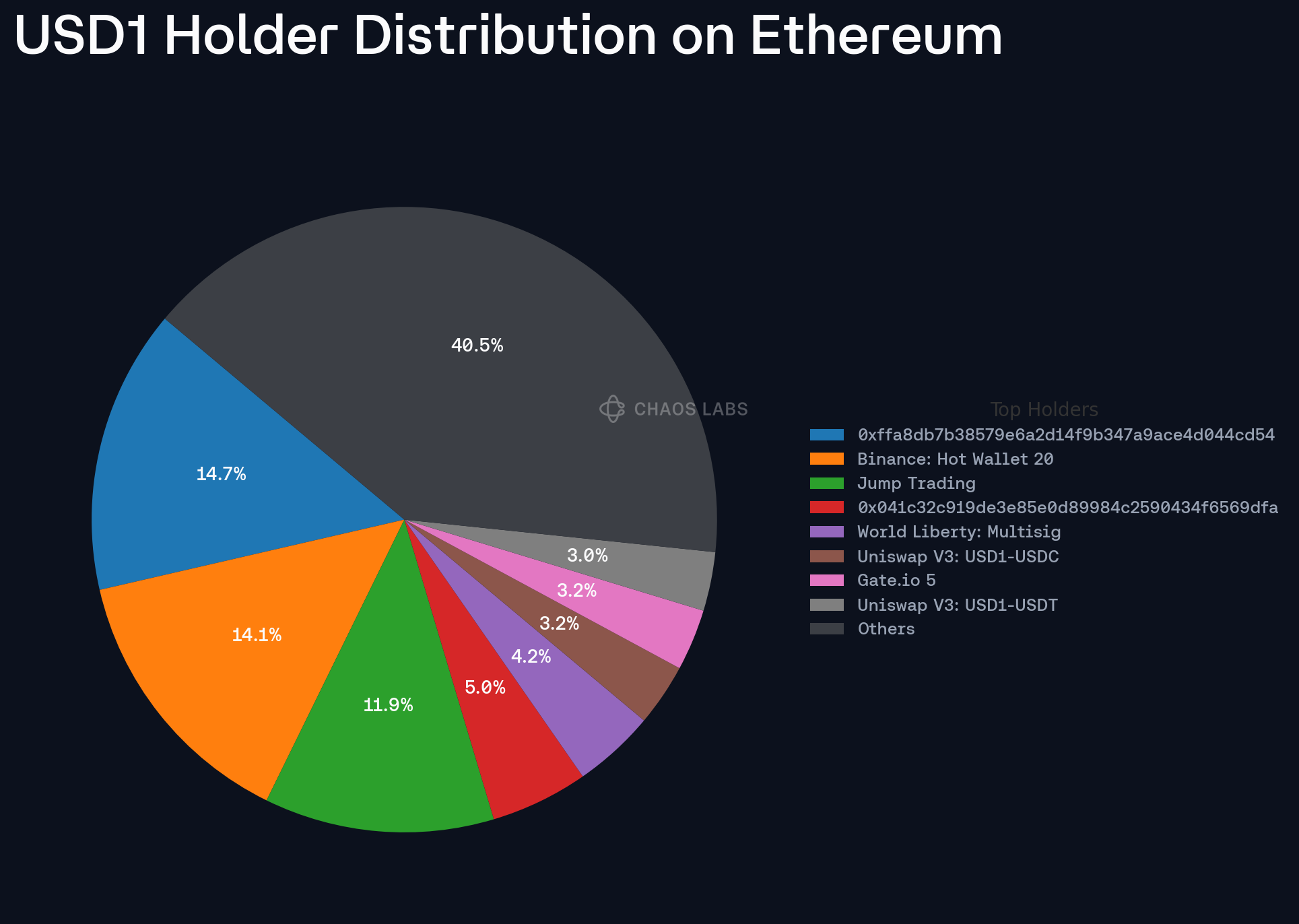

1.3.1 Token Holder Concentration

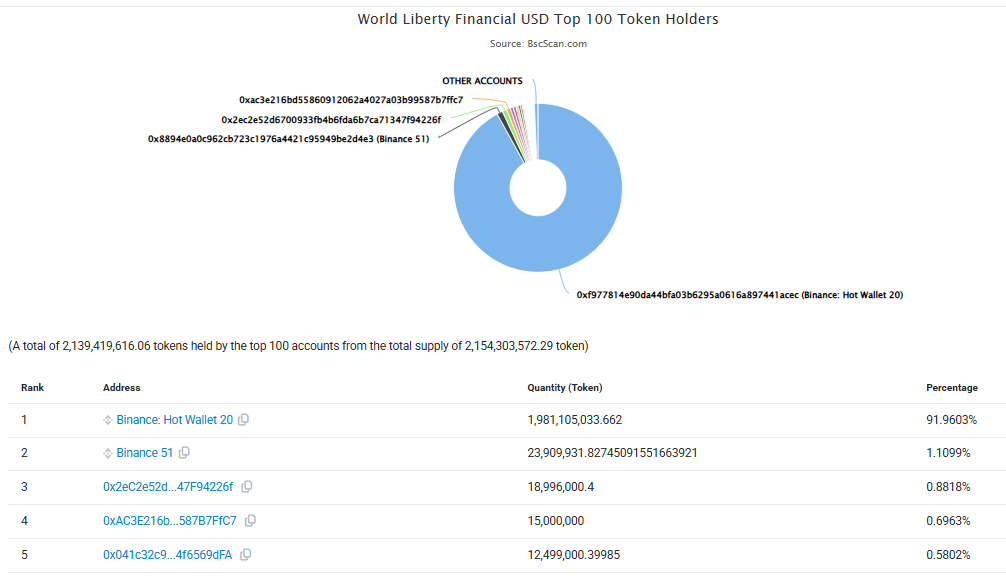

Source: USD1 Holders, BscScan, July 23, 2025

USD1 on BNB Chain is highly concentrated, with Binance-linked addresses holding >90% of the supply.

That said, USD1 is a newer asset, and the team reports they will shortly undertake an aggressive go-to-market campaign with new chain deployments, integrations with DeFi protocols, retail payment products, and planned programs for corporate treasuries to convert and hold USD1 directly. Market makers have been engaged to seed liquidity across multiple chains and venues. Holder fragmentation may increase in the future.

2. Market Risk

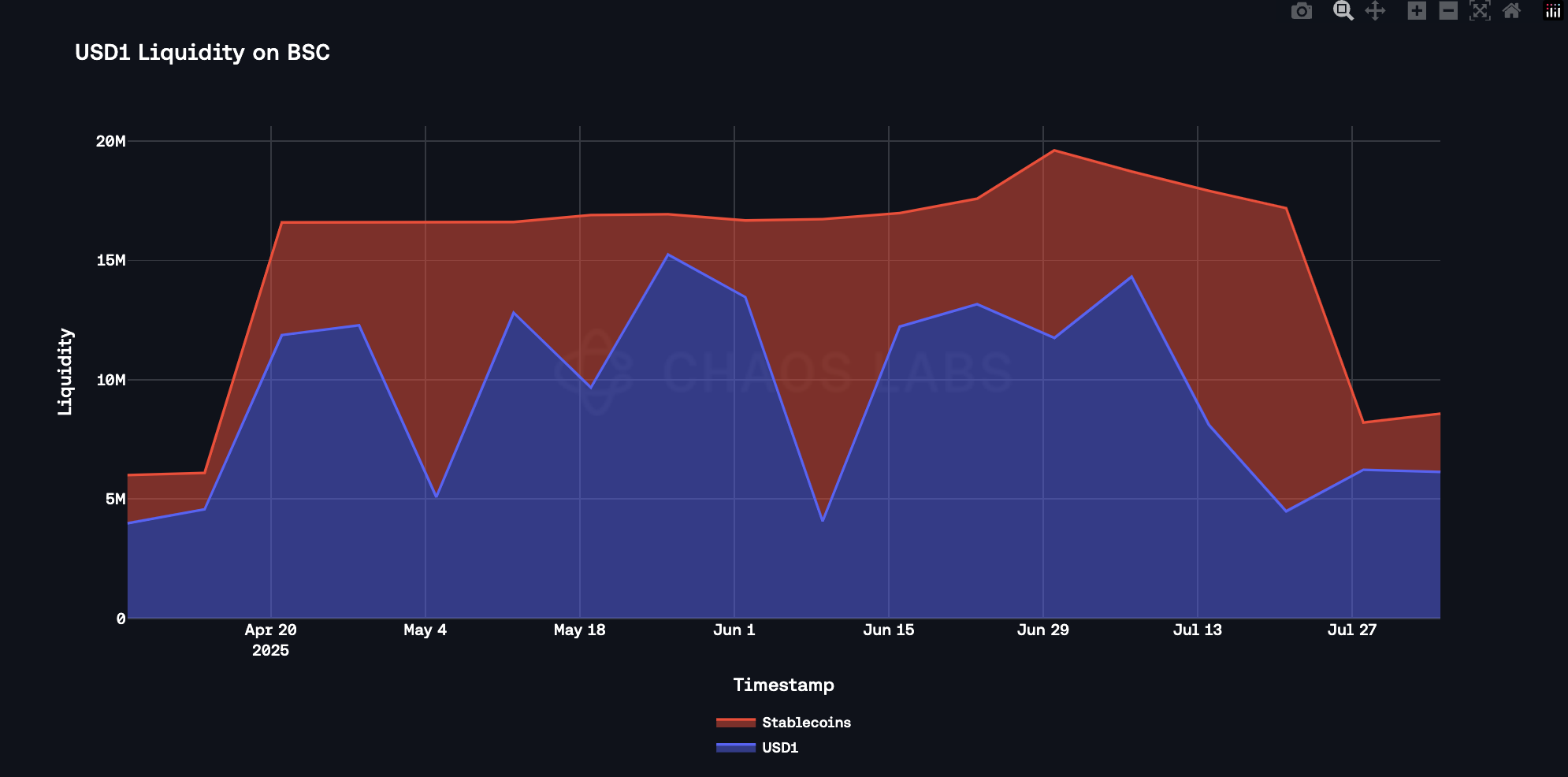

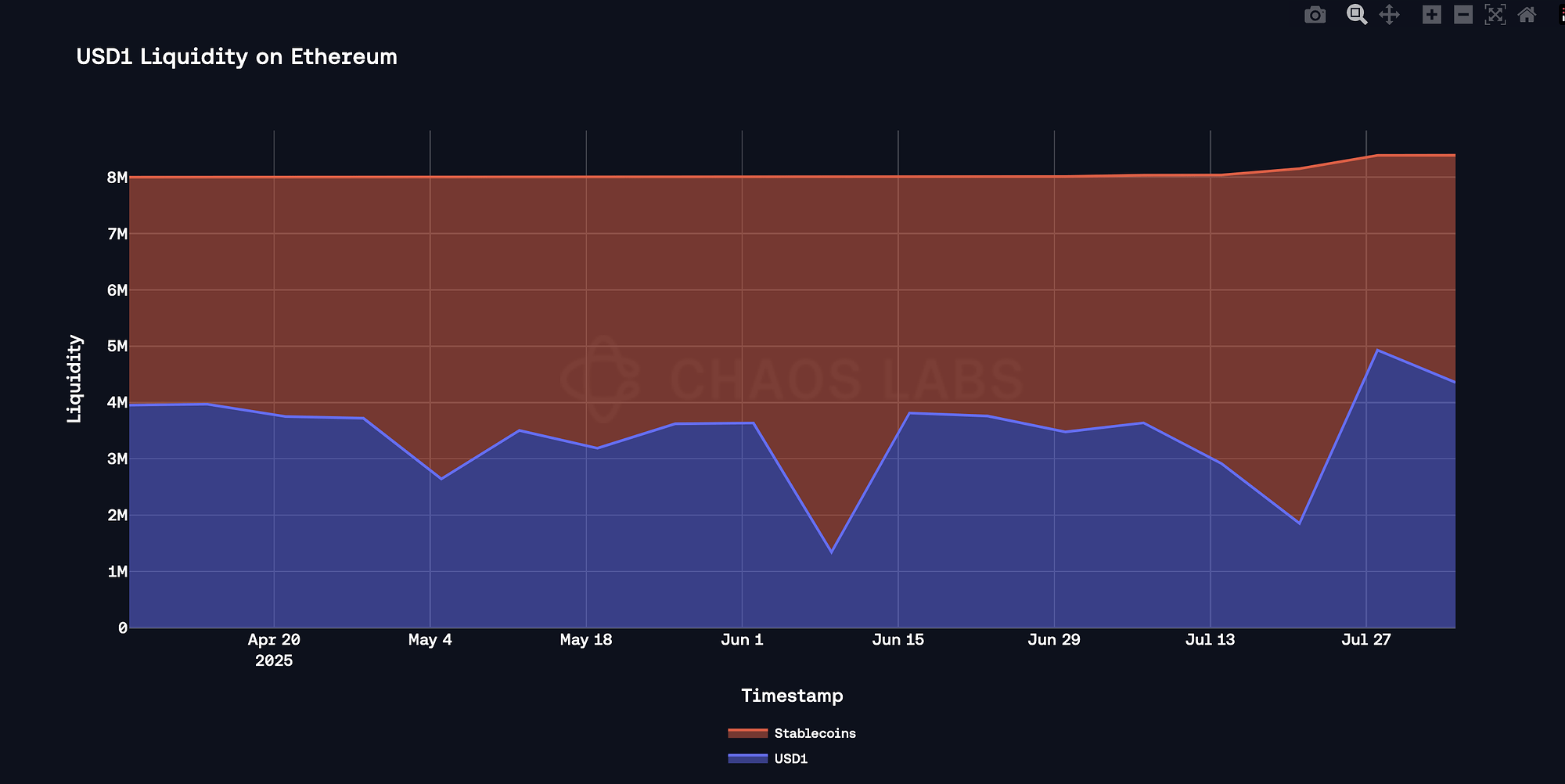

2.1 Liquidity

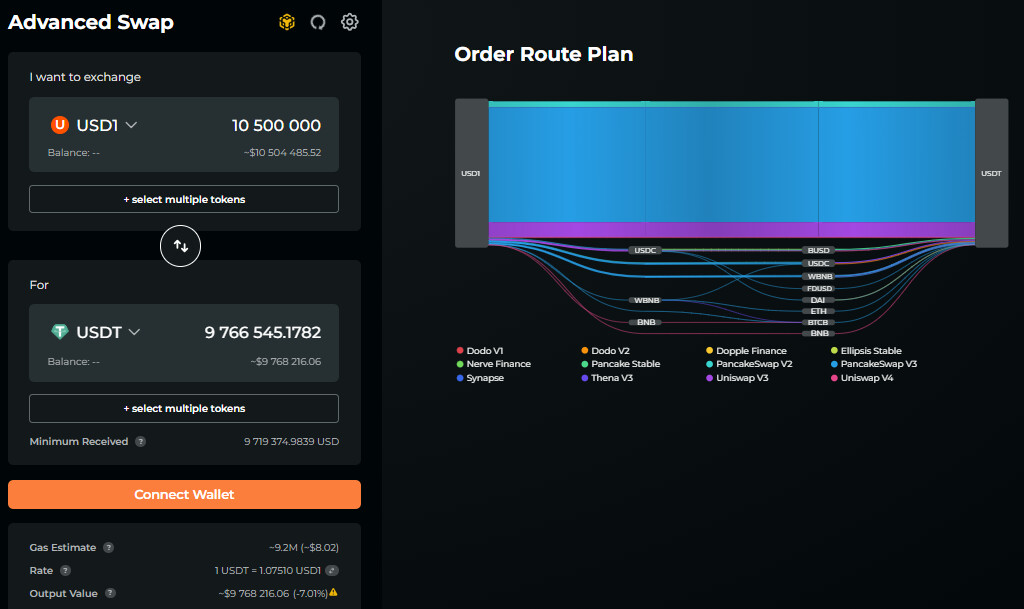

Source: USD1 to USDT trade, Odos, July 23, 2025

On-chain USD1 liquidity is acceptable, with trades under $10 million facilitated with limited (approximately 2.7%) price impact.

2.1.1 Liquidity Venue Concentration

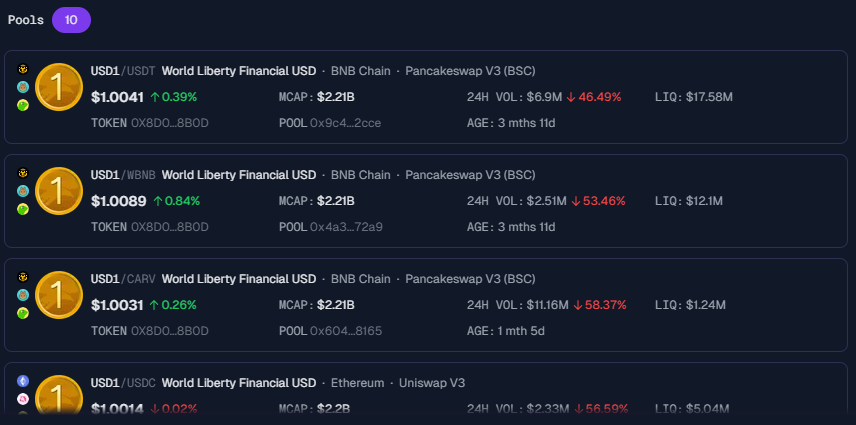

Source: USD1 Pools, Geckoterminal, July 23, 2025

USD1 has liquidity in Uniswap V3 and PancakeSwap V3 pools to facilitate most of its trading. It is primarily paired with USDT and WBNB.

2.1.2 DEX LP Concentration

DEX LP concentration for PancakeSwap USD1 pools is high:

- For USD1/USDT, 4 addresses control 99.4% of all liquidity.

- For USD1/WBNB, 3 addresses control 98.4% of all liquidity.

- One address supplies >60% of liquidity to both pools.

On Uniswap, the liquidity in the USD1/USDT pool is fragmented, with no holder in control of more than 15% of the pool.

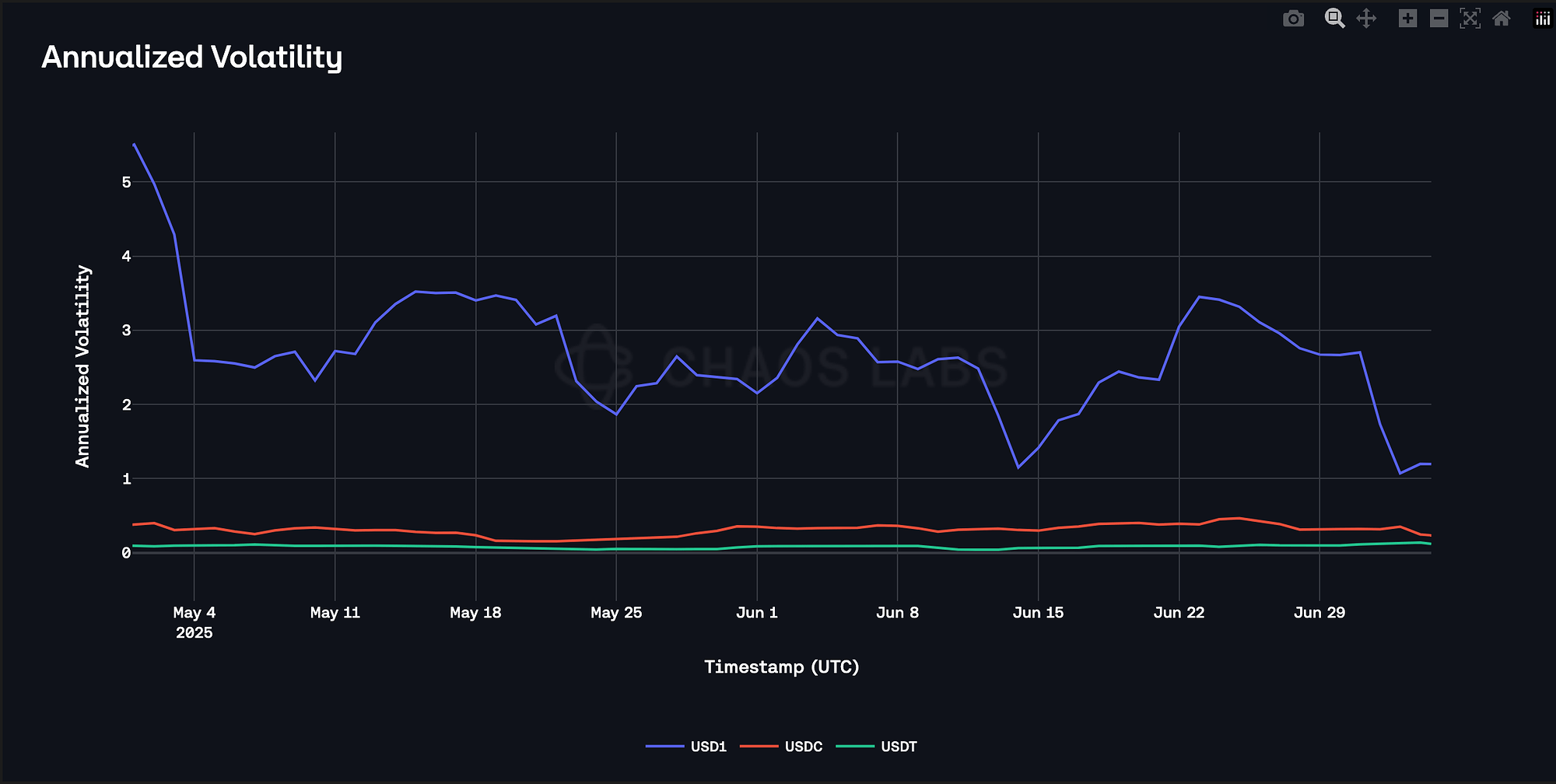

2.2 Volatility

Source: USD1/USD, Geckoterminal, July 23, 2025

USD1 continues to hold its peg to USD. Frequent basis-point-sized depegs occur with infrequent and up to 2% price deviations.

2.3 Exchanges

Source: USD1 Exchanges, Coingecko, July 15, 2025

USD1 has extremely high volume with exotic assets, such as Tag—a “Decentralized Full-Stack AI Data Solution powered by a Comprehensive Data Authentication and Authorization System.” These volumes may be inflated to increase the likelihood of an airdrop.

2.4 Growth

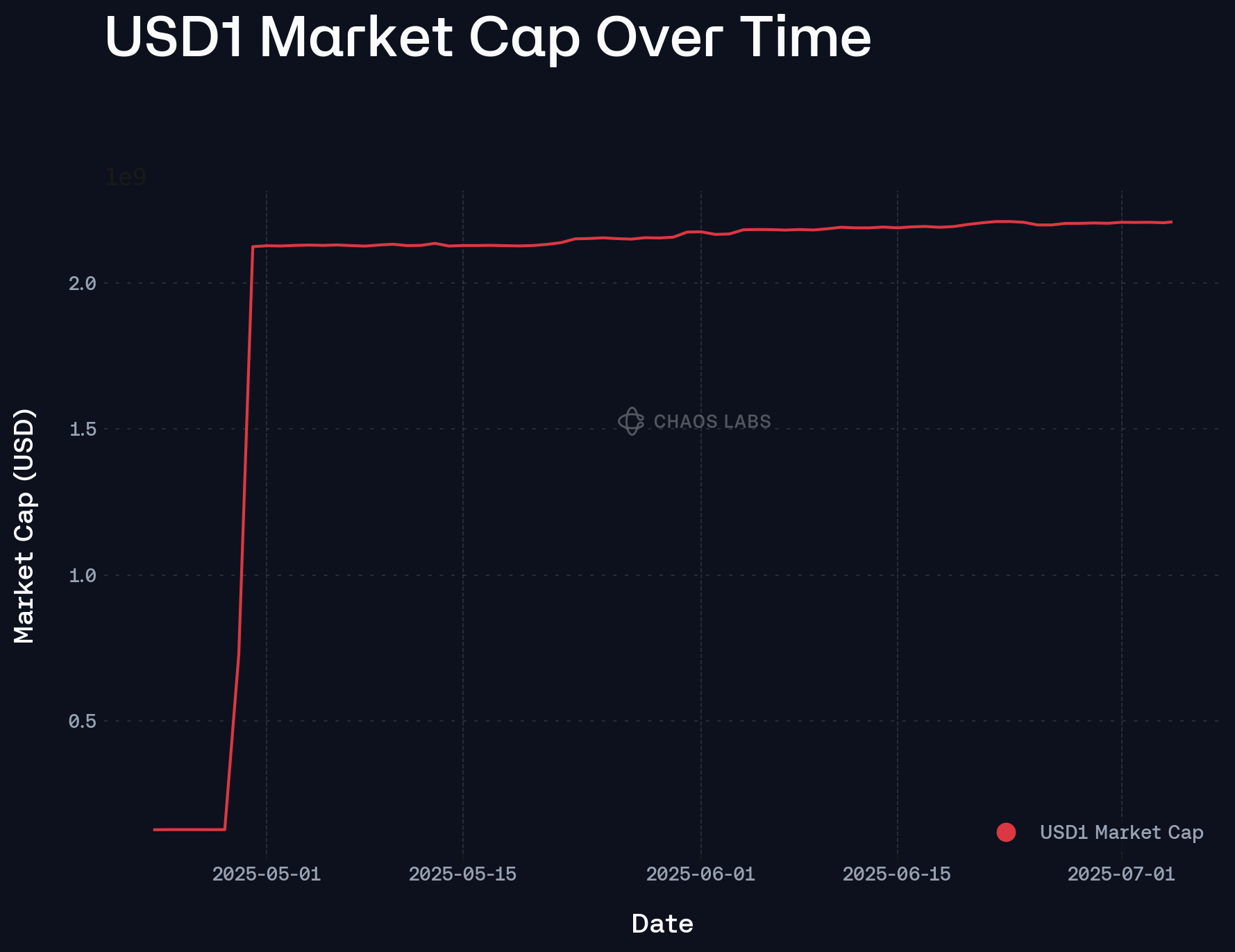

Source: USD1 Market Capitalization, Coingecko, July 23, 2025

USD1’s market capitalization has grown to above $2 billion in a brief period, due to an investment from an Abu Dhabi–based fund working alongside Binance (Reuters). This is fast stablecoin growth compared to other projects, though it has effectively flatlined since May.

3. Technological Risk

3.1 Smart Contract Risk

No public audits are available, though the team reports that PeckShield has audited USD1 contracts and that more audits will be done as the protocol develops. Given that these are not public, limited value can be placed in them.

3.2 Bug Bounty Program

No bug bounty program has been created.

3.3 Price Feed Risk

A USD1/USD Chainlink market feed is available on many networks, including Ethereum and BNB Chain. It has a 24-hour heartbeat, 16 underlying oracles, and a 0.5% deviation threshold.

3.4 Dependency Risk

As a BNB Chain–deployed stablecoin backed by short-term Treasuries, this system introduces few incremental dependencies.

BitGo’s Stablecoin as a Service product is one such incremental dependency. While BitGo has a long history of operating assets onboarded to Aave (such as WBTC), these have not been without complications. Given this is a new product, further similar complications are possible. Of particular note is the novel legal engineering conducted by BitGo to comply with the United States’ regulatory regime, which is covered in the next section.

4. Counterparty Risk

4.1 Governance and Regulatory Risk

Legal Structure

The USD1 program is an implementation of the sponsor–promoter model where the legal and operational functions are split between the “sponsor” (World Liberty Financial, Inc., or the WLFI team) who drives branding, product development, smart-contract architecture, and front-end interfaces, and the “issuer/promoter” (BitGo Trust Company, Inc.) who is the regulated legal entity that issues, mints, burns, and custodies the stablecoin—and holds the reserves.

Through this split, the WLFI team seeks to ring-fence regulatory exposure: the WLFI team can engage in higher-risk marketing and interface-building, while BitGo, acting as trustee, is tethered to financial and custody regulations. It also shields the WLFI team from direct reserve management risk and limits token-holders’ recourse to the issuer.

BitGo Trust Company, a South Dakota–chartered, FinCEN‑registered money services business, is contractually the issuer and holds all reserve assets in segregated accounts for token-holders’ benefit. Assignment of both roles to BitGo is possible because trust companies can legally act as both issuers and custodians, provided regulatory requirements and segregation of client assets are respected.

Only eligible BitGo customers (i.e., parties who have undergone KYC/AML and registered an account) can redeem USD1 directly. BitGo processes all purchases/redemptions; however, the WLFI team has no redemption liability. BitGo reserves the right to freeze or block redemptions if there is any suspicion of legal or regulatory infraction, not solely upon a court or law-enforcement order, but also at BitGo’s discretion.

There is no explicit “pro‑rata claim” to the reserve pool, or specific legal protection, if BitGo becomes insolvent. The risk disclosure clearly states holders only have a contractual right to request redemption, with no security interest or guarantee regarding the reserves. The disclosure further acknowledges potential deferral or suspension of redemptions in stressed or illiquid market conditions. There is no guarantee of timely redemption, even if assets are “fully reserved.”

BitGo keeps the backing assets in “cash, demand deposits, short-term U.S. Treasuries and other cash equivalents,” rebalancing daily through its treasury desk. In capital-structure terms, BitGo and the WLFI team earn fees from the interest on reserves. They have sole rights to earnings—USD1 holders receive none. There is explicit acknowledgment that “interests may differ” between holders and the sponsor/issuer, including through related-party transactions. As a result, the risk of redemption delays or weaker consumer protection is borne by token holders.

There is another company associated with USD1, namely SC Financial Technologies, LLC. The public-facing documentation about it is exceptionally thin. The only authoritative reference that has surfaced so far is in the April 2025 independent reserve attestation of USD1, which states that “the USD1 brand and certain associated trademarks are owned and controlled by World Liberty Financial, Inc. and SC Financial Technologies, LLC.”

Monthly Attestations

Crowe’s USD1 Reserve Report is a short-form AICPA attestation confirming that at two discrete mid-April dates, BitGo’s self-reported supply of redeemable USD1 tokens did not exceed the face value of assets held in a segregated trust. Crowe’s engagement is an “examination” under AICPA attestation standards, not an audit. It cites the experimental “2025 Criteria” developed by the AICPA for fiat-backed tokens, a framework not yet incorporated into PCAOB or SEC regulations, so the work falls outside the supervisory schemes that govern traditional financial-statement assurance.

The reserve pool exhibits no asset-class or custodian diversification: the attestation reflects neither direct holdings of U.S. Treasury securities nor reverse repurchase agreements, and as of the reporting date, 100% of the collateral consisted of units in a single government money market fund (identified by one CUSIP). The report does not address the fund’s internal liquidity-gating provisions, underlying portfolio composition, or committed bank credit lines capable of supporting same-day redemptions. Therefore, exclusive dependence on a single CUSIP gives rise to a material concentration risk that warrants fuller disclosure and a documented mitigation strategy.

4.2 Access Control Risk

4.2.1 Contract Modification Options

The owners of USD1 may modify a range of contract parameters, including (BEP-20 Token | Address: 0x8d0d000e...476f08b0d | BscScan):

- A global pause function for the stablecoin.

- An account-specific freeze function (that blocks transfers on the frozen address).

- An ownership transfer function that migrates contract ownership from the current owner.

These are significant control and upgrade options that introduce risk if not managed responsibly. They are nonetheless widely used by most leading stablecoins.

The USD1 team assures LlamaRisk that these functions will be used to comply with all legal processes/law enforcement. Ownership would only be transferred under conditions that satisfy BitGo’s fiduciary duties, maintain current legal compliance, and ensure operational competency under a formal agreement without economic conflicts of interest.

4.2.2 Timelock Duration and Function

USD1 is owned by a TokenGovernor contract, which uses a 3‑day defaultAdminDelay. This functions as a 3‑day timelock.

4.2.3 Multisig Threshold / Signer Identity

TokenGovernor is owned by a 3/6 Safe with signers:

Note: This assessment follows the LLR-Aave Framework, a comprehensive methodology for asset onboarding and parameterization in Aave V3. This framework is continuously updated and available here.

It will be presented jointly with Chaos Labs.

It will be presented jointly with Chaos Labs.

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded in part by the Aave DAO. LlamaRisk is not directly affiliated with the protocol(s) reviewed in this assessment and did not receive any compensation from the protocol(s) or their affiliated entities for this work.

The information provided should not be construed as legal, financial, tax, or professional advice.