Summary

Based on the LlamaRisk analysis, while profitable, the deep integration between Ethena and Aave has created risks due to Ethena’s large-scale deposit of its stablecoin backing assets (USDC, USDT, USDtb) into Aave’s lending pools. This exposure has surpassed previously recommended thresholds from the Ethena Risk Committee, creating a rehypothecation risk where Ethena’s assets are lent out and may not be immediately available to service USDe redemptions. Our analysis explores how it could lead to a liquidity bottleneck during market stress or following the maturity of large Pendle PT pools, directly challenging Ethena’s instant redemption capacity.

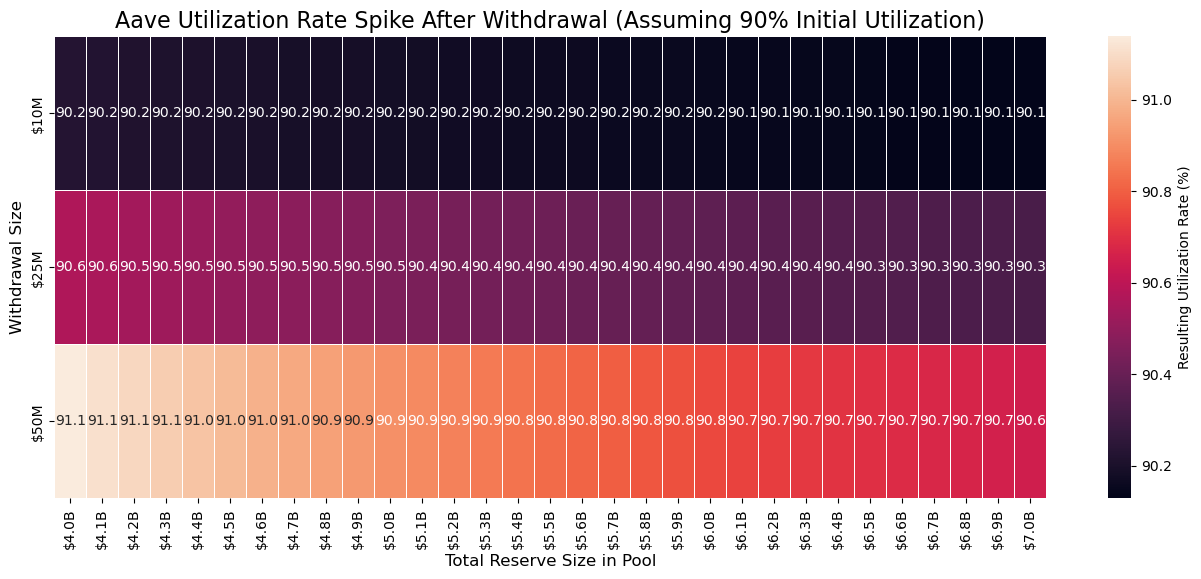

This concentration of assets also introduces sensitive points for the Aave protocol itself. The primary concern is direct borrow rate stress; a large, sudden withdrawal by Ethena to meet its redemption needs would cause a spike in stablecoin borrow rates, negatively impacting all users of Aave’s core market. Nonetheless, we underline that Aave is well-equipped to handle large-scale integrations, with risk management frameworks in place to maintain borrow rate stability.

In addition, the analysis points to several mitigating points, strategies, and action points for both protocols. These include the self-correcting nature of loan repayments, which can free up liquidity, Ethena’s Reserve Fund robustness, and proposals to expand Aave’s Umbrella Module coverage. Finally, after further diligence, Ethena’s Risk Committee has updated its guidance to recommend allocating up to 30%-50% of Ethena’s stablecoins into aTokens, also issuing guidelines for a gradual, measured unwinding of its Aave exposure, particularly as large PT pools approach maturity, to avoid sudden liquidity shocks and ensure the long-term stability of both ecosystems.

0. Background

As Ethena continues to expand, it strengthens the integration ties with Aave. This relationship is largely driven by the profitable yield leveraging of Pendle PT tokens and the integration of the Liquid Leverage program. While this double-sided exposure brings incremental revenues to both protocols, it also introduces risk consequences. Both @LlamaRisk and @ChaosLabs have focused on these risks over the past months, releasing several analyses covering various angles of this integration: (1), (2), (3), (4). Our objective in addressing these angles is to ensure that both the Aave and Ethena ecosystems are well-prepared for market stress situations and can effectively mitigate the risks associated with this deep integration.

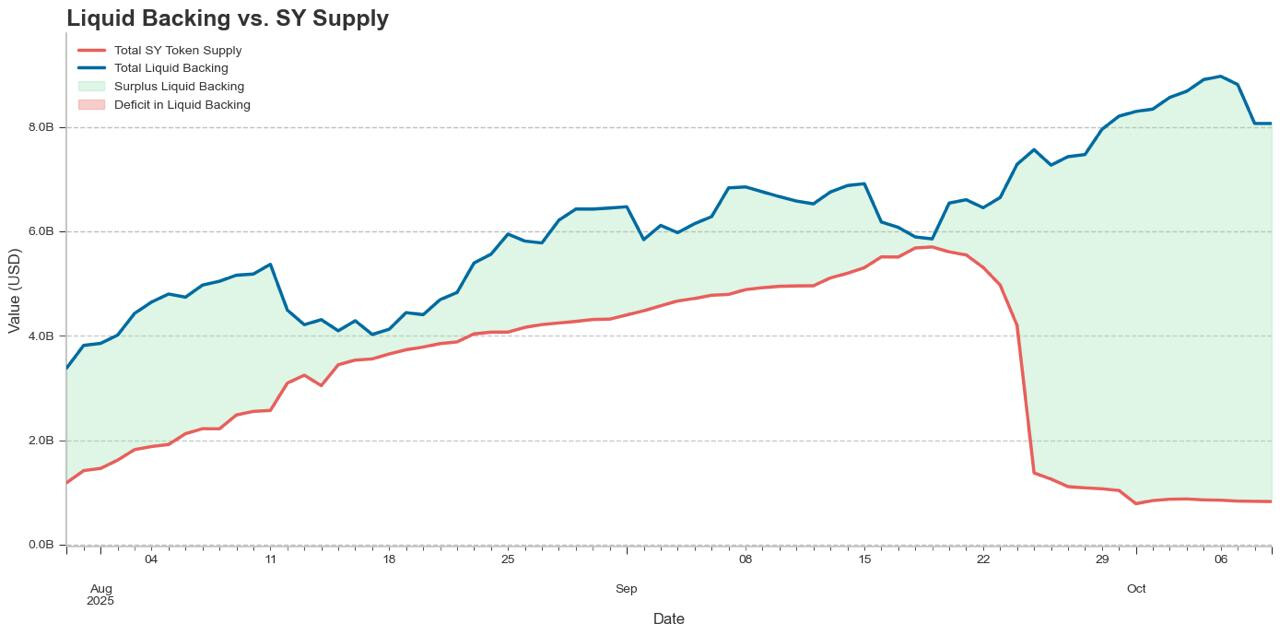

This newest analysis specifically tackles Aave’s exposure to stablecoin deposits from Ethena. This exposure has exceeded the thresholds previously recommended by the Ethena Risk Committee. More precisely, Ethena’s allocation of USDC and USDT backing to Aave has surpassed the advised limit of 10% of its total stablecoin reserves.

Over the past months, the growth in borrowing demand has placed considerable strain on Ethena’s free stable asset liquidity buffer, which is crucial for processing USDe redemptions. While temporary, the primary downstream risk directly challenges USDe’s instant redemption capacity. In an unlikely market stress scenario, a surge in redemption requests could create a liquidity bottleneck, as a significant portion of the backing assets would be locked as collateral within Aave. Therefore, we aim to analyze and quantify this risk to provide further recommendations that would help ensure stability for stablecoin borrow rates on Aave’s Core market while also keeping Ethena’s liquid buffer constraints minimal.

1. Ethena’s aToken exposure

1.1 Backing Assets Flow

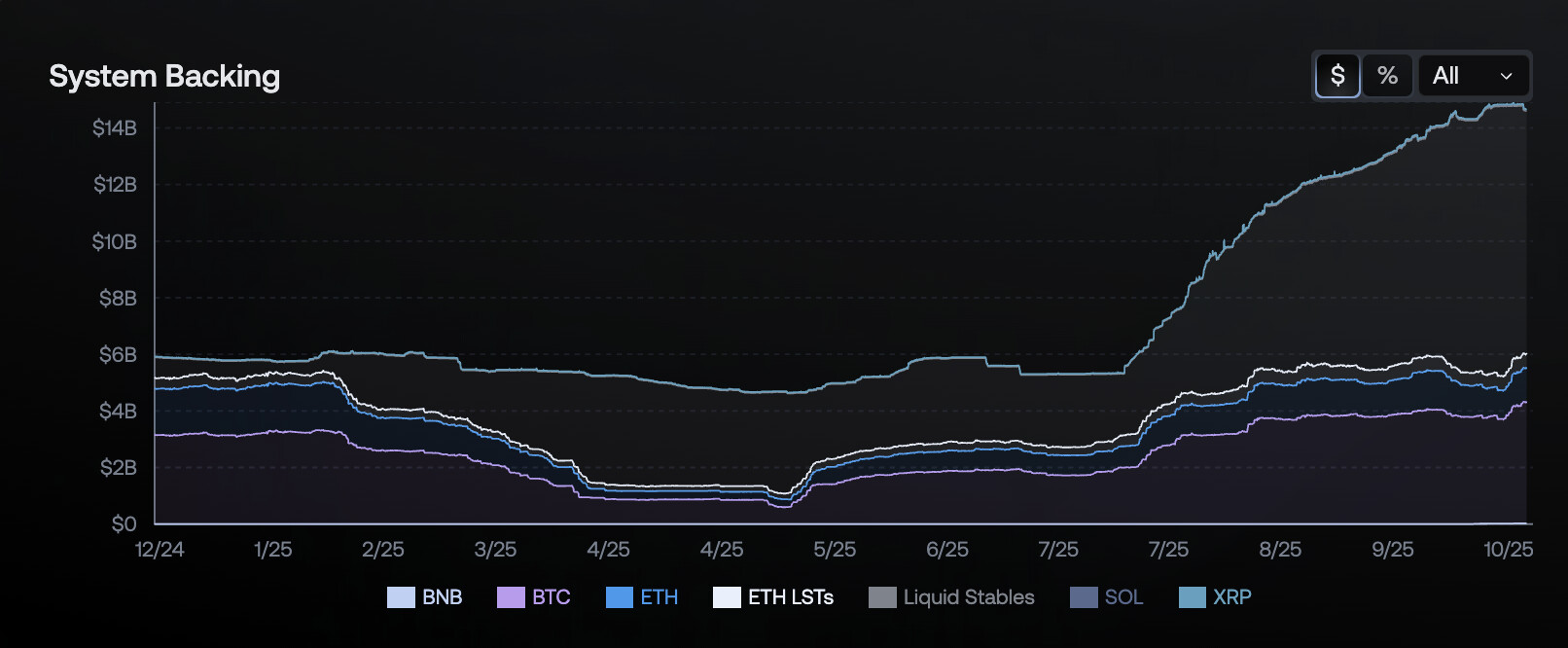

Ethena’s protocol is centered on USDe and its downstream derivative assets. When USDe is minted, its backing is either held in stable assets (USDC, USDT, USDtb) or allocated to perpetual futures hedging positions, where ETH/BTC are held as spot assets and short positions are opened on CEX perpetual venues. The allocation between stablecoins and perpetuals depends on underlying market conditions. Suppose funding rates are higher than the base rate (T-bill or Aave stablecoin supply rate) and Open Interest is sufficient to accommodate the incremental short interest. In that case, the portion of perpetual futures positions grows. Conversely, if funding rates are low, keeping a large T-bill exposure via USDtb and depositing USDC/USDT on Aave can bring revenue above the funding rate yield.

Source: Ethena Transparency Dashboard, October 9, 2025

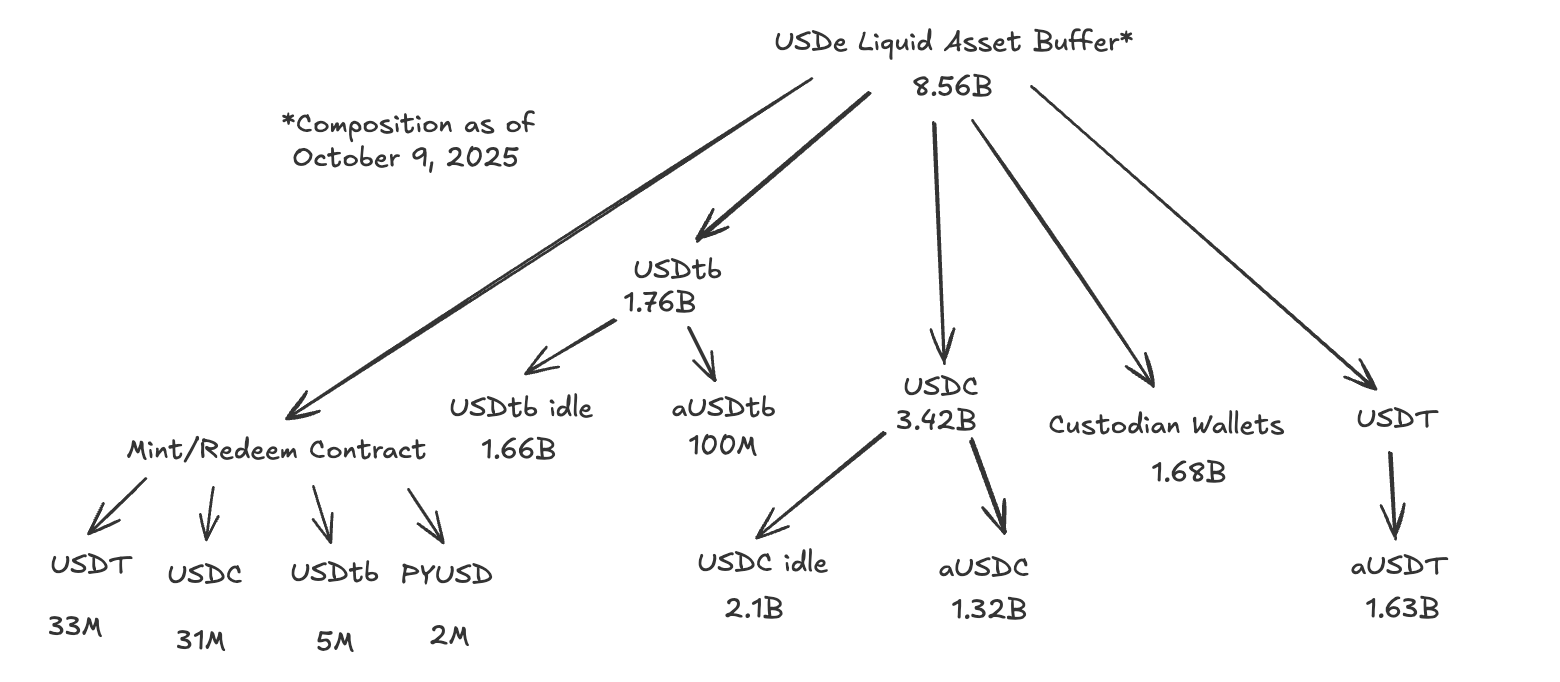

In recent months, positive market conditions have led to a growth in funding rates, which has driven higher sUSDe yields. These attractive yields have sourced new demand for USDe, resulting in the current 14.6B USDe supply. As supply increased, the overall Open Interest failed to expand enough for Ethena to allocate all incoming supply to perpetual futures hedging without diluting funding rates. Consequently, Ethena has allocated a large part of the inflows to Aave’s Core market as USDC and USDT to capitalize on attractive rates and expanded liquidity. At its peak, the aUSDT allocation reached 1.63B, while the aUSDC allocation reached 1.32B.

The overall picture of USDe liquid asset backing is more diverse. In addition to USDT, USDC, and their corresponding Aave allocations, the USDtb portion also represents 1.76B in the backing, of which 100M is currently deposited on Aave. Furthermore, up to 200M USDC was allocated to a Morpho Spark vault, albeit this amount is now minimal. The remaining liquid backing is held in the Mint/Redeem Contract and custodian wallets, including 600M PYUSD in the Copper Custody wallet. Historically, allocations to sUSDS were also prevalent but are not currently present.

Source: LlamaRisk, October 9, 2025

For the reasons explained above, the aUSDC/aUSDT portion has grown the most of all liquid assets in USDe’s backing portfolio. At the same time, the portion of idle USDC and USDT has become smaller. This can also be attributed to Ethena’s goal of maximizing yield efficiency, especially as USDT and USDC supply yields on Aave exceeded the T-bill rate captured via USDtb.

Source: LlamaRisk, October 9, 2025

1.2 The Rehypothecation Issue vs. Instant Redemption Processing

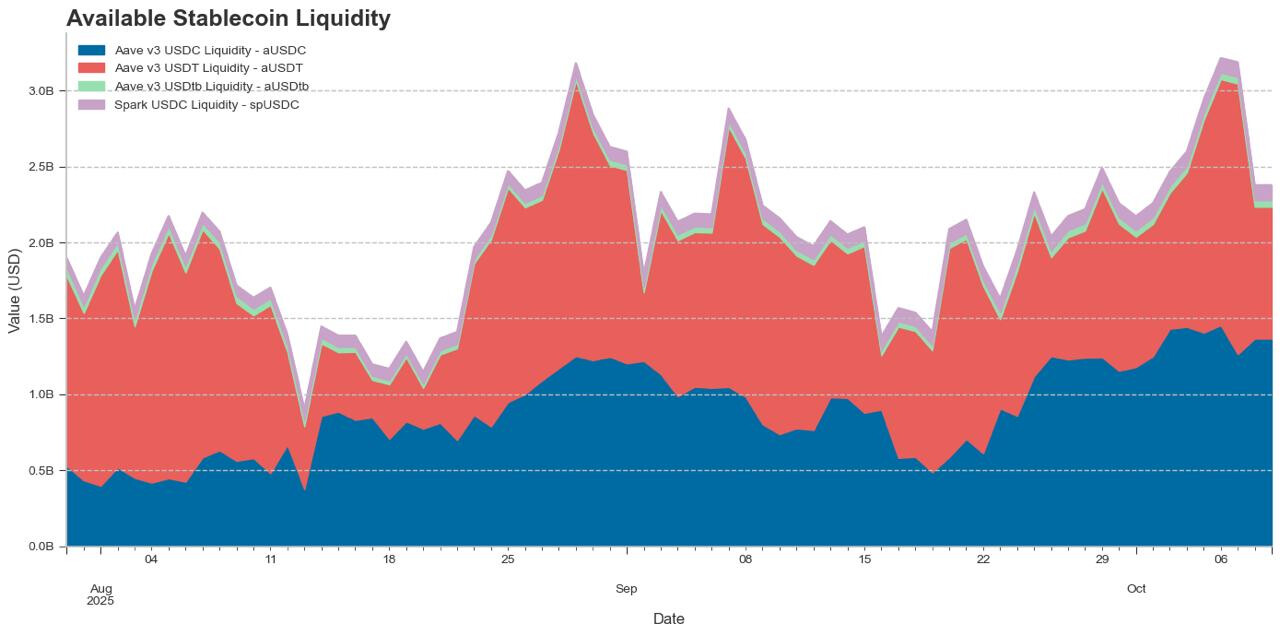

As outlined, many of Ethena’s liquid assets reside on Aave as USDT, USDC, and USDtb. Sourcing liquidity from these deposits is not guaranteed; it depends entirely on the available (unborrowed) capital in Aave’s lending pools. To put this into perspective, we analyzed the historical available liquidity for these stablecoins, focusing on the liquidity crunch in August when stablecoin demand grew. At its lowest point in mid-August, the aggregate available liquidity buffer was $638M, substantially below Ethena’s total deposited portion of ~$2.8B.

Source: LlamaRisk, October 9, 2025

From Aave’s perspective, if Ethena were to withdraw its entire liquid buffer at peak utilization, it would cause rate spikes, similar to what was observed during the HTX withdrawals of USDT earlier this year. Notably, performing such partial withdrawals when a large portion of one’s deposits is illiquid can be profitable, as rate shocks generate incremental revenue for suppliers. However, for Ethena, this would be a double-edged sword. Ethena PTs back many USDT/USDC borrows; therefore, rate shocks would make these positions unprofitable, forcing borrowers to repay their leveraged loans. In the long run, this would trigger deleveraging and could lead to USDe redemptions. Therefore, Ethena would unlikely withdraw in large quantities, preferring a gradual unwinding of its deposits or even unwinding the perpetual positions.

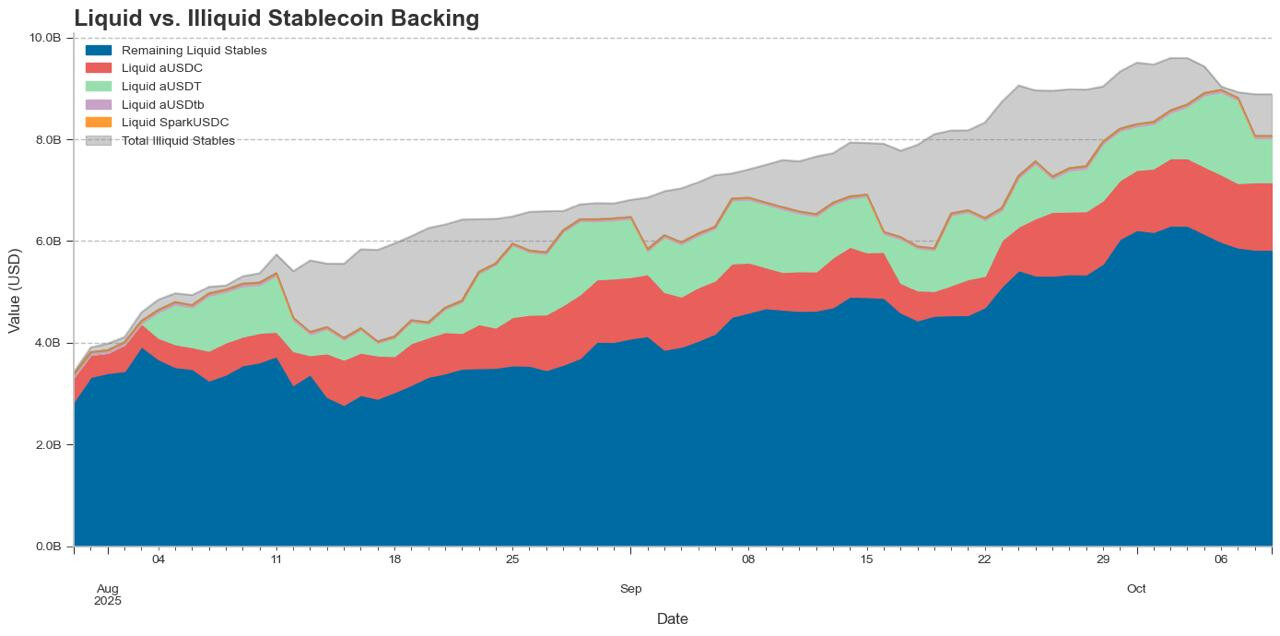

To put the effective liquid redemption capacity into perspective, at the moment of highest stablecoin utilization, the effective liquid stablecoin backing reached a low of $4.1B, or 70% of the total stablecoin backing of USDe. USDT liquidity constraints mainly impacted this. It is also notable that the USDtb free buffer is constantly below 50% of the total portion deposited by Ethena, solely because Ethena is the major supplier to that reserve (100M out of 101M total deposits).

Source: LlamaRisk, October 9, 2025

1.3 Asset Flow

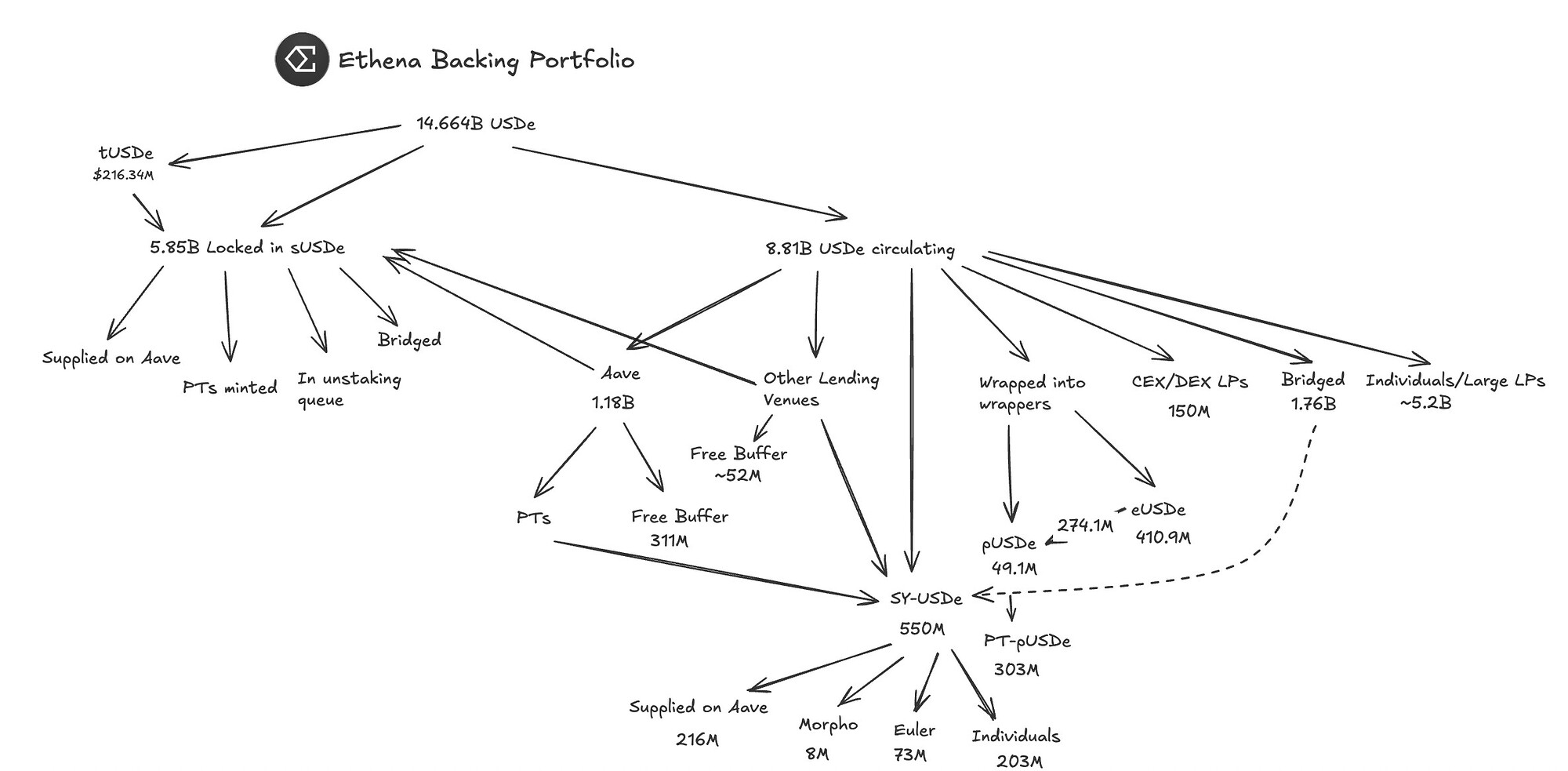

When analyzing USDe flows, we can divide them into two categories: freely circulating USDe and locked USDe. On October 9, 2025, out of the 14.66B total USDe supply, 5.85B was staked into sUSDe, directly or via a tUSDe deposit vault.

Source: LlamaRisk, October 9, 2025

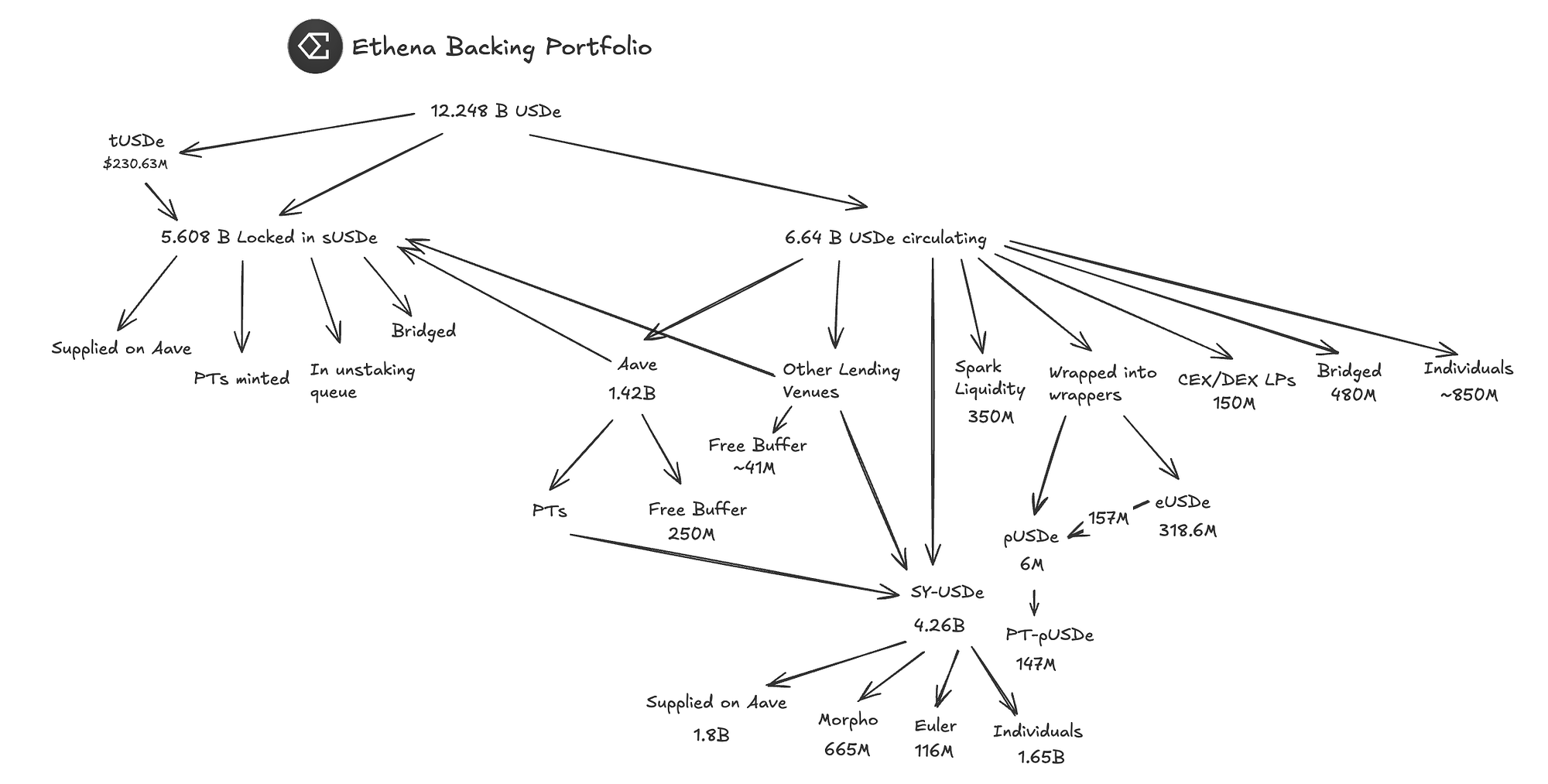

Notably, the backing composition continuously shifts, and, compared with late August 2025, the USDe portion locked on Pendle decreased sharply after old maturity pools expired and implied APY went down. Therefore, monitoring the flows as the market situation changes continuously is important.

Source: LlamaRisk, August 29, 2025

Looking further, sUSDe has multiple paths: it can be supplied on Aave (or other lending venues) for yield leverage, used to mint YTs and PTs (which also flow to lending venues), bridged, held idle, or placed in the unstaking queue with a 7-day cooldown. Because of this cooldown, sUSDe cannot be redeemed immediately, allowing Ethena to monitor and prepare for unstaking events and subsequent redemptions.

Source: LlamaRisk Ethena Risk Dashboard, October 9, 2025

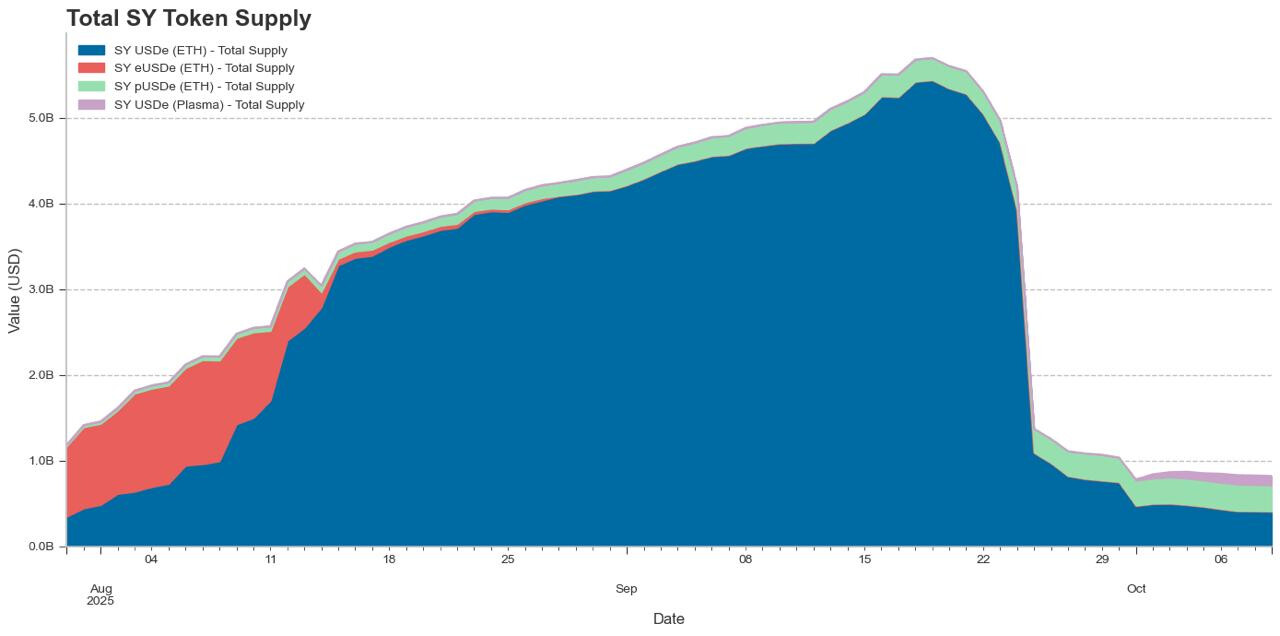

On the circulating USDe side, at times of continued positive market conditions, a large majority ends up wrapped as SY-USDe tokens, either directly or leveraged via lending markets, predominantly Aave. USDe can also be deposited on lending markets as is. Lately, the main driver for its demand on Aave has been the Liquid Leverage program run by Ethena, which incentivizes supplying a mix of sUSDe and USDe on Aave’s Core market.

Smaller portions of circulating USDe are deposited into the Spark Liquidity Layer, held in eUSDe and pUSDe pre-deposit vaults, used in LPs and CEXs, bridged, or held idle. While all of this circulating USDe can be subject to immediate redemption, its multiple indirect and wrapped downstream paths make it less likely to be redeemed simultaneously.

1.4 PT Flow and Assumptions

Given that a large ratio of circulating USDe supply has been historically held on Pendle as PT and YT tokens, it is important to delve deeper into the flow assumptions for this asset type. Here, we focus on the USDe Pendle token side, as sUSDe does not possess immediate redeemability.

When USDe is deposited and wrapped on Pendle, it is represented as a standardized yield (SY) token. This SY token is then split into a Principal Token (PT) and a Yield Token (YT) of a specific maturity. Users can acquire one or the other, gaining fixed or long yield exposure.

PT-USDe can be redeemed in several ways. The simplest is to wait until maturity, when PT-USDe is directly redeemable for the underlying asset. For users who do not wish to wait, there are two primary options: 1) sell their PTs on the Pendle AMM, or 2) acquire a corresponding YT to pair with their PT, which allows the redemption of the underlying SY token. A common strategy for leveraging PTs is to mint the PT/YT pair directly from USDe, thus avoiding fees and slippage. These users then deposit the PTs on Aave as collateral while keeping the YTs, which allows them to unwind their positions at any time without needing to use the market, especially when their debt is USDe. Due to these mechanics, limited secondary market liquidity, and PT deposits on Aave as collateral, the largest risk of USDe redemptions from PTs occurs just after the maturity of a large PT pool, especially if coupled with poor market conditions and low utility for fixed yield offerings.

To put this into perspective, most ($4.2B) of the USDe-related PT tokens at the end of August were concentrated in the end-of-September maturity pool. When the pool expired, some freed USDe could have moved into secondary markets and been presented for redemption by whitelisted minters.

Source: LlamaRisk, October 9, 2025

After the major PT-USDe September pool expired, most holders did not roll over the positions to a new maturity pool. Nonetheless, it did not result in major redemptions, partially due to the above-mentioned Liquid Leverage program, which incentivizes holding and supplying USDe & sUSDe.

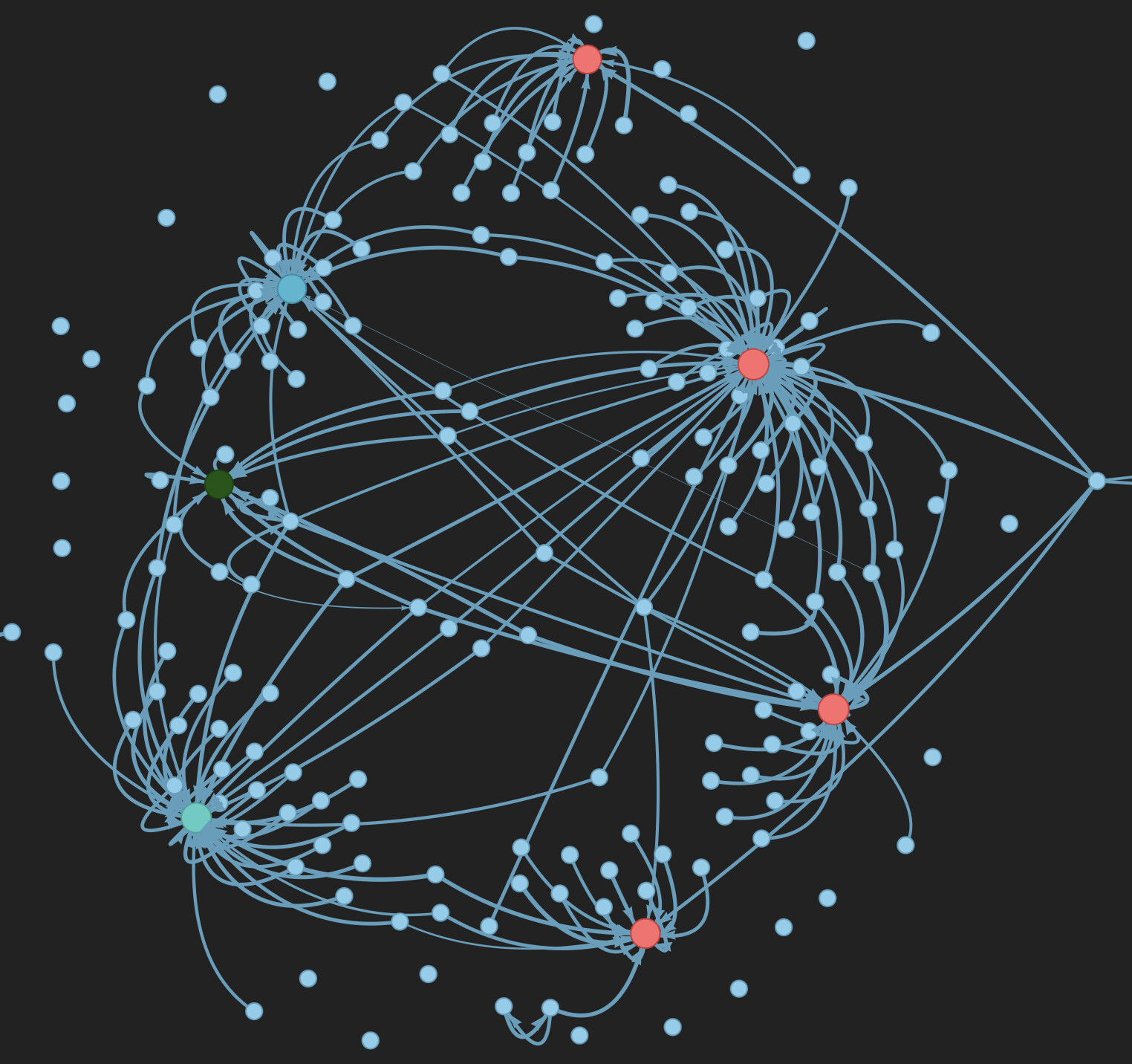

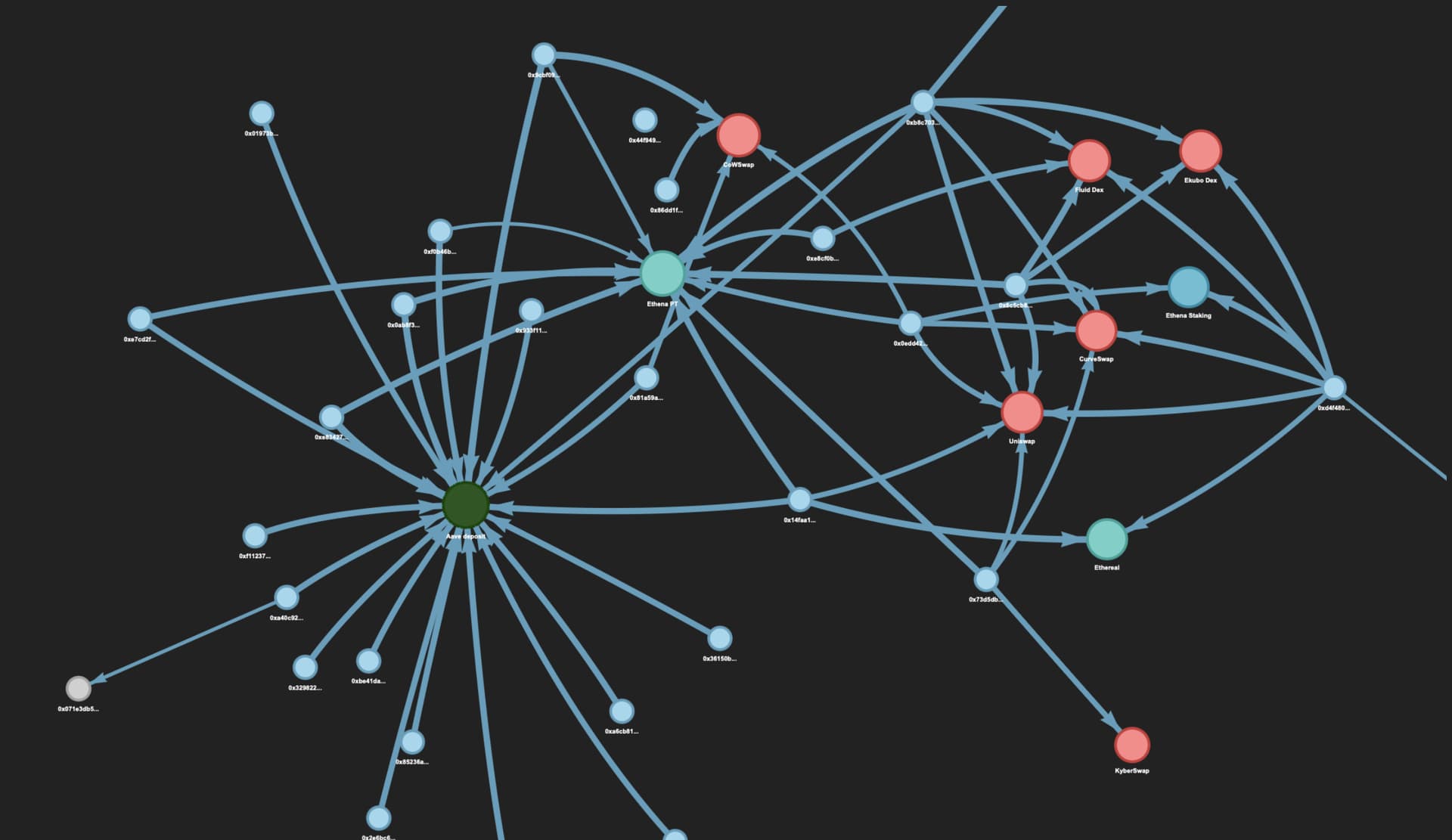

To better understand and quantify the risks at maturity, we mapped the on-chain flow of capital from wallets that withdrew USDe from matured Pendle SY pools. Using network graphs, we can visualize the primary destinations for these funds. The small blue nodes represent individual wallets, while the larger, colored hubs represent the primary actions taken: Red Hubs signify sales on DEXs, Blue Hubs represent capital retention within the ecosystem, such as migrating to new maturities or staking, and the Green Hub specifically denotes deposits into Aave. Analyzing major maturity dates reveals a clear evolution in user behavior over time.

Source: PT-USDe-25Jul2024 post-maturity behavior, October 9, 2025

Initially, post-maturity behavior was characterized by high sell pressure. The PT-USDe-25Jul2024 maturity, for instance, saw 89% of all withdrawn USDe being immediately sold on DEXs. During this period, capital retention was very low, with only a small fraction of funds being rolled into new maturities or utilized in other ecosystem strategies. This event established a historical worst-case scenario for redemption risk, demonstrating a strong tendency for users to exit their positions at maturity.

Over time, this picture began to grow more complex. The PT-USDe-27March2025 maturity showed a significant, though still high, sell pressure of approximately 61%. However, a notable portion of capital was also retained within the ecosystem. This change was largely driven by institutional players who began migrating their funds to new PTs or depositing them into Aave rather than selling, indicating a shift in strategy among more sophisticated market participants.

Source: PT-USDe-31Jul2025 post-maturity behavior, October 9, 2025

The latest major maturities, such as PT-USDe-31Jul2025, demonstrate a complete paradigm shift. Driven by new incentives like the Liquid Loop program, the primary action for maturing funds is no longer selling, but rather re-deployment and leveraging within the ecosystem. The sell rate dropped to <50% of withdrawn funds, with much of that pressure likely coming from users unwinding leveraged loops rather than exiting USDe entirely. In fact, the amount of USDe deposited into Aave exceeded the total withdrawn amount by 37%, signaling high capital retention and an injection of new capital, marking a clear shift from selling to strategic reinvestment.

1.5 Possible USDe Redemption Stress

Since we deem the most likely redemption stress to arrive in an unlikely scenario of unwinding PT token exposure, we can compare the free stable asset buffer size with the total USDe-related PT token supply. This comparison reveals that even during the brief period of contracted USDT and USDC liquid buffers on Aave, the overall effectively liquid portion of the stable asset backing would still surpass the total USDe-backed PT token supply.

Source: LlamaRisk, October 9, 2025

As the redemption stress assumed in this scenario would happen close to or shortly after the maturity of PT pools, Ethena should prepare for such cases by expanding its buffer or unwinding Aave positions gradually as large PT pools approach maturity.

Even if this historical view supports Ethena’s ability to service all unexpected USDe redemptions in a high-stress scenario, at least with a small margin, it is rational to assume that the secondary market peg of USDe and sUSDe would be challenged in such cases. Historically, we have seen that the sUSDe secondary market peg is more susceptible to stress, as its locked nature implies higher duration risk.

2. The Risks for Aave

This section focuses on the risks posed to the Aave protocol due to this large, concentrated exposure. Some of these risks were already covered in previous analysis, albeit remain in focus as Ethena’s exposure, both on the stablecoin supply and PT tokens side, remains high.

2.1 Direct Borrow Rate Stress

As discussed, any further withdrawal of stablecoin supply would only aggravate borrow rate stress during periods of high stablecoin utilization. This would affect PT-backed borrow positions and all other strategies borrowing the same stablecoins. Historical observations show that borrowers repay earlier than additional stablecoin supply is sourced, directly resulting in deleveraging. As Ethena allocates more stablecoins to Aave during expansionary phases, it boosts Aave’s market capacity. However, if PT collateral inflows fuel this, it does not alleviate stress. Instead, it creates a loop where USDe backing generates incremental revenue from PT leveraging, which is then redistributed as sUSDe yield, boosting the asset’s baseline yield.

This flow, shared with USDe, is backed by PT tokens, boosting demand for USDe overall. With such leverage loops, USDe is not sold on the secondary market but re-enters the loop on the collateral side in the form of PT-USDe tokens minted on Pendle using the borrowed USDe. For example, for PT-USDe-backed loans in late August, USDe was the most preferred borrow asset, taking a 49.3% share of total borrows. In addition, USDT and USDC borrow demand is consistently significant, as with other borrow strategies. Consequently, these three stablecoins are the most utilized on Aave’s Core market, further supporting the rate stress thesis.

Source: LlamaRisk, September 1, 2025

2.2 PT Price Shocks and Oracle Price Adjustments

A downstream risk of the PT and stablecoin exposure is that the PT’s implied yield could become volatile during redemption stress. Chaos Labs implements a TWAP-based price update approach for PTs using a dynamic linear discount rate oracle, which controls for volatility effects. Nonetheless, if the dislocation between the reported and PT market price grows, highly leveraged positions could become subject to liquidations if the down-pricing takes effect. This should be mitigated by large TWAP thresholds so that positions are not affected by temporary price movements, as the PT price always converges to the full price of the underlying asset at maturity.

2.3 Peg Pressure on USDe vs. Fixed USDe Price on Aave

As a reminder, Aave prices USDe on par with USDT, eliminating secondary market price effects when USDe-correlated assets are used as collateral against USDT/USDe borrows. Due to this setup, in the event of USDe insolvency, positions would not be liquidatable until an oracle swap is performed.

As Chaos Labs explained in their analysis, having Aave as a whitelisted redeemer in such a scenario would enable it to internalize liquidations and mitigate bad debt exposure. Another note is that such last-resort redemptions should be zero-fee, contrary to the current setup where Ethena charges a small redemption fee to whitelisted entities.

3. Mitigations & Action Points

The risks presented for Ethena and Aave also come with favorable arguments, as both protocols possess numerous mitigation mechanisms. This section discusses these mitigations and provides action points to reinforce stability further.

3.1 Redemption Stress is Dependent on Loan Repayment

A key detail emerges when discussing redemption stress scenarios stemming from the unwinding of PT-USDe leveraged positions: Ethena deposits USDT and USDC, which are then loaned against PT-USDe collateral. This results in an interesting flow during potential deleveraging. Before PT-USDe-backed loans can be closed, the borrowed USDT and USDC must be repaid. In a high-utilization environment, this repayment would free up the liquid buffer for Ethena, allowing it to withdraw its USDT and USDC deposits to service redemptions. This simultaneous flow would alleviate instant capital needs, reinforcing redemption servicing capabilities.

Source: LlamaRisk, October 9, 2025

On the other hand, if PT-USDe collateral is paired with USDe borrows, any loan repayment would necessitate sourcing USDe from secondary markets. This would delay peg and redemption pressure, again allowing Ethena to better prepare for servicing redemptions.

3.2 Reserve Fund Targets

In a tail-risk scenario where all possible USDe redemptions need to be processed at T+0 and sUSDe redemptions at T+7, Ethena would also need to unwind its perpetual positions. Even though this process would come with operational losses due to slippage (potentially amplified by negative funding rates), this scenario is simulated and embedded into LlamaRisk’s Ethena Reserve Fund methodology. The reserve fund helps ensure operational flexibility and coverage from negative market conditions while keeping USDe over-collateralized.

Recent reserve fund simulations confirm that the current fund size remains adequate as USDe supply grows, primarily due to the expanded liquid asset buffer. Even when accounting for the partial illiquidity of this buffer, the conservative target for reserve fund capitalization remains unchanged. According to the methodology, we assume all perpetual positions would need to be closed within 24 hours, incurring 50 bps in negative funding rate losses and 50 bps in slippage losses. Therefore, as long as the reserve fund adheres to these recommended size targets, it remains robust against the above-mentioned operational loss scenarios.

3.3 Umbrella Targets and Expansion

To further bolster Aave’s defenses, we must look to its ultimate backstop: the Umbrella Module. It is important to underline that the current Umbrella targets offer partial coverage against potential bad debt events for stablecoins like USDT and USDC. This mechanism provides a foundational layer of security for the protocol. However, the stablecoin reserves on Aave have grown significantly since these targets were initially deployed. Consequently, the existing coverage is no longer proportional to the current size of the reserves and the concentrated risk exposure from large entities like Ethena. Therefore, we propose to reconsider and increase the Umbrella coverage targets for USDT and USDC to align with their expanded market sizes, as further discussed & analyzed in our recent ARFC proposal. In addition, we also propose introducing the USDe Umbrella module, which would cover incremental risks, also partially related to PTs and overall Ethena exposure.

Raising these targets will directly benefit a larger fund to protect the protocol from bad debt. But it would also introduce a subtle yet positive secondary effect on the protocol’s free liquidity buffer. An increase in Umbrella targets, especially with attractive staking yields, would incentivize new capital to be staked. A significant portion of this new stake would likely come from external sources—that is, from token holders who are not currently active stablecoin suppliers on Aave. While Umbrella is not a primary liquidity source, a larger and more diverse set of stakeholders contributes to overall resilience. It can help alleviate supply shocks, albeit minimally, by fostering a stickier capital base.

3.4 Updated aTokens Exposure Recommendations

Initially, Ethena Risk Committee deemed that Ethena’s allocation to aTokens should not exceed 10% of the total USDe’s stablecoin backing portion. Nonetheless, after performing further analysis, the Risk Committee has revised the recommendations, now deeming that 30-50% aToken allocations are considered safe. LlamaRisk, being a member of the Risk Committee, has also contributed to the analysis, while being mindful of the potential conflict of interest. Ultimately, the priority remains continuous review of these recommendations to ensure they reflect the most up-to-date market conditions and maintain optimal safety.

3.5 Gradual Unwinding of Exposure

To proactively manage potential exposure risks, Ethena will adopt a strategy for the gradual and careful unwinding of its Aave exposure, especially as large Principal Token (PT) pools approach maturity. This strategy emphasizes a planned, phased reduction rather than an immediate withdrawal designed to minimize any adverse market impact. This approach will prevent sudden liquidity shocks on Aave, allow borrow rates to adjust smoothly, and ensure Ethena consistently holds sufficient liquid assets to meet redemption demands, thereby reducing systemic risk for both protocols involved.

The Ethena Risk Committee has also established guidance (Proposal: Onboarding Aave's aUSDC and aUSDT as USDe Backing Assets - #6 by BlockworksAdvisory - General - Ethena Governance) for unwinding exposure when predefined thresholds are exceeded. Specifically, aToken exposure will be reduced when there’s a significant increase in floating USDe size, as large Pendle pools near shorter maturities, if total liquid backing decreases, or when Aave utilization rates become elevated. It is crucial to note that rate stability is paramount for both Aave and Ethena. Therefore, any unwinding actions will be performed in measured increments to avoid affecting Aave’s utilization by more than 1% before any deleveraging is triggered.

Source: LlamaRisk, October 9, 2025

Conclusion

The deep integration between Ethena and Aave has created a symbiotic relationship that generates significant yield and utility. However, this concentration of assets also introduces critical risks, primarily centered on Ethena’s redemption capacity and Aave’s borrow rate stability.

Our analysis shows that while Ethena’s liquid buffer has historically been sufficient to cover potential redemption stress from PT maturities, periods of high utilization on Aave can significantly constrain this buffer. This could create a potential bottleneck for Ethena and rate volatility risk for Aave.

Fortunately, several powerful mitigants exist, including the self-correcting nature of loan repayments, Ethena’s robust Reserve Fund, and Aave’s risk management framework. We will continue to monitor Ethena’s Aave exposure, providing regular updates to both communities to ensure transparency and proactive risk management. By taking a measured approach, Aave and Ethena can continue to foster a mutually beneficial relationship while ensuring their respective protocols’ long-term health and growth.

Disclaimer

This review was independently prepared by LlamaRisk, a community-led decentralized organization funded partly by the Aave DAO. LlamaRisk serves as Ethena’s Risk Committee member and an independent attestor of Ethena’s PoR solution. LlamaRisk did not receive compensation from the protocol(s) or their affiliated entities for this work. The information should not be construed as legal, financial, tax, or professional advice.