May 2025

This update highlights Chaos Labs’ activities and proposals in May.

Highlights

Staking Penalties on Babylon’s Bitcoin Staking Protocol

Following last month’s in-depth research on the impact of Ethereum consensus-layer slashing and penalties, this month we turned our focus to Babylon’s staking protocol. Specifically, we reviewed the protocol workflow, key protocol components, and examined Bitcoin Supercharged Networks and the Babylon Genesis Chain. Our analysis continued on the penalties that can be accrued via the remote slashing architecture, including for equivocation by finality providers and inactivity or downtime. We also examined the slashing protection measures, including client-level protections and external anti-slashing tools. Finally, we conducted a slashing scenario analysis, finding that the net effect of a slashing scenario would be a negligible impairment in collateral value.

PT Token-Related Adjustments and Listings

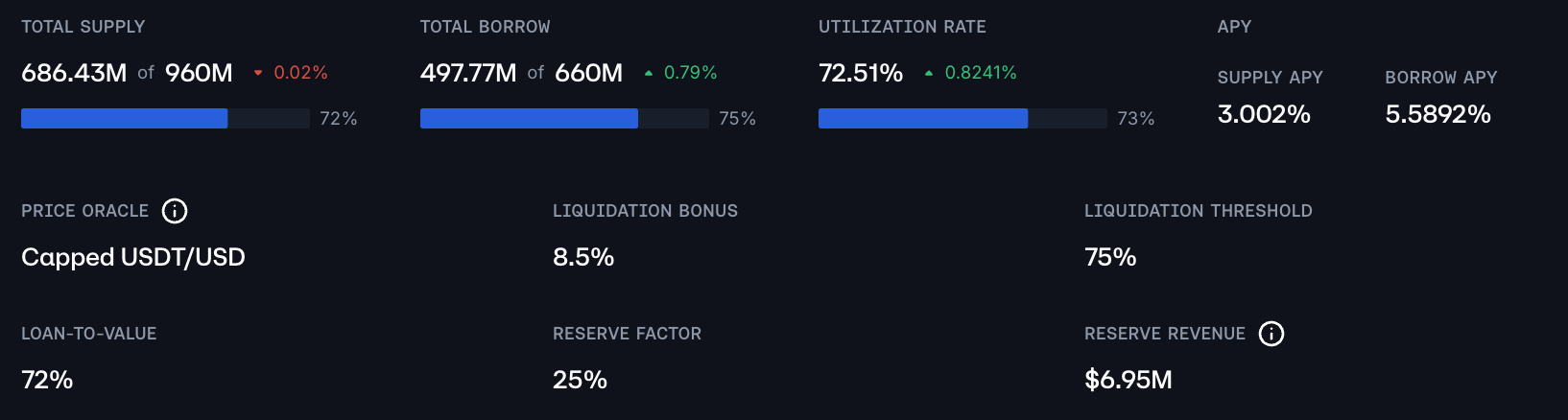

We responded to two proposals — to onboard USDe July and August PT token on Ethereum Core. Additionally, we recommended the adoption of a PT token and USDe E-Mode, in which USDe-related PT tokens would be used to borrow USDe, reducing protocol risk by using the underlying asset for leverage. This necessitated a change in USDe’s parameters, specifically altering its interest rate curve to capture additional protocol revenue. The PT token to USDe E-Modes without any changes would be expected to generate greater user profit because of its more permissive LT parameters; to account for this we proposed a series of hikes in USDe’s target interest rate that would make its yield comparable with that of the normal stablecoin E-Mode.

Ultimately, these changes, coupled with a higher Reserve Factor for USDe, has made USDe a significant revenue generating market for Aave, especially considering its size, currently accruing nearly $7M annualized; these figures can be viewed on our newly updated Community Analytics page.

New Deployments

We provided responses to proposals for new Aave deployments on the following networks:

- Rootstock

- We supported the deployment on the network contingent upon the availability of adequate price feed infrastructure. We recommended listing USDT, WRBTC, and ETHs as initial assets.

- Soneium

- We supported the proposed deployment and recommended listing WETH, USDC.e, and USDT0.

- Tron

- We also supported the proposed deployment on Tron and recommended listing USDT and WTRX as initial assets.

Risk Oracles

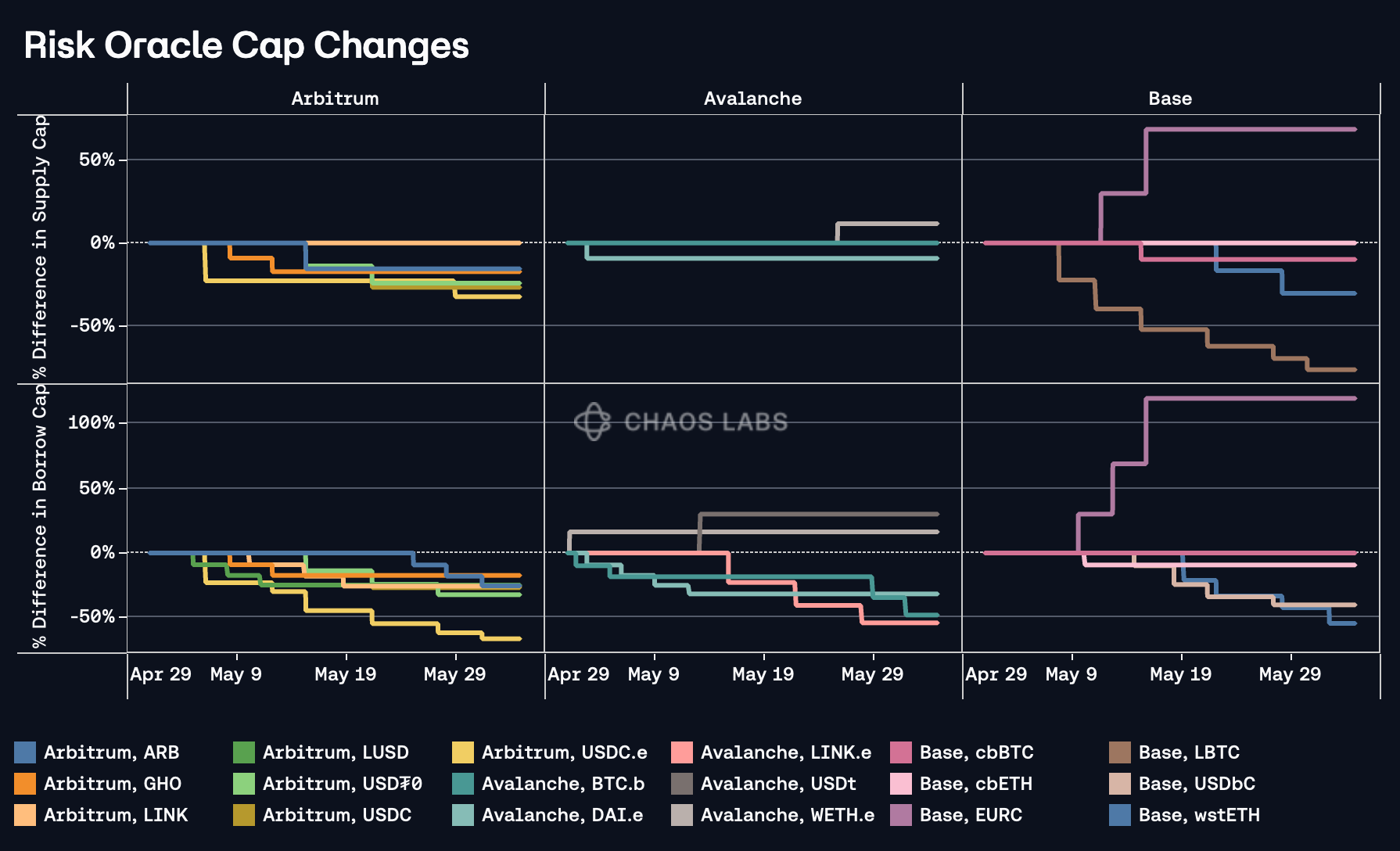

Supply and Borrow Cap Oracles

The supply and borrow cap risk oracles on Arbitrum, Avalanche, and Base continued to function efficiently, executing changes across a wide variety of assets. The most significant changes came on Base - EURC, where the oracle allowed for significant increases in the asset’s supply and borrow caps.

In the other direction, it has also frictionlessly reduced caps for assets with lower demand, including USDC.e on Arbitrum and LBTC on Base.

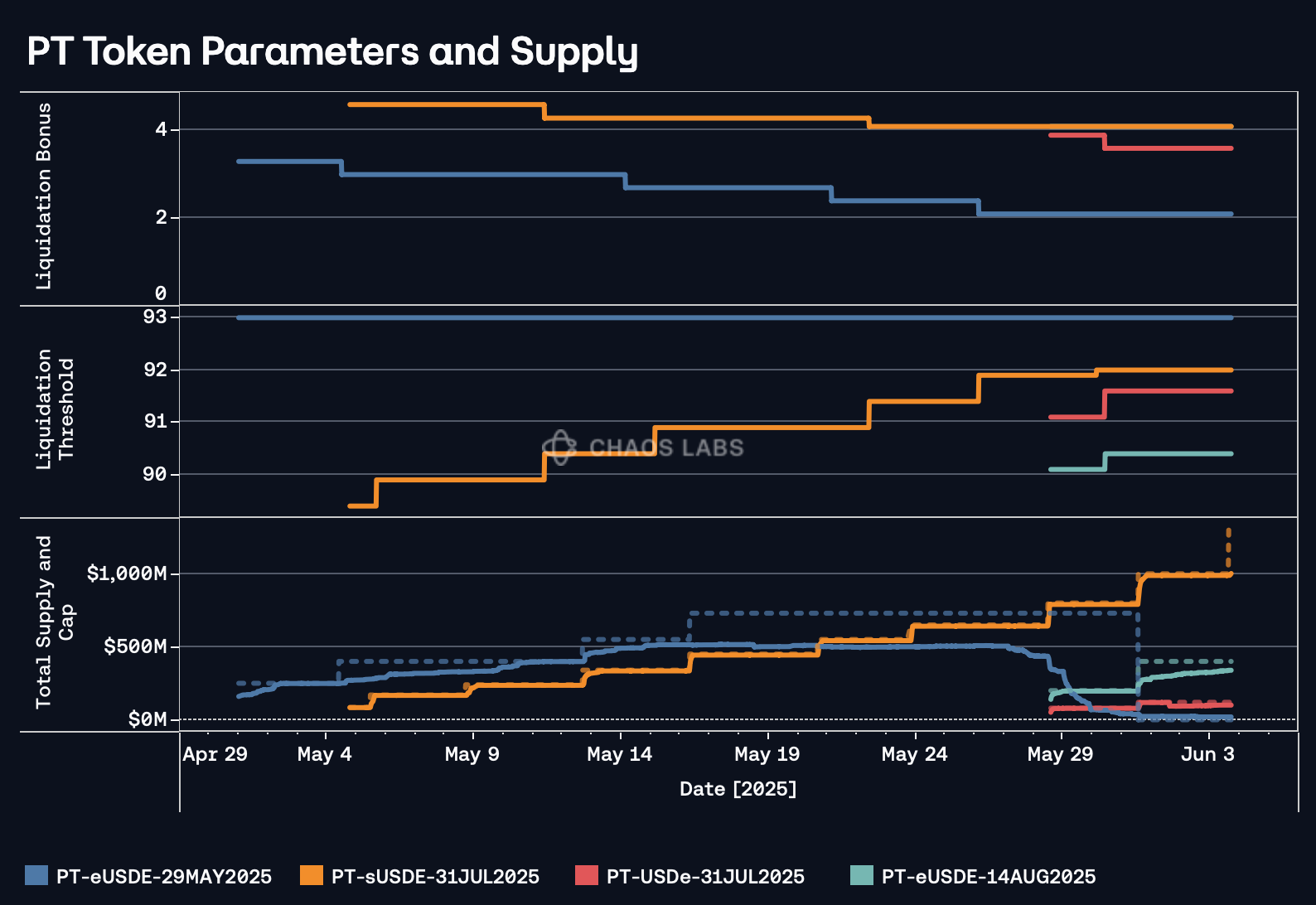

PT Risk Oracle

The newly listed assets utilizing our PT risk oracle have reached $1.456B in combined TVL. The chart below shows two of the three parameters dictated by risk oracles: Liquidation Bonus and Liquidation Threshold, as well as total supply and supply cap, represented by the dashed lines. In the case of PT-eUSDe-May, it maxed out its LT by May, experiencing only reductions in its LB.

PT-sUSDe-July, however, had a consistently increasing LT, and thus required numerous supply cap increases; supply increased nearly immediately following the implementation of cap increases. The new listings of PT-USDe-July and PT-eUSDe-August have already achieved significant adoption.

Forum Activity

- We published the following proposals and updates, including risk parameter updates:

- [ARFC] GHO Cross-chain Parameter Adjustments

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.04.25

- [Direct-to-AIP] wS and BTC.b Interest Rate Curve Optimization

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.05.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.06.25

- Chaos Labs Risk Stewards - Stablecoins Interest Rate Adjustment on Aave V3 - 05.06.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.08.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 05.12.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.13.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 05.14.25

- [ARFC-Addendum]: Supply and Borrow Cap Risk Oracle Constraint Specification

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.15.25

- Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 05.17.25

- Chaos Labs Risk Stewards - Adjustment of Supply Caps, Borrow Caps and Debt Ceiling on Aave V3 - 05.19.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.20.25

- Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 05.23.25

- Chaos Labs Risk Stewards - Increase Supply Caps and Borrow Caps on Aave V3 - 05.28.25

- Staking Penalties on Babylon’s Bitcoin Staking Protocol

- Chaos Labs Risk Stewards - Increase Correlated E-mode LTV and LT for eBTC and LBTC - 05.28.25

- Chaos Labs Risk Stewards - USDe Interest Rate and Borrow Cap Adjustments - 05.28.25

- Chaos Labs Risk Stewards - Adjustment of Supply Caps on Aave V3 - 05.31.25

- Additionally, we provided analysis regarding the following proposals and discussions:

- [ARFC] Onboard tETH to Aave v3 Prime Instance

- Risk Stewards - USDS Borrow Rate Update Prime Instance

- [ARFC] Deploy Aave v3 on Tron

- [ARFC] Onboard osGNO to Aave v3 Gnosis Instance

- [ARFC] Onboard USDe July expiry PT tokens on Aave V3 Core Instance

- [ARFC] Deploy Aave on Soneium

- [ARFC] Onboard eUSDe August expiry PT tokens on Aave V3 Core Instance

- [ARFC] Deploy Aave on Rootstock Network

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- Supply and Borrow Cap Risk Oracle integration on additional Chains leveraging Edge infrastructure.

- Continuous monitoring of SVR and associated parameterization

- Pendle Dynamic Risk Oracle for each PT asset deployment

- Risk Oracle integration for automated interest rate curve adjustments in response to demand

- Circuit Breaker for LSTs and LRTs

- Umbrella parameterization and methodology

- GHO: ongoing recommendations, including a comprehensive quantitative framework for the GHO savings rate.

- Continuous optimization of risk parameters on all V3 deployments.

- Parameterization for new Liquid E-Modes.

- Analysis and parameter recommendations for new assets and markets.