September 2024

This update highlights Chaos Labs’ activities and proposals in September.

Highlights

WBTC Parameter Adjustment

We first published our recommendations to change WBTC’s parameters to reflect its new custody arrangement. Following community feedback, we aligned with other service providers to recommend parameter adjustments that will balance the user experience with the asset’s altered risk profile.

LTV and LT Alignment

To continue optimizing the protocol and improving the user experience, we published an exhaustive recommendation to align LTV and LT for the same assets across networks. This improved the borrowing power for many assets, including AAVE, LINK, and rETH by increasing their LTVs on some networks. This added, for example, over $4M more borrowing power to LINK on Ethereum at current supply levels.

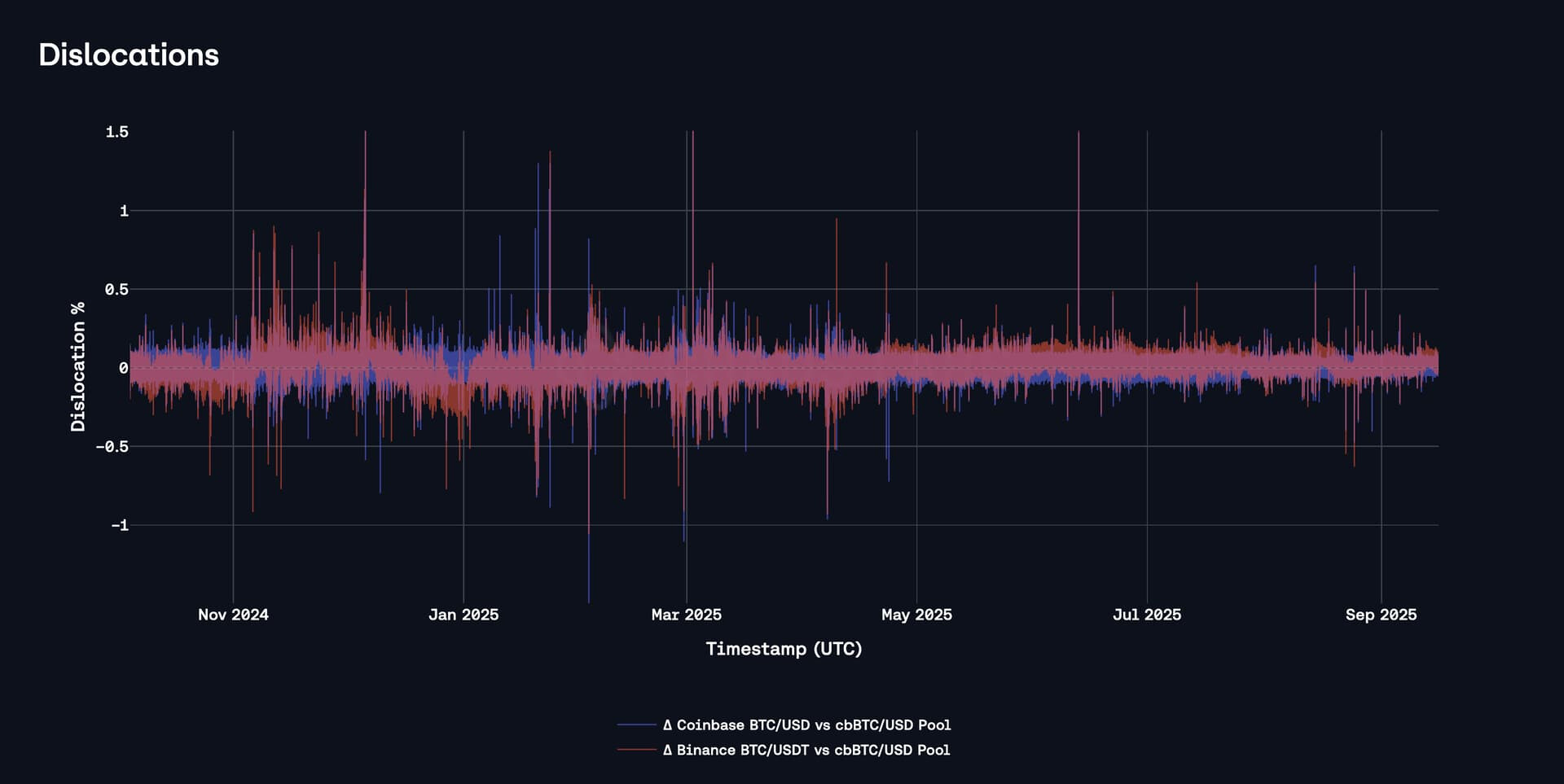

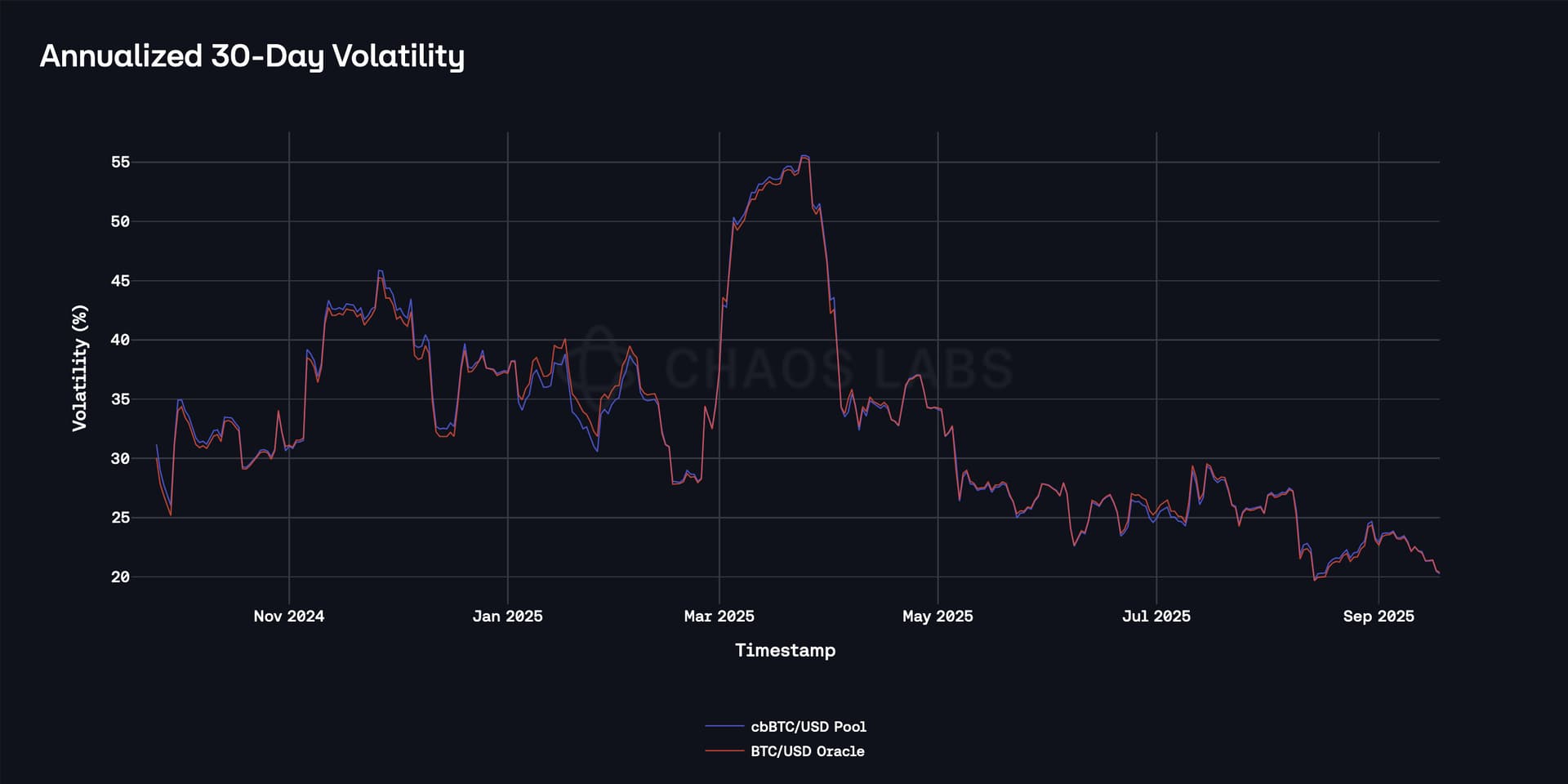

cbBTC Listing

We provided recommendations to list cbBTC in a timely manner, conducting research before the asset had been listed by conversing with the relevant teams. This allowed Aave to be one of the first lending protocols to list the asset, whose supply has grown quickly and for which we have facilitated cap increases.

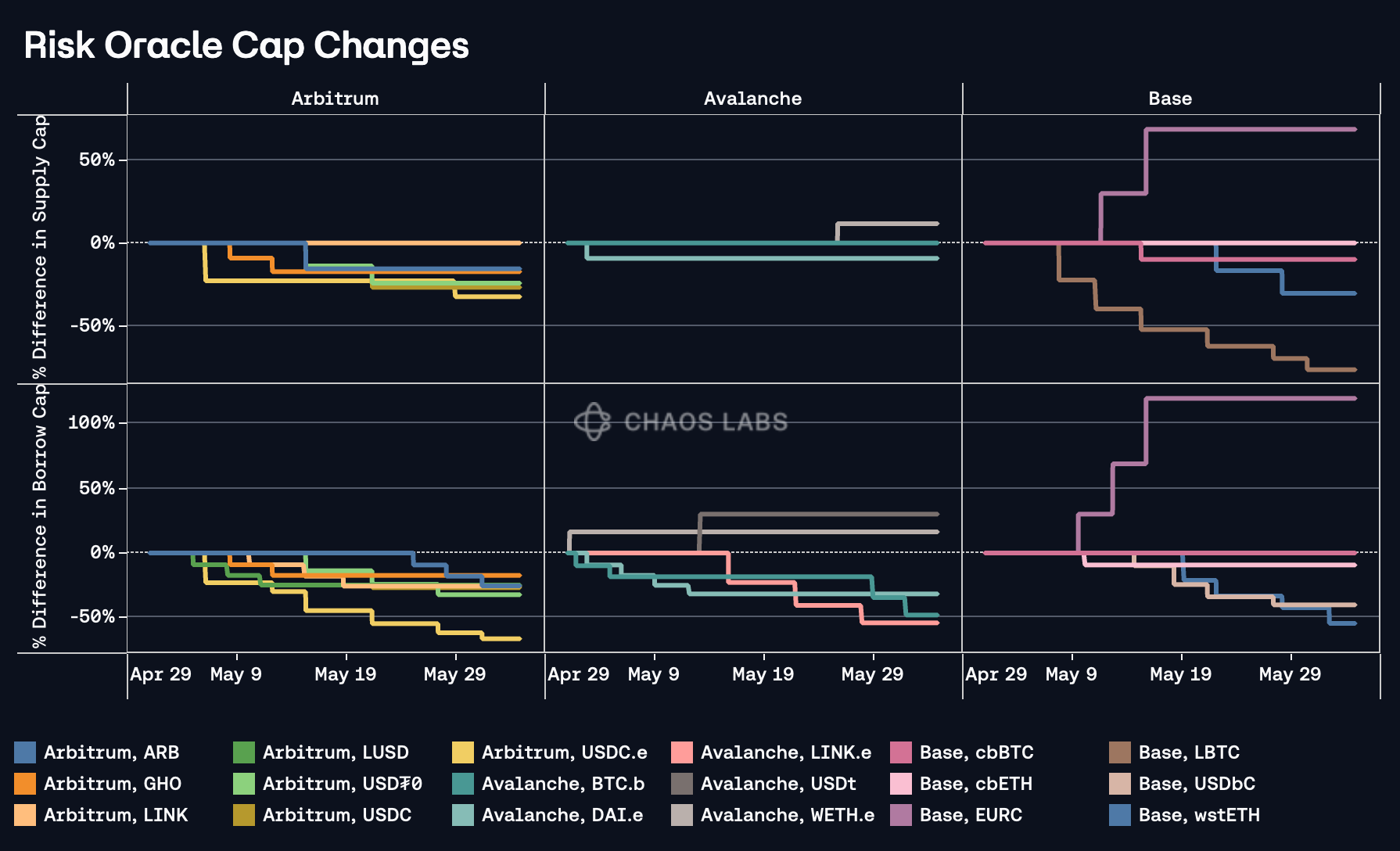

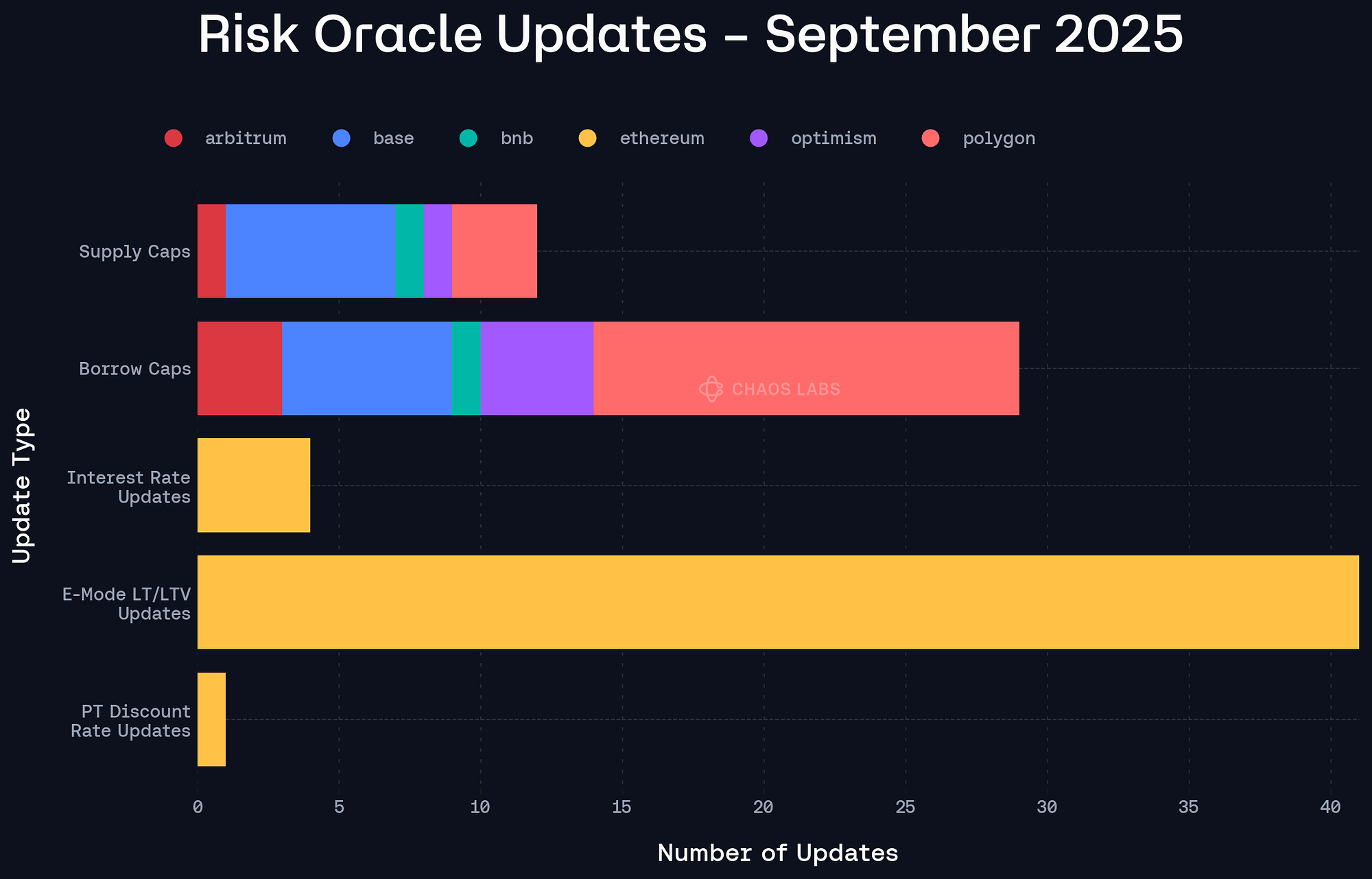

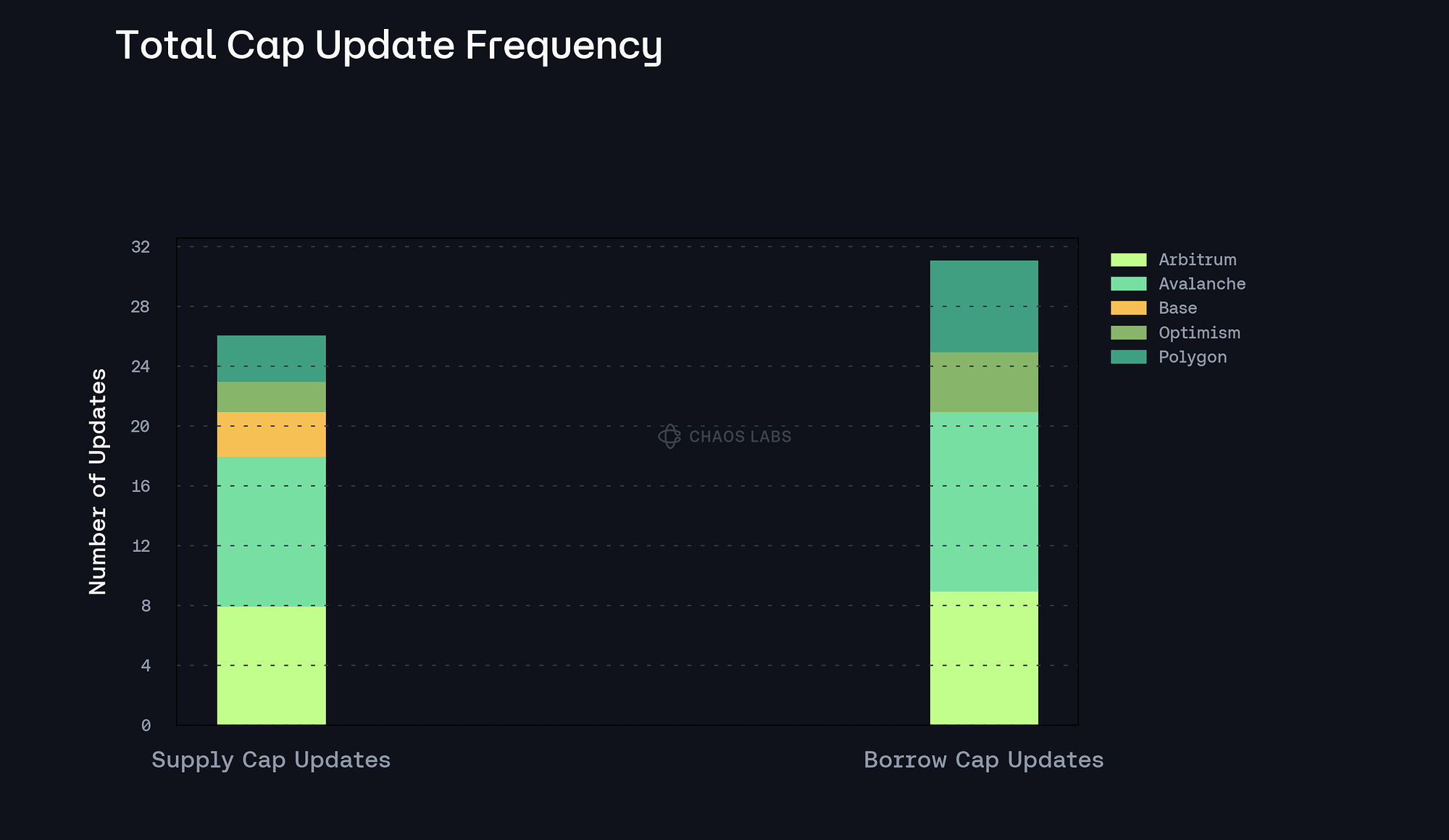

- Over the course of the month, we published the following proposals for risk parameter updates:

- [ARFC] Chaos Labs Risk Parameter Updates - Increase Supply Caps on Aave V3 - 09.03.2024

- [ARFC] Chaos Labs Risk Parameter Updates - Increase Supply Caps on Aave V3 - 09.04.2024

- [ARFC] Chaos Labs Risk Parameter Updates - Increase GHO Borrow Caps on Arbitrum V3 - 09.04.2024

- [ARFC] Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 09.06.2024

- [ARFC] Chaos Labs Risk Stewards - Increase Supply Caps on Scroll V3

- [ARFC] Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3

- [ARFC] Chaos Labs Risk Parameter Updates - sAVAX LT/LTV Adjustment

- [ARFC] Chaos Labs Risk Parameter Updates - LTV and LT Alignment

- [ARFC] Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 09/17/24

- [ARFC] Chaos Labs Risk Stewards - Increase GHO Supply Caps on Arbitrum V3 - 09/17/24

- [ARFC] Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3 - 09/24/24

- [ARFC] Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 09/23/24

- [ARFC] Chaos Labs Risk Parameter Updates - WBTC Parameter Adjustments

- [ARFC] Chaos Labs Risk Stewards - Increase ETHx Supply Caps on Ethereum - 09/25/24

- [ARFC] Chaos Labs Risk Stewards - Increase GHO Borrow Caps on Arbitrum V3 - 09/26/24

- [ARFC] Chaos Labs Risk Stewards - Increase Supply and Borrow Caps on Aave V3 - 09/25/24

- [ARFC] Chaos Labs Risk Stewards - Increase Supply Caps on Aave V3

- Additionally, we provided analysis regarding the following proposals and discussions:

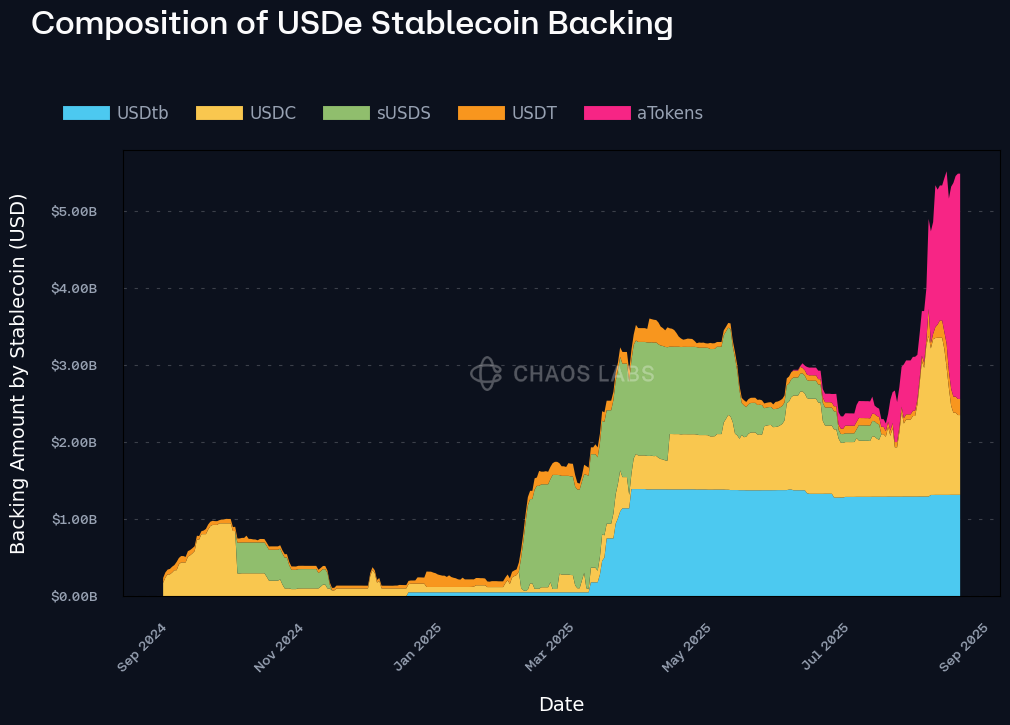

- [ARFC] Onboard USDS and sUSDS to Aave v3

- [ARFC] Adjusting WBTC Parameters to Address BitGO Transition Risks

- [ARFC] Lido Instance - wstETH Slope1 & Uoptimal Update

- [ARFC] Onboard tBTC to Aave v3 on Ethereum, Arbitrum and Optimism

- [ARFC] Onboard cbBTC to Aave v3 on Base and Mainnet

- [ARFC] Remove Community Preference For Supply Cap Limits

- [ARFC] Lido Instance - Reduce wstETH Borrow Cap

- [ARFC] Onboard STONE to Aave V3 on Scroll

- [ARFC] Onboard wstETH to Aave V3 on BNB Chain

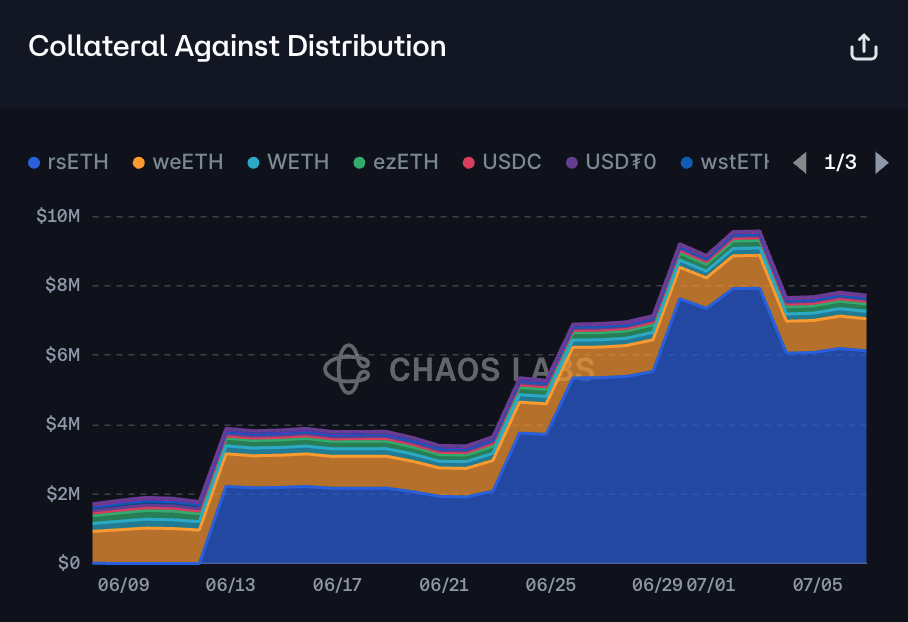

- [ARFC] Deploy an Etherfi/Stablecoin Aave v3 Instance

What’s Next

In the coming months, the Chaos team will continue its focus on the following areas:

- GHO: ongoing recommendations, including updating parameters for GHO on Arbitrum.

- Continuation of the V2 risk parameter updates to gradually reduce capital efficiency across V2 collateral assets.

- Continuous optimization of risk parameters on all V3 deployments.

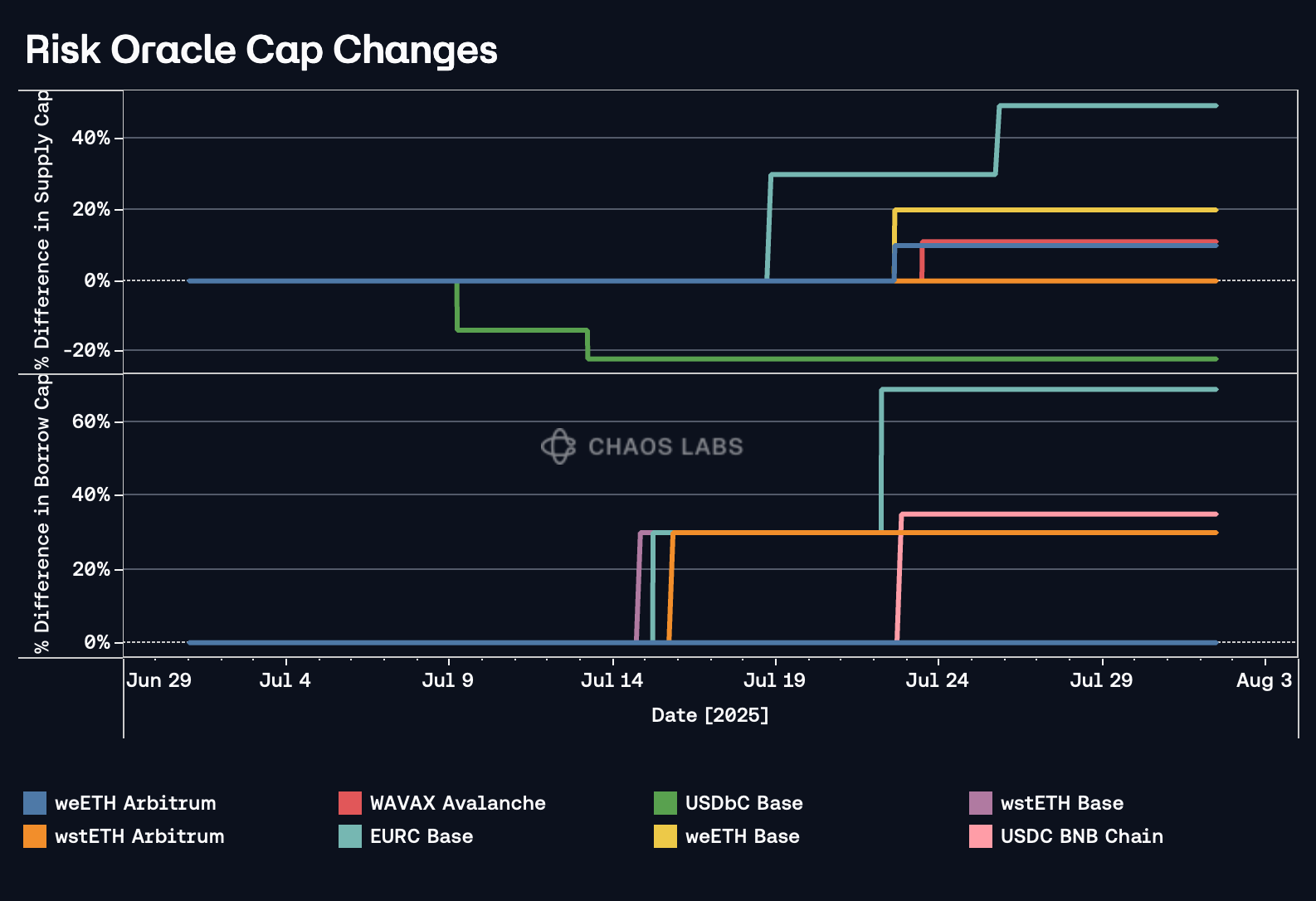

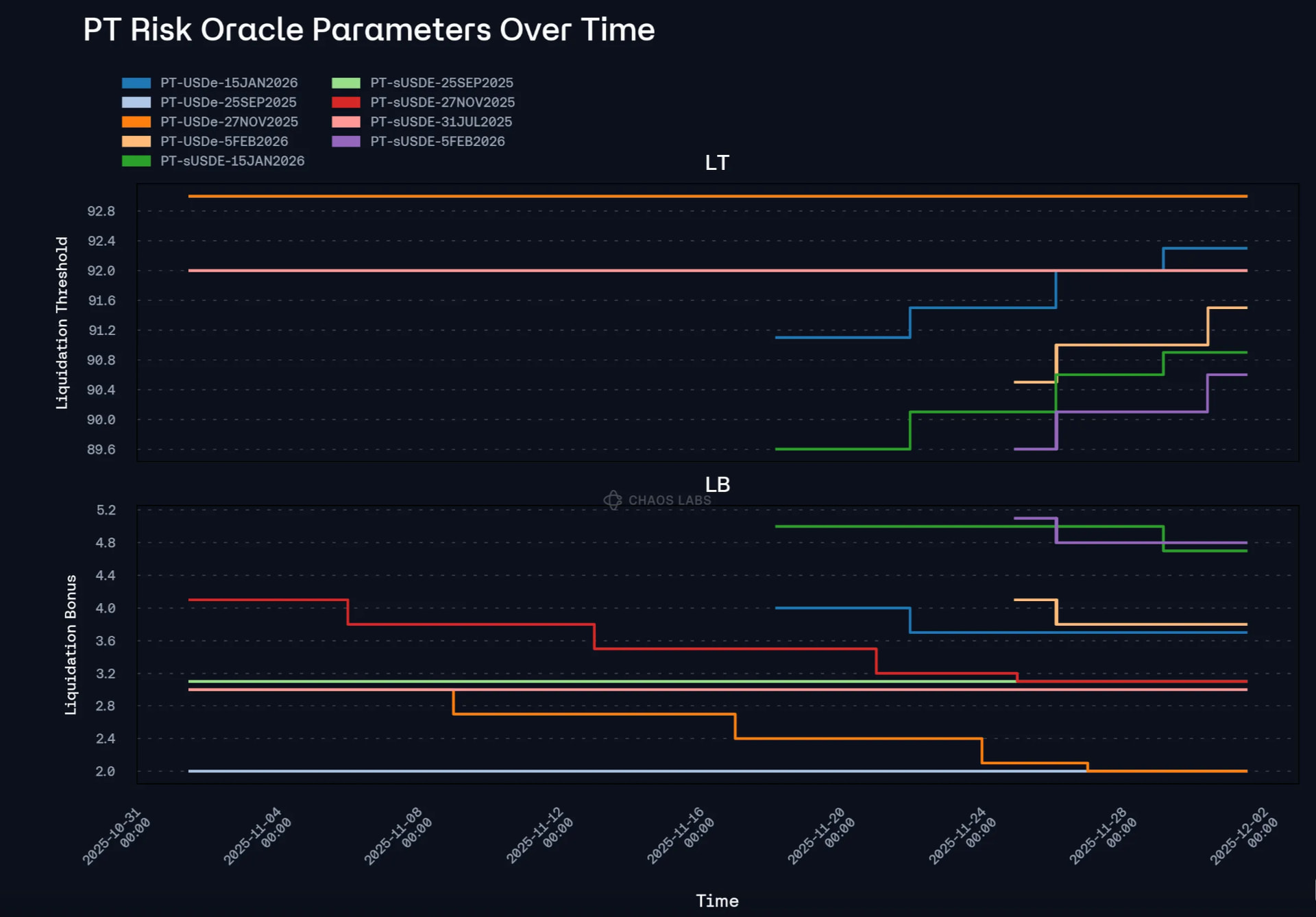

- Implement Chaos Labs Risk Oracles.

- Analysis and parameter recommendations for new assets and markets.