Overview

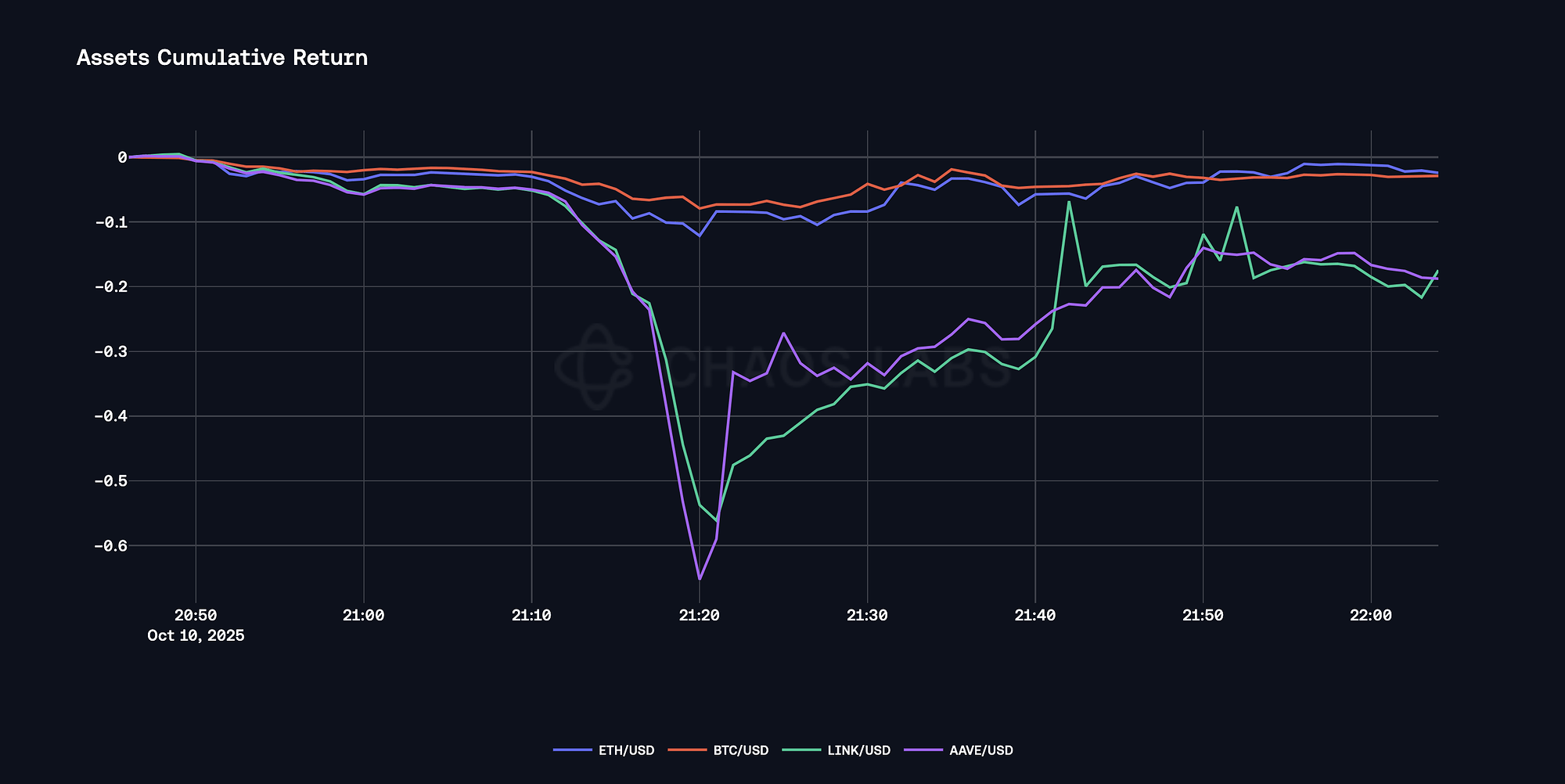

Following President Trump’s announcement of new tariffs on Chinese imports, financial markets underwent one of the most severe and rapid drawdowns in recent history. Within a span of just 30 minutes, Bitcoin’s price declined by over 12%, falling from $116,500 to $102,700. Ether experienced an even sharper correction of approximately 20%, while numerous other assets depreciated by more than 50-60% in just a 10 minute span during the same period. This abrupt market dislocation triggered widespread liquidation cascades across both DeFi and CeFi platforms. Notably, alongside significant liquidation bonus accrual, of which highly outpaced deficit accrual, Aave concluded the event with a net profit of $1.5 million, facilitating over $180M in liquidations.

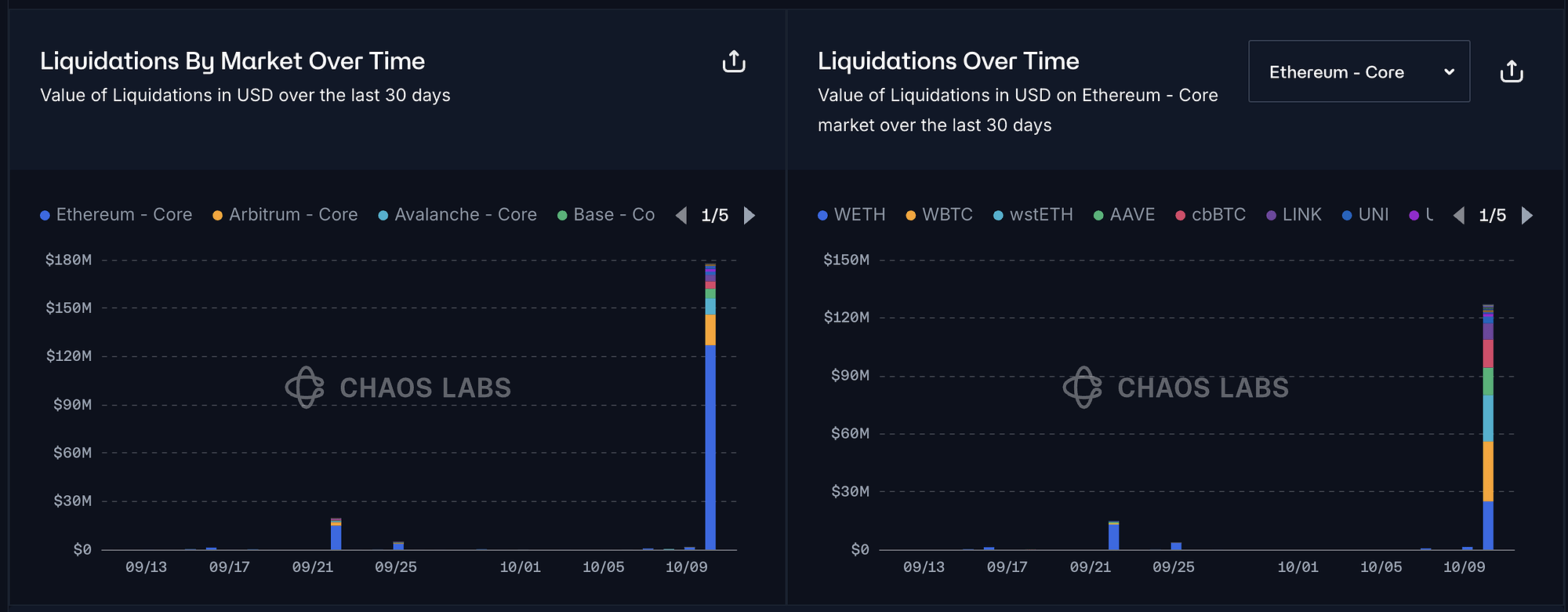

Liquidation Volume

The market downturn triggered a broad wave of liquidations across Aave instances, primarily concentrated in BTC, ETH and WSTETH markets. Total onchain liquidation volume reached approximately $180 million.

The event generated approximately $10 million in liquidation bonuses, of which $1 million was paid to the DAO treasury as liquidation fees.

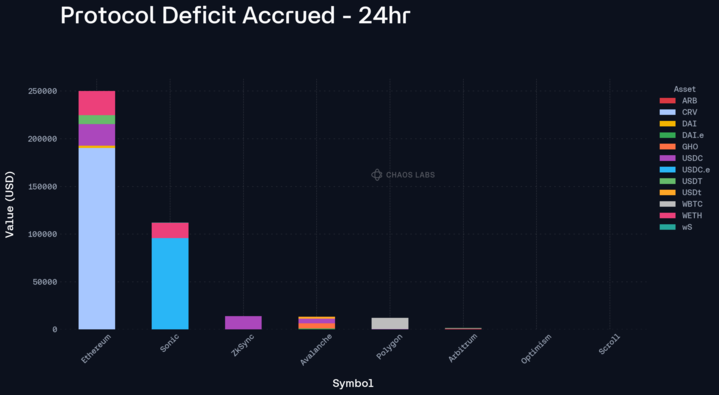

Bad Debt

In accordance with the market downturn, certain positions failed to clear due to thin liquidity and gas spikes, alongside significant oracle delays. As of writing, the protocol accrued approximately $400,000 in deficits outstanding. The majority of this deficit originated from CRV and ENS debt positions, which faced limited onchain liquidity during the drawdown and thus enabled effective arbitrage by an entity simply based on the ability to utilize the ETH generalized config (83% LT) to borrow assets whereby the price oracle had not updated sufficiently relative to onchain prices, leading to bad debt.

One notable ENS debt position, backed by only $2 in ETH collateral against roughly $88k in ENS debt, remains unliquidated due to its unprofitable liquidation conditions. As a result, this position is not reflected in the aggregated deficit data, among another $10K in external non-deficit expected bad debt.

Additionally, collateral contributions to the deficit mostly stemmed from LINK, wS and UNI exposures.

These positions represent a manageable shortfall as market conditions stabilize.

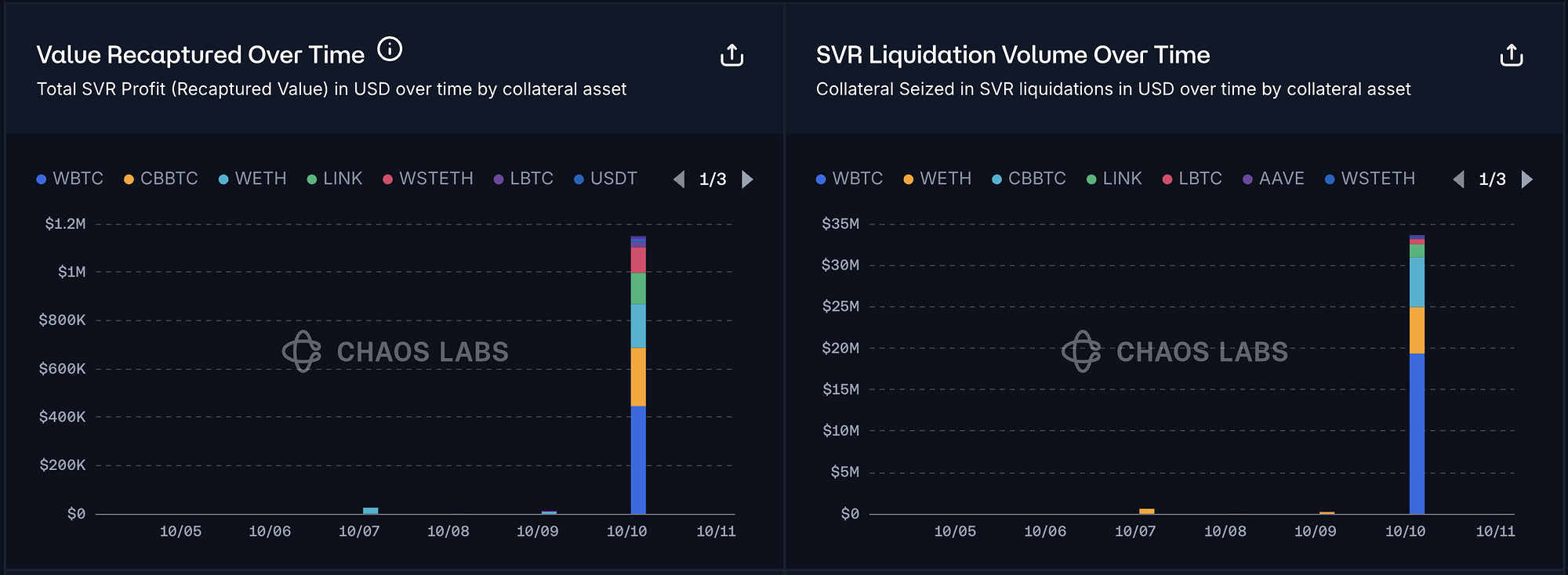

SVR

SVR liquidations generated approximately $1 million in additional revenues for the DAO, across $35M in liquidation volumes primarily stemming from WETH and BTC feeds.

However, the event temporarily impacted oracle performance, with the price updates delayed by 5 blocks for some markets. During the delay, onchain prices for AAVE and LINK SVR feed deviated by 45% and 32%, respectively, from their purported newTransmission value, while ETH exhibited a 6.51% dislocation. Specifically, this implies that, during severe price deviations such that oracle prices attempted to update nearly every block, the lagged state of the SVR feed until the cutoff window of 5 blocks made it such that the ultimate singular relative price update led to 30-40% price dislocations, and thus instantaneous reporting of collateral/debt value at levels of deficit accrual.

Since market prices rebounded shortly after, the delayed oracle updates did not result in further losses. Nonetheless, in a scenario where price declines had persisted, the lag could have led to an increase in bad debt due to delayed liquidations.

Conclusion

Overall, the flash crash resulted in approximately ~$500k in bad debt and expected deficit, primarily driven by illiquid CRV and ENS positions and SVR oracle delays. While this represents a moderate negative outcome, it was offset by liquidation activity that generated around $1 million in liquidation fees and an additional $1 million from SVR liquidations.

The protocol remained overall net positive, with an estimated net profit of $1.5 million following the event.