Title: [ARFC] Ethena USDe Risk Oracle and Automated Freeze Guardian

Author: LlamaRisk

Date: Friday, October 24th, 2025

Summary

This post outlines a proposal for an enhanced, risk-managed price oracle and automated freeze guardian for USDe and its derivatives on the Aave protocol. Recent market events have highlighted the importance of having resilient collateral pricing strategies to mitigate the solvency risk Aave takes on. Given these events, it is prudent to upgrade Aave’s USDe pricing mechanism, which currently pegs USDe to the USDT market price.

The proposed system creates a more resilient and proactive framework that protects Aave from solvency risk while shielding users from premature liquidations caused by transient market dislocations. This improvement is enabled by @Chainlink_Labs, whose battle-tested decentralized oracle network (DON) infrastructure already underpins numerous data and interoperability oracle services used by Aave (e.g., Price Feeds, Proof of Reserve, CCIP, LlamaGuard NAV).

At this time, supply caps are set in Ethena-related assets such that Aave has up to $5.5B additional potential exposure to Ethena. To mitigate risks of this potential additional exposure, this trust-minimized system consists of two parts: 1) the dynamic, risk-managed pricing oracle, using the most representative pricing source in different situations, and 2) the protective action-taking mechanism, performing USDe-related reserve freezes if any of the specified risk signals indicate potential solvency stress. These components shield Aave from further harm while protecting current users, creating a more resilient and secure solution.

A critical aspect of this architecture is that it introduces no additional trust assumptions. The entire solution will run on-chain with DAO-approved oversight and via the existing Chainlink infrastructure. LlamaRisk will have no privileged access controls and cannot make unilateral changes to the system’s logic or parameters. This design ensures the system is both highly secure and fully auditable. Furthermore, introducing proactiveness into the system will improve Aave’s resiliency and, therefore, can improve the collateral efficiency of Ethena’s assets on Aave.

This is an early-stage proposal to kick off discussion on fundamental upgrades to Aave’s pricing strategies. We continue to collaborate with Ethena on suitable system stress indicators and parameterization of emergency response. Our highest priority is to ensure the continued stability of Aave markets and support its safe exposure to Ethena assets for the benefit of both protocols and their users.

Motivation

Aave currently prices USDe on par with the USDT price feed. This design was chosen deliberately to safeguard Aave users from the risk of unnecessary liquidations, while tying USDe’s price to its most heavily weighted backing asset for hedging positions (i.e., USDT), and the largest stablecoin backing allocation. Given that USDe can experience temporary de-pegs driven by market sentiment or short-term liquidity constraints on secondary markets, a direct market-priced oracle could trigger liquidations that do not reflect USDe’s actual backing. While this approach effectively protects borrowers, it transfers the solvency risk to the Aave protocol.

In a fundamental backing-related USDe failure scenario, the on-par pricing would prevent necessary liquidations until the oracle is manually updated, potentially leading to an accumulation of bad debt, as outlined in extensive discussions earlier this year. Protection from further exposure depends on a manual freeze initiated by the Guardian multisig. This method introduces inherent latency, as the process necessitates a coordinated human response for situational analysis, signature collection, and transaction execution. Nonetheless, this framework was chosen because Aave already bears most of Ethena’s solvency risks.

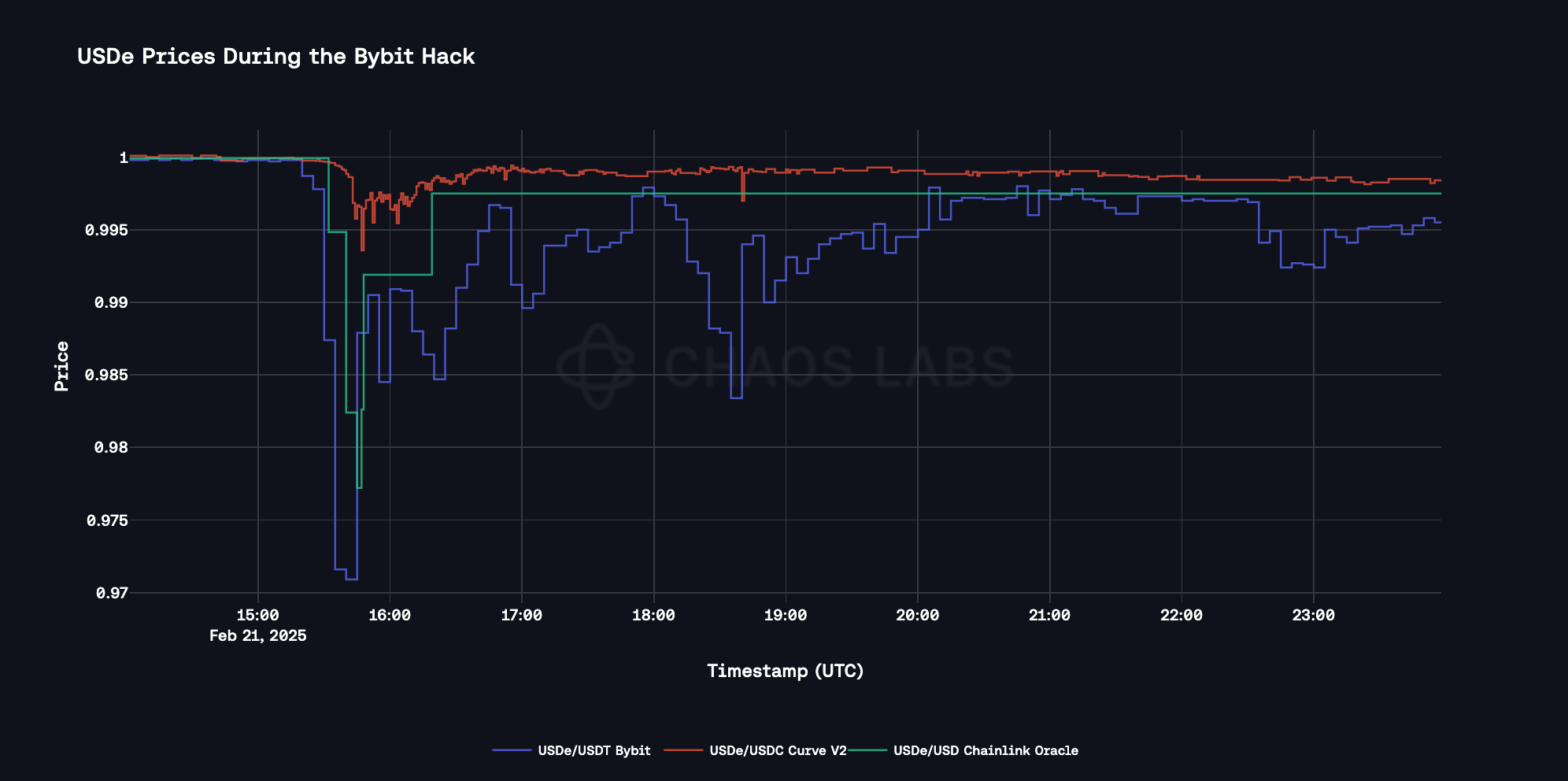

During the October 10th aggressive cryptocurrency market volatility events on centralized exchanges, most notably Binance, USDe’s secondary market price experienced a significant, albeit temporary de-peg, moving the price down to $0.65 at the lowest point. However, it is crucial to note that Ethena’s core redemption mechanism proved resilient despite this secondary market dislocation. The protocol handled a significant inflow of redemptions during this event and during the previous stressful event of the Bybit exploit, keeping the redemption flow completely functional and successfully processing more than a billion dollars of USDe redemptions without issue.

While Aave avoided immediate issues from the de-peg on Binance by pricing USDe on par with USDT, the crypto community again raised concerns that this was not an optimal pricing method. In a real insolvency event, this approach would cause Aave to assume all of Ethena’s solvency risk, as the protocol could be exploited as an exit venue for USDe holders. Such tail risks must be addressed proactively.

Note: Chainlink USDe/USD price feed, which sources from multiple venues, did not deviate significantly during this localized de-peg, registering a minor 70 basis point deviation, in line with broader market pricing.

Why is Exposure Limiting Important?

Aave currently prices USDe collateral using the Chainlink USDT/USD price feed. This pricing mechanism creates a critical dependency: in the event of a fundamental failure of Ethena’s backing, USDe’s market price could collapse, but the USDT/USD oracle used by Aave would remain stable at ~$1.00. This opens a window for exploitation:

- Acquire de-pegged USDe at a steep discount on the open market.

- Deposit it into Aave, valued at ~$1.00 via the USDT price feed.

- Borrow fully collateralized assets against it up to the maximum LTV.

- Default on the loan, leaving Aave with overpriced collateral and bad debt.

To understand the magnitude of the potential bad debt that could be created from this point forward, the table below outlines the maximum new debt that could be created against USDe-related assets. This is calculated using the remaining available supply capacity for each asset. In a de-peg scenario, this entire amount could be rapidly borrowed against newly deposited, devalued collateral, turning into immediate bad debt for the Aave protocol.

| Asset Name | Max LTV (%) | Supply Cap ($M) | Currently Supplied ($M) | Remaining Capacity ($M) | Potential New Debt ($M) |

|---|---|---|---|---|---|

| USDe | 94.0 | 2,700 | 920 | 1,780 | 1,673 |

| sUSDe (Staked USDe) | 90.0 | 2,050 | 1,010 | 1,040 | 936 |

| eUSDe (Pre-deposit Vault) | 94.0 | 550 | 64 | 487 | 457 |

| PT sUSDe Nov 2025 | 92.0 | 2,380 | 1,540 | 840 | 773 |

| PT USDe Nov 2025 | 92.6 | 1,990 | 175 | 1,815 | 1,681 |

| Total Immediate Risk Exposure | 5,521 |

In comparison, Ethena’s current stablecoin backing is at $7.35B.

Improving Upon the System

The choice between user protection and protocol solvency is not a binary one. A more advanced system can be implemented to achieve both. We propose a new framework that separates the oracle’s functions into two distinct components: a dynamic pricing system and a proactive action-taking system. The pricing system is designed to switch between different data sources based on real-time indicators of Ethena’s health, ensuring the most appropriate price for USDe is used under various conditions. The action-taking system works in parallel as a circuit breaker, capable of freezing the USDe markets to protect Aave’s solvency if severe stress signals are detected and avoid additional exposure. Together, these components create a comprehensive, responsive, prudent risk management framework.

The Action-Taking System

The Action-Taking System is a proactive safety mechanism. This system is minimally invasive for existing users and, importantly, is not responsible for determining liquidation prices. It acts as an emergency circuit breaker to protect the protocol, freezing the USDe-priced reserves and implicitly limiting the incremental exposure to USDe’s solvency.

The circuit breaker is triggered by stress signals from any of the following four distinct categories, providing comprehensive, defense-in-depth monitoring. These categories are subject to change depending on viability:

- Market Stress: Monitors the market prices of USDe and its backing stablecoins (e.g., USDT, USDC) for signs of broad market de-pegging.

- Redemption-System Stress: Tracks the on-chain health and operational capacity of Ethena’s core mint and redeem functions.

- Proof of Reserve (PoR) Stress: Verifies official reports on Ethena’s collateralization to confirm that assets fully back the circulating supply.

The system acts on a single‑trigger basis: if one stress category fires, the system freezes all USDe‑priced reserves. Unfreezing happens only after signals normalize for a defined cool‑off period. The mechanism is automated through the Chainlink platform, inheriting the same trust and liveness properties as existing Chainlink price feeds.

The first category is market stress, captured from Chainlink price feeds for the USDe backing stablecoins such as USDT, USDC (and PYUSD if the amount held in the backing is significant to exceed the current reserve fund size). Following the same rationale, stETH/ETH internal exchange rate (and other LSTs) should be included in the aggregation, due to Ethena’s exposure to these LSTs as part of its hedging assets portfolio. If these prices trade below $0.99, the system interprets that as a broad, cross‑stable dislocation rather than a single‑venue artifact. Price weakness in the stablecoin complex tends to precede redemption pressure, so reacting here gives Aave time to contain risk before stress propagates into positions.

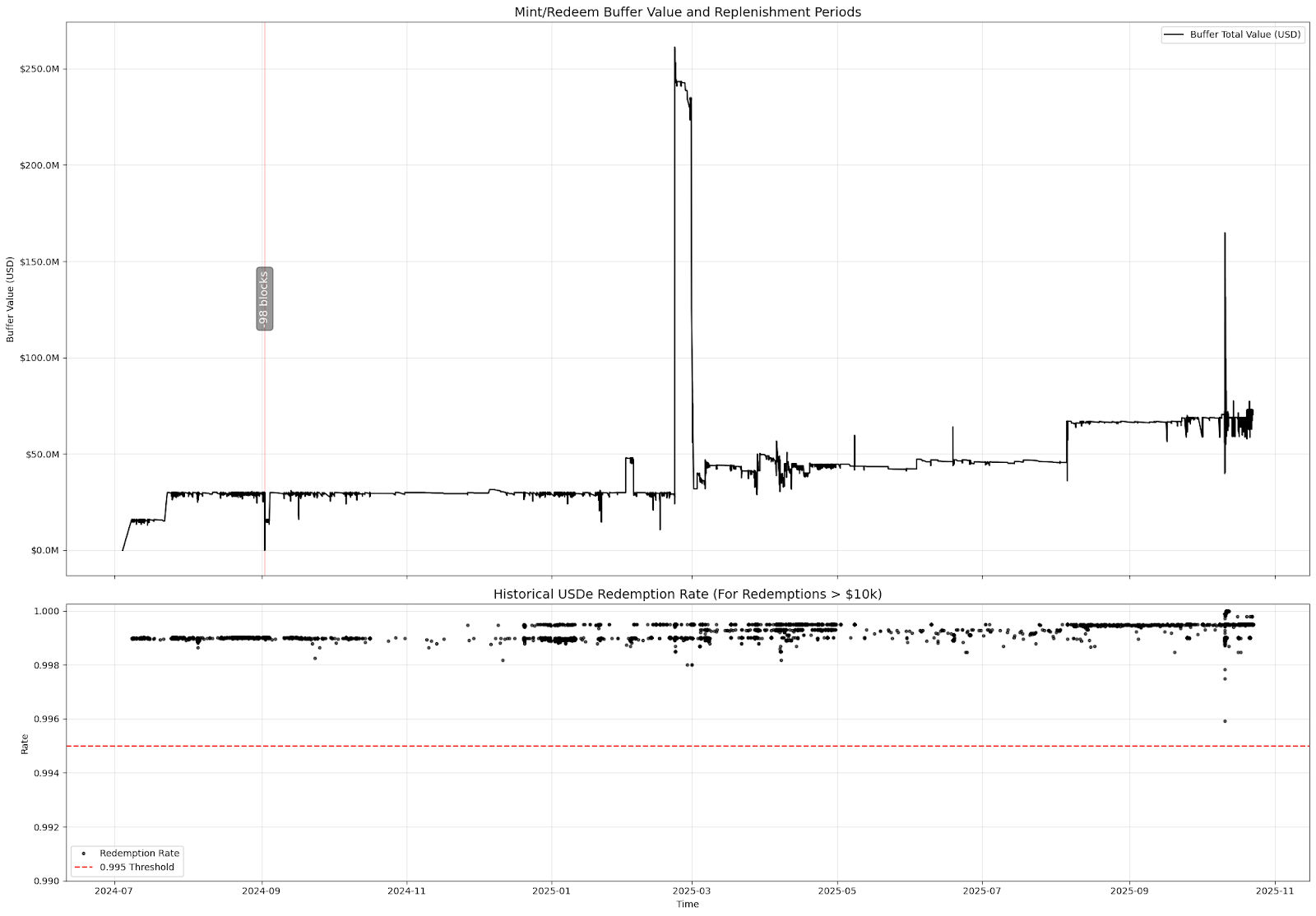

The second category is redemption‑system stress, which monitors the health of Ethena’s mint/redeem process directly on-chain. The mechanism monitors whether the redemption buffer is replenished to at least $2M within 50 blocks, and whether the redemption contract is paused. Any of these conditions suggests that operational liquidity is constrained or deliberately throttled. When redemptions cannot be served promptly, the safest course is to ensure Aave cannot be used as exit liquidity while Ethena stabilizes operations.

The third category is the PoR reported by Ethena and verified by independent third parties, including LlamaRisk, Chaos Labs, and Chainlink. It accepts the PoR report as an authority on Ethena’s solvency and will trigger action if collateralization < 100% is reported. This is most likely a lagging indicator, given the infrequent PoR updates; however, it is the most direct insight available about the state of Ethena’s reserves.

Future upgrades to the Action Taking Mechanism can include hedging stress indicators that take perp exchange data, such as slippage, spot vs. perp spreads, and funding rates as proactive risk triggers. To minimize false positives, such trigger conditions shall involve extensive analysis and back testing by Aave risk providers working in collaboration with the Ethena team.

When any category triggers, the system freezes USDe‑priced reserves across Aave. A freeze halts new borrows and disables new collateral enables on the affected assets, but existing positions continue to accrue interest and can be repaid or deleveraged normally. Liquidations can also happen during that time, facilitating exposure lowering. This design prevents Aave from becoming an exit venue during stress and caps incremental exposure without forcing liquidations purely due to transient signals.

The scope of the freeze includes USDe itself and downstream assets priced from it, such as sUSDe and PT‑USDe, ensuring consistent behavior. After all triggered indicators clear (metrics back within thresholds), the mechanism waits for a cool‑off interval—defined in blocks or minutes—before automatically unfreezing; Guardians and governance retain override capability for exceptional cases.

Because the circuit breaker only freezes new supply and borrows, and never changes collateral valuations, it does not create bad debt. It simply buys time for pricing to converge and for operations to normalize, allowing natural repayments and deleveraging to proceed. In effect, the mechanism mitigates Aave’s exposure to USDe‑related insolvency risk, yet minimizes user disruption and preserves the protocol’s openness once conditions stabilize. Our design, however, prioritizes stable protocol operation; therefore, we implement risk triggers that minimize instances of false positives.

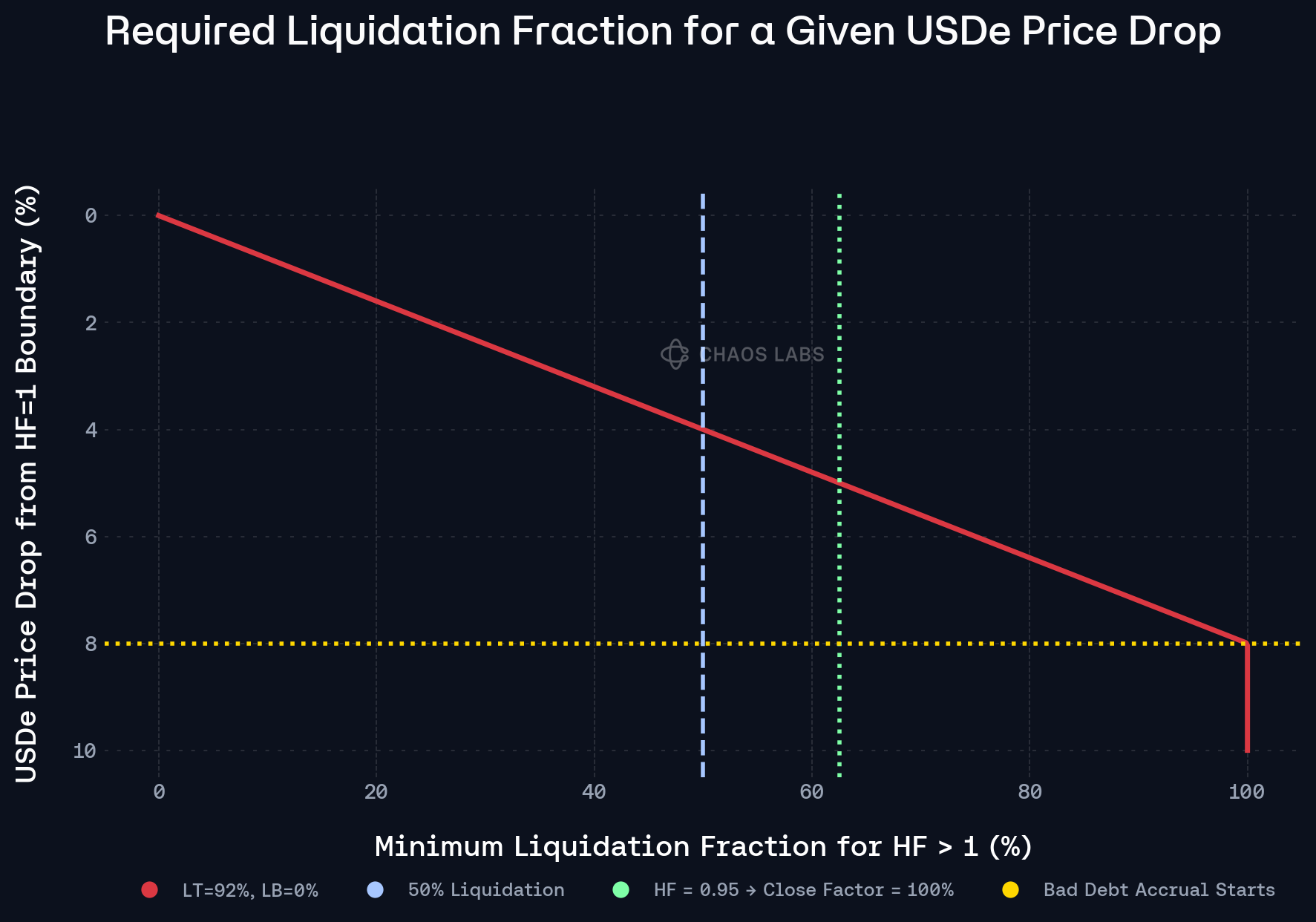

Risk-managed Pricing

The core of the new proposal is a dynamic pricing logic that evaluates a hierarchy of signals to determine the preferred USDe pricing method. The system is designed to be resilient, defaulting to the most reflective pricing sources as risk signals appear. The logic is illustrated in the following flow chart.

The system operates as follows:

- It first checks Ethena’s core operational health by verifying if redemptions are being processed promptly and the mint/redeem buffer has been replenished to at least $2M over the last 50* blocks (~10 minutes). Suppose the redemption buffer is not being replenished on time. In that case, it indicates a severe operational issue, and the system switches to a market-based pricing source, a time-weighted USDe/USD market price oracle.

- If redemptions are operational, the system verifies Ethena’s Proof of Reserves (PoR) from the attestors - LlamaRisk, Chainlink, Chaos Labs & HT Digital - to check if the system is fully collateralized. If collateralization is below 1, it signifies a direct risk to USDe’s backing, and the system then defaults to a mechanism that defines USDe price as the latest USDe redemption rate returned in the Mint/Redeem contract. It is notable that due to the assumed staleness of Ethena’s PoR (currently reported at a 7-day frequency), the indicated collateralization cannot be taken as an accurate measure of the exact USDe backing level, needing to source the USDe backing rate from the Mint/Redeem contract.

- If redemptions and collateralization are healthy, it performs a final check on the live redemption rate from Ethena’s Mint/Redeem contract. If the rate is at or very near par, excluding the usual 10 bps redemption fee (>= 0.999) and gas costs (which are included in the exchange rate calculation), the system is considered fully healthy. Due to the gas cost impact on the exchange rate, a redemption size threshold would be applied. In this state, the oracle can use the most accurate of several price sources, either the currently used Chainlink USDT/USD price or an aggregate market price measure of the stable assets backing USDe and denominating the perpetual hedging pairs.

- If the redemption rate is below this threshold, the oracle will use it as the price source, again applying a redemption size threshold. In cases where the initial checks on redemptions or PoR reported collateralization fail, the system switches to a time-weighted USDe/USD oracle price, which is designed to handle market stress gracefully, not switching to a potentially more aggressive market price of USDe at an instant, but doing it gradually.

Note: Ethena has been briefed on the overall operational flow, and we are actively working with their team to align on all trigger conditions and parameterization to ensure high reliability of the dual price feed and the incorporated risk indicators.

Time-Based USDe Oracle

A key component of the stressed-condition response is the time-weighted oracle. This mechanism is designed to smooth out sudden, volatile price dislocations and protect the Aave protocol from the short-lived de-pegs observed historically. This is achieved using a specifically tuned exponential moving average (EMA) of the USDe/USD market price.

Instead of instantly adopting the new, lower market price during a de-peg, this oracle gradually moves the price from 1 USD toward the Chainlink USDe/USD market price. The adjustment is based on a simple formula where the new price is a weighted average of the current oracle and live market prices. This creates an exponential slope that allows the oracle to catch up to a sustained de-peg quickly but dampens the immediate impact of flash crashes, giving the market time to stabilize and preventing unwarranted liquidations.

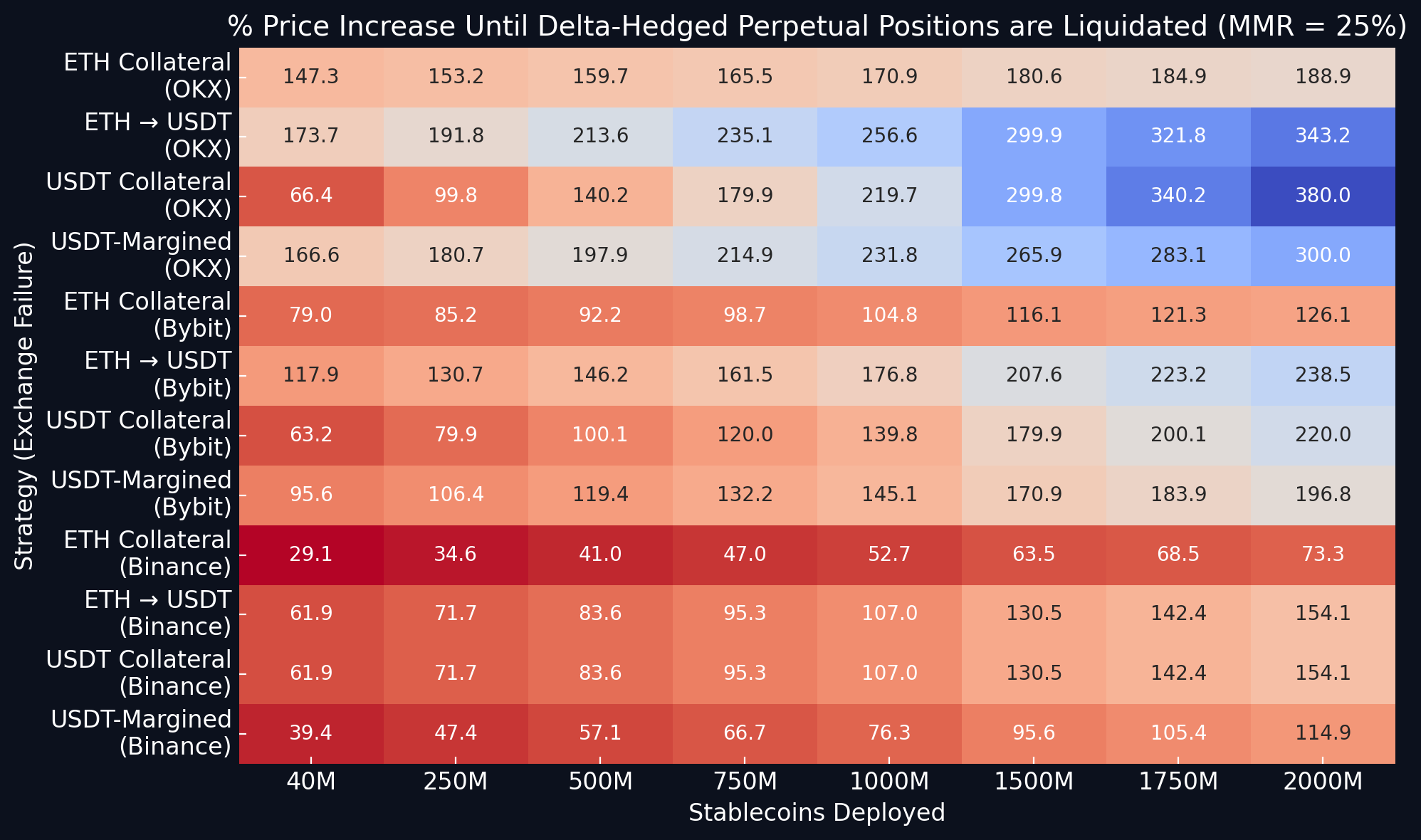

Another effect of the gradual price move is making the positions liquidatable in increments, not aggressively at once. Based on our previous analysis, sharp depegs were observed not to have the immediate DEX liquidity depth required to support successful liquidations.

Aggregate Market Price Based on Backing Composition

Instead of relying on a single stablecoin (e.g., USDT) as a fallback reference, we propose an aggregate market‑price oracle constructed from the stable assets that back USDe or denominate the perpetual hedging pairs. The idea is straightforward: each constituent stablecoin or asset contributes to the reference price in proportion to its share of Ethena’s effective exposure. If USDT accounts for 50% of the combined backing and hedge‑denomination footprint, it receives a 50% weight; if USDC accounts for 20%, it receives a 20% weight; and so on for PYUSD, DAI, or other constituents. If significant, stETH/ETH internal exchange rate (and other LSTs) should be included in the aggregation, due to Ethena’s exposure to these LSTs as part of its hedging assets portfolio. The resulting index reflects the value of the collateral basket and the currency units in which hedge PnL accrues, producing a more accurate proxy for USDe’s underlying economics than any stable.

Weights would be sourced from Ethena’s reported backing composition, which is already published and can be consumed programmatically. The oracle ingests this composition on a regular cadence (daily by default) and can refresh more frequently if Ethena provides interim updates during periods of rapid rebalancing. For operational reasons, however, frequent updates to the rebalancing may not be possible. Between updates, the index prices each constituent using its respective Chainlink USD feed, applying the most recent weight vector. This approach keeps the price reference aligned with the real-time backing and hedge denomination mix without introducing undue operational churn.

Operationally, the aggregate index maintains the same trust assumptions as existing Chainlink feeds: constituent prices are read from Chainlink oracles, the weighting and aggregation are executed on a transparent contract, and all parameters and updates are emitted as on‑chain events. Governance and Guardians can set guardrails such as maximum per‑asset weights, minimum asset quality criteria, and failover behavior if a constituent feed is stale. This produces a robust, auditable fallback that tracks USDe’s effective exposure across the stablecoin complex rather than relying on any single asset.

Analysis & Takeaways

Our analysis of the proposed USDe Risk Managed Oracle validates the design via historical data and simulations. The system’s effectiveness is rooted in its use of verifiable, on-chain signals to inform its pricing and safety mechanisms.

A primary signal for the action-taking and pricing modules is the status of Ethena’s mint/redeem buffer. From a historical perspective, the contract shows a sole instance where the buffer was depleted, after which it was replenished within 98 blocks. Since that event, Ethena has adopted a more conservative management strategy, consistently maintaining a healthy buffer and even increasing its capitalization during periods of high redemption demand. This consistent operational performance is significant because a well-capitalized buffer ensures redemptions can be processed reliably and the value of USDe remains stable. This track record of stability validates using the buffer’s replenishment status as a dependable input for our proposed system. A failure to meet the replenishment threshold, as defined in the proposal, would serve as a clear, data-driven indicator of potential stress, allowing the system to take pre-emptive protective measures.

This operational integrity is also reflected in the on-chain redemption rates. The redemptions are serviced at a constant 1:1 rate, deducting a 10 basis point fee and gas costs, leading to consistent values around the $0.9990 level. The stability of this rate provides a reliable proxy for USDe’s fundamental value, anchored directly to its backing assets rather than fluctuating secondary market sentiment. In scenarios where market prices become dislocated, this on-chain rate offers a stable valuation anchor in scenarios where market prices become dislocated, especially as the mint/redeem contract remains functional. The proposed oracle is designed to leverage this, incorporating an adjusted redemption rate as a pricing source under specific stress conditions. This ensures the system has a logical, economically grounded value to fall back on, preventing it from being immediately influenced by temporary market panic or pricing anomalies.

Backtesting the proposed pricing feeds reveals further insights into its expected functioning. During a recent de-peg event, the observed spread between USDe and USDT widened notably. This was caused by a decrease in USDe’s price and a simultaneous increase in USDT’s price, driven by high demand for stablecoins during market-wide liquidations. This event illustrates the limitations of a single-asset peg for an asset like USDe, whose backing is composed of multiple stablecoins. The proposed system addresses this by incorporating an aggregate stablecoin feed designed to reflect the composition of USDe’s backing more closely. By sourcing prices from a basket of assets (USDT, USDC, PYUSD) and LSTs’ internal exchange rates, the feed’s construction goes a step further: the weights of these assets would be dynamically adjusted based on Ethena’s reported backing data. This approach creates a price benchmark representing USDe’s actual collateral dependencies. Instead of enforcing a full correlation with a single asset like USDT, the oracle’s price would inherently reflect the weighted value of its true backing. Consequently, should an issue arise with a single constituent stablecoin, its impact on USDe’s valuation would be adequately weighted according to its share of the collateral, providing a more accurate risk assessment and a more resilient price feed than a simple peg to USDT.

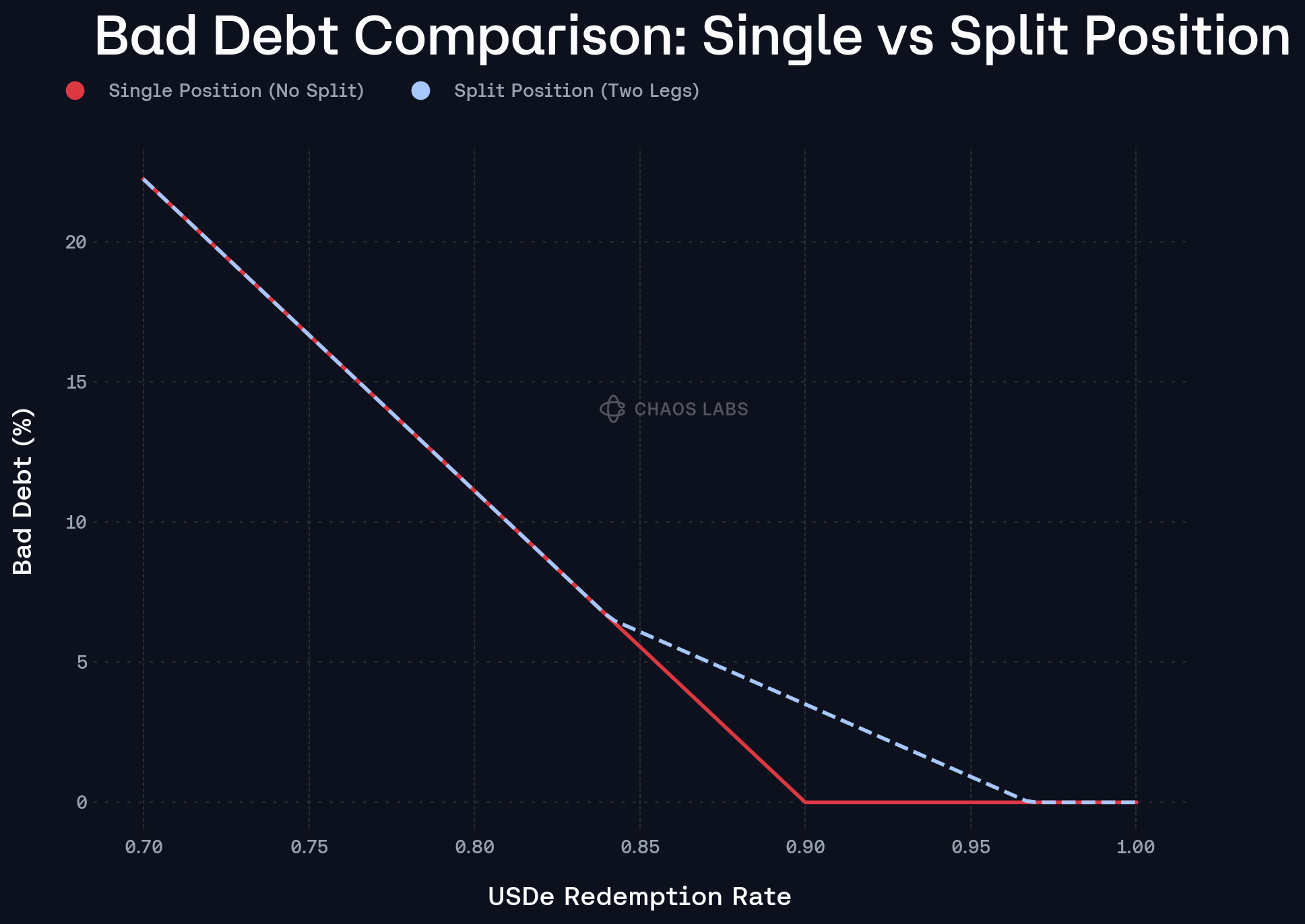

A central element for managing market stress within the proposal is the mechanism for transitioning the oracle’s price. A direct switch to a raw market price feed during volatility is suboptimal, as immediate price shocks on secondary markets are often more aggressive and rapid than any potential impairment to the underlying backing. To address this, the proposal utilizes a time-weighted price based on an Exponential Moving Average (EMA) to serve as a controlled, gradual smoothing mechanism. Our backtesting confirms that an EMA with a low alpha parameter (in the 0.05 to 0.1 range) is most effective. By design, a low-alpha EMA gives more weight to its stable historical price than to the most recent, and potentially volatile, market update. This means that a sudden, sharp price drop that quickly recovers—a common occurrence under volatile, stressful conditions—will have only a minimal impact on the oracle’s reported price. The system effectively waits for confirmation that a de-peg is sustained over time before it materially adjusts its valuation, thereby distinguishing between transient market noise and a genuine pricing dislocation.

The practical implication of this EMA mechanism is improving user protection and protocol safety. As our simulations show, collateral positions are not immediately subject to liquidation during temporary de-pegs. This creates a critical buffer period, allowing time for market arbitrage to potentially restore the peg or for users to manage their positions by adding collateral. This design balances the protocol’s need to respond to genuine de-pegs while protecting users from forced liquidations caused by short-term volatility.

This deliberate stability, however, introduces a tradeoff that must be considered: the system’s response to a slow, protracted de-peg that falls outside the distribution of historical volatility. Feed updates would be infrequent if a de-peg were to develop slowly and remain just within the Chainlink feed’s 0.5% deviation threshold. As the final heatmap illustrates, with a low-alpha EMA, it could take numerous updates (>5) for the oracle price to catch up, creating a window where the spread between EMA and raw price is apparent.

This risk is substantially mitigated by the oracle’s design; the EMA does not operate in a vacuum. A genuine, prolonged de-peg is highly likely to manifest across metrics the system monitors, such as increased redemption pressure, declining mint/redeem buffer, or even a reported undercollateralization, triggering a protective freeze before significant bad debt can accrue. A second, more benign tradeoff is that the oracle price will also recover back to its peg more slowly after a stress event stabilizes. For Aave, this is an acceptable outcome, as the minimal resulting price spread would not create meaningful arbitrage opportunities or significantly lower the borrowing power of the collateral.

Conclusion and Next Steps

This proposal represents a significant evolution in how Aave manages the risks associated with integrated assets like USDe. By moving from a static peg to a dynamic, risk‑managed framework, Aave can better balance user protection with protocol solvency. The system combines a responsive pricing mechanism that adapts to conditions with a proactive circuit breaker that limits exposure when credible stress emerges.

We are working closely with Chainlink to implement both components—the risk‑managed feed and the action‑taking mechanism—so they share the same reliability, transparency, and operational discipline as the price oracles already trusted by Aave. The intent is to publish all inputs and state changes on-chain, preserving transparency while ensuring robust automation and liveness through Chainlink’s infrastructure.

We will also work closely with the Ethena team to identify operational limitations and set reasonable expectations for determining potential stress scenarios. Our highest priority is to advance Aave’s pricing strategies toward improved resilience in all scenarios while maintaining superior user assurances. Ensuring these qualities will require Ethena’s alignment with Aave risk service providers and their support for the final system design.

The immediate next steps are to finalize the system’s thresholds and integrate guardian‑controlled fallbacks. Guardians would retain the ability to override, freeze, or revert configuration in edge cases, keeping operational risk assumptions minimal and aligned with the current Chainlink oracle model on Aave. This approach improves risk management and capital efficiency while maintaining Aave’s open and permissionless nature. We welcome comments and discussion from the community and Aave’s service providers to refine the design and help the DAO make a measured, well‑informed decision.

Disclaimer

LlamaRisk has not been compensated by any third party for publishing this proposal. LlamaRisk serves as a member of Ethena’s risk committee. Both LlamaRisk and Chainlink Labs provide independent third-party verification for Ethena Proof of Reserve (PoR).

Next Steps

- Publication of a standard ARFC, collect community & service providers’ feedback before escalating the proposal to the ARFC snapshot stage.

- If the ARFC snapshot outcome is YAE, publish an AIP vote for final confirmation and enforcement of the proposal.

Copyright

Copyright and related rights waived via CC0