Summary

A proposal to:

- Increase the supply cap of CELO on the Celo instance

- Increase the supply cap of PT-sUSDe-15JAN2026 on the Plasma instance

- Increase the borrow cap of USDe on the Plasma instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

CELO (Celo)

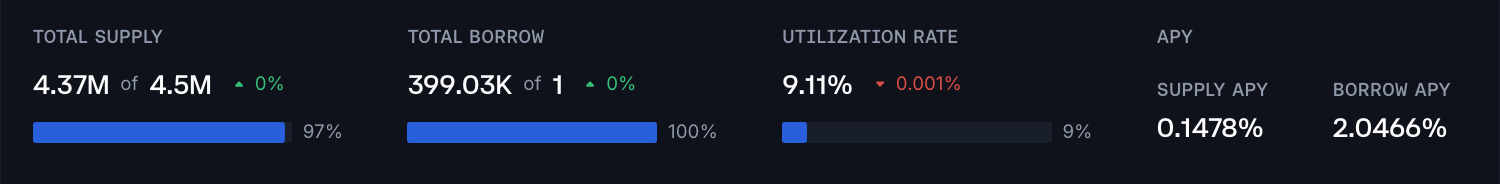

CELO has hit 97% utilization of its supply cap on the Celo instance, following an inflow of over 750 thousand tokens in the last 10 days, indicating substantial demand for supplying the token.

Supply Distribution

The supply distribution of CELO is moderately concentrated as the top user represents approximately 23% of the total, while top 7 positions have a cumulative share of over 75%. As can be observed from the chart, the majority of users either have no debt or very high health factors, which substantially limits the liquidation risk.

Currently, a net amount of $125 thousand is borrowed against CELO, where USDT represents over 92% of all debt posted. Additionally, CELO has a $500k debt ceiling, which limits the market’s maximum exposure to collateral volatility. Given the amount of borrowing, the debt ceiling, and high health factors, the market currently presents minimal risk.

Liquidity

Currently, a sell order of 1,000,000 CELO tokens would result in 5% price impact, presenting limited on-chain liquidity.

Recommendation

Considering the expansion in demand to supply CELO, the relatively low level of borrowing associated with the asset, and the active debt ceiling, we recommend increasing the supply cap of the asset.

PT-sUSDe-15JAN2026 (Plasma)

PT-sUSDe-15JAN2026 has reached its 400 million supply cap on the Plasma instance shortly after the previous supply cap increase. The parameters proposed further were achieved in close collaboration with the Plasma team, aiming to optimize collateral distribution, asset utilization, and enhance user retention.

Supply Distribution

The supply distribution of PT-sUSDe-15JAN2026 is moderately concentrated. The top user represents approximately 25% of the total supply, while the top 5 positions account for over 65% of the market. The distribution of health factors is expected for this type of strategy as they are clustered in the 1.02-1.05 range.

We observe that users are utilizing PT-sUSDe-15JAN2026 to collateralize USDT0 debt, thereby leveraging the spread between the fixed implied yield of principal tokens and USDT0 borrow rates. Given the correlation between the debt and collateral assets in the market, no significant liquidation risk is assumed.

Market & Liquidity

The implied yield for PT-sUSDe-15JAN2026 has exhibited moderate volatility, decreasing from 7.44% to 6.59% in the past 10 days. While the decrease in implied yield affects the price of the principal token, the magnitude of the impact is discounted proportionally to maturity; hence, the fluctuation in the price of the token has been minimal.

Additionally, Pendle’s AMM currently has over 23 million in liquidity and is able to facilitate a sell order of over 20 million tokens at minimal (0.05%) slippage, supporting an increase in the supply caps.

Recommendation

Considering the persistent demand to loop sUSDe-based principal token with stablecoins, along with the safe distribution of users’ health factors and highly correlated lending activity, we recommend increasing the supply cap of PT-sUSDe-15JAN2026 on the Plasma instance.

USDe (Plasma)

USDe has reached 75% of its $200 million borrow cap on the Plasma instance. With the recommended increase to the PT-sUSDe-15JAN2026 supply cap, we anticipate a proportional uplift in stablecoin borrowing demand. We expect a significant portion of this increased demand to be driven by the previously mentioned supply cap increase of PT-sUSDe-15JAN2026.

Borrow Distribution

The borrow distribution of USDe is fairly concentrated, as the top user presents approximately 38% of the total, while the top 4 users have a cumulative share of over 75%. As noted previously, USDe debt is predominantly collateralized by PT-sUSDe-15JAN2026 and PT-USDe-15JAN2026. Users are posting appreciating collateral and borrowing the stablecoin to continuously loop until the desirable risk-reward profile is achieved, thereby leveraging the spread between the fixed implied rate of the principal tokens and the borrow rate of USDe.

Considering the high correlation of the debt and collateral assets along with relatively safe mean health factors (1.05-1.15), the liquidations of user positions in this market can mainly occur due to interest rate accrual, presenting limited risk to the protocol.

Liquidity

USDe liquidity on Plasma has sufficient depth. The Curve and Balancer USDe/USDT0 pools have a combined TVL exceeding $20 million, with additional liquidity on Fluid. A sell order of 15 million USDe would result in only 1.16% slippage.

USDe liquidity on Plasma has sufficient depth. The Curve and Balancer USDe/USDT0 pools have a combined TVL exceeding $20 million, with additional liquidity on Fluid. A sell order of 15 million USDe would result in only 1.16% slippage.

Recommendation

Given the substantial expected increase in borrowing, we recommend doubling the borrow cap of USDe, as this will facilitate low-risk, high-efficiency PT looping while substantially increasing the protocol’s revenue due to a higher reserve factor of USDe compared to USDT0. Additionally, we observe that the market presents limited risk due to highly correlated borrowing, safe user behavior, and substantial on-chain liquidity.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Supply Cap | Recommended Supply Cap |

|---|---|---|---|---|---|

| Plasma | PT-sUSDe-15JAN2026 | 400,000,000 | 800,000,000 | - | - |

| Celo | CELO | 4,500,000 | 9,000,000 | 1 | - |

| Plasma | USDe | 1,750,000,000 | - | 200,000,000 | 400,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.