Summary

A proposal to:

- Increase the supply and borrow caps of PYUSD on the Ethereum Core instance

- Increase the borrow cap of CELO on the Celo Instance

- Increase the supply cap of weETH on the Plasma Instance

- Increase the borrow cap of WETH on the Plasma Instance

- Increase the borrow cap of USDe on the Plasma Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

PYUSD (Ethereum Core)

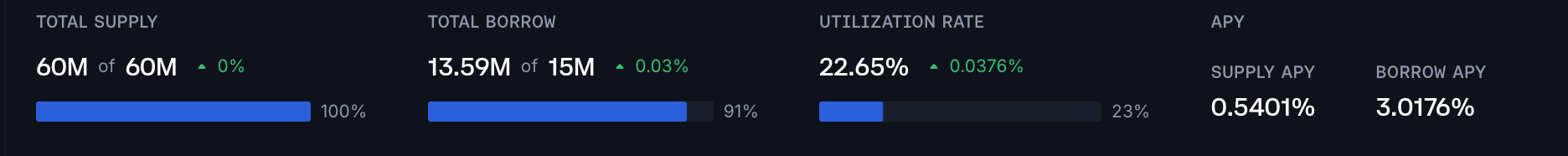

PYSUSD has reached its supply and borrow caps on the Ethereum Core instance at 60 and 13.6 million, respectively, following a substantial increase in lending activity over the last week.

Supply Distribution

The supply distribution of PYUSD is moderately concentrated. The top user represents approximately 28% of the total, while the top 4 wallets account for over 75% of the supply. The users are predominantly borrowing stablecoins with health factors in the safe 1.05 - 1.15 range. The observed user behavior suggests suppliers maximize PYUSD incentive exposure by looping the asset with USDC.

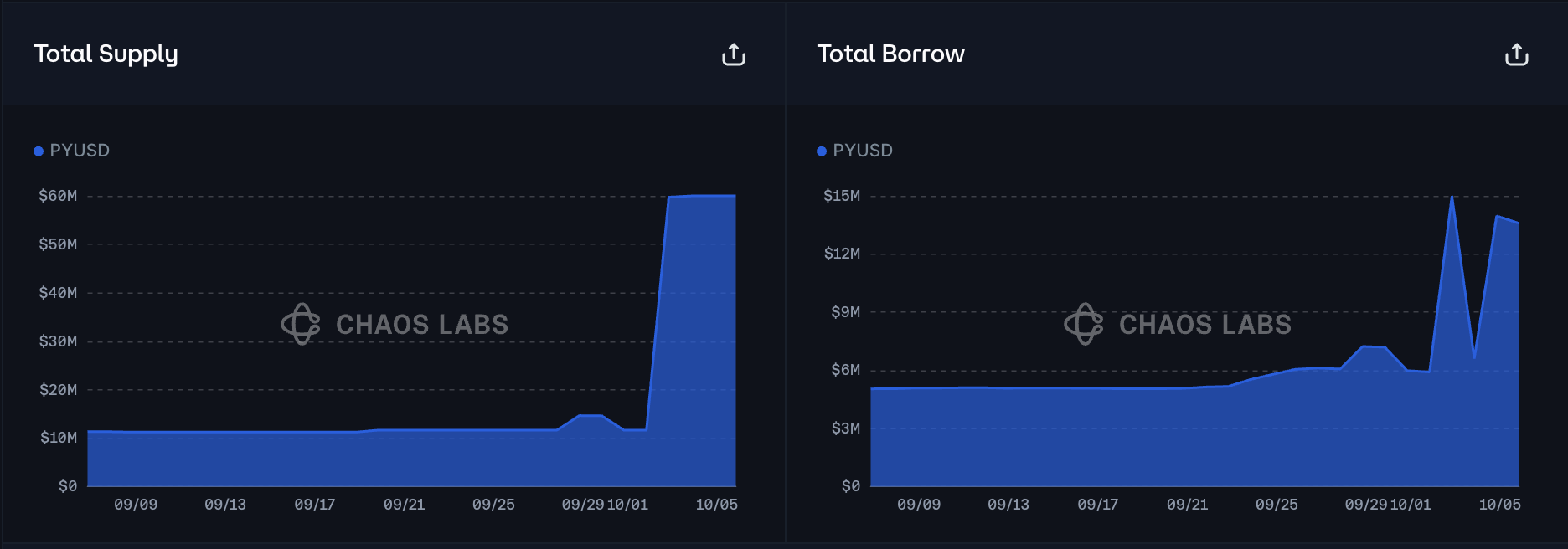

As mentioned, USDC represents the dominant debt asset for PYUSD collateral, which accounts for over 93% of all borrowing. Due to both collateral and debt assets being stablecoins, no imminent liquidation risk is present in the market.

Borrow Distribution

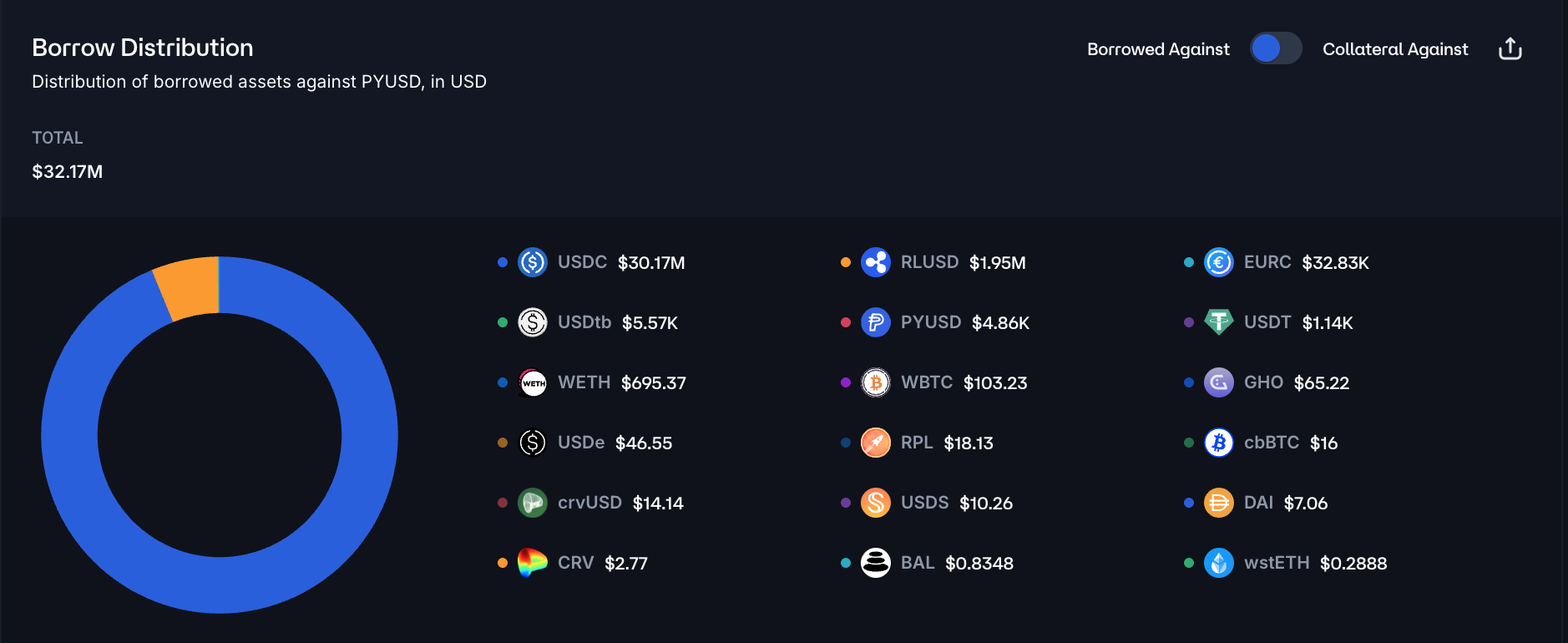

PYTUSD’s borrow distribution exhibits a lower level of concentration than that of the supply. The top user currently accounts for less than 10% of the total, while the top 10 wallets have a cumulative share of approximately 60%. The observed health factors are in a wide safe range from 1.21 to 3.58, presenting limited liquidation risk.

PYUSD debt is backed primarily by volatile assets like wstETH, WETH, and WBTC, representing over 80% of all posted collateral. While the positions are exposed to volatility risks, the safe health factors substantially constrain the volume of potential liquidations.

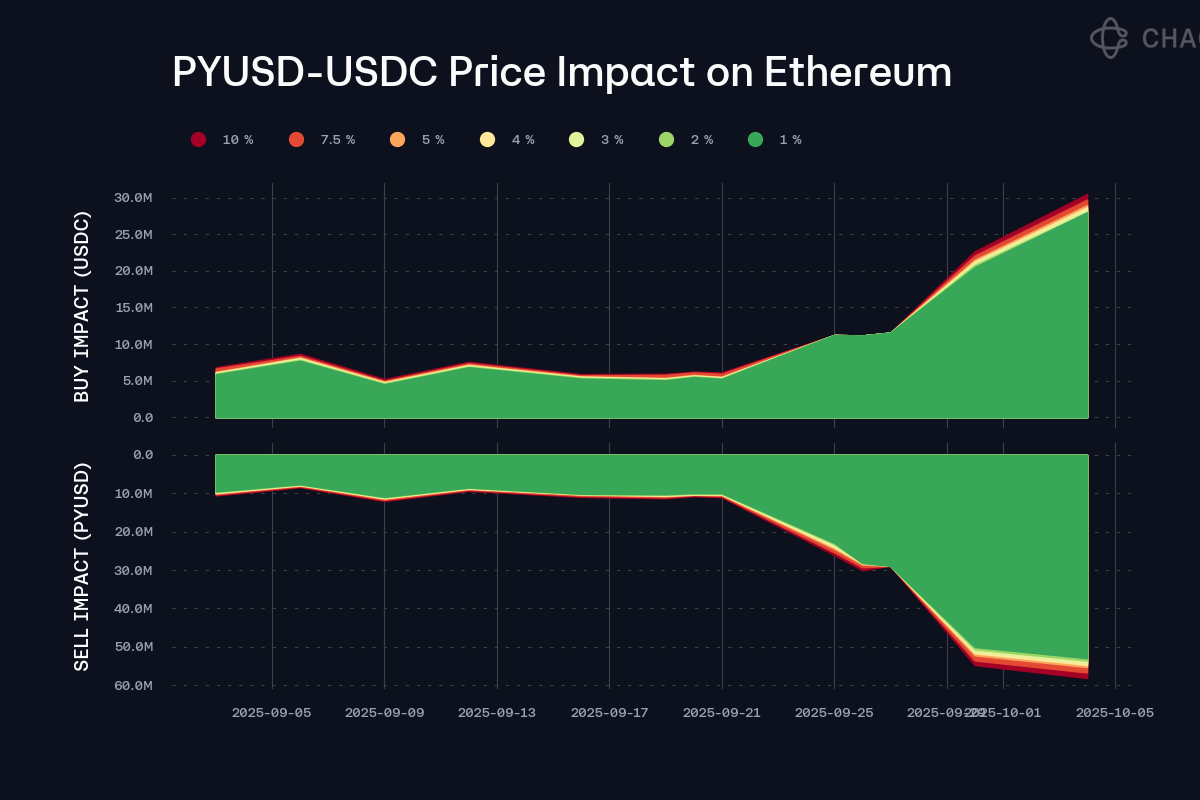

Liquidity

PYUSD liquidity has exhibited significant growth, increasing from 15 million to over 50 million. At the time of writing, a sell order of 52 million would be limited to 1% slippage, supporting an increase in the supply and borrow caps.

Recommendation

Given the substantial demand to supply and borrow the asset, safe user behavior, and deep on-chain liquidity, we recommend doubling the caps of PYUSD to facilitate further growth.

CELO (Celo)

CELO had reached its borrow cap on the Celo instance at 400 thousand tokens, as demand doubled since the start of September.

Borrow Distribution

The borrow distribution is highly concentrated, as the top user represents approximately 40% of the market, while the top 3 users account for over 85% of all borrowing. The health factors of the top positions are in the 1.13-1.64 range, limiting the probability of significant liquidations. Additionally, we have observed that borrowers are primarily taking on CELO debt to provide liquidity in the CELO/USDT Uniswap V3 pool; specifically, the top borrower is also the top supplier of liquidity in the pool.

As mentioned, USDT0 is the primary collateral for CELO debt. While the assets are not correlated and hence are exposed to volatility risks, the liquidation risk is minimal due to safe health scores.

Liquidity

At the time of writing, on-chain liquidity is sufficient to limit slippage on a 300,000 sell order of CELO to 3%, supporting an increase of the borrow cap.

Recommendation

Considering the strong liquidity, small absolute market size, and safe user behavior, we recommend increasing the borrow cap of CELO on the Celo instance.

weETH & WETH (Plasma)

weETH has reached its supply cap on Plasma following substantial inflows after the last cap increase to 80K weETH, at the same time WETH borrow cap is currently 40K tokens and is at 30% utilization. The parameters proposed further were achieved in close collaboration with the Plasma team, aiming to optimize collateral distribution, asset utilization, and enhance user retention.

Motivation

To accommodate continued demand and support market growth, we propose doubling the weETH supply cap from 80 to 160 thousand tokens and raising the WETH borrow cap. We expect the additional weETH collateral capacity to be utilized in WETH borrowing. Under current market conditions, the loop remains highly attractive: the spread between the weETH underlying yield and the effective WETH borrowing cost is elevated as the WETH borrow rate on Plasma is ~0.32%—about 200 basis points lower than on the Ethereum Core instance.

WETH Borrowing

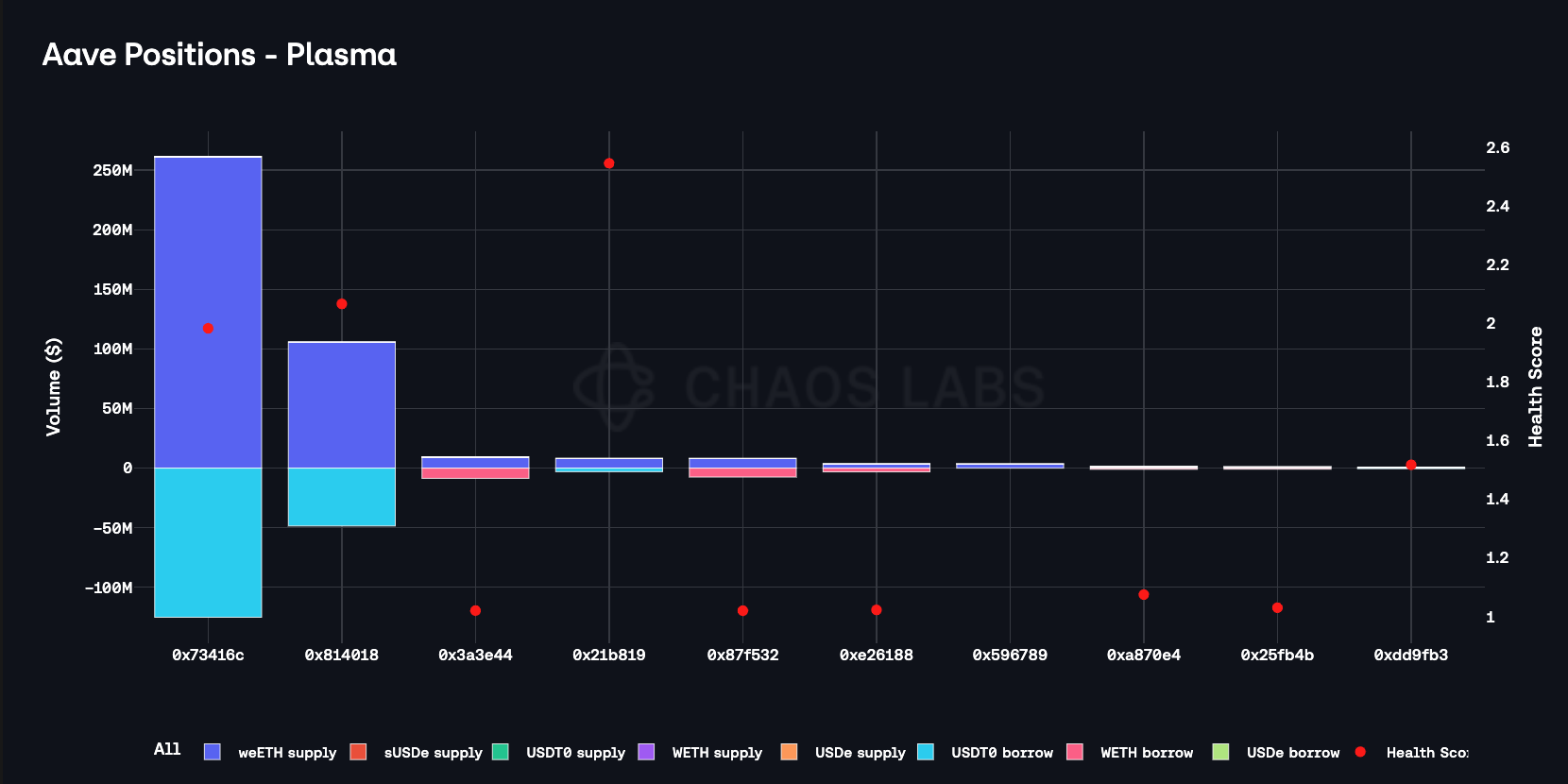

WETH borrowing utilization on Plasma stands at approximately 30% of the cap, with ~12 of 40 thousand tokens currently borrowed. As a result, supply-side yields are discounted relative to other instances, such as Ethereum Core. Borrowing activity is primarily collateralized by weETH and USDT0. USDT0-backed positions exhibit strong health factors in the 1.15–1.50 range, while weETH-collateralized positions are ETH-correlated on both sides—limiting liquidation risk—with health factors in the 1.02–1.11 range.

weETH Supply

weETH on Plasma functions exclusively as collateral, predominantly backing USDT0 and WETH debt. Positions borrowing WETH against weETH exhibit lower health factors, clustered at health scores around 1.05, but entail limited liquidation risk given the strong price correlation between collateral and debt. By contrast, USDT0 borrow positions maintain substantially higher safety buffers, with average health factors in the 2.0–2.6 range, indicating no meaningful liquidation risk under current market conditions.

Liquidity

At the time of writing, a sell order of 5,000 weETH for WETH would be limited to 4% slippage, supporting an increase in the supply cap of weETH and borrow cap of WETH. Additionally, Plasma’s team has established a $300 million liquidation backstop to ensure timely execution of liquidations during periods of high market stress, which substantially reduces the risk of bad debt for the protocol.

Recommendation

Considering the persistent demand to use weETH as collateral, stagnating WETH supply rates, safe user behavior, and substantial on-chain liquidity, we recommend increasing the supply cap of weETH and the borrow cap of WETH.

USDe (Plasma)

USDe has reached its borrow cap on the Plasma instance at 50 million tokens, indicating persistent demand to borrow the asset. While the demand for the asset has been posted primarily from WETH, we expect this dynamic to change in light of the upcoming listing of USDe-based principal tokens.

Borrow Distribution

USDe’s borrow distribution exhibits high concentration as the top user represents over 40% of total debt, while the top 5 borrowers account for over 75%. The majority of users are collateralizing USDe-debt with WETH and, in some cases, with USDT0. While WETH-backed positions create additional exposure to volatility risks, the safe health factor distribution (1.2 - 1.7) of the top borrowers limits the risk of large-scale liquidations. Additionally, a minor share of USDe-based debt is backed by USDT0 collateral, not presenting any liquidation risk due to the high correlation of the assets.

Liquidity

Plasma’s USDe liquidity has sufficient depth, with the Curve and Balancer USDe/USDT0 pools having a cumulative TVL of over $33 million; additionally, a WETH/USDT0 Uniswap pool is available for USDe/WETH routing in case of liquidations on WETH-collateralized positions.

Recommendation

Considering safe user behavior, substantial on-chain liquidity, and upcoming borrowing demand from USDe-based principal tokens, we recommend increasing USDe’s borrow cap.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum | pyUSD | 60,000,000 | 120,000,000 | 15,000,000 | 30,000,000 |

| Plasma | weETH | 80,000 | 160,000 | - | - |

| Plasma | WETH | 160,000 | - | 40,000 | 80,000 |

| Celo | CELO | 4,500,000 | - | 400,000 | 600,000 |

| Plasma | USDe | 1,750,000,000 | - | 50,000,000 | 100,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.