Summary

A proposal to:

- Increase the supply and borrow caps of USDT0 on the Plasma instance

- Increase the supply cap of WETH on the Plasma instance

- Increase the supply cap of USDe on the Plasma instance

- Increase the supply cap of sUSDe on the Plasma instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

WETH (Plasma)

WETH reached both supply and borrow caps on the Plasma instance within 24 hours of the launch. At the time of writing, the supply and borrow caps are 80 and 10 thousand tokens, respectively.

Supply Distribution

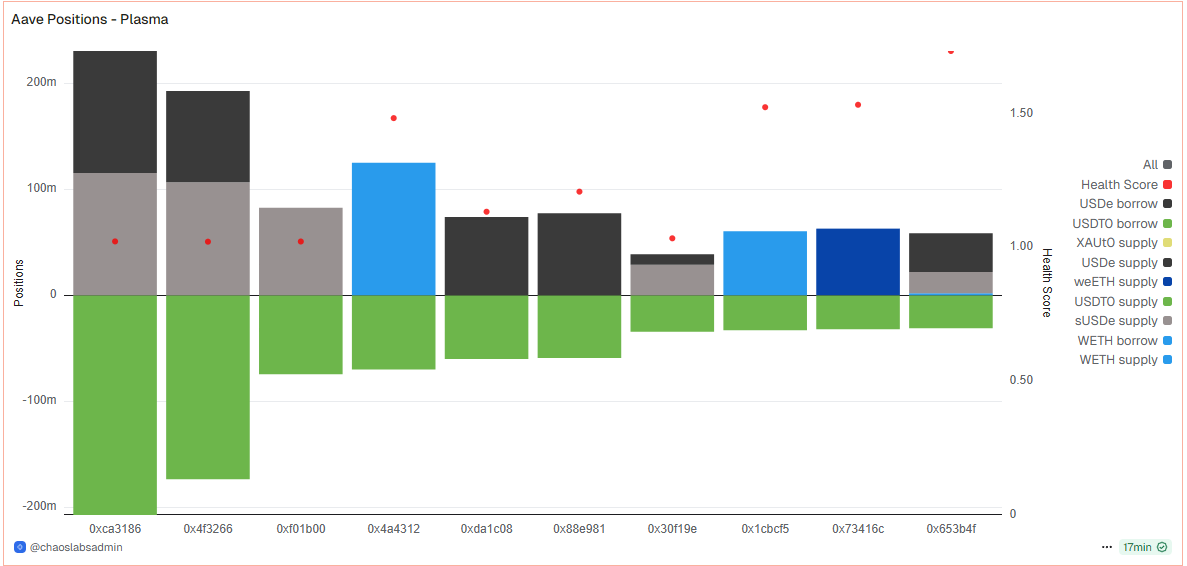

The supply is highly concentrated, as the top supplier represents over 40% of the total. The majority of suppliers use WETH as collateral to back a substantial amount of USDT0 debt, likely to participate in the incentive programs. The distribution of health factors is safe, ranging from 1.33 to 1.87, substantially limiting the liquidation risk.

Borrow Distribution

Borrow distribution exhibits lower concentration as the top user represents less than 25% of the market. However, we observe that the borrowers are collateralizing WETH debt primarily with USDT0, likely to increase their exposure to the ongoing incentives. While this behaviour does not increase the risk of the positions, it does diminish the positive effect of the incentive program.

Liquidity

At the time of writing, WETH on-chain liquidity on Plasma is mostly allocated in a Uniswap V3 pool, which has over 2,500 WETH and 6 million USDT0. As the chain launched recently, we expect the liquidity to expand.

Additionally, the Plasma protocol team has established a $300M liquidation backstop to ensure efficient execution of liquidations on the Aave Plasma instance during periods of market stress.

Recommendation

Given the persistent demand to leverage WETH on the Plasma instance, safe user behavior, and growing liquidity, we recommend increasing the supply cap of WETH on the instance.

USDe and sUSDe (Plasma)

USDe and sUSDe have both reached their respective supply caps of 500 and 425 million within less than 24 hours of the instance’s launch. The supply patterns in the assets signal growing and persistent demand.

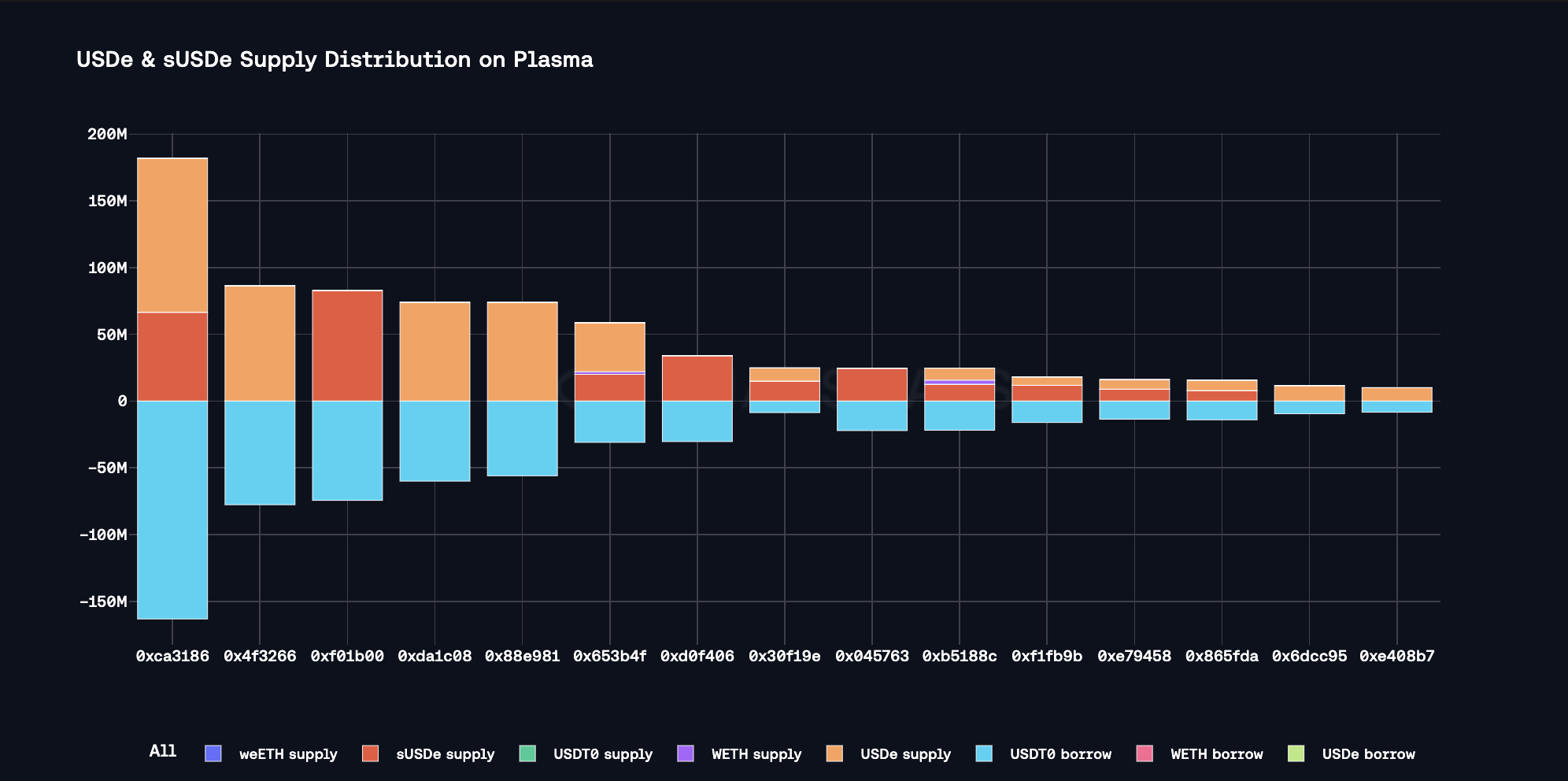

Supply Distribution

The supply of USDe and sUSDe is moderately concentrated, as the top user represents over 35% of the total, while top 8 wallets have a cumulative share of approximately 62%. We additionally observe that the users predominantly use the assets in equal shares to collateralize USDT0 debt position, likely participating in Ethena’s Liquid Leverage, which allows for leveraged exposure to Ethena rewards.

Given that the assets are predominantly collateralizing USDT0 debt, the liquidation risk is minimal, as the debt and collateral(s) prices are tightly correlated.

Liquidity

At the time of writing, the majority of sUSDe and USDe liquidity is allocated in the following pools:

- USDT0/USDe Balancer ($10M TVL)

- USDT0/USDe Curve ($4M TVL)

- USDT0/sUSDe Balancer ($13M TVL)

- USDT0/sUSDe Curve ($3.6M TVL)

Given the chain’s recent launch and ongoing LP incentives, we expect liquidity to expand further, supporting an increase in the supply caps.

Recommendation

Considering the low liquidation risk, safe user behavior, and expanding liquidity, we recommend increasing the caps of USDe and sUSDe on Plasma.

USDT0 (Plasma)

USDT0 has reached over 75% of its initial 2.2 billion supply cap in the past hours, indicating elevated demand to supply the asset as the ongoing incentives offer over 20% APY.

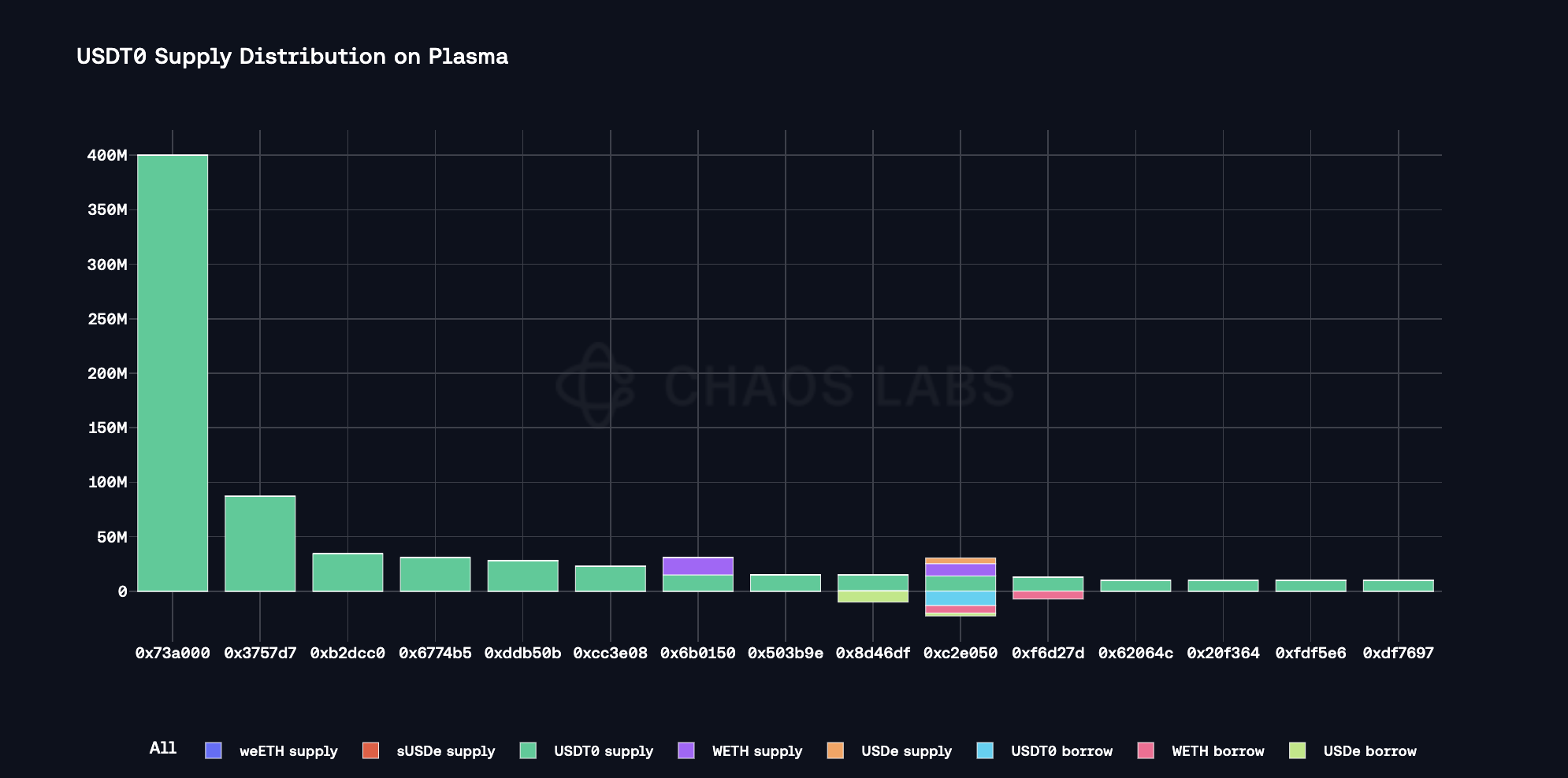

Supply Distribution

The supply is highly concentrated, as the top position, at $400 million, represents over 25% of the market; however, this position is held by the Plasma USD Veda vault, which represents the deposits of users who participated in the XPL sale. Additionally, only a small minority of the suppliers have outstanding debt, minimizing the risk of forced liquidations.

While the share of USDT0, which is used as collateral, is relatively minor, it still adds up to over $80 million, split between USDT0, USDe, and WETH.

Borrow Distribution

The borrow demand of USDT is fairly distributed, with the majority of top borrowers using highly correlated collateral such as USDe and sUSDe. The positions that do use volatile collateral, such as WETH and weETH maintain a safe health score of over 1.50. These two elements minimize the liquidation risks in the market.

Recommendation

Given that the overwhelming majority of users are not utilizing USDT as collateral, the risk of large-scale liquidations is minimal. Hence, we recommend increasing the supply cap and borrow caps of USDT0 on Plasma.

Specification

| Market | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Plasma | WETH | 80,000 | 120,000 | 10,000 | - |

| Plasma | USDe | 500,000,000 | 1,000,000,000 | 50,000,000 | - |

| Plasma | sUSDe | 450,000,000 | 900,000,000 | - | - |

| Plasma | USDT | 2,200,000,000 | 4,000,000,000 | 2,000,000,000 | 3,800,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.