Summary

A proposal to:

- Decrease the supply cap of osETH on the Ethereum instance

- Decrease the supply cap of rETH on the Arbitrum and Optimism instances

- Decrease the supply cap of stS on the Sonic instance

Motivation

Recent exploit targeting Balancer v2 liquidity pools and its forks have resulted in a significant reduction in on-chain liquidity for several assets listed on Aave across multiple instances. While the underlying collateral and protocol backings of these assets remain intact, the affected liquidity pools have reduced secondary market depth.

Given these conditions, Chaos Labs recommends reducing the supply caps of the affected assets across Ethereum, Arbitrum, Optimism, Base and Sonic instances. This measure aims to prevent opportunistic borrowing activity and protect the protocol against potential risks stemming from secondary market distortions.

Effected assets rely on exchange rate oracles rather than spot price feeds, temporary deviations in secondary market pricing are not expected to directly trigger liquidations. However, temporary deviations could cause liquidations of the existing positions to be temporarily unprofitable, which could lead to liquidation risks in the case of stablecoin debt.

Additionally, during periods of temporary market dislocation, new borrowers could potentially exploit the situation by purchasing discounted tokens on secondary markets and using them as collateral to borrow stablecoins, thereby arbitraging Aave pools. Reducing supply caps to the current utilization levels helps prevent such opportunistic behavior and ensures that no new supply inflows amplify protocol risk during the period of impaired liquidity.

osETH (Ethereum)

osETH supply currently stands at 43% utilization, while its borrow cap has been previously set to 1. No increase in supply has been observed following the Balancer hack.

Supply Distribution

All of the top users currently supplying osETH maintain highly correlated debt in the form of WETH. Given the use of exchange rate oracles in the market, these positions currently do not pose any liquidation risk.

A similar distribution of debt is visible in the collateral distribution, where over 98% of the osETH is used as collateral to borrow highly correlated assets.

Liquidity

The osETH primary liquidity pool was situated on Balancer, which has been exploited during this event, with the hacked osETH supply amounting to ~$24M. Following the incident, the current liquidity available on the Ethereum chain for osETH amounts to $11M with a 7% price impact.

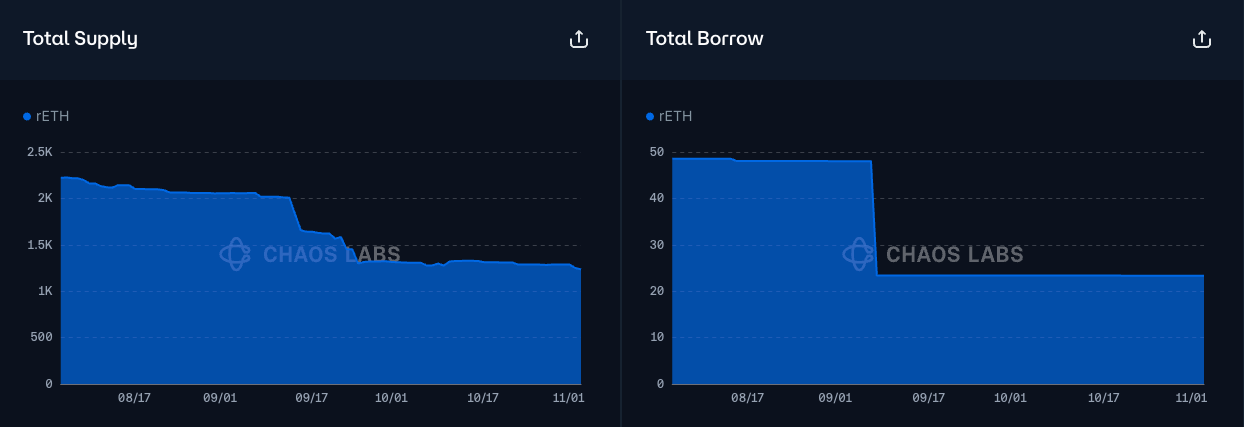

rETH (Arbitrum)

rETH supply currently stands at 40% utilization, while its borrow cap has been previously set to 1.

No increase in supply has been observed following the Balancer hack.

Supply Distribution

Top users currently supplying rETH hold a mix of correlated debt in the form of wETH and uncorrelated debt in stablecoins. The positions backed by correlated assets are fully protected through exchange rate oracles, while the uncorrelated stablecoin positions maintain very strong health factors of 3.08 and 3.31, indicating minimal liquidation risk across the board.

Liquidity

The rETH primary liquidity pool on Arbitrum was situated on Balancer, which has been exploited during this event, with the hacked rETH supply amounting to ~$1.8M. Following the incident, the current liquidity available on the Arbitrum chain for rETH amounts to $400K with a 6.5% price impact.

rETH (Optimism)

rETH supply currently stands at 40% utilization, while its borrow cap has been previously set to 1.

No increase in supply has been observed following the Balancer hack.

Supply Distribution

All of the top users currently supplying rETH maintain highly correlated debt in the form of wETH. Given the use of exchange rate oracles in the market, these positions currently do not pose any liquidation risk.

Liquidity

The rETH liquidity pools on Optimism are situated on Beets, and while they have not been exploited in this event, their liquidity remains limited with a price impact of 6% following a $1M swap.

stS

stS supply currently stands at 70% utilization, while it is not enabled as a borrowable asset. No increase in supply has been observed following the Balancer hack.

Supply Distribution

All of the top users currently supplying stS maintain highly correlated debt in the form of wS. Given the use of exchange rate oracles in the market, these positions currently do not pose any liquidation risk. Among users with uncorrelated debt, overall risk remains negligible as their health factor stands at a comfortable levels like 2.21 and 1.62.

Liquidity

The stS primary liquidity pool on Sonic was situated on Beets, a fork of Balancer v2, which was exploited during this event, with the hacked stS supply amounting to approximately $2.8 million. Following the incident, the current liquidity available on the Sonic chain for stS stands at around $100,000 with a 5% price impact.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum | osETH | 350,000 | 152,000 | 1 | - |

| Arbitrum | rETH | 3,100 | 1,300 | 1 | - |

| Optimism | rETH | 4,300 | 1,800 | 1 | - |

| Sonic | stS | 180,000,000 | 126,000,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.