Summary

A proposal to:

- Increase EURe’s supply and borrow caps on the Gnosis instance.

- Increase FBTC’s supply cap on the Ethereum Core instance.

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

EURe (Gnosis)

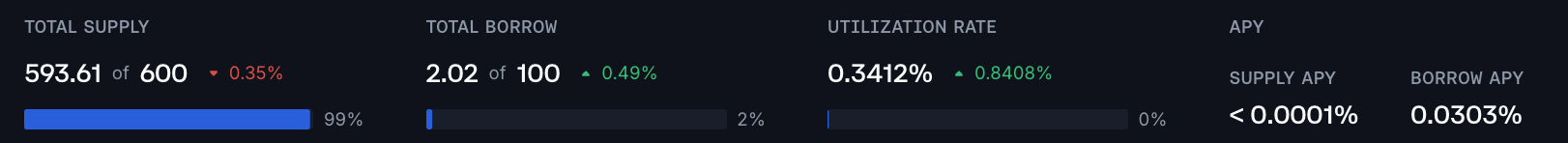

EURe has reached full supply cap utilization and 95% borrow cap utilization, resulting in an overall utilization rate of 82%.

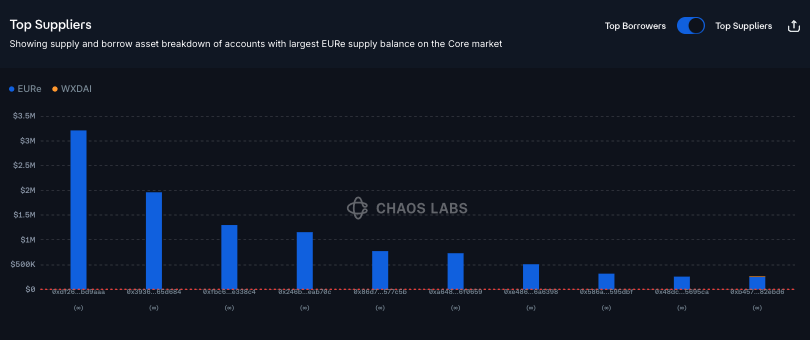

Supply Distribution

Supply is highly distributed, with the largest user accounting for just 16% of the total.

Additionally, the asset cannot be used as collateral and thus this market is at very low risk on the supply side.

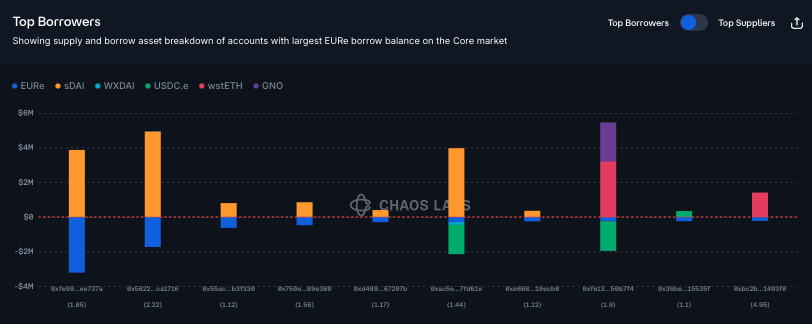

Borrow Distribution

Borrowing is also highly distributed, with no user accounting for more than 20% of the total amount borrowed.

The most common collateral asset against EURe is sDAI, putting the market at low risk of large scale liquidations because of the strong correlation between the two assets.

Liquidity

EURe’s on-chain liquidity is sufficient to support an increase in its caps, as a 2M EURe ($2.34M) swap for sDAI can be completed with less than 1% price slippage.

Recommendation

Taking into account the low-risk borrowing activity in this market relative to its on-chain liquidity, we recommend increasing the asset’s supply and borrow caps.

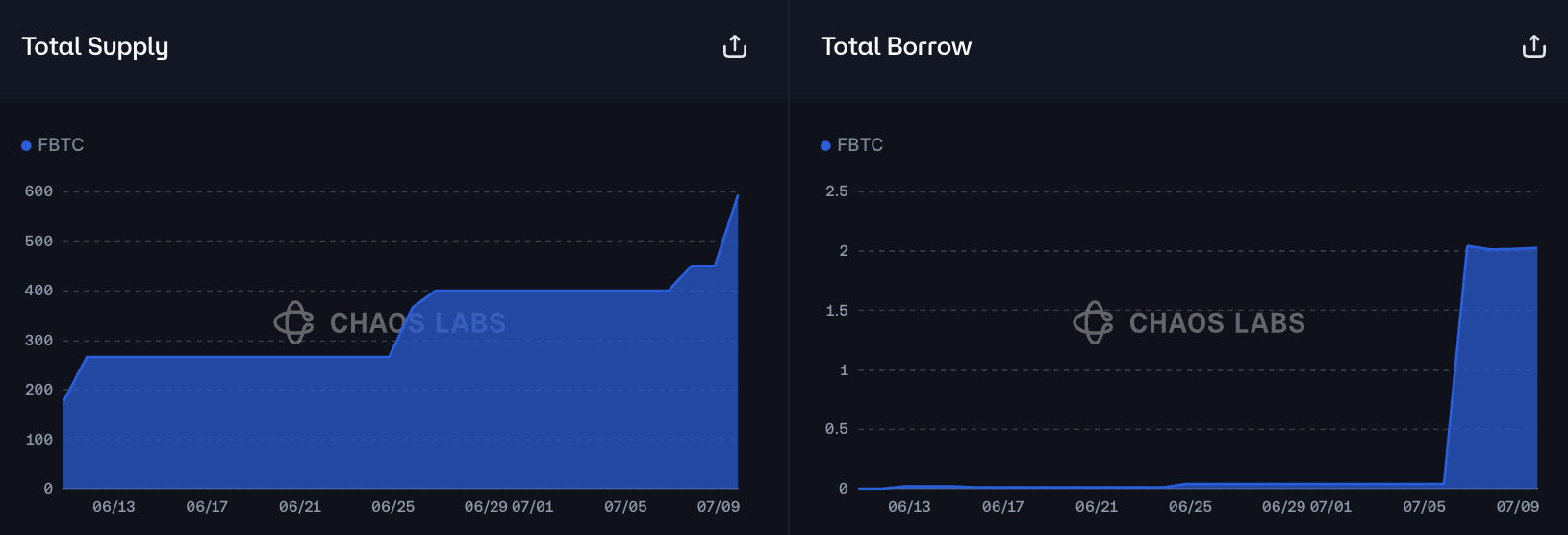

FBTC (Ethereum Core)

FBTC has reached nearly full supply cap utilization following new deposits while its borrow cap remains lightly utilized.

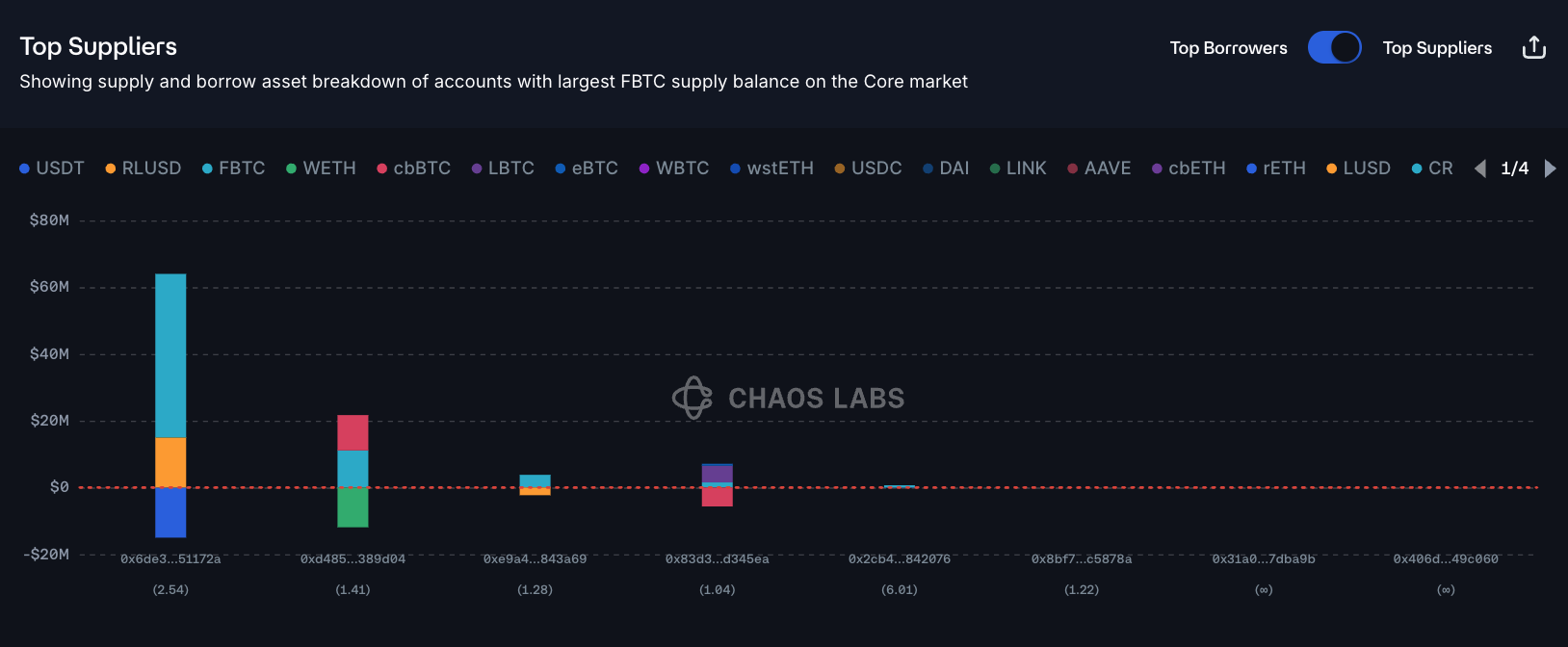

Supply Distribution

Supply is relatively concentrated, with the largest user accounting for more than 70% of the total. This user is borrowing USDT against both FBTC and RLUSD with a health score of 2.54, putting the user at low risk of liquidation.

The second largest user is borrowing WETH against cbBTC and FBTC with a health score of 1.41, putting them at a higher risk of liquidation. Largely because of these two users, the top borrowed assets against FBTC are USDT and WETH.

Liquidity

FBTC’s on-chain liquidity is sufficient to support an increase in its supply cap, as a 150 FBTC to USDT swap can be completed at 5% price slippage.

Recommendation

Taking into account the asset’s relatively strong liquidity and low-risk usage, we recommend increasing its supply cap.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Gnosis | EURe | 13,000,000 | 16,000,000 | 11,200,000 | 15,000,000 |

| Ethereum Core | FBTC | 600 | 900 | 100 | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0