Summary

A proposal to:

- Increase supply and borrow caps for EURC on the Ethereum Core Instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

EURC (Ethereum Core)

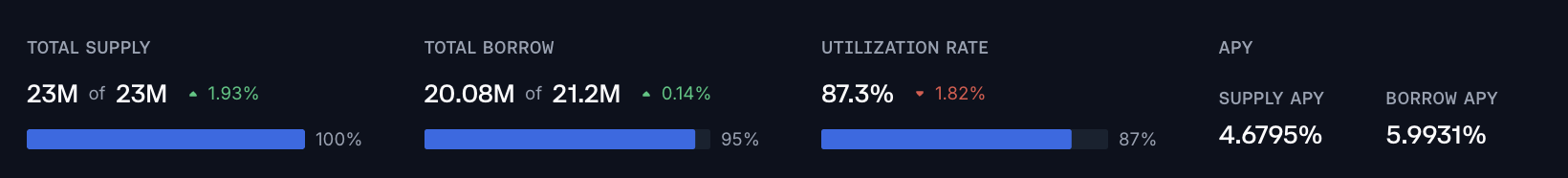

EURC has reached 100% supply cap utilization and 95% borrow cap utilization.

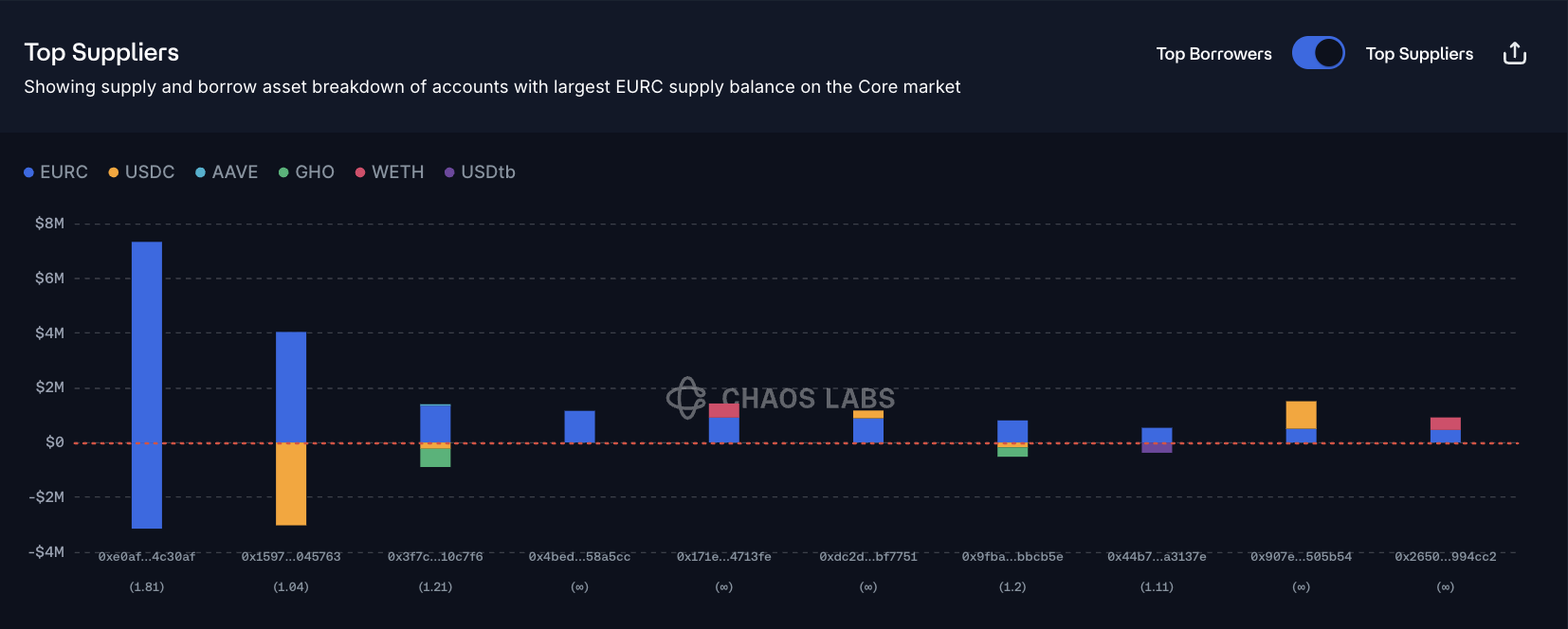

Supply Distribution

The supply of EURC shows a moderate concentration risk, with the top supplier accounting for around 30% of the total distribution. However, since this top supplier is borrowing EURC itself, we do not view this as an immediate risk.

The rest of the top suppliers are either borrowing stablecoins or have no borrowing activity, presenting limited risk at the moment.

The largest borrowed asset against EURC is EURC itself, which largely reduces the chance of large-scale liquidations.

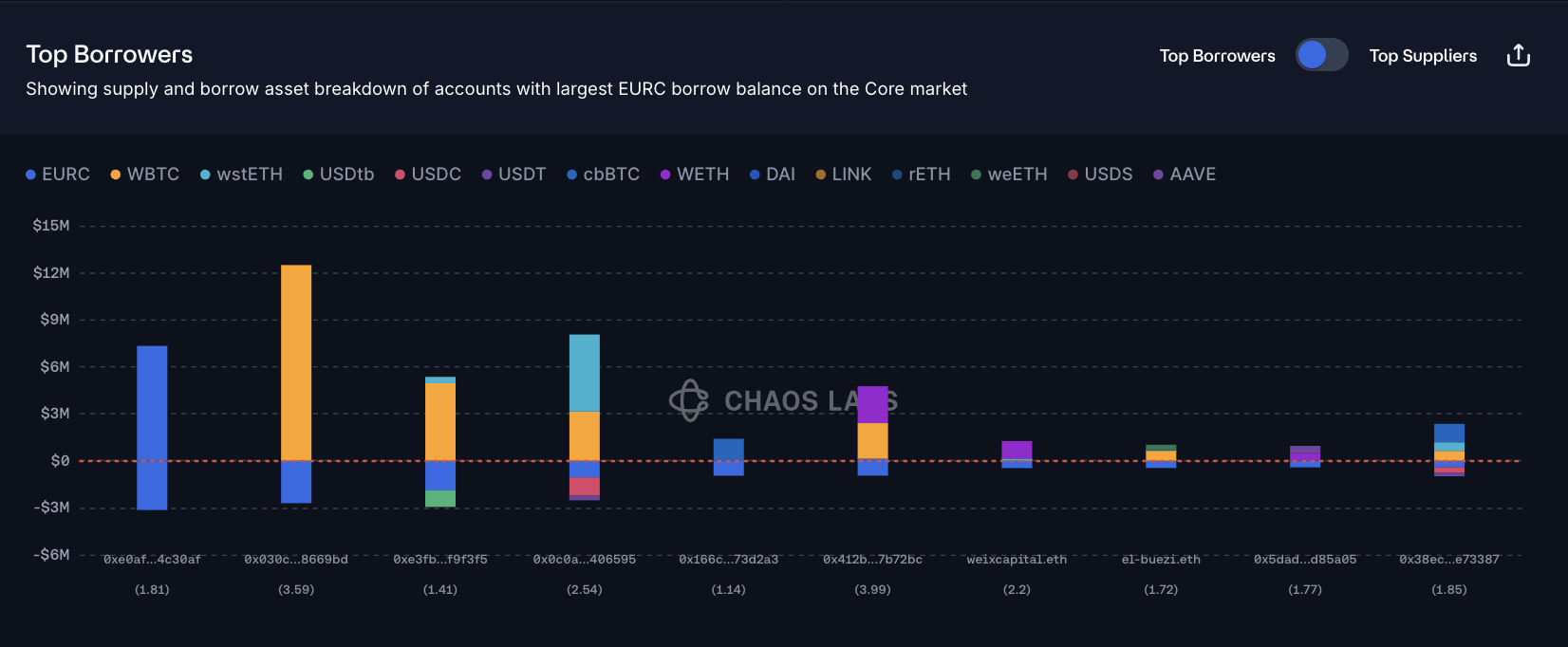

Borrow Distribution

The borrow distribution of EURC presents limited liquidation risk, as all top borrowers maintain robust health scores.

In addition to its highly conservative distribution, the vast majority of collateralized debt stems from robust collateral assets such as WBTC, cbBTC, wstETH and WETH.

Liquidity

EURC’s on-chain liquidity can currently support selling 8M EURC for USDC with less than 5% price slippage, supporting the case for the cap increase.

Recommendation

Given the user behavior and on-chain liquidity, we recommend increasing EURC’s supply and borrow caps by twofold.

Specification

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.