Summary:

A proposal to:

- Increase supply and borrow caps for USDC on the Ethereum Core instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDC (Ethereum Core)

USDC is currently at 84% overall utilization, with the supply cap filled by 93% at 6B and the borrow cap at 84% utilization at 5B total. Both supply and borrow have grown significantly in the past two weeks, adding 1.5B and 1.1B, respectively, indicating consistent demand for both borrowing and supplying USDC.

Supply Distribution

The supply distribution of USDC is moderately concentrated, with the top supplier accounting for over 20% of the total, while the top 10 have a cumulative share of 60%. Additionally, no supplier from the top 10 holds any debt against USDC collateral, minimizing liquidation risk.

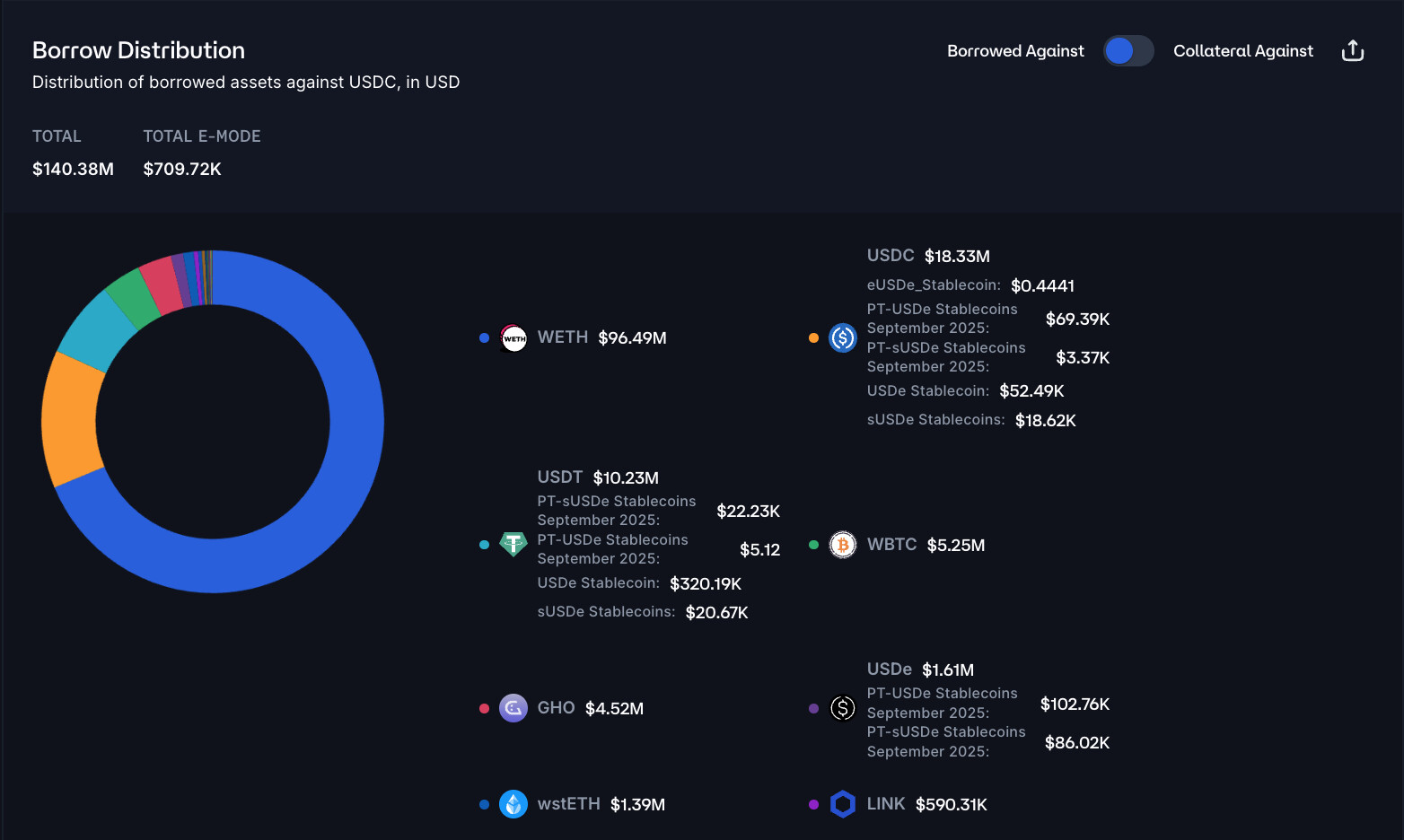

Only a minor share of the 6B supplied USDC is used as collateral. Total USDC-backed debt stands below 145M, with the primary debt assets being either WETH and WBTC (~100M combined) or stablecoins including USDC, USDT, GHO, and USDe (~30M total). Given the limited proportion of USDC used in debt positions, liquidation risk remains negligible.

Borrow Distribution

The borrow distribution of USDC is much less concentrated, with the top borrower accounting for less than 3% of the total, while the top 125 users have a cumulative share of approximately 60%. We can observe two distinct behavior patterns among USDC borrowers. One group collateralizes its debt with volatile assets and maintains higher health factors (1.47 - 2.25), as these positions require active management due to significant volatility exposure. The other group collateralizes their USDC debt with various USDe-based Principal Tokens and maintains minimal health factors in the 1.02–1.15 range. This second group presents minimal liquidation risk as the prices of debt and collateral are tightly correlated, while the first cluster maintains high health scores, effectively limiting the probability of forced liquidations.

As mentioned previously, the majority of USDC debt is collateralized by two main asset types: volatile assets like WETH, WBTC, and wstETH with a total share of approximately 3B; and correlated assets like stablecoins and USDe-based Principal Tokens, which have a cumulative share of just over 2B.

Recommendation

Considering USDC’s low risk profile on the supply side, the sustained and growing borrowing demand, which is in large part driven by relatively low-risk USDe-based PT looping, and the depth of on-chain liquidity capable of absorbing significant liquidations with minimal slippage, we recommend increasing both the supply and borrow caps for USDC on the Ethereum Core instance by 1B tokens each.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDC | 6,500,000,000 | 7,500,000,000 | 6,000,000,000 | 7,000,000,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.