Summary

A proposal to:

- Increase supply and borrow caps for USDC on the Ethereum Core instance

- Increase supply and borrow caps for EURC on the Ethereum Core instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

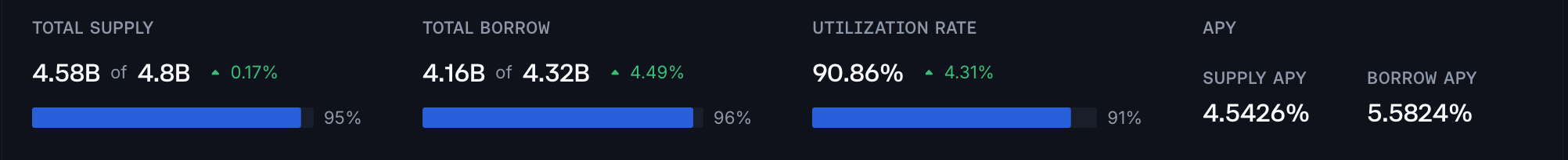

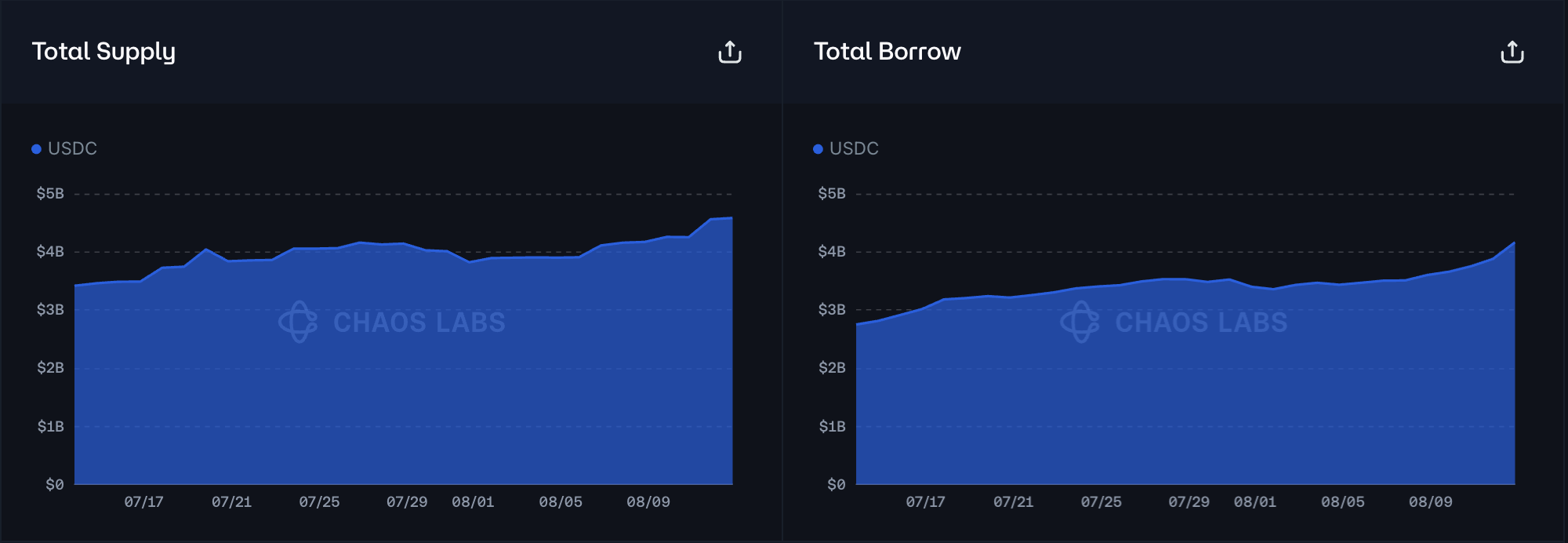

USDC (Ethereum Core)

USDC has reached 95% and 96% of its supply and borrow caps, with current utilization at ~91%. Additionally, the total supply has grown by over 800M in the recent two weeks, in line with the borrowing, suggesting significant demand.

Supply Distribution

The supply shows high concentration, with the top user accounting for approximately 19% of the total and the top 5 wallets comprising 48%. Although such concentration typically presents significant risks, actual risk is minimized as most top suppliers maintain no borrow positions.

WETH is the dominant asset borrowed against USDC, accounting for 75% of all borrowing activity, while stablecoins make up 20% of total.

Borrow Distribution

Compared to supply, USDC’s borrowing is much less concentrated, with the top 61 wallets accounting for less than 50% of the total. The health scores for borrowers fall into two clusters: 1.02-1.05 and 1.5-4. Users from the first cluster collateralize their stablecoin loans with USDe-based PTs, while the other group uses volatile assets like WETH and WBTC

The majority of the collateral posted against USDC is volatile assets like (WETH, WBTC, wstETH, cbBTC, weETH) with a 65% dominance, the second largest group of assets are USDe-based PTs with 23% cumulative share.

Recommendation

Considering the recent market dynamics, firm and consistent liquidity, and safe user behaviour, we recommend increasing the supply and borrow caps of USDC on Ethereum Core to 6.5B and 6B, respectively.

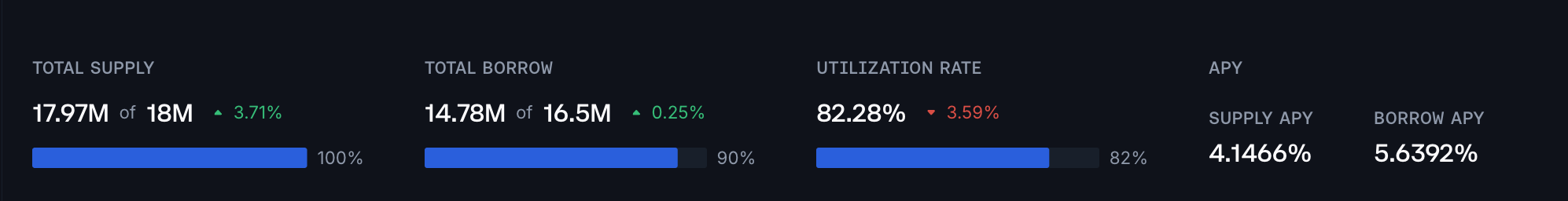

EURC (Ethereum Core)

Following the recent rapid increases in both supply and borrowing, EURC has reached 100% of its supply cap and 90% of the borrow, with the current utilization rate approximately at Uoptimal.

Supply Distribution

EURC’s supply distribution is highly concentrated, with the top supplier accounting for 25% of the total and the top 4 wallets having a cumulative share of 57%. However, most suppliers borrow stablecoins like USDC and EURC against the posted collateral, significantly reducing the liquidation risk.

The majority of borrows against EURC are in stablecoins with EURC, USDC, USDtb, and USDT accounting for over 90% of the total. Due to the high correlation of debt and collateral price,s the liquidation risk is minimal.

Borrow Distribution

The borrower distribution is slightly milder than supply, with the top EURC borrower accounting for 18% of the total and the top 12 users accounting for 57%. The distribution of health factors among top borrowers is sparse within the 1.21 - 4.37 range.

Most collateral is in volatile assets, including WETH, WBTC, cbBTC, and wstETH; these four assets have over 60% cumulative dominance. Additionally, 20% of the EURC borrowing is collateralized by supplied EURC. Given the moderately high health factors, the positions do not imply significant risks at the moment.

Recommendation

Given the recent increase in EURC lending and borrowing demand, user behavior, and sufficient liquidity, we recommend increasing the supply and borrow caps by 5M and 4.7M EURC, respectively.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDC | 4,800,000,000 | 6,500,000,000 | 4,320,000,000 | 6,000,000,000 |

| Ethereum Core | EURC | 18,000,000 | 23,000,000 | 16,500,000 | 21,200,000 |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.