Summary:

A proposal to:

- Increase the supply and borrow caps of USDe on the Ethereum Core instance

- Increase the supply and borrow caps of WETH on the Linea instance

- Increase the supply cap of LBTC on the Base instance

- Increase the supply cap of ezETH on the Arbitrum instance

All cap increases are backed by Chaos Labs’ risk simulations, which consider user behavior, on-chain liquidity, and price impact, ensuring that higher caps do not introduce additional risk to the platform.

USDe (Ethereum Core)

USDe has reached 86% of its supply cap and 92% of its borrow cap, following an inflow of over 80 million tokens since early September.

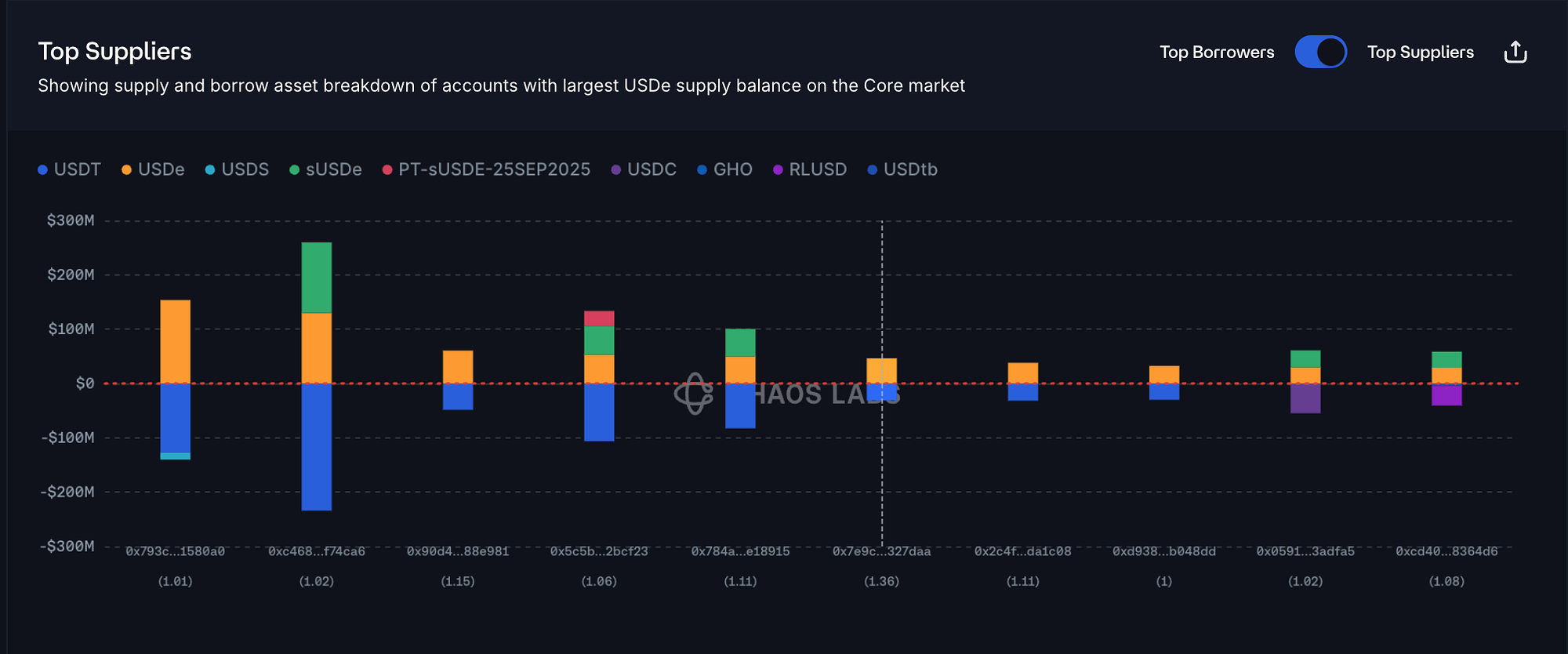

Supply Distribution

USDe’s supply shows moderate concentration, with the top user holding less than 10% of the total and the top 17 wallets collectively accounting for 50%. Users typically maintain low health factors, mostly in the 1.02-1.11 range, as they primarily hold substantial USDT or USDC debt positions.

USDe primarily serves as collateral for stablecoin debt positions. Many users participate in Ethena’s Liquid Leverage incentive program, which offers increased rewards when supplying equal amounts of USDe and sUSDe. Through this program, users collateralize stablecoins and convert their debt into USDe and sUSDe, creating a continuous loop to capitalize on the spread between Liquid Leverage incentives and stablecoin borrowing rates.

USDe currently collateralizes over 1.3 billion in stablecoin debt, facilitated by a set of E-modes that enhance capital efficiency. Despite this substantial market size, the risk of liquidations and bad debt remains minimal because the supplied and borrowed stablecoins maintain tight price correlation.

Borrow Distribution

The USDe borrower distribution is well-diversified, with the top 15 borrowers accounting for 50% of the total. Most borrowers use USDe-based principal tokens as collateral, and their health factors cluster around 1.02, placing them in the lower health factor range.

As noted, USDe-debt positions are primarily backed by USDe-based principal tokens. This significantly reduces liquidation risk for two reasons: the high price correlation between these assets and the fact that principal tokens naturally converge to the value of their underlying assets at maturity.

Liquidity

At the moment, USDe’s DEX liquidity on Ethereum is sufficient to facilitate a sell order of 75 million USDe, limited to 1% slippage, supporting an increase in the supply and borrow caps.

Recommendation

Based on the strong demand for USDe supply and borrowing, the prevalence of correlated assets on both sides of the market, and sufficient on-chain liquidity, we recommend increasing the USDe supply and borrow caps on the Ethereum Core instance.

WETH (Linea)

WETH has reached its supply cap on the Linea instance at 230,000 tokens, following the recent inflow of over 40,000 WETH over the last 7 days.

Supply Distribution

The supply distribution exhibits low concentration as the top user accounts for less than 5% of the total, while top 50 users have a cumulative share of approximately 60%. Additionally, the majority of users have either no debt or high health factors, significantly limiting liquidation risk in the market.

Users are primarily collateralizing stablecoin (USDC, USDT) debt with WETH, with over $220 million in total debt posted against the asset. Given the safe distribution of health factors, the liquidation risk is minimal.

Borrow Distribution

Compared to the supply, the borrow distribution is much more concentrated. The top borrower represents 18% of the market, while the top 11 users account for over 68%. Users primarily borrow WETH to engage in leveraged restaking strategies, earning the difference between the underlying yield of LRTs and the borrow rate of WETH.

As mentioned, the overwhelming majority of WETH is collateralized with LRTs (wrsETH, ezETH, weETH), minimizing the liquidation risks as the debt and collateral assets are highly correlated in price.

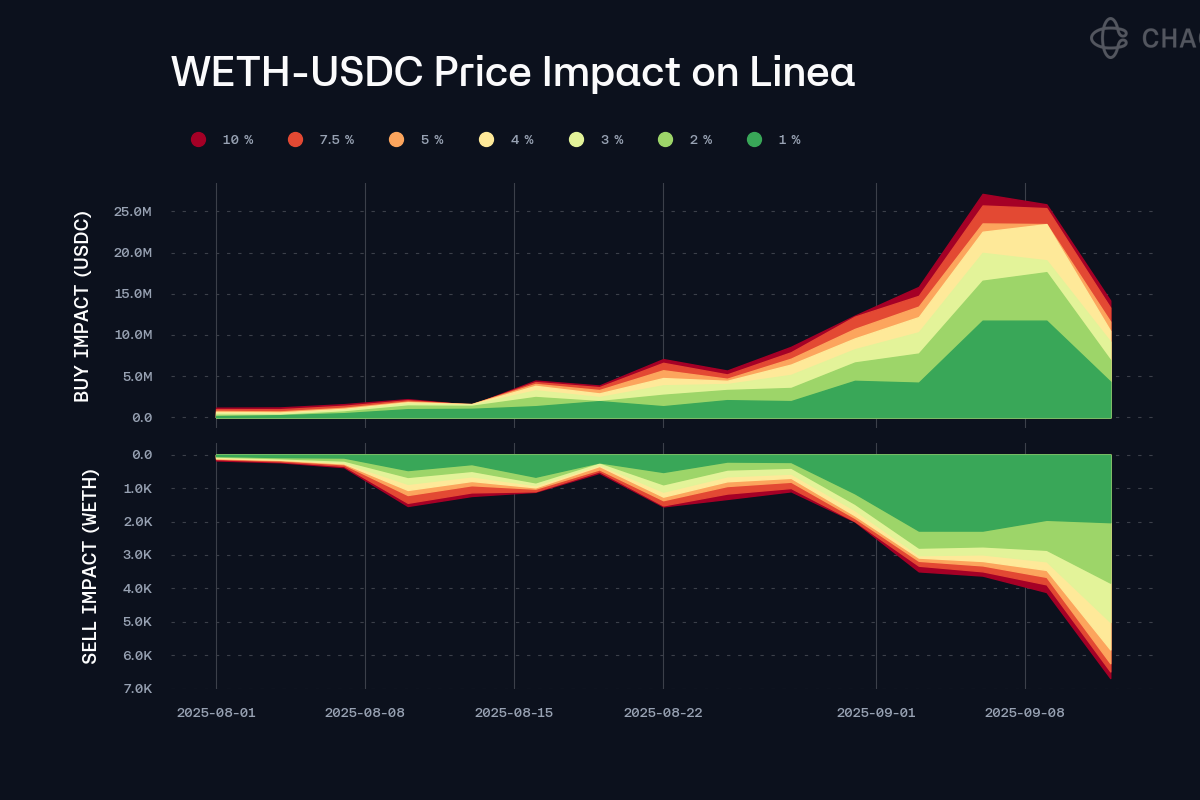

Liquidity

WETH on-chain liquidity has increased substantially in recent days. At the moment, a sell order of 5,000 WETH would incur 3% slippage, supporting an increase in the supply and borrow caps.

Recommendation

Given the persistent demand, conservative user behavior, and sufficient DEX liquidity, we recommend increasing the supply and borrow caps of WETH to support further growth of the instance.

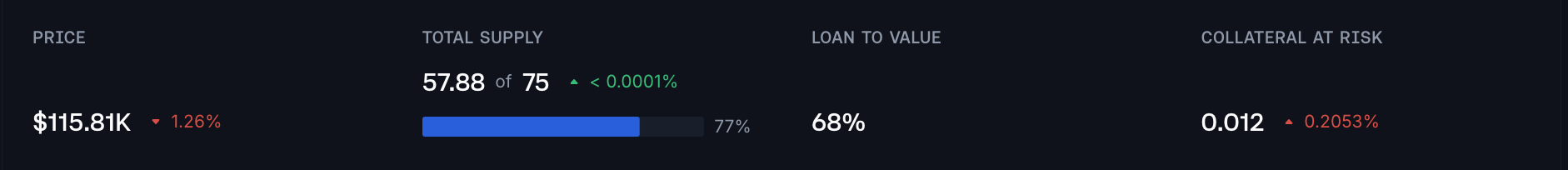

LBTC (Base)

LBTC has reached 77% of its supply cap at 58 tokens, following an inflow of 26 LBTC. This sharp increase signals a significantly growing demand for using the asset as collateral.

Supply Distribution

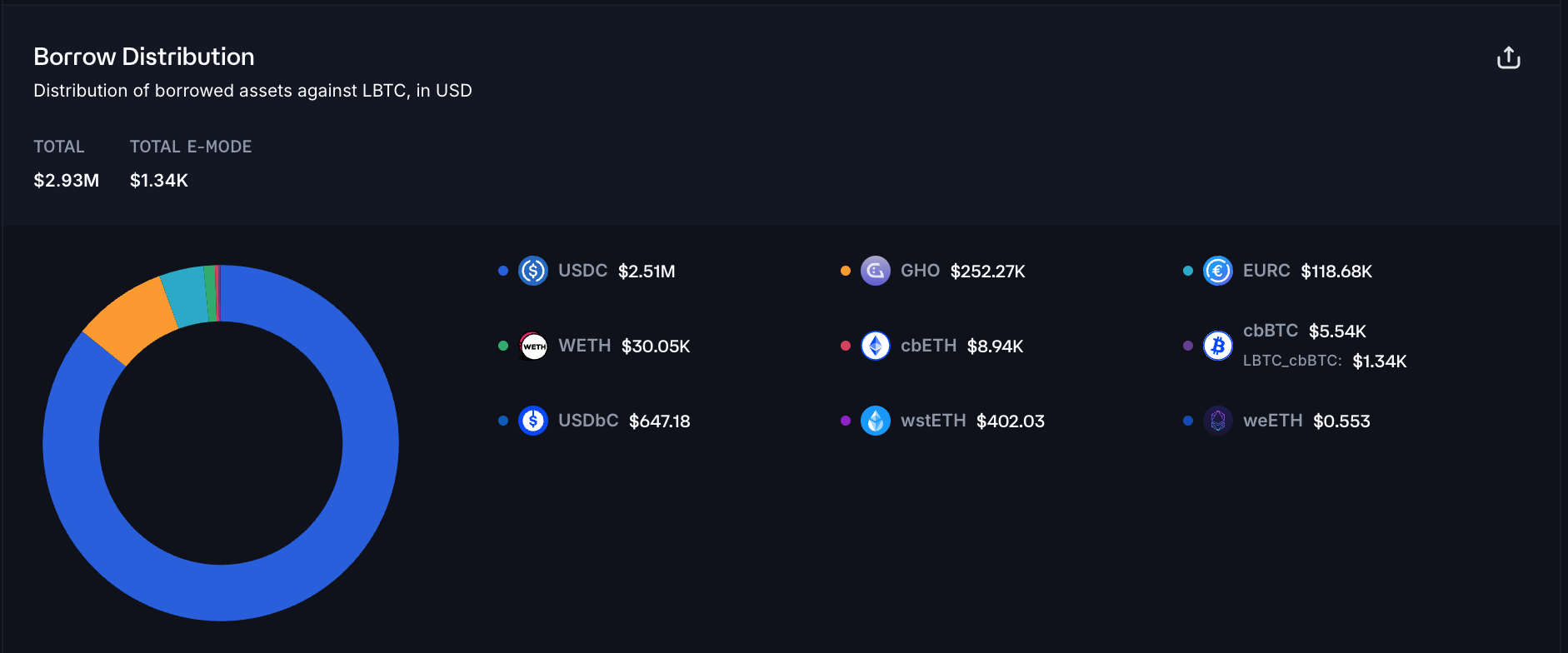

The supply distribution of LBTC is moderately concentrated, as the top 8 users account for over 65% of the total. The suppliers are primarily using LBTC to collateralize stablecoin debt. The distribution of health factors is within a safe 1.23 - 2.11 range, significantly limiting the liquidation risk.

Out of 2.9 million borrowed against LBTC, USDC represents over 86%, limiting the market’s exposure to additional volatility.

Liquidity

At the moment, a sell order of 50 LBTC on Base would incur 1% slippage. Such depth is ample to liquidate most of the market, consequently minimizing the probability of bad debt for the protocol.

Recommendation

Considering ample on-chain liquidity, safe user behavior, and elevated demand, we recommend increasing the supply cap of LBTC on the Base instance.

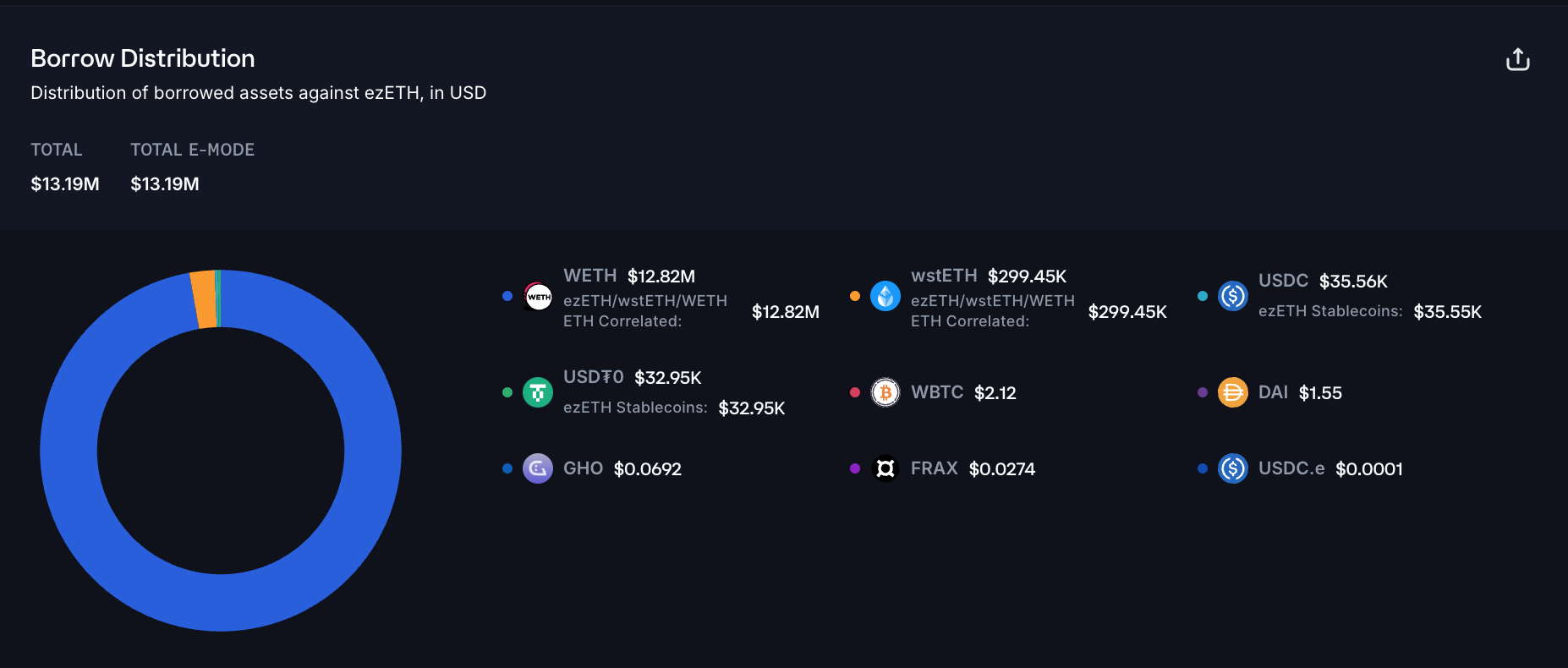

ezETH (Arbitrum)

ezETH has reached 98% of its supply cap on the Arbitrum instance, as the supply has doubled in the last 3 days, indicating a sharp increase in demand.

Supply Distribution

ezETH supply currently exhibits moderate concentration. The majority of users are holding substantial WETH or wstETH debt with lower-band health factors in the 1.02-1.3 range. It is important to note that the top supplier does not hold any debt, signaling potential positioning for further WETH borrowing, as ezETH does not earn any supply yield.

As mentioned, ezETH is primarily used to facilitate WETH and wstETH borrowing. Users execute leveraged restaking strategies, earning the underlying yield on LRTs while paying the borrow rates. Due to the high correlation between debt and collateral assets, the liquidation risk is minimal.

Liquidity

While the liquidity profile of the ezETH/WETH has decreased recently, the current depth is still sufficient to facilitate a swap of 300 ezETH limited at 1% slippage.

Recommendation

Given the safe user behavior, low debt and collateral volatility, along with strong liquidity, we recommend increasing the supply cap of ezETH.

Specification

| Instance | Asset | Current Supply Cap | Recommended Supply Cap | Current Borrow Cap | Recommended Borrow Cap |

|---|---|---|---|---|---|

| Ethereum Core | USDe | 1,800,000,000 | 2,100,000,000 | 1,500,000,000 | 1,750,000,000 |

| Linea | WETH | 230,000 | 350,000 | 210,000 | 315,000 |

| Base | LBTC | 75 | 150 | - | - |

| Arbitrum | ezETH | 7,000 | 14,000 | - | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.