Overview

In light of recent market developments, Chaos Labs recommends increasing the slope1 parameter for stablecoins. The adjustment will be executed through the Risk Steward process.

Motivation

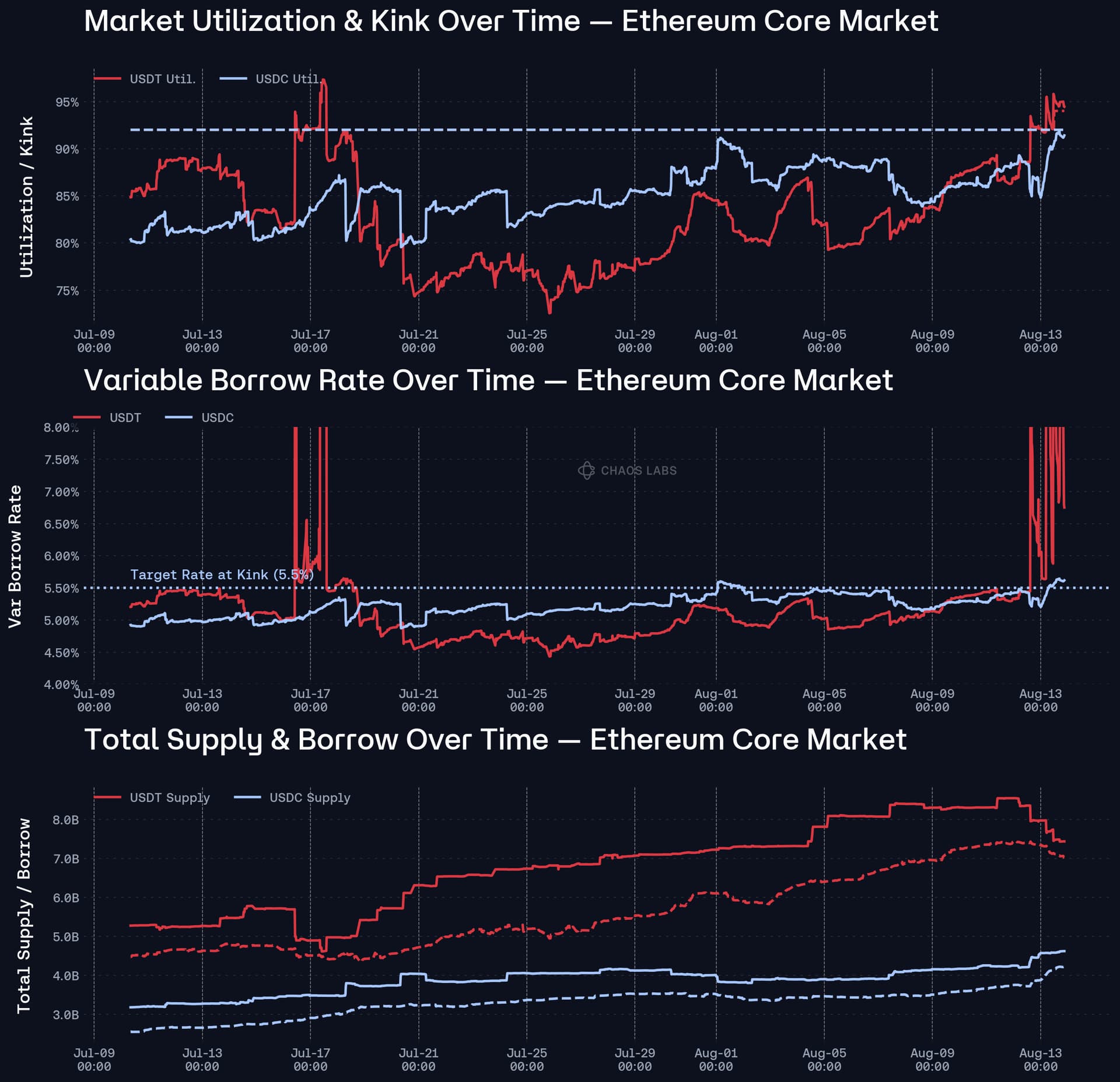

Over the past three months, the three largest stablecoins by volume in Aave’s Ethereum Core market—USDT, USDC, and USDe—have all shown a consistent increase in borrowing demand. USDT’s aggregate borrow size grew from $4.77B in July 2025 to $7.36B in August 2025, a 54% increase in just one month. Similarly, USDC’s borrow volume rose from $2.70B in July to $3.88B in August, representing a 43.70% increase.

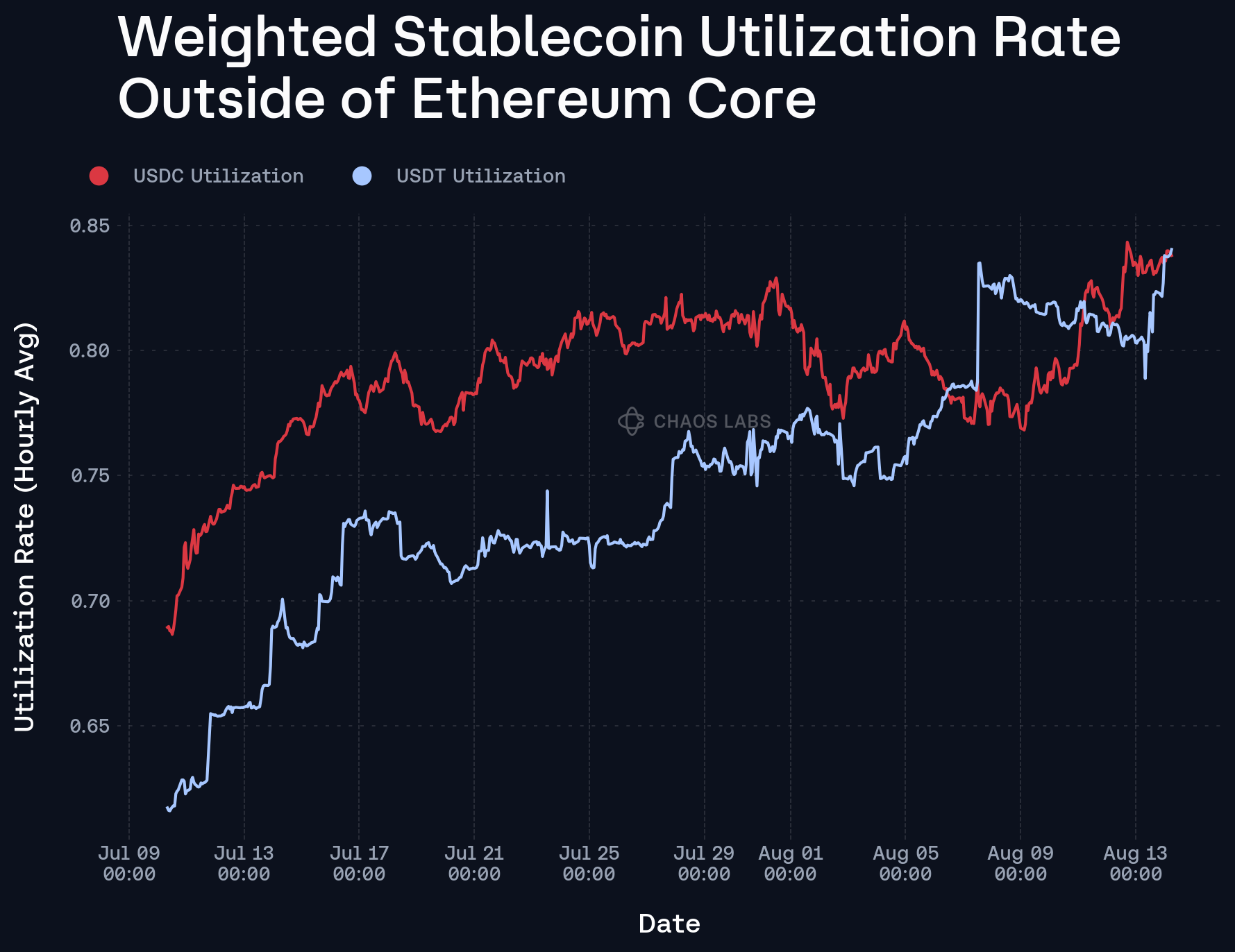

This surge in borrowing demand as a result of broader market activity has translated directly into elevated utilization rates and market convergence at such borrow rates. Over the past month, USDT’s utilization has stayed above 80% for most of the time (while amassing considerable deposits in the process). A similar trend was observed for USDC: maintaining a consistently high utilization rate, staying above 85% for most of the time and approaching 90% on several occasions stemming from increases in borrowing demand.

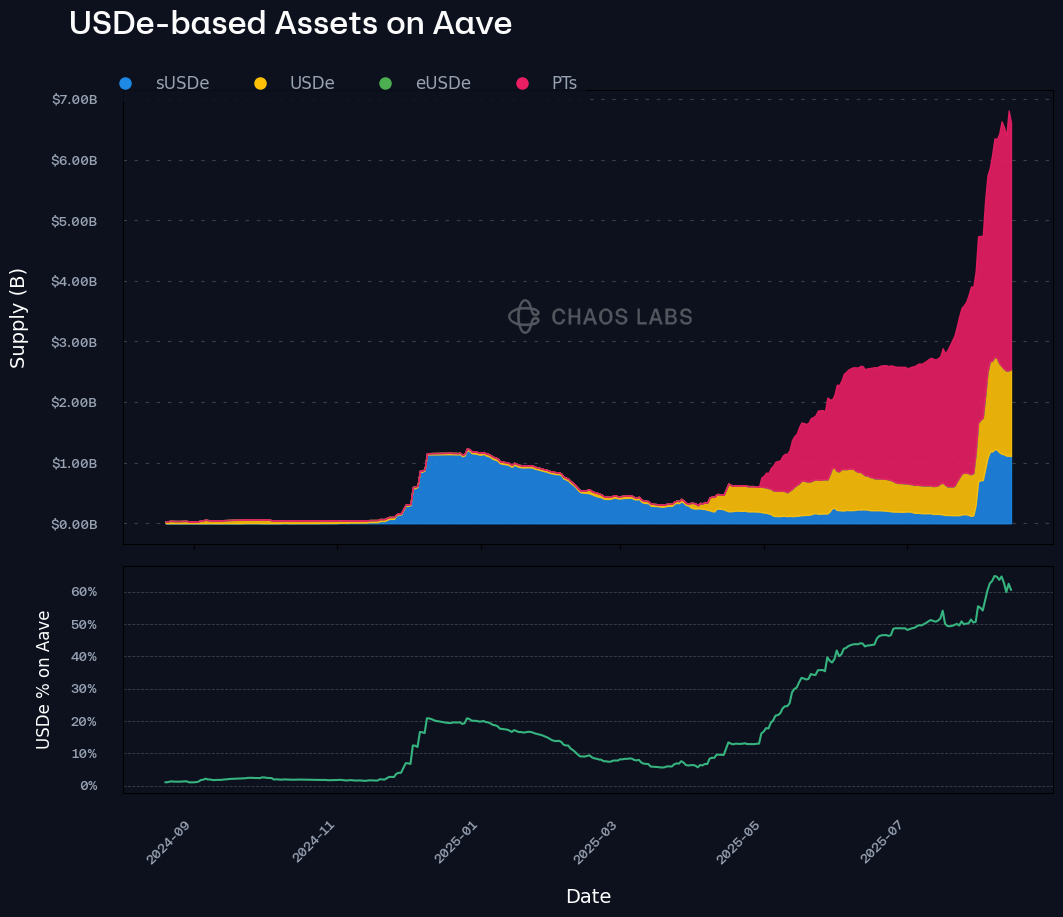

As highlighted in our research paper *Stress Testing Ethena: A Quantitative Look at Protocol Stability,* the onboarding of USD-based PTs to Aave in May 2025 has had significant second-order effects on relevant stablecoin markets. In particular, PT-driven collateral inflows have amplified borrowing activity in core stables to a significant degree, coupled with the introduction of Liquid Leverage for sUSDe and USDe collateralized stablecoin debt positions, scaling liquidity in a proportionate manner.

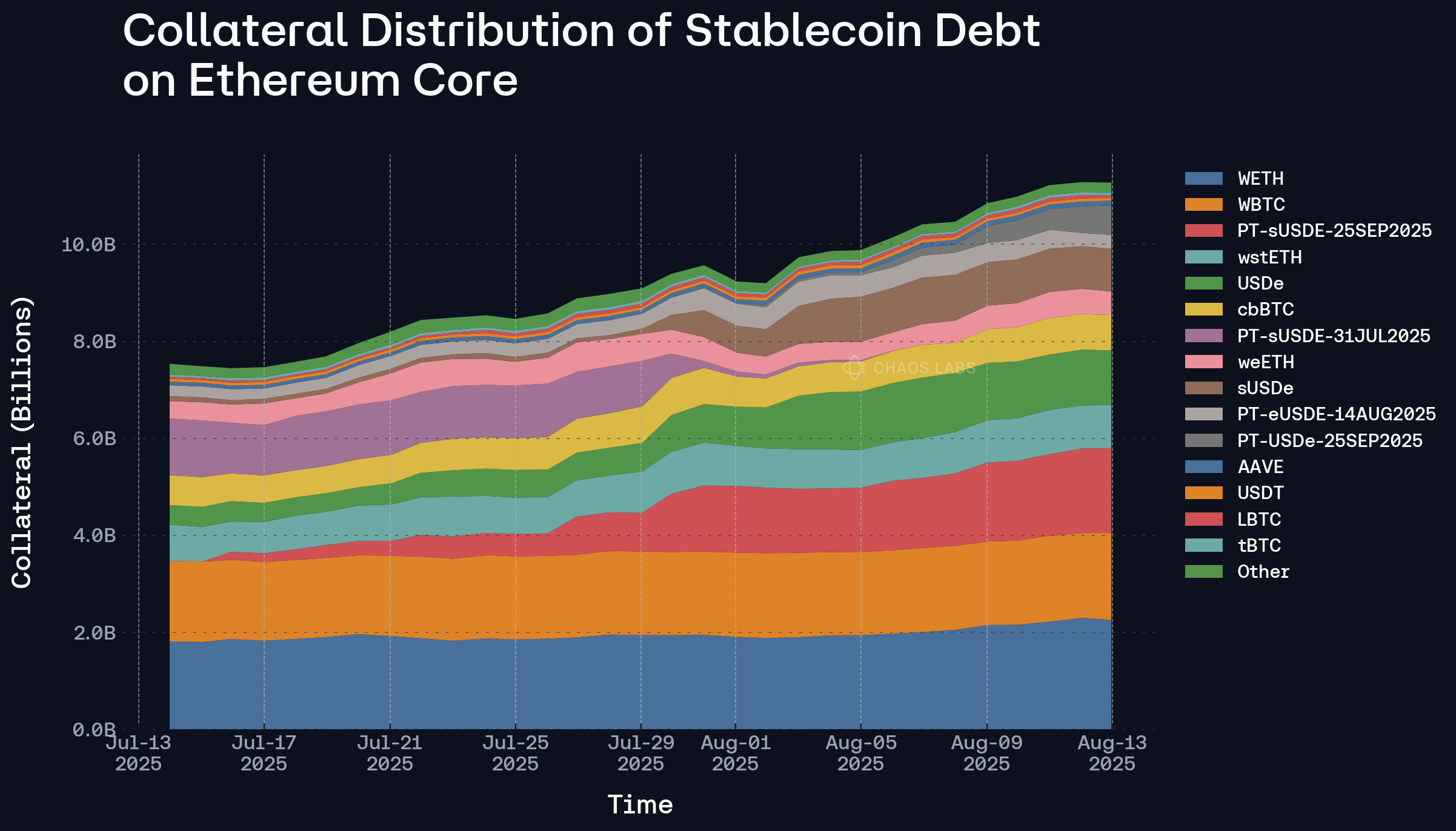

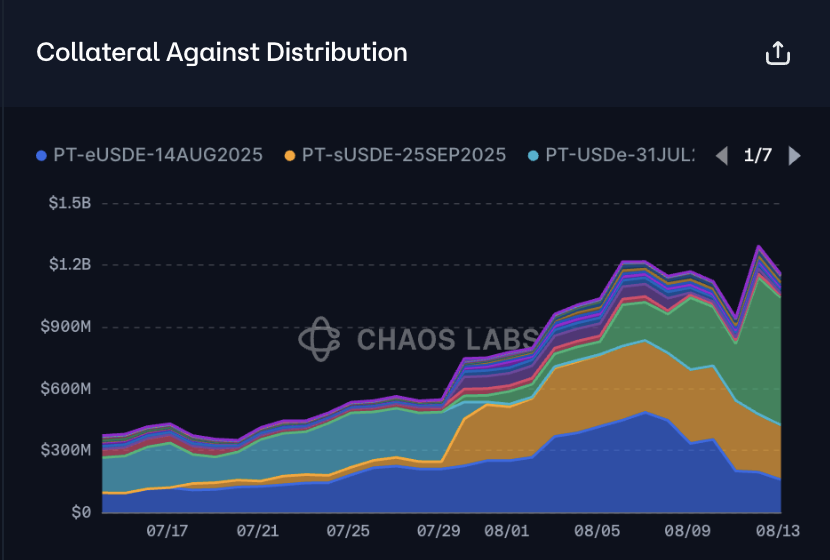

The chart below shows the collateral composition backing USDT and USDC debt over the past month, whereby amongst growth across all verticals, the introduction of high-yielding PTs coupled with liquid leverage stemming from external market activity (sUSDe yields) has thus led to significant growth.

Collateral Distribution of USDC and USDT Over Time

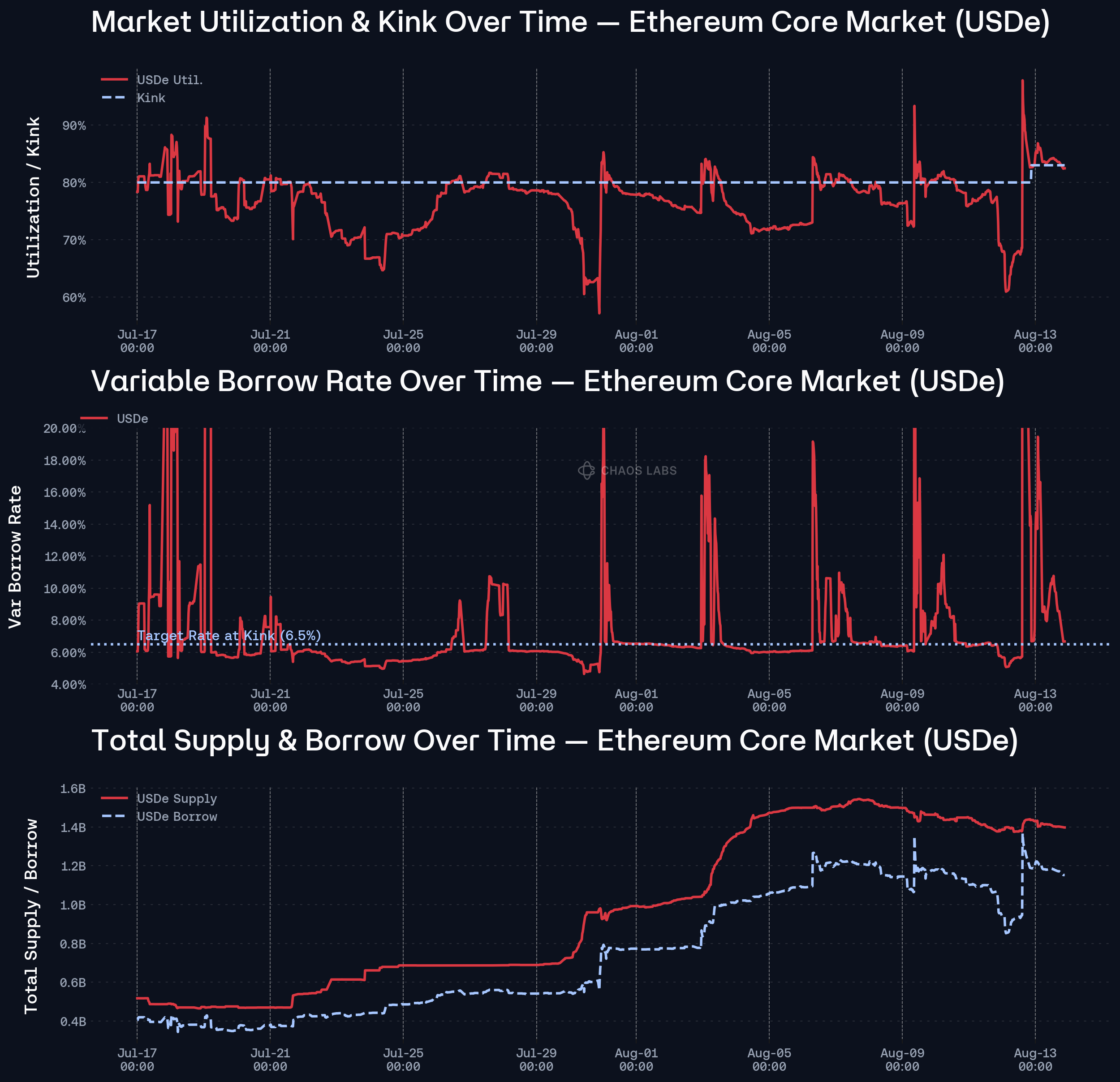

Compared to USDT and USDC, the growth in USDe borrowing was even more pronounced, stemming from scalability on both sides of the market (liquid leverage on the supply side, PTs on the demand side). As shown, USDe’s borrow volume surged from $342M in July to $1.25B in August, a 265.5% increase in just one month. Its utilization rate mirrored the patterns seen in USDT and USDC, remaining above 75% for most of the time and breaching its Uoptimal of 83% multiple times during the month.

The majority of USDe collateral currently consists of USD-based PTs such as PT-USDE-25SEP2025 and PT-sUSDE-25SEP2025. As of this writing, PTs account for approximately 90% of the total USDe collateral distribution.

Collateral Distribution of USDe Over Time

Beyond USDT, USDC, and USDe, other stablecoins on Ethereum have also shown similar trends. USDtb’s borrow amount grew from $38M to $57M within a month, while DAI increased from $131M to $167M over the same period, as of this writing. Together, these figures underscore the broader growth in stablecoin borrowing demand on Aave.

Non-Ethereum Chains

Beyond the Ethereum Core Market, stablecoins in other Aave instances have exhibited the same pattern. Total stablecoin borrow volumes across different Aave instances have portrayed a significant increase in borrowing demand across all verticals.

This growth in borrow volumes is also reflected in utilization trends. Across each instance over the past three months, in aggregate, stablecoin utilization rates have converged upwards, nearing the derived kink, stemming from the aforementioned increase in borrowing demand.

Recommendation

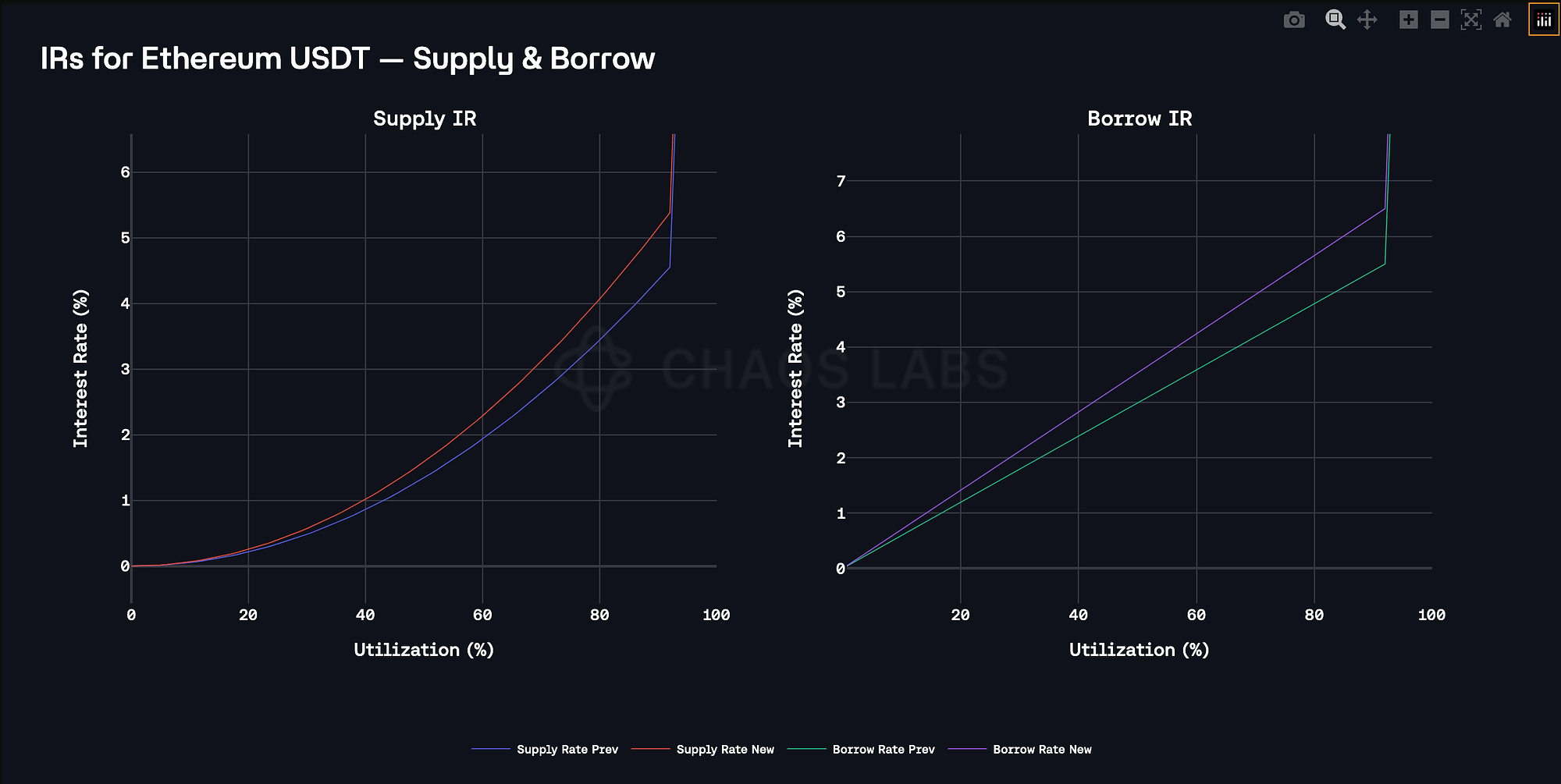

Based on sustained borrowing demand and recurrent spikes in utilization across core stablecoin markets, our interest rate modeling indicates that increasing slope1 across all Aave instances is warranted. From a modeling perspective, the current slope1 values do not sufficiently moderate demand before reaching the kink point. Specifically, a 100 bps increase in slope1 for all relevant stablecoins produces meaningfully higher borrow rates in the 70–90% utilization range, reducing the likelihood of abrupt rate jumps once Uoptimal is breached and improving rate stability.

Moreover, due to the extreme demand associated with PT looping with USDe debt, we recommend a 100 bps increase in its slope1 to align incentives further optimally. As derived via our PT risk oracle, leveraging USDe as debt enables superior capital efficiency and more lenient risk parameterization compared to USDC and USDT as debt assets, as the PTs share the same underlying anchor (USDe), thereby neutralizing fundamental losses in the underlying valuation relative to the debt.

Specification

| Protocol | Instance | Asset | Current Slope1 | Recommended Slope1 |

|---|---|---|---|---|

| Aave V3 | Ethereum Core | USDC | 5.50% | 6.50% |

| Aave V3 | Ethereum Core | USDT | 5.50% | 6.50% |

| Aave V3 | Ethereum Core | USDe | 6.50% | 7.50% |

| Aave V3 | Ethereum Core | USDtb | 6.00% | 6.50% |

| Aave V3 | Ethereum Core | DAI | 5.50% | 6.50% |

| Aave V3 | Ethereum Core | pyUSD | 11.50% | 6.50% |

| Aave V3 | Ethereum Core | LUSD | 5.50% | 6.50% |

| Aave V3 | Ethereum Prime | USDC | 5.50% | 6.50% |

| Aave V3 | Arbitrum | DAI | 5.50% | 6.50% |

| Aave V3 | Arbitrum | USDT | 5.50% | 6.50% |

| Aave V3 | Arbitrum | LUSD | 5.50% | 6.50% |

| Aave V3 | Arbitrum | USDC | 5.50% | 6.50% |

| Aave V3 | Optimism | DAI | 5.50% | 6.50% |

| Aave V3 | Optimism | USDT | 5.50% | 6.50% |

| Aave V3 | Optimism | USDC | 5.50% | 6.50% |

| Aave V3 | Base | USDC | 5.25% | 6.25% |

| Aave V3 | Metis | m.DAI | 6.00% | 6.50% |

| Aave V3 | Metis | m.USDC | 6.00% | 6.50% |

| Aave V3 | Metis | m.USDT | 6.00% | 6.50% |

| Aave V3 | Avalanche | DAI.e | 5.50% | 6.50% |

| Aave V3 | Avalanche | USDC | 5.50% | 6.50% |

| Aave V3 | Avalanche | USDt | 5.50% | 6.50% |

| Aave V3 | Avalanche | AUSD | 5.50% | 6.50% |

| Aave V3 | Gnosis | WXDAI | 5.50% | 6.50% |

| Aave V3 | Gnosis | EURe | 5.50% | 6.50% |

| Aave V3 | Gnosis | USDC.e | 5.50% | 6.50% |

| Aave V3 | BNB | USDC | 5.50% | 6.50% |

| Aave V3 | BNB | USDT | 5.50% | 6.50% |

| Aave V3 | BNB | FDUSD | 5.50% | 6.50% |

| Aave V3 | Scroll | USDC | 5.50% | 6.50% |

| Aave V3 | ZkSync | USDC | 5.50% | 6.50% |

| Aave V3 | ZkSync | USDT | 5.50% | 6.50% |

| Aave V3 | Linea | USDC | 5.50% | 6.50% |

| Aave V3 | Linea | USDT | 5.50% | 6.50% |

| Protocol | Instance | Asset | Current Base | Recommended Base |

|---|---|---|---|---|

| Aave V3 | Ethereum Core | RLUSD | 2.50% | 3.50% |

| Aave V3 | Ethereum Core | USDS | 4.50% | 5.50% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.