Summary

Recent market data indicate that stablecoin borrowing activity has not recovered meaningfully following the previous parameter reduction, primarily due to declining yields in leveraged strategies and muted demand for PT assets. Chaos Labs recommends lowering the target borrow rate for major stablecoins from 6.00% to 5.50% through a coordinated adjustment of Slope 1 across Aave V3 markets. In parallel, updates to the Plasma instance for USDe and USDT are proposed to align IR curves with the other Aave Instances.

Motivation

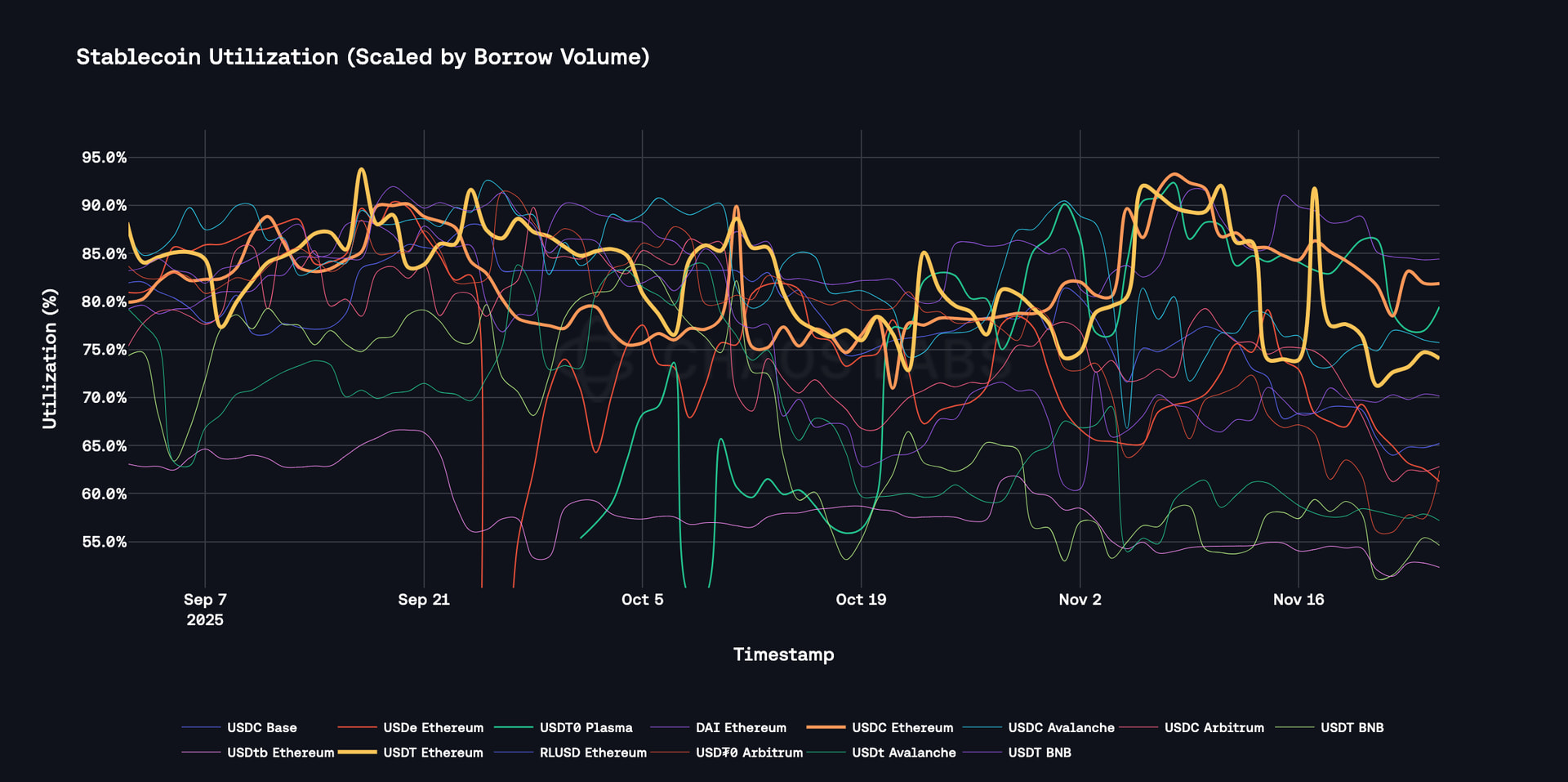

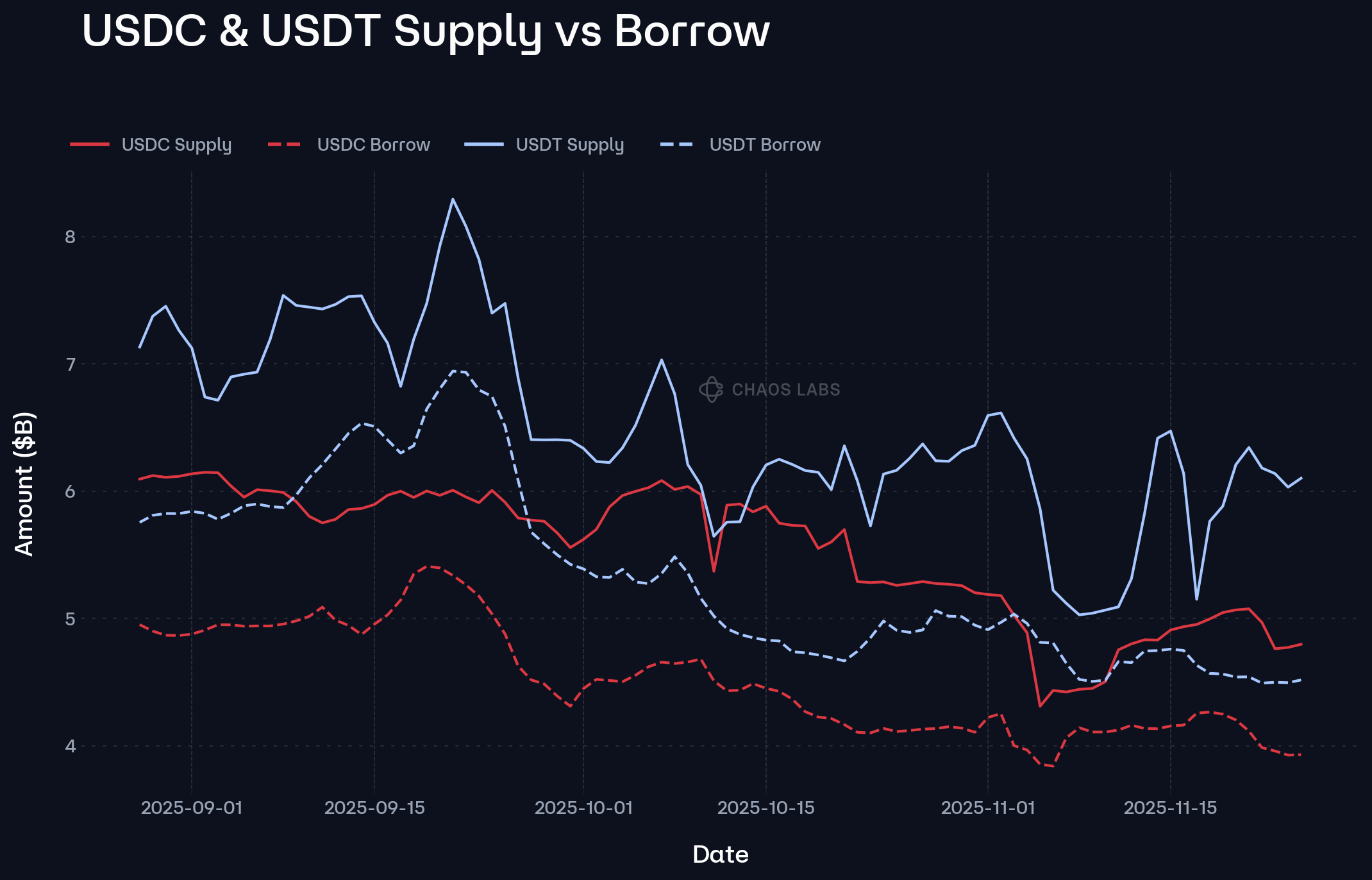

Over the past month, stablecoin utilization initially re-accelerated in the wake of the last Slope 1 recalibration, but the trend has since rolled over and is now drifting below target into the ~75–80% range. In aggregate, this reflects an asymmetric adjustment between legs of the market: while supplier liquidity has been gradually reverting and expanding back toward baseline, borrow balances have contracted more persistently and then plateaued at lower levels. With the borrow-side trajectory remaining flat-to-down versus a steadier recovery in supply, utilisation has continued to compress, signalling that leverage-driven demand is still weakening faster than capital is exiting on the supply side.

Borrowing activity earlier this year was heavily influenced by Ethena-driven looping strategies, which temporarily expanded stablecoin demand due to the significant spread between protocol yields and borrowing costs. While Ethena-based collateral remains a significant contributor to demand, its relative importance as a component of aggregate borrowing demand has diminished. Similarly, as the supply of outstanding USDe has shrunk, Ethena has withdrawn a portion of its backing from Aave markets in order to meet the redemption demand.

Additionally, as Ethena November PTs near maturity, a significant portion of previously locked liquidity will be released back into the market through positional unwinding. Meanwhile, demand for the newly listed February PT series is likely to stay muted, in line with Ethena yields drifting toward the low-3% APY range. These compressed yields materially weaken the appeal of stablecoin leverage and, under the current rate configuration, limit any organic rebound in borrowing demand.

Additional Parameter Adjustments on Plasma

During the initial configuration of the Plasma instance here, we proposed a specialized implementation of an interest rate curve for USDe and USDT, which utilized a configured base rate to ensure a higher supply rate at lower utilization rates. This was intended to address the expectation of high USDT supply thanks to the strong launch incentives. As the Plasma market has matured, we now recommend adjusting the IR curves of these assets to align with their counterparts in other instances.

USDe

Chaos Labs recommends adjusting the base rate of USDe from 2% to 0% combined with a Slope 1 adjustment from 5% to 5.75%. This configuration is expected to significantly increase the market’s utilisation, thereby boosting the supply rate. The higher supply rate will directly affect the attractiveness of Liquid Leverage strategies on the chain, driving further supply and enabling PT-denominated looping.

USDT

With utilization consistently above 80%, primarily driven by system contraction, the USDT market on Plasma is now operating in a regime distinct from its initial bootstrapping phase. As such, we recommended aligning its IR curve to that of other instances with a base rate of 0% and a Slope of 1 of 5.5%.

Recommendation

Given our expectation of continued softening in looping demand, driven by compressed Ethena yields and broader risk-off market conditions, we recommend an additional downward recalibration of Slope 1 across the major stablecoin markets. Specifically, lowering the target variable borrow rate from 6.00% to 5.50% would realign protocol pricing with prevailing market carry and improve rate competitiveness. This adjustment should help anchor underlying market demand characteristics around a sustainable equilibrium as liquidity freed from the November PT maturities re-enters the system, reducing the likelihood of abrupt utilization drawdowns or rate volatility.

For clarity, several stablecoin categories are intentionally excluded from this assessment, including GHO, bridged stablecoins, assets actively undergoing depreciation/offboarding, and other non-core or operationally constrained stablecoins.

Specification

| Protocol | Instance | Asset | Current Slope1 | Recommended Slope1 |

|---|---|---|---|---|

| Aave V3 | Ethereum Core | USDC | 6.00% | 5.50% |

| Aave V3 | Ethereum Core | USDT | 6.00% | 5.50% |

| Aave V3 | Ethereum Core | USDe | 6.25% | 5.75% |

| Aave V3 | Ethereum Core | USDtb | 6.00% | 5.50% |

| Aave V3 | Ethereum Core | DAI | 6.00% | 5.50% |

| Aave V3 | Ethereum Core | pyUSD | 6.00% | 5.50% |

| Aave V3 | Ethereum Core | LUSD | 6.00% | 5.50% |

| Aave V3 | Arbitrum | DAI | 6.00% | 5.50% |

| Aave V3 | Arbitrum | USDT0 | 6.00% | 5.50% |

| Aave V3 | Arbitrum | USDC | 6.00% | 5.50% |

| Aave V3 | Optimism | DAI | 6.00% | 5.50% |

| Aave V3 | Optimism | USDT | 6.00% | 5.50% |

| Aave V3 | Optimism | USDC | 6.00% | 5.50% |

| Aave V3 | Base | USDC | 5.75% | 5.25% |

| Aave V3 | Metis | m.DAI | 6.00% | 5.50% |

| Aave V3 | Metis | m.USDC | 6.00% | 5.50% |

| Aave V3 | Metis | m.USDT | 6.00% | 5.50% |

| Aave V3 | Avalanche | DAI.e | 6.00% | 5.50% |

| Aave V3 | Avalanche | USDC | 6.00% | 5.50% |

| Aave V3 | Avalanche | USDt | 6.00% | 5.50% |

| Aave V3 | Avalanche | AUSD | 6.00% | 5.50% |

| Aave V3 | Gnosis | WXDAI | 6.00% | 5.50% |

| Aave V3 | Gnosis | EURe | 6.00% | 5.50% |

| Aave V3 | Gnosis | USDC.e | 6.00% | 5.50% |

| Aave V3 | BNB | USDC | 6.00% | 5.50% |

| Aave V3 | BNB | USDT | 6.00% | 5.50% |

| Aave V3 | BNB | FDUSD | 6.00% | 5.50% |

| Aave V3 | Scroll | USDC | 6.00% | 5.50% |

| Aave V3 | ZkSync | USDC | 6.00% | 5.50% |

| Aave V3 | ZkSync | USDT | 6.00% | 5.50% |

| Aave V3 | Linea | USDC | 6.00% | 5.50% |

| Aave V3 | Linea | USDT | 6.00% | 5.50% |

| Aave V3 | Celo | USDT0 | 6.00% | 5.50% |

| Aave V3 | Celo | cUSD | 6.00% | 5.50% |

| Aave V3 | Celo | USDC | 6.00% | 5.50% |

| Aave V3 | Celo | cEUR | 6.00% | 5.50% |

| Aave V3 | Plasma | USDT0 | 4.00% | 5.50% |

| Aave V3 | Plasma | USDe | 5.00% | 5.75% |

| Protocol | Instance | Asset | Current Base | Recommended Base |

|---|---|---|---|---|

| Aave V3 | Ethereum Core | RLUSD | 3.00% | 2.50% |

| Aave V3 | Plasma | USDT0 | 2.00% | 0.00% |

| Aave V3 | Plasma | USDe | 2.00% | 0.00% |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclosure

Chaos Labs has not been compensated by any third party for publishing this AGRS recommendation.

Copyright

Copyright and related rights waived via CC0.