Overview

In light of recent incentives deployed on the USDC Aave V3 Base market, we recommend adjustments to the interest rate curve to minimize supply and borrow rate volatility. The changes proposed in this recommendation will be performed through the Aave Risk Steward.

Motivation

As part of the Base Incentive Campaign Funding, Aave is incentivizing USDC suppliers and borrowers on the Aave V3 Base instance.

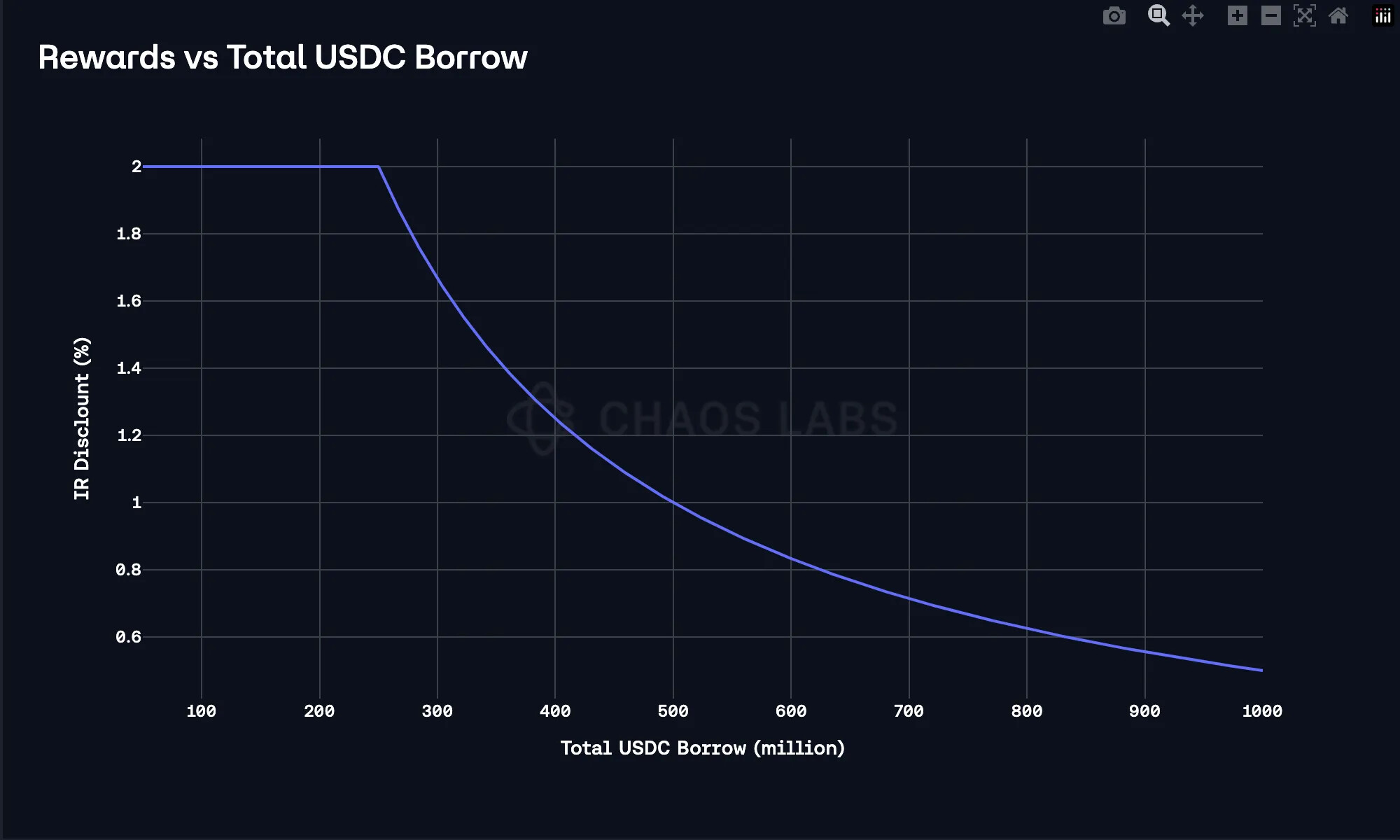

Thanks to this incentive campaign, started on July 23rd, the suppliers of USDC receive an additional 1% reward, while the borrowers receive a volume-adjusted discount on their borrowing rate equal to a 2% reward on borrowing rates until the total borrowing volume reaches $250M. Following the reach of this borrowing level of $250M, the rewards will be distributed pro rata to the borrowing volume. e.g., if borrow demand reaches $500M, the borrow rate will be discounted by 1% through incentives distribution.

Below, we plot the trajectory of the effective borrow rate discount over the total borrow volume of the USDC pool.

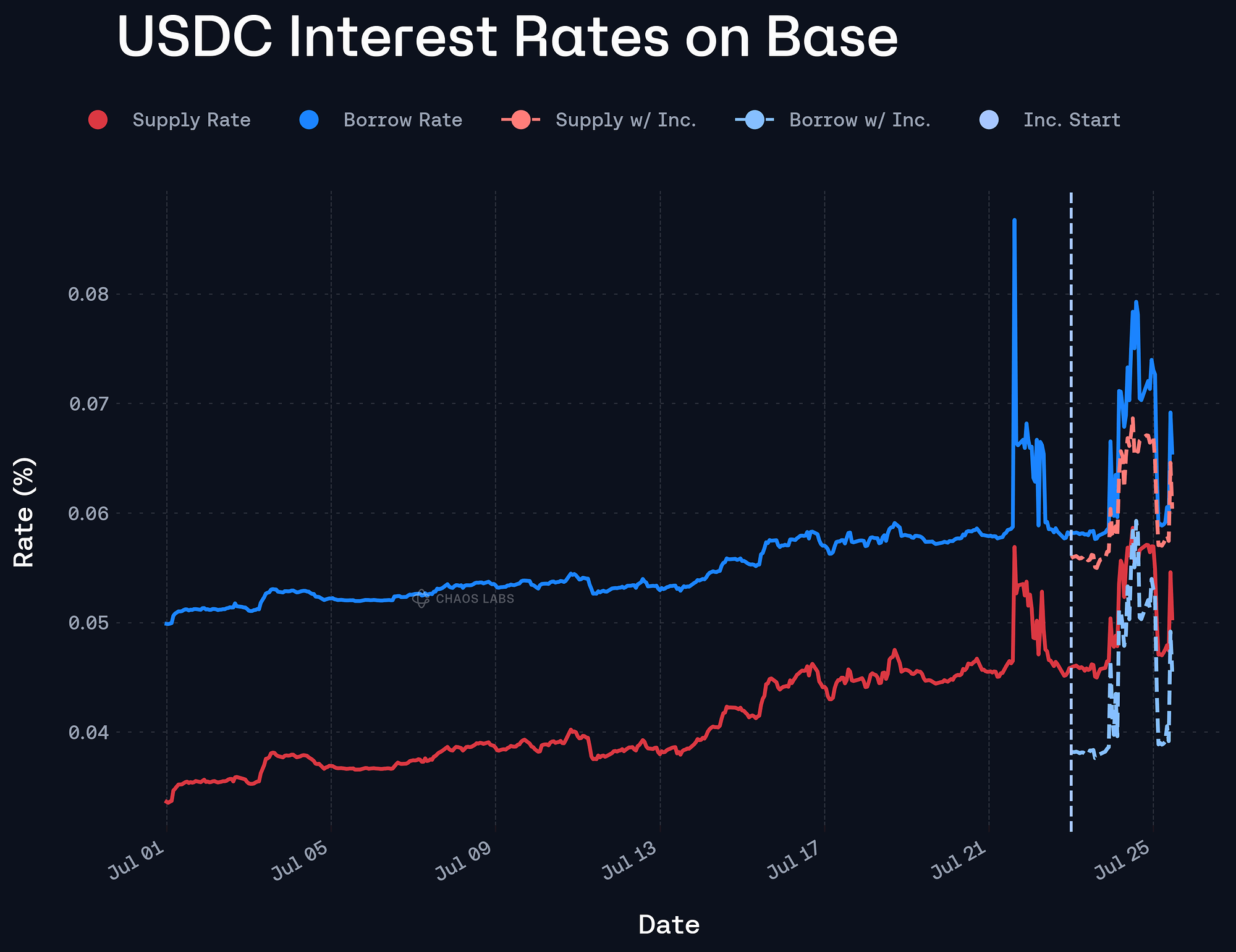

As it can be observed, the introduction of incentives on July 23rd caused the utilization of the market to exceed UOptimal, which caused the borrow rate of the USDC market to spike above the 5.75% target at UOptimal.

In order to address this rate volatility, and at the same time, to provide a more stable supply rate in the event of significant inflows of supply.

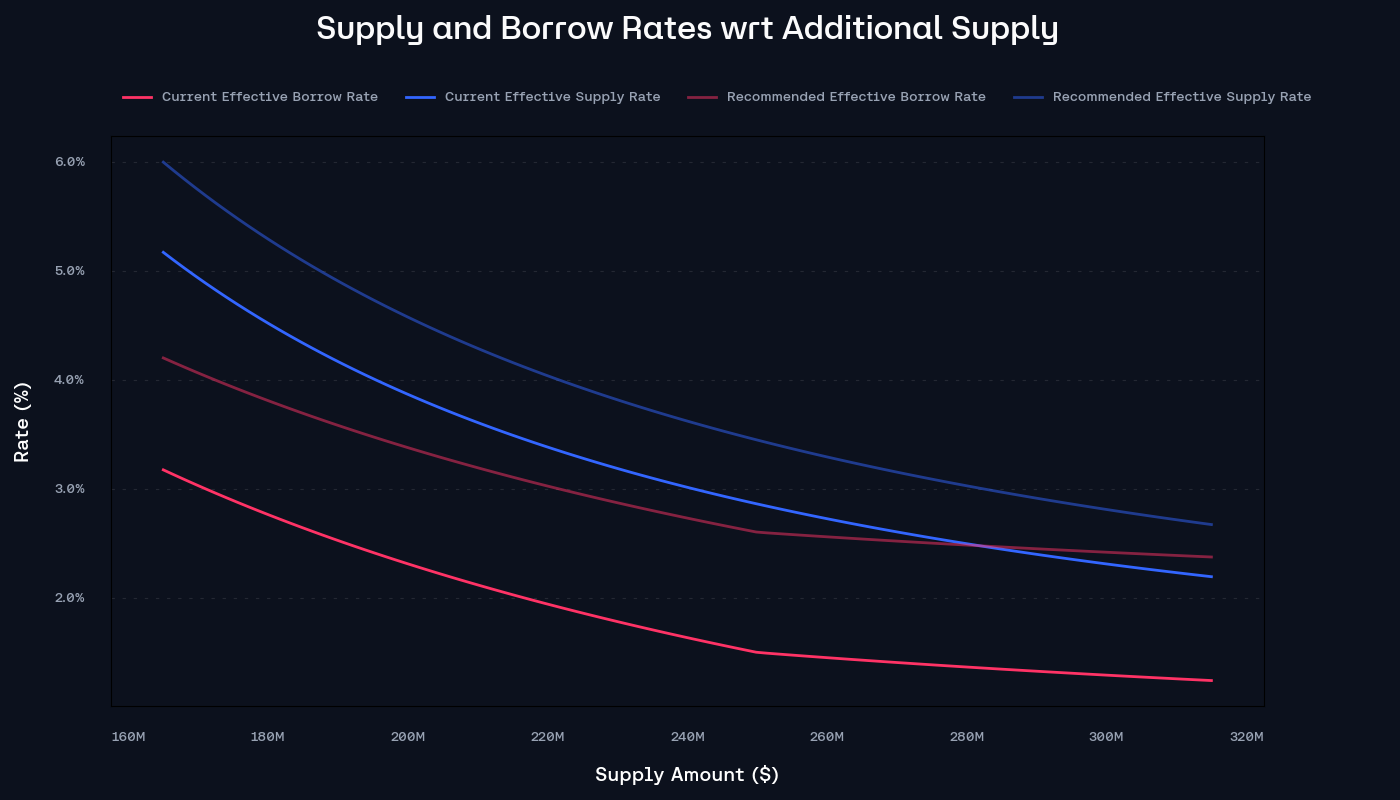

We target this goal by increasing the Base of the Interest Rate curve from 0.25% to 1.75% and by decreasing Slope 1 from 5.50% to 5.25%. Effectively increasing the Borrow Rate at UOptimal from 5.75% to 7.00%, and limiting the drop of borrow rate caused by additional USDC supply.

The following chart shows the difference between the current and the proposed rates in relation to the new USDC supplied, which is expected to be attractive through this campaign incentive.

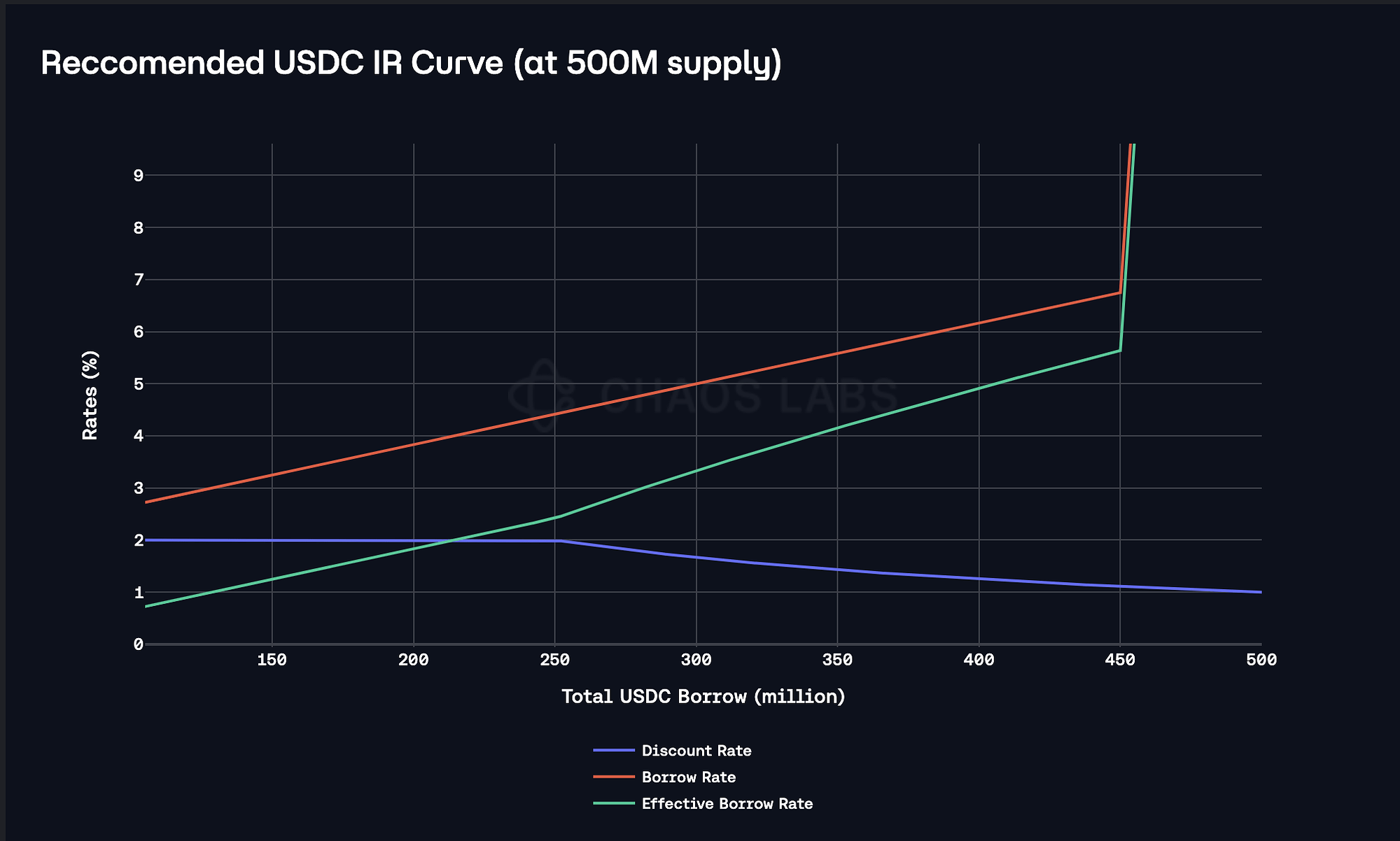

And the following chart shows the change in reported and effective Borrow rate in relation to the borrow demand given the reach of 500M USDC supplied within the Base instance.

As observed, while the proposed changes’ effect on the rates results in less drastic supply-to-borrow rate discrepancies over additional deposits, the primary element necessary to maintain a high borrowing rate in the market is attracting additional borrowing demand to maintain a high market utilization. As such, to effectively drive the migration of the funds currently supplied in competing strategies, as the goal described within the Incentive Campaign Funding post, the primary step should be increasing the capital efficiency of the market to attract additional borrowing demand.

Specifications

| Market | Asset | Current Base Rate | Recommended Base Rate | Current Slope1 | Recommended Slope1 | Current Slope2 | Recommended Slope2 |

|---|---|---|---|---|---|---|---|

| Base | USDC | 0.25% | 1.75% | 5.5% | 5.25% | 40% | - |

Next Steps

We will move forward and implement these updates via the Risk Steward process.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this ARFC.

Copyright

Copyright and related rights waived via CC0