Summary

This proposal outlines the final deprecation path for DPI (DeFi Pulse Index) across all Aave deployments where it remains listed: Ethereum v2, Polygon v2, and Polygon v3. DPI has been frozen across all instances for an extended period and now represents negligible exposure within the protocol.

The currently utilized DPI price feed has exhibited reduced stability and is scheduled for deprecation; it is thus timely for Aave to conclude DPI’s lifecycle by adjusting its risk parameters and implementing a simplified valuation approach that maintains accurate accounting for the small number of remaining positions.

Motivation

DPI has been frozen across all Aave instances for an extended period, with no new deposits or borrows permitted. Usage has steadily declined, and its residual exposure is now negligible across the protocol. Current positions are concentrated among a handful of users, with no material systemic or market risk implications.

Recently, Chainlink has indicated its intention to deprecate the DPI price feed due to reduced stability and limited data availability. Given that DPI’s trading activity and liquidity have declined significantly, maintaining this feed is no longer viable from an oracle operations standpoint. This development prompts the need for an internal Aave decision on how to handle valuation of the remaining DPI positions once the feed is sunset.

To address this, the following proposal outlines a minimal-risk approach to finalizing DPI’s deprecation across all Aave deployments while ensuring continuity for existing users.

Current Exposure Overview

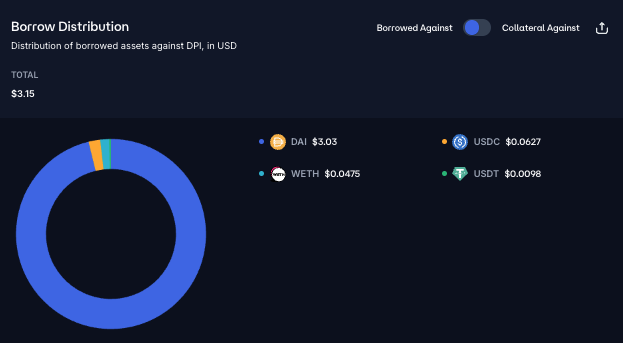

The remaining DPI exposure across Aave deployments is extremely limited, with negligible borrow activity and minimal collateral utilization. The following summarizes current positions to illustrate the low-risk profile and expected impact of the proposed parameter changes:

Polygon v3:

- ~$38K total supply

- ~$1.9K in debt backed by DPI collateral

- ~$14K in DPI borrowed, primarily collateralized by WBTC and other major assets

- Setting LT to 0.05% would trigger a single small liquidation (~$2.5K) of an account also holding LINK collateral, making the impact immaterial

Ethereum v2:

- ~$35K total supply

- ~$8.7K in debt borrowed, primarily against WBTC collateral

- Negligible collateral utilization; LT is already configured to 0.05%

Polygon v2:

- ~$1.4K supply

- No borrows or collateral usage; LT is already configured to 0.05%

Oracle and Price Feed Changes

While DPI remains frozen, the protocol must still value existing debt and collateral positions. Given its residual exposure (~$21K in aggregate debt across deployments), maintaining a complex dynamic feed is unnecessary, such as building a NAV representation of the underlying assets that comprise DPI’s backing (e.g., AAVE, UNI, ENA, MKR, LDO, PENDLE, COMP, RPL).

Alternatively, as discussed with @bgdlabs, we recommend a simple implementation of a fixed price feed to denominate the outstanding DPI debt, configured as a function of historical DPI price returns. Specifically, we recommend fixing the DPI/USD feed to $102, corresponding to DPI’s 12-month average market price, during which realized variance has been limited to roughly ±5%. As DPI’s underlying basket has effectively ceased rebalancing in accordance with its deprecated state, the index behaves like a static portfolio of DeFi assets. In this context, a fixed oracle price is a practical approximation of residual value.

The risk that DPI’s true NAV diverges from $102 does not create material insolvency concerns at current scale. If DPI were to trade below the fixed price, borrowers are naturally incentivized to repay cheaper debt; if it trades above, the upside is effectively bounded by the combination of frozen collateral use, minimal circulating exposure on Aave, and the fact that no new debt can be initiated. Moreover, DPI’s dominant AAVE weight (~39%) means upside NAV drift is, in expectation, correlated with broader protocol health; conversely, downside scenarios are cushioned by the tiny outstanding borrow base and the forthcoming parameter changes (LT = 0.05%, 10% base rate, reduced slope2) that encourage timely deleveraging without creating runaway interest accrual. The plots below illustrate the representation of the underlying DPI backing since its final rebalancing, both in terms of NAV price share and relative share over time.

From a conceptual standpoint, fixing the oracle at $102 functions like a conditional covered call with respect to treasury valuation: the “coverage” is that a substantial portion of intrinsic value is anchored by large-cap components (notably AAVE), while the “conditional” aspect is that if market price dips below the fixed level, economic incentives push borrowers to reduce exposure, thus lowering residual risk to the protocol over time.

Risk Parameter Changes

To finalize deprecation, the following adjustments are proposed:

- Set Liquidation Threshold (LT) = 0.05% on

- Polygon v3 (note: triggers one minor liquidation, ~$2.5K notional)

- Adjust Interest Rate Parameters (Polygon v3 and Ethereum v2)

- Base rate: 20% (to encourage baseline debt repayment)

- Slope 2: 40% (reduced from 300%) to avoid excessive reserve inflation on residual balances

Specification

| Asset | Deployment | Current Liquidation Threshold | Recommended Liquidation Threshold | Current Base Interest Rate | Recommended Base Interest Rate | Current Slope2 | Recommended Slope2 |

|---|---|---|---|---|---|---|---|

| DPI | Ethereum v2 | - | - | 20% | - | 300% | 40% |

| DPI | Polygon v3 | 45% | 0.05% | 0% | 20% | 300% | 40% |

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this proposal.

Copyright

Copyright and related rights waived via CC0