Overview

Chaos Labs supports listing syrupUSDC on Aave V3’s Base instance. Below is our analysis and risk parameter recommendations for the initial listing.

Technical Overview

Chaos Labs has conducted a comprehensive technical evaluation of syrupUSDC on Ethereum; the full assessment can be found here. At a high level, syrupUSDC is Maple Finance’s yield-bearing representation of USDC deposited into the Maple credit pool. It is an ERC-4626 vault token that tokenizes a pro-rata claim on a diversified portfolio of institutional loans originated and managed by Maple Direct. Users mint syrupUSDC by supplying USDC to the pool and receive vault shares whose value increases as interest accrues on both fixed-term and open-term credit exposures.

The syrupUSDC on Base is bridged using Chainlink CCIP, which burns syrupUSDC on the source chain and mints it on the destination chain. When a user initiates a transfer, the CCIP Router sends their syrupUSDC to the chain’s designated token pool, which is authorized to destroy the tokens. CCIP then relays a verified cross-chain message to the destination network, where the corresponding token pool, holding the minting rights, creates the same amount of syrupUSDC for the recipient. Any minor price deviations of bridged syrupUSDC on Base are expected to be corrected by cross-chain arbitrage.

Technical Implementation

The MaplePool contract is an immutable ERC-4626 vault that holds USDC and mints or redeems syrupUSDC, while delegating control, permissions, and accounting to its paired PoolManager. The PoolManager gates all state-changing Pool entry points via its canCall hook, deploys liquidity into loans through LoanManager modules, coordinates withdrawals through a queue-based WithdrawalManager, and maintains pool accounting by aggregating on-chain cash, outstanding principal, and accrued interest net of fees. Pool value accrues through an increasing exchange rate rather than rebasing, with deposits priced at the deposit exchange rate and redemptions settled at the withdrawal exchange rate. When users request redemption, their shares are escrowed in the WithdrawalManager and processed FIFO as liquidity becomes available, with payouts calculated using the exit exchange rate (totalAssets − unrealizedLosses) / totalSupply.

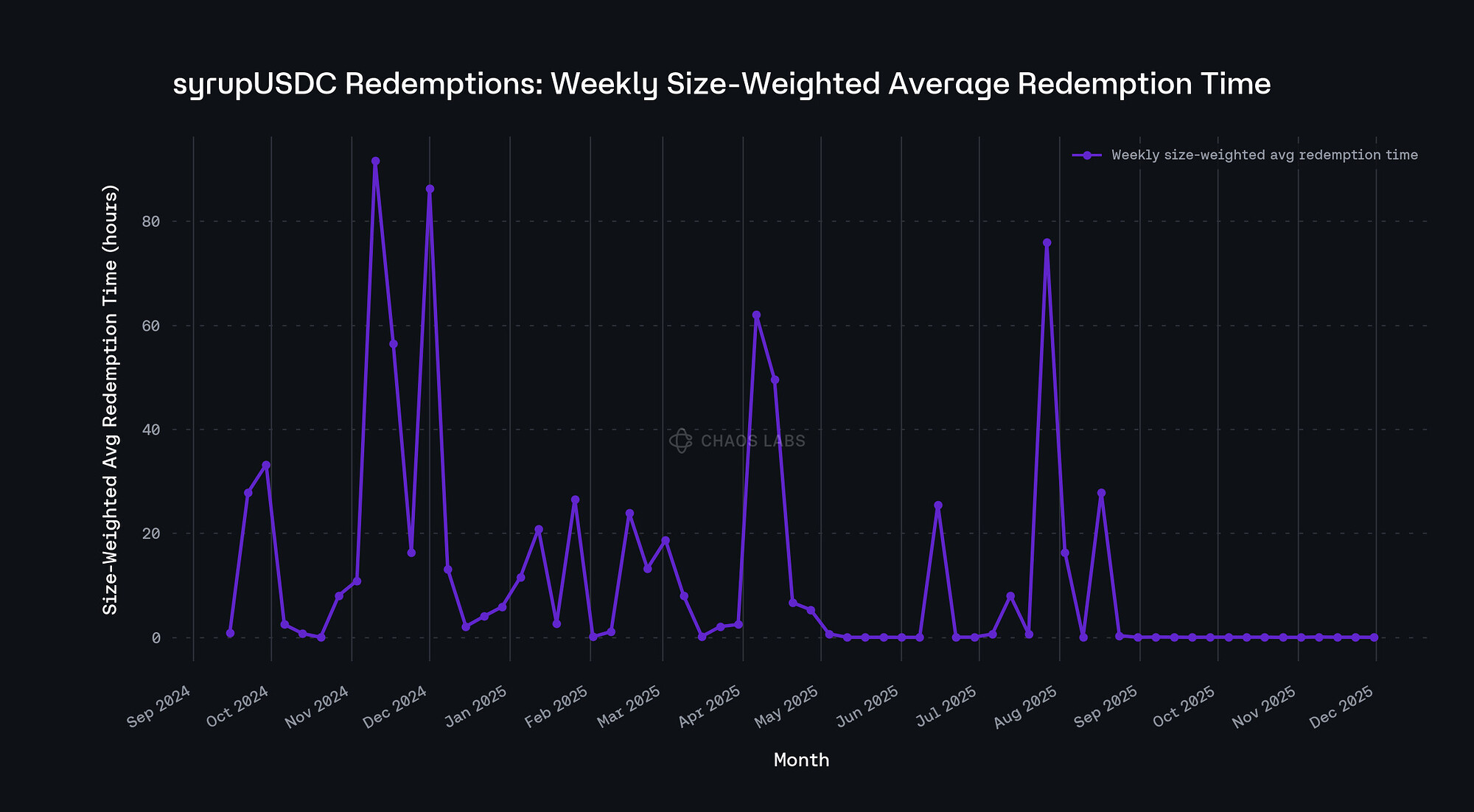

In our initial visit, we analyzed all redemption events from July 2024 through June 2025 and observed that most redemptions were processed within roughly one hour. The updated dataset shows the same behavior: even very large redemptions exceeding $10M move quickly through the queue and are executed promptly by the PoolManager.

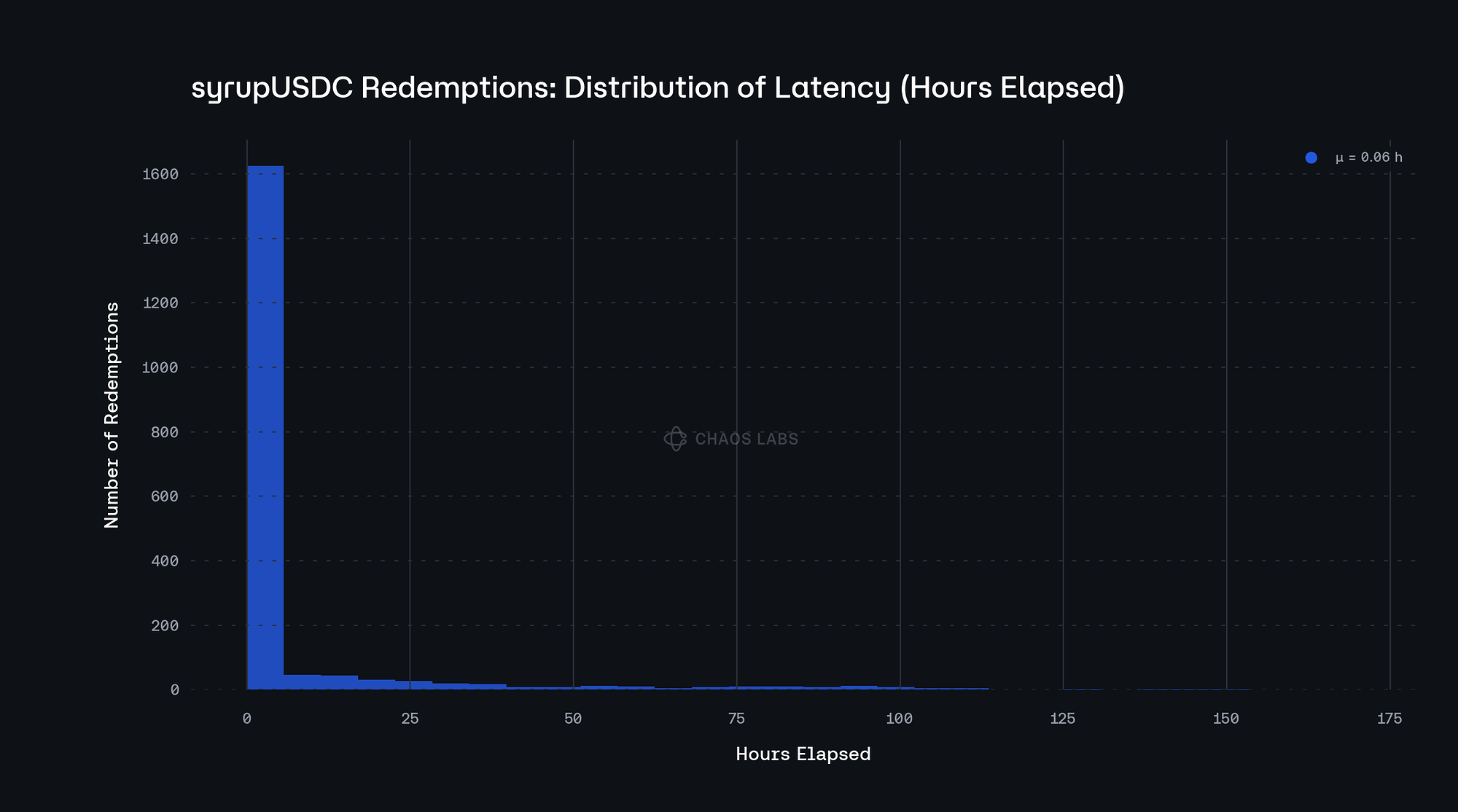

As illustrated in the chart, 81.03% of all redemptions complete within one hour and 91.19% settle within 24 hours. The distribution is highly skewed toward fast processing, with a median redemption latency of 0.06 hours.

Then, examining weekly redemption dynamics, the chart below reports the average processing time for all events between September 2024 and December 2025. While modest week-to-week fluctuations are observable, redemption latency remains generally low throughout the period. Notably, over the past three months, the average redemption time for syrupUSDC has remained firmly below one hour.

Reserve Backing Update

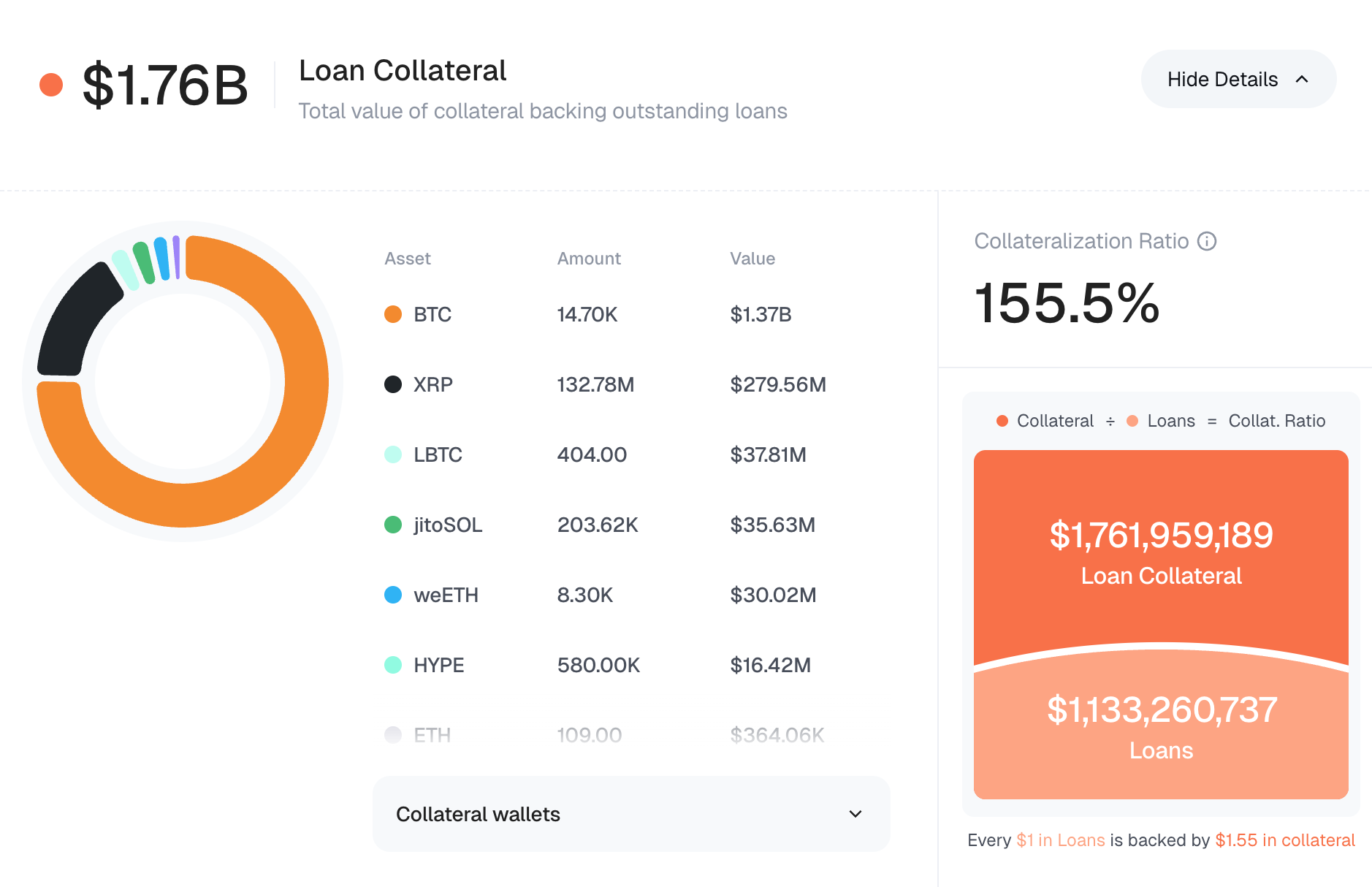

Collateral backing Maple’s USDC and USDT loan books currently totals $1.76B, against $1.15B in outstanding stablecoin loans, implying an aggregate collateralization ratio of 153%. BTC remains the dominant form of collateral at 77.4% of the total, or roughly $1.37B. In addition to loan collateral, Maple pools hold approximately $1.17B in DeFi liquidity deployed across secondary strategies; these positions function as liquid reserves that can be recalled to facilitate redemptions and have grown meaningfully since our prior review. Unlike syrupUSDT, none of syrupUSDC’s backing is deployed on Aave, so it does not carry the reflexive liquidity risk discussed in our syrupUSDT analysis.

In addition, after discussions with the Maple team, we further explained in this post their collateralized credit-lending risk-parameter framework and the systemic linkage between syrupUSDC and syrupUSDT. This outlines how risk and collateral mechanisms are configured across pools and how, under extreme conditions, the two syrupUSD pools could potentially transmit risk from one to the other.

Market Cap & Liquidity

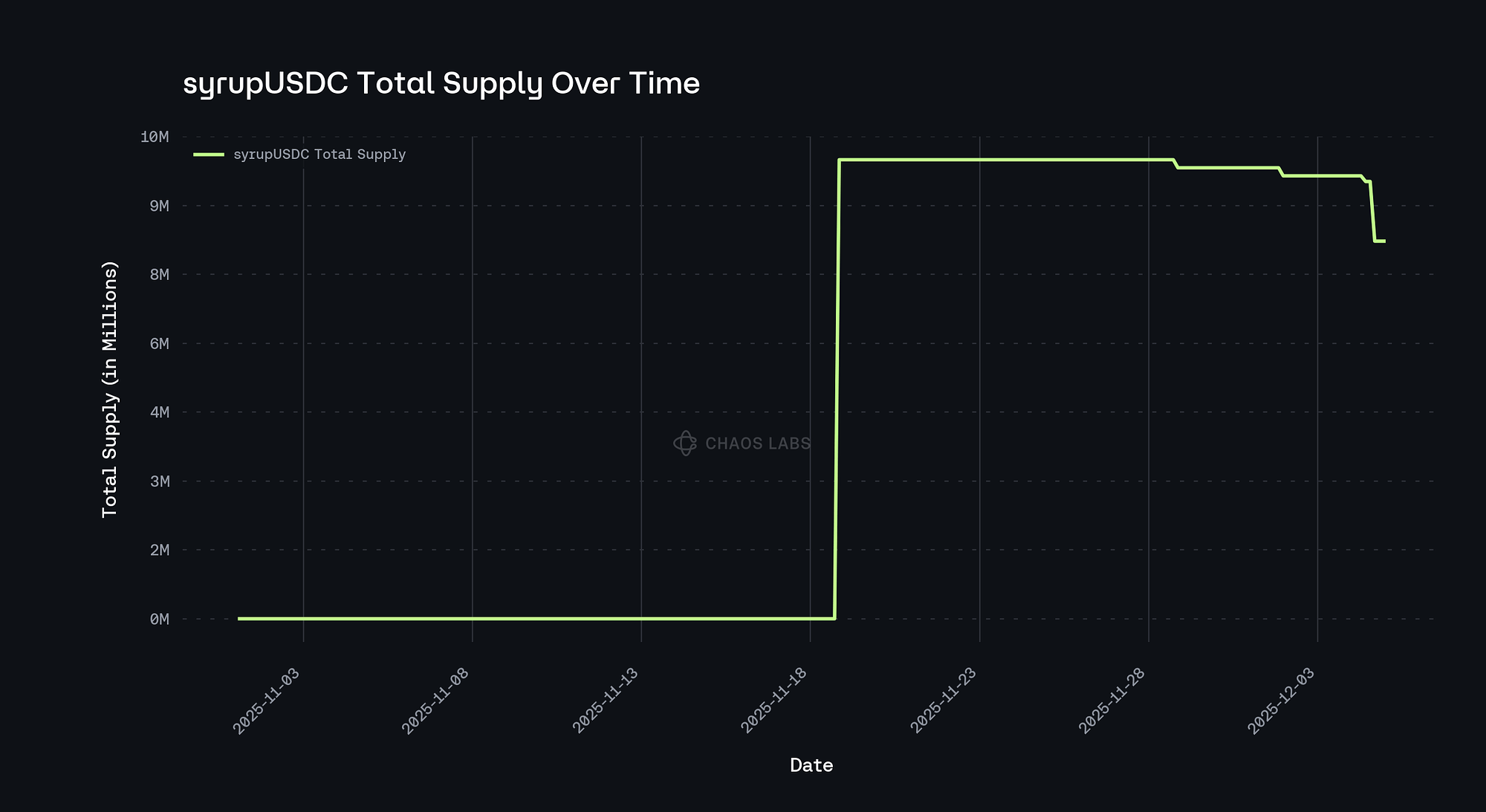

syrupUSDC’s total supply on Base showed significant growth in November 2025, reaching approximately 10M in mid-November. As of this writing, the total supply stands at 9.8M, translating to a market cap of $11.3M and indicating a strong upward trend.

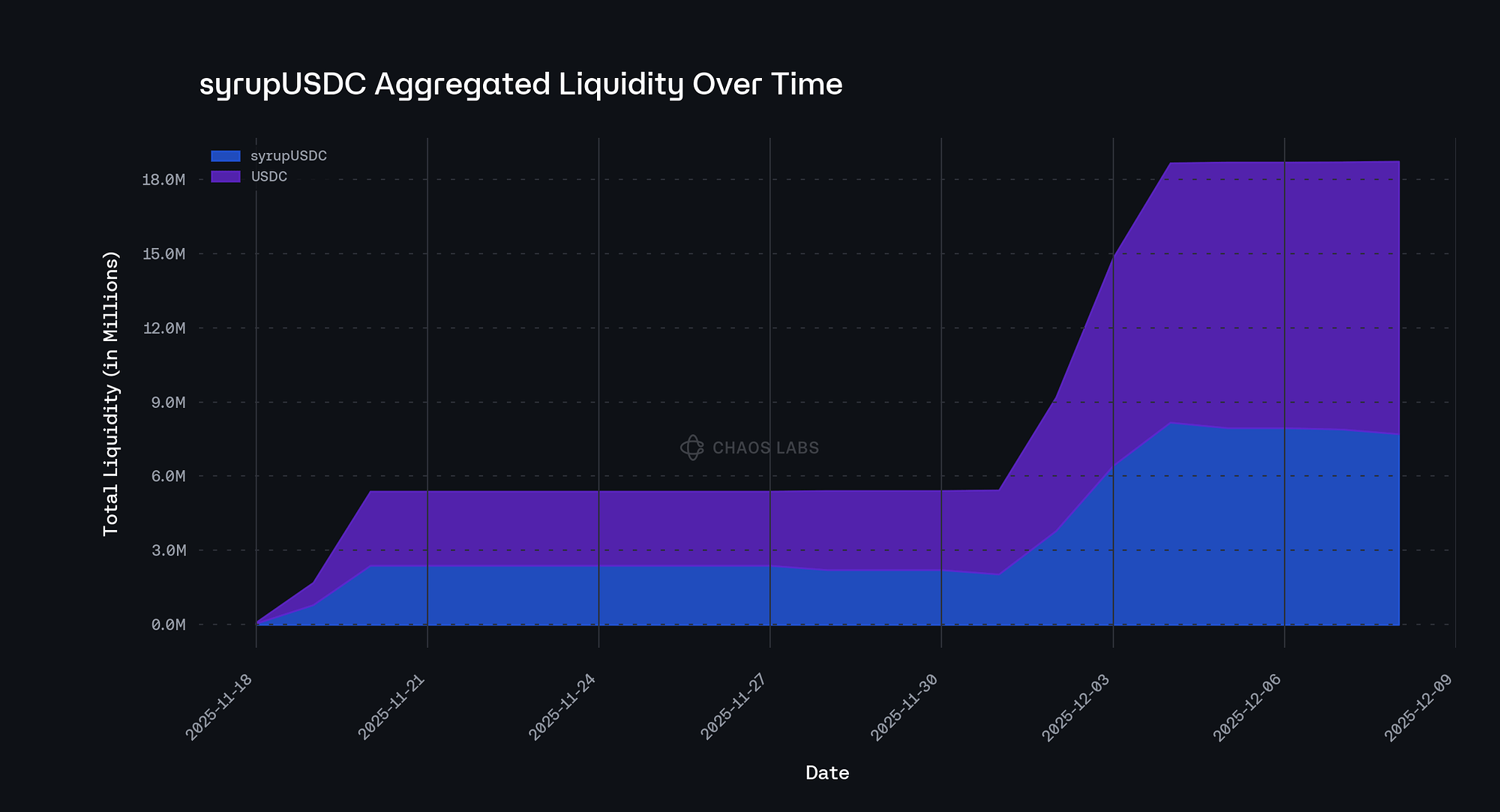

syrupUSDC’s liquidity is currently concentrated in two primary venues: the Fluid syrupUSDC/USDC liquidity pool with a $10M TVL and the Aerodrome syrupUSDC/USDC liquidity pool with a $9.8M TVL. Together, these two pools account for 99% of the total syrupUSDC supply on Base. Below, we show the aggregated liquidity of syrupUSDC across these two pools. As illustrated, syrupUSDC liquidity has been on a steady upward trend, with a notable increase toward the end of November 2025.

Peg Stability

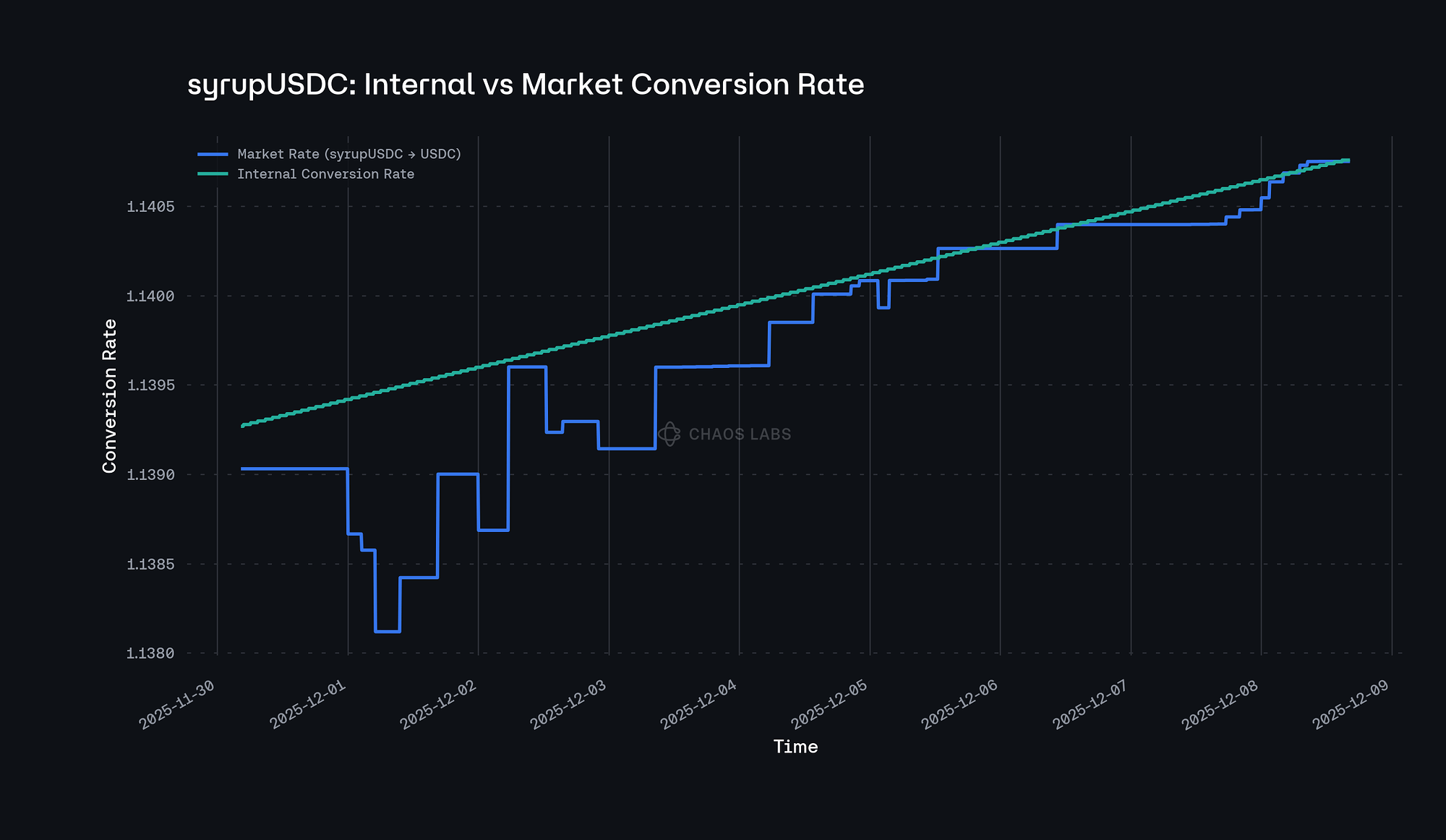

Peg stability evaluates whether the exchange rate users receive through syrupUSDC’s internal exit path is strongly aligned with the exchange rate available through secondary-market exit paths. Below, we present the syrupUSDC-to-USDC market exchange rate from the syrupUSDC/USDC Aerodrome liquidity pool, alongside syrupUSDC’s internal exchange rate fetched from the convertToExitAssets function.

As shown, syrupUSDC’s internal exchange rate and market exchange rate have consistently maintained a robust peg, with maximum deviation at 14 bps. This demonstrates that the protocol’s internal exit exchange rate is tightly aligned with secondary-market liquidity and that syrupUSDC maintains strong redeemability across both exit paths.

Parameter Recommendations

E-Mode

Given syrupUSDC’s nature as a yield-bearing stablecoin, its primary practical use case on a lending market is expected to be leverage looping: using syrupUSDC as collateral to borrow stablecoins and amplify exposure to the underlying yield. Therefore, we recommend enabling syrupUSDC only as collateral and restricting its collateral usage exclusively to E-Mode following the implementation of the Aave 3.6 update.

In anticipation of the update, we recommend adopting minimal temporary collateral parameters, making the asset unattractive for usage outside its designated E-Mode.

Supply Cap

Considering the ample liquidity, its consistently upward trajectory since creation, and the orderly redemption behavior, we believe a higher supply cap for syrupUSDC is justified. Specifically, we recommend setting the supply cap at 50M.

Oracle Implementation & CAPO

Consistent with the implementation used for syrupUSDC on Ethereum, Chaos Labs recommends utilizing a USDC/USD price feed augmented with the convertToExitAssets() value from the syrupUSDC contract. In the event that any practical deficit is observed within a Maple debt position following liquidation, this exchange rate will be adjusted to account for the underlying shortfall.

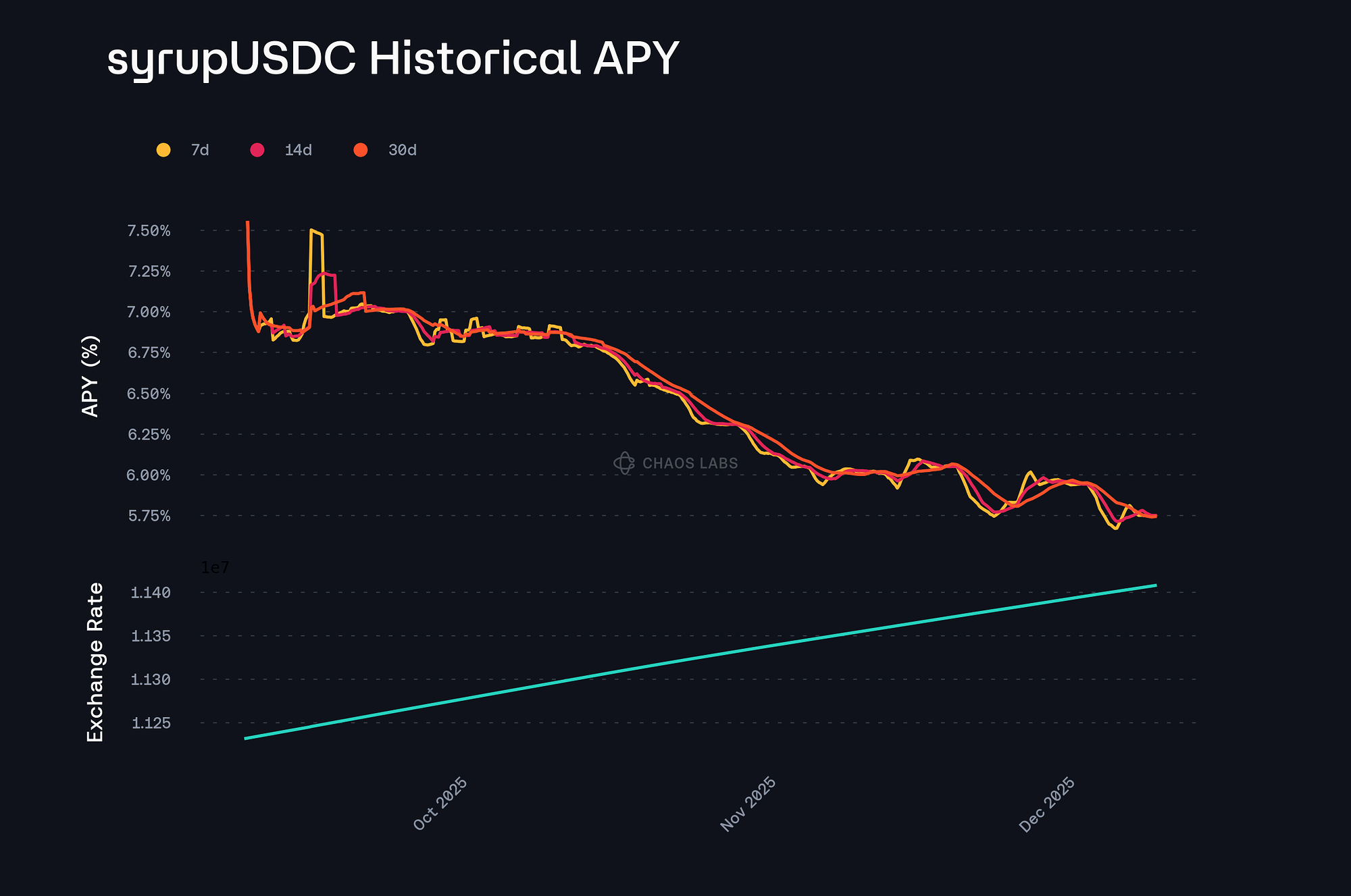

This mechanism will also be protected through CAPO. As shown below, syrupUSDC’s yield has exhibited minor volatility over the past three months. Taking this into consideration, we recommend setting the Snapshot Delay to 7 days and the maxYearlyGrowthRatio to 8.04%.

Specification

Configuration

| Parameter | Value |

|---|---|

| Isolation Mode | No |

| Borrowable | No |

| Collateral Enabled | Yes |

| Supply Cap | 50,000,000 |

| Borrow Cap | - |

| Debt Ceiling | - |

| LTV | 0.05% |

| LT | 0.10% |

| Liquidation Bonus | 4% |

| Liquidation Protocol Fee | 10% |

| Variable Base | - |

| Variable Slope1 | - |

| Variable Slope2 | - |

| Uoptimal | - |

| Reserve Factor | - |

| Stable Borrowing | Disabled |

| Flashloanable | Yes |

| Siloed Borrowing | No |

| Borrowable in Isolation | No |

| E-Mode Category | syrupUSDC/Stablecoins |

E-Mode Configuration

| Parameter | Value | Value | Value |

|---|---|---|---|

| Asset | syrupUSDC | USDC | GHO |

| Collateral | Yes | No | No |

| Borrowable | No | Yes | Yes |

| Max LTV | 90.00% | - | - |

| Liquidation Threshold | 92.00% | - | - |

| Liquidation Bonus | 4.00% | - | - |

CAPO

| maxYearlyRatioGrowthPercent | ratioReferenceTime | MINIMUM_SNAPSHOT_DELAY |

|---|---|---|

| 8.04% | monthly | 7 |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.