Overview

Chaos Labs supports listing syrupUSDT on Aave V3’s Ethereum Core instance. An in-depth risk review of the asset for previous listing on Plasma is available in the respective post. Additionally, a comprehensive technical overview of the Maple Finance protocol is also available.

Motivation

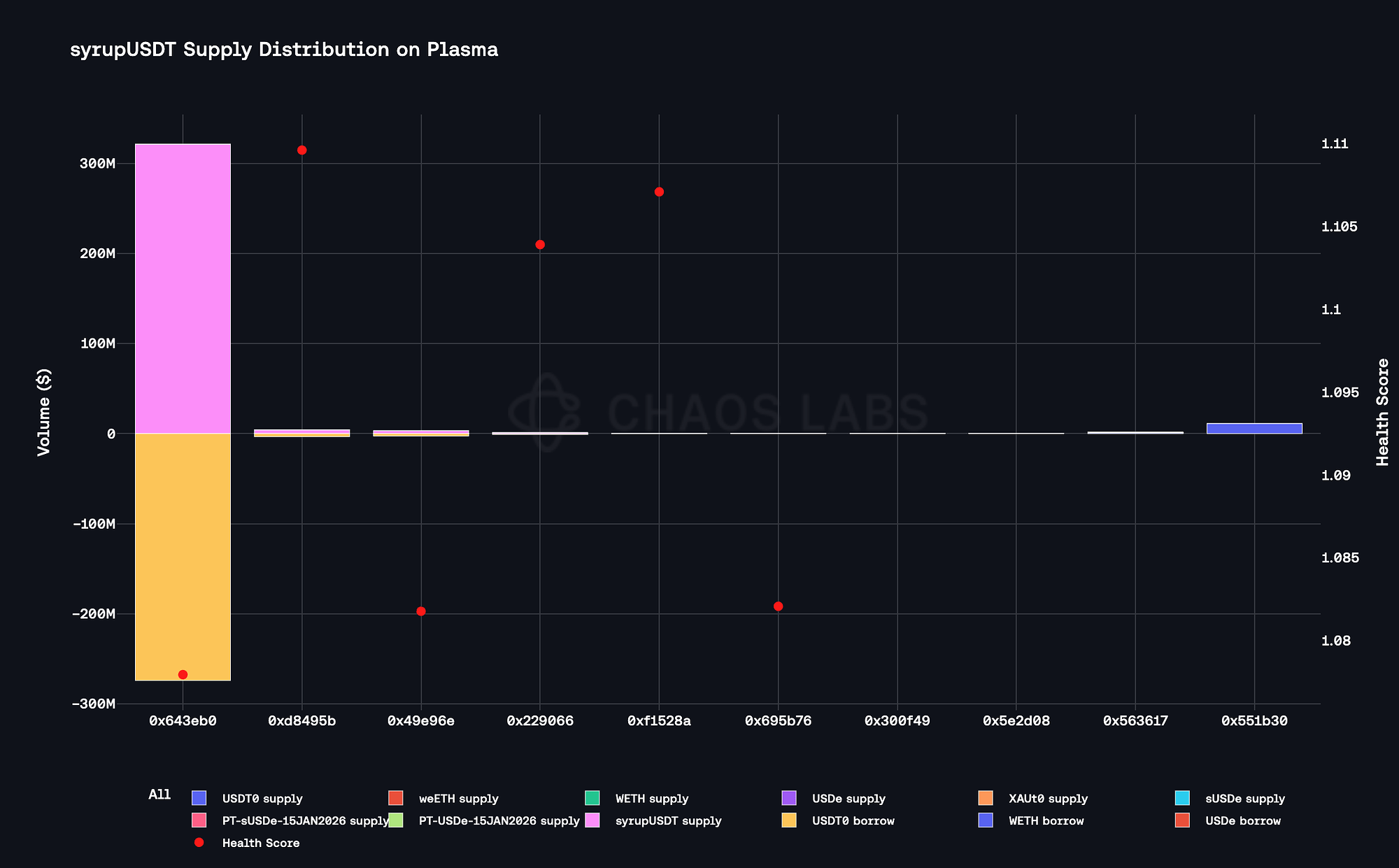

Since the listing of syrupUSDT on the Aave V3 Plasma instance in late October, the asset has gained substantial traction as one of the leading yield-bearing stablecoins, characterized by rapidly filled supply caps and consistent outstanding demand. At the time of writing, over 300 million tokens are supplied on the instance, the overwhelming majority of which is used to collateralize highly correlated USDT0 debt positions.

Considering the substantial implied yield of the asset, its capacity to create additional stablecoin demand is very high. Users on the Plasma instance are borrowing USDT0 at approximately 4.75%, while syrupUSDT’s underlying yield is over 6%, effectively resulting in a positive spread. The highly capital-efficient E-Mode configuration, namely a liquidation threshold of 92%, enables users to take on substantial leverage in looping positions, enhancing the net earnings from the strategy and driving lending activity. Hence, a portion of demand for stablecoin borrowing can be roughly approximated as a function of the spread between the underlying yield of syrupUSDT and borrow rates of the stablecoins included in the E-Mode.

Events Related to the CORE Dispute

Maple Finance recently disclosed that its BTC Yield program, which operated through a segregated portfolio vehicle dedicated to a pilot strategy involving CORE staking, has been affected by an ongoing legal dispute with the CORE Foundation. Public statements indicate that the BTC Yield program required partial conversion of BTC into CORE tokens to enable staking and that this exposure was hedged via put options supported by collateral provided by CORE. Following CORE’s objection to Maple’s planned syrupBTC product, an injunction was issued restricting Maple’s ability to utilize CORE-related assets, including both the purchased CORE tokens and the associated hedging instruments. Maple states that this injunction, together with CORE’s alleged non-performance under the hedge agreement, has prevented the orderly unwinding of the position and led to an estimated potential shortfall for BTC Yield depositors. Maple has announced that it will return 85 percent of principal to affected lenders while pursuing legal remedies for the remainder.

These events are fully ring-fenced to the BTC Yield program and are isolated from Maple’s other offerings, including syrupUSDT and syrupUSDC. Each Maple product is structured through an independent segregated portfolio with distinct assets, liabilities, and counterparty exposures, and there is no evidence of cross-contamination between programs. The reserves backing syrupUSDT and syrupUSDC remain separate from the BTC Yield vehicle, and no impairment or operational disruption has been observed in either product. Given the structural separation, the absence of shared collateral, and the continued normal functioning of Maple’s stablecoin products, we do not assess the CORE dispute as posing material risk to syrupUSDT or syrupUSDC. Within the constraints of publicly disclosed information, both assets continue to demonstrate sound operational performance and remain suitable for listing under the proposed parameters.

Reflexivity Risk

syrupUSDT introduces an element of recursive dependency for Aave, as a portion of the asset’s backing is represented by aethUSDT deposits on Ethereum Core and Plasma instances. This structural reliance means that the dominant portion of syrupUSDT’s liquid reserves is deposited within the same market, which will facilitate borrowing against syrupUSDT. Consequently, the asset both contributes to and depends on Aave’s USDT market liquidity.

Under normal market conditions, the relationship is highly beneficial for both parties: the spread between the underlying yield of syrupUSDT and USDT borrow rates allows for the growth of syrupUSDT’s total supply, which in turn contributes to USDT liquidity, lowers utilization, and further incentivizes borrow activity. However, in a high-stress scenario, the dynamic can reverse. Large-scale syrupUSDT redemptions would require Maple to withdraw the aethUSDT deposits from Aave in order to meet the redemption requests in a timely manner. The decrease in USDT supply will increase market utilization, pushing interest rates higher and causing additional unwinding of syrupUSDT / USDT looping positions, thereby amplifying Maple’s redemption queue pressure and shrinking the USDT supply on the market.

The Slope2 Risk Oracle dynamically mitigates this risk by adjusting Aave’s variable-rate curve in real time. When utilization deviates from the optimal, the oracle gradually steepens the Slope 2 segment of the rate function, increasing borrowing costs as liquidity tightens. This mechanism prevents sudden rate spikes during large withdrawals and encourages organic deleveraging, thereby dampening short-term volatility in the USDT market.

Additionally, Maple’s reserve composition has gradually shifted towards diversification into different lending markets such as Fluid. While this presents additional risk considerations, such as exposure to Fluid’s collateral risk parameters, it minimizes the reflexivity risk posed by its Aave allocation. Chaos Labs is in contact with the Maple team and is working closely with them to ensure the liquidity composition of the asset remains safe and that backing changes are properly reviewed. We will continuously monitor syrupUSDT’s reserve composition and lending flows, managing recursive liquidity exposure through ongoing parameter oversight and cap management to ensure sustainable market growth.

Market and Liquidity

As syrupUSDT has scaled in both adoption and market cap, the underlying yield has exhibited a moderate decline, specifically since July, it has fallen by over 12%, stabilizing at 6% annualized APY.

The primary liquidity venues for syrupUSDT on Ethereum are currently the Fluid DEX and Uniswap V4, with respective reserves of 4.6 and 3.8 million tokens. At the time of writing, a sell order of 10 million syrupUSDT would incur approximately 3.5% slippage, providing substantial liquidity in case of liquidations.

Redemptions

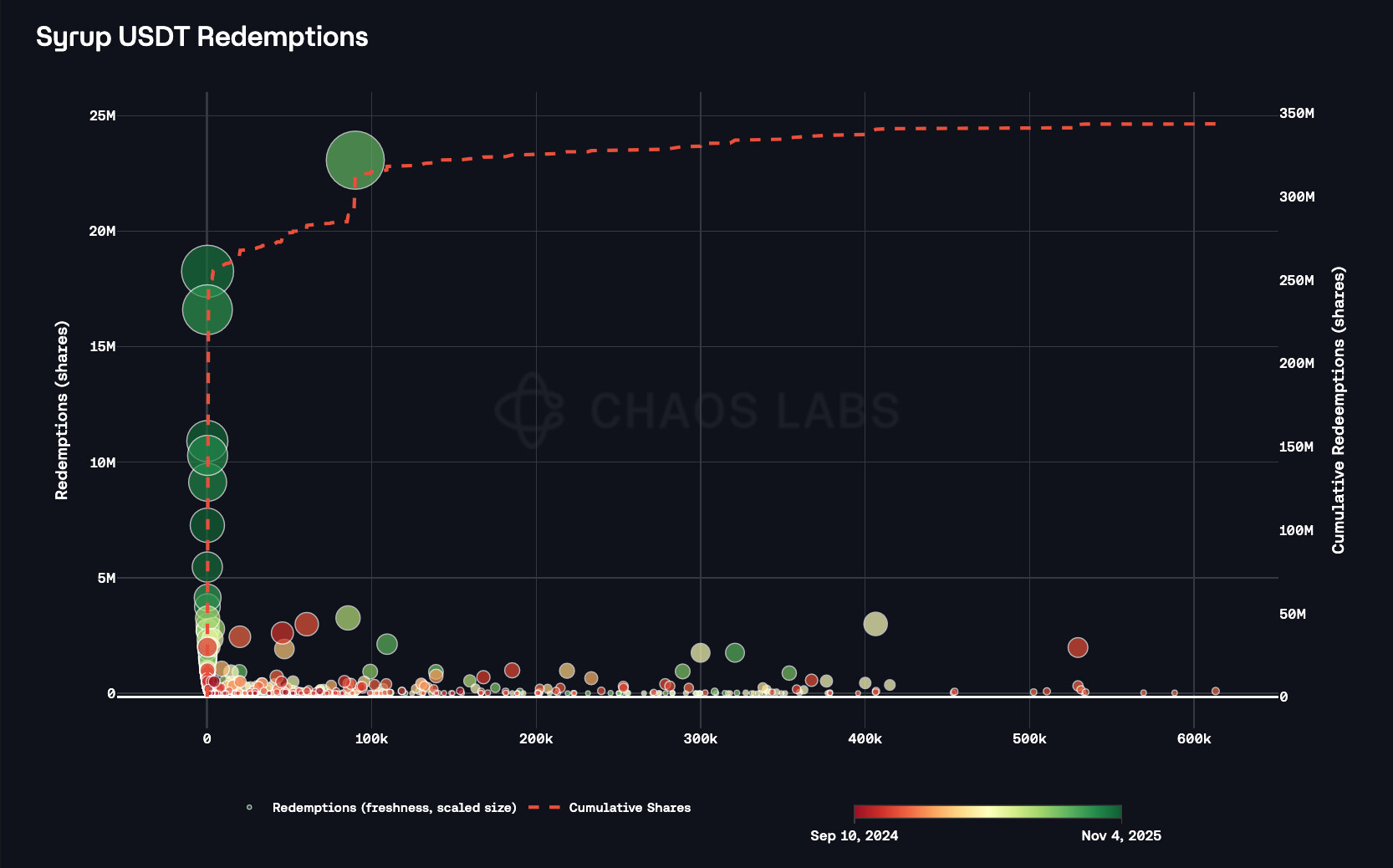

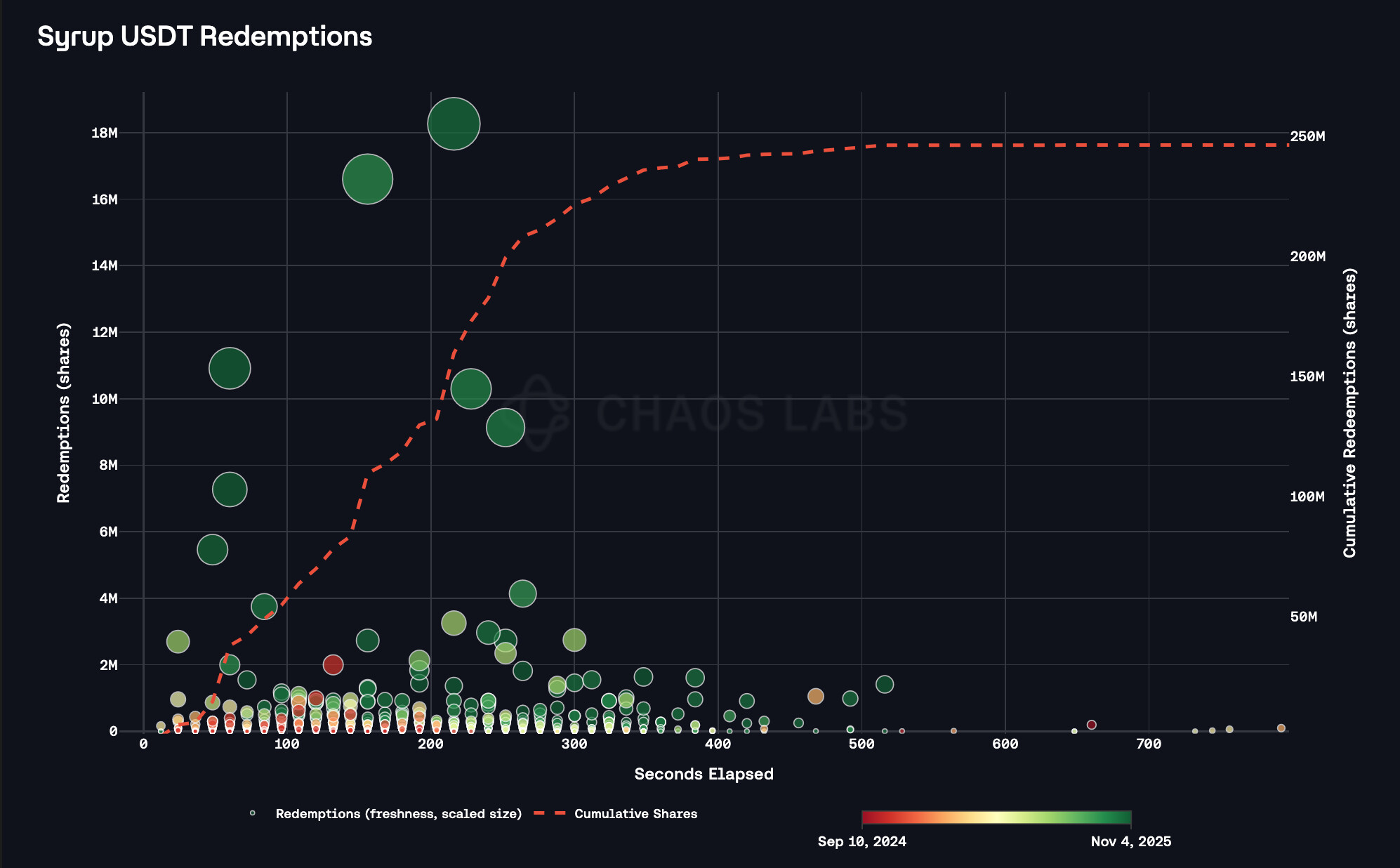

syrupUSDT redemptions have remained fast and orderly, supported and facilitated by the reserves deposited on Aave. This setup allows the repayment funds to be sourced directly from the protocol, instead of prompting a return of funds from other counterparties, decreasing the settlement times considerably. The argument is further supported by the plot below, as we observe that redemption times have decreased substantially over time.

Moreover, we observed that redemption speed exhibits minimal correlation with redemption size, highlighting efficient liquidity management across scales. Overall, the redemption process demonstrates strong operational resilience, in part due to the reliance on Aave-allocated reserves, with responsiveness improving substantially recently.

Pricing and CAPO

Consistent with the implementation used for syrupUSDT on Plasma, Chaos Labs recommends utilizing a USDT / USD price feed augmented with a convertToExitAssets() value from the syrupUSDT contract. Such a structure ensures that any potential shortfall from the Maple protocol borrowers is accurately reflected within the reported price. Additionally, the setup will be safeguarded by CAPO, which maintains price integrity through bounded updates.

Recommendation

Chaos Labs recommends onboarding syrupUSDT to the Ethereum Core instance of Aave V3 under the parameters outlined below. The asset has already demonstrated strong traction on the Plasma instance. The main risks associated with the asset are constrained by the orderly redemptions and substantial on-chain liquidity. Given its recursive exposure through aethUSDT reserves, we recommend limiting its collateral capacity to the E-Mode and maintaining a conservative initial supply cap. Future cap adjustments will be evaluated with the level of recursive exposure in mind, and Chaos Labs will closely monitor reserve composition and market behavior to ensure systemic stability as the asset scales.

Specification

| Parameter |

Value |

| Isolation Mode |

No |

| Borrowable |

No |

| Collateral Enabled |

Yes |

| Supply Cap |

50,000,000 |

| Borrow Cap |

- |

| Debt Ceiling |

- |

| LTV |

0.05% |

| LT |

0.10% |

| Liquidation Bonus |

6% |

| Liquidation Protocol Fee |

10% |

E-Mode

| Parameter |

Value |

Value |

|

| Asset |

syrupUSDT |

USDT |

GHO |

| Collateral |

Yes |

No |

No |

| Borrowable |

No |

Yes |

Yes |

| Max LTV |

90.00% |

- |

- |

| Liquidation Threshold |

92.00% |

- |

- |

| Liquidation Bonus |

4.00% |

- |

- |

CAPO

| maxYearlyRatioGrowthPercent |

ratioReferenceTime |

MINIMUM_SNAPSHOT_DELAY |

| 8.45% |

monthly |

7 |

Disclosure

Chaos Labs has not been compensated by any third party for publishing this recommendation.

Copyright

Copyright and related rights waived via CC0.