Overview

The growth of Ethena-related exposure within the Aave protocol, currently exceeding $4.7 billion in deposits, has closely tracked the recent surge in protocol yields, driven by elevated market dynamics and thus rising funding rates. Correspondingly, the extent of outstanding rehypothecation at the protocol level has scaled proportionally, raising important considerations around systemic leverage and risk propagation.

This analysis examines the growth and contraction cycles of USDe, with a particular focus on the effects of the contraction phase on Aave. It explores how Aave’s role in supporting Ethena’s expansion can amplify risks during a contraction, identifies the key mechanisms and triggers that could lead to a deleveraging cycle, stress tests Aave’s resilience to scenarios involving USDe and PT unwinding. By proactively understanding these dynamics, Aave governance and risk teams can better manage the cyclicality of high-growth protocols like Ethena, leveraging their composability while minimizing the potential for systemic instability during downturns.

Growth-Contraction Cycles in Ethena

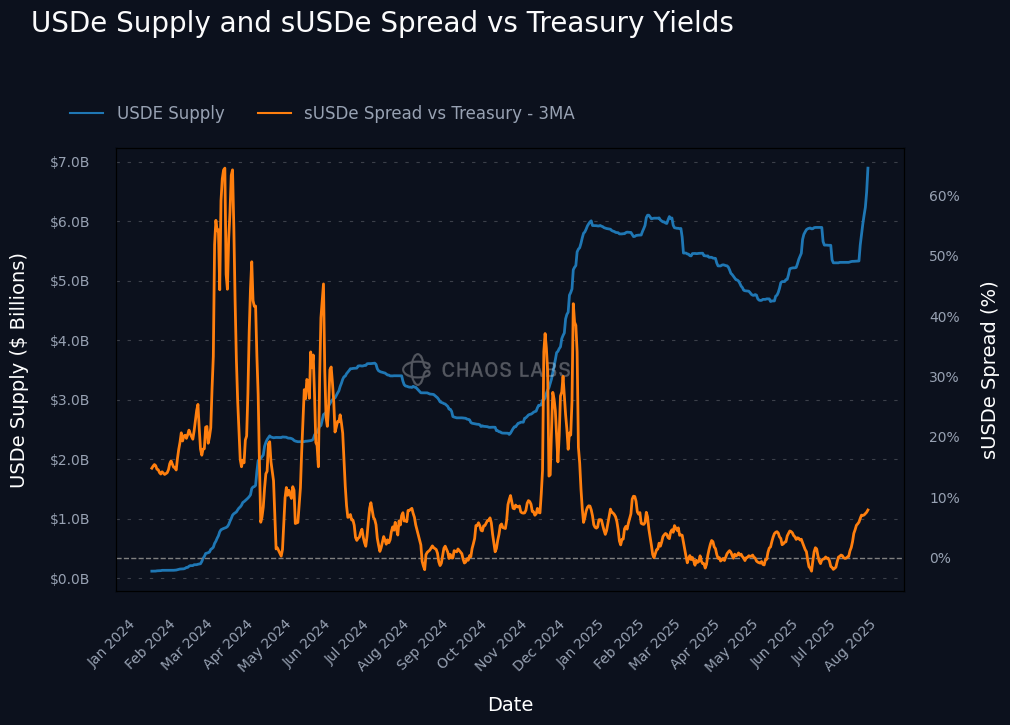

A defining feature of Ethena is its reliance on perpetual futures funding rates. When funding rates are positive and rising, Ethena enters a growth phase, as more users mint USDe to capitalize on attractive sUSDe yields. However, if funding rates fall or turn negative, Ethena enters a contraction phase. These cyclical dynamics cause the USDe supply to expand and contract based on prevailing market conditions.

Growth Phase

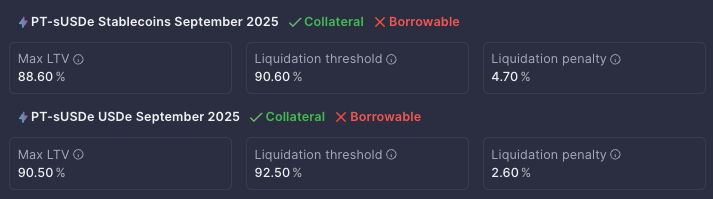

Ethena is currently undergoing a renewed growth phase. Over the past two weeks, USDe supply has surged from 5.33 billion to 8.6 billion, driven by rising funding rates and increased demand for leverage in the market. This has had a profound impact on Aave, where 4.7 billion USD of exposure now comes from USDe backed assets, including PTs and sUSDe, accounting for more than 55% of total USDe supply.

This concentration is expected to intensify with the launch of a liquid leverage campaign, which allows users to deposit 50% USDe and 50% sUSDe to loop their positions and enjoy a blended return that ultimately matches the sUSDe reward yield across their entire position.

USDe Growth Dynamics

The growth of USDe is closely linked to broader risk-on conditions in the crypto market. When asset prices rise, investor appetite for leverage increases, driving up open interest in perpetual futures markets. This expansion of open interest enlarges the addressable market for Ethena’s delta-neutral strategy, as it creates more opportunities to take the short side of funding markets. As demand to go long increases, funding rates rise, which in turn boosts the yield offered to sUSDe holders. In parallel, positive market sentiment often drives up the price of ENA, which increases the perceived value of point based rewards distributed to users. Together, these dynamics reinforce user incentives and contribute to rapid USDe supply growth.

Higher sUSDe yields incentivize users to mint more USDe to capture these returns. To further amplify the yield, users can take on leverage, often borrowing stablecoins on lending markets such as Aave to loop their positions. This behavior drives up borrowing demand for assets like USDC, USDT and USDe pushing up utilization and raising borrow rates.

While profitable for short-term loopers during bull cycles, this behavior introduces risk to Aave: elevated borrow rates can crowd out long-term, collateral-based borrowers, such as users borrowing against ETH or LSTs, whose positions become economically unviable.

As a result, these market participants may be forced to exit, reducing protocol stickiness and undermining stability in Aave’s core lending markets. This phenomenon was already observed during the December 2024 growth phase of USDe, when sharp increases in borrow rates drove out other borrowers.

Elevated borrow rate risk is further compounded by upcoming shifts in Aave’s liquidity supply. Plasma, which currently has over $1 billion deposited in Aave, with ~$390 million in USDT and ~$590 million in USDC, is expected to begin withdrawing funds starting in August. If these withdrawals coincide with a USDe led growth phase, stablecoin utilization may rise sharply, amplifying borrow rate spikes and further pressuring long term borrowers.

In pursuit of additional yield, Ethena may opt to deposit part of its backing capital, such as USDC or USDT, into Aave. While this can enhance capital efficiency by allowing the protocol to earn on otherwise idle reserves, it introduces a new layer of rehypothecation risk. The stablecoins backing USDe, which are meant to support redemptions, end up being lent out to other users participating in leverage loops. This dual use of backing assets boosts returns during expansion phases but also increases systemic vulnerability, as the same reserves are tied to both protocol solvency and broader market leverage. If the share of backing capital deployed into Aave crosses a prudent threshold, relative to either USDe’s total reserve pool or Aave’s stablecoin markets, it could undermine Ethena’s ability to meet redemptions smoothly during times of stress.

As a result, USDe’s growth is not solely a function of Ethena’s internal mechanics but is deeply intertwined with broader market conditions and external lending platforms like Aave. The system’s ability to scale rapidly through recursive leverage and redeployment of backing capital drives impressive expansion during favorable conditions. However, it also concentrates risk: both the stability of USDe and the resilience of lending markets like Aave become increasingly dependent on sustained funding rate incentives and liquidity conditions. Understanding this reflexive growth loop is essential for anticipating the vulnerabilities that may emerge in a contraction phase.

Aave as a Leverage Engine

Aave has become a critical component of Ethena’s growth, providing the deep stablecoin liquidity required to scale leveraged USDe based strategies. Users are increasingly utilizing Aave to execute leveraged looping strategies, where they borrow stables to mint more USDe, convert it into sUSDe or PTs, and repeat the cycle, effectively amplifying their exposure to sUSDe rewards and Ethena points.

For large capital allocators seeking to amplify sUSDe yield, liquid options have historically been limited. The two primary choices, purchasing sUSDe, which comes with a 7 day cooldown period, or acquiring relatively less liquid USDe based PT tokens with fixed maturity, both restrict rapid exit. The new liquid leverage mechanism addresses this by allowing only half of the capital to be locked in sUSDe, while the other half remains in liquid USDe. This improves exit flexibility, as the USDe portion can be quickly withdrawn or redeployed, reducing the risk of being trapped during periods of market stress and making the strategy more attractive to larger, more sophisticated participants.

Importantly, this added liquid leverage optionality is expected to shift incentive structures across the Ethena ecosystem. As liquid leverage gains traction, it is likely to attract large capital toward leveraged configurations, thereby increasing overall system leverage. This could accelerate the pace of future contraction phases, as fewer users would be constrained by cooldown or maturity periods that have historically led to more gradual unwinds. In such a scenario, a sharp downturn in funding rates could trigger faster and more reflexive position unwinds, heightening systemic risk for both Aave and the broader USDe market.

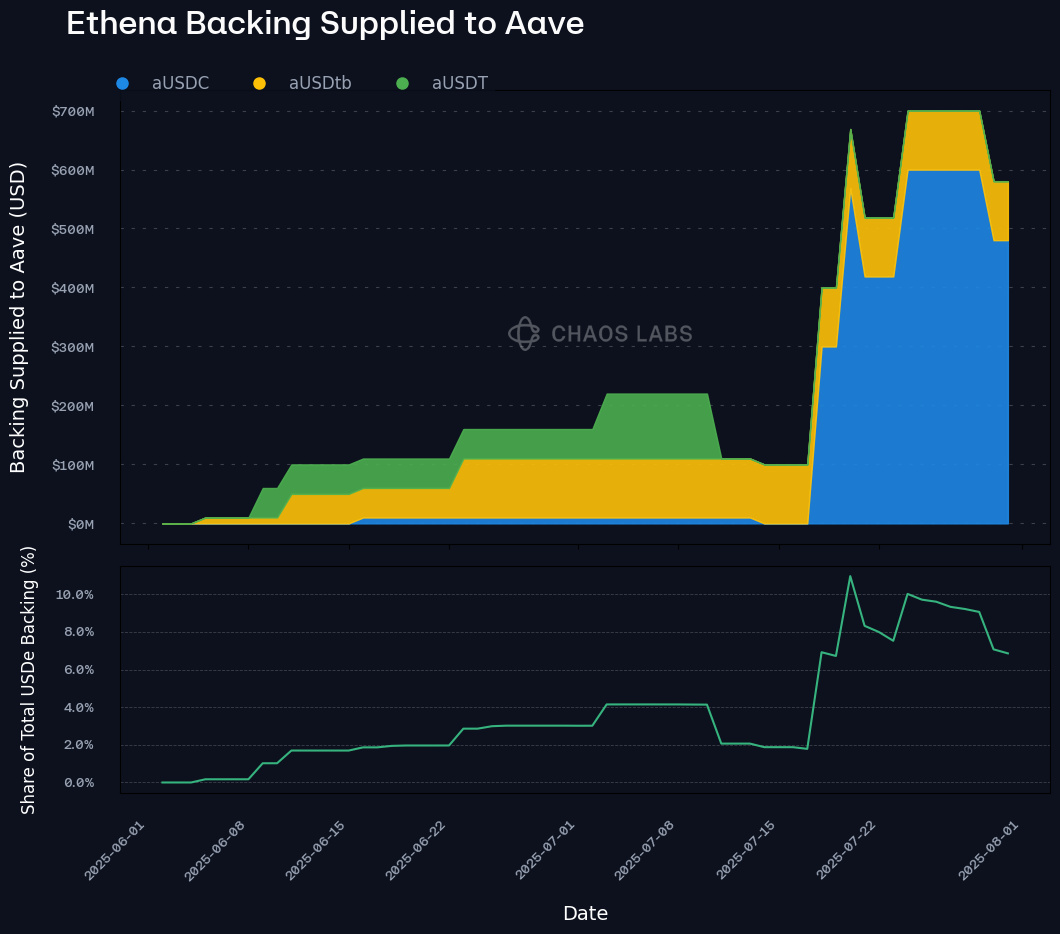

Backing Assets Supplied into Aave

As detailed in our previous research on Ethena the protocol has demonstrated agility in dynamically allocating its backing between short ETH/BTC perpetual positions and yield bearing stablecoins. This flexibility allows Ethena to optimize yield and risk exposure as market conditions evolve.

Currently, approximately 45% of USDe’s backing is held in various stablecoins, totaling around $3.9 billion. Of this amount, $580 million has been supplied back into Aave, with $480 million in USDC and $100 million in USDtb.

In the case of USDtb, Ethena is the sole supplier on Aave. This position allows Ethena to earn the short term Treasury yield from T-bills off-chain, while simultaneously earning the on-chain supply rate from Aave, effectively stacking yield sources. While capital efficient, this also creates a single point liquidity risk: if Ethena decides to withdraw its USDtb, there may not be sufficient borrower repayment or exit liquidity, leaving the asset trapped or forcing a disorderly unwind.

In the USDC market, Ethena has also emerged as a major player, accounting for 12% of all supplied USDC on Aave, making it one of the largest suppliers. Combined, the USDC and USDtb deposits represent approximately 6.8% of the total backing for USDe and 15% of all stablecoin backing, now actively deployed within Aave.

This strategy underscores Ethena’s deep integration with Aave, not just as a source of leverage for users, but also as a venue to generate yield on idle backing assets. However, it also introduces a negative feedback loop risk: if Ethena were to exit these markets, either to rotate its backing, deleverage, or meet redemptions, Aave could face a sudden liquidity shortfall and utilization spikes. These dynamics must be carefully considered when evaluating the systemic exposure Aave now has to both sides of Ethena’s capital structure.

Contraction Phase

As sUSDe yields begin to decline, Ethena’s ecosystem can experience rapid reflexive unwinds. These dynamics pose a range of risks to Aave, particularly given its deep integration with both liquid leverage and PT loop positions. However, certain countervailing flows can help stabilize the system during downturns. Below, we break down both the risk vectors and stabilizing forces, and assess whether the current market structure is resilient enough to handle a USDe contraction.

Key Risks During Contraction

Liquid Leverage Triggers USDe Outflows

As sUSDe yields compress, users engaged in liquid leverage strategy, specifically USDe/stablecoin and sUSDe/stablecoin loopers, begin to unwind their positions. When the borrowing cost on Aave exceeds the net reward from sUSDe, these positions become unprofitable, triggering exits. As these positions are closed, USDe is withdrawn from the market, reducing liquidity for USDe and putting upward pressure on USDe borrow rates. The current size of these looped positions is decent and expected to rise with the adoption of liquid leverage campaign: $800 million in USDe/stablecoin debt and $550 million in sUSDe/stablecoin debt, making them an important reflexive driver in the early stages of a contraction phase.

To help manage elevated USDe utilization in a more graceful manner, a time and impact sensitive slope2 risk oracle could be implemented for the USDe reserve. We are currently developing a mechanism that would dynamically adjust the slope2 parameter based on how high and how long utilization remains elevated. This design aims to nudge redemptions forward in a smoother way, gradually increasing borrow costs when needed without triggering abrupt spikes that might unsettle leveraged positions. Such a mechanism would enhance Aave’s ability to manage deleveraging pressure in a controlled and predictable manner.

PT Loop Stress Leads to Debt Swaps and Unwinds

As USDe is withdrawn from the market, borrowing demand by PTs may persist, but available liquidity diminishes. This puts pressure on PT loopers, particularly those with PT/USDe positions, which currently account for $560 million in outstanding debt. To avoid elevated borrowing costs or liquidation risk, these users may be forced to either sell their PTs into the market to unwind or swap their debt from USDe to another stablecoin, further increasing utilization across core stable markets like USDC and USDT.

Meanwhile, PT/stable positions, which represent a much larger $3 billion in outstanding debt, are not directly affected by USDe liquidity, but are highly sensitive to rising interest rates on stables. As USDe debt is swapped into stables, it drives up utilization and borrowing costs, potentially rendering PT/stable positions unprofitable as well, and forcing additional deleveraging.

Backing Assets Locked on Aave

A unique systemic vulnerability arises from the fact that a portion of USDe’s backing capital is actively deployed into Aave. As of today, Ethena has supplied $480 million in USDC and $100 million in USDtb into Aave’s lending pools, representing approximately 6.8% of total USDe backing and 15% of all stablecoin backing. While this deployment generates yield, it also creates a conflict between Aave’s internal liquidity needs and Ethena’s redemption obligations during a contraction.

When redemptions begin to rise, Ethena must retrieve this capital to fulfill withdrawals. However, this capital is not readily liquid. In the case of USDtb, the situation is particularly acute: Ethena is the sole supplier, and roughly 50% of its supplied $100 million is currently borrowed. While there is $10 million in available on-chain buy-side liquidity to repay loans without spiking rates, only $25–35 million of the USDtb is realistically recoverable in current conditions without causing disruptive borrow rates for USDtb borrowers. This leaves Ethena exposed to potential fund lock-in if redemption pressure coincides with high utilization in the USDtb market.

On the USDC side, the notional exposure is higher but structurally less fragile. Ethena has supplied $480 million in USDC, making it the largest individual supplier on Aave and accounting for approximately 12% of the total USDC supply. While the USDC market is more liquid and diversified, a forced withdrawal of this size would still pose a significant shock to the lending pool. Such a withdrawal would rapidly drive up borrowing rates, potentially forcing other users to unwind positions or absorb higher borrowing costs, resulting in broader stress across Aave’s markets.

This dynamic highlights a systemic liquidity mismatch: assets that are meant to provide redemption stability for USDe are simultaneously functioning as the foundation of leverage and liquidity within Aave. During a contraction, these dual roles become incompatible, as the same collateral cannot be reclaimed without destabilizing the system it underpins. Therefore, the use of backing capital within Aave, especially in concentrated or illiquid markets like USDtb, must be carefully monitored and included in exposure limits to mitigate redemption risk spillovers.

Rising Stable Utilization Forces Collateral Borrower Exits

As PT loopers debt swap from USDe into stables and drive utilization higher, other borrowers, particularly those using ETH, wstETH, or other LSTs as collateral, may face higher interest rates. In many cases, the economics of these loans no longer make sense, prompting users to close positions and withdraw capital from Aave altogether.

Stabilizing Counter Flows

While contraction risks are significant, the Ethena-Aave system also contains several self correcting flows that act to absorb or negate stress during deleveraging cycles. This section breaks down the key positive flows that operate during a contraction phase and evaluates their effectiveness in offsetting risk.

Liquid Leverage Unwinds Repay Stablecoins

As users unwind USDe & sUSDe looped positions during a contraction, they not only reduce USDe supply but also repay large amounts of borrowed stablecoins. This process directly replenishes liquidity in Aave’s lending pools, easing upward pressure on stablecoin utilization rates. With $800 million in USDe/stable and $550 million in sUSDe/stable debt outstanding, the unwind of these loops could return up to $1.3 billion in stablecoins to the protocol. This inflow acts as a buffer against utilization spikes caused by other market participants, particularly PT loopers, swapping debt from USDe into stables. In effect, this stabilizing force helps to offset one of the primary risk vectors identified earlier.

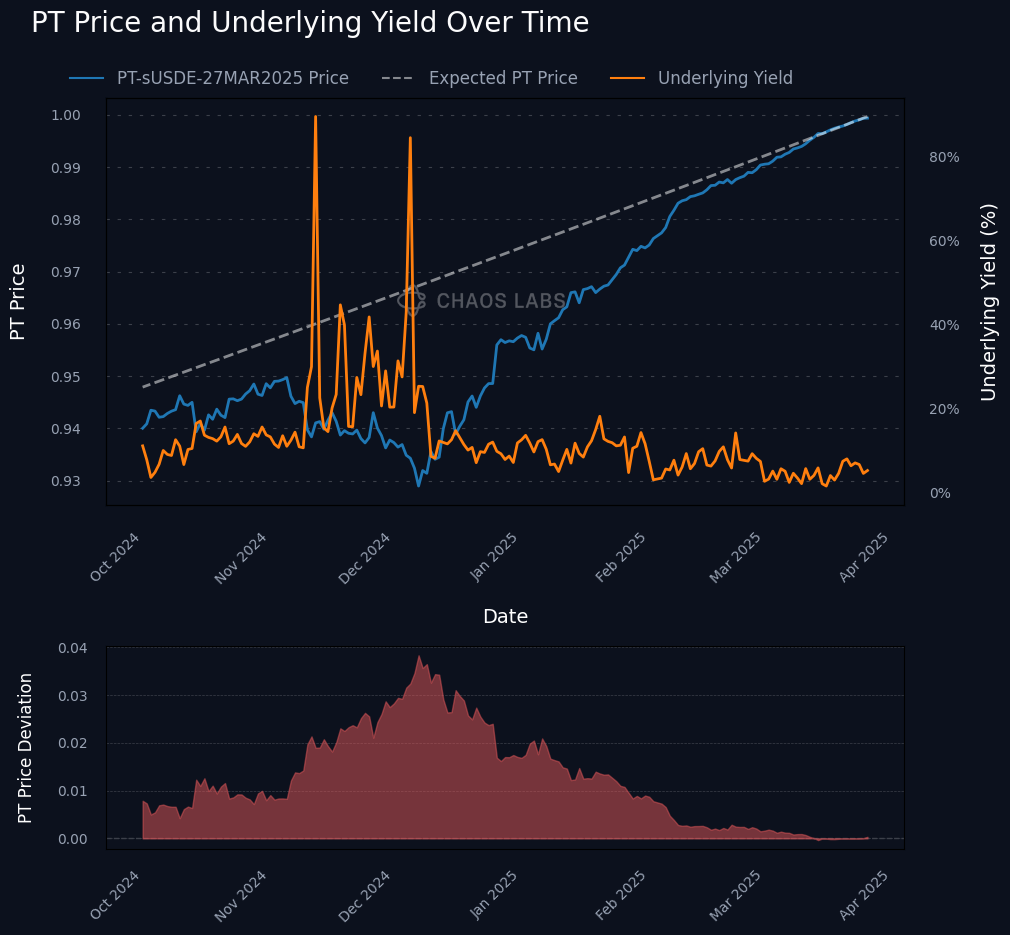

PT Prices Rise as Yields Fall

Pendle PTs reflect the discounted value of future sUSDe yield. As funding rates decline and market participants anticipate lower forward yields, the YT component loses value, causing PT prices to rise.

This repricing dynamic is especially important during a contraction phase. Higher PT prices improve exit conditions for PT loopers, enabling them to unwind positions with less slippage and reduced risk of triggering disorderly market behavior. Rather than amplifying stress, PT unwinds in this environment can serve as a stabilizing force, helping absorb deleveraging pressure in a more controlled manner.

To illustrate this mechanism in practice, the chart below shows the price of PT-USDe-27Mar2025 relative to its underlying yield. In December 2024, sUSDe yields started to dropped sharply, causing USDe contraction. As expected, the PT began to reprice upwards, diverging from its prior trajectory and converging toward its fair value. This type of price adjustment allows PT holders to exit more favorably, reinforcing the thesis that PT repricing can serve as a stabilizer during unwind scenarios.

Debt Swaps Improve USDe Peg Stability

Another important counterbalancing flow emerges through debt swaps executed by PT/USDe borrowers. As these users swap their USDe debt into stables, selling stables and buying USDe in the process. This creates net buying pressure for USDe at the exact time that broader market sentiment is skewed toward redemptions. In scenarios where USDe begins to trade at a slight discount, this behavior becomes even more pronounced, as arbitrage opportunities encourage loopers to purchase USDe to close out positions. These flows not only help stabilize the USDe price, but also reduce redemption pressure on Ethena’s reserves. Importantly, this peg-stabilizing mechanism occurs organically, without the need for discretionary intervention, and helps anchor market confidence during deleveraging events.

The efficiency of this mechanism is visible in practice. Since September 2024, a net $50 million of inflows into USDe have occurred via debt swaps, compared to $32 million in outflows. Notably, during the third week of July, when USDT borrow rates spiked, daily inflows into USDe via debt swaps reached their highest levels. This illustrates how the debt swap enables dynamic repositioning based on market conditions.

Net Risk Assessment

The dynamics of contraction and stabilization within the Aave-Ethena ecosystem are closely intertwined. As sUSDe yields decline, users begin to unwind their leveraged positions, leading to outflows of sUSDe and USDe collateral and corresponding repayments of USDC and USDT debt. This deleveraging process frees up stablecoin liquidity on Aave. At the same time, PT/USDe holders gradually migrate their debt positions into USDC and USDT. This shift involves selling stables and buying USDe, which applies upward pressure on the USDe peg exactly when redemptions begin to rise.

Importantly, the volume of PT debt migrating into stables is typically less than or around half the amount of stablecoin debt being repaid by liquid leverage unwinders. As a result, there is sufficient freed-up stablecoin liquidity to absorb the debt migration from PTs without creating strain. Even if Ethena begins withdrawing backing assets from Aave, withdrawals of the current magnitude can occur without destabilizing the market, thanks to the liquidity buffer created by prior deleveraging activity.

Based on current data, looped USDe and sUSDe positions total $1.3 billion in stablecoin debt, representing the primary source of stabilizing inflows during contraction. These positions, once unwound, repay stablecoins into Aave, directly counteracting the utilization spike caused by PT loopers swapping USDe debt into stables.

On the risk side, PT-based loop positions total $3.5 billion in outstanding debt, split between $560 million in PT/USDe and $3 billion in PT/stable debt. The PT/USDe segment represents a direct pressure point if USDe becomes scarce or expensive to borrow, while the PT/stable segment is vulnerable to rising stablecoin borrow rates driven by debt migration. While the PT repricing effect does improve exit conditions, its ability to absorb stress is indirect and dependent on Pendle liquidity, unlike the deterministic nature of stablecoin repayments.

Compounding these pressures is a structural liquidity mismatch stemming from the fact that $580 million of USDe’s backing is currently deployed into Aave itself, $480 million in USDC and $100 million in USDtb. These assets, intended to support redemptions, are simultaneously being used to generate yield via lending. In the event of a severe contraction, Ethena may need to withdraw these funds to meet redemption requests. However, such withdrawals, could trigger utilization spikes and borrower stress, exacerbating liquidity conditions across Aave. This dual role of backing assets, both as redemption capital and liquidity on Aave, creates a fragility that could amplify stress across both protocols during a deleveraging event.

Here is a summary table evaluating the balance between unwind risk and stabilizing flows:

| Segment | Exposure | Behavior During Contraction | Direct Impact | Consequence |

|---|---|---|---|---|

| USDe/stables | $800M debt | Unwinds, repays stable debt, withdraws USDe | ↓ Stable borrow rate ↑ USDe borrow rate | Improves stablecoin liquidity, may pressure USDe peg |

| sUSDe/stables | $550M debt | Unwinds, repays stable debt | ↓ Stable borrow rate | Improves stablecoin liquidity |

| PT/USDe | $560M debt | Swaps debt to stables, buys USDe to close USDe short | ↑ Stable borrow rate ↓ USDe borrow rate | Increases pressure on stablecoin utilization, improve USDe peg |

| USDC (Backing) | $480M supply | Withdrawn by Ethena to meet redemptions | ↑ Stable borrow rate | Forces USDC borrowers to repay |

| USDtb (Backing) | $100M supply | Withdrawn by Ethena; only ~$30M liquid | ↑ USDtb borrow rate | Borrowers forced to repay due to utilization spike, small part of the backing may get trapped |

| PT/stables | $3B debt | Unwinds if stable borrow rates rise | ↓ Stable borrow rate | Large volume may flood Pendle LP markets |

| PT Repricing | System wide | PT prices increase as YT value falls | ↑ PT exit price ↓ Exit slippage | Eases unwind pressure for PTs |

As long as the total outstanding debt from USDe/stable and sUSDe/stable leverage positions remains larger than the combined outstanding PT/USDe debt and the stablecoin backing of USDe deposited into Aave, Aave’s stablecoin markets have a natural buffer against contraction pressure. In such a scenario, the unwind of liquid leverage positions leads to the repayment of stablecoin debt, which can offset or even fully neutralize the increase in stablecoin utilization caused by PT/USDe users swapping their debt into stables. This dynamic helps maintain rate stability and peg integrity, allowing the system to self-correct without requiring external intervention.

However, the embedded redemption risk within backing assets deployed on Aave reduces the margin for error. If redemptions accelerate while Aave markets are already strained, forced withdrawals by Ethena could flip a manageable deleveraging cycle into a systemic liquidity crunch, driving up stablecoin borrow rates and triggering contagion into other markets reliant on stablecoin borrowing, ultimately forcing those non-Ethena positions to exit Aave as well.

Conclusion

The current incentive structure in the Ethena ecosystem favors capital-efficient strategies such as liquid leverage, making it unlikely that the total debt from USDe/stable and sUSDe/stable loop positions will fall below the outstanding PT/USDe debt. This imbalance is not inherently destabilizing, so long as liquid leverage positions remain the dominant source of risk, their unwind acts as a stabilizing flow, repaying borrowed stablecoins and easing utilization pressure during a contraction.

However, the system’s resilience depends not just on the relative size of PT/USDe debt, but also on the scale of stablecoin backing actively deployed within Aave. If Ethena’s deployed backing grows too large, the margin for safe deleveraging narrows. These assets, which should serve as redemption buffers, become embedded in the lending markets they are meant to stabilize. In such a setup, even a modest contraction in USDe supply could force simultaneous deleveraging and backing withdrawals, exerting compounding stress on Aave’s stablecoin markets.

To preserve the effectiveness of counterbalancing flows during future contraction phases, it is critical that Ethena avoids over deploying its stablecoin reserves into Aave. While allocating a portion of the backing to Aave for yield generation may be efficient under normal conditions, we believe the amount deployed should remain below a prudent threshold relative to USDe’s total backing and Aave’s overall stablecoin liquidity. Self-limiting this exposure can help safeguard both redemption integrity and market stability.

More broadly, the importance of USDe in Aave’s ecosystem has grown substantially, and this trend is likely to continue. USDe positions now account for a large and growing share of borrowing activity, making it imperative that market parameters are optimized for stability under both expansion and contraction regimes. To that end, we are currently working on a dynamic slope2 risk oracle design tailored for the USDe market. This mechanism aims to modulate interest rate curve behavior based on utilization and time at high utilization, ensuring more predictable and orderly redemptions during times of stress. We look forward to sharing further details in an upcoming post.

Disclaimer

Chaos Labs has not been compensated by any third party for publishing this research paper. Our pre-launch risk reports on Ethena, published over a year ago, represented a temporary compensated engagement, bear no implications on the current state of the protocol and can be viewed here on our website. We additionally provide proof-of-reserve attestations for the Ethena Protocol, which periodically reflect the aggregate state of the portfolio relative to the underlying USDe shares emitted.